8 Shady Real Estate Practices To Look Out For In Singapore

March 12, 2022

As a whole, Singapore’s real estate scene is much improved from decades ago; some of our parents probably remember when the rules were more like suggestions than laws. But while the rise of CEA has weeded out most of the bad realtors, there are still some dodgy practices to look for. Regulators can’t be everywhere, so be on your toes when you run into these:

Table Of Contents

- 1. Shady people posing as agents

- 2. Asking for rental deposits without any Letter Of Intent (LOI)

- 3. Fake listings

- 4. Sellers not being informed of offers, because their agent wants higher commissions

- 5. Kickbacks from commissions

- 6. Sending you messages that they have a buyer or tenant ready to transact, right now

- 7. Telling you that your property is worth a lot more than you’re listing it for

- 8. Selective presentation of prices

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

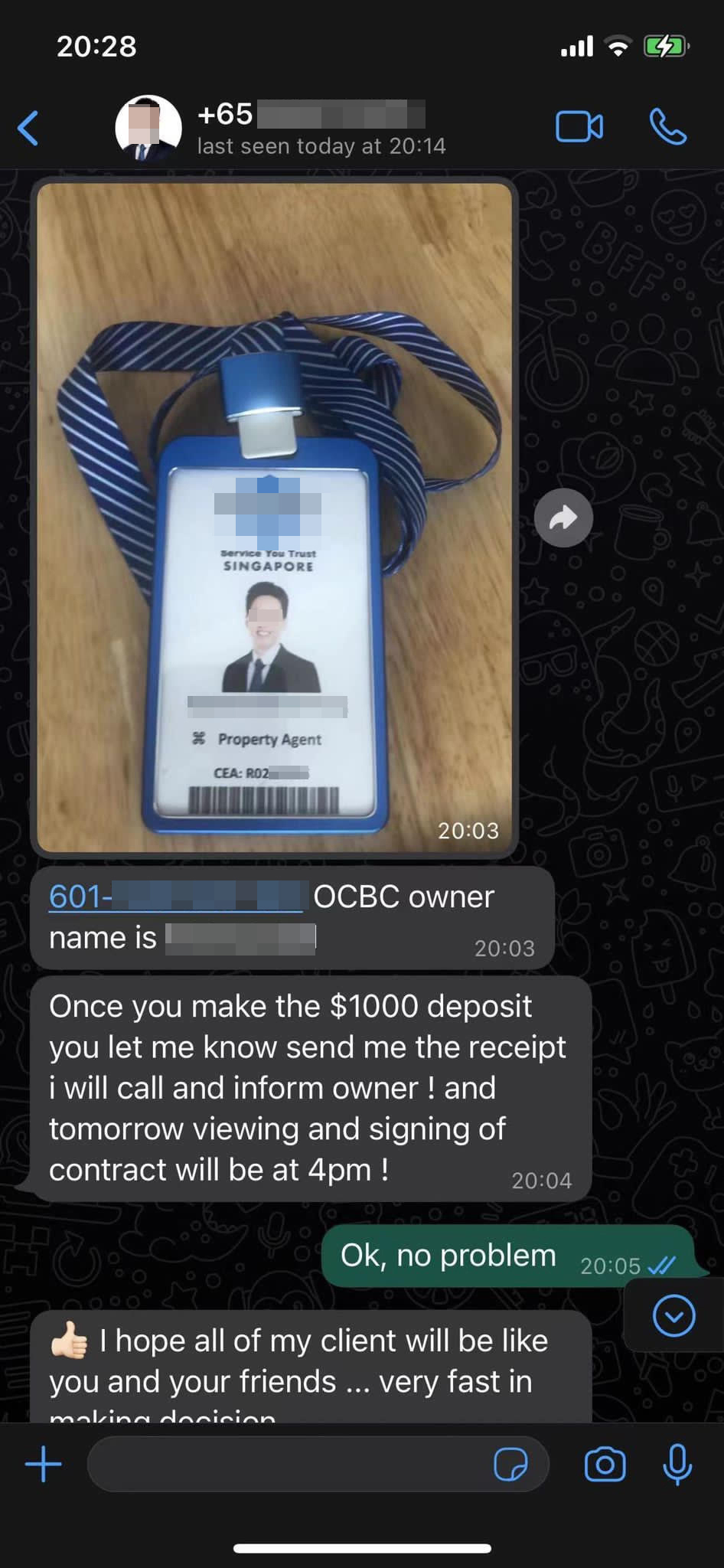

1. Shady people posing as agents

There is no need to pay a deposit just to view a property. If you’re being asked to do this, then odds are you’re not dealing with a real property agent; just a scam artist trying to make a quick buck.

There won’t be any viewing, as they’ll ask you to transfer the “deposit” first, and then ghost you.

You can easily verify a realtor’s identity by checking their CEA license number, but the problem is the people perpetrating this scam may steal an existing agent’s identity; some even set up fake social media accounts, using the actual agent’s name and image.

In general, just refuse to put down any deposits for viewings, as this is not the accepted practice.

It does also only work during a hot property market, where some scammers take advantage of the desperation of some tenants/buyers.

2. Asking for rental deposits without any Letter Of Intent (LOI)

This can be a potential rental scam. The good faith deposit for rental should be accompanied by a Letter Of Intent (LOI), sent to the landlord. If there are no supporting documents of any sort, you should be suspicious.

Any deposit for the landlord should also go straight to the landlord; not the agent – not even if they offer to help “handle” the money for you.

With regards to the rental, try to speak with the landlord if possible, or current tenants; this is to verify a scammer isn’t just trying to hijack a real listing.

Lastly, just know that LOIs are not a pre-requisite, in the event, there’s no LOI, please have the Tenancy Agreement to back everything up.

3. Fake listings

This is when you see a property at an unusually low price, but when you call, you’re told it’s already sold. You will then be given a sales pitch to view some “other options” nearby.

This is the real estate marketing equivalent of clickbait. The initial listing probably never existed, at least not at that price – but it would put up just so the realtor could get your call.

There are also those popular ones that have been sold a couple of weeks ago, but have been left there to “capture” buyers.

Property portals have gotten better at weeding out these agents and listings over time; but they still exist as a nuisance and time-waster. These fake listings often share some similar traits:

- Vague information, or barely any write-up

- When you run the pictures through Google Image Search, you’ll see it has been used in previous listings (they may be re-using an image of an old listing)

- The price is unrealistically low

- Only generic photos of the development as a whole, such as images from the developer’s brochures, rather than pictures of the specific unit

At best, these are a waste of your time. At worst, they can lead to attempts at identity theft. Be wary of filling out forms or answering personal questions, if the listing leads you to such situations.

Though it must be said, there are plans to improve the property search experience for buyers. An Alliance for Action (AfA) on Accurate Property Listings has been set up to combat the issue of fake listings, with the proposal that each property will have a unique serial number implemented before it’s listed. We do hope it will make searching for a home online a lot less tedious than it is today.

4. Sellers not being informed of offers, because their agent wants higher commissions

It is mandatory for the seller’s agent to inform their client of all offers made. They can advise their client to take or refuse the offer, but they must notify them of it.

Shady agents sometimes ignore or refuse to respond to texts from a buyers’ agent. This is because, for most private property sales, the seller pays a commission of two per cent (negotiable), and this amount is split (can be evenly or unevenly, depending on who has the power) between the buyer agent and seller’s agent. In today’s market, the seller agent likely has the upper hand.

Some sellers’ agents, however, want the full commission for themselves. As such, they ignore any calls from buyers’ agents, and the sellers could lose out on potential offers.

There are some sellers’ agents known to be infamous for this, and the hot seller’s market so far has only strengthened their case. But it’s a fine line to tread, as if your direct buyer pulls out of the deal you could end up with no buyers ultimately.

Buyers’ agents sometimes know when this is happening (when they text from a different number, they can suddenly get a response from the sellers’ agent!)

What balances this ecosystem is that most experienced agents understand that there is always going to be a buying season and a selling season. As a seller’s agent, you can’t enjoy this run forever. You could choose to ignore other buyer agents today, but when that swing comes around and there’s a lot more supply than demand? It’s a short-sighted move, that could bite you back.

Finally, for sellers, you will need to do your own due diligence as well. One possible way to mitigate this is through some good old on-the-ground research. If your condo has a healthy volume of sales transactions, try and spot viewings that happen over the weekends. You might notice that buyers that come in may only do so with no accompanying buyer agent, and the same seller agent every time. This typically means that it could be one of the agents that shun co-broking deals, so stay wary.

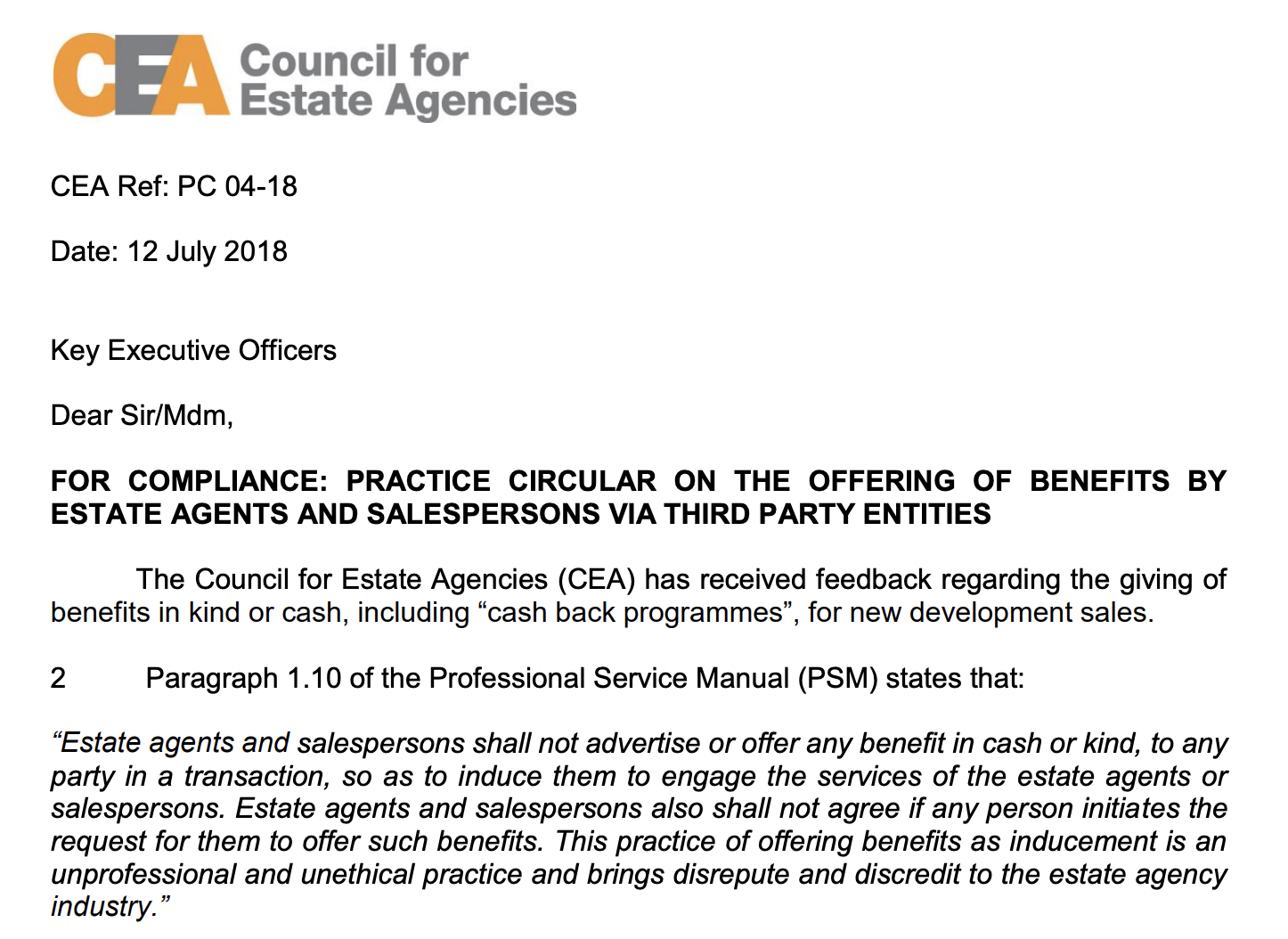

5. Kickbacks from commissions

This is when a real estate agent gives buyers a portion of their commissions, to close a sale. These are sometimes disguised under other names, such as “referral fees”, or maybe routed to the buyers via third parties.

The practice became most prevalent in the aftermath of raised ABSD rates, during the 2018 cooling measures – it was a way to alleviate the stamp duties for some buyers.

While this is illegal, it is very difficult to catch such agents. Some buyers are even in on it, and deliberately seek out agents willing to cut such deals with them.

You need to be wary of any agent that proposes such deals. While it may seem great on the surface, keep in mind that they are doing something illegal, and involving you in the process. We’ve written about it before here, but do remember that there is nothing stopping the agent from not fulfilling their end of the deal when the commissions do come in. There’s no regulatory body that you can appeal to that would help.

Be especially cautious if the agent is the one who initiated just to close the deal over other agents. It speaks volumes of their character, and that they are the sort that may just be in it for quick cash to get in and out.

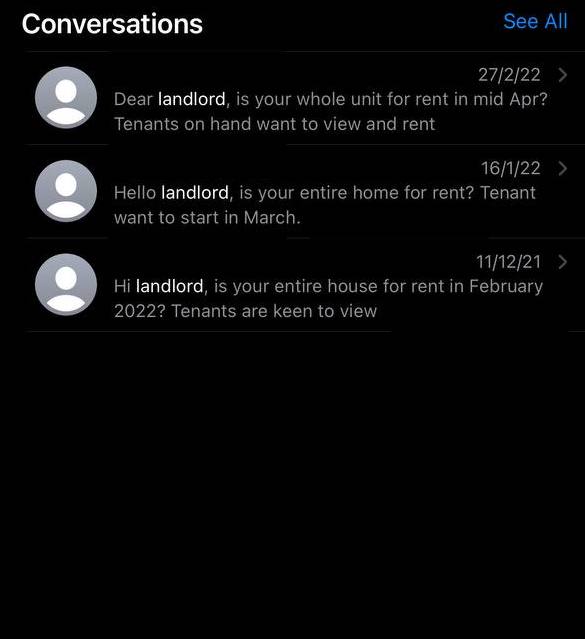

6. Sending you messages that they have a buyer or tenant ready to transact, right now

One unique challenge of being a realtor is that you need to build your own inventory. There’s no point having buyers, when you have nothing to sell.

Hence this bait-and-switch tactic, to get the seller, to engage them. Why continue with a current agent, when they have a ready buyer or tenant for right now? Likewise, if the seller happens to be using a DIY route, this is to convince them it’s quicker and faster to just engage the agent instead.

The buyer or tenant is likely fake. Once you’ve taken on the agent, you may be told that they “decided on another property”, or “had family issues”, or have some reason or other to change their mind.

This is against the code of ethics for property agents; but some are so skilled at doing it, they’re almost impossible to catch. Some even have an accomplice masquerading as an interested buyer or tenant for a time, before making up an excuse to pull out.

An easy way to combat this is to register yourself on the DNC list. If you are still getting unsolicited messages from agents, you have every right to report them to the PDPA.

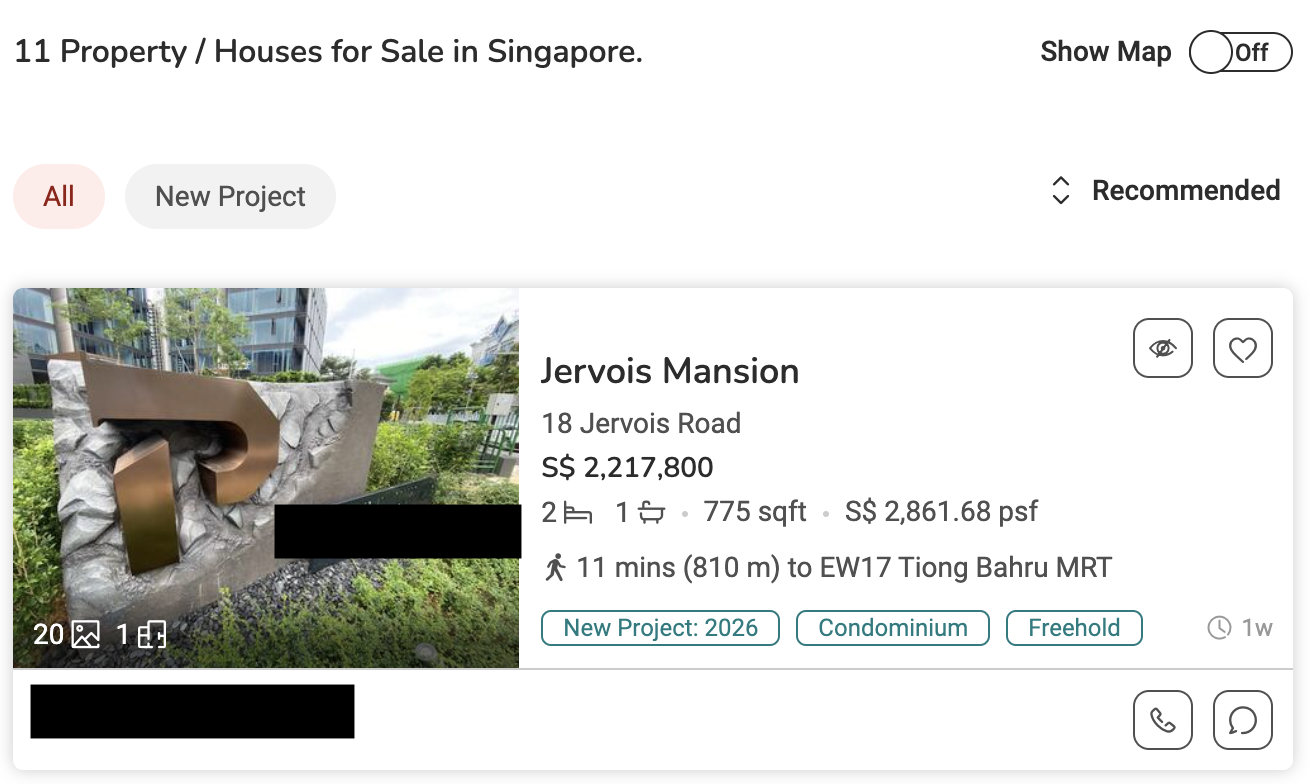

7. Telling you that your property is worth a lot more than you’re listing it for

As with point 7, this is an agent trying to get a seller to engage them. The agent will often take the highest transaction they can find, and use it as an example of why you should be selling for more (and they can totally do that for you, of course).

Sometimes the examples they give are inappropriate – such as by showing you the price of a unit on the 30th floor, and comparing it to your 10th floor unit.

It’s a good idea to check URA transaction records to discover the plausibility of what the agent is claiming. You can also get quotes from multiple agents, to check if there’s a huge discrepancy (if they’re quoting you a price higher than three or four other agent’s quotes, then their numbers are probably questionable).

Since everything is so transparent nowadays, another easy way is to approach a mortgage banker to do a valuation of your property to really be safe.

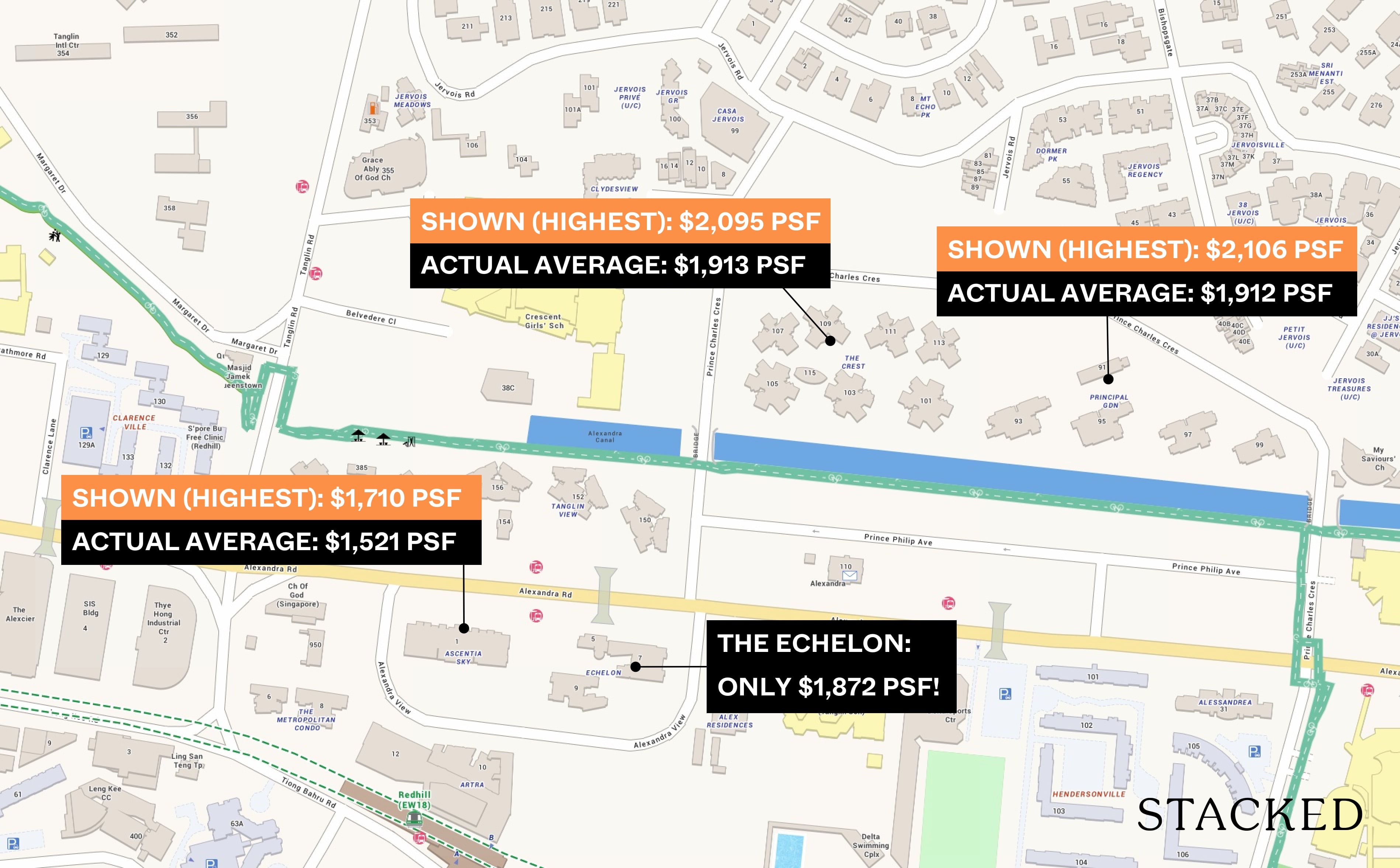

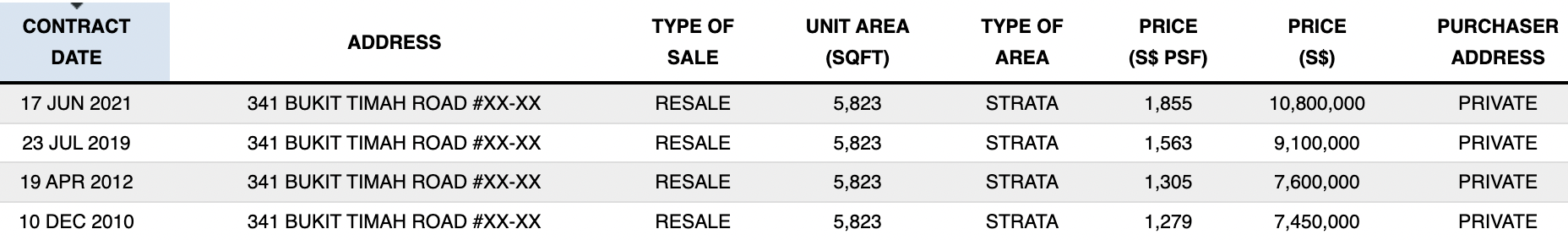

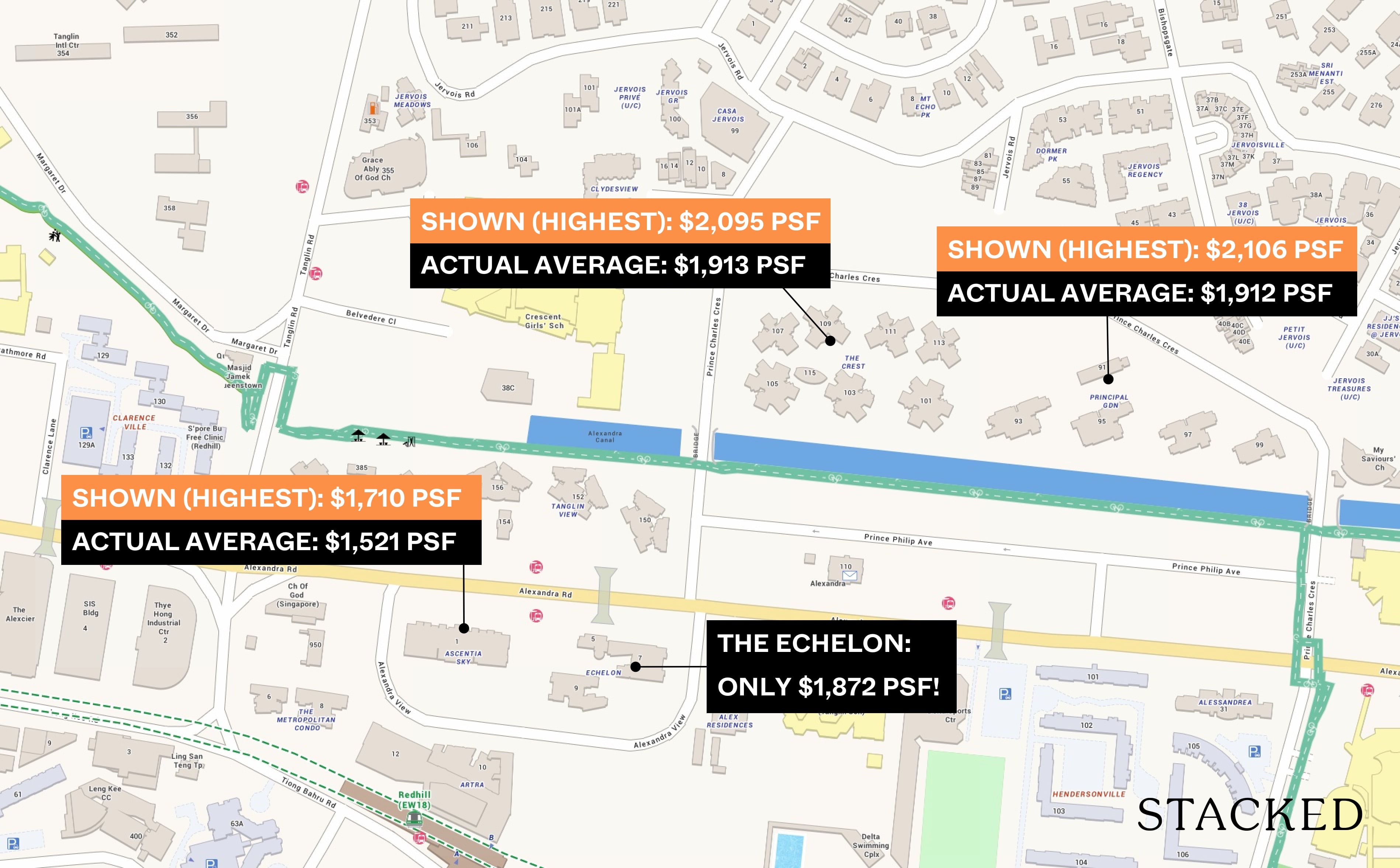

8. Selective presentation of prices

The same trick in #7 can also be used to convince you to buy. For example, the agent may show you only the highest prices in nearby developments, to convince you that the property you’re viewing is “cheap in comparison”.

One trick is to tell you the average price when the average has been rendered useless by an outlier. As a simplified example:

Say there are 10 units in the same development, of which nine sold for $1 million. However, one unit was an outlier, which managed to sell for $1.5 million. The average price among the 10 units is thus $1.05 million.

This answer to your question “what’s the average price?” can thus be $50,000 higher than what nine out of 10 buyers paid – and it wouldn’t be a lie.

In another example, let’s say the last few units were sold at $1 million, but the very last unit was sold at $900,000. The seller agent keeps fixating on that in order to get you to lower your price to sell it quicker. Do your own due diligence to try and find out why that specific unit was sold at $900k. Was it facing a rubbish chute? Or was it an urgent sale?

While most property agents no longer resort to these tactics, that doesn’t mean none of them will. Given the huge amounts involved, it pays to be extra careful about the realtor you engage. You can contact us for more direct advice on Stacked, or also follow up on news and trends in the Singapore real estate market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments