Should You Upgrade To A Condo, Or Just A Bigger Resale Flat?

August 1, 2020

So your five year Minimum Occupation Period (MOP) is up, and you know what the whole internet screams at you to do: upgrade! Sell one, buy two! Buy a prime district condo, it’s more affordable than you think! Etc.

Except at this point, you’ve already felt the weight of a home loan for five years; switching to a private property means taking on an even bigger mortgage, with issues like maintenance fees to boot. So for most people, the thought that creeps into their mind is: why not just buy a bigger resale flat?

Why not upgrade from, say, a three or four-room flat to just a five-room resale flat? You’ll still get more space, and it’s a lot better for your pocket. The right answer varies between individuals, but here’s a clearer breakdown of the costs and advantages (as well as drawbacks):

What to consider when choosing between a condo, and a bigger flat:

- Difference in down payment and monthly loan repayments

- Maintenance fees versus conservancy fees

- Resale levies (if buying a second subsidised flat)

- Whether the additional condo facilities are worth the cost

- Capital gains over the long term

- Cash-out refinancing options

1. Difference in down payment and monthly loan repayments

We will assume that your upgrade choice is between a:

- Five-room HDB flat

- Fully private condo or an Executive Condominium (EC).

The average size of a five-room flat today is 1,184 sq. ft., while a three-bedroom condo unit is about 1,100 sq. ft. (varies by development – some new launches can go as low as 900ish sq. ft). This is also a typical size chosen by new upgraders with family.

| 5-room flat* | Private condo | EC | |

| Average price | $413 psf | $1,503 psf | $990 psf |

| Estimated quantum | $490,000* | $1.65m | $1.09m |

| Minimum down payment (HDB loan) | $49,000, payable with any combination of cash or CPF | Cannot use HDB loan | Cannot use HDB loan |

| Minimum down payment (Banks loan) | $24,500 in cash $98,000 payable in any combination of cash or CPF | $82,500 in cash $330,000 payable in any combination of cash or CPF | $54,500 in cash $218,000 payable in any combination of cash or CPF |

*Flat prices are significantly higher if you purchase a flat in a mature or central location, such as Tanjong Pagar, Clementi, Marine Parade, etc. In Clementi, for instance, five-room flats average $645 psf, so a quantum of $760,000+ is possible.

Next, we look at the monthly loan repayments. HDB loans have an interest rate of 0.1 per cent above the prevailing CPF rate. Bank loan rates are variable, but we use 1.3 per cent as it’s typical of current home loan rates.

We will assume a 25-year loan tenure.

(Ps. If your current home loan rate is much higher than 1.3 per cent, do drop us a message on Facebook and we may be able to help you out).

| 5-room flat on HDB loan | 5-room flat on bank loan | Private condo | EC | |

| Maximum loan quantum | $441,000 | $367,500 | $1,237,500 | $817,500 |

| Est. monthly repayment | Approx. $2,001 | Approx. $1,435 | Approx. $4,834 | Approx. $3,193 |

| Total paid after 25 years, at current interest rate* | Approx. $600,205 | Approx. $430.645 | Approx. $1,450,132 | Approx. $957,966 |

*Interest rate fluctuations are inevitable for bank loans; the eventual amount may be significantly higher or lower depending on future interest rate changes.

Remember to deduct the sale proceeds of your previous home from the costs! Otherwise everything will seem outlandishly unaffordable.

To work out the costs after factoring in the sale of your previous home, please contact us on Facebook.

2. Maintenance fees versus conservancy fees

For HDB flats, conservancy fees for five-room flats range between $80 to $90 per month.

For condos, the discrepancy in maintenance fees is huge – anywhere from as low as $100 per month, to as high as $2,889 per month. However, most three-room condo units will have maintenance fees of about $400 per month (note that condos tend to collect on a quarterly basis).

Property Advice10 Things a First Time Condo Buyer Should Look Out For To Avoid Regret

by Druce Teo3. Resale levies (if buying a second subsidised flat)

If you (1) didn’t get any subsidies for your former flat, or (2) are not buying a second subsidised flat, you can skip this part; it’s not applicable to you.

Otherwise, you need to pay the following levy:

| Size of the flat you’re selling | Normal households | Singles Grant recipients |

| 2-room | $15,000 | $7,500 |

| 3-room | $30,000 | $15,000 |

| 4-room | $40,000 | $20,000 |

| 5-room | $45,000 | $22,500 |

| Executive | $50,000 | $25,000 |

| EC | $55,000 | N/A |

Resale levies are automatically deducted from the sale proceeds of your flat.

4. Whether the additional condo facilities are worth the cost

There are no numbers to give you here, as it’s purely a qualitative judgement. You can see that condos cost more, and have especially higher maintenance (see above).

In exchange for this, a full suite condo gives you facilities like:

- 24/7 private security

- Pools

- Gym

- BBQ pits

- Playgrounds

- Clubhouse

- Some retail and café outlets (not all developments)

- Concierge services (not all developments)

The worth of these facilities is subjective to your lifestyle. For example, if you are currently staying in an HDB and are paying monthly fees for an external gym, the convenience could be worth it to you.

Probably the main reason for most people to upgrade to a condo will be the benefits for the family. Whether it be safer grounds for kids to run around, kids swimming pools, playgrounds or sporting facilities – these are all tough things to put a price on.

5. Capital gains over the long term

This is such a huge topic, we need to refer you to previous articles over this. But to quickly summarise it here, condos – including ECs – have shown stronger gains than HDB flats over the past decades.

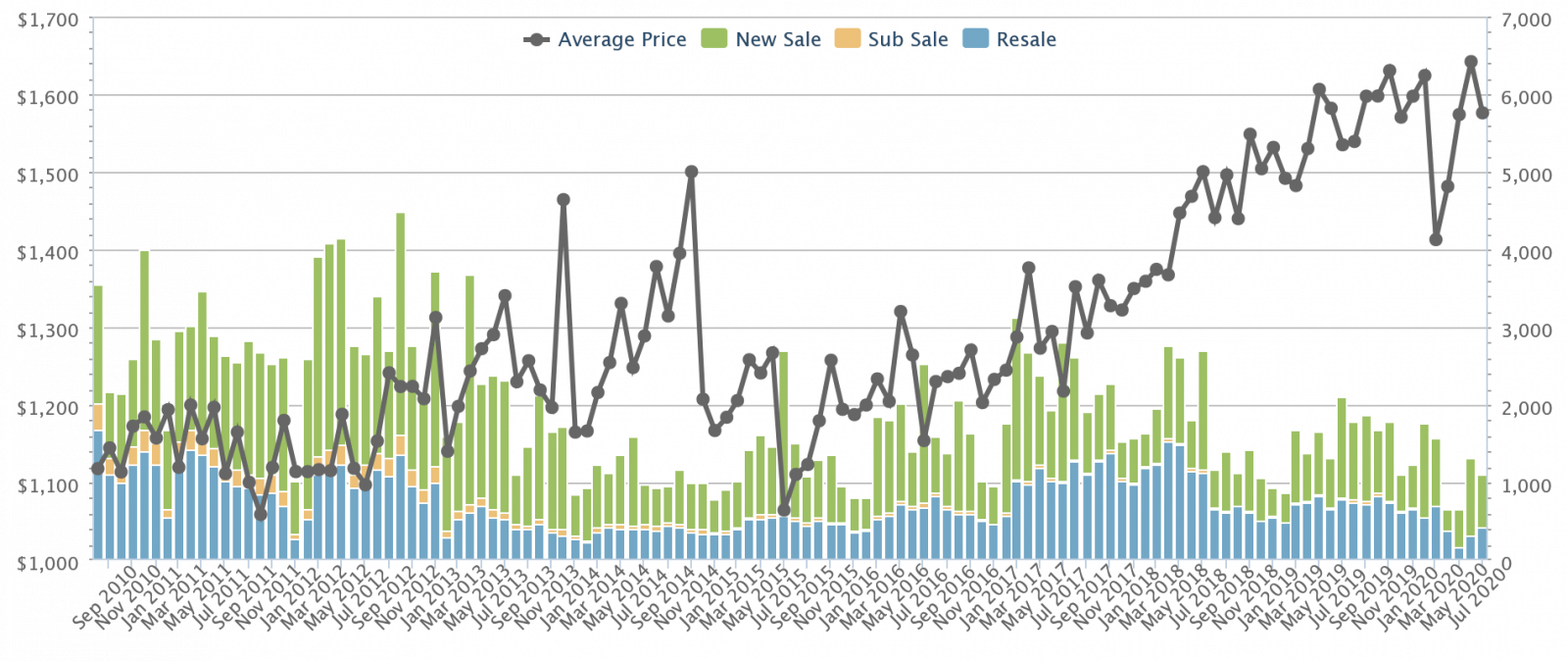

This is the price movement of condos over the past decade:

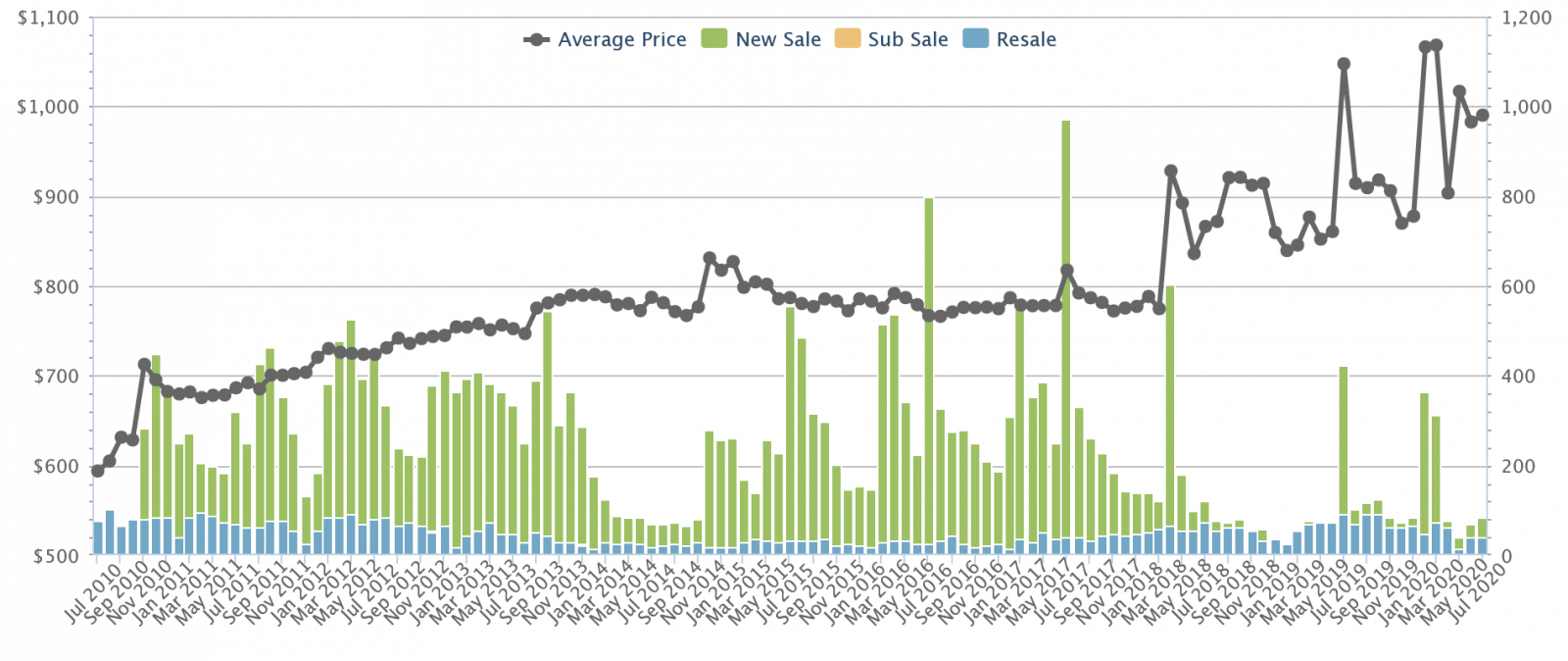

This is the price movement for ECs:

This is the price movement for HDB flats:

Price movement over 10 years

| HDB flats | Private condos | ECs | |

| Average price appreciation over 10 years | $373 to $418 psf | $1,080 psf to $1,567 psf | $594 psf to $990 psf |

| Percentage of return | 12% | 45% | 66.6% |

| Annualised return | 1.15% | 3.79% | 5.24% |

Based on average price movements, those intending to use their property as a retirement asset (e.g. downgrade after retirement, and use the proceeds for retirement income) are likely to seek out private condo / ECs, instead of another flat.

Do note that these figures are if you’ve bought approximately 10 years ago, the numbers can change quite a bit depending on your entry and exit point.

6. Cash-out refinancing options

As an ancillary concern, cash-out refinancing is possible for private condos, but not HDB properties (for ECs, this is only possible after they’re fully privatised).

Cash-out refinancing allows you to borrow up to a percentage of your property value (e.g. up to 70 per cent of the value of your condo), at a very low interest rate – often in the range of 1.3 to 1.6 per cent per annum. This can make private condos more attractive to the financially savvy buyer, such as those who can use this cheap loan for other investment opportunities.

For genuine home buyers, this is less of a concern.

In light of the above, when should you choose a five-room flat instead of a condo / EC?

The most important factor is the state of your personal finances. Do look over the required down payment and monthly loan repayments, and try to keep to the guidelines in point 1.

Be realistic and conservative. Property is not an asset you can offload quickly, should your financial situation worsen. Remember, you can always upgrade again from a five-room flat later.

That said, those who are in a position to get a private condo or an EC should weigh up the potential gains. If you were to buy a flat and invest in something else, would your returns ultimately beat the capital gains on a private condo? This is a matter to discuss with a qualified financial professional.

Finally, don’t forget that the potential for gains applies if you buy the right property. Just because the average condo appreciates well, it doesn’t mean they all do.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

1 Comments

I think the age of the 5 room flat would factor a lot as it can range from a fresh 5 year old 5 room flat to a 40 year old 5 room flat. The price and future value would differ greatly then.

Personally i moved from a 3 room BTO to a 20 year old 5 room flat (1300+ sqft) to move nearer to my in-laws at a great price (about 40% more than what i sold my 3 room BTO flat for). A condo of the same size would be 3 times more expensive.