4 Curious Singapore Property Trends We’re Seeing In 2024

June 15, 2024

Buying a property is seldom as detached and rational as buying into a unit trust, or a drum of oil. Because there’s so much in the way of aspirations, emotional connections, and the sheer magnitude of the debt (something most of us spend our working lives paying off) buyer behaviours can be unexpected. Some things have gotten especially strange in the aftermath of Covid though, such as the following:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. The surprising resilience of the luxury property market

The luxury market, particularly for properties in the Core Central Region (CCR), took a hard initial hit from the April ‘23 cooling measures. At the time, ABSD rates for foreigners were doubled to 60 per cent, the highest point in Singapore’s history.

Affluent foreigners are a significant demographic for luxury and prime region properties; so we did see an initial impact. However, as of Q1 2024, with regard to resale luxury condos, reports claim volumes were up by 17.6 per cent compared to the last quarter.

Taking a closer look, we see that for new launch luxury properties in the CCR, transaction volumes have fallen, but prices are in fact rising:

In Q3 2023, the quarter right after the new cooling measures, prices were at $2,999 psf. As of Q2 2024, even though new launch transactions have dipped a lot, prices have risen even higher to $3,254 psf.

Concerning the resale market, we can see prices and volumes have been surprisingly resilient:

We can see that right after new cooling measures in Q3 2023, there was a low point with resale luxury averaging $2,110 psf. However, this has since risen to $2,219 psf, along with transaction volumes.

So the question is, who is buying these luxury properties at this time? For most foreigners, a 60 per cent tax should make these assets much less attractive than the conventional stock and bond markets. For locals, it’s plausible that some have rushed in after the price gap between the CCR and RCR narrowed, as they sensed an opportunity.

Another possibility is that well-capitalised landlords sniff rental potential: with ABSD rates being so high, there’s a greater possibility that affluent foreigners will choose to rent instead of buy.

One other factor, which some realtors pointed out, is that the wider economy looks volatile; this is due to issues like the war in Europe and the next US election. This might be prompting a flight to safety, and Singapore’s freehold properties have been a favourite refuge in the past.

We wonder if – given how our government is well aware of this – the timing of the ABSD hikes is partly in anticipation of such a rush.

2. A lot of prime land is being released, despite developers being rather cool to the idea

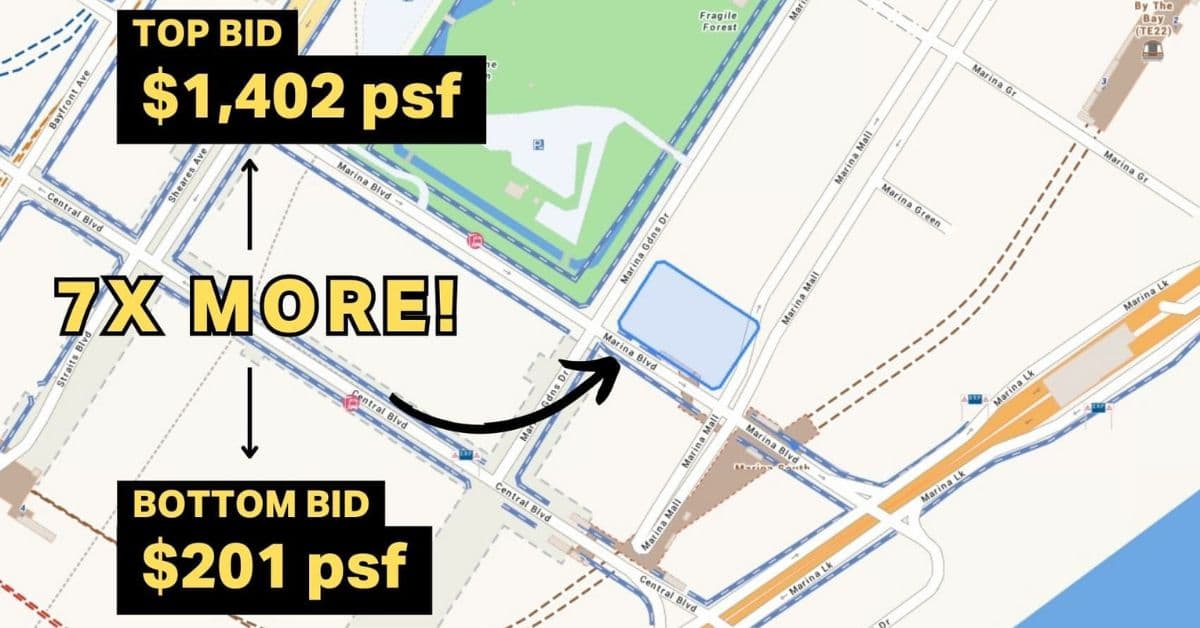

We’ve previously mentioned the Marina Crescent white site, which ultimately wasn’t awarded as the winning bid was too low. This is not something most would have foreseen just a few years ago: anything in such a prime location is usually solid gold to developers.

However, the hesitation of developers does reflect growing concerns over rising interest rates (which also affect development costs, not just sales prospects), higher Land Betterment Charges, and wider economic issues. As such, most would assume the government would hold off on the release of these prime sites.

Now we do know that the government intended to put out more sites for grabs in ‘23 and ‘24, as part of a way to boost supply. This will help with the housing shortage we experienced in the immediate aftermath of Covid. However, consider the number of prime locations on the confirmed list so far:

Residential Sites:

| Location | Site Area (Ha) | Gross Plot Ratio | Status |

| Media Circle | 1.06 | 2.9 | Awarded |

| Orchard Boulevard | 0.68 | 3.5 | Awarded |

| Upper Thomson Road (Parcel A) | 2.44 | 2.2 | Open for Tender |

| Upper Thomson Road (Parcel B) | 3.2 | 2.5 | Awarded |

| Zion Road (Parcel A) | 1.51 | 5.6 | Awarded |

| Holland Drive | 1.23 | 4.7 | Awarded |

| River Valley Green (Parcel A) | 0.93 | 3.5 | Open for Tender |

| Canberra Crescent | 2.05 | 1.6 | Open for Tender |

| De Souza Avenue | 1,92 | 1.6 | Open for Tender |

| Margaret Drive | 0.95 | 4.2 | Open for Tender |

| Media Circle | 0,57 | 4.2 | Open for Tender |

| Dairy Farm Walk | 2.16 | 2.1 | Open for Tender |

| Tengah Garden Avenue | 2.55 | 3 | Open for Tender |

White Sites:

| Location | Site Area (Ha) | Gross Plot Ratio | Status |

| Jurong Lake District | 6.5 | Tender Closed |

There’s a definite tendency toward prime locations, despite apparent signals that developers are cautious about such areas. Perhaps this is a deliberate attempt to impact costs in the CCR and some high-quantum RCR areas, for reasons that will become clear later. It may also be confidence that developer interest will return shortly, interest rates and stamp duties aside.

We don’t know the intent here, but it is rather ironic: some of the more desirable plots have come up for sale, right at the time when many developers aren’t ready to buy.

3. An insistence on ignoring lease decay for the sake of location

This is from observations on the ground, and the interactions we’ve had. That many younger Singaporeans are eager to have their own home is no surprise: this started during Covid and the trend hasn’t stopped. What’s remarkable, however, is the increasing willingness to ignore factors like high Cash Over Valuation (COV) and lease decay.

We’ve seen more younger buyers who are okay with the following:

- Forking out bigger cash payments, because of the COV, and because the lease of the flat won’t last till the youngest buyer reaches 95 (this restricts the maximum CPF usage)

- The need for a replacement property near or even after retirement, even if the current old property has limited resale value

- Less concern over issues like stairs, in units such as maisonettes or walk-up apartments, even in an intended “forever home.” For walk-up apartments, we’ve even heard some people say it’s less of an issue today, as you can have food or groceries delivered.

It’s not that they’re unaware of the drawbacks, but rather that the disadvantages are considered minor or a far-off issue, compared to the advantages of living in a more convenient area (e.g., nearer to a desirable train line or an area like Orchard, Bishan, Tanjong Pagar, and so forth)

We do wonder if this is partly due to the great wealth transfer, where help from parents can support these decisions. But with regard to private properties, it may be due to our history of private projects going en-bloc long before the lease expires, thus prompting more confidence in older developments.

This seems to overlap with an interest in another type of property

We notice younger buyers are less hesitant about older mixed-use projects, which the earlier generation of Singaporeans would shun. These are projects like People’s Park Complex, or other apartments that are set above haphazard commercial mixes (previously, Peace Centre and Golden Mile Complex were examples of this, but both have gone en-bloc as of 2024).

There’s a sort of pride that comes from buying and refurbishing such old units, on par with the attitudes we saw in the gentrification of Tiong Bahru a few years back. Given that some of these properties are in highly desirable central locations though (despite possibly poor maintenance, or having dodgy massage parlours downstairs), expectations of an eventual en-bloc are more reasonable.

The success or failure of the Peace Centre/Golden Mile redevelopments will likely be used as indicators for these ageing projects.

For more updates on what’s going on in the property market right now, stay in touch and follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is the luxury property market in Singapore still strong in 2024 despite recent cooling measures?

Why are prime land sites still being released for development despite developers' caution?

Are younger Singaporeans willing to buy older properties despite lease decay?

How has the luxury property market in Singapore responded to the April 2023 cooling measures?

What trends are seen in Singapore's property development and buying behaviors in 2024?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments