Can Lower-Income Singaporeans Better Afford HDB Flats In 2024? Here’s What The New Measures Mean

September 7, 2024

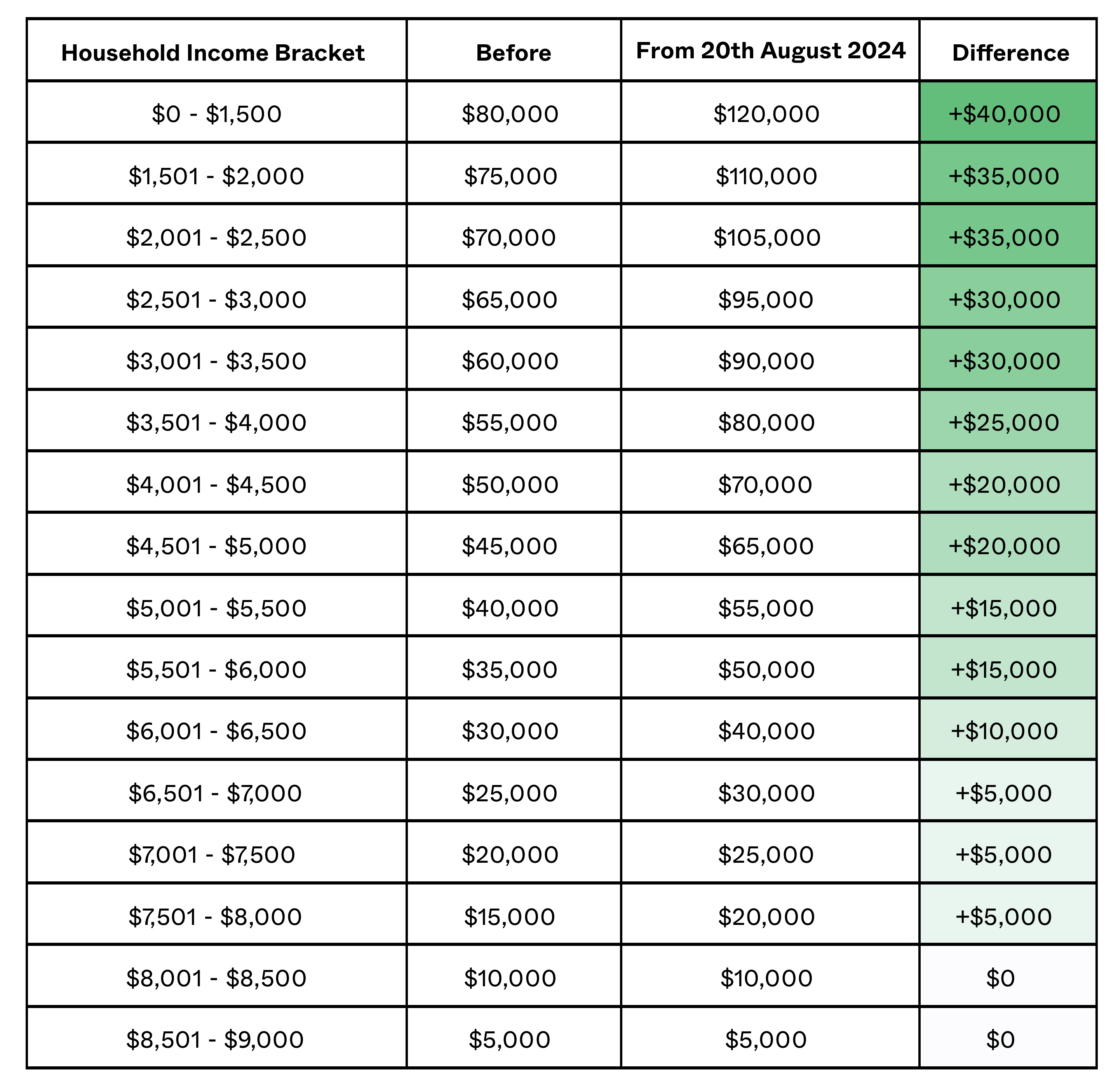

Since the news of the cooling measures in August, we’ve written about how it has impacted the middle-class group in Singapore. However, the news comes with a silver lining for the lower-income group – the maximum Enhanced Housing Grant (EHG) subsidy was previously $80,000, but the ceiling has now been raised to $120,000.

In this piece, we take a closer look at how Singapore’s lower-income households are likely to be affected by the recent changes.

First up, here’s how the increased EHG helps:

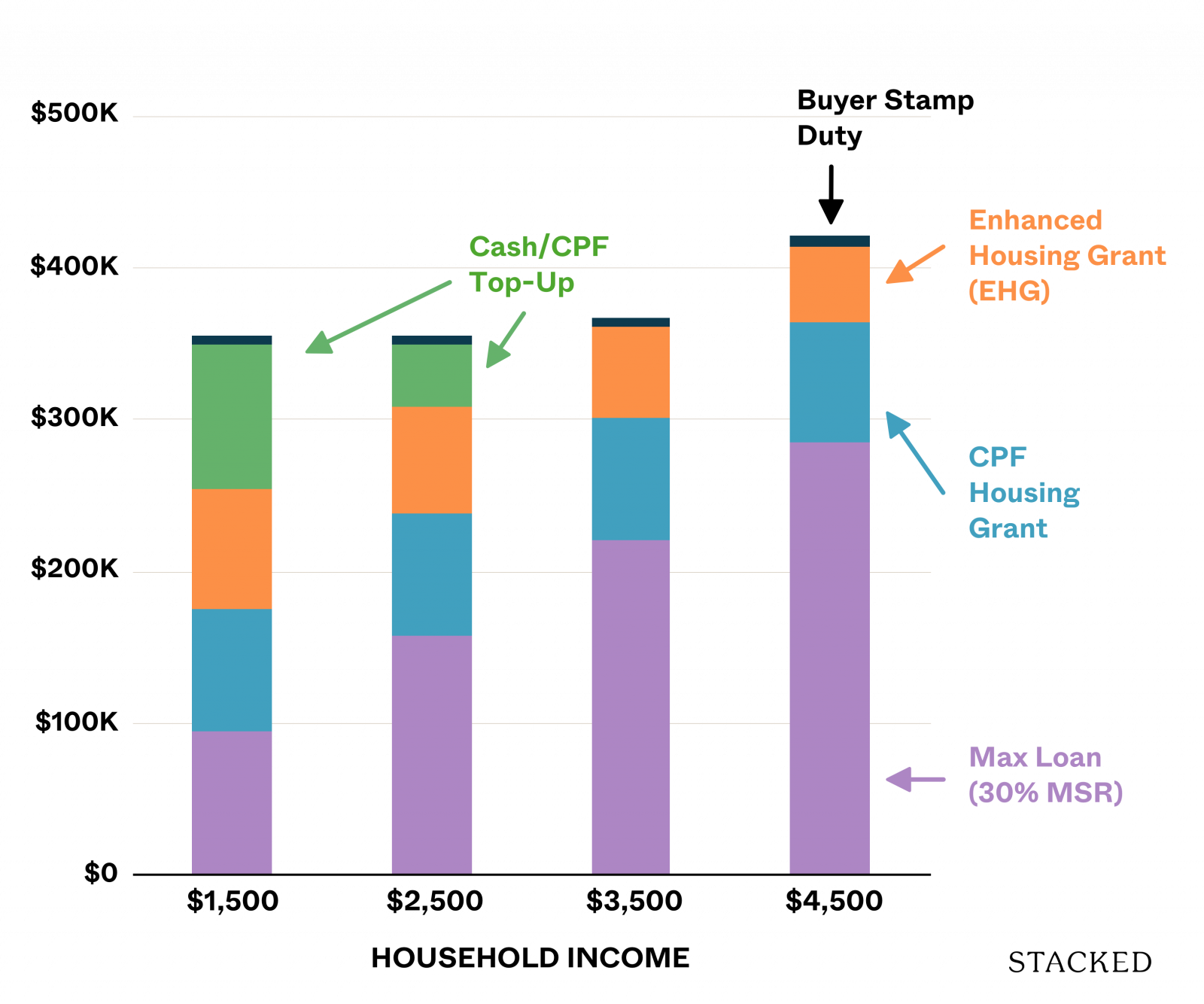

Next, let’s see how it impacts affordability. It has to be said, answering this question puts us in a predicament as we have to make some assumptions. Unlike the middle income where using a simple formula lets us find out what they can afford based on the MSR, lower income groups have to put up a lot more cash/CPF to meet the minimum requirement for even a 3-room HDB flat.

And this is difficult even with the higher Enhanced Housing Grant.

The middle income can simply choose an older flat or a cheaper estate. The lower income has fewer options.

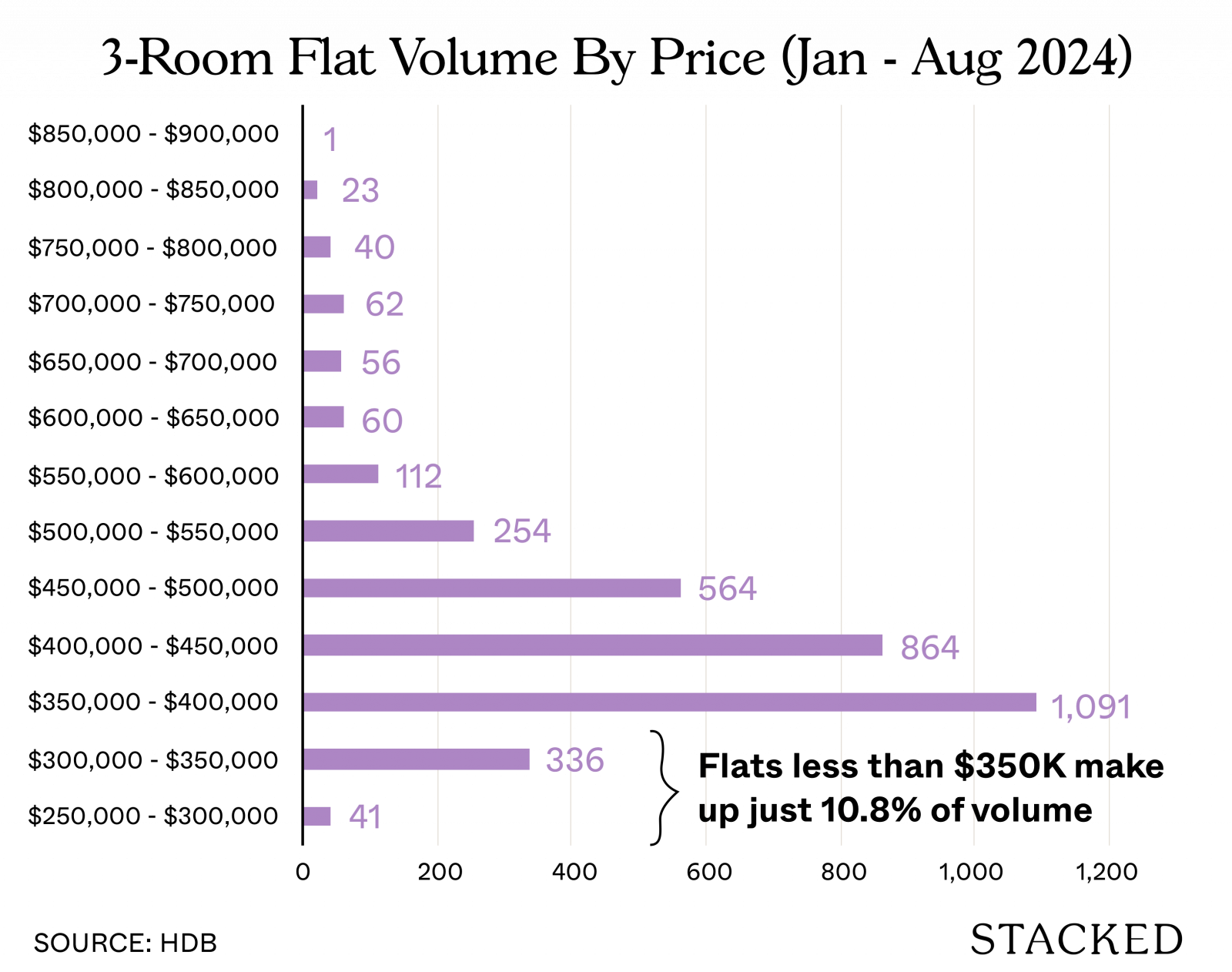

To illustrate, here’s a look at the volume of 3-room flats transacted by price bands, starting with $250K:

Only around 11% of all 3-room flat transactions (excluding Terrace homes for obvious reasons) transacted for $350K and below. If you’re stuck within this price range, you don’t have a lot of choices at all. These would be the oldest 3-room flats you can buy in Singapore.

Since calculating a purchase price using an MSR formula alone isn’t sufficient, we’ll need to consider a scenario. For example, a lower-income family looking to start their journey towards homeownership might aim to purchase a 3-room flat, typically priced around $350K. We will base our analysis on this assumption.

With that in mind, let’s now look at how the regulation plays out for them.

| Before 20th August 2024 | Household Income | |||

| Type | $1,500 | $2,500 | $3,500 | $4,500 |

| Enhanced CPF Housing Grant | $80,000 | $70,000 | $60,000 | $50,000 |

| CPF Housing Grant (Families) | $80,000 | $80,000 | $80,000 | $80,000 |

| Max Loan (Based on 30% MSR) | $94,894 | $158,157 | $221,420 | $284,683 |

| Max Loan + Grants | $254,894 | $308,157 | $361,420 | $414,683 |

| HDB Flat Price (Loan + 20%) | $350,000 | $350,000 | $361,420 | $414,683 |

| LTV Ratio | 27% | 45% | 61% | 69% |

| Top-Up Required | $95,106 | $41,843 | $0 | $0 |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should I Buy J Gateway Even Though The HSR Was Cancelled?

Hi there!

The MSR of 30% severely restricts the affordability of a household earning $1,500 (they can loan $94,894). Plus the grants, this comes up to $254,894. At this price, the household will have few options that topping up is necessary. If we assume they have saved up to purchase a $350,000 flat, then the cash/CPF top-up they have to top up $100,306 (including the BSD):

Here’s what their affordability looks like after the recent changes:

| From 20th August 2024 | Household Income | |||

| Type | $1,500 | $2,500 | $3,500 | $4,500 |

| HDB Flat Price (From Previous Example) | $350,000 | $350,000 | $361,420 | $414,683 |

| Enhanced CPF Housing Grant | $120,000 | $105,000 | $90,000 | $70,000 |

| CPF Housing Grant (Families) | $80,000 | $80,000 | $80,000 | $80,000 |

| Max Allowable Loan Based On 75% Of Purchase Price | $262,500 | $262,500 | $271,065 | $311,012 |

| Max Loan Based On MSR | $94,894 | $158,157 | $221,420 | $284,683 |

| Max Loan + Grants | $294,894 | $343,157 | $391,420 | $434,683 |

| Buyer Stamp Duty | $5,200 | $5,200 | $5,443 | $7,040 |

| Top-Up Required | $55,106 | $6,843 | $0 | $0 |

| Difference in top-up | $40,000 | $35,000 | $0 | $0 |

You can clearly see the difference in the change in the Enhanced Housing Grants. Now the low-income group who wants to afford the $350K is closer to being able to afford a $350k flat.

You’ll also see that now, households earning $3,500 and $4,500 saw their affordability go up by $30,000 and $20,000 which is equivalent to the EHG increase. In this case, their affordability is now $391,420 and $434,683 respectively.

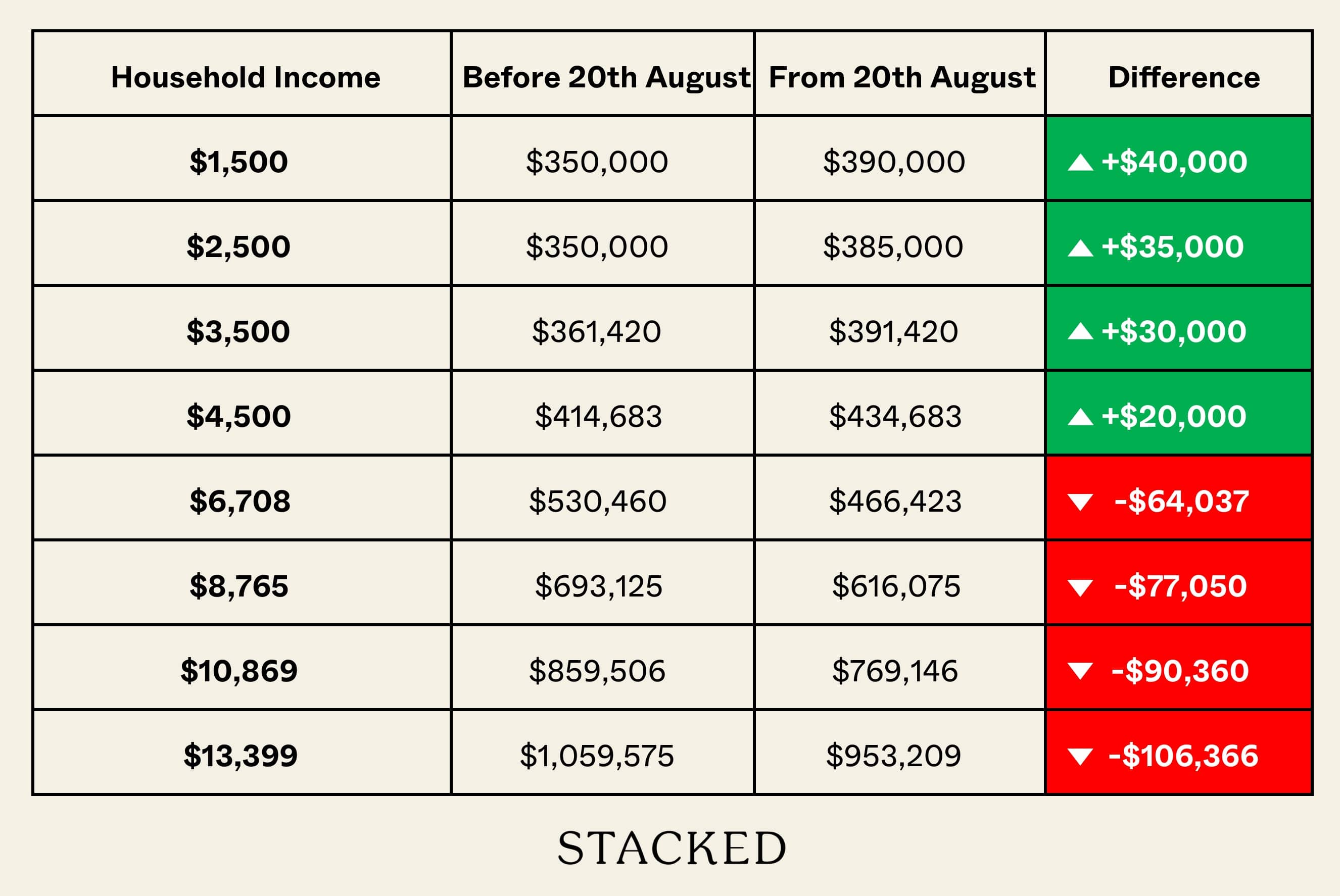

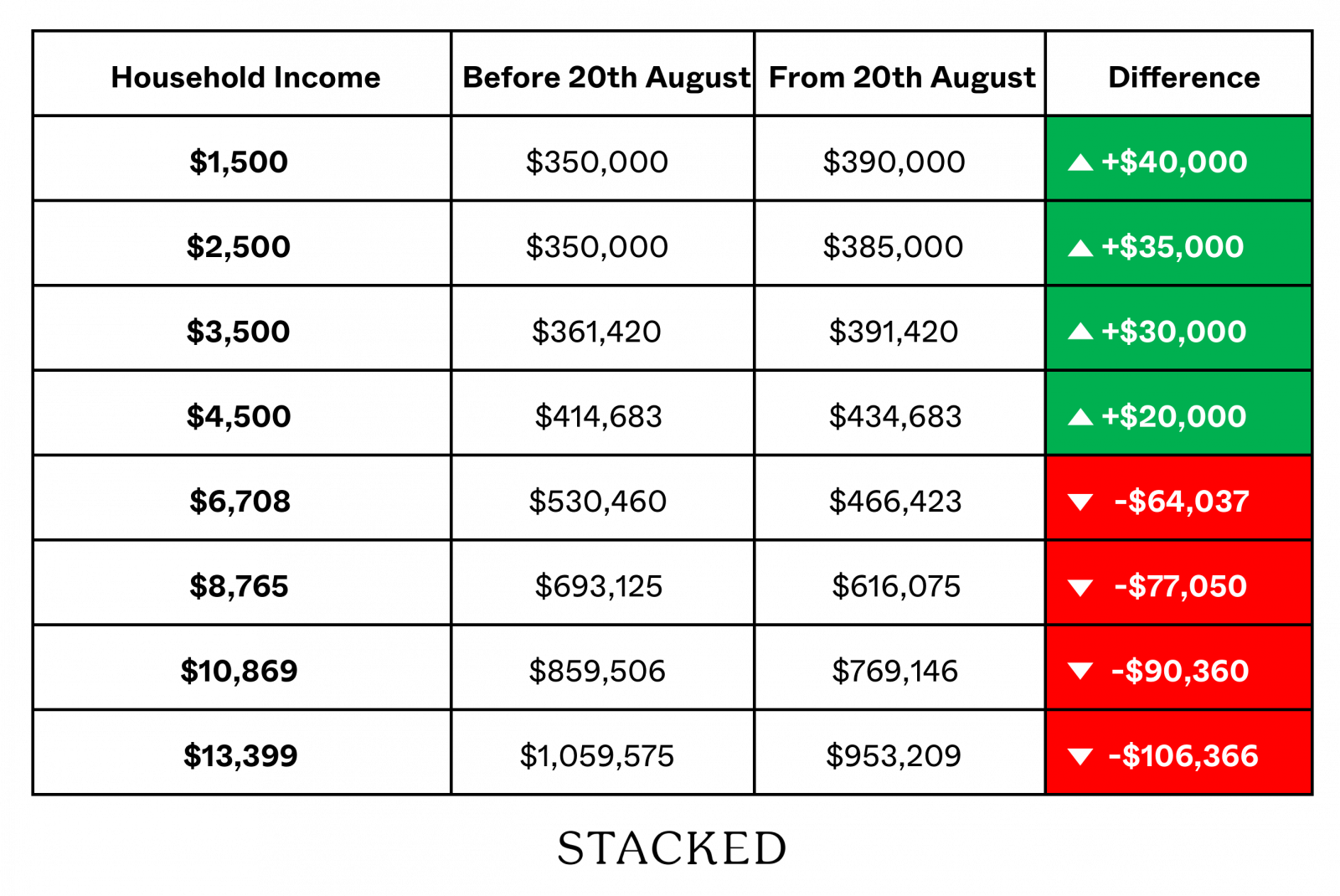

Now that we have all the figures, we can put every income group looked at together (based on our previous article here) and see the before-after effects assuming the top-up amount remains the same:

What’s interesting here is how the income groups between $4,500 and $6,708 converge. While the increased grant amount of $20,000 doesn’t look like much, the drop in affordability for middle-income earners who aren’t able to meet the top up puts them in almost the same category as those earning $4,500.

Another way to look at it is – now, lower-income groups, who were hardest hit by inflation and the increased interest rates, have received the greatest benefit. So for those in the lower income, while affordability remains a challenge, the playing field has evened out slightly.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How does the increase in the Enhanced Housing Grant affect lower-income Singaporeans trying to buy HDB flats in 2024?

What are the main challenges for lower-income families in affording HDB flats despite the increased grants?

How does the recent regulation change impact the affordability of a typical $350,000 3-room flat for low-income households?

What is the significance of the change in affordability for middle-income earners after the new measures?

In what way do the new measures help lower-income households compared to middle-income households?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments