5 Handy Ways To Use Your Property For Retirement Planning

March 10, 2021

It’s quite common to hear that “property is a good retirement asset”. But in practice, not every homeowner is clear on the role of their property in their retirement portfolio; many don’t have considerations beyond selling and downgrading, or even assuming they’ll move in with children. But there are more ways in which property can boost retirement funds, and here are some other methods out there:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Caveat:

The following isn’t financial advice, and proper retirement planning has to be done on a case-by-case basis. They are only general concepts on how property can and has been used to support a home owner’s retirement. Always talk to a qualified financial planner, wealth manager, etc. or other professional that you trust, before trying to implement any retirement strategies. Remember, what works for one home owner may not work for another.

Five methods to complement your retirement with your property:

- Sell and downgrade at retirement

- Seek cash-flow positive properties

- Partial rental

- Pledging your property for CPF

- Lease Buyback Scheme (for HDB properties)

1: Sell and downgrade at retirement

This is probably the most common approach: the idea is that at retirement, you’ll sell your home, move into a smaller one, and then use the remaining sale proceeds for retirement (e.g. sell your condo for $1.5 million, buy a flat for $400,000, and have $1.1 million left over for retirement).

However, there are a few risks involved here.

The first is that you don’t really know the future prices on your property. While property generally appreciates over time, it’s hard to know by how much, and if the overall returns are sufficient for your retirement plans. There is a possibility that, at your particular time of retirement, the real estate market may be in a downturn.

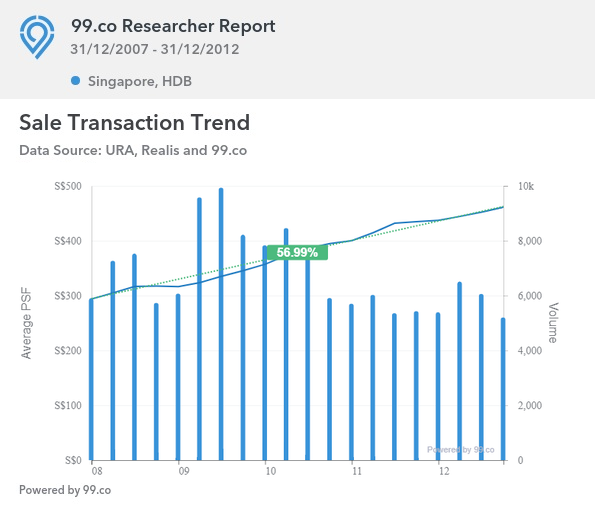

Consider, for instance, the price movement of resale flats since the early 2000’s. In the run-up between the financial crisis of 2008 to 2013, resale flat prices moved like this:

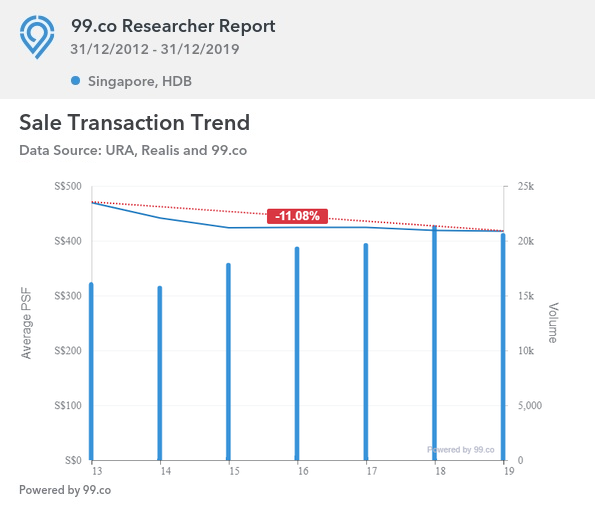

Right after that, HDB resale flat prices fell for around seven years straight, before recently picking up again:

Of course, a dip in property values will hardly destroy retirements; and in the above case most flat owners still made a lot more than they lost, even if they sold in 2009 or 2010. But it is worth noting that your property value could fall below expectations closer to retirement.

In addition, other factors – such as the remaining lease on a property – can also impact resale value. This could be one consideration for choosing a freehold property, despite the price premium (for a more in-depth consultation on whether a specific property can meet your targets, contact us directly).

Finally, our experience tells us some home owners ultimately fail to go through with this plan, for other than financial reasons.

If you’re in your 60’s, and you’ve lived most of your life in a given area, how willing will you be to move?

All your friends and hang-out places are already in the immediate surroundings, and the location may not be replaceable. If you’ve lived in landed property your whole life, and are used to keeping certain pets or having a garden, you may not be able to adapt to HDB life. This has caused some retirees to refuse to sell, even under the craziest conditions.

If you have no income, but own a high-value property that you refuse to sell, there’s a good chance you won’t be getting much in the way of government support (e.g., the Annual Value of your property alone could disqualify you from certain help schemes).

2. Seek cash-flow positive properties

Another viable strategy is to focus less on the potential gains of the property, and simply focus on raw rental income. This means investing in strategies where the rental income can pay for recurring costs (e.g., property tax, maintenance fees) while still generating excess cash on top of it.

(Earlier on, you may want to ensure the home loan is covered by rental income as well; but as the property is likely to be fully paid-off by the time you retire, removing this is a consideration).

We have picked out some properties that might be able to do this.

Some buyers who are after these properties will only buy already-tenanted properties, or properties with a 10-to-15-year track record (despite the age issue). New launch properties tend to be a no-go among these buyers, because (1) new launches cannot be rented out until completion, and (2) there’s a lot of volatility in rental rates during the first few years; not to mention the cash-flow element is much more speculative at the start.

3. Partial rental

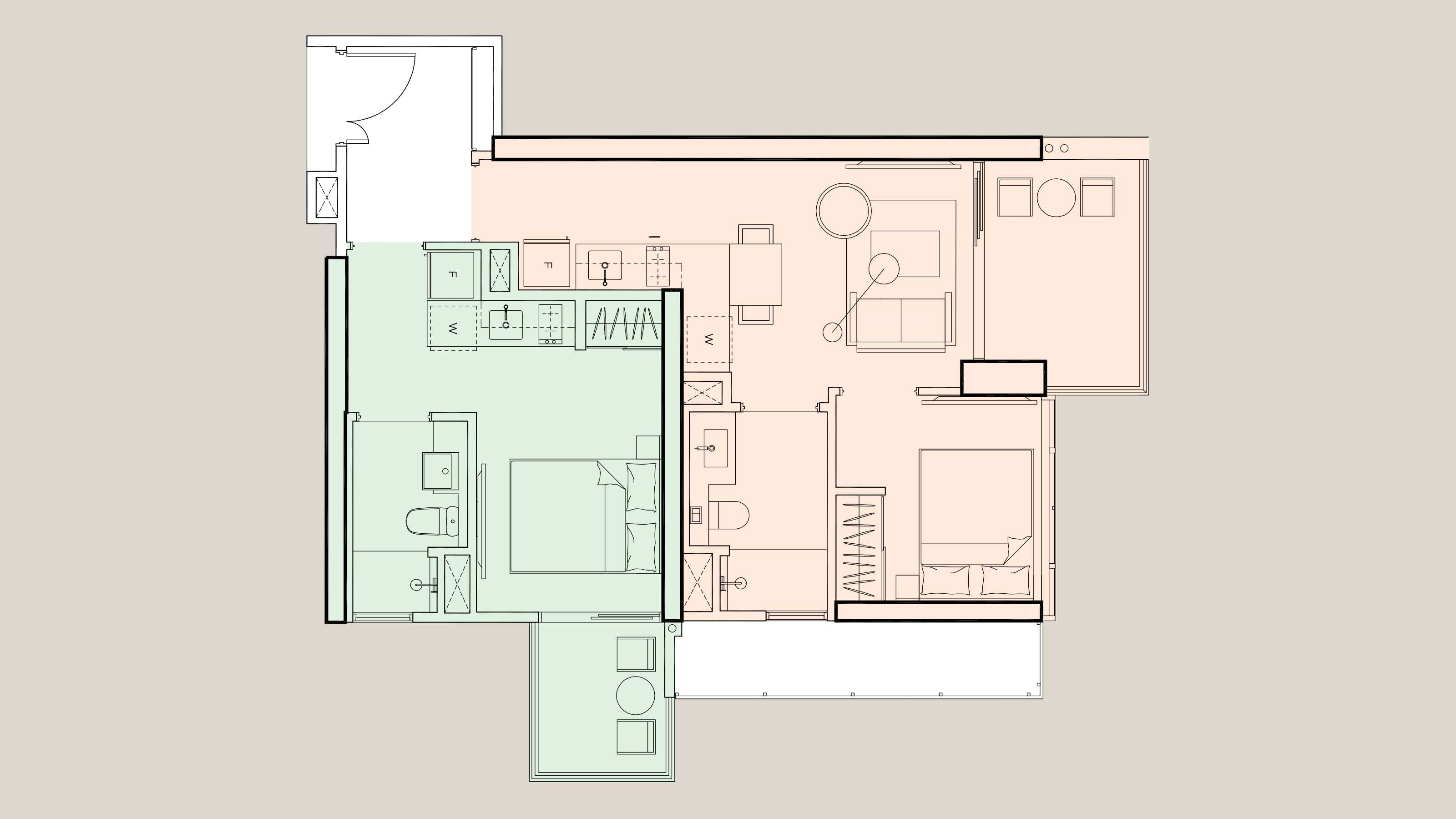

Some condos have dual-key layouts. This means there are two separated halves of the same unit. While more expensive on a per-square-foot basis, dual key units can actually serve retirees in two ways.

The first is that you can comfortably rent out half the unit, while living in the other half. Dual-key units make this far more comfortable than, say, renting out rooms in the same shared condo. Each sub-unit even has its own separate functional spaces, such as its own bathrooms, pantries, etc. This could provide a source of rental income with minimal frustration, and without having to own a second property.

The second reason isn’t purely financial. Consider if you’re going to sell and downgrade (see point 1). One variant of this is to sell your home, and then move in with your children, siblings, etc. However, this is risky as you may find you don’t get along later, or lack privacy. In these instances, you might consider selling, and then moving into a dual-key unit with your children, siblings, etc. As the units are separated, you would preserve your privacy.

4. Pledging your property for CPF

Once you reach the draw down age of 55, you can take out any CPF monies in excess of your full retirement sum. The rest of it must be left in your CPF, to form your Retirement Account (RA).

(Your retirement sum varies based on age; you can check it on the CPF website.)

If you own a property however, you can opt to pledge your property. Doing so means you only need to keep your basic retirement sum (half of your full retirement sum) in your CPF, and can withdraw more.

Pledging your property does not mean losing ownership. All it means is that, if and when you sell the property, the pledged amount must be refunded into your CPF from the sale proceeds.

You can pledge a property so long as the value of your property is enough to meet the full retirement sum, and the property has at least 30 years of lease remaining. Your property must also not be a two-room flexi flat, or have been put up for the Lease Buyback Scheme (LBS) below. Of course, if you only co-own the property, you are only able to pledge up to your share of the property value.

This frees up more cash to invest as you see fit; but speak to a financial professional on how to allocate it. Please don’t buy a big-screen TV or a car with it.

5. Lease Buyback Scheme (LBS) for HDB properties

The LBS allows you to sell back a portion of your unused lease to HDB.

For example, if you’re 65 years old, you won’t need 60 years of remaining lease on your flat. As such, you might decide to sell back 30 years of lease. The pay out you receive will be determined based on market value (although note that the tail end of a lease is less valuable than the front end).

The pay out goes into your CPF first; any excess above your retirement sum can be taken out in cash.

Recall that in point 1, we said one of the issues was older homeowners being unwilling to sell despite lack of retirement funds – the LBS is designed to fix this, as you can get money out of your property without having to sell and move.

The drawback, however, is that you can no longer sell your flat on the open market. Even if someone comes with a better deal, you can no longer sell (you can still rent out the spare bedrooms). It also means you won’t have a flat to leave to the children or other family members (but this is a non-issue if they already have a home, and can’t also own your HDB flat anyway).

If this is something of interest to you, here are the eligibility conditions:

| Criteria | Eligibility |

| Age | All owners must have reached the eligibility age (currently set at age 65) or older |

| Citizenship | At least one owner must be a Singapore Citizen |

| Income | Gross monthly household income of $14,000 or less |

| Flat type | All flat types* (Excluding short-lease flats, HUDC, and EC units) |

| Property Ownership | No concurrent ownership of second property |

| Minimum Occupation Period | All owners have been living in the flat for at least 5 years |

| Minimum Lease | At least 20 years of lease to sell to HDB |

Quantify your retirement targets first, analyse your property options second

Almost any property will “go up in value”, it’s a generic statement that doesn’t mean much. For retirement purposes, you first need to identify a required amount for your retirement, and the necessary rate of return. This is a job for any financial planner you trust.

Once those numbers are known, it’s possible to shortlist properties that could deliver the required gains. For that issue, we’re always ready to help you identify the right prospects. You can also check out in-depth reviews of both new and resale properties on Stacked Homes, to make the right choice.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments