More than one Singaporean (or expatriate) has been ambushed with a walk-up apartment. You’re told a particular property is spacious, it’s got a great location, low price, etc. but then you arrive and find out the one problem: no elevator.

We find it impossible to predict how you’ll react at that point.

Some people immediately feel faint, seeing visions of them staggering up the 40+ steps with groceries. Others like the place even more – some people secretly feel satisfaction at not being one of the lembeh people, who are too soft to handle stairs.

But are walk-up apartments really hidden gems in the Singapore private property market? Or are they just a dead-end of property investments? Let’s find out:

What is a walk-up apartment?

In the context of this article, we’re referring to apartments in which there’s no elevator. These tend to be small, older developments, which don’t usually go beyond the fifth floor, because that’s where your thigh muscles will give out.

(Another type of walk-up is the shophouse, but we’ve excluded these for now as shophouses are a whole different ball game.)

With that in mind, let’s get straight to the first big question:

How well can walk-up apartments appreciate, really?

Let’s look at three examples that are in good locations:

- Eng Aun Mansion

- Rosalia Park

- Tiong Bahru Estate

1. Eng Aun Mansion

Eng Aun Mansion has featured before, on our list of 148 obscure freehold properties. Good thing it’s freehold, as its completion date is a mystery (try looking for it, you’ll see).

This small development (only 30 units) is along Thomson Road, and is just four to five minutes’ walk from the Novena MRT station (District 11); this is quite a desirable location, despite its age.

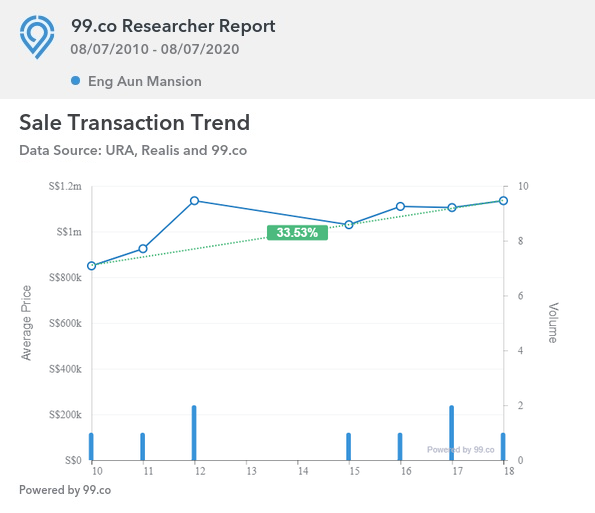

Over the past 10 years, the average price of a unit at Eng Aun Mansion has appreciated by just over a third, from $850,000 to $1.135 million. The last recorded transaction was on 12th February 2018, when an 872 sq.ft. unit transacted at $1.135 million ($1,303.79 psf).

2. Rosalia Park

Rosalia Park is a freehold development in Lorong Ong Lai (Upper Serangoon), in District 19. This is also a small development with just 88 units, that was completed way back in 1995.

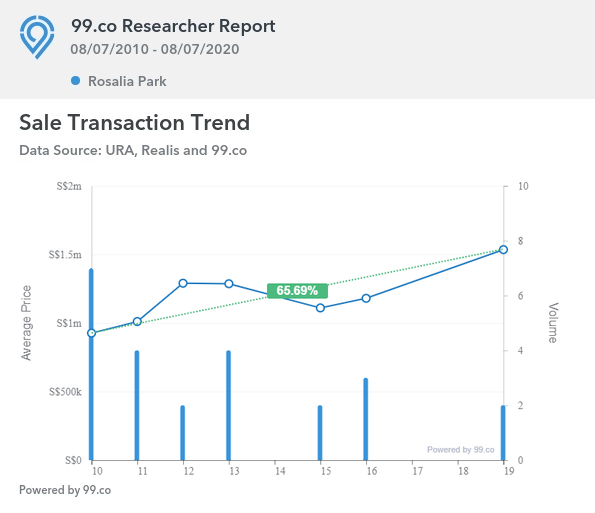

Here’s how prices have fared:

Prices have appreciated from an average of $926,429 in 2010, to about $1.535 million; an increase of 65.69 per cent. The last recorded transaction was on 19th December 2019; this was for a 1,475 sq.ft. unit, at $1.37 million ($929.03 psf).

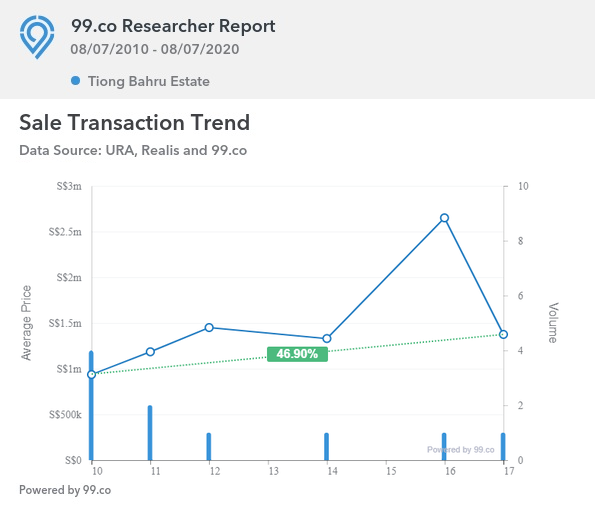

3. Tiong Bahru Estate

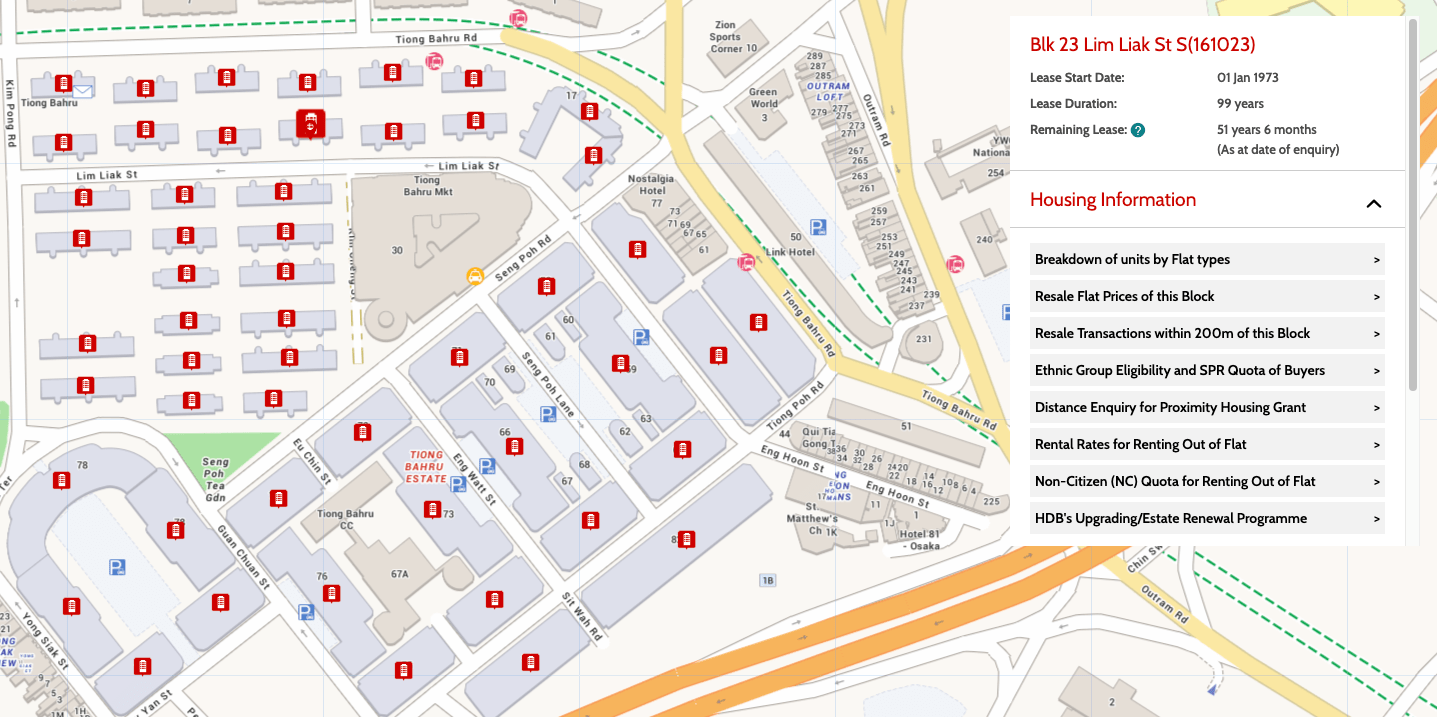

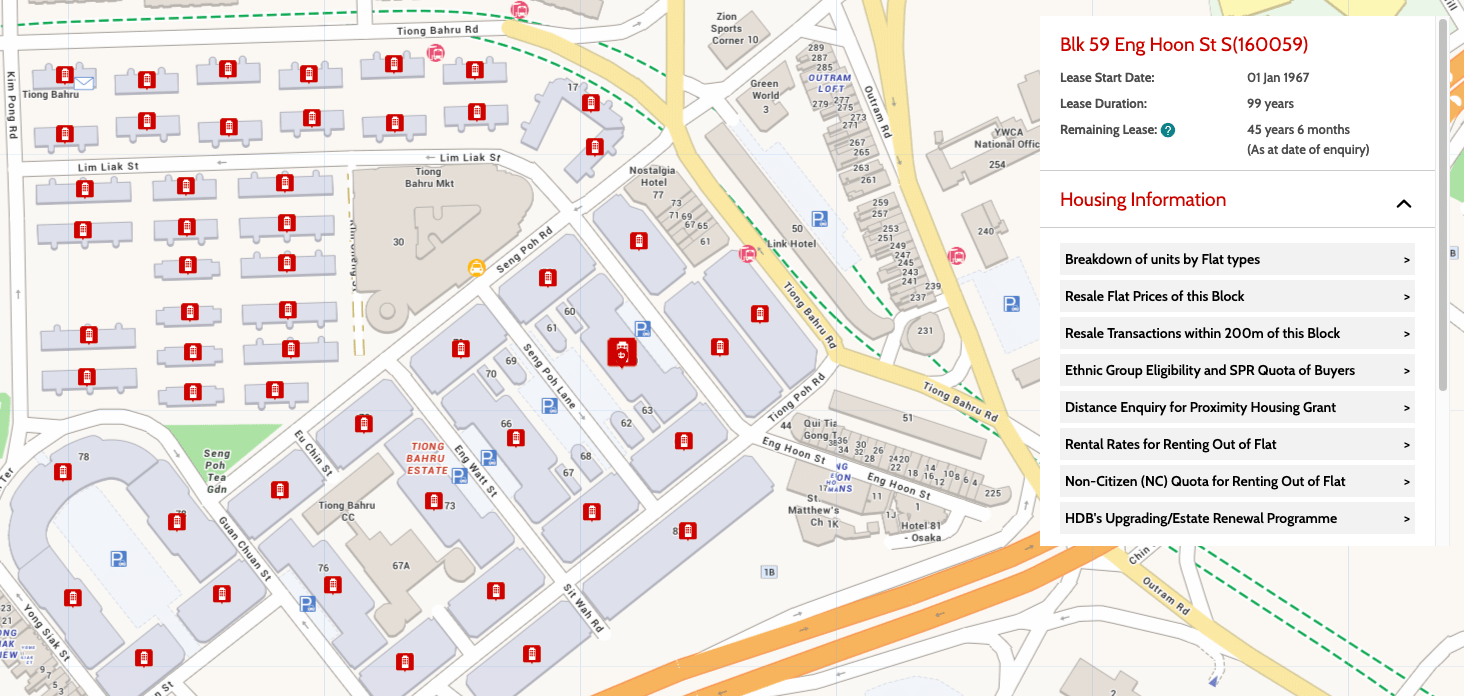

If you’ve walked past Tiong Bahru Estate before you’ll be forgiven for thinking it is a walk-up HDB apartment. This is a very old estate that was completed in 1937, which means its first buyers also hold the record for worst investment timing ever (World War II started in 1939). It’s actually a really fascinating piece of real estate in Singapore – it’s transactions are classified under private property caveats but if you have any rebuild requirements you will have to take it up with the HDB rather than BCA.

But as you can see, different blocks all have different build dates – with varying lease dates remaining too.

Also note that this is a 99-year leasehold development – so it basically has just 16 years of lease remaining.

We can’t actually call this a condo, as that concept didn’t exist back then, and it has no condo facilities (count the stairs as a gym if you’re on the fifth floor, we guess?)

The average unit price has appreciated from $936,000 in 2010, to $1.375 million today; an increase of 46.9 per cent. That figure is mainly due to the last transaction on 31st October 2017. This was for a 1,001 sq.ft. unit, priced at $1.375 million ($1,373.5 psf). But the most stunning part? The previous transaction was sold at $2.65 million, or $1,865 psf in 2016 – an otherworldly amount to pay for a place with so few years remaining.

Overall, we can see there’s still a lively demand for walk-up units. However, there are other factors to consider:

- Facilities wise, apartments are not the same as full-suite condos

- Small numbers of units, and low volume of transactions

- The age factor of walk-ups

- En-bloc prospects

- A smaller prospective pool of buyers and tenants

1. Facilities wise, apartments are not the same as full-suite condos

Notice that the above developments are not called walk-up condos, but walk-up apartments.

Most walk-ups are not condos with full condo-style facilities. Some may have basic features like a small pool, but you’re probably not getting the full suite of clubhouses, BBQ pits, gyms, etc.

More from Stacked

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Make $200k Per Year And Own A Freehold Condo In Potong Pasir: Is A Leasehold Condo A Better Option Or Would We Lose Money?

Hello,

This should make you pause for consideration, as a walk-up can still cross the $1 million mark, without offering any of those facilities.

2. Small numbers of units, and low volume of transactions

Walk-up developments tend to have small numbers of units. While that’s great for privacy, it can make resale prospects more volatile.

Consider, for example, a walk-up development with just 20 units, of which there have been 10 transactions over the past 30 years. This isn’t really enough to “anchor” the prices of the units. There’s a risk that, if the last unit happened to sell at an unusually low price, it can also be a drag on your unit.

It’s hard to ask for $1.5 million when the only other recorded transaction – just across from you – was for $1.2 million.

3. The age factor of walk-ups

Most walk-ups are older condos; most don’t have a completion date before the late 1990s.

In general, this will mean larger units (this is true of most older property types, not just walk-ups). However, that could come at the cost of higher maintenance and renovation needs. Some walk-ups are so old, they don’t even have air-conditioning; not a pleasant prospect when you’re already climbing four or five storeys to your unit.

Also, even if you maintain your unit property, a neighbour may not. The apartment one floor above you may not have had its pipes serviced in 25 years, and start leaking onto your living room carpet.

The good news is that most walk-ups are freehold, so at least lease decay isn’t a problem.

4. En-bloc prospects

You should never make property purchasing decisions on en-bloc potential alone.

That said, it’s one consideration that can factor into your overall decision.

Some walk-up apartments have the advantage of very good locations. Areas like Novena, Bukit Timah, or Tanglin all have old walk-up apartments; and the central location is attractive to developers.

Further, walk-up apartments are usually sitting on small land plots. This can help with collective sales potential. Developers are subject to the same five-year deadline to complete and sell their project, regardless of the development size (e.g. a developer that builds a boutique, 40-unit condo has the same five-year deadline as a developer that builds a 1,000+ unit mega project).

While this rule remains unchanged – and the economy stays headed into a Covid-19 downturn – this could make small developments more attractive than big ones, when it comes to an en-bloc.

The small number of units also helps in the en-bloc vote, as it’s easier to attain consensus when there’s a smaller number of owners.

5. A smaller prospective pool of buyers and tenants

Some buyers and tenants simply cannot choose a walk-up unit, full stop. This includes elderly people who can’t safely go up the stairs, those with health conditions, or those who are otherwise mobility impaired.

Buyers who are moving into their forever home (e.g. retirees) will look further ahead, and realise that a fourth-floor apartment with stairs-only isn’t great for their twilight years.

This does make the unit a bit harder to resell or rent out.

Overall, walk-up apartments are a tricky buy, and may be a tough call for new investors / first-time buyers

Before you purchase an older walk-up unit, consider nearby condo units at the same price range, and then weigh-up your reasons.

Do you really want to pay $1.2 million for, say, a 30-year old walk-up, when the same price can get you a smaller condo unit with more facilities?

Also, good appreciation in 30- or 40-year-old walk-ups doesn’t “just happen”; you do need to be more active in upgrading your unit, such as with top-end interior design. An ageing walk-up is not like a condo, which can bank more on its extensive facilities.

That said, a walk-up can present opportunities for home ownership in central or mature locations; and many have a unique architectural charm due to their age (unlike most contemporary developments, they don’t all look like stacks of Lego blocks).

If you need help with your decision, drop us a message on Facebook, and we can take a closer look at the property in question. You can also follow us on Stacked Homes as we review other options in the property market, to make your comparisons.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are walk-up apartments a good investment in Singapore?

What are the main disadvantages of buying a walk-up apartment?

How do walk-up apartments compare to condominiums in Singapore?

Can walk-up apartments be suitable for elderly or disabled buyers?

What should I consider before buying a walk-up apartment in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

2 Comments

can a foreign person buy these walk-up apartments?