6 Surprising Property “Red Flags” That Are Bad For Some, But Good For Others

December 7, 2023

This is the most ideal topic to use the old “one man’s floor/another man’s ceiling” saying because it’s true: not every property “downside” is universally bad for all buyers. There are even cases where buyers go out of their way to find supposedly negative features, for own-stay reasons or special needs. Here are a few situations where supposedly “bad” property issues can work in some buyers favour:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

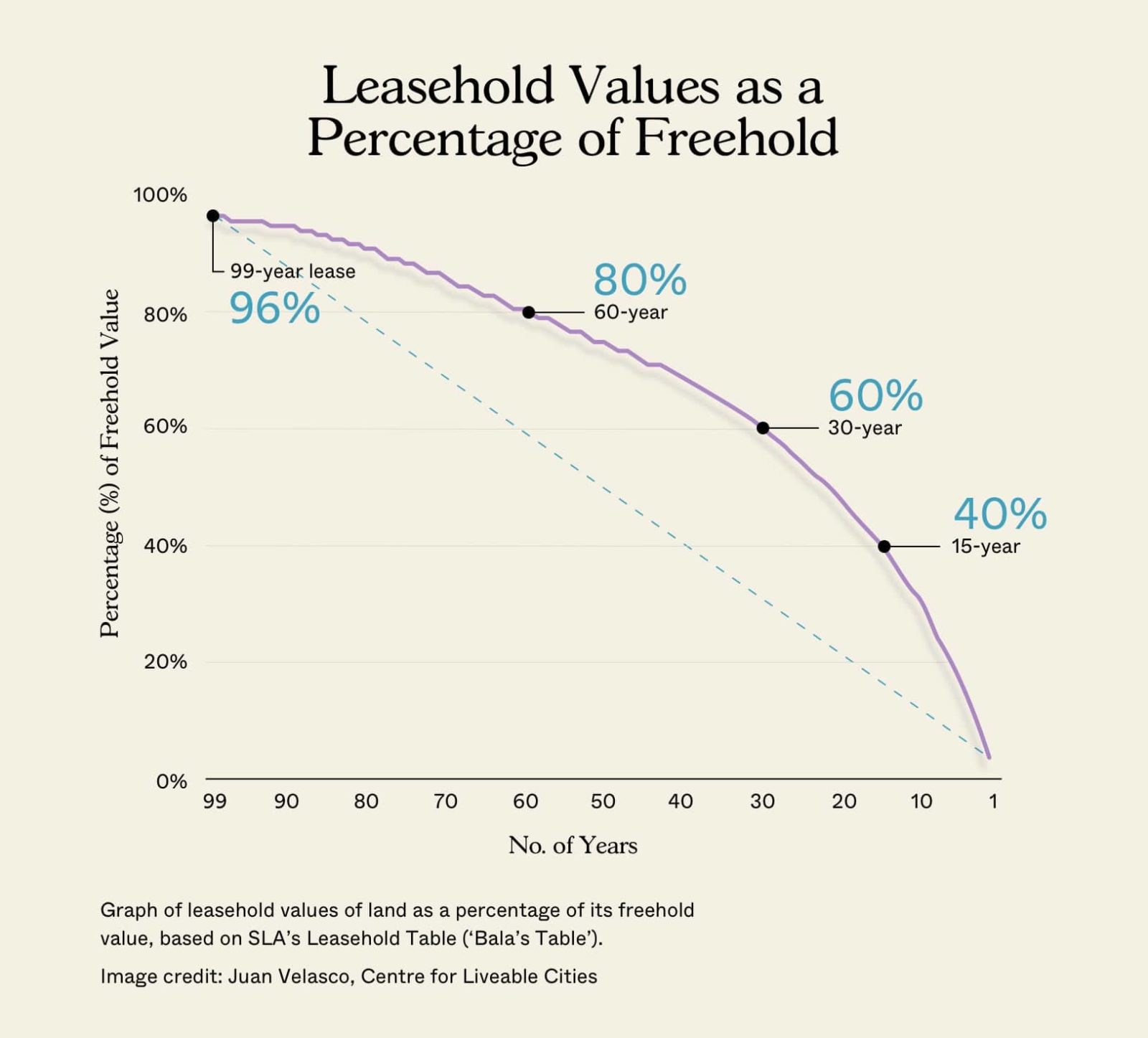

1. Advanced lease decay

Most buyers would never consider a property that’s 40+ years old, where a 99-year lease is involved. They theorise that such a property will have little to no resale potential; and there’s almost always a higher cash outlay, as banks may not give out the full loan for such an old place.

However, there are some buyers who go out of their way to find such old properties; and they even use it to their advantage.

The first are older buyers, looking purely for own-stay use. These buyers have other forms of legacy planning (they have other things to leave to their children, who already own their own homes,) and may just want to stay in a convenient location for cheap with the potential for en bloc being the icing on the cake. An ageing leasehold property can provide this option.

Lutheran Towers, for example, is a leasehold condo built back in 1974. And yet you can still see decent transactions among its 76 units. That’s because, despite being in pricey Bukit Timah (District 10), its huge 1,900+ sq. ft. units are barely above $2 million.

The other type of buyers are seasoned investors and landlords. Because a tenant doesn’t care about the remaining lease, it’s possible to refurbish ageing properties, and rent them out for close to similar market rates in the area.

People’s Park Complex is probably the most famous example of this. This is a leasehold project, where the lease started in 1968. The units here transact for as little as $950+ psf. However, rental rates here average about $4.70 psf, as Chinatown is very central. This consistently produces gross rental yields of 4.9 per cent or higher.

Some landlords only seek these types of properties, whether to be cashflow positive from the start, or because their plan doesn’t involve resale (they just want to collect rent indefinitely, as retirement income.)

Mind you, this strategy is best left to very experienced landlords, as you need the right acumen to determine which properties can be affordably refurbished and rented out. If you make a mistake, it is very hard to sell such an old property; so this is strictly not for newbies.

2. Obstructed or lower-floor views

If you’re buying a unit for own-stay use, consider how much the view really means to you. Is it so important that you’re happy to pay tens of thousands more to be a few floors higher? Or to pick a “premium” stack with unblocked views?

You also need to consider the proximity of other land plots, and their zoning. There’s not much point in paying for a good view, only to have it blocked by a new office tower or condo in a matter of years.

If you’re the sort of homeowner who usually leaves the curtains drawn, or just gets tired of the view, then consider skipping it. The savings from an obstructed view might mean a bigger unit, or it might even cover a large part of your renovation.

There are even some investors who believe in “bad views.” Some landlords will tell you tenants, as a general group, don’t pay more for nicer views. Charge more, and they’ll opt for a cheaper unit in the same project instead; even if the view is pointed at someone’s service yard. There’s no accurate way to study or prove this though!

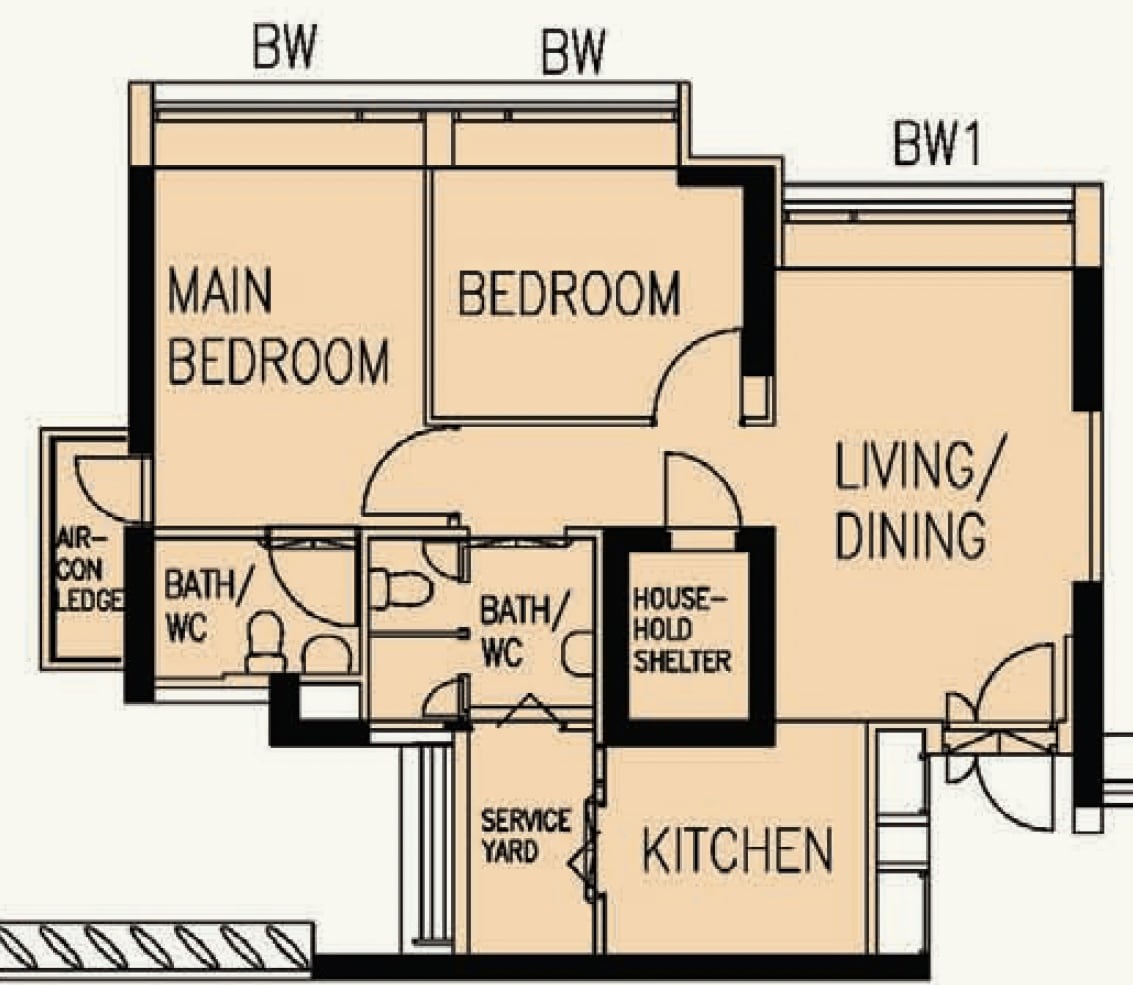

3. Merged rooms for resale units

Most property agents advise against units with merged rooms (e.g., the owner hacked away walls, to turn a three-bedder into a two-bedder with larger bedrooms).

This is often considered a disadvantage: most buyers would prefer an extra bedroom, study, etc. to one big bedroom. This also applies to investors, who prefer the added room to take on another tenant.

However, some owner-occupiers may find such a layout to be an improvement. Couples whose children are moving abroad to study, getting married soon, etc., may find it a practical setup. Certain design themes with a minimalist bent, such as Japanese or Scandinavian styles, may also work better with the new layout. Among buyers who intend to make such changes anyway, finding such a unit will save renovation costs.

If you do have intentions to knock down walls for bigger rooms, communicate this to your agent – otherwise, they may filter out or recommend against such units.

4. Being next to a hospital

Properties like Ola (next to Sengkang General Hospital) or Treasure at Tampines (some blocks are closer to Changi General Hospital) come to mind here. Some buyers rejected these projects – or at least certain stacks in the project – because of proximity to the hospital.

New Launch Condo ReviewsTreasure At Tampines Review: Affordable Pricing At The Expense Of Privacy

by Reuben DhanarajThis can be due to personal taboos, like Feng Shui* or not wanting to live “near sickness.” Other buyers have more earthly reasons, such as not wanting their baby to be woken up by ambulance sirens all the time.

However, being near the hospital has its share of advantages as well. Landlords, for instance, tend to be quite fond of such properties. Singapore has a serious shortage of healthcare workers, and many nurses, EMTs, doctors, etc. are foreigners. Quite a number prefer to live near their workplace, thus providing a catchment area for these tenants.

(That property prices may be lowered by proximity to the hospital also helps, as now the landlord can pay even less)

Some homebuyers also have practical reasons to stay close to the hospital; such as those with medical needs, or who work in the hospital themselves. And as an unexpected quirk, hospitals often end up becoming an amenity to nearby residents: this is due to our tendency to open large food courts, chain eateries, etc. in our hospitals.

*We believe the rule is to be no closer than 500 metres, and anything out of that range is okay; but we’re not Feng Shui experts!

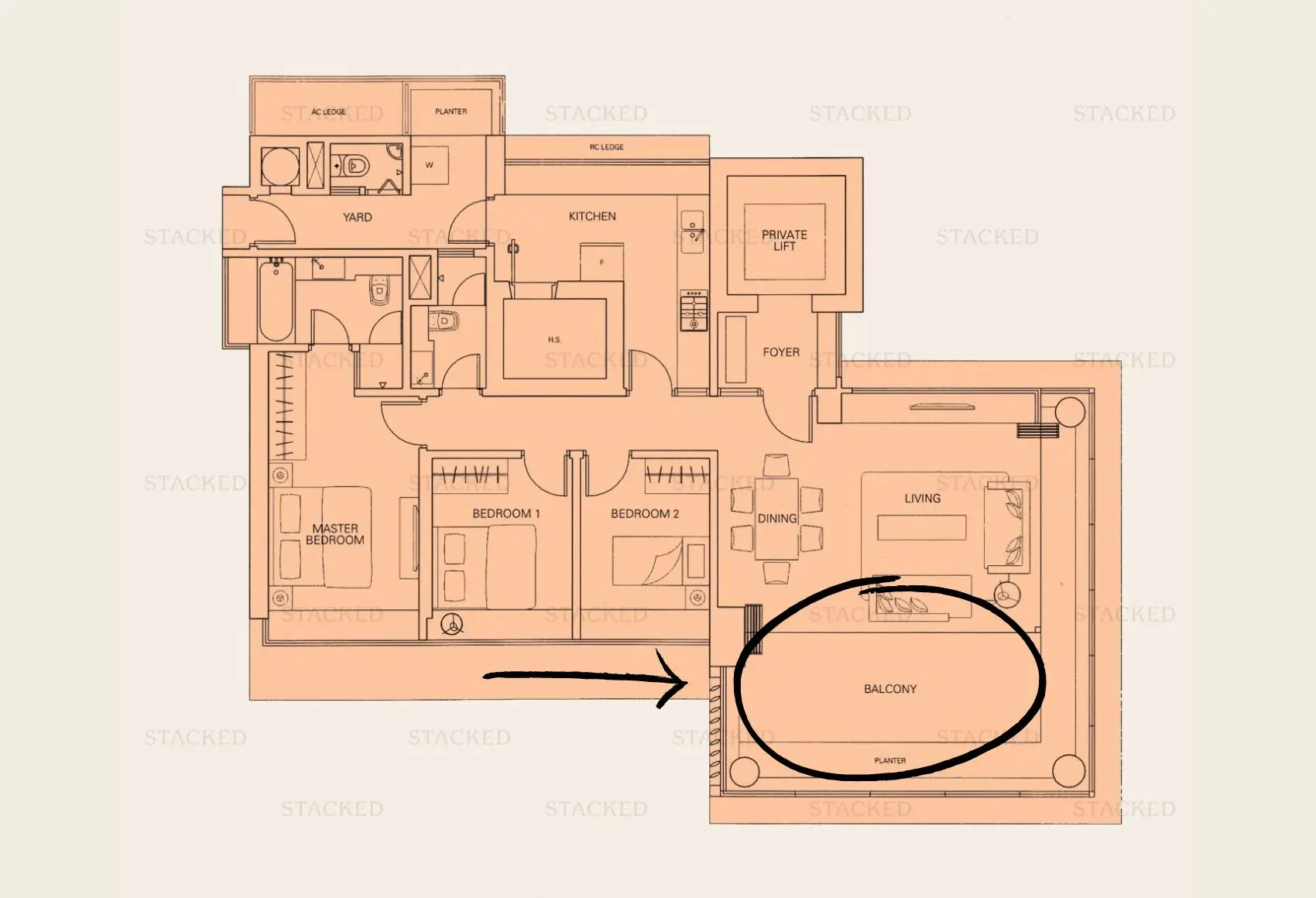

5. Big bay windows and balconies

Bay windows were common in the 2000’s, largely as a cash grab. Back then, developers would charge for the square footage taken up by bay windows, planter boxes, and air-con ledges, etc., despite these areas not contributing much to living space.

As such, most buyers are immediately put off when they see large bay windows. However, some owner-occupiers actually like these – if the bay windows are large enough, they can be converted into reading nooks or napping spaces, right next to the window. Some homeowners also like bay windows for indoor gardening, as they’re safer than leaving plants on an open balcony.

Likewise, you’ll often notice that it’s older condos that feature large balconies. This was considered trendy back in the ‘80s and ‘90s. However, in more recent years, buyers have begun to avoid balconies as a waste of living space. Homeowners today also dislike the maintenance needs of balconies, which are exposed to the elements.

There are, however, home buyers who still appreciate large balconies. Some people like to use these as dining spaces, or see it as an outdoor extension of the living room. Homeowners who have lived in landed properties may also find the transition less jarring, compared to a condo unit that’s completely “sealed off” from the outside.

That said, very small balconies – the sort you can barely fit two chairs on – are still a red flag all around. These small features eat into living space, and are too small to do anything nice with.

(With the exception of homeowners who are very much into their Gundam, Airfix, Warhammer, etc. A small balcony is better than your kitchen service yard, when it comes to airbrush fumes.)

6. There was an en-bloc attempt two years ago, that nearly succeeded

If you’re a homeowner, this is something to be avoided. You don’t want to buy, move in, pay for renovations, and then face an en-bloc sale a year or two later. Keep in mind you’re even liable to pay Sellers Stamp Duty (SSD), if the en-bloc happens within the first three years.

This is every homebuyer’s nightmare scenario, as even trying to fight the en-bloc is a stressful and time-consuming process. For this reason, we suggest you always check out the previous collective sale attempts, before buying a resale condo unit. Even maintenance is an issue, as the MCST is less motivated to upkeep the property, when everyone is just waiting around for a collective sale.

For high-stakes investors, who want to make a quick profit on an en-bloc, it’s the reverse. In these cases, you would probably want a property that’s close to an en-bloc, where developers are already expressing interest. Ideally, you can rent out the unit till the en-bloc happens, then quickly upgrade to another property. While it’s risky, we can’t say you won’t make money doing this, as people can and have done so.

We really wouldn’t bet on many en-bloc sales happening in 2024 though; not when the cost of a replacement property is still sky high.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments