Why Are Singapore Property Prices Returning To Pre-Covid-19 Levels So Fast?

April 21, 2021

There’s been some recent buzz over a report by Colliers, predicting a return to pre-Covid-19 levels for Singapore property. Before we get too excited, this isn’t specific to Singapore’s residential property scene only; the prediction is based on real estate investment across all segments, including commercial property.

However, rising property investment does include a residential component; and what we’re seeing coincides with a surge of luxury condo sales in March 2021. Note that many luxury condos are bought purely as a form of investment, rather than for own-stay use.

While great for the current owners, new investors with smaller budgets – as well as home owners eyeing prime region properties – by being less enthusiastic about the fast-rising prices. It seems those expecting discounted rates from Covid-19 are going to be disappointed after all. Here’s what’s happening:

What happened with property investment figures over Q1?

According to the Colliers report, real estate investment rose by over a quarter (25.8 per cent) in Q1 2021. This is a 47.9 per cent increase over the same time last year. Note, however, that it was commercial / industrial property that accounted for most of the amount, not residential (in particular, the purchase of a 50 per cent stake in OUE Bayfront for $634 million).

On the residential front alone, investment sales reached $1.6 billion in Q1, a rise of 12.9 per cent from Q4 2020. This is a 154 per cent increase from the same time last year.

This isn’t completely unexpected, as 2020 was the height of the Covid-19 pandemic; Q1 of last year was the build-up to the Circuit Breaker, which hit in April. As such, it’s not surprising we’d see a big jump between the same quarter in 2020 and 2021.

At the same time, new private home sales surged in March 2021, especially in the luxury segment

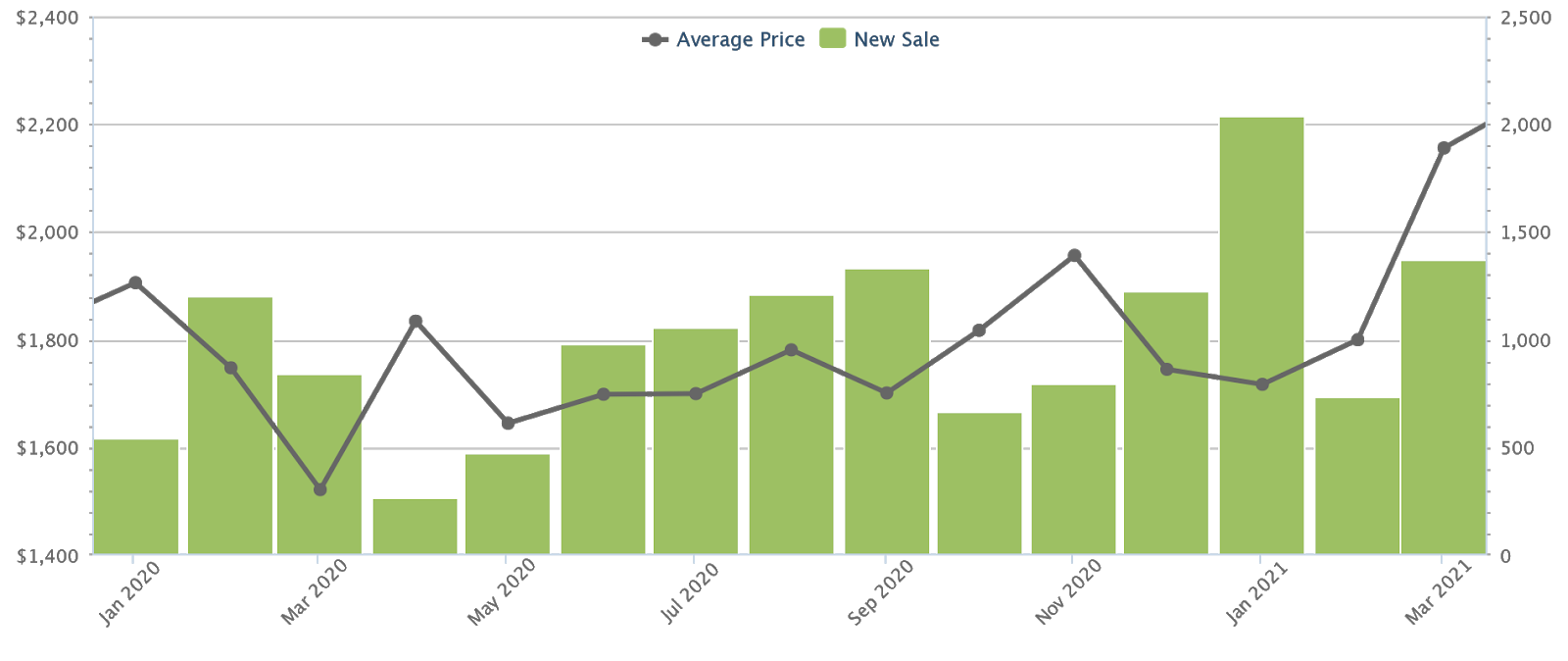

Transaction volumes jumped in March 2021, to 1,368 units. While this is still lower than the peak in January (2,033 units), it does that show that the momentum starting from 2020 has yet to die down:

(The lower transaction volumes in February were due to Chinese New Year, and fewer launches being heavily marketed at the time).

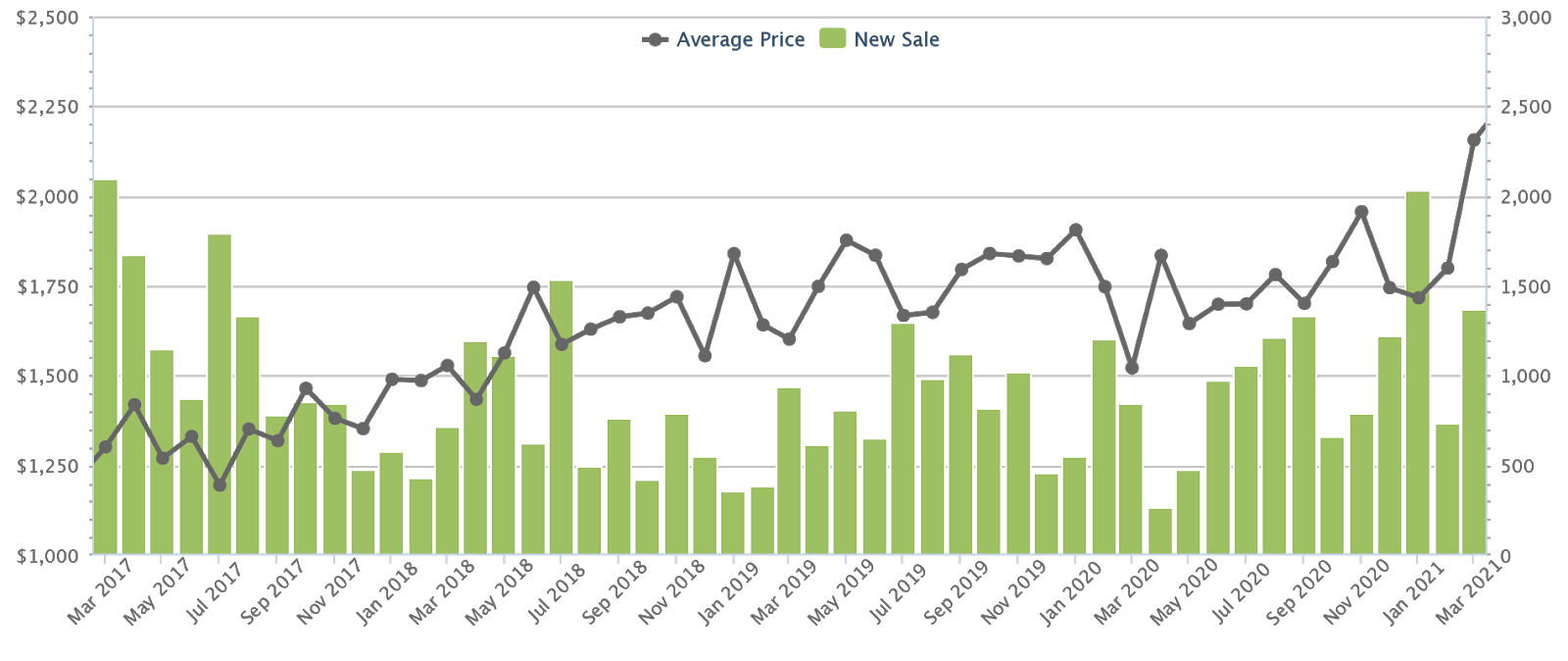

This is the highest number of new unit transactions recorded for a month of March since 2017 (2,089 units):

What’s most significant about March transactions, however, was that the properties in the Core Central Region (CCR) moved the biggest number of units. Of course, you could say that the numbers are up precisely because there are new launches – but not many would argue about the resulting performances.

They accounted for close to half (42.2 per cent) of new sales. This was headlined by two strong launches: Irwell Hill Residences, which sold out 50 per cent on its launch, and Midtown Modern, which sold out 60 per cent at launch.

This is also the first time since around the last property peak in 2013, that CCR condos have accounted for the bulk of new sales.

What are the key drivers in the market right now?

- The boost to commercial property may be related to ABSD costs

- The threat of new cooling measures

- Higher prices per square foot, but lower quanta

- Low interest rates

- Singapore is attractive to foreign investors

1. The boost to commercial property may be related to ABSD costs

It may be surprising that commercial property is doing so well, despite the Covid-19 situation. However, generous government support – such as rental relief and tax cuts for business tenants – have buoyed sentiment (if not always prices).

Many analysts were also quick to point out that during the last Global Financial Crisis in 2008/9, rental rates for Grade A offices fell by as much as 49 per cent. As it turns out, the dip in office rents for 2020 was only around 9.3 per (from $10.81 psf to $9.81 psf, between Q4 2019 and Q4 2020).

The surge of vacancies predicted from “Work from Home” arrangements has also lacked teeth, with Grade A offices seeing vacancy increase by just around 2.7 per cent. While still concerning, it’s nowhere near as bad as most market watchers expected.

Coupled with this surprisingly strong performance, the Additional Buyers Stamp Duty (ABSD) provides an incentive to consider commercial over residential investment.

Singaporean Citizens buying a second home would pay ABSD of 12 per cent on the price or value (whichever is higher), while Permanent Residents pay 15 per cent and foreigners pay 20 per cent.

Commercial property, on the other hand, incurs no ABSD; only the usual Goods and Services Tax (GST) of seven per cent.

As such, the commercial segment of Singapore’s private property market may appear more attractive to investors right now. New cooling measures in the property sector will strengthen this effect.

2. The threat of new cooling measures

More from Stacked

“We Saved Money By Living Above An MRT” 5 Homeowners Share The Good And Bad About Integrated Developments

Integrated projects, like mega-developments, are currently an “in” thing in the Singapore property market. However, not everyone shares the same…

As we’ve pointed out before, rumours of new cooling measures tend to make themselves a reality. With the risk of rising stamp duties, investors may decide to move fast and buy now; this in turn results in rising transaction volumes and prices, which in turn mandate the new measures.

Nonetheless, we’ve witnessed the rise of “if you don’t buy now you may have to pay more ABSD later” as the latest sales pitch. This is not untrue, given the context.

Property Market Commentary4 Reasons Why Resale Condos May Be More Popular In 2021

by Ryan J. OngWe’re inclined to believe new cooling measures will take the form of loan curbs, rather than just heightened stamp duties (lest people simply spend even more of their CPF money to buy a second home). See the linked article above, for more on issues regarding possible new cooling measures.

3. Higher prices per square foot, but lower quantum

A good example of this for Q1 2021 would be Irwell Hill Residences. Around 80 per cent of its 540 units are one or two-bedders; so even with a price of $2,5XX to $2,6XX psf, it’s still possible to purchase a unit for $1.1 million or under.

This simply continues the earlier trend that we already saw from 2019 onward, such as when The M had units that reached $3,000 psf, but had a quantum of below $1 million.

In effect, developers are making condos in the Core Central Region (CCR) accessible to investors with a lower budget. This is done by shrinking the unit sizes, as they can still be easily rented to singles or couples (who make up the bulk of expatriate tenants).

A lower quantum also translates to higher rental yields, and smaller loans; this makes it more probable that investors can meet limitations like the Total Debt Servicing Ratio (TDSR).

This trend has allowed CCR properties to maintain strong demand, despite rental concerns in the aftermath of Covid-19.

4. Low interest rates

We have a more detailed article on this topic. But to offer a quick summary, home loan rates are at their lowest since the last financial crisis. Interest rates as low as 1.2 per cent are on the market; and given the state of the US economy, it will be some time before the rates normalise.

Local property investors have also heard the “interest rates will rise” warning so often, the effect may have worn off. Private bank loans have been at two per cent or lower for over a decade, despite repeated warnings of rate hikes.

(That said, we wouldn’t be too dismissive of the warnings; home loan rates used to reach four per cent in the late 1990’s).

5. Singapore is attractive to foreign investors

In spite of the 20 per cent ABSD, Singapore is one of the most attractive safe havens right now. We’re one of the few countries to beat GDP predictions (growing rather than contracting) despite Covid-19.

On top of this, Chinese investors have favoured Singapore over Hong Kong since 2019. This is partly due to political unrest in Hong Kong; but it’s also because Singapore is outside of China. This provides greater diversification, which investors tend to seek in volatile times like the present.

It also helps that Singapore doesn’t impose a capital gains tax, and has few restrictions on residential resale (although foreigners are barred from buying landed homes outside of Sentosa Cove, without special permission). Along with constant appreciation and low interest rates, this can help diminish the impact of the ABSD.

It’s still too early to declare the Singapore private property market has escaped Covid-19 unscathed

It’s beginning to look that way, but we’ll only be sure toward the end of 2021. We don’t know if the still-soft rental market will be encouraging to investors for long; or how soon foreign tenants will be making it back to our shores.

With regard to commercial properties, the dip isn’t as bad as we thought it would be – but it’s still a dip. Rental rates are falling, and vacancy rates are still rising. This still has the potential to get worse.

Nonetheless, there are more positive than negative signs, that we’re headed back to pre-Covid-19 levels already. This will probably be a disappointment to first-time buyers, who may have been holding back for possible fire sales or developer discounts. At this point, their best hope would be for new cooling measures to kick in, and for prices to drop afterward; because Covid-19 doesn’t seem to have done that job yet.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are Singapore property prices rising so quickly back to pre-Covid levels?

Are residential property prices in Singapore recovering faster than expected?

What factors are driving the recent surge in Singapore property investments?

How do new cooling measures affect property buying in Singapore?

Why are commercial properties in Singapore performing well despite Covid-19?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

Latest Posts

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

0 Comments