4 Reasons Why HDB Upgraders Prefer Executive Condos To Private Condos

January 26, 2021

Two common expressions you’ll hear in Singapore are “What? Why is an EC so expensive?” followed by “What? The EC sold out again?”

Few market watchers will ever forget the famed Piermont Grand EC. When it first came on the scene, we heard one criticism after another: it’s too expensive, Sumang Walk is not convenient, there’s no MRT station, etc. And yet, Piermont Grand was one of the better selling projects after all; some would say because of its EC status (it was the only EC launched in its year). For those curious, it has sold 86% of its 820 units at the time of writing.

And in 2021, if you head to an EC show flat, you’re bound to notice a large throng of buyers who are upgrading from their HDB flat. This often leads to the question of why so many upgraders prefer ECs – and we’ll tell you right away, it’s about more than just the price:

HDB upgraders seem to love ECs and resale ECs

As an example, let’s look at some recent resale EC transactions, from developments completed in 2015 (to account for the the usual five-year Minimum Occupation Period, or MOP)

1. Waterwoods (Punggol)

| Date | Unit Size | Price | Buyer address |

| 15 Jan 2021 | 1,044 sq.ft. | $1,050,000 | HDB |

| 7 Jan 2021 | 807 sq.ft. | $775,00 | HDB |

| 6 Jan 2021 | 1,044 sq. ft. | $990,000 | HDB |

| 4 Jan 2021 | 1,044 sq. ft. | $1,016,800 | HDB |

| 15 Dec 2020 | 1,044 sq. ft. | $970,000 | Private |

2. Heron Bay (Hougang)

| Date | Unit Size | Price | Buyer address |

| 11 Jan 2021 | 1,281 sq. ft. | $1,300,000 | HDB |

| 5 Jan 2021 | 1,281 sq. ft.. | $1,250,00 | HDB |

| 30 Dec 2020 | 1,389 sq. ft. | $1,370,000 | Private |

| 28 Dec 2020 | 1,023 sq. ft. | $942,000 | HDB |

| 22 Dec 2020 | 775 sq. ft. | $760,000 | Private |

3. 1 Canberra (Yishun)

| Date | Unit Size | Price | Buyer address |

| 15 Jan 2021 | 1,442 sq. ft. | $1,300,000 | HDB |

| 8 Jan 2021 | 1,270 sq. ft.. | $1,250,00 | HDB |

| 7 Jan 2021 | 1,055 sq. ft. | $1,370,000 | HDB |

| 4 Jan 2021 | 1,582 sq. ft. | $942,000 | HDB |

| 29 Dec 2020 | 947 sq. ft. | $840,000 | HDB |

While we don’t have data for buyers of new ECs yet, we’re certain that a quick visit to any show flat – along with conversations with some agents – will also reveal the popularity of ECs with HDB upgraders.

You may be wondering why that is, given that private condos tend to have more accessible locations (ECs are often further from MRT stations, barring the occasional exception like Parc Canberra). These are the reasons to consider:

- Price

- Additional Buyers Stamp Duty (ABSD)

- The HDB-like restrictions are immaterial to these buyers

- Increasing number of ECs in better locations

1. Price and financing

Let’s get the most obvious factor out of the way: ECs are priced lower. This matters a great deal for HDB upgraders, especially as they need to take bank loans (there’s no HDB loan for ECs).

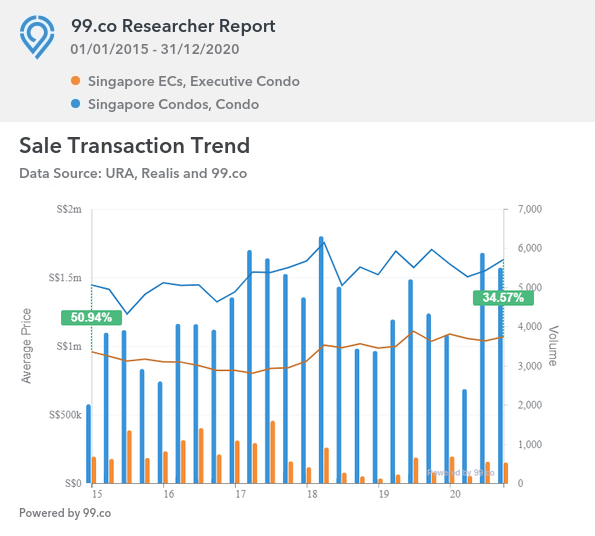

As of December last year, the island-wide average price for condos was about $1.63 million, while the average for ECs was around $1.066 million; a price difference of about 34.6 per cent (do note that the gap has narrowed from five years ago though).

With a bank loan, the average EC has a minimum down payment of about $266,500, of which at least $53,300 must be in cash (the rest can come from CPF). This can usually be covered by the sale of, say, a 4-room flat at $350,000.

For the average condo, the minimum down payment is about $407,500, of which at least $81,500 needs to be in cash. There’s a higher chance that the sale proceeds from a flat won’t cover the full amount, especially the cash portion after refunding CPF.

In addition to the price difference, there is up to $30,000 in grant for ECs. Not a huge amount, but every little bit helps.

But to give you a clearer idea of the EC vs private condo price gap, let me show you the average prices from 2020.

| Project | District | Average Price | District Average Price | District Average New Launch Price |

| Ola | 19 | $1,138 | $1,279 | $1,437 |

| Parc Canberra | 27 | $1,102 | $985 | $1,131 |

| Piermont Grand | 19 | $1,105 | $1,279 | $1,437 |

| Rivercove | 19 | $978 | $1,279 | $1,437 |

For those wondering about the low prices of District 27, it’s worth noting that there weren’t a lot of transactions in 2020 for resale condos, and the bulk of new sales were due to Parc Canberra.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How To Spot Cheaper Home Alternatives If You’ve Missed Out On Your First Choice

It’s not uncommon for your first choice to fall through when shortlisting a home. Maybe the seller changed their mind,…

2. Additional Buyers Stamp Duty (ABSD)

When you upgrade to a condo, you can either sell your flat first, or buy the condo first. For most families, it’s more convenient to buy the condo first – this allows them to live in their flat until the condo unit is ready to move into.

However, buying the condo while still owning your flat will incur the ABSD; the condo counts as the second property. At present, this is 12 per cent for Singapore Citizens, and 15 per cent for Permanent Residents.

So if you want to upgrade to a $1.63 million condo, for instance, this incurs ABSD of $195,600. Note that if you purchase the condo with a non-citizen spouse, the higher ABSD rate will apply; so if your spouse is a Permanent Resident, this means paying $244,500.

You can apply for ABSD remission later, if you meet the requirements and also sell your flat within the next six months. But at the immediate moment, the ABSD must be paid two weeks after completing the transaction.

This compounds the problem in point 1: the down payment on a private condo is already more substantial, and the addition of upfront ABSD can make it even more unmanageable.

There is, further, the stress of having to sell your flat within the time limit.

But with an EC, there’s no need to pay the upfront ABSD. That means the upgraders can still live in their flat while waiting to collect the keys to the EC; and that they don’t have to worry about ABSD remission deadlines.

Additionally, HDB upgraders who are moving from “difficult” units – such as units where a neighbour is targeted by loan sharks – also face higher risks with the six-month ABSD time limit.

3. The HDB-like restrictions are immaterial to these buyers

As HDB upgraders previously qualified for a flat, they can most likely qualify for an EC also – the only issue is the income ceiling (ECs still have an income ceiling, but it’s $16,000 instead of $14,000).

Restrictions such as ethnic quotas, or meeting eligibility requirements, are thresholds through which HDB upgraders have already passed, and can probably pass again.

As most HDB upgraders are owner-occupiers rather than investors, the disadvantage of waiting 10 years* for privatisation isn’t too significant to them. In addition, there’s no MOP for the second batch of EC buyers anyway, so they can already sell to PRs or rent out the unit.

*Less if it’s a resale EC.

4. Increasing number of ECs in better locations

While ECs have a reputation for being more inaccessible, launches in recent years have shown significant improvement.

For example, ECs like The Brownstone, Esparina Residences, Parc Canberra, etc. are all within walking distance to an MRT station. We were able to locate 26 ECs in which residents are close to a train station.

To be clear, ECs are still not the most accessible developments in general – but we have seen a marked improvement over the past few years. In addition, the decentralisation of Singapore, along with the appearance of more and more MRT stations, is gradually eroding this drawback of ECs.

We can think of ECs as yet another intermediary step, between an HDB flat and a condo

With loan curbs and the ABSD in place, the jump from an HDB flat to a condo is a much wider hurdle compared to the early 2000’s. This is what makes ECs such a favourite among many HDB upgraders today – it’s a “bridge” between their HDB flat and a full-fledged private condo; and we think the appeal will rise even further in a Covid-19 economy.

This isn’t to say every HDB upgrader should immediately pick an EC first; different financial situations and goals may dictate otherwise. But it does mean that upgraders who can’t make the jump to a condo just yet – or who want to exercise greater prudence – might do well to examine EC offerings first.

You can find out more about new and resale ECs from the in-depth reviews we do at Stacked; or contact us directly, so we can help determine whether an EC is right for you.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do HDB upgraders prefer executive condos over private condos in Singapore?

How does the price of executive condos compare to private condos in Singapore?

What are the financial advantages of buying an EC instead of a private condo for HDB upgraders?

Why is avoiding the upfront ABSD important for HDB upgraders?

Are executive condos becoming more accessible in terms of location?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments