5 Tell-Tale Signs To Look Out For When Evaluating A Resale Property Purchase

November 16, 2021

Property in Singapore is booming.

For some who took the plunge in 2020, they may already have seen paper gains in recent resale transactions in 2021.

Now I’m not here to create more FOMO to encourage you to buy a property asap…

Because as the saying goes, a rising tide lifts all ships.

So while it may seem that almost every property is rising in price, it doesn’t mean whichever property you buy today will be a winner in the future.

In fact, you should be even more careful in your evaluation of your property purchases.

A prime example is the dot-com era of the late 1990s, where the rapid rise and valuations of internet companies caused many people to get caught as they were afraid of missing out.

And arguably the most infamous flop from that era was Pets.com.

Launched in August 1998, Pets.com was created to sell pet food and accessories online.

Because everything was about the Internet back then, they were able to raise a ton of money ($110 million in the first few rounds) and spent it frivolously on marketing.

Pets.com ran ads of a dog sock puppet interviewing people on the street. That same mascot appeared in a Super Bowl commercial and even got its own balloon in the Macy’s Thanksgiving Day parade in 1999.

But the business wasn’t sustainable.

The company lost $147 million in the first nine months of 2000, and its stock price crashed from a high of $14 to below $1 till it folded.

On the other hand, companies such as Amazon and eBay (while undoubtedly affected by the crash), have since thrived and turned into the behemoths that you see today.

Likewise, with the property market we are in at present.

Because even though almost all properties are increasing in price, this actually disguises properties with a poorer outlook.

Remember, buying a house is unlike buying an expensive watch – you can’t return it if you are unhappy with it.

You could, of course, try to sell it – but with the seller’s stamp duty in Singapore, you’d definitely have to incur a loss to let it go.

There’s no question about it, buying a home is a huge commitment – you have to be thorough.

And so with that, here are 5 signs that you should looking out for when you are evaluating a resale property purchase:

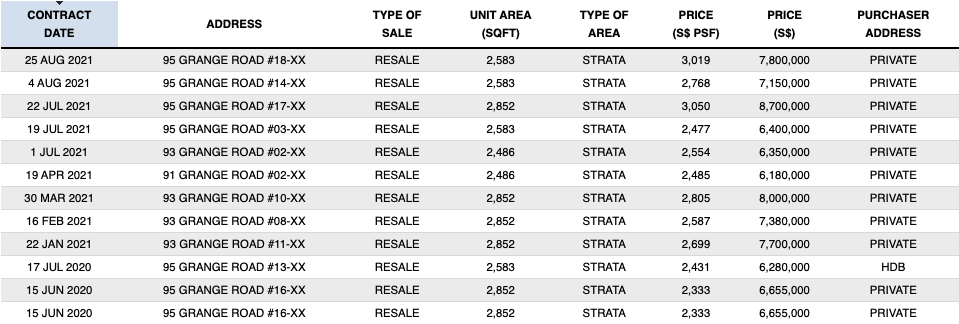

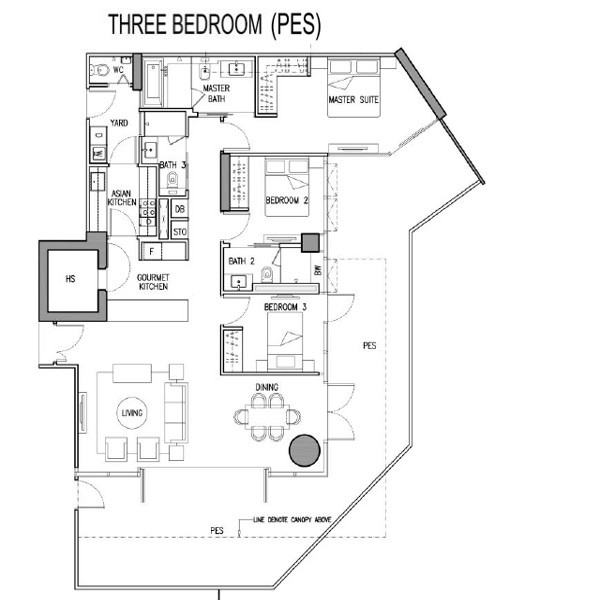

- Number of PES, Penthouse units

The first one up is the unit mix of a property.

This isn’t something that most people would think about, but there could be secondary effects to how a property might perform in the resale market.

While most properties won’t actually face this issue (especially the bigger the condo gets), but you’d want to be a little wary when it comes to a development with more penthouse and PES units than the typical development.

This is because penthouse and ground floor units with a large PES will usually command a lower price per square foot than a regular unit due to the large outdoor spaces.

Which is why if you are trawling through online portals to look for resale listings and sometimes come across a price psf that makes you giddy with excitement, more often than not this would be a penthouse/ground floor unit.

So if you are just looking at a regular unit, why would this affect you?

For example, let’s say the development you are eyeing is a boutique one with 50 units.

If a quarter of them are penthouse and PES units, there’s a higher chance that these could be sold consecutively, thereby dragging down the average psf for the development.

So if a casual buyer were to be browsing and looking at the overall historical pricing, they might assume that the property isn’t performing as well – when actually it is just down to the type of units being sold.

That said, I wouldn’t say this will always be a huge factor, but it’s certainly something to think about should you be caught in between 2 properties that you like.

- Number of units

So what you’d really want to see here are healthy transactions.

Ever come across one of those old and small developments, with the last transaction dating back more than 10 years ago?

How would you begin to price the property today? What would be a fair value?

Bigger developments tend not to have this issue, as there would usually be a transaction every month.

As such, buyers have a reference on past prices to bid on.

This creates a “step-up” scenario, where every transaction can be priced a little higher as there is a basis to compare with (especially in a hot market).

So if you are trying to buy a unit in a boutique condo with a price of $2 million today, but the last transacted price was $1 million 10 years ago, you can see why it would be harder for you to meet that price.

This brings me to my next point.

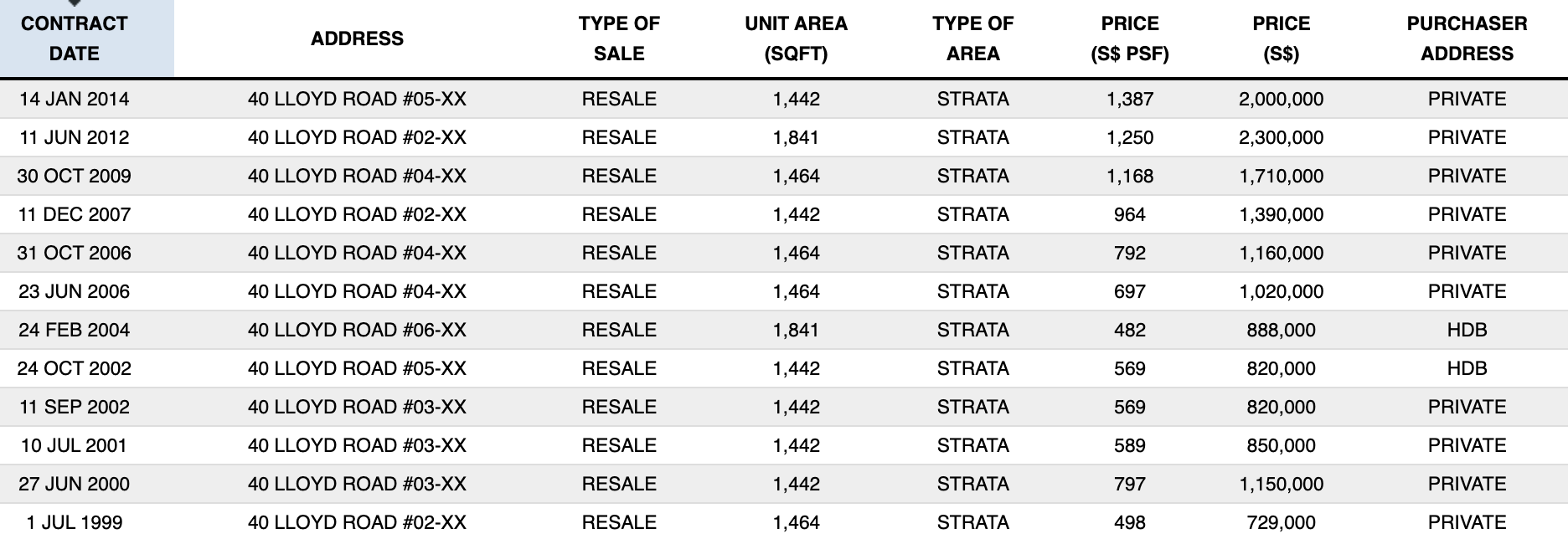

- Recent transactions

Here’s another sticky point of buying into an older resale development sometimes.

Everyone has bought in at a different price.

Now, when the market is hot, this is definitely not an issue – everyone should be able to achieve an ideal price as the demand is strong.

But, when the property market is soft, that is when you might face this issue.

Imagine if you decided to purchase that boutique condo example above for $2 million, whereas everyone else has bought in ten years ago at $1 million.

Make no mistake, your neighbours would probably be very happy that you’ve set a new high for the development.

But let’s say due to financial issues or just poor timing, you happen to have to sell during a down market.

Unfortunately, your neighbours too have decided they would be selling at the same time.

Unlike you, however, they have the option of selling at a price of $1.8 million (which they would still come away with a healthy profit).

You, on the other hand, won’t be able to let it go for under $2 million unless you are willing to sustain a loss.

Which is why I find it safer to buy in when there have been multiple transactions around the same period at about the same price point.

I wouldn’t say it was a dealbreaker, but to me, it’ll be a less risky bet if there were multiple recent transactions that have bought in at equivalent prices.

Property Market Commentary5 Unpopular, Slow-Selling New Launch Condos In 2021: What’s Going Wrong?

by Ryan J. OngSo many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

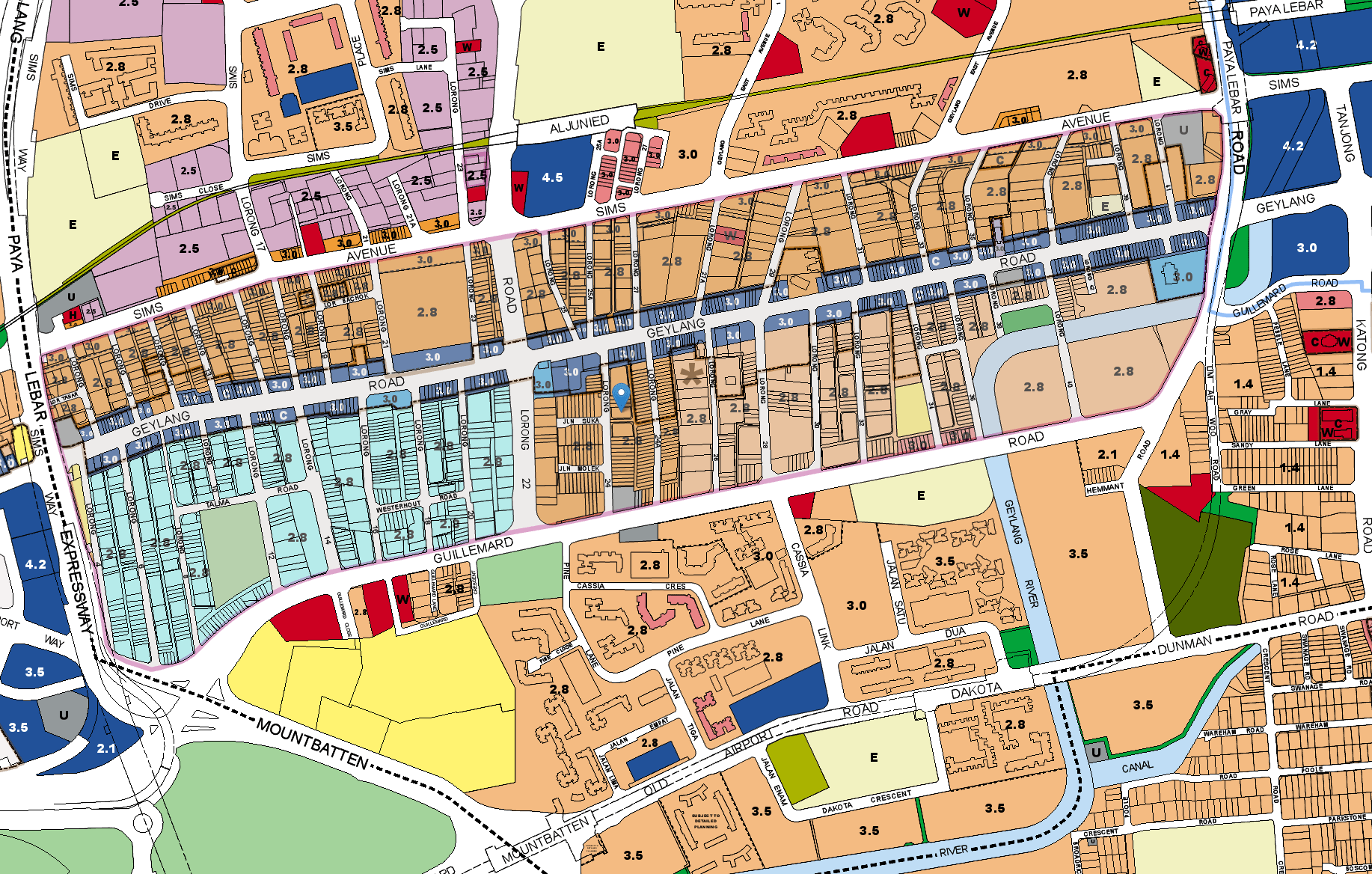

4. Look at the building height restrictions

I know of many buyers that have bought a home in hopes of striking the en bloc lottery in the future.

But the mistake here is that most people don’t think too much of contributing factors beyond an old and freehold space.

The truth is that there are many more factors that contribute to a successful en bloc sale.

So while it may be true that today a smaller condo will be more in vogue than a bigger development, there are certainly other factors that you will need to look out for.

Of particular importance is building height restrictions.

A prime example of this is the many freehold condos in Geylang.

Even though some of these have a plot ratio of 2.8 with an allowable building height of 36 storeys, they are only built up to 8 storeys because of the height restriction.

This essentially means that the development potential is capped unless the height restriction is removed.

So if you’ve unknowingly bought a small old freehold apartment in view of a collective sale in the future, you may just be waiting for a very long time.

5. Number of BTO flats nearby

Ryan has written about this a couple of times, but in short – the number of BTO flats sold within a year of MOP is rising:

- 11.8 per cent (1,392 units) in 2018

- 12.2 per cent in 2019 (2,736), and

- 13.4 per cent in 2020 (2,919 units)

And with over 50,000 flats expected to reach MOP by the end of 2021, it represents a big group of HDB upgraders.

So what does this mean for you?

Well, if you are stuck on a few choices and are narrowing down your options – look out for HDB flats that are close to MOP (or for MOP dates that are close to your planned exit).

Again, this isn’t a be all end all factor, but there is some merit in identifying your possible support when you exit.

While obviously, not everyone would be looking to stay in the same location, there is also a good number that would have their roots established there already.

Humans by nature are creatures of habit, and changing location after 5 years of living in one may just be too much of a change for the family.

For example, children having established good connections in school, or close proximity to a current workplace, or even living close to their parents.

It could even go down to just friendly neighbours or connections made in the nearby shops and relationships with the hairdresser.

So if these groups want to upgrade, they’d definitely want to live somewhere nearby.

You can see that with an area that has had little to no supply of new launches in recent years.

Couple that with BTO upgraders demand which will lead to a price uptick for the resale developments in the area.

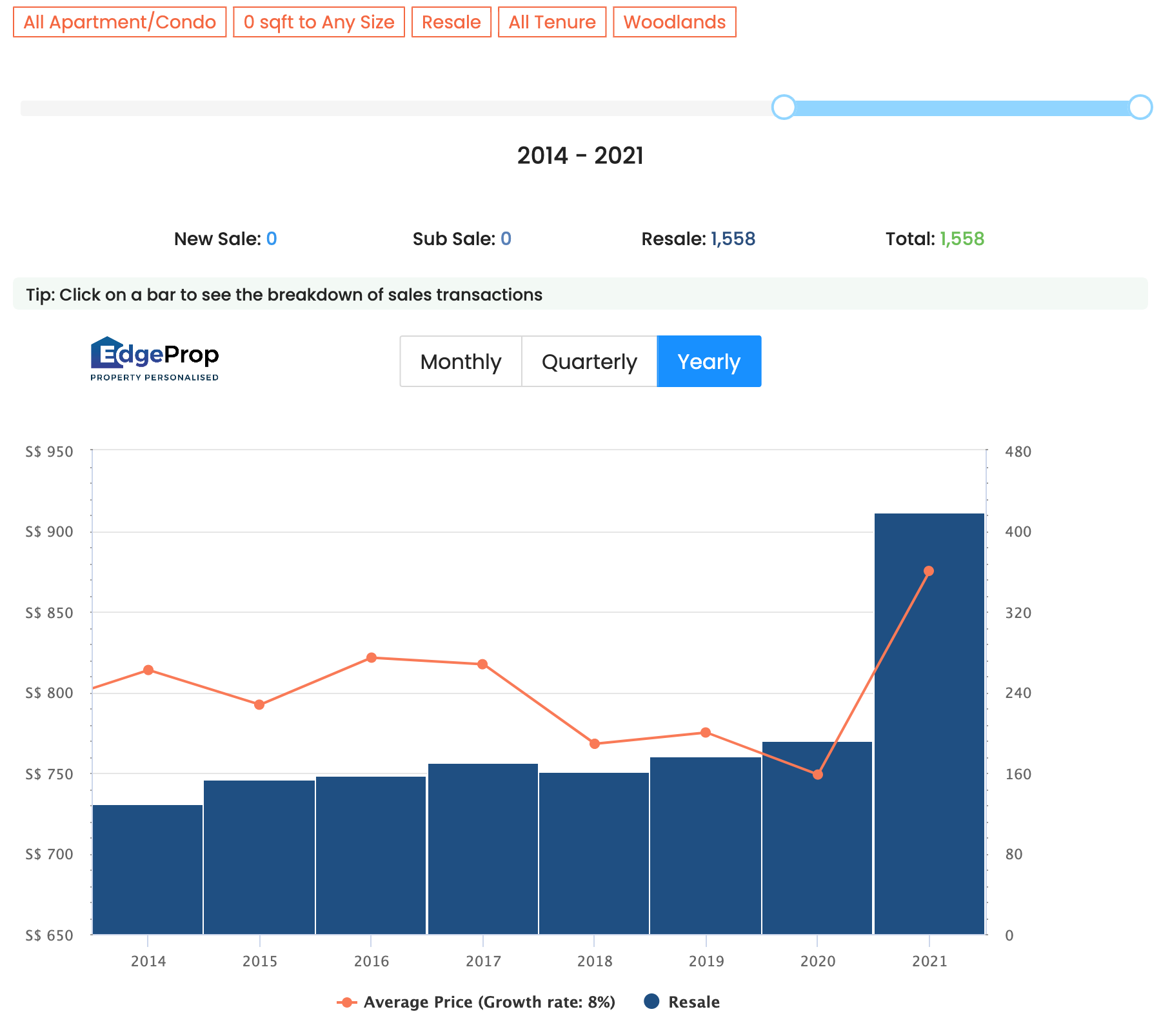

One example is Woodlands, as it is seeing a price increase of close to 16% within a short span of 1 year.

This is likely due to the lack of new launches and those that would like to upgrade to the same area; have limited choice but to look at resale condos only.

Final Words

My key takeaway for you today – if you want to ensure you own the right type of property once the property cycle changes, you’ll need to make the right decisions today.

Unfortunately, I see many buyers that are still unaware of the indicative key points when it comes to purchasing a development. Perhaps also because of the current fear of missing out situation – which is likely to lead to further problems down the road.

Property is such a big part of most people’s portfolios, and can play a huge impact on your life should you make the wrong choices today.

This is not only important for when this property cycle finishes, but it will be critical to own the right assets whether you plan to retire in 10, 15 or 20 years time.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’re pondering the viability of your property purchase, do reach out to us for a proper consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

2 Comments

what’s the reason that plot ratio is 2.8, yet there is height restriction of 8 storeys only? can you elaborate?