6 Key Steps To Take When Right-sizing Your Property

November 25, 2020

So the children have moved out, and you’re sick of cleaning up your huge 1980’s five-room flat / three-storey bungalow / humongous condo. Or perhaps it’s time to cash out and retire early or retire well. Whatever the case, you’re thinking right-sizing: and what better time to do it than in Covid-19, because having cash turns crisis to opportunity.

This is also, however, the point at which you realise right-sizing is easier in concept. The devil, as they say, is in the details – from accidentally trading up your maintenance costs, to a CPF refund that wipes you out. So before you go ahead with this, here’s a Stacked Homes checklist on the key steps to take first:

- Set quantifiable targets

- Review available grants and short-lease options (for HDB)

- Check HDB’s requirements before assuming you can right-size into a flat

- Address financing issues involving age

- Plan long-term for maintenance costs

- Work out differences in required amenities

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Set quantifiable targets

This is more in the realm of financial planning, but it has to be mentioned as a common right-sizing goal is supplementing your income. This means you need to work out how much of the net sales proceeds will go into your next home, and how much will go into your retirement fund.

For example, say you need $150,000 from your property gains, to supplement your retirement fund. Your estimated net sale proceeds are $350,000. This leaves you with only about $200,000 left, when scouting out potential replacement properties.

Now as we’re not financial planners, so it’s not our place to advise you on how much you need to retire – but you should consult a qualified professional to work out how much you need.

Knowing the exact number helps you to shortlist viable properties, based on their quantum and required down payment. For your reference, here are some general prices today:

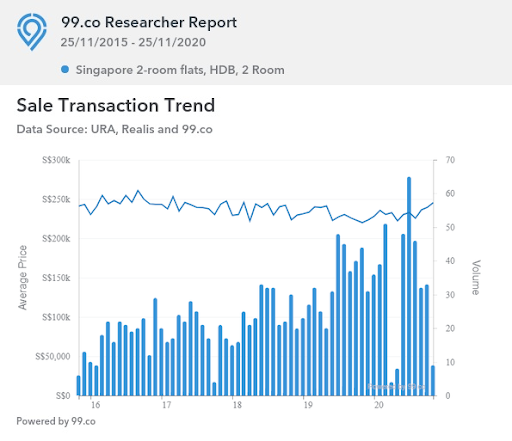

Resale 2-room flats average $239,412 as of October 2020 (see below regarding short-lease options).

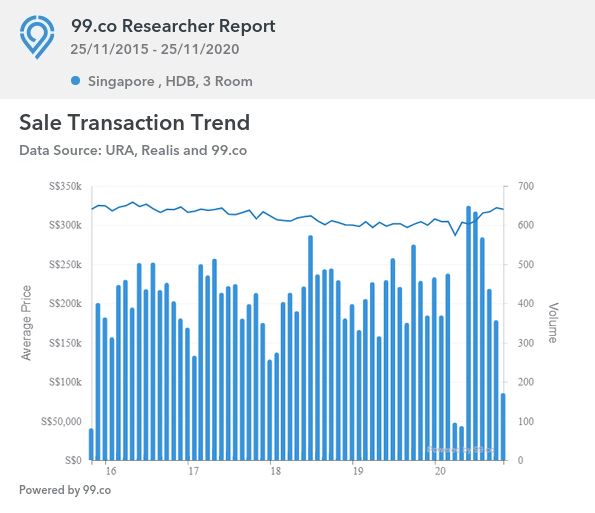

3-room resale flats average $322,033 as of October 2020.

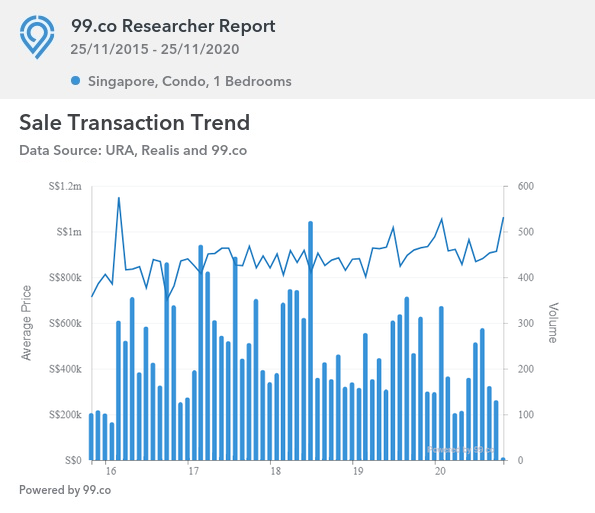

Resale one-bedder condo units (mostly up to 520 sq.ft.) average $913,686 in October 2020.

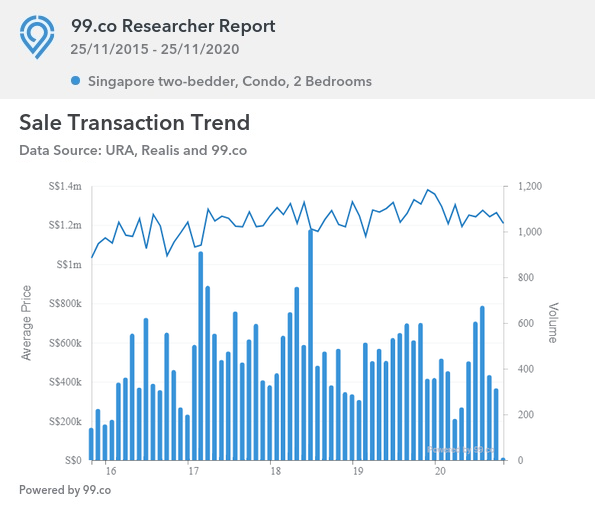

Resale two-bedder condo units average $1,263,387 as of October 2020.

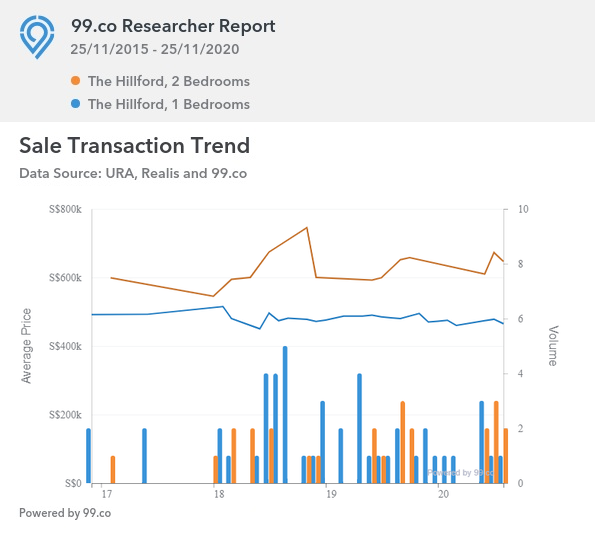

We’re making special mention of The Hillford as it is a private condo/retirement resort. It’s specially designed for the convenience of older residents, with clinics, shops, restaurants, etc. all within the development.

In the last recorded transactions in November 2020, the price of a one-bedder unit was just $490,000. The price of a two-bedder unit was $695,000.

Do note, however, that The Hillford is on a 60-year lease dating from 2013. Think of it as a long term rental and it starts to make more sense. In the simplest of calculations possible $695,000/53 years will mean you are paying about $1,100 a month to “rent” a 2 bedroom unit – as compared to the current rental rates of $2,000 a month. Note these are just gross figures and not inclusive of other costs like maintenance, taxes etc.

2. Review available grants and short-lease options (for HDB)

If you’re downgrading from one HDB unit to another, make sure you research the Silver Housing Bonus (SHB), and short-lease flats (if you’re an older retiree, or helping your parents with their downsizing).

The SHB provides a cash bonus of up to $30,000, for downgrading a 3-room flat or smaller (assuming a top-up of $60,000 for your CPF Retirement Account, from the sale proceeds). Do note that, the top-up is less than $60,000, the cash bonus is reduced to only half of the amount put in your CPF RA.

In addition, if you’re downgrading from a private property, the property must not have an Annual Valuation (AV) of more than $13,000. The purchase price of the flat you buy must not exceed the sale price of your previous property.

Singaporeans who are 55 or older might consider a short lease flexi-flat.

These are two-room flats, which can be bought on a shorter lease than the usual 99-years. The lease option can range from just 15 to 45 years, although it must be enough to last till you are 95 years old.

Short-lease flats are the cheapest possible forms of housing; 15-year leases have gone for as low as $30,000, for instance, while even 45-year leases seldom exceed $70,000.

However, you cannot sell these flats, and there is no loan available to purchase them. For more terms and conditions, contact HDB directly; these flats are not always available.

Property Market CommentaryHow Much Would You Save By Buying An Assisted Living HDB Flat?

by Ryan J. Ong3. Check HDB’s requirements before assuming you can right-size into a flat

If for some reason you’re right-sizing into a BTO flat, remember you must wait 30 months after disposing of any private property, before you can apply for a new flat. As such, it’s usually more practical to look for resale flats, if right-sizing from a private home.

Also, if you’re still earning an income when you right-size, bear in mind the income ceilings still apply. This is currently $14,000 for HDB flats, and $16,000 for Executive Condominiums (ECs). However, if you’re expecting your income to fall significantly – such as due to likely retrenchment – you can appeal to HDB for consideration.

In addition, if you happen to have just become a Permanent Resident (PR), remember you still need to wait three years before you can buy a resale flat.

You get the idea: double-check to ensure there won’t be eligibility issues for the flat-type you want to right-size into, before you start listing your home and making plans. You can contact us on Facebook if you’re uncertain and need help.

4. Address financing issues involving age

Most right-sizers can fund the entire cost of their next property with the sale of their previous home. However, there are some exceptions, and some right-sizers who simply don’t want to commit so much cash upfront.

The maximum Loan To Value (LTV) ratio for residential properties is usually 75 per cent with a bank loan, or 90 per cent with an HDB loan. However, the loan quantum can be reduced if your loan tenure stretches past the retirement age of 65.

For example, say you’re 50 years old when you decide to right-size. You want a loan tenure of 20-years, for a property valued at $350,000. As your loan tenure takes you past the age of 65, the maximum you can borrow is only 55 per cent of the property price or value (whichever is lower). As such, this would mean a total down payment of $157,500 ($35,000 in cash, $192,500 in CPF).

So if for some reason you need financing, even after the sale of your previous home, do be prepared for a lower loan quantum.

5. Plan for long term maintenance costs

Unlike a mortgage, you can never “finish” paying for maintenance costs while the property stands. This is often overlooked, for those right-sizing from flats into a smaller but more luxurious private property.

If right-sizing into a condo or apartment, be sure to factor in the quarterly maintenance. For most mass-market condos, this is around $300 a month for a three-bedder; smaller units will incur smaller costs.

The exact amount is based on the share value of your unit. So if it’s $75 per share value, and your unit has a share value of 5, then you’d pay $375 per month.

Ensure that you have sufficient funds to cover such costs, over the next half of your life. If it would be too much, you may have to consider HDB instead, where conservancy charges rarely reach $100 a month even for five-room flats.

6. Work out differences in required amenities

If you’re intending to lose the car in the coming years – or will minimise PHV use due to the retirement budget – then being near an MRT station / bus stop is more important.

Likewise, amenities such as clinics, wet markets instead of supermarkets, and walking trails may replace your current norms. Being near a school, for instance, just means more noise and traffic if your children are already grown up, and you don’t intend to resell ever again after right-sizing.

As a matter of on-the-ground experience, most older Singaporeans who are right-sizing are most focused on living near friends and family; not on things like being near shopping malls, hawker centres, etc. This may, for instance, be the case if you’re looking after grandchildren.

Simply put, you may want to re-write the book on “must-have” amenities when right-sizing.

On a related note, you might want to rethink high-floor units

First, the higher up you buy, the higher the price tends to get. The same two-room unit that’s one floor up might cost you another $10,000. Do consider if that money is better off padding a retirement fund, paying off remaining debts, etc.

In addition, older Singaporeans should consider future issues like being less mobile – it can be more convenient to live on the ground floor where you don’t need lift access, and where help can get to you fast if it’s needed.

Finally, remember not to conflate right-sizing with downgrading

The two are not necessarily the same.

There are well-to-do retirees who right-size from a five-room flat to, say, a $1.3 million shoebox unit in town. If it’s somewhere like Midtown Bay, it would be close to healthcare like Raffles Hospital, while also eliminating travel difficulties as you’re already in town.

Likewise, right-sizing can mean moving from cluster housing or landed housing to an equally high-value condo unit; it’s just more convenient as you don’t need to maintain the façade, clean multiple floors, etc.

Sometimes, right-sizing can be the smart move; even if you don’t need the money from getting a smaller unit.

As to which condos might be best for your next home, check out our in-depth reviews on Stacked. We’ll also keep you up to date on the latest developments in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments