2024 Property Tax Hike: What’s The Impact On Homeowners And Tenants In Singapore?

December 14, 2023

Everything is going up in price, so it comes as little surprise that property taxes are too. Rising Annual Value (AV) will apply to most homes across the board; but it’s the higher-end properties that will see the biggest impact. It may also bear consequences for tenants, as landlords may pass down the costs. Here are the possible consequences ahead:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s the rise in property taxes like?

For owner-occupied properties, these were the tax rates in 2023:

| Annual Value ($) | Effective 1 Jan 2023 | Property Tax Payable |

| First $8,000 Next $22,000 | 0% 4% | $0 $880 |

| First $30,000 Next $10,000 | – 5% | $880 $500 |

| First $40,000 Next $15,000 | – 7% | $1,380 $1,050 |

| First $55,000 Next $15,000 | – 10% | $2,430 $1,500 |

| First $70,000 Next $15,000 | – 14% | $3,930 $2,100 |

| First $85,000 Next $15,000 | – 18% | $6,030 $2,700 |

| First $100,000 Above $100,000 | – 23% | $8,730 |

As of 2024, this has increased to the following:

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

| First $8,000 Next $22,000 | 0% 4% | $0 $880 |

| First $30,000 Next $10,000 | – 6% | $880 $600 |

| First $40,000 Next $15,000 | – 10% | $1,480 $1,500 |

| First $55,000 Next $15,000 | – 14% | $2,980 $2,100 |

| First $70,000 Next $15,000 | – 20% | $5,080 $3,000 |

| First $85,000 Next $15,000 | – 26% | $8,080 $3,900 |

| First $100,000 Above $100,000 | – 32% | $11,980 |

For non-owner occupied properties, here’s the property tax rate last year:

| Annual Value ($) | Effective 1 Jan 2023 | Property Tax Payable |

| First 30,000 Next $15,000 | 11% 16% | $3,300 $2,400 |

| First $45,000 Next $15,000 | – 21% | $5,700 $3,150 |

| First $60,000 Above $60,000 | – 27% | $8,850 |

And here’s the property tax rate we’ll see from 1st January 2024:

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

| First $30,000 Next $15,000 | 12% 20% | $3,600 $3,000 |

| First $45,000 Next $15,000 | – 28% | $6,600 $4,200 |

| First $60,000 Above $60,000 | – 36% | $10,800 |

As you can see, it’s mainly the properties with a higher AV that are affected. But this is where rate increases – such as due to the rise in property values and rental rates the past year – may have an impact. The tax increases are not unexpected by the way, as they have been rolled out since the announcement of Budget 2022.

The assigned AV is an estimation of your home’s rental value, in an unfurnished state, minus its maintenance fees. You can find the AV of your specific property here.

More from Stacked

Is An Executive Condo A Better Deal Than An HDB Flat Today? Here’s What The Price Gap Tells Us

The EC scheme is the most successful and long-lived of the “sandwich housing” solutions; and has done much better than…

In general, most HDB properties will have an AV of under $12,000, while most condos will have an AV of about $20,000 to $30,000. Anything higher than that is usually (but not always) a landed property of some sort.

The government is quite generous in this regard, as estimated AV is often below the actual rental rate. It’s unlikely, for instance, that even the smallest bungalow or semi-detached house would cost as little as $60,000 a year to rent in whole; and yet we may see such properties with an even lower AV than that.

Mainly a concern to investors

For owner-occupiers of HDB flats, these property tax increases are trivial (likely to stay under $30 a month, even for larger executive flats.) However, the increase can matter to landlords, who are renting out private properties.

Take, for instance, a rented-out condo unit that has its annual value bumped from $40,000 to $45,000. In the previous year, at an annual value of $40,000, the landlord would have paid a property tax of $4,900.

Most realtors, however, opined that it would be maintenance rates and interest rates, and not so much property taxes, that would discourage investment. However, they did tell us that the combination of all three would make it difficult for landlords to lower rental rates further, even as rising supply presents tenants with more options.

If the AV reaches $45,000 in 2024, this amount is increased to $6,600, translating to just over $141 a month in added costs. Not a seemingly huge amount in itself, but keep in mind that the increase follows rising interest rates, as well as rising condo maintenance costs.

Property TrendsBeware Rising Home Loan Rates In 2022: We Breakdown Exactly How Much It Will Cost You As Interest Rates Increase

by Ryan J. OngOne realtor also told us that there’s natural “compensation” for the rising property tax, if we consider how AV is calculated. He says:

“AV is based on current market rates. If your property value is going up, and your location is improving, then AV and property tax also go up. But I would take it as a good sign. That means your area is being upgraded, people now pay more to live there. If now there is an MRT station at your doorstep, your AV and tax may go up, but the increase in your rent and resale gains easily make up for that.”

We are getting a one-time rebate in 2024

Just for the coming year only, there’s a one-time property tax rebate. Unfortunately, it’s for owner-occupied properties only. The amounts are as follows:

| 1 & 2-room flat | 3-room flat | 4-room flat | 5-room flat | Executive HDB | Private property |

| 100% (You pay nothing) | 70% | 50% | 40% | 30% | 15%; capped at $1,000 |

This isn’t a huge amount, but every little bit helps. 2024 is shaping up to be an expensive year, and some homeowners are still adapting to their higher home loan rates.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much will property taxes increase for homeowners in Singapore in 2024?

Will tenants in Singapore be affected by the property tax hike?

What is the one-time rebate on property taxes in Singapore for 2024?

Why are property taxes increasing despite the government’s efforts?

How does the Annual Value (AV) affect property taxes in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

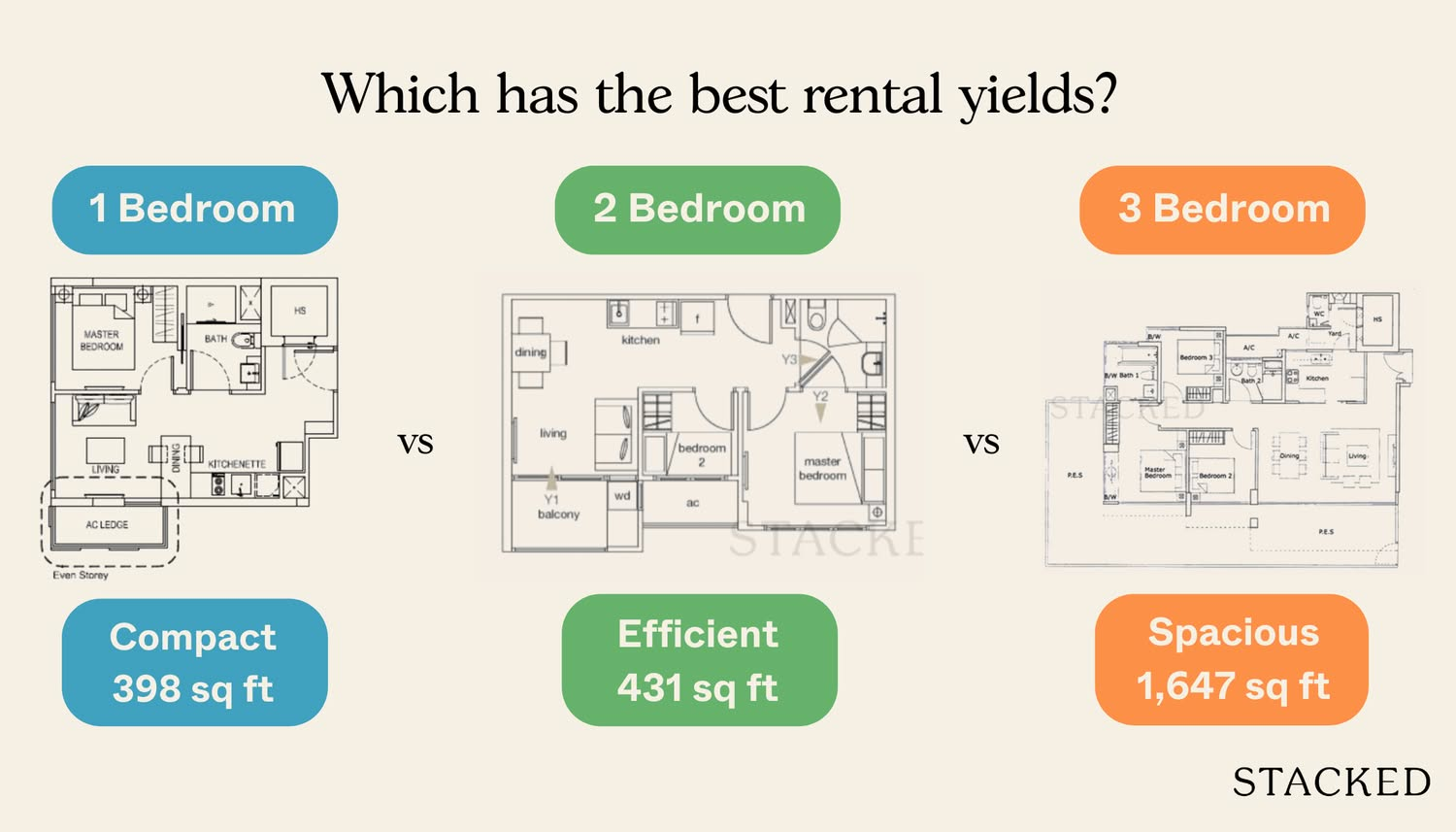

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments