With the current trend toward larger homes, it’s inevitable that some Singaporeans will think of 3Gen flats. After all, these larger flats are designed for those who want to accommodate their parents; and that’s a growing need in our ageing society. But with some other options, like 1980’s flats (bigger), or executive flats, are 3Gen flats still worth it? Here’s what to consider:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

3Gen flats versus other flats

3Gen flats, also called multi-generational flats, are designed for extended families living together (e.g., couples staying with one or both parents). These flats were first introduced in the Sept 2013 BTO launch as a means to help multi-generation households live under one roof.

The 115-sqm flats come with four bedrooms and three bathrooms, two of which are en-suite, to give their occupants more privacy and comfort.

This does mean 3Gen flats are bigger than 5-room flats, although it’s often pointed out the size difference isn’t all that great. A typical 5-room unit is about 1,184 sq. ft., while a typical 3Gen unit is about 1,238 sq. ft.

It’s a difference of just around 54 sq. ft. Most of this is taken up by functional space: in terms of layout, a 5-room flat has three bedrooms and a bathroom, and a 3Gen flat has four bedrooms and three bathrooms.

There are also different restrictions on purchase and resale.

You must be able to buy under the Public Scheme to obtain a 3Gen flat.

The family nuclei can consist of:

- Married couple with one or both parents

- Fiancé / Fiancée couples with one or both parents

- Widow or widower with child, and one or both parents

- Divorcee with child, and one or both parents

Your parents must be registered as essential occupiers of the flat. Remember that essential occupiers cannot have another property under their name.

Apart from the usual restrictions (see the Public Scheme linked above), the income ceiling works a little different for new 3Gen flats. For these units, the income ceiling is set at $21,000 per month, instead of $14,000 per month. However, your parents’ income (if any) will also be counted.

There is no income ceiling for resale flats.

The biggest difference is the limitation on rental and resale

Your future buyers must meet similar restrictions to purchase your 3Gen flat. This means they must also be a multigenerational family as above; and this significantly limits your potential pool of buyers.

In addition, you cannot rent out individual rooms in a 3Gen flat, until your five-year Minimum Occupancy Period (MOP) is up. For other flats, you can usually rent out rooms (but not the whole flat) even before the MOP is up, so long as it’s 3-room or larger.

How do 3Gen flats compare price-wise?

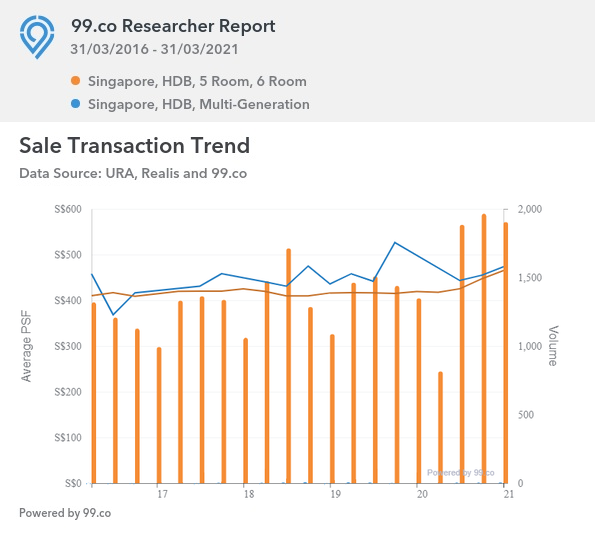

It’s hard to tell as 3Gen flats are quite rare, and transaction volumes are low; there are often five or fewer transactions per quarter. So, take the following with a grain of salt:

We included a comparison to 5-room flats, as these are their closest counterparts (they can’t fairly be compared to executive flats, maisonettes, etc., as those are much larger and older).

As of Q1 2021, the average 3Gen flat, island-wide, averaged $473 psf. The average for 5-room flats was $465.

As an aside, resale 5-room flat prices are up around 13.4 per cent, from $410 psf in 2016. Resale 3Gen prices haven’t changed much in that time, nudging up about 3.4 per cent from $458 psf.

Given the above, when is it worth getting a 3Gen flat?

- You can handle the price difference from a 5-room flat

- Dual-key units are not within the budget

- Gains are not the main issue to you

- Functional space can trump living space

- You can handle the financial implications if you can’t live together

1. You can handle the price difference from a 5-room flat

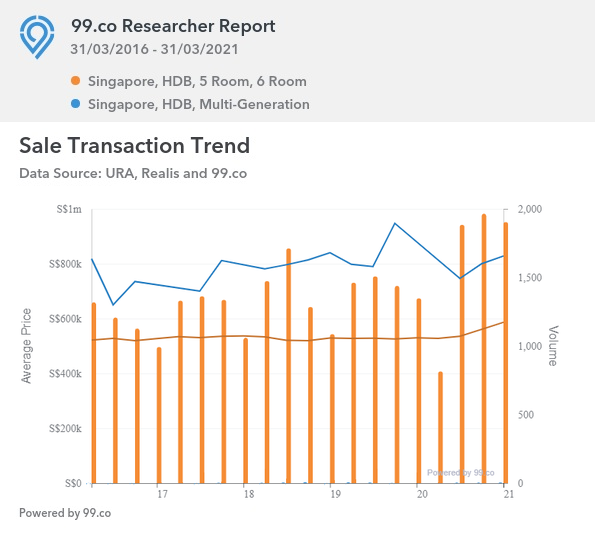

Note that in terms of absolute quantum, the price difference between a resale 5-room and 3Gen flat can be significant:

Data from 99.co suggests the average quantum of a 3Gen flat, island wide, was $828,000 in Q1 2021, as opposed to an average of $586,474 for 5-room flats*. This is a significant cost savings, with the added bonus that a 5-room flat is easier to sell, should that ever become necessary.

For BTO flats this isn’t an issue. In fact, new 3Gen flats and 5-room flats are very close in terms of quantum, with both often in the $400,000 range (depending on the estate). But 3Gen flats are quite rare, and many BTO launches don’t include any.

*Again, with the caveat that transaction volumes are low

2. Dual-key units are not within the budget

Dual-key units are almost purpose-built for extended families. These private condo units divide into two sub-units, providing a much-improved degree of privacy.

Many of the drawbacks of dual-key units are going to be found in 3Gen units anyway, such as trading living space for functional space, or having a smaller pool of potential buyers. But at least with dual-key units, you have improved privacy and no HDB-like restrictions (such as ethnic quotas and the MOP).

Those who have the means to go private, and buy a dual-key unit, should give this some thought.

3. Gains are not the main issue to you

3Gen flats are tougher to sell, as the only prospective buyers are other multigenerational families. This also explains their low volume of transactions, as described above.

This isn’t to say your 3Gen flat will never sell for a good profit; just that it may take longer to market, and buyers may low-ball you because they know about the restrictions.

This may not be big deal though, since 3Gen flats are typically bought by pure home owners rather than investors. If you’re thinking of asset progression or returns, you really should be looking at 5-room flats instead.

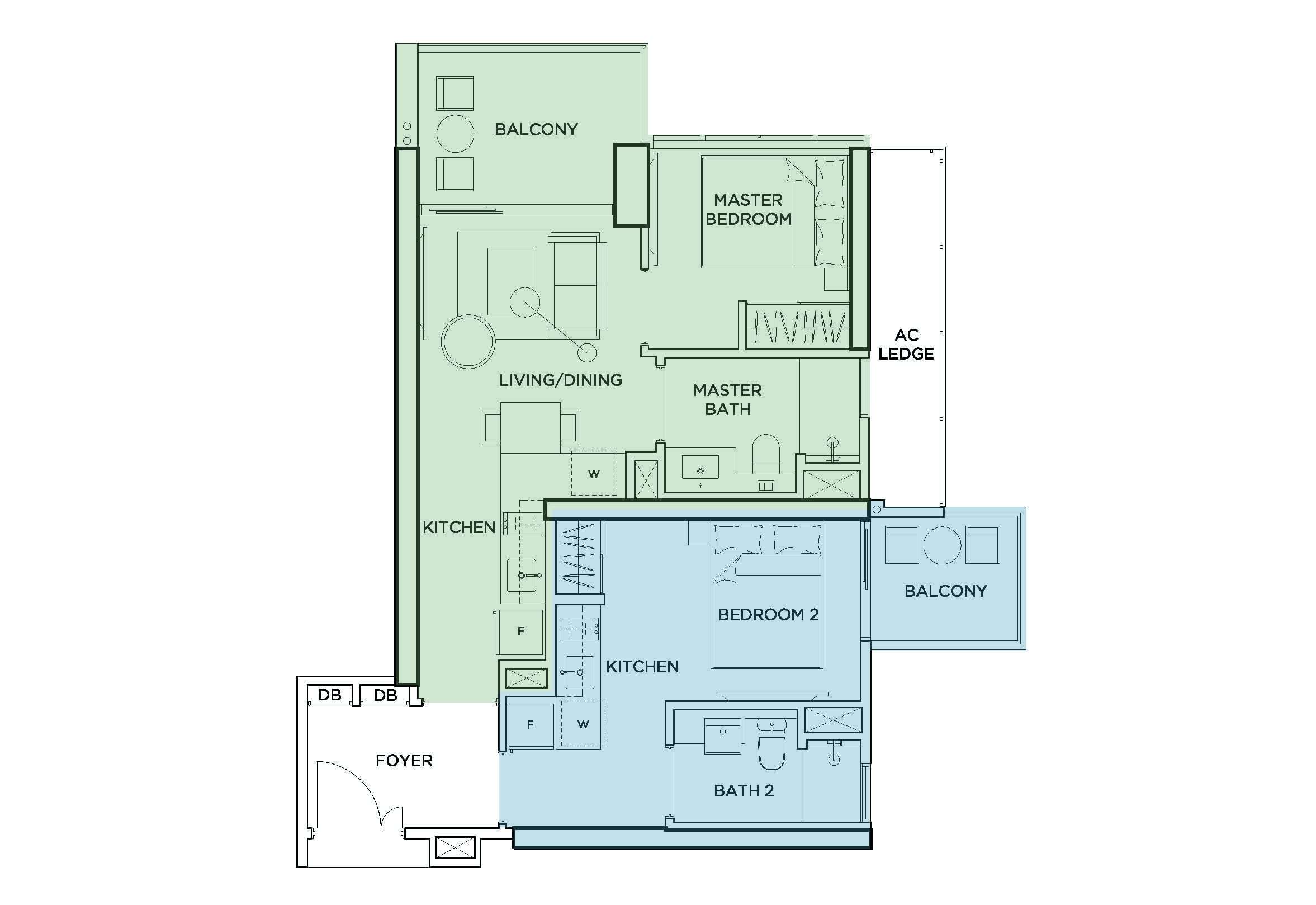

4. Functional space can trump living space

While 3Gen flats are bigger, they may have less living space. By this, we mean that the extra 54 sq. ft. or so is mostly taken up by the extra bedroom and attached bathroom.

This can also lead to some other areas of the house – such as the living room or other bedroom – actually being smaller compared to a regular 5-room flat. This varies between projects, but it’s important that you consult the layout carefully (for BTO units).

Whether this is acceptable depends on your needs. Families who need the extra bathroom may not mind; but those who want a bigger living room, a dining room or more customisable layout may find that a 5-room flat fits their needs better.

5. You can handle the financial implications if you can’t live together

Say you and your parents pool your money together, to buy an $800,000+ 3Gen flat. What happens if later on, you decide you can’t live under the same roof?

You might be in a situation where neither party has the financial means to go off and get their own place, now that the flat has been bought. And again, a 3Gen flat is not easy to resell. This can result in a painful domestic situation.

As such, we suggest that – before everyone pools their cash and buys a shared home – everyone works out their alternatives, if things go wrong. Only take the plunge if you have some sort of back-up plan or safety net.

Ultimately, 3Gen flats are worth buying only for true home-owner reasons

Dual income families with children (i.e., both parents are at work) tend to benefit the most from 3Gen flats. This is because grandparents can be in the same home to look after the children. Busy children also tend to visit their parents less often, so a 3Gen flat could foster better family relations.

However, a 3Gen flat is never going to top the list when it comes to choices for asset progression; especially not with the hefty quantum on resale units, coupled with the limited pool of future buyers. For more on picking the right home, follow us on Stacked. We’ll also provide you with the latest in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments