Investing in a rental property? Here are 3 absolutely essential tips you need to know before you plunge in.

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

1. Rental Yield – The right way to calculate your rental yield

While evaluating potential capital gain is important, it is also equally essential to get your rental yields right especially as today’s low interest rates are not permanent. Most agents would try to tempt you in with statements such as “this unit has a high rental yield!” But this is usually calculated as such: Yearly rental income divided by purchase price of property.

While not entirely wrong, it does not take into account other important costs that have to be factored in, thus giving you a myopic view of the situation.

For a quick example, purchasing a home includes other costs such as, stamp duty, ABSD, legal fees as well as renovation costs. This can quickly amount to a six figure sum! And that is not the end of it, you still have to consider your rental expenses into the equation. This includes monthly maintenance, commissions to the agent (which can be saved) and property tax.

For more information visit Frugal in Singapore’s comprehensive guide on how to calculate your REAL yield.

2. Supply under construction

As the rental market is always going to be a demand and supply game, it is crucial to take a look at the supply under construction as a whole. This is especially so when there is a large amount of units that would be available or in the pipeline. If you are looking at a particular district with many new developments being built, this just simply means competition for rentals would be high and more often than not, rentals would be suppressed. Good news for tenants, not so much for landlords.

3. Foreigners coming into Singapore

More from Stacked

The Surprising Lifespan Of Freehold And Leasehold Condos In Singapore: What Age Do Most Condos Go En-Bloc?

Singaporeans love freehold properties; and in many discussions, there’s an emphasis on the permanence of a housing asset. Many feel…

By and large if you have rented out a property before, it would usually be to an expatriate. In general, Singaporeans do not usually rent homes. The numbers speak for themselves, as of 2016 Singapore has a home ownership rate of more than 90 percent. Also unlike our western counterparts, young Singaporeans do not move out of their family home until they get married. Owning a home in Singapore will always be seen as something prestigious, as such we never had much of a rental culture here.

Owning a home in Singapore will always be seen as something prestigious, as such we never had much of a rental culture here.

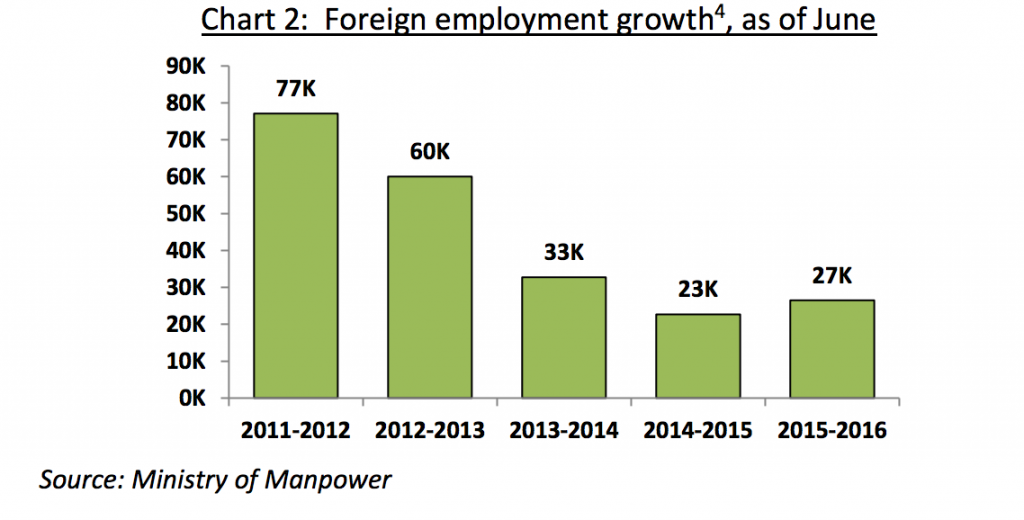

This means that our rental prices here are largely affected by the amount of foreigners coming in. Back before when Singapore used to get a lot of highly paid expatriates on big pay packages, this used to prop up a lot of the high rental prices. This is coupled with the foreign employment growth of 77k from 2011-2012. Foreign employment growth has dropped since then to 27k from 2015-2016, but this has however increased from the year before.

Perhaps with the recent news of Singapore dropping out of the top 20 most expensive location for expatriates to live in we may perhaps be looking at a resurgence of expats coming into Singapore.

As always, these are just a couple of fundamental tips that you have to know about the rental market in Singapore. There are still many other factors to consider when investing in a property, such as tenure, surrounding potential development of the area, proximity to transport links and many more. If you have any questions feel free to email hello@stackedhomes.com

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

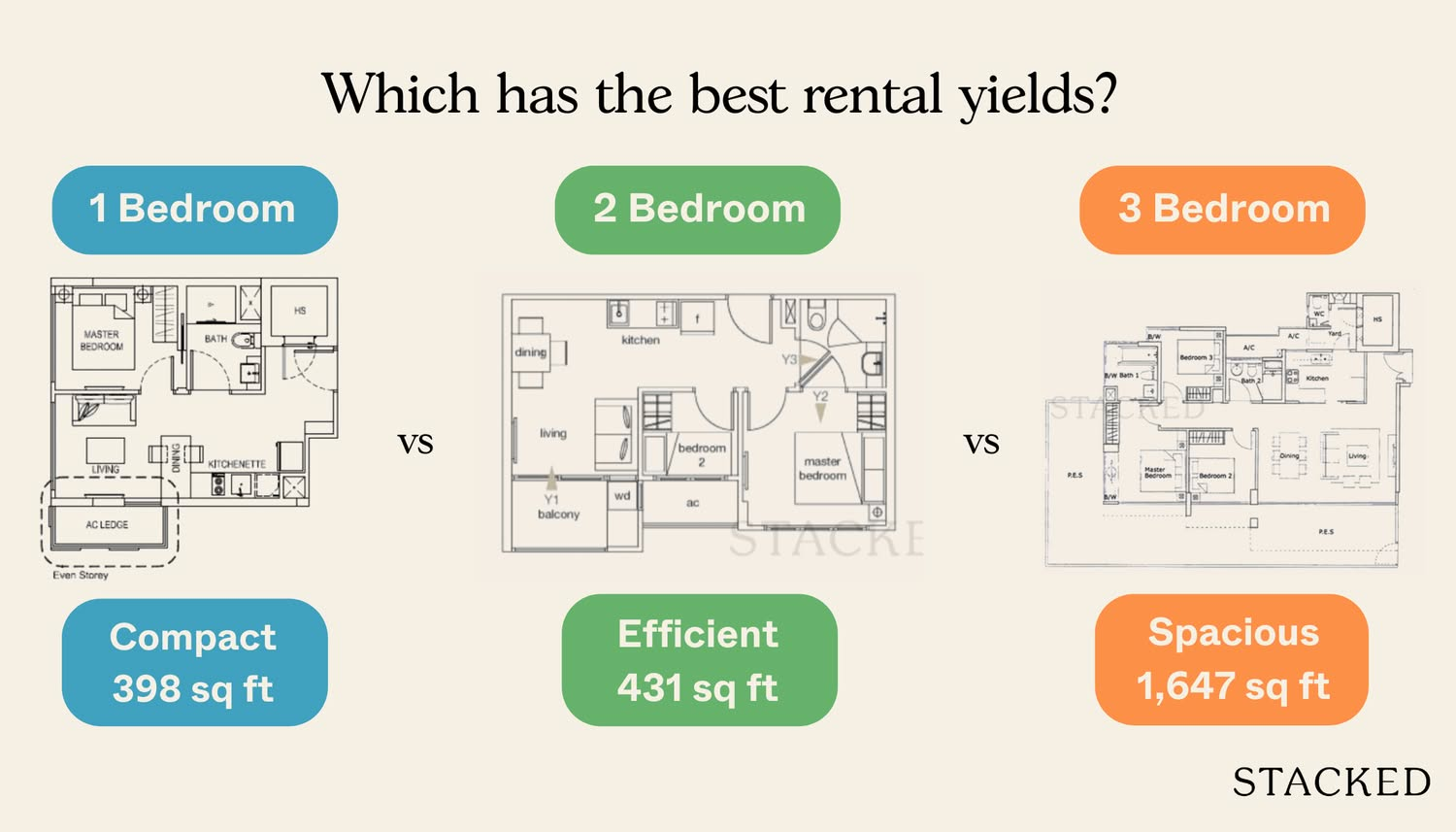

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

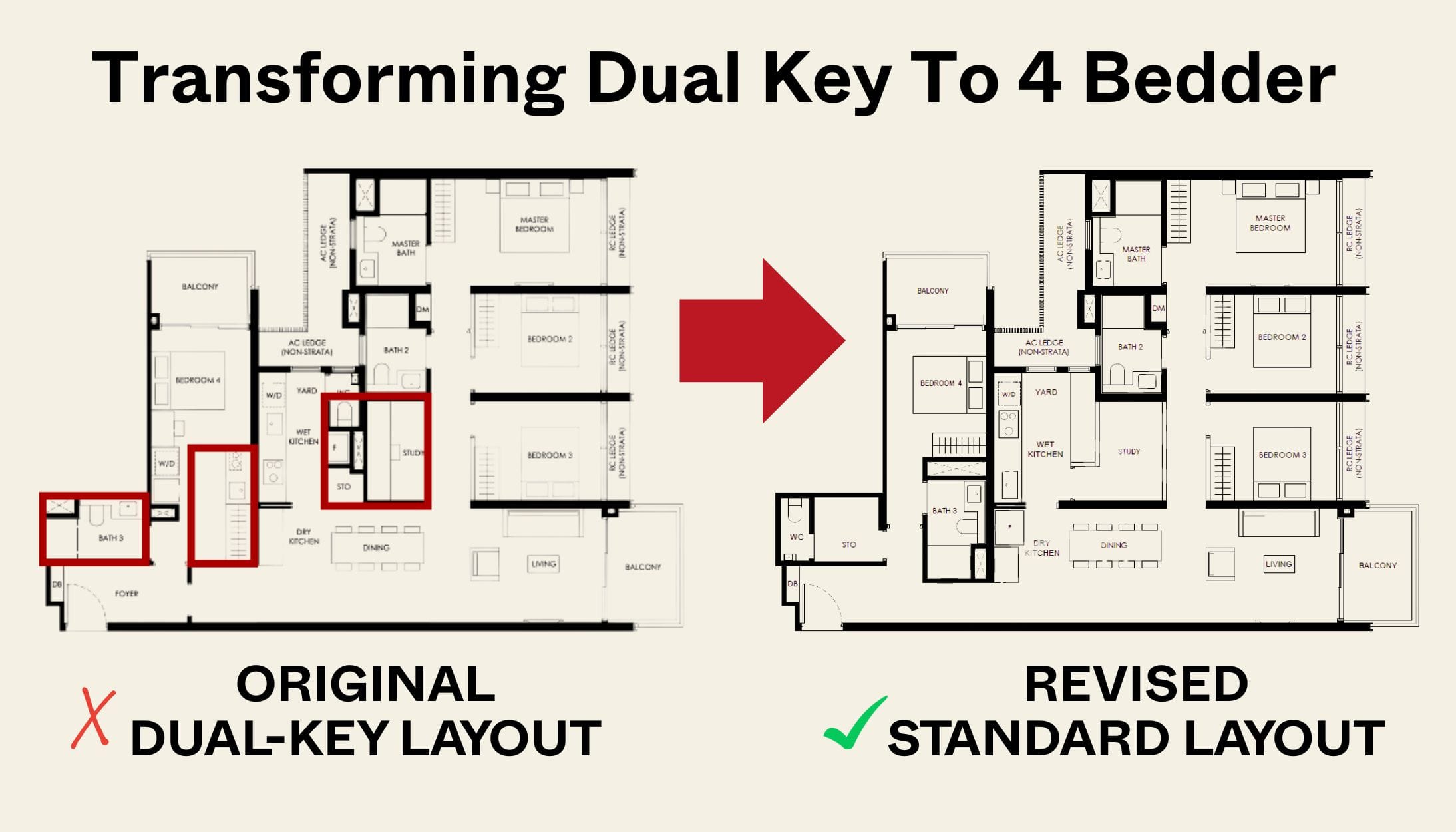

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

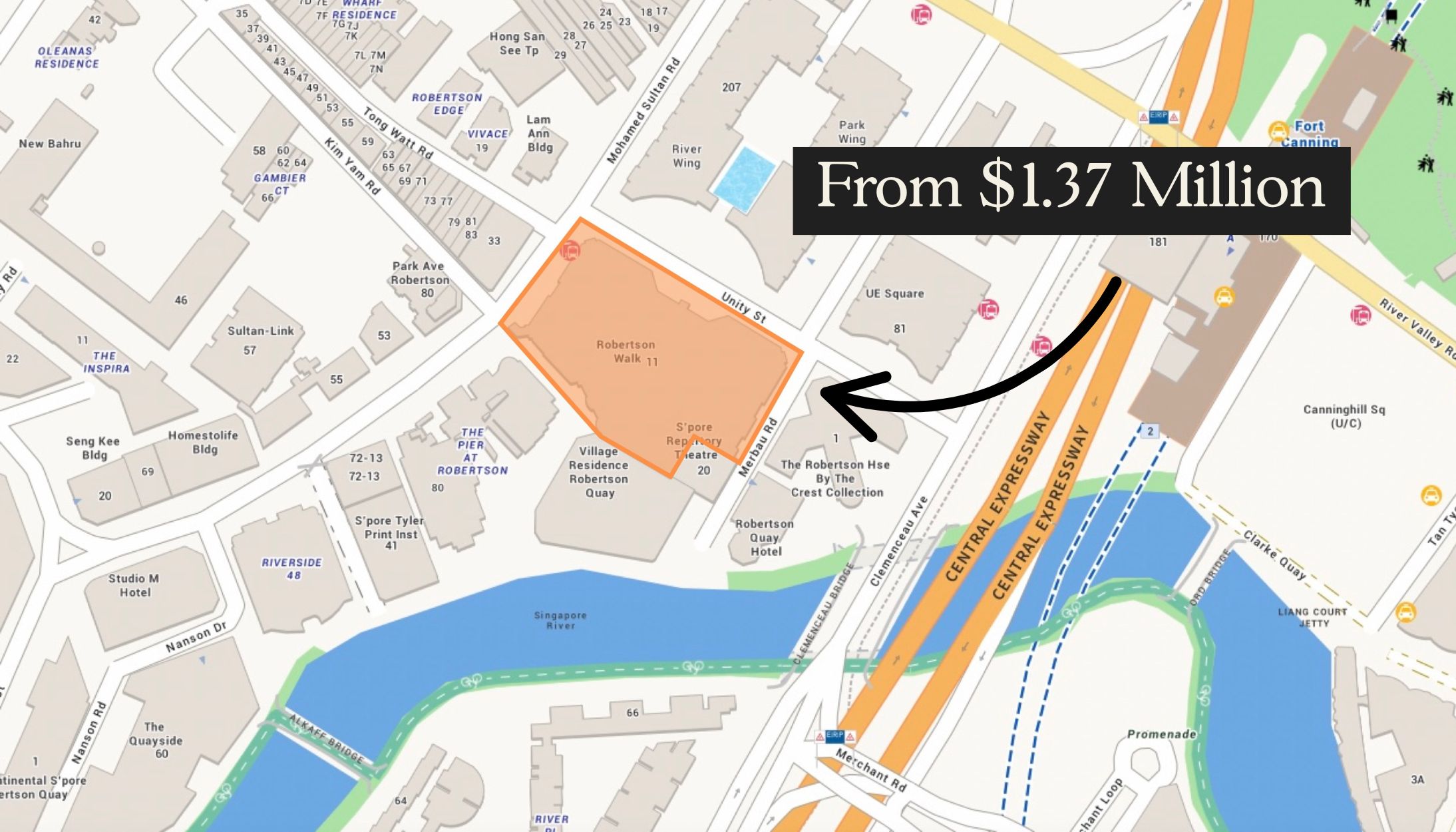

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

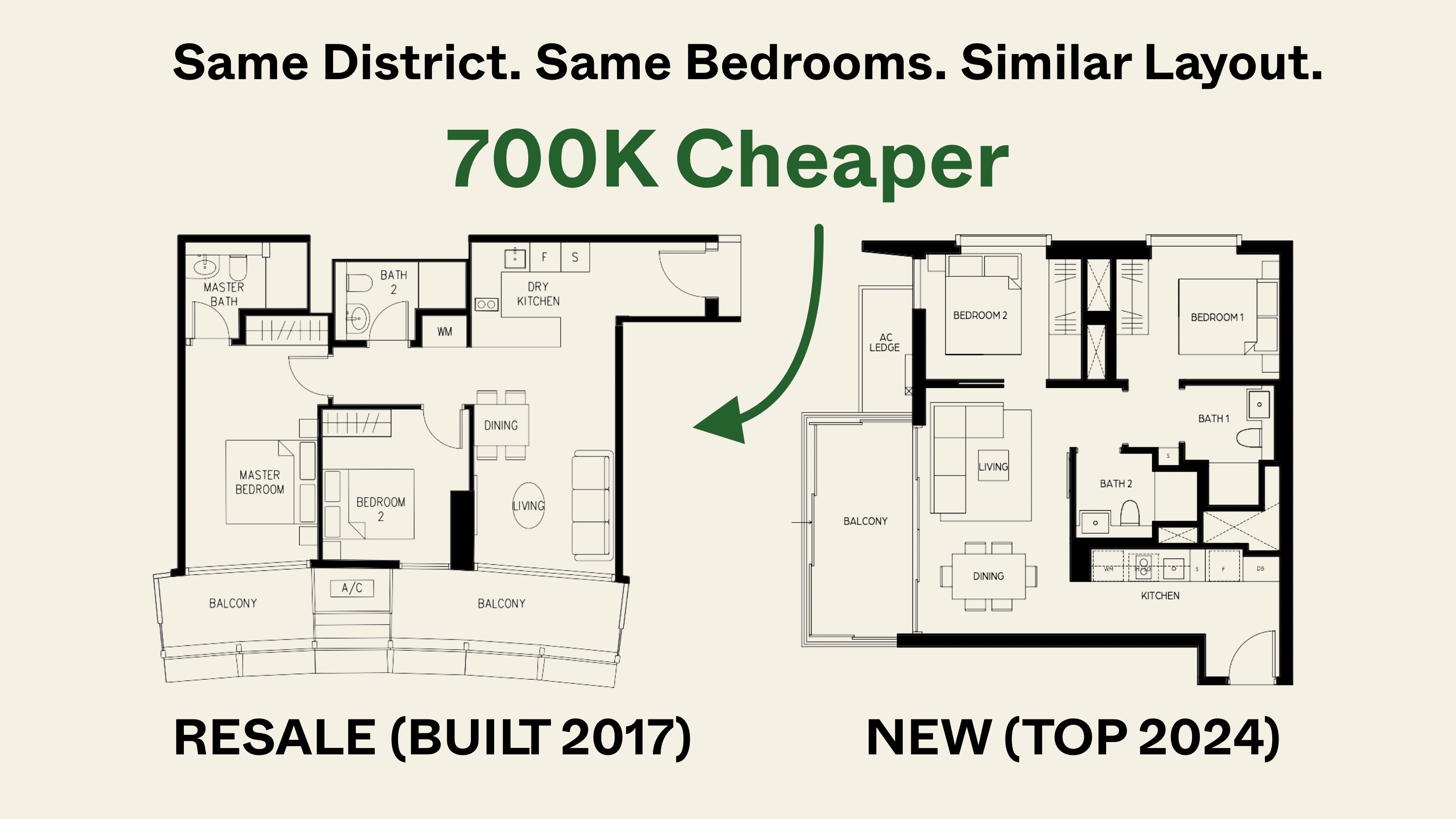

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

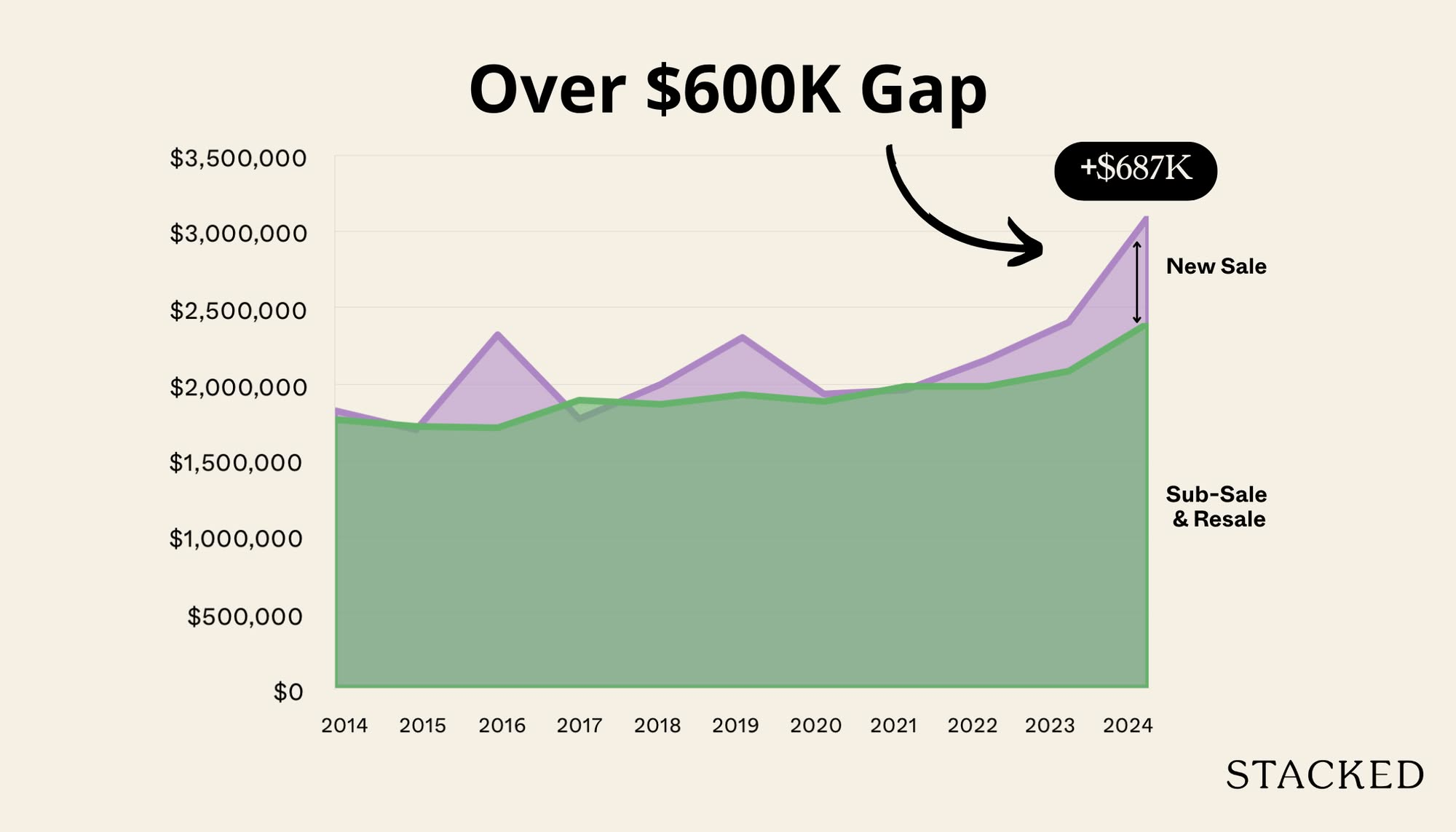

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

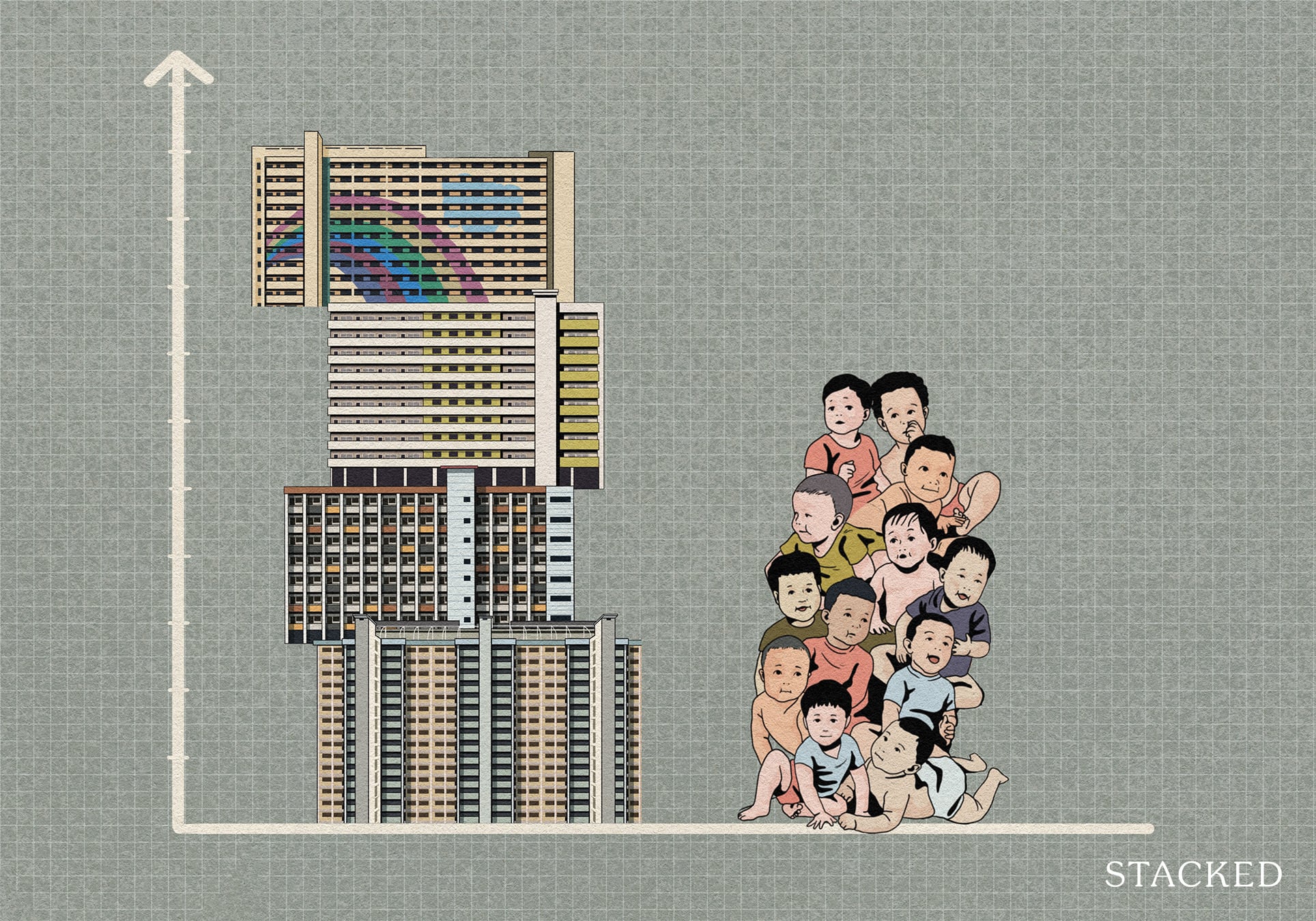

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look