5 Factors To Negotiate Besides Price When Buying A Resale Flat In 2021

November 28, 2021

With resale flat prices at an eight-year high, most buyers in 2021 are focused on negotiating the price. While that’s the crux of the purchasing decision, haggling over numbers sometimes draws attention from other things you can negotiate. Sometimes, a few small concessions can help to significantly push through with the deal; just like a few missed issues can ultimately make your home cost more. Here’s what to look at, outside the numbers:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The buyer or seller’s situation can matter as much as the flat’s features

Factors such as urgency (to move in or complete a transaction), or simply whether the other party likes doing business with you, can all impact the eventual price. Don’t get us wrong; the flat’s location, features, etc., are still the main issues to look for.

But if you understand the buyer or seller’s situation, you can help your negotiations by addressing other factors:

- Vacant possession date

- Speed of transaction

- Maintenance works

- Current appliances and furnishings

- Existing tenants

1. Vacant possession date

Negotiating when you take possession of the flat can impact the price.

For example, if you’re a seller, and your new home won’t be ready after the transaction, you could be without a place to stay. As temporary accommodation is expensive, you might want to try and negotiate to stay on longer, or even negotiate to pay a bit of rent for each month of an extended stay. Do try to compare the cost of your temporary accommodation, to any discount or rent that you end up giving to the buyer.

For example, say your temporary accommodation is going to end up costing just over $2,500. You know that your buyer did ask if you’ll cover $1,000 worth of home repairs. You could counteroffer, and say you’ll over the desired repairs, in exchange for a later vacant possession date.

Conversely, a shorter move-in date can be a major draw to some buyers. It’s not unheard of for some buyers to pay more, if you can have the flat ready for them in a short time. If you’re a seller who has already moved into your new property, you might be able to press this to your advantage.

Sometimes, agreeing to extend the vacant possession date is what tips the deal in your favour. If you and another buyer are offering close to the same price, for example, the seller may prefer the one who lets them stay on longer.

So if you’re ever stuck on the price, try negotiating the move-in date to sweeten the deal.

2. Speed of transaction

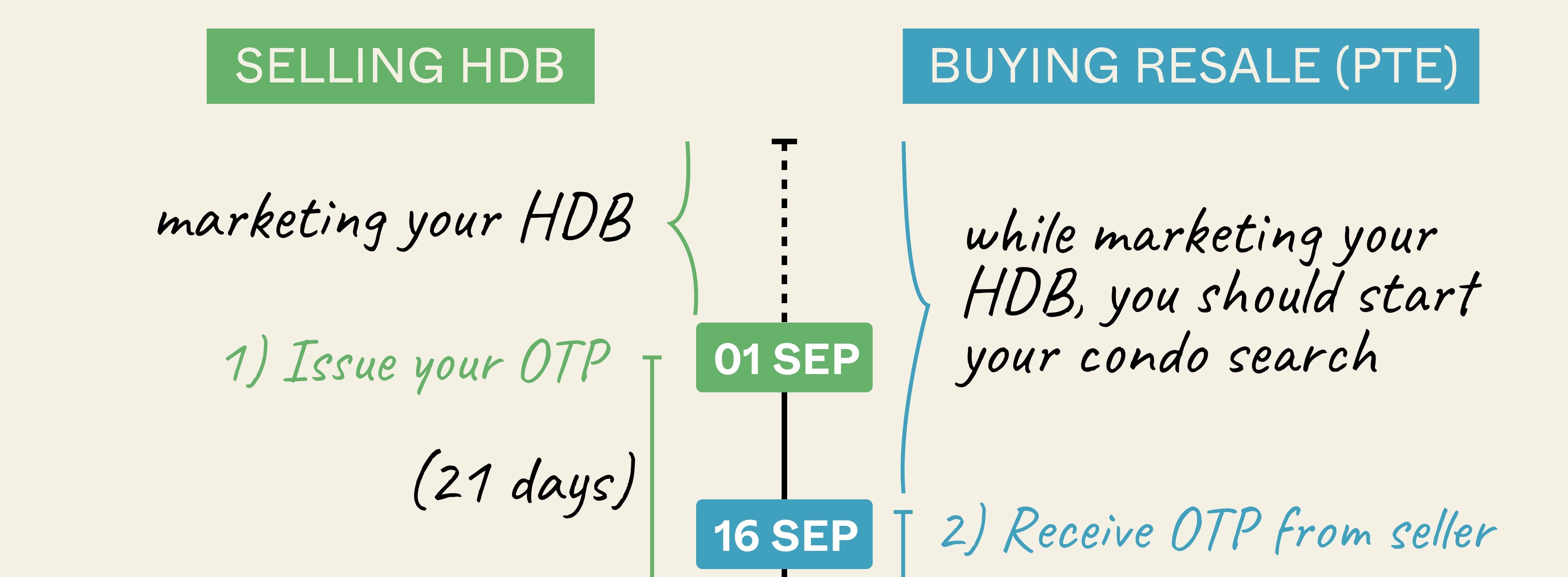

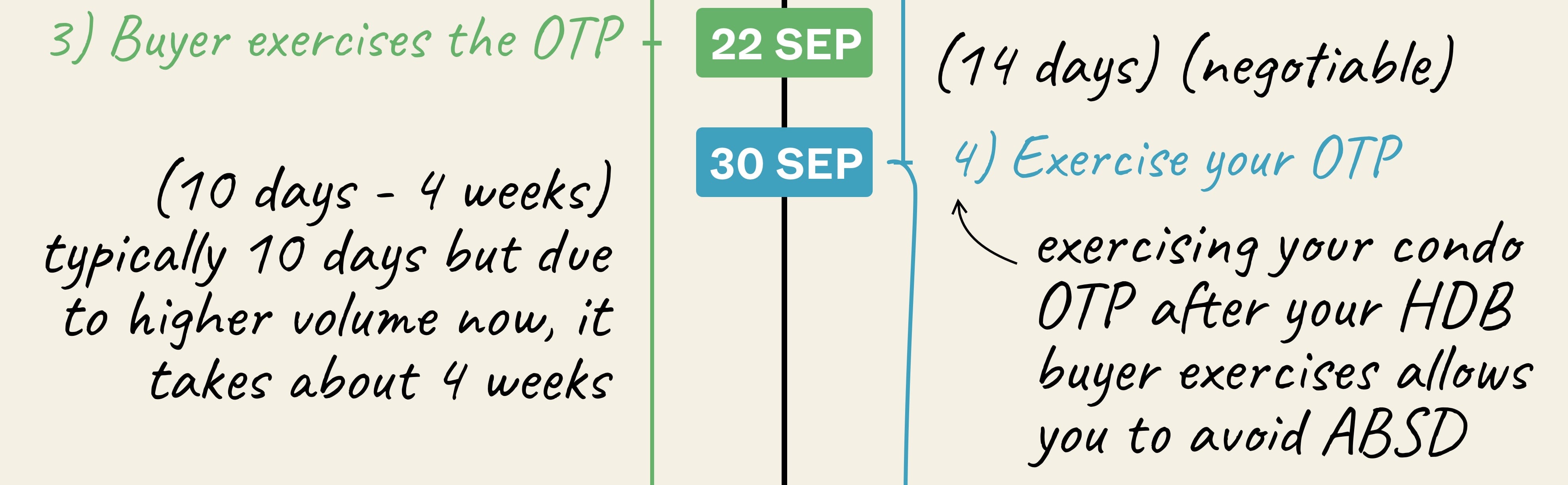

Like the date of possession, timing is vital. Some sellers are in urgent situations, such as having to meet the six-month Additional Buyers Stamp Duty (ABSD) guidelines. Others may be eyeing another home, and may need to close quickly in order not to lose out on their next purchase.

(If you want to claim ABSD remission from upgrading, your previous home must be sold within six months of buying the new one).

Even among sellers moving to a new flat, there is still a six-month time limit to sell off the older home.

There are even cases where the sellers pay higher commissions – as high as three to five per cent – just to incentivise a quicker transaction. These sellers may also be willing to lower the price slightly, if you show you’re ready to close the deal right away.

Also, in cases where two or more buyers are offering close to the same price, the deal often goes to the one ready to transact earlier.

Few sellers are willing to show they’re desperate, as they don’t want to get lowballed; so what you can do is outright declare you’re ready to transact immediately, and show you have Approval In Principle (AIP). A mortgage broker can help you to secure this.

3. Maintenance works

You can require, as a condition of sale, that the seller fix certain things about the flat. This can include fixing broken water heaters, repainting walls, or patching leaks. Conversely, some sellers might – in order to justify a discount – require that the buyer accept the flat “as is”.

Both provide good grounds for negotiation.

For example, buyers who want to move in quicker will probably want everything fixed and functional from day one. Conversely, those who aren’t in a rush can sometimes get themselves a discount – buy over the flat “as is” for cheaper, and then patch it up in your own time (or perhaps as part of a package deal with your contractor, which lowers costs).

Property AdviceRenovating Your Investment Property: Do’s And Don’ts You Absolutely Must Know

by Ryan J. OngThe key is to get estimates before you negotiate. Consult a contractor, so that you know the likely value of such maintenance works.

Your realtor should check that any agreed works are completed, just before you take possession of the property; a common mistake is failing to re-check after the Option is exercised.

4. Current appliances and furnishings

White goods, air-conditioning, and even sometimes high-end sofa sets can be worked into the deal. Not every seller wants to take it all with them – especially if they end up having to pay for temporary storage.

So if you’re the kind of buyer who doesn’t need to immediately replace everything, you can consider working some of the good furnishings into the deal (some buyers replace the furnishings slowly over time, so they don’t need any loans or credit).

If you’re a seller, and your appliances and furnishings are in good condition, you can consider throwing them in as part of the offer. In any case, if you’re buying a property like a new launch condo, chances are washers, dryers, and other such goods already come with your new home.

Do highlight to the buyers or agents if your existing goods are new (e.g., replaced just a year or two ago).

5. Existing tenants

Sometimes, the flat you’re buying over may have a tenant – it’s not uncommon for foreigners or students to rent out a room or two.

This is sometimes problematic for the seller; it’s up to them to negotiate with their tenant, in the event the lease has to be cut short. Some sellers may give you more concessions (e.g., earlier move-in date, do more repairs) if you spare them the hassle of negotiating with the tenant.

As an alternative, if you’re not averse to having a tenant, you can also negotiate with the existing tenant. For example, some young couples don’t mind having the tenant stay on, as the rental income helps with initial costs.

Price and Cash Over Valuation (COV) can be affected by these supposedly “small” issues

There have been cases of buyers accepting higher COV, solely because the seller is able to move out and give them the space right away. Conversely, we have seen buyers turn down reasonable prices, just because they hate the sellers won’t fix a few doors or leaks (perhaps not so much, in this current hot market).

Always remember that, more so than most asset types, property transactions have an emotional aspect. This is the kind of asset where the price can rise just because the seller heard you say something offensive about their décor.

Work with your realtor (or seller if you don’t have one) to try and understand the other party’s motives and what’s important to them.

For more direct help on this, contact us on Stacked. You can also check out reviews of new and resale condos alike, if you’re in the process of upgrading this year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments