1,480 New Condos Sold In 1 Weekend: Why Are Singaporeans Rushing Despite “High” Prices?

November 19, 2024

If you haven’t heard the news, well, new launch fever has hit town. Emerald of Katong sold out 99 per cent of its 846 units over the launch weekend, Nava Grove moved 65 per cent of its units, and Novo Place managed to sell 57 per cent at an average of $1,654 psf. That’s a total of 1,480 transactions so far, not even counting the 696 units sold at Chuan Park the previous weekend. This runs contrary to a lot of what we hear online, where buyers have been saying prices are more unaffordable than ever. What’s going on? We asked around on the ground:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Pent-up demand in some of the recent areas/lack of launches in 2024

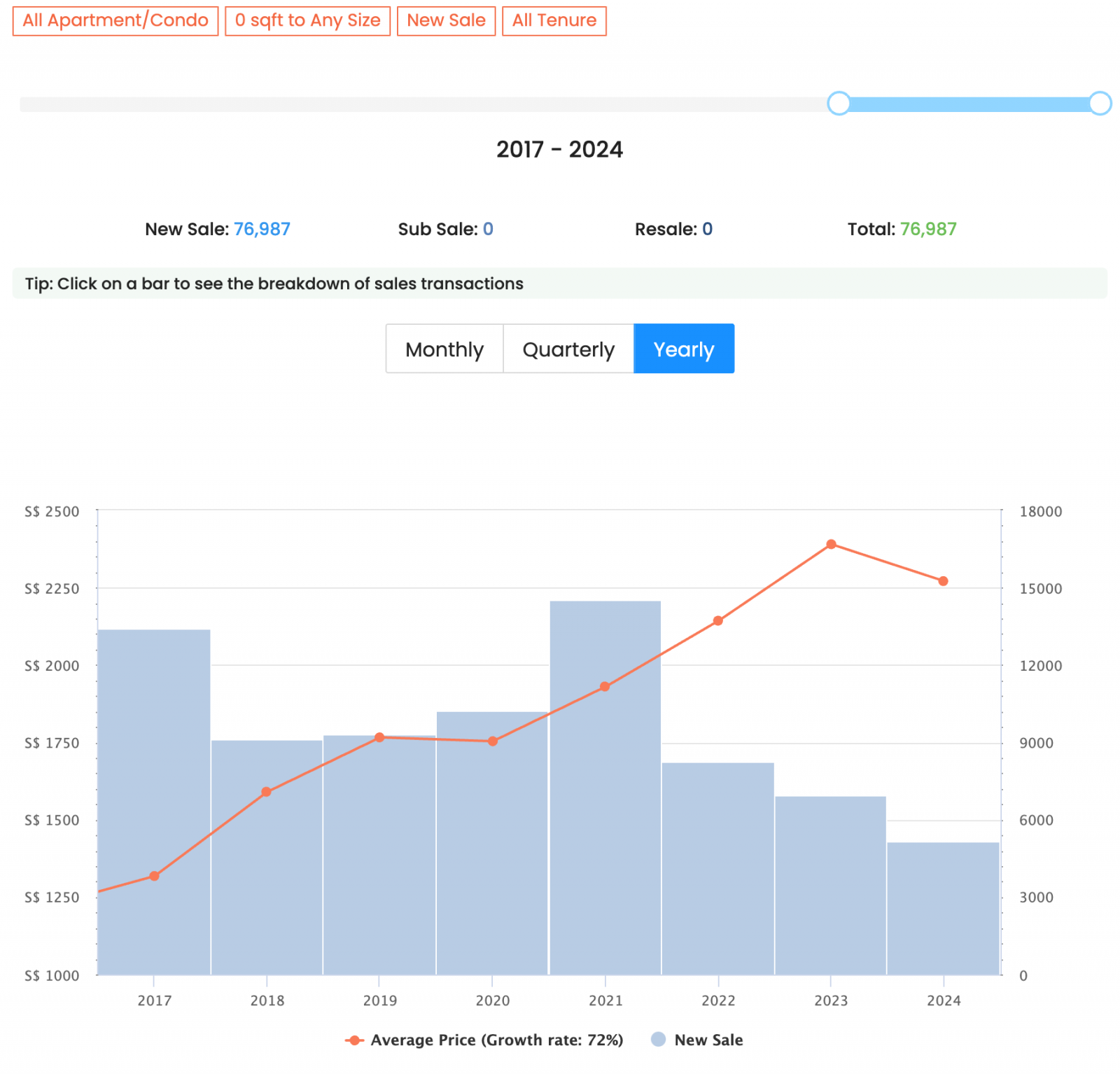

If you’ve been keeping track of the new launch market, you would know that the first half of 2024 only registered 1,916 units sold. This figure is the lowest half-year figure recorded since 2008, and more incredibly, it is even lower than the second half of 2008 (the global financial crisis) when 1,977 units were sold.

If we add last weekend’s 1,480 units to the current 5,186 units, that brings to a total of 6,666 units. Looking at the numbers from the past few years, this still represents a low number of new units sold – which isn’t reflective of last weekend’s bumper sales. It’s more that the new launches have been concentrated in the last quarter of 2024, which may have distorted the overall view.

And as we saw with AMO Residence, and Chuan Park, a lot of the buying could be due to pent-up demand. That is, HDB upgraders in the area have had view options over the past few years. When the rare new launches come about, they’re quick to make the leap, having waited in the wings for a long time.

(Proximity to their old home makes a big difference to some buyers, as they want to continue being near their parents, favourite hang-out spots, etc. even after they move).

Some of these new launches are also big projects (Chuan Park has 916 units), and the sale of so many units makes the jump in transaction volumes very noticeable.

2. More projects near MRT stations, and more mega-developments

This is related to point 1 on pent-up demand, but another reason for the sales figures we’ve seen is that it has coincided with 2 strong new launches (Emerald of Katong and Chuan Park). For one, they are both mega-developments (which we’ve explained more below) and two, they’ve been pushed for some time as the ones to look out for in 2024.

Mega-developments, with 1,000+ units, will lose out in terms of exclusivity. But they compensate with typically more competitive prices, lower maintenance, and a larger range of facilities. Any scepticism may also have been wiped out by several successful previous launches: Treasure at Tampines, Normanton Park, and Parc Clematis may have paved the way for bigger launches like Chuan Park and Emerald of Katong.

It appears that homeowners and buyers are satisfied with what they’ve seen; it helps even more than many of these projects are near MRT stations. Projects like Grand Dunman and Emerald of Katong, for instance, could be quite inaccessible without the new Thomson-East Coast Line. Do note that the slew of new launches in the Lentor area, such as Lentor Modern, Lentor Mansion, Lentoria, etc. have also benefited from the same factor: the coming of Lentor MRT station on the TEL.

As an aside, this also bodes well for the moribund en-bloc scene. If mega-developments keep selling well, developers may rediscover the confidence needed to take on large land parcels, so common to older condos.

3. Optimism over the return of a lower-interest rate environment

The US Federal Reserve has cut rates recently, with a jumbo rate cut in September 2024. This has a knock-on effect in Singapore, where SORA-based home loans tend to move in tandem with US interest rates. You can see the effect on our mortgage rates in this article.

(Note that falling interest rates are specific to SORA-based loans, and don’t apply to HDB loans, or some loans that use internal board rates)

More from Stacked

6 Factors To Look Out For When Buying An Old 40-Year-Old Resale Flat

A few years ago, not many buyers would have been eager to buy a flat halfway through its lease. In…

We’re not sure how long this will last though. In more recent news, the Fed has been noises about pausing further rate cuts. We’re also told that the US election results may have something to do with this, as tariffs can cause inflation rates to rise (raising interest rates is one of the Fed’s main tools for fighting inflation). Now we don’t know either way about that as we’re not economists, but it could mean rates won’t fall as low as expected.

Regardless, a lower interest rate means better returns on property and a more affordable monthly loan repayment. This may not be the main reason why buyers are buying, but it certainly helps to make the decision easier.

4. People cashing out of other investments

There’s been a recent surge in the stock market, as well as in other alternatives like crypto. This results in more cash-rich investors that have exited their positions coming into the market, looking for their next investments. Or it could also just mean many have done well enough, and are looking to indulge in a new home.

In any case, private property can serve two purposes for them: first, it’s a safe haven asset that they can use to “lock in” whatever gains they’ve had. With the next four years looking more volatile, real estate could serve as the lower-risk portion of their overall portfolio.

Second, property can act as a good hedge against inflation, which has been on everyone’s mind (and everywhere in the world) of late. More affluent Singaporeans, who can afford a sell-one, buy-two strategy, maybe especially tempted as they’re not saddled with ABSD.

5. Attractive pricing (comparatively speaking)

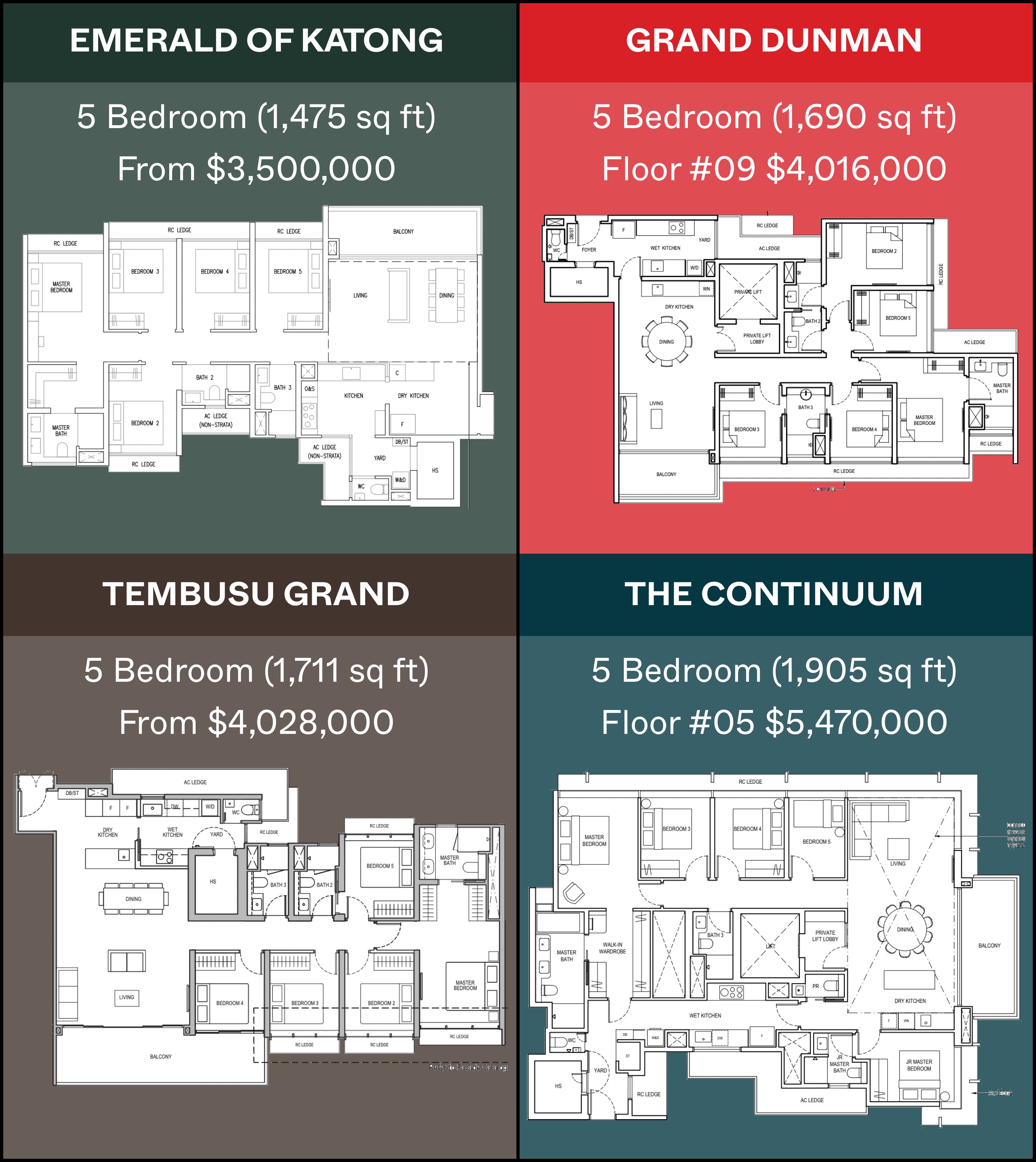

Yes, we know: anyone who says condos are cheap right now had better duck for cover. But in context: recent offerings have shown efforts to reign in pricing. Emerald of Katong is the best example of this – despite coming later than the triad of Tembusu Grand. Grand Dunman, and The Continuum, it was generally priced lower. For a full breakdown, you can read our pricing review here.

Where we encountered divided opinions, however, was on the issue of land availability and land costs. Recent bids for GLS sites have been low, with fewer bids, and some bids rejected for being too low. There are also clear attempts to ramp up the supply, perhaps to moderate prices from the previous Covid-era shortage.

Some realtors told us this can contribute to lower condo prices, as developers have more room to drop the price. Increased supply should also, logically, require the price to go down. But not everyone agreed, and some realtors pointed out that:

(1) Developers are inclined to follow the current market rates, even if they got the land for cheaper. If the current rate is $2,200+ psf for a new launch, a developer is likely to aim for that, even if the land was purchased for less, and…

(2) Some of the low or rejected bids were due to highly situational reasons. One such reason was the government’s insistence on long-stay service apartments, which developers have little interest in; the other is specific to the CBD and prime regions, where developers are reacting to the high ABSD rates on foreigners.

These realtors argue that lower land prices from GLS sites won’t really keep prices down. Time will tell; but for now, we have seen new launch prices moderate, and developers trying to stay reasonable.

Despite what we’re hearing on social media, there’s been a strong disconnect between the property market, and the online complaints of unaffordability. But against all appearances, the Singapore private property market can handle the big price tags.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

Everyone wants to be the first buyer so they can resell with $400-500k profit

Little do people realize with these prices, reselling will be very expensive