5 Cash-flow Positive Properties In The Core Central Region (CCR)

January 18, 2021

In these Covid-19 days, buying a prime region property attracts a lot of finger-wagging and warnings. We’re entering a weak rental market, you’ll be told, and such expensive (in terms of quantum) properties could well become liabilities.

As always – there are exceptions in the property market. Even today, there are units where the rental income is likely to cover the whole mortgage repayment or more. They’re rare, but they do exist – and here are the developments where you’re most likely to find them:

How did we pick the following condos?

The following is based on URA rental data over the past 12 months (for the given unit size). We’ve compared the rental rates of the units to the estimated monthly loan repayment.

(The home loan is assumed to have an interest rate of 1.3 per cent per annum, with a loan tenure of 30 years).

We then picked out CCR condo units where the median rental rate would exceed the loan repayment.

We then arrive at the following developments, where you’re most likely to find units with a positive cash-flow:

*We only used those with rental transactions of 5 and up in case of any outliers.

**The cash flow was calculated with just mortgage monthly repayment in mind, not taking into account other costs such as maintenance etc.

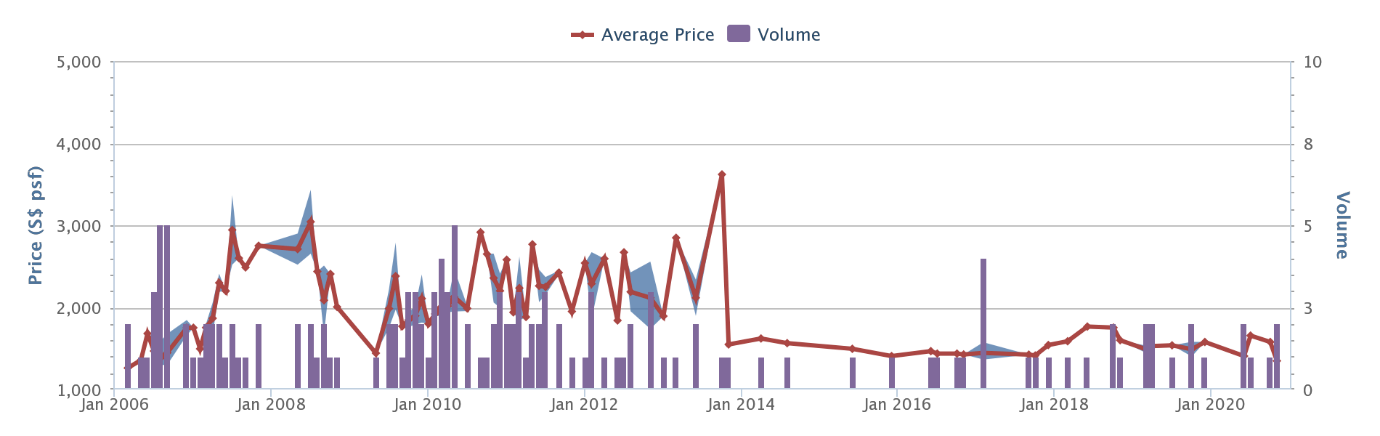

1. Orchard Scotts

| Unit size | Volume | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 1,625 sq. ft. | 19 | $2,300,000 | $7,907 | $7,718.90 | $188.09 |

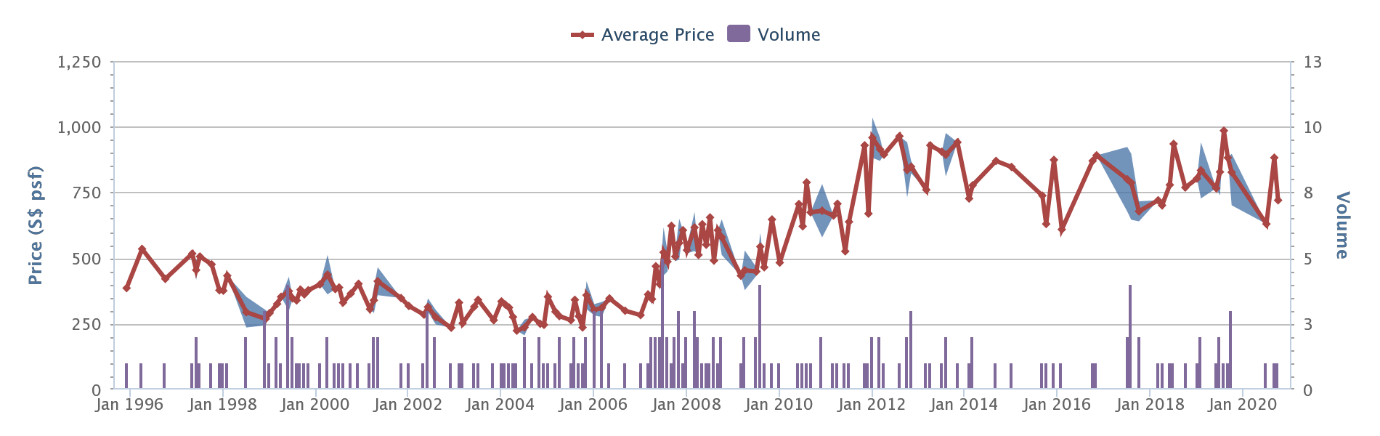

Current Prices

The indicative price range on Square Foot Research is $1,282 to $1,587 sq.ft., with an average price of $1,425 psf.

Square Foot Research gives an indicative rental rate of $3.02 to $6.09 psf for the entire development, with an average of $4.35 psf. The implied rental yield is 3.67 per cent.

Location: Anthony Road (District 9, Newton)

Developer: Far East Organization

Lease: 99-years from 2001

TOP: 2008

Number of units: 387 units

Key highlights:

Orchard Scotts sees more competition these days, from new developments like Kopar at Newton. However, it remains in high demand as it’s just 299 metres (around five minutes’ walk) to Newton MRT station. The Newton Food Centre is also located in the vicinity of the MRT.

This being an early 2000’s condo, Orchard Scotts has units that would be considered on the larger end today: even the two-bedders range between 958 sq ft to 1,087 sq ft, while the four-bedders start from an impressive 2,228 sq ft. As such, tenants who dislike the preponderance of small, shoebox units in the Orchard area should look here.

It also helps that Anglo-Chinese School is practically right next door, at just 260 metres. Expatriate families, with children studying at Chatsworth International (Orchard) may also be interested, as Newton is just one train stop away.

That said, we’re not certain if rental rates can be maintained, when newer alternatives like Kopar emerge; but for now, Orchard Scotts is one of the rare CCR developments where a cash-flow positive unit is possible.

As we mentioned in our previous article, it doesn’t mean a positive cash-flow property makes for a property that does well capital gain wise. In the case of Orchard Scotts, prices have been on the slide. On the resale front, there have been only 18 profitable transactions, and 31 unprofitable ones so far.

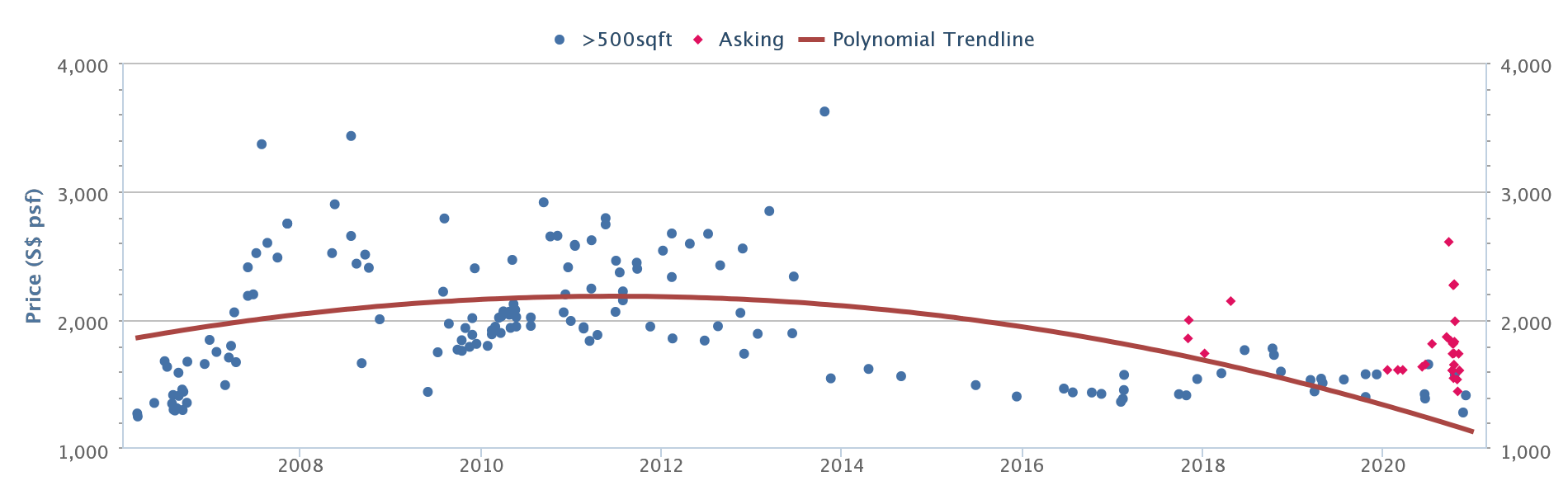

2. One Shenton

| Unit size | Volume | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 603 sq. ft. | 5 | $1,020,000 | $3,500 | $3,423.17 | $76.83 |

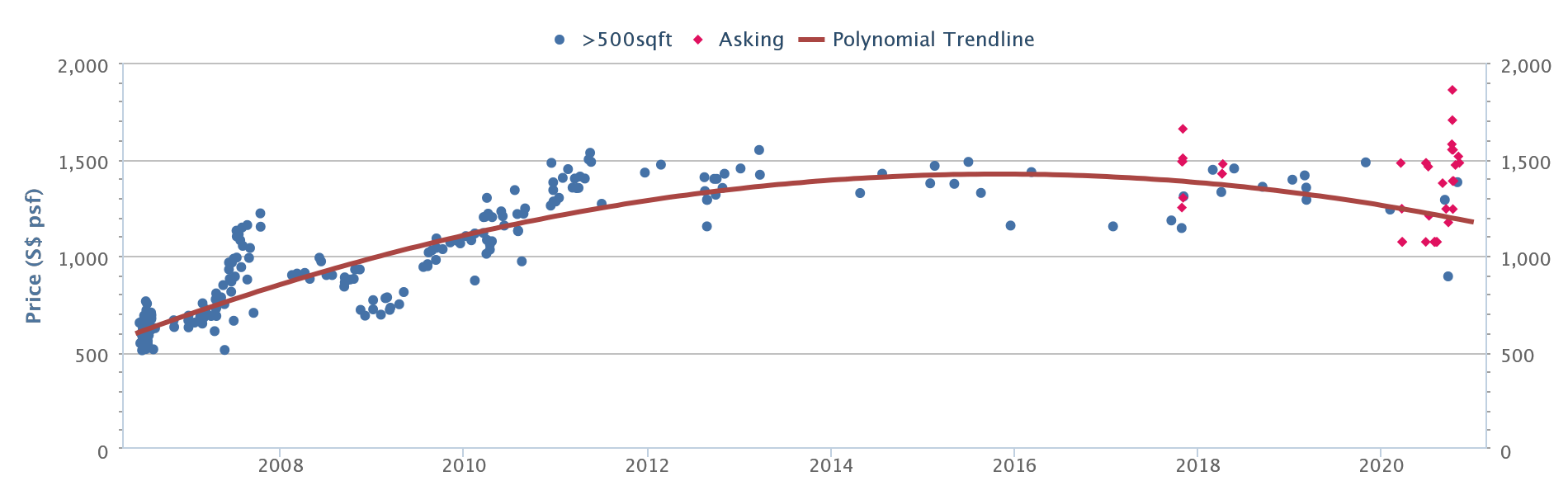

Current Prices

Location: Shenton Way (District 1, Downtown Core)

Developer: City Developments Limited

Lease: 99-years from 2005

TOP: 2011

Number of units: 341

Key highlights:

The appearance of One Shenton on the list should be no surprise to most market watchers. For the past decade, the one-bedders here have been a go-to rental option for singles working in the CBD. $3,500 per month can be considered a steal, for a unit along commerce street, and across the road from SGX Centre.

The opening of Downtown MRT station has been a huge boon to this property, being located just 200 metres away (about a three-minute walk). One Shenton also has the advantage of being well-known; in our experience, almost every expat who asks for a “not-too-expensive” CBD unit gets shown this property first.

The only drawback of One Shenton is obvious if you’ve visited this area on a weekend: it’s a dead town, because there’s nothing much to do here besides work. Still, this is a minor drawback, as tenants would just be a few stops from Orchard, Bugis, etc.

The proximity of Marina Bay and Chinatown also makes up for the weekend void.

Prices here have been on the downtrend as well, with 74 profitable transactions, closely followed by 61 unprofitable transactions.

3. Spottiswoode Park (note: HDB property)

| Unit size | Volume | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 1,270 sq. ft. | 36 | $800,000 | $2,800 | $2,684.84 | $115.16 |

Current Prices

Location: Spottiswoode Park Road (District 2, Bukit Merah)

Developer: HDB

Lease: 92-years from 1989

TOP: 1979

Number of units: Unstated

Key highlights:

When it comes to older HDB properties, buyers tend to have a love-it or hate-it relationship. That’s typically the case with Spottiswoode Park.

On the one hand, this is one of the best-priced properties for its location. Compared to the slew of million-dollar flats at Pinnacle @ Duxton, prices at Spottiswoode are practically a steal. However, it means accepting the significant lease decay issues that come with these 40+ year old flats.

If your intent is to hold on past the Minimum Occupation Period (MOP), and then buy a private property while renting this one out, the yields are likely to be solid; but you shouldn’t expect too much in the way of future gains. The property may not be easy to offload in another decade or so, despite its central location.

In any case, much of what we said regarding The Beacon’s location (see above) also applies to Spottiswoode Park. It’s a good central location, and only around 750 metres – or nine minutes’ walk – to Outram MRT station. Tenants are unlikely to be in short supply, this close to the CBD; and the proximity of Tanjong Pagar, Chinatown, and Keong Saik road means there’s no shortage of entertainment and amenities.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Cheapest Yet Sizeable 4-Room HDB Flats From $490k

When it comes to finding a new home, space is often non-negotiable—but in land-scarce Singapore, balancing size and budget can…

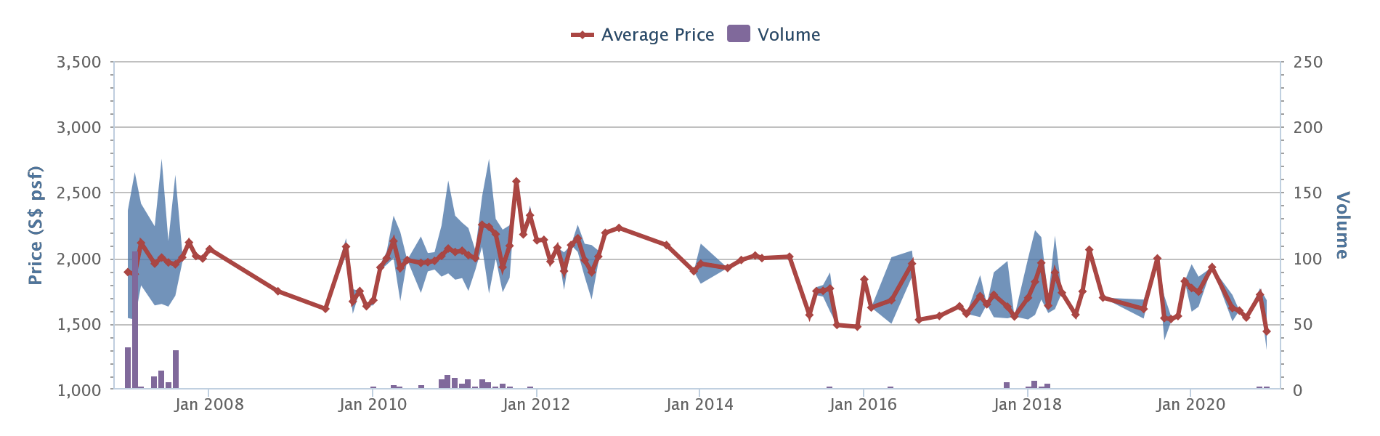

4. Altez

This is a similar entry to our earlier list of top cash-flow positive properties

| Unit size | Volume Of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 527 sq. ft. | 29 | $1,070,000 | $3,900 | $3,590.97 | + $309.03 |

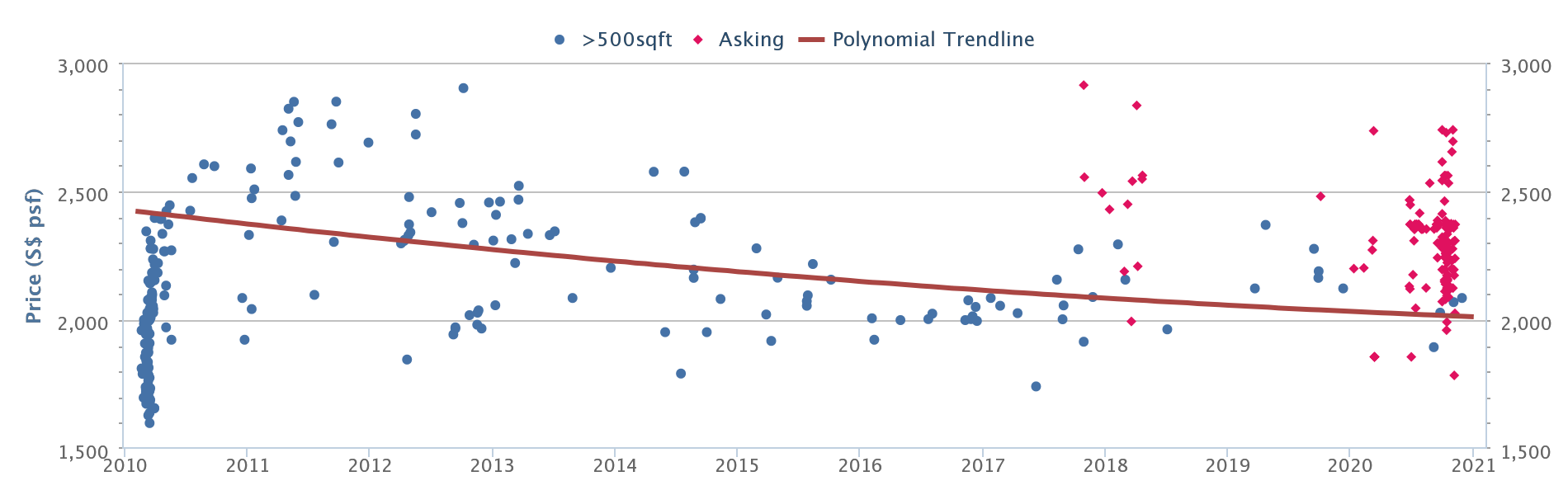

Current Prices

The indicative price range on Square Foot Research is $1,895 to $2,086 sq ft, with an average price of $2,020 psf.

Square Foot Research gives an indicative rental rate of $4.40 to $8.18 psf for the entire development, with an average of $6.03 psf. The implied rental yield is 3.59 per cent.

Location: Enggor Street (District 2, Downtown Core)

Developer: MCL Land (Balmoral 2) Pte. Ltd.

Lease: 99-years from 2008

TOP: 2014

Number of units: 280 units

Key highlights:

Altez is located right in the heart of the CBD, about 250 metres (four minutes’ walk) from the Tanjong Pagar MRT station. Next to it is Union Building, and just after that is Tras Street with its various cafes and eateries. Via Tras Street, you can get to the centre of Chinatown with about a 12-minute walk.

We probably don’t need to explain the rental demand, given the location.

At just $3,900 per month, this residence is a dream for single tenants who need to work within the CBD. We’d also venture that a shoebox unit at just $1.07 million is cheap, compared to other options within District 2.

That said, Altez appeals to a specific demographic. Families aren’t likely to choose this location, and it might not be ideal for owner-occupancy (unless you’re a true urbanite). Altez is well and truly “packed in” by other tall buildings, the road noise roars at rush hour, and there’s no disguising the feel of being in a concrete jungle (there isn’t even much greenery to alleviate the space).

Imagine if you had to live between the banks at Raffles Place; that’s a little what the location feels like. Nonetheless, tenants in the CBD are probably just happy to find a unit without an exorbitant price tag; and landlords seem amply rewarded.

For those looking at potential appreciation as any indication, the price trend for the Altez does not make for a good picture. There have been 31 profitable and 11 unprofitable transactions thus far.

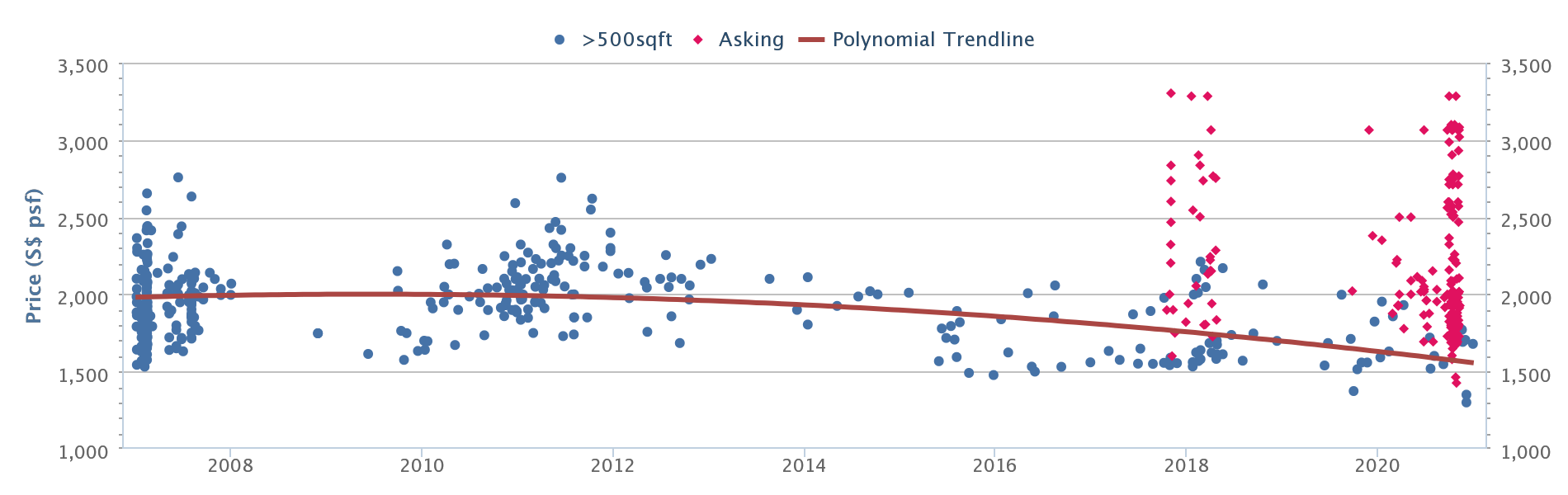

5. The Beacon

This is a similar entry to our earlier list of top cash-flow positive properties

| Unit size | Volume | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 807 sq. ft. | 8 | $1,000,000 | $3,600 | $3,356.05 | $243.95 |

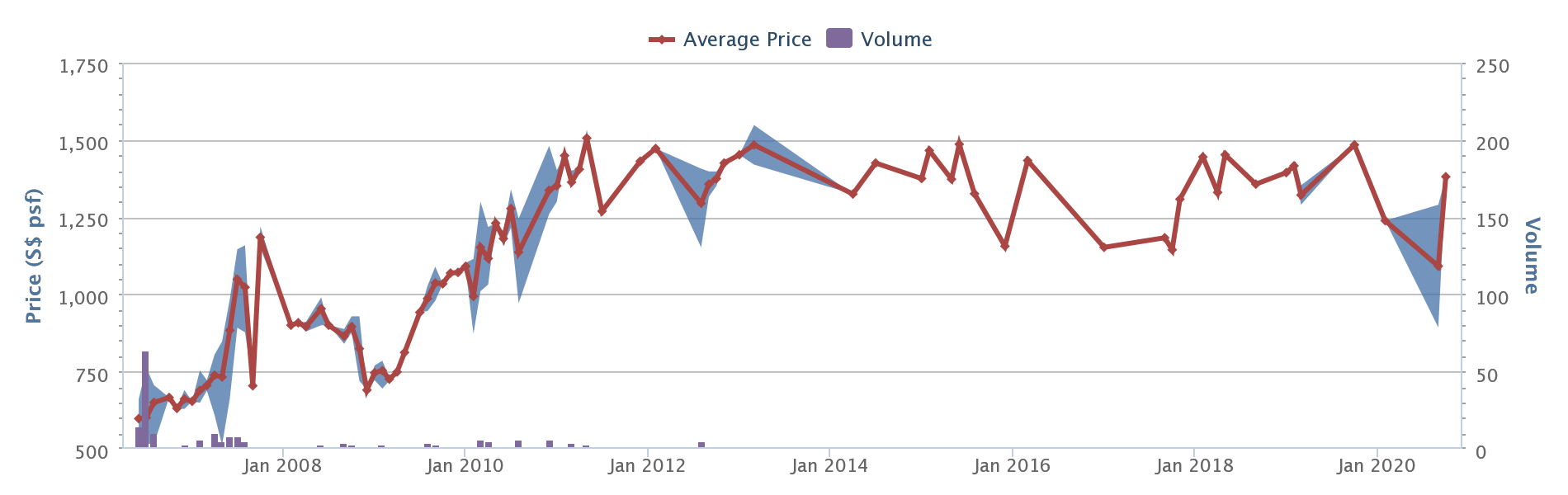

Current Prices

| Unit size | Volume of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 807 sq. ft. | 8 | $1,000,000 | $3,600 | $3,356 | + $243.95 |

Current Prices

The indicative price range on Square Foot Research is $893 to $1,381 sq ft, with an average price of $1,188 psf.

Square Foot Research gives an indicative rental rate of $2.87 to $4.47 psf for the entire development, with an average of $3.56 psf. The implied rental yield is 3.59 per cent.

Location: Cantonment Road (District 2, Downtown Core)

Developer: Cantonment Realty Pte Ltd

Lease: 99-years from 2004

TOP: 2008

Number of units: 124 units

Key highlights:

The Beacon is sometimes mistaken for Pinnacle @ Duxton, as the façade can look similar at first glance, and it’s directly across the road from Pinnacle.

This condo has been a favourite among expats working in the CBD area since its inception; it’s only about 2 kilometres to Raffles Place via South Bridge Road, and 850 metres (11 minutes’ walk) to Chinatown. The current median rental rate – about $3,600 per month – makes this one of the more affordable options with CBD access.

One recent advantage is the transformation of Keong Saik Road, a former red-light area. This stretch has been cleaned up, and is now home to several artisanal cafes, bars, restaurants, and a major co-working space (The Working Capitol at 1 Keong Saik Road). This stretch is only about 600 metres away from The Beacon, or roughly an eight-minute walk.

Cantonment Primary School is also right next to The Beacon; but on the downside, this is the only nearby school.

The closest MRT station is Tanjong Pagar, which is 850 metres away, or 11 minutes’ walk. This is on the East West line, so you’ll get direct access to Raffles, Bugis, and Changi Airport.

The downside is the urban density of the area, which may be off-putting to some. Apart from Pinnacle @ Duxton across the road, you’re also next to a cluster of HDB flats. You’re also directly facing Cantonment Road, so traffic noise and congestion are a given. There’s very little in the way of greenery in this area; barring the small park spaces near Pinnacle.

Nonetheless, most tenants are likely to consider this a fair trade-off, given the convenience and amenities.

The Beacon enjoyed a good growth in prices in the earlier years, but that has slowed down as of recent years. It has enjoyed 141 profitable and just 4 unprofitable transactions.

We have mentioned that CCR properties will bear the brunt of the weak rental market in the near term

That said, if you’re looking at a more long-term view, this may well be the time to do a spot of bargain hunting in the prime region.

What’s worth noting, however, is the gradual shift from District 9 to District 7. As the Ophir-Rochor corridor developers, we may see the traditional office areas expand – or move – from the current CBD.

For more in-depth reviews of new and resale properties in the CCR, follow us on Stacked. We’ll also be doing a follow-up on cash-flow positive properties in the city fringes next.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some properties in the CCR that can generate positive cash flow from rental income?

How was the data for these cash-flow positive properties in the CCR selected?

Are these properties suitable for long-term investment or mainly for rental income?

What are the key factors that make these CCR properties cash-flow positive?

What are some considerations or risks when investing in CCR properties for cash flow?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments