Could Your HDB Flat Be Worth $1 Million? Here’s How Many Are Close In 2024

October 24, 2024

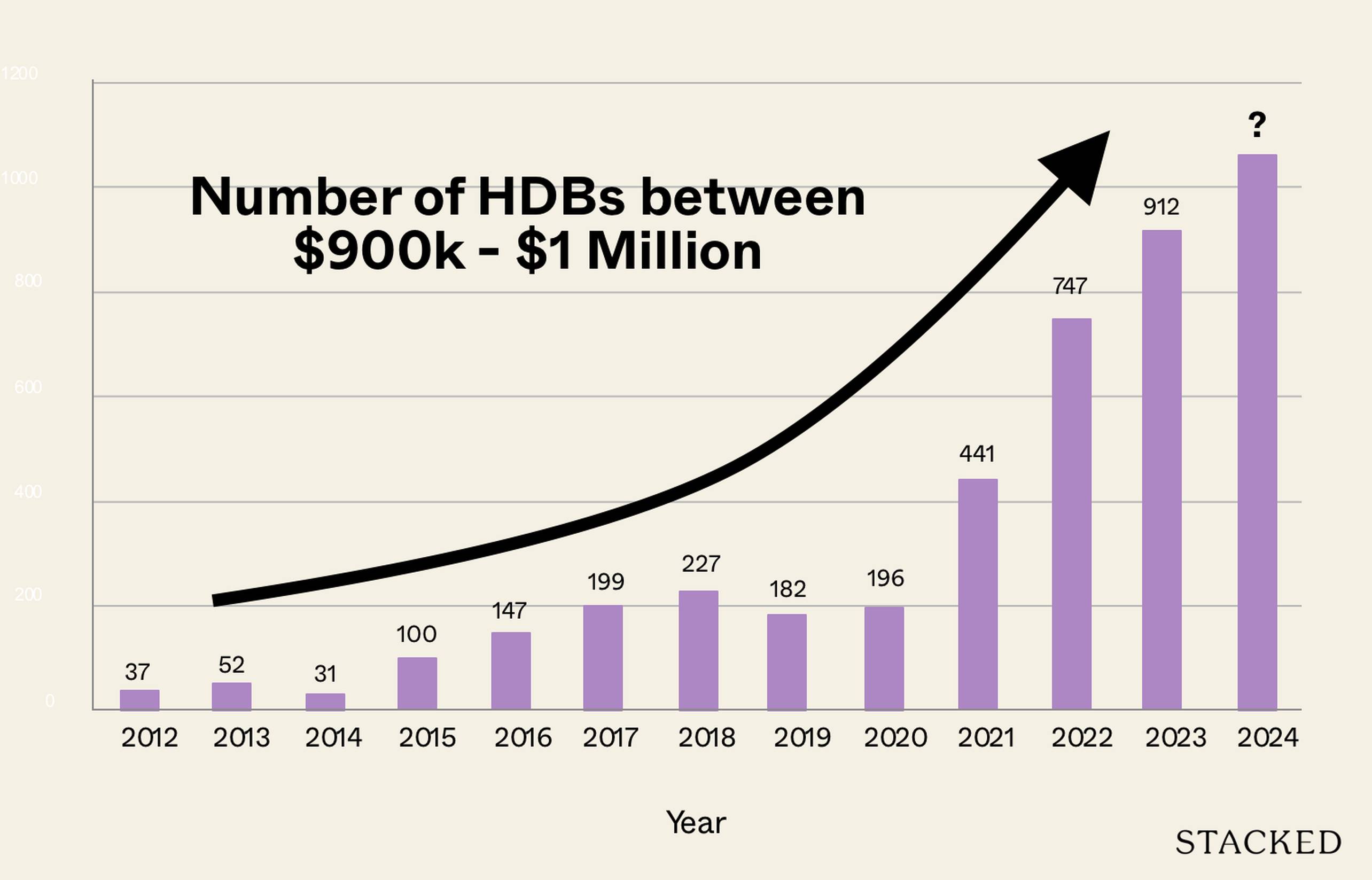

As the old saying goes, don’t focus on the ball but on where the ball is going. We’ve seen an explosive rise in the number of million-dollar flats in the past few years, even if they’re still the minority of transactions (for now). So let’s look instead at the up-and-coming resale flats: the ones that are creeping toward the $1 million mark, but are not quite there yet. Here’s how the proportion of $900,000+ resale flats has been mounting:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How has the number of near million-dollar flats risen over the years?

For the purposes of “near” a million, we’re looking at flats with a quantum of between $900,000 and $1 million:

| Year | <900k or >1m | Between 900k & 1m | Total | Proportion |

| 2012 | 23,161 | 37 | 23,198 | 0.16% |

| 2013 | 16,045 | 52 | 16,097 | 0.32% |

| 2014 | 16,065 | 31 | 16,096 | 0.19% |

| 2015 | 17,680 | 100 | 17,780 | 0.56% |

| 2016 | 19,226 | 147 | 19,373 | 0.76% |

| 2017 | 20,310 | 199 | 20,509 | 0.97% |

| 2018 | 21,334 | 227 | 21,561 | 1.05% |

| 2019 | 22,004 | 182 | 22,186 | 0.82% |

| 2020 | 23,137 | 196 | 23,333 | 0.84% |

| 2021 | 28,646 | 441 | 29,087 | 1.52% |

| 2022 | 25,973 | 747 | 26,720 | 2.80% |

| 2023 | 24,862 | 912 | 25,774 | 3.54% |

| 2024 | 21,457 | 1,059 | 22,516 | 4.70% |

Some notable trends:

1. These transactions are still the minority, but are growing rapidly

If we were to take a truly big-picture view, 1,059 transactions would not be a huge number in relation to the wider market. Flats between $900,000 to $1 million still make up less than five per cent of all resale transactions; and in a sense, the way we treat the news reflects that. (i.e., realtors and news outlets blast these high transactions on the front page, which if you think about it, reflects on how they’re still not the norm.)

We’d also point out that percentage-wise, an increase of 37 to 52 transactions between 2012 and 2013 (around a 40.5 per cent increase) was a bigger jump than 2023 to 2024 (about a 17 per cent increase).

Nonetheless, the growth over 10 years has been explosive. For the whole year of 2012, a mere 37 flats in the entire country reached the $900,000+ range; far below even a single percentage point. But today? From word on the ground, analysts and realtors have also told us there isn’t a single HDB town without at least one $900,000+ transaction.

While these transactions are still rare, the market seems to be in the process of normalising them.

2. High-value flats seemed more resilient toward the 2014 cooling measures

By 2013, resale flat prices were so high, that the government stepped in with aggressive measures. HDB stopped publishing Cash Over Valuation (COV) data, and the Mortgage Servicing Ratio (MSR) was capped at 30 per cent.

This move had serious teeth in the wider resale market, with COV rates plummeting immediately. In the years immediately following the change, it was a norm to see zero COV transactions; and the resale market remained on a near-consecutive slide for the following eight years; its revival only came in the immediate aftermath of Covid, when there was a housing supply crunch.

A quick snapshot might explain the situation better. Here are average resale flat prices across all types, and all towns, since the big drop in 2014:

If you look at the number of $900,000+ flats, however, they seem to have bucked the trend. The number of these pricey flats steadily increased all the way up to 2018, seeing a decrease only in 2018/19 (partially related to the end of the en-bloc craze, which brought about heightened market sentiment toward lease decay).

This shows that people were still forking out huge sums for $900,000+ flats, throughout the period when MSR and lack of COV data was dragging the wider market down. This likely reflects the superior location of these flats, which (before the Plus and Prime schemes) couldn’t be replicated by new supply.

3. Fewer concerns over lease decay

Most flats in the $900,000+ price range and above tend to be older. Among these, we find maisonettes and jumbo flats that are no longer built; and the scarcity partly contributes to the price.

(An exception would be the newer DBSS projects which came from the ‘00s, but even these are far from new, built between 2005 to 2012).

There doesn’t seem to be much concern over the lease decay today, however. There was a period when it more deeply affected market sentiment (see point 2); but perhaps the post-Covid housing shortage, plus rallying news of flat prices, have helped buyers to quickly get over the fact.

Speculatively, schemes like the Lease Buyback Scheme (LBS), as well as an increasing tendency to see flats as homes rather than investments may be contributing to this. Older Singaporeans, who simply want a good location to live out the rest of their lives may be unconcerned about “overpaying.” Resale gains, rental yields, and other such factors may be meaningless abstractions to them; and for someone in their mid-60s to 70s, even a 30-year lease can be deemed sufficient.

4. In the short term, Plus and Prime models may support rather than bring down these prices

It is possible that, in the long run, higher availability of flats in desirable areas could help to moderate prices. Restrictions like a 10-year MOP don’t matter to true homebuyers, who intend to live there a long time (possibly for their whole life); so restrictions don’t change the impact of higher supply in traditional hot spots.

In the shorter term, however, the opposite may happen. We’ve already heard the sales pitch to resale flat owners in Kallang – Whampoa, Bukit Merah, Queenstown, and other hot spots: their flat has the same location as Prime projects, but none of the drawbacks – no 10-year MOP, clawback, eligibility requirements, etc. As such, they’re justified in pushing up their asking prices; and it’s hard to argue that doesn’t make some sense.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have the prices of near million-dollar HDB flats changed over recent years?

Are high-value HDB flats more resistant to market cooling measures?

Do buyers worry about lease decay when purchasing high-priced HDB flats?

What impact do new schemes like Plus and Prime have on high-value flat prices?

Has the proportion of high-value flats in the resale market increased significantly?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments