9 Low-cost Methods To Retain Tenants During Covid-19

December 18, 2020

The mental image that Singaporeans have of landlords is all wrong. If you’re like most people who have a second property to rent out, you’ll know what we mean: everyone visualises you as a towkay who can sit back and just let the money roll in.

But given the Covid-19, your hairs may well be turning white – and now’s not the time for inaction. More than ever, landlords need to find ways to retain their tenants; and without methods that involve, say, huge discounts or expensive renovations.

Here are some basic, low-cost methods to note; especially if you’re new to the rental game:

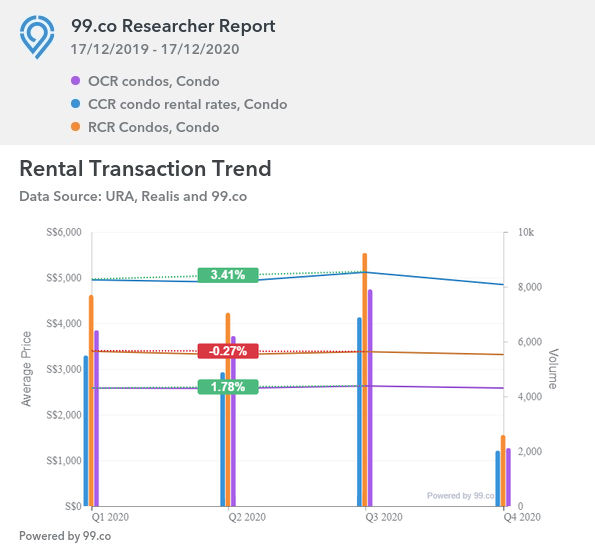

A snapshot of the condo rental market since Q1 2020

The following are the monthly rental rates in the Core Central Region (CCR), Rest of Central Region (RCR), and OCR (Outside of Central Region), since the start of the year:

Rates in the CCR averaged $4,950 per month in Q1, and had risen 3.4 per cent to $5,119 per month in Q3.

RCR condos saw rents dip slightly; they averaged $3,389 in Q1, and $3,380 in Q3.

OCR condos averaged $2,583 per month in Q1, and $2,629 per month in Q3.

Note that at least some of the uptick in rental rates can be ascribed to the height of Covid-19. This was when some foreigners – such as Malaysians unable to return home due to control measures – were forced to seek rental options. The bulk of such cases, however, would have been in the rental flat rather than the condo market.

In the year to follow, however, landlords should brace for the possibility of a softening rental market. The real estate agents we spoke to highlighted two key risks:

- An economic downturn could cost companies to shrink expatriate allowances, or replace them with locals.

- “Second wave” infections abroad could result in travel bans and restrictions, further reducing the number of potential tenants entering Singapore.

This could result in increased leasing volumes*, coupled with shorter lease terms and a higher risk of vacancies.

*More leases may be signed, but they’re likely to be of a shorter duration, such as six months instead of a year. This is because tenants suspect rental rates will drop, and aim to renegotiate or find a cheaper alternative when it happens.

What are some ways to retain tenants, without steep discounts or pricey renovations?

Some methods you can easily apply are:

- Take over the utilities, and claim them as tax deductions

- Accept rental deposit guarantees

- Implement a room-mate scheme

- Start a referral chain

- Reprice the loan and pass on savings (if possible)

- Consider a small furnishing package

- Offer annual deep-cleaning at the tenant’s direction

- Reduce the tenant’s liability for small repairs

- Paying their rent with a credit card

1. Take over the utilities, and claim them as tax deductions

Bear in mind that rental expenses can be deducted from your property tax. One of these deductions are the utility expenses: as long as you pay on behalf of the tenant (and are not reimbursed), you can take it out of your property tax.

This can be a win-win scenario: your tenant gets to lower their monthly expenses, and you indirectly recoup the cost by paying lower tax. Note that internet charges are also tax-deductible this way.

However, do track the actual rental expenses more closely if you do this. IRAS allows you to either claim a flat 15 per cent of rental income as a deduction, or to file for the specific amounts. If your tenants are energy or water guzzlers, you may be better off claiming the exact amount.

2. Accept rental deposit guarantees

Using a rental deposit guarantee, the tenant pays an annual fee to a third party, which then funds their security deposit. This means a lower upfront cost to the tenant, as they don’t need to lock down one to two-months of rental as a deposit.

Companies like Sing-Guarantee provide this type of service, although there may be some variations in their methods.

Not all tenants are aware that this option exists, so you may want to point it out to them. While some traditionalist landlords are suspicious of the novelty, accepting such guarantees can make a tenant more likely to stick with you; or attract them in the first place.

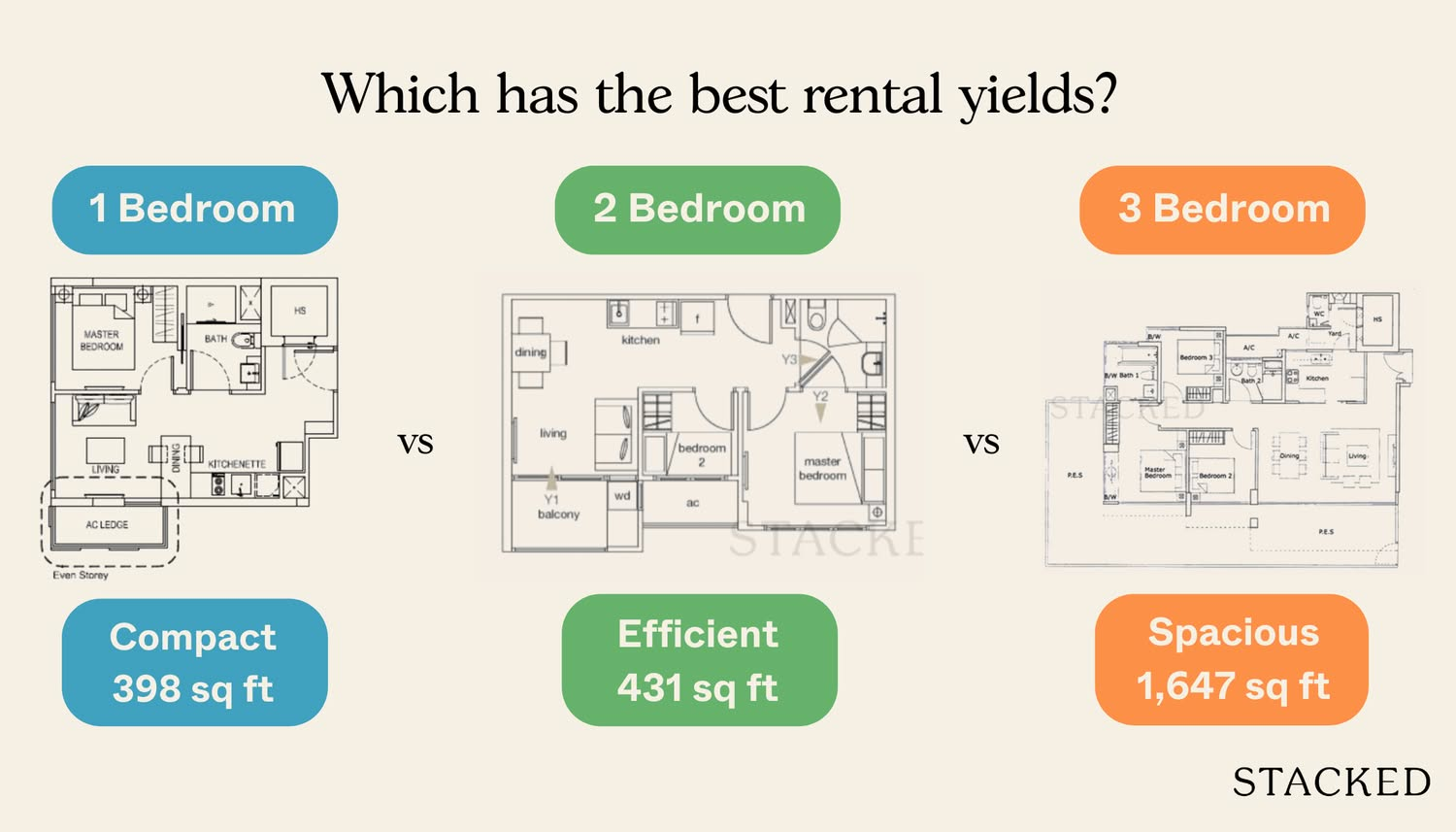

3. Implement a room-mate scheme

This is one of the reasons many landlords are advised to prefer two-bedders: two tenants might more easily afford the rental for a two-bedder, than one tenant can handle a whole shoebox unit (e.g. two tenants splitting $4,000 a month for a two-bedder unit pay $2,000 each, whereas one tenant renting a shoebox may pay about $2,500).

In some cases, you may be better off incentivising your tenant to find a room-mate to split the costs, rather than losing them outright. Some landlords will even lower the monthly rent slightly, if the tenant finds a room mate rather than leaves (it’s better than an outright vacancy).

Rental MarketWill Singapore’s Rental Market Maintain Its Resilience In 2021?

by Ryan J. Ong4. Start a referral chain

This is quite common among landlords who rent out to students, who mostly come from the same school. The landlord simply gives a better rate to a future tenant, that’s referred by the current one. For student tenants, this sets up an ongoing line of tenants – students who are graduating will recommend your property to their juniors, who in turn recommend it to their own juniors, and so forth.

This is sometimes done for training institutions and offices as well. For example, you could extend the same method to, say, air crew who refer their colleagues, or to expatriates who refer others in the company before moving on.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Best And Worst Performing HDB Estates In 2023: Where Does Yours Rank?

Resale flat prices are finally starting to slow; but that’s not the impression on the ground level. Just about everyone…

This does require that you make a good impression on existing tenants.

5. Reprice the loan and pass on the savings (if possible)

Some home loan options come with free repricing options; and home loans are low right now due to Covid-19. Rates have fallen as low as 1.3 per cent.

Assuming your old home loan is for $1 million at two per cent (for 25 years), you’d be paying around $4,238.50 per month. Repriced to 1.3 per cent, repayments could fall to about $3,906 per month.

If rental income is your priority, you could pass on these savings to tenants, retaining them without taking too much of a loss.

However, do note that we use the term reprice and refinance. Refinancing is a different process that can cost between $2,500 to $3,000, whereas repricing is around $800 or potentially free (depending on your home loan features).

For help in getting a lower interest rate, message us on Facebook.

6. Consider a small furnishing package

This is a one-time deal, given to tenants who opt to renew their lease for an appropriate length. A furnishing package allows tenants to pick items of furniture that they’d like on the property, such as replacement beds, study lamps, desks, a new microwave etc. Some landlords even include entertainment devices, such as game consoles.

While this does cost money, it’s cheaper than the cost of a vacancy. Also, the furnishings are an upgrade to your property anyway. Some of it – such as beds, desks, floor fans, etc. will continue to be of use to future tenants.

Do remember to add items from the furnishing package to the inventory list.

7. Offer annual deep cleaning at the tenant’s direction

Deep cleaning services, also called moving-out / moving-in cleaning, typically costs up to $400. However, some landlords don’t hesitate to offer this once a year to tenants, for free.

Their reasoning is that they’d have to pay for it anyway. Just for the sake of maintenance, it’s a good idea to deep clean the unit at least once a year (and many landlords do this whenever a tenant moves out anyway, in preparation for the next one).

Because of this, you may as well position it as a perk for your tenants. Other than your basic requirements, do let the tenants pick out what they want – such as dust-mite removal from their mattresses, steam cleaning, etc. This may add a bit more to the costs, but it’s seldom a large amount.

8. Reduce the tenant’s liability for small repairs

In CEA’s template Tenancy Agreement (TA), it usually spells out how much a tenant is liable to pay for certain small repairs. For example, your tenant may be required to pay the first $150 for damaged lights, water pipes, etc., before you cover the rest of the costs.

(We use $150 because it’s a common amount; the actual amount is negotiable)

Some landlords raise the attractiveness of their property by waiving this. They reason that the amount the tenant is liable for is not particularly significant anyway. Also, maintenance costs can usually be deducted from your property tax anyway (see point 1).

If your property is new, it’s also less probable that you’d end up paying for anything this way.

Do point this out to your tenants if you offer it; some of them are unaware that it isn’t the norm.

9. Paying their rent with a credit card to earn miles

There are services out there that allow you to pay for your rent with a credit card (shamless plug: Renthero). In return (depending on the type of credit card you use) that monthly rental payment will earn you airline miles. Of course, there is a small transaction fee involved, but if you know your stuff (Milelion is a great resource) it can potentially be worth paying those fees.

So absorbing those fees may go a long way in letting you retain your tenants. Travel may not exactly be the flavour of the month right now considering the situation, but you can be sure once it returns many will start travelling with a vengeance.

And if you have expatriate tenants, I’m sure they would appreciate enough miles to redeem a flight back home.

Besides all these, the best free thing you can do is know your tenants.

Make little notes so you can engage socially with them – student tenants notice when their landlord sends them chicken essence during exam week; or asks a family about their pet’s operation. The annual Christmas / New Year greeting doesn’t just make tenants inclined to stay – it can also ease any potential disputes later.

In the meantime, keep track of how Covid-19 is affecting Singapore’s private property market, by following us on Stacked. We also provide in-depth reviews of various developments, to help you plan your next investment property.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some low-cost ways for landlords to keep tenants during Covid-19?

How can landlords benefit from taking over utility payments for tenants?

What is a rental deposit guarantee and how does it help landlords?

Why might offering a small furnishing package be a good idea during Covid-19?

How can landlords use loan repricing to retain tenants?

What are some personal touches landlords can do to improve tenant retention?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

2 Comments

Hi Ryan,

Thanks for the article. I am attracted by the suggestion of paying utilities bills for the tenant and that enables the landlord to claim tax deduction from the IRAS.

Is this customarily allowable for tax deduction by the IRAS? I have got a long discussion with the IRAS on one similar item and IRAS has not agreed with me for tax deduction. That was: when I rented out my apartment, the tenant requested to rent it without my furniture, hence I had to store my furniture at a warehouse and incurred storage expense. I submitted storage expense for tax deduction against the rental income, but the IRAS refused to agree with it.

What is your view on my encounter? Can let me know? Thank you.