6 Major Property Trends To Watch In The Singapore Property Market In 2022

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

With the start of the new year, some first-time homebuyers in Singapore are understandably nervous: home prices are at record highs across the board, and it’s uncertain if late cooling measures from last December will have a significant impact. At the same time, the market has shown shifting preferences, as the realities of Work From Home arrangements and construction delays start to bite deep. There are possible effects globally to contend with too, from the Fed raising interest rates in 2022 to the ongoing threat of Omicron. Here are some of the trends that we’ll probably see throughout the year 2022:

- HDB resale flats may see a continued uptick, even with cooling measures

Resale flat prices ended 2021 at their highest point in around a decade. Average prices ended at $511 psf, higher even than $478 psf in the last property peak of 2013.

At the time of writing, the data suggests a price rise of 10.6 per cent for 2021 alone. This would make it the highest annual price spike in a single year (the last recorded high was 2010 when prices spiked around 17.6 per cent).

The bad news for resale flat buyers is that, even with December’s cooling measures, we’re not likely to see a significant dip. Realtors and analysts seemed to come to the same consensus:

First, the loan curbs imposed on HDB properties are not stringent enough to impact demand.

There is a five per cent reduction in Loan To Value (LTV) ratio for HDB loans, capping financing at 85 per cent of the flat price or value. However, most Singaporeans already pay more than the minimum down payment of 15 per cent (you can only keep up to $20,000 in your CPF Ordinary Account, and the rest of it must be used for the down payment).

Realtors opined that most Singaporean couples have sufficient funds to cover 20 to 25 per cent of the flat’s price, once their CPF accounts are fully used.

For example, a typical couple of 35-year-old Singaporeans, earning around $2,500 to $3,000 per month, probably have as much as $100,000 to $120,000 in their combined OAs (a rough estimate, assuming total monthly contributions of $425 compounding at 2.5% per annum).

This is far more than the minimum 15 per cent down payment on a $500,000 resale flat ($75,000).

An additional loan curb – a reduction of the Total Debt Servicing Ratio (TDSR) by five per cent – is almost irrelevant to HDB buyers.

TDSR matters when buying private properties or Executive Condominiums (ECs), but HDB already restricts loan repayments to 30 per cent of monthly income under the Mortgage Servicing Ratio (MSR).

Second, the large number of new flats being built cannot immediately sap demand for resale flats

The government has ramped up the supply of BTO flats for the next two years, by around 23,000 per year.

To be clear, this will help to lower demand for resale flats at some point in the future. However, the common consensus among realtors is a lack of immediate impact. Building more BTO flats, for instance, doesn’t fix the issue of Singaporeans who need new homes now, due to factors like Work From Home arrangements.

Likewise, a number of realtors pointed out that some buyers cannot opt for BTOs instead of resale, even if they wanted to. These include those who have just sold off private properties to downgrade (they have to wait 30 months before they can ballot for a BTO flat, which is unrealistic), those who bust the HDB income ceiling, and families that are all Permanent Residents.

As such, the construction of more BTO flats provides no real abatement to the demand for resale flats.

Resale flat buyers in 2022 may want to temper their optimism, even in the face of cooling measures. The best we can hope for is perhaps a slower rise in prices.

2. Rising resale flat values, coupled with fewer new launches, may see resale condos retaining centre stage

The number of unsold private homes had shrunk to around 17,140 by Q3 of last year. This has since reversed predictions of a supply glut back in 2019, as most of the redevelopments from the 2017 en-bloc fever have now been completed and sold.

This is coupled with the fact that fewer new launches are expected for 2022, compared to last year. Current estimates suggest 5,000 to 6,000 new private homes being built for 2022 (excluding ECs), down from as many as 10,800 units last year.

While the government has put up more GLS sites, this is counterbalanced by higher stamp duties for developers. Under the December 2021 cooling measures, developers now pay 35 per cent ABSD, up from 25 per cent previously. Given the tight margins developers are on, this could see costs passed down to buyers; probably at least in the form of less attractive prices.

It could also crimp developer confidence, preventing more en-bloc sales for larger sites. This will further tighten supply.

The lower supply of new homes, coupled with upgraders flush with cash from high resale values (see point 1), could help to maintain rising prices for new launch condos – even in the face of a tighter TDSR. So as with resale flats, it’s unlikely that we’ll see much price dips; just a slower pace of price hikes (and even then, it’s assuming good luck on the part of buyers).

Singapore Property News16 Dec 2021 New Property Cooling Measures Kick In: Here’s How It May Affect You

by Ryan J3. For seasoned investors, commercial properties may replace residential as an alternative

For investors who already own two homes, the cooling measures make a third residential property unpalatable. The ABSD for the third and subsequent home, even for Singaporeans, is now 25 per cent – an increase of 10 percentage points from the previous tax.

For PRs, the ABSD doubled from 15 per cent to 30 per cent.

Realtors on the ground expect that, for pure investors who already have multiple properties, residential may be out of the picture for 2022. Rather, investors may divert to commercial properties, which have no ABSD.

There is, however, a seven per cent GST, which some expect to be revised upward after the next budget announcement (prompting some to buy before it happens).

In the office sector, sentiment has been buoyed by reports since Q3 2021, which suggest rising rentals and fewer vacancies despite Covid-19. However, realtors have cautioned that these reports are for Grade A office spaces in the CBD, and will apply quite selectively.

Meanwhile, logistics and industrial sectors – and the related properties – have also performed unexpectedly well since around July 2021. However, their continued performance is not assured and is dependent on factors like the Omicron variant and confidence in the face of a continued pandemic.

In any case, it’s expected that investors who already have multiple residential properties will be inclined to diversify in 2022. If they remain focused on real estate, they might move into the commercial sector, or into tangentially related investments like REITs.

4. Tenants are likely to seek longer leases, to lock in good rental rates

Landlords are the big winners of the last round of cooling measures, with foreigners seeing ABSD rates spike to 30 per cent. This comes on the back of rising rental rates, which are currently at a six-year high.

2021 and 2022 present a rare situation, where rental demand from locals is also at a peak: rising prices, or construction delays, are forcing more Singaporeans into the rental market.

Then we have expats who don’t want to pay higher ABSD rates and foreign workers – including many Malaysians – who are eager to secure accommodations in case of travel movement restrictions.

This presents little possibility for rents to fall right now, and most tenants near the end of their lease are feeling the heat. We expect many tenants will try to jump to secure a longer lease if the landlord doesn’t raise their existing rent.

At the same time, prospective tenants – which includes HDB upgraders – may want to set aside a higher budget for accommodations. There is very little bargaining power on the side of tenants right now, and this is likely to carry on for all of 2022. This could see a drop in leasing volume further ahead, with fewer tenants settling for short three to six-month leases (there’s too much risk that the rental rate will be higher at the end of a short lease).

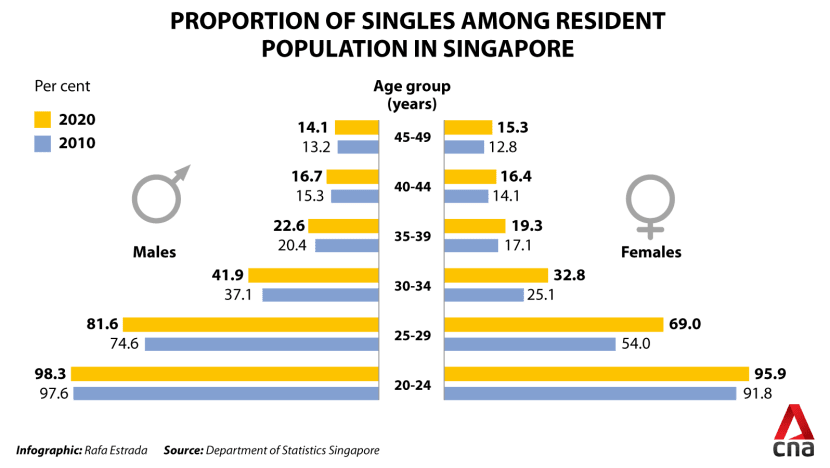

5. Marriage rates are starting to have an impact

As we’ve known since last year, more Singaporeans are choosing to stay single. This will have a growing impact on the real estate market. For example, singles are unable to purchase HDB flats until they turn 35; so millennials who need to leave home are more inclined toward rental, or private properties if it’s within their means.

While the effects are difficult to quantify right now, we’re almost certain to see them in the next few years – and Work From Home arrangements during Covid-19 may be the tipping point. One example of a big potential change is in the demand for larger homes: bigger units were the vogue in 2021 due to a large number of HDB upgraders. However, with singles gradually becoming a larger demographic, we may see a returning preference for single or double-bedder units.

It also raises the question of whether the supply of homes – including HDB flats – will be sufficient, if more Singaporeans are owning homes as singles rather than families. Already, one of the chief complaints about housing models like Prime Location Housing (PLH) has been discrimination against singles.

Singles became a more vocal group of home buyers in 2020 and 2021, and we expect the clamour – and demand – from this group to grow in the coming year.

6. A general shift to fixed-rate loans again

Variable-rate loans, or loans with short interest rate periods of one month, were quite prevalent during the past two years. This was because interest rates hitting record lows, as the US tried to stimulate its economy in the face of Covid-19. Here’s a crazy stat for you, 35 per cent of all US dollars in existence has been printed since the start of 2020.

Hence, low-interest rates have caused inflation to surge in the US, and drove Singapore’s headline inflation to 3.8 per cent. In the coming year, interest rate hikes are coming in the US, as the Fed tries to rein in inflation. We’re likely to see a knock-on effect in Singapore, as interest rate packages start to creep up from the current average of 1.3 per cent.

For reference, rates of around two per cent were common in 2018, when the US was stabilizing from the last Global Financial Crisis.

Mortgage brokers we spoke to said there’s growing appeal in longer interest rate terms (e.g., three-month SORA instead of one-month SORA), or a renewed interest in fixed-rate packages. But at the same time, many cautioned that (borrower preferences aside) fixed-rate packages could still be more expensive than floating rates, even for all of 2022.

This is because the Fed doesn’t just normalise interest rates in one fell swoop. Rather, the rate is often gradually raised in increments of 0.25 per cent, and variable rates could still end up cheaper than fixed rates over the next 12 months.

Speak to us if you need to refinance or are looking for a home loan, and we can put you in touch with an appropriate expert. Don’t opt for locked-in rates as a knee-jerk reaction.

Finally, 2022 is shaping up to be a year of exploration

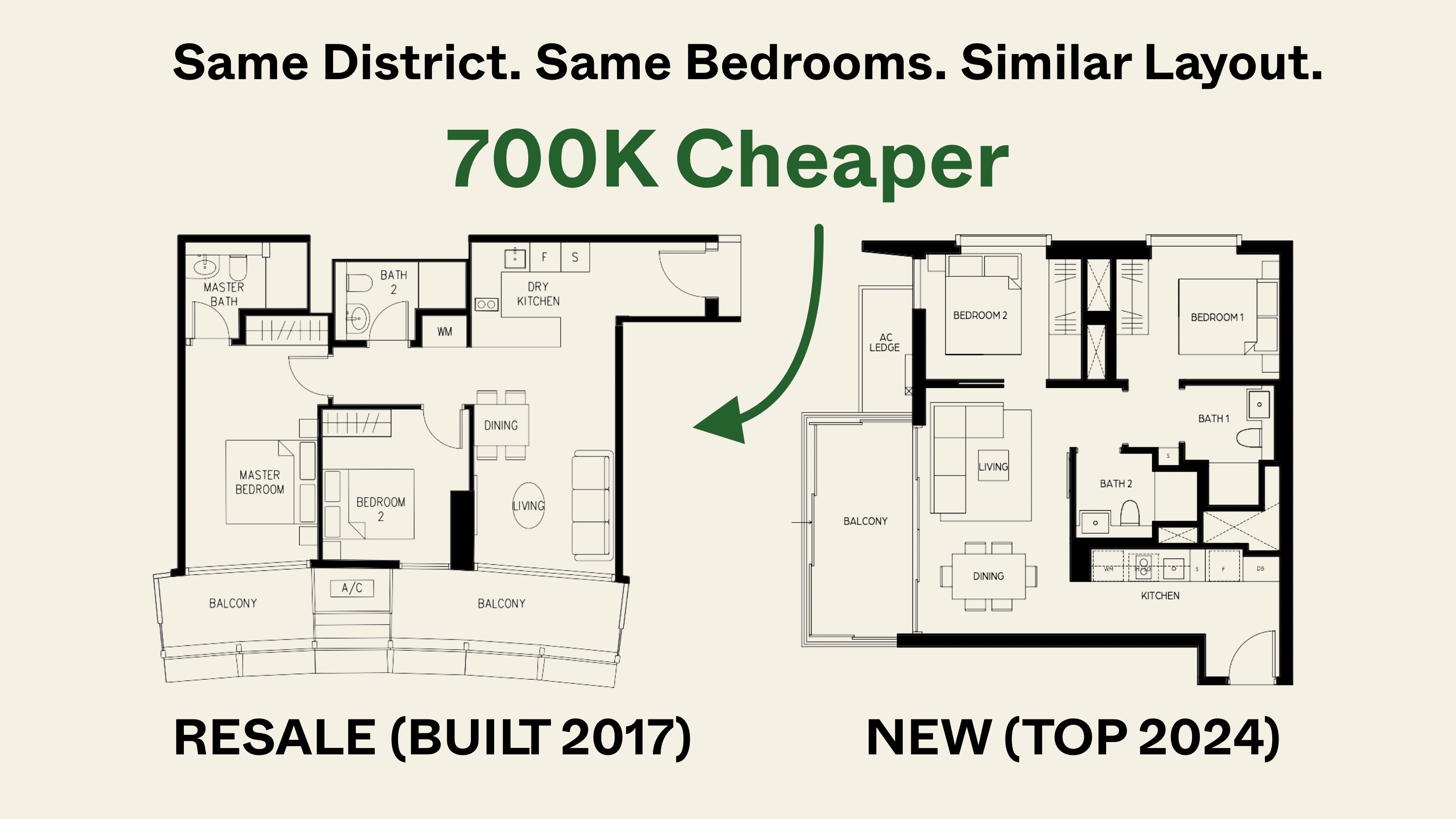

On the ground, we’re seeing increasingly bold moves from buyers – such as a willingness to purchase even 40-year-old walk-up properties.

Some pure home buyers, due to high prices in the condo market, have instead gone for resale flats; and the excess savings are used to splurge on renovations. At least one agent told us of a couple who “saved” over $600,000 by opting for a resale flat instead of a condo, and was hence happy to spend over $120k on renovations alone!

This exploration has leaked into digital real estate. With the high stamp duties on physical properties, as well as eligibility restrictions (e.g., singles can’t buy flats, foreigners can’t buy freehold landed homes, and so forth), more new investors might be tempted to look into virtual options like the Metaverse.

With conventional stock and bond markets looking threatening, and new investors being priced out of the physical real estate, we can understand the appeal (although this isn’t an endorsement, so much as an observation).

Do follow us on Stacked, so we can keep you up to date on new trends as they appear. We’ll also provide you with an in-depth look at new and resale condos alike, as 2022 is a year to be especially picky with your home purchases.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Trends

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

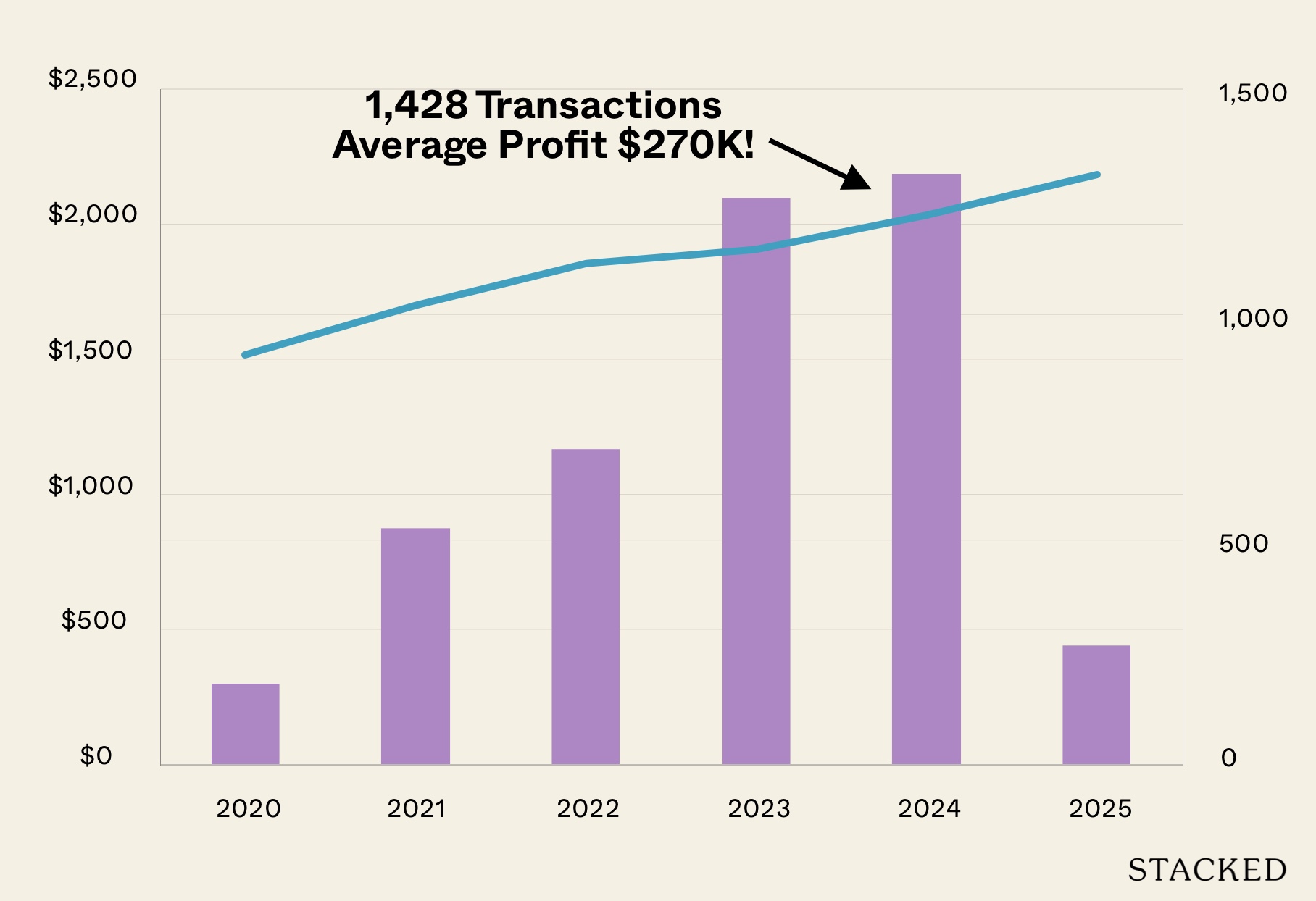

Editor's Pick Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

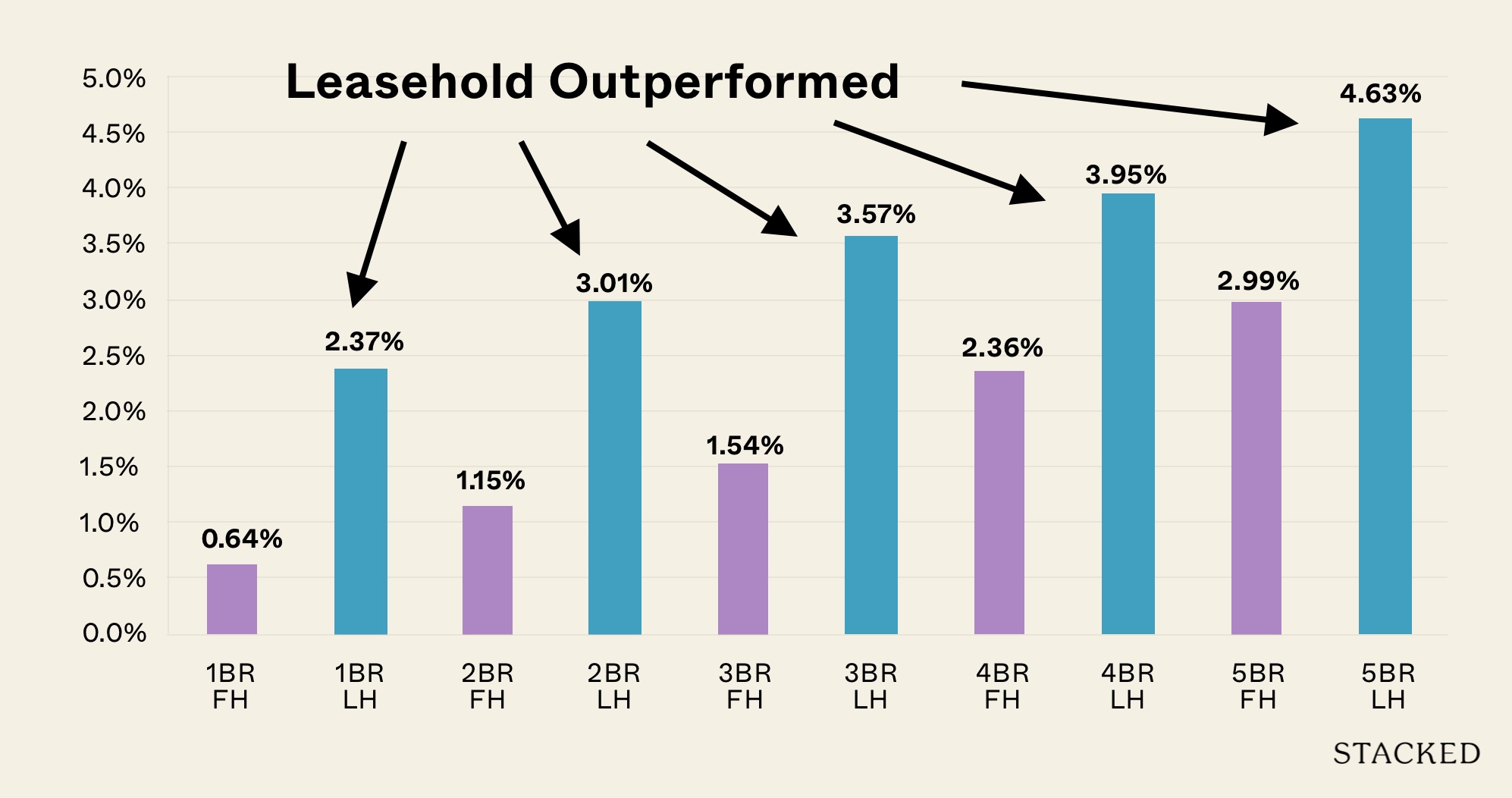

Property Trends Should You Buy A Freehold Or Leasehold Condo In 2025? Here’s The Surprising Better Performer

Latest Posts

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

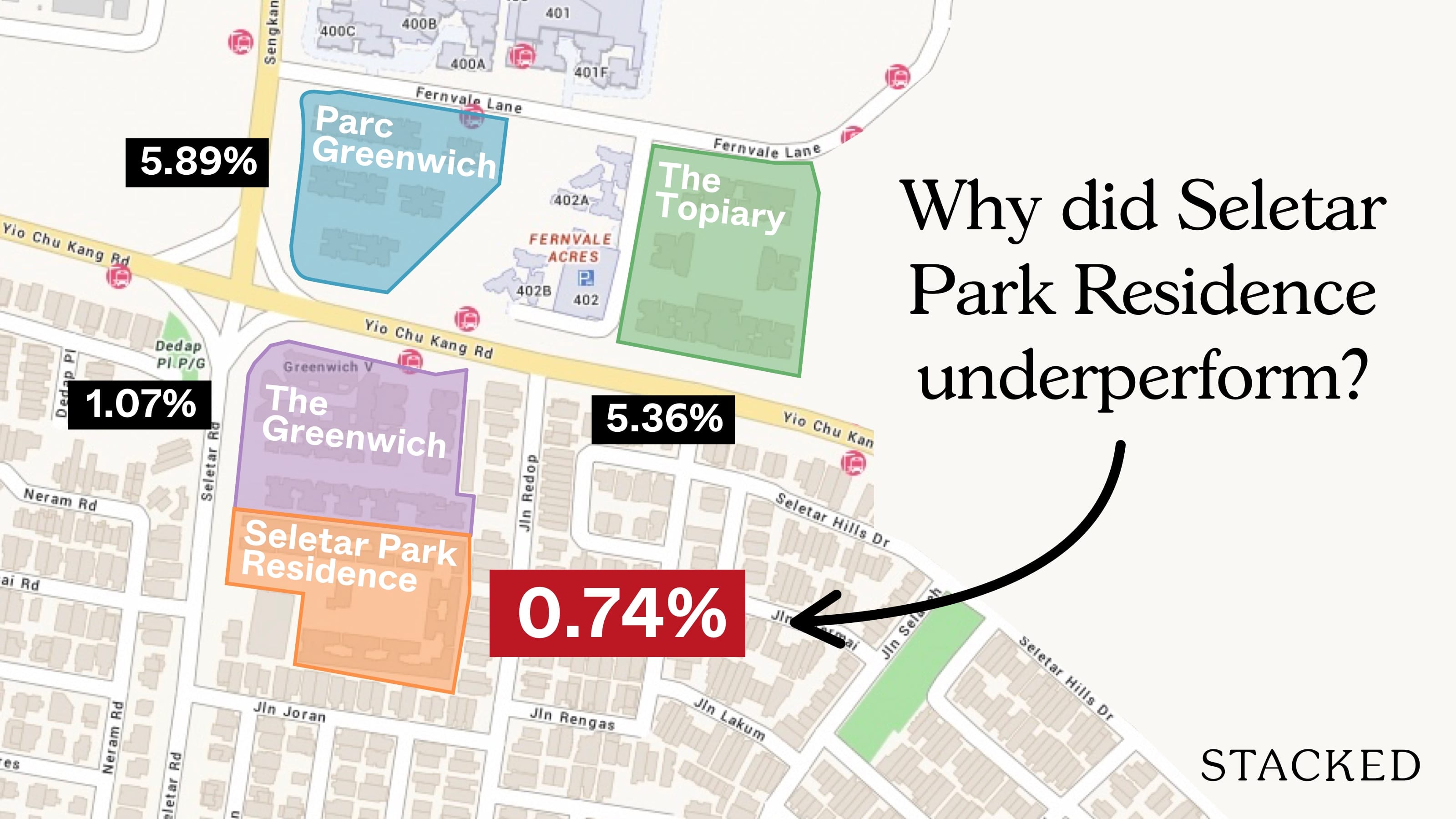

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

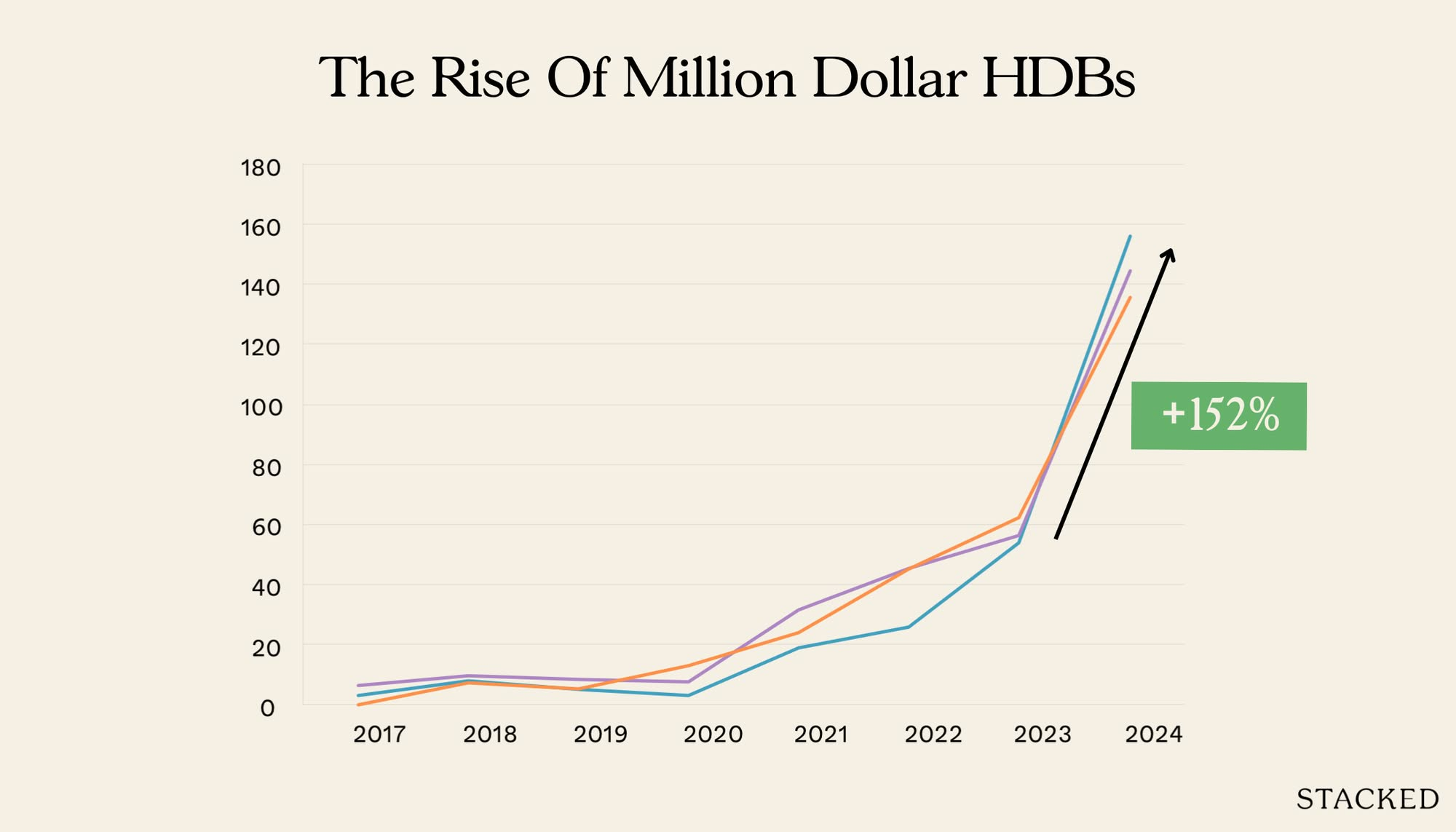

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

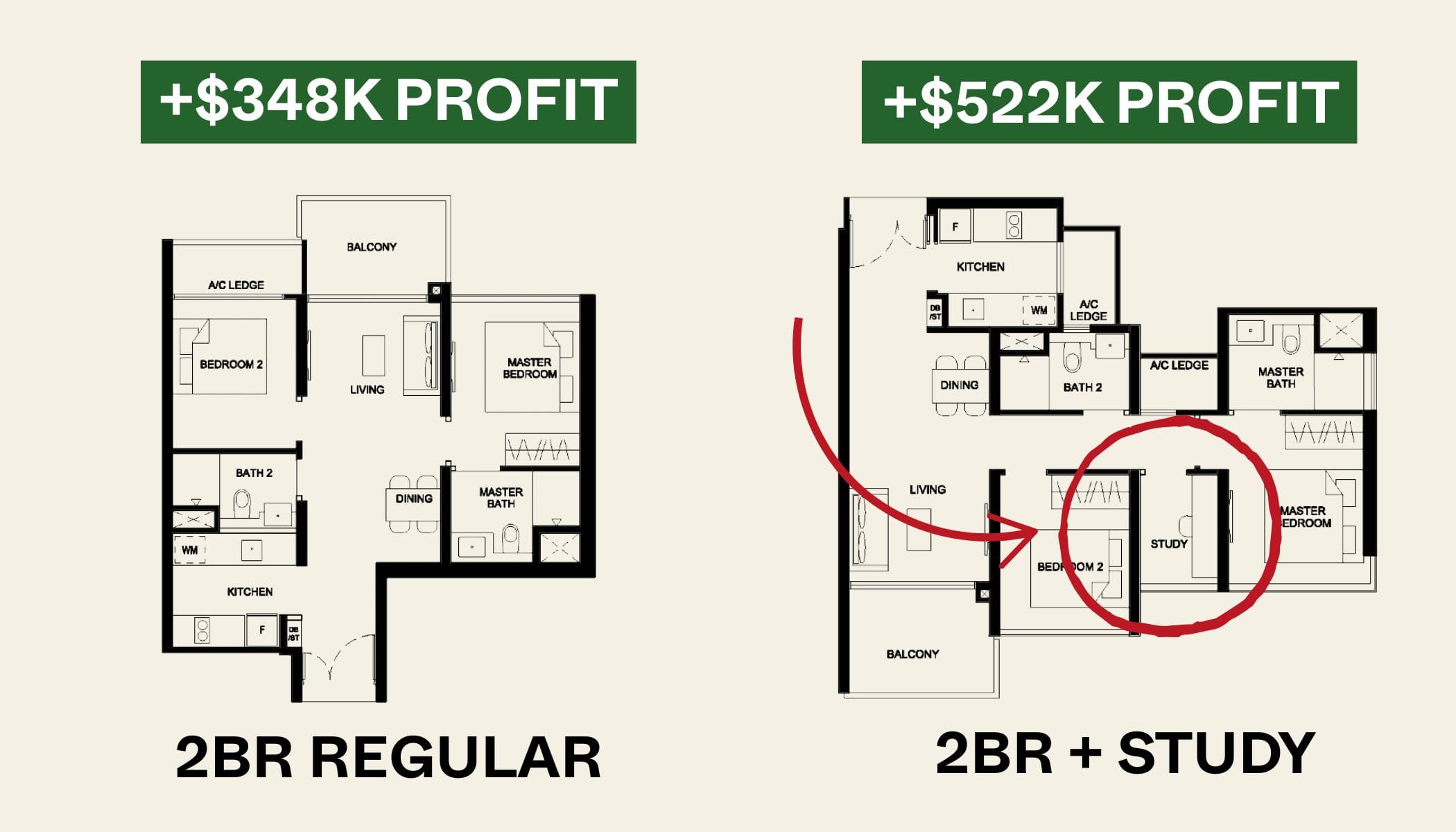

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

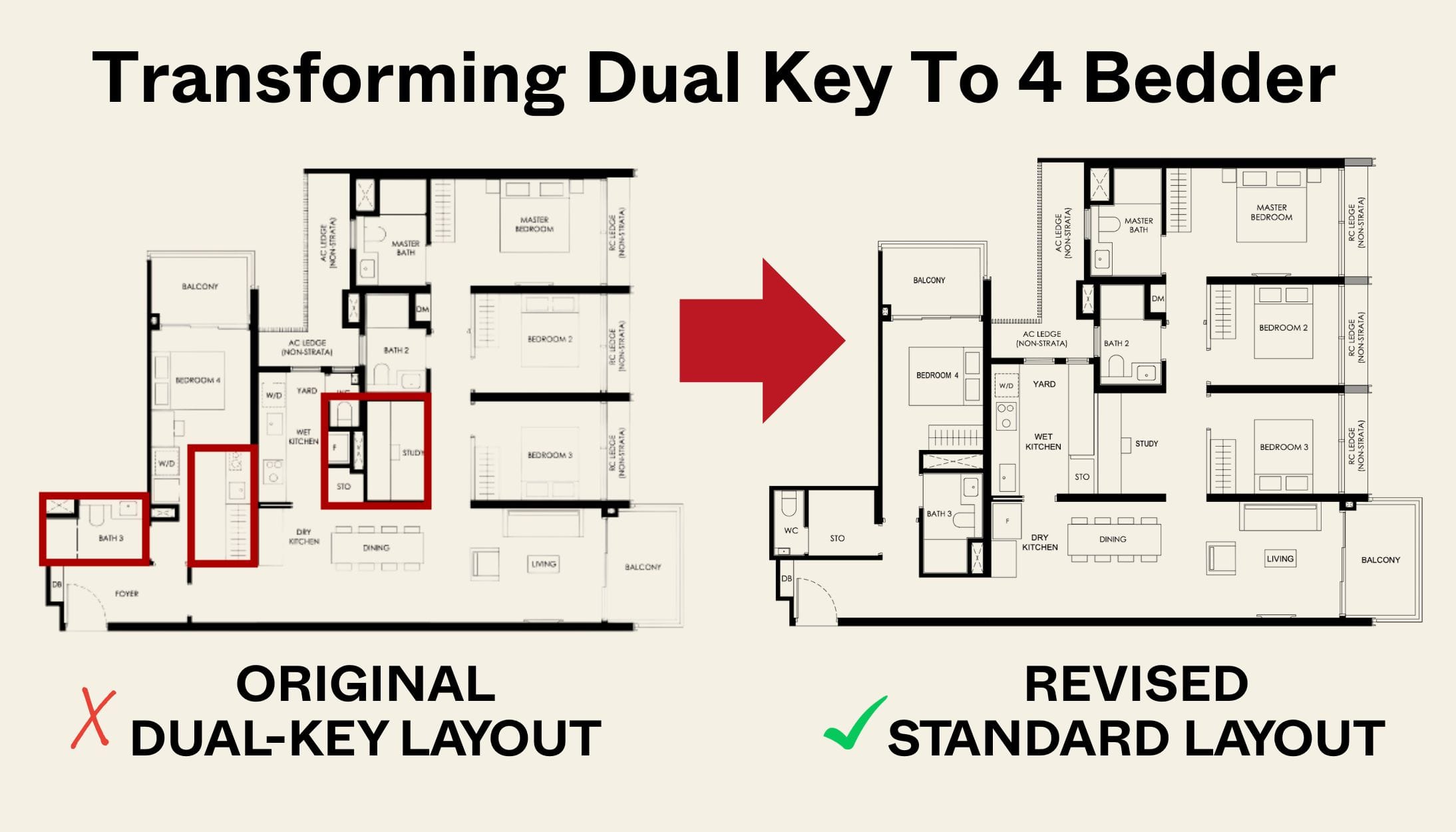

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Editor's Pick The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Hello, Ryan. My mane is yumiko. my husband and I are looking for a private condo for first purchase to live ourselves, but we have no clue for SG real-estate market…

We can’t find any good agents so far ….and We got impression that they are all just interesting to make quick money…… so I need some advice from you…. if you don’t mind.

My husband holds American Citizenship. We are currently renting a unit in The Cosmopolitan (freehold, 2008) which is just across from the Great World City and we love this condo very much. this condo has a lot of sunlight-in and efficient layout and high ceiling and open-concept living area ( 3 beds 1399sqft.)

FYI, We have to move out this unit in March 2023. If we decided to buy a condo, we have to resale in 5 to maximum 7 years and have to move back to our country.

I am wondering that if we buy the unit in The cosmopolitan 1399sqft here, in 5to 7 years could potentially lose money??? Since SG Government placed another restriction, market will be calm down….I am worry that if we buy this property this year, it may end up losing money in 5-7 years….. Also because it’s old condo. By the time we resale a unit, this condo will be very old….it maybe difficult to sell…..??? but so far this condo has great reviews and maintain quite well and great location.

Also another factor concerns for me…. I heard from an agent that 3 piece of empty lands will be on sell near future near the GWC MRT station. it means that another 3 new condo will be build in this area soon. But Right now, 3 condos are under construction near by. 2 condos will be finished in 2023 and other one will finished in 2026. All those new developments and future developments effects on old condos near by negatively in 5-7year ???

Do you have any suggestion?

Also I look at Echelon near redhill art, I like the layout but reviews are quite bad and 99years lease, 2016…..

soon there will be another condo develop in front of echelon….. but good location near MRT.

Another place I look at is Sail @marinabay. I like the space and many light coming in, but 99 years lease, 2008. It’s old and not good reviews….but it’s cheaper compared to River valley area suprisingly. I don’t know why its so cheap…. it’s in front of marina bay with good view from unit and larger sqft…. something is fishy…..

If we chose to buy one of those three, it would be risky to lose money or difficult to resale in 5-7 years???

Should we postpone buying some place?

Renting price is sky rocketing these days and not many renting place is available around here and probably it will continue to increase….. since GWC MRT is coming up behind this condo…. Do you think its worth to buy here and resale in 5-7 years later? It’s too risky?

I am quite lost….. would you give me some advice please…….

Thank you very much,

Best regards,

Yumiko