The Effect Of Trump’s Policies On Singapore Property: What Could Happen This Time?

February 20, 2025

The US seems to be undergoing a volatile time, and it’s just the start of their current President’s (the Trump administration) four-year term. So it’s not surprising how many questions we’ve had of late, regarding how all of this is impacting the property market. There are a whole bunch of problems when it comes to answering this question, but that doesn’t mean we can’t get an approximate sense of what happened. Here’s a look:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Caveat: Property prices move for all sorts of reasons, and the effect of US politics is indirect

Property prices in Singapore are mainly driven by local issues, such as available housing supply or government policies. It’s difficult – in some cases impossible – to isolate the specific impact of foreign policies on the local property market. As such, we’d consider the following to be correlations rather than causation.

That said, here are three of the main issues we saw:

1. US-China Trade War and Capital Flight

The current Trump administration has made the news for imposing tariffs. This is the same as we saw from the previous administration, where trade wars with China were front-page news. In fact, some political commentary considers the current situation to be a continuation of that same trade war, which started in 2018.

This was one of the factors behind a major capital flight from China in 2019. At the time, political troubles in Hong Kong also eliminated it as an alternative for some Chinese buyers, leaving Singapore a prime destination. Singapore property, long considered a safe haven in most crises, thus drew more Chinese buyers. At the same time, Singaporeans themselves turned to the property market as an alternative to conventional stocks and bonds, much as we saw during the Global Financial Crisis. In particular, we saw strong demand for luxury properties – such as those in prime districts like 9 or 10 – from Chinese buyers.

Given we’re seeing a continuation of the trade war, we also face the same volatility in the stock market today. This might once again drive investors toward the safe harbour of the Singapore real estate market.

How might it be different this time?

During the first Trump administration, ABSD rates* were lower; they were just 15 per cent for foreigners, prior to July 2018. Today, however, ABSD rates for foreigners are a stunning 60 per cent. This may be enough to dissuade foreign buyers, even as a safe haven asset.

But this may be counterbalanced by the Trump administration having even more stringent and aggressive tariffs than before, and by the added uncertainty of the war in Ukraine and Gaza. If these continue to disrupt global stock and bond markets, Singapore real estate could look appealing despite the high ABSD tax.

*Note that the ABSD rates don’t appeal to American buyers, as US Citizens pay the same tax rate as Singaporeans. It might affect Chinese buyers, however, or foreigners of other nationalities.

2. Pressure on the Fed to lower interest rates

Many (not all) Singapore home loans are pegged to SORA, and SORA tends to move in tandem with US interest rates.

For example, a bank loan rate may be expressed as 3M SORA + 0.4%, which means the total interest rate is the prevailing three-month SORA rate, plus the bank’s spread of 0.4 per cent. As the SORA rate rises or falls (influenced by US interest rates), such a home loan would be cheaper or pricier accordingly.

(Note: this is irrelevant to HDB Concessionary Loans, which are pegged to prevailing CPF interest rates instead).

During Trump’s last presidency, he notably pushed the Fed for steeper interest rate cuts. We’re seeing the same behaviour today; and if the White House gets its way, this could mean lower mortgage rates for many Singaporeans. As we’ve seen in past and recent history alike, cheap mortgages do tend to spur buying – so if Trump has his say, we could see continued momentum in the housing market.

How might it be different this time?

Going back to tariffs and the trade war: protectionism tends to result in higher inflation rates. This has already been a sore point for the US economy (and we daresay the economies in many other countries, including Singapore.)

One of the main tools to lower the inflation rate is the interest rate. In general, the higher the interest rate set by the Fed, the more it helps to slow the pace of inflation. The question now is whether the tariffs set by the Trump administration result in a higher US inflation rate, which would prevent interest rates from coming down (or in a worst-case scenario, even cause them to go up).

More from Stacked

Here’s Why You Shouldn’t Judge A Property Purely On It’s “HIGH” PSF

In May 2018 last year, a research report by DBS forecasts new private homes to cost between $2,300 to $2,900…

Perhaps a bigger factor this time round is the lower Total Debt Servicing Ratio (TDSR). During the first Trump administration, the TDSR was set at 60 per cent. At present, the TDSR limit has been lowered to 55 per cent.

That is, the TDSR used to limit home loan repayments to 60 per cent of borrowers’ monthly income, but it’s now lowered to 55 per cent of monthly income instead.

On top of that, the floor rate (projected interest rate) used to calculate TDSR during the first Trump administration was 3.5 per cent. Today, the floor rate has been raised to four per cent.

The end result is that, even if interest rates are lower in a real sense, borrowers may still find it harder to “stretch” and get a bigger loan quantum. This might help to restrain transaction volumes and prices, even if rates dip.

3. Concerns in commercial real estate

During the first Trump administration, there were mounting concerns regarding rental rates in retail, industrial, and other commercial properties. This had become especially pronounced by 2019, as companies scaled back operations in light of trade tensions.

Singapore is an export-based economy, so our economic outlook is often dimmed by trade wars between nations; especially when it comes to major economies like China and the US. At present, analysts are expecting the trade war to bite only toward the second half of 2025; but as business outlooks sour, we may see serious concerns regarding retail, office, and industrial rents.

This raises the question as to whether investments may flow back into residential real estate, regardless of the much higher ABSD today.

How might it be different this time?

Simply put, it isn’t. This is a similar situation to the previous Trump administration, except it’s arguably worse given the wider range of countries affected (e.g., Mexico and Canada weren’t also high-profile targets the last time around.)

The only possible difference, as mentioned above, is the now higher ABSD on residential properties. This might dissuade some investors from making a move, from commercial back into residential. It’s still too early to tell for now though.

Finally, let’s look at how prices moved during the last Trump administration

This is where it gets tricky. The Trump administration ended in a year when Covid-19 hit its peak; and the subsequent price movements were impacted more by the pandemic than by factors such as trade wars. We would also, again, stress that local factors like supply, wealth transfer, upgrading desires, etc. weigh far more on prices than a foreign administration (even the US).

This limits the usefulness of tracking price movements, but here’s what we saw regardless:

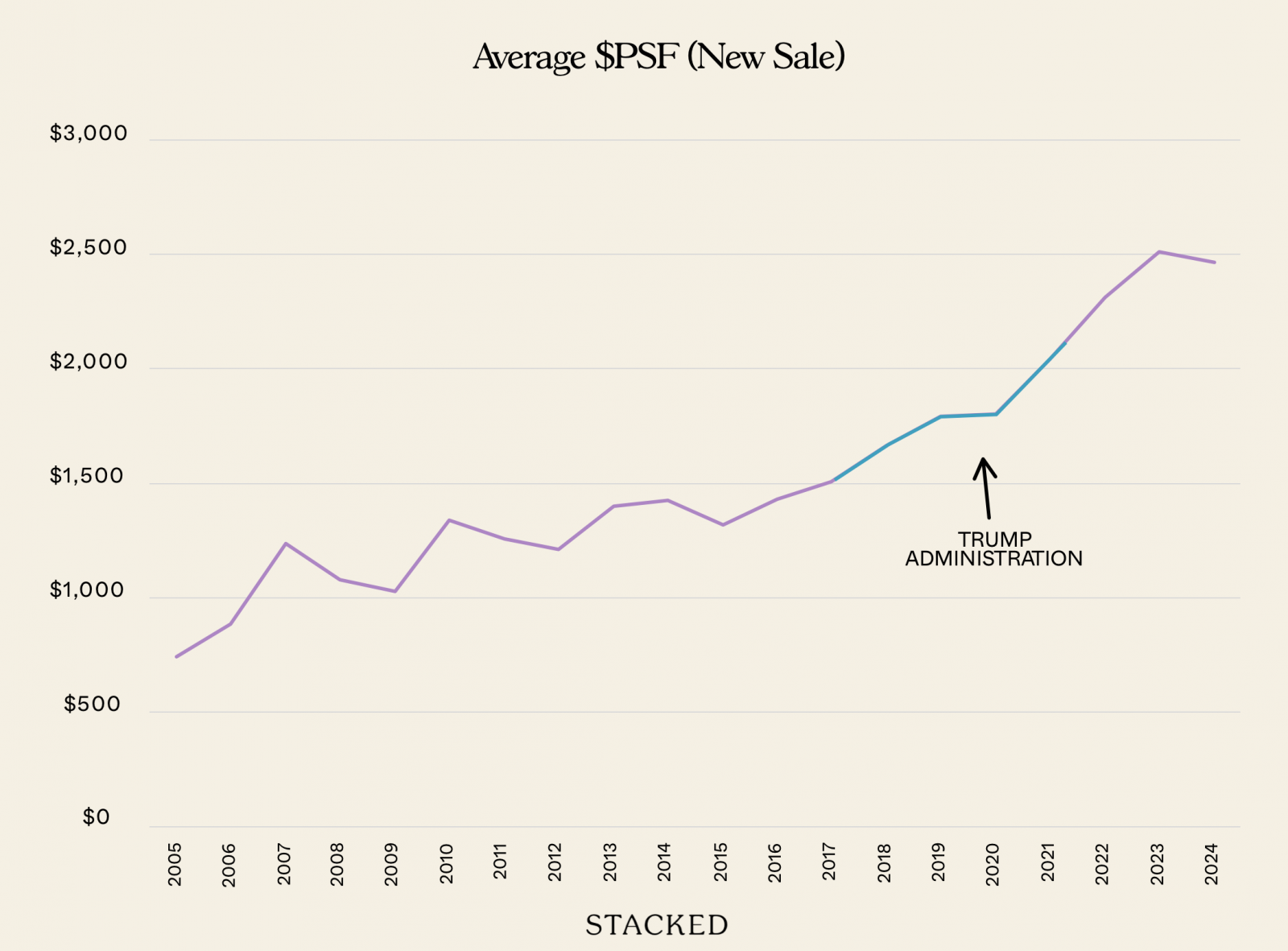

When the last Trump administration ended, prices for new sale condos moved from an average of around $1,500 psf, to over $2,000 psf. Again though, the uptick from 2020 onward may just be due to developers facing higher costs of materials and labour (from Covid-19).

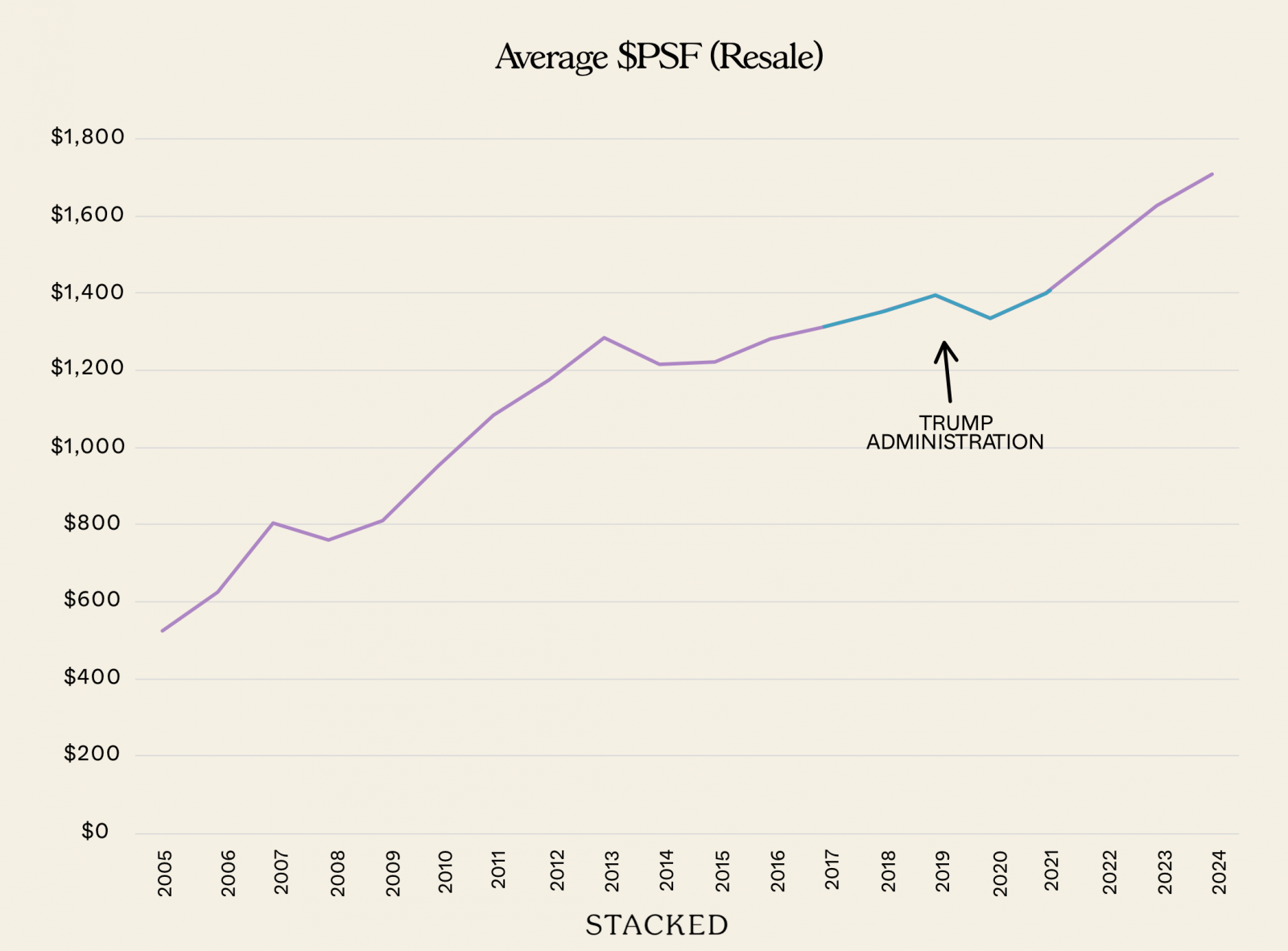

For resale condos, we saw prices stay mostly stagnant, hovering between the $1,300 to $1,400 psf mark.

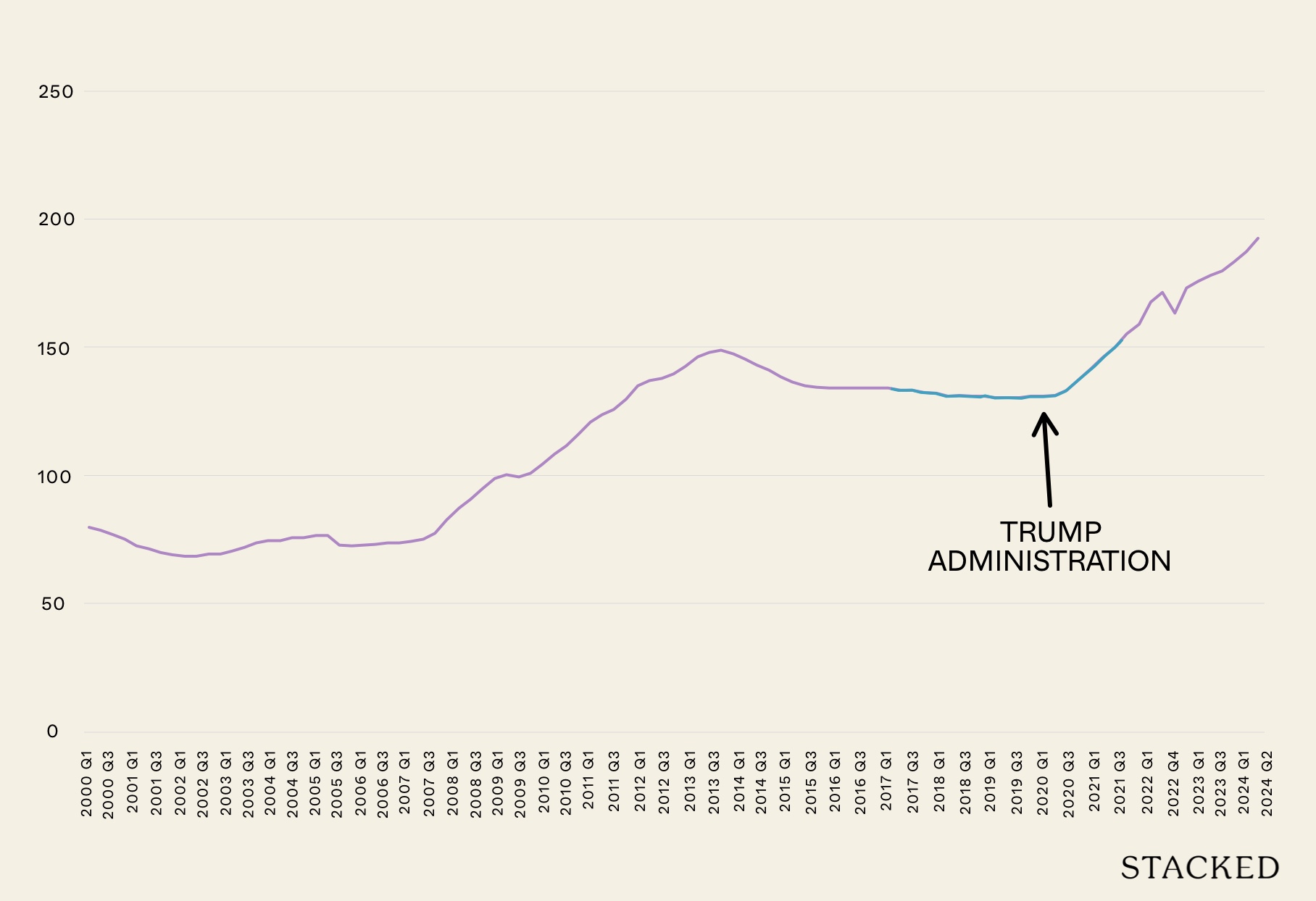

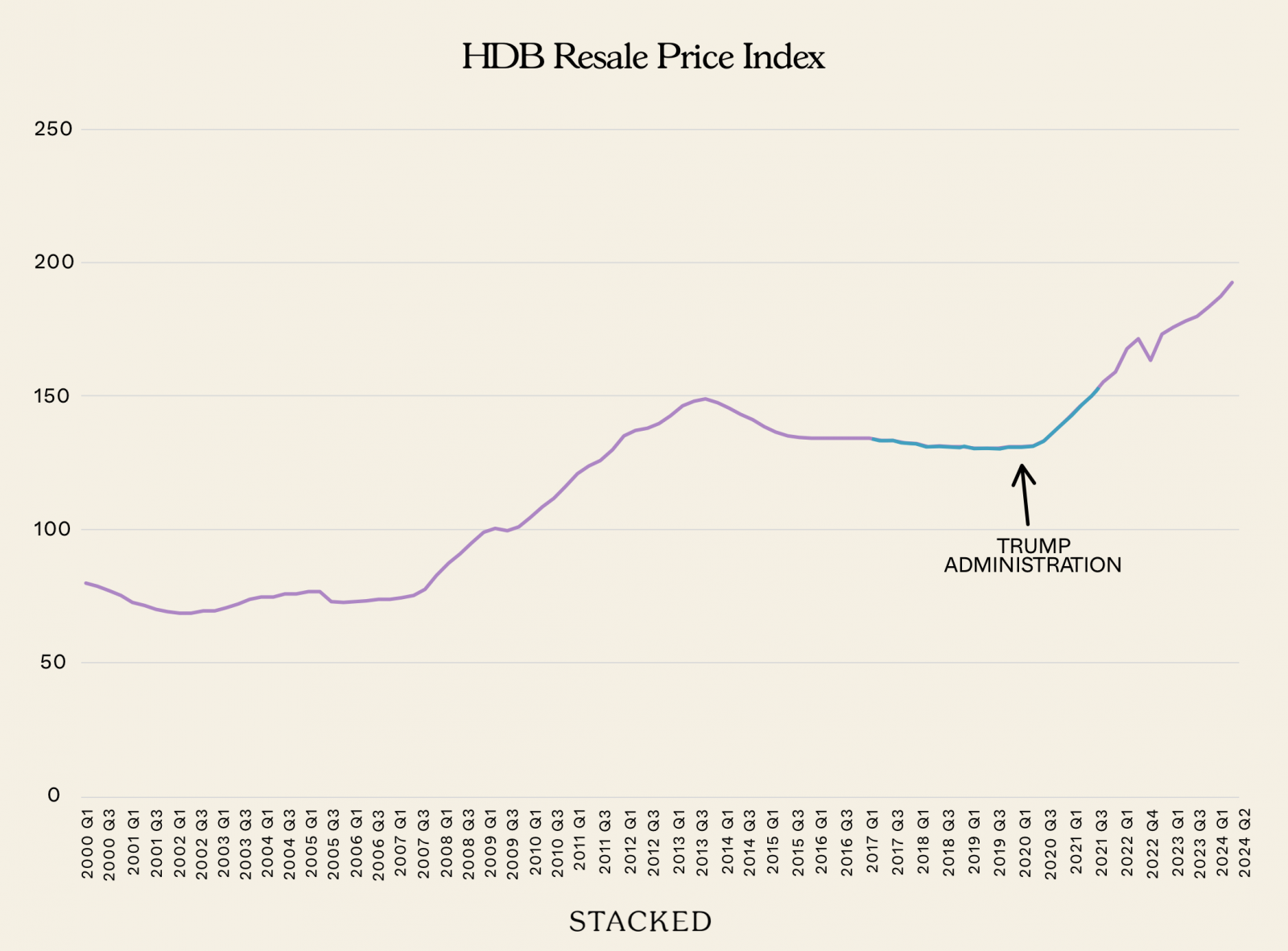

Finally, these are the HDB resale prices; but we should caution that any relationship within this market is at best fleeting. Many HDB flats are bought with HDB loans, for instance, which have no relation to interest rates for private loans (although those who buy HDB flats with bank loans could have been affected).

The flat prices before Covid-19 were due to a downward slide from 2013 when the Mortgage Servicing Ratio was introduced, and when HDB stopped publishing Cash Over Valuation data. The upswing in 2020 and after was due to the housing shortage after Covid.

Overall, we’re better prepared than the first time, even if it wasn’t due to deliberate effort

We can’t seriously use the term “lucky” with regard to tragedies like Covid-19. But we can say that, by coincidence if nothing else, the crazy aftermath of Covid seems to have prepared us for the next four years of volatility.

Tighter loan curbs and higher ABSD rates are already in place, which could help to prevent runaway prices. And despite the greater scope of the Trump administration, we can at least say we’ve lived through somewhat similar policies of theirs, the first time around. The end result is that we’re not totally unprepared for what’s to come.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do US policies affect Singapore property prices?

What impact did the US-China trade war have on Singapore real estate?

Will US interest rate changes influence Singapore home loans?

How do US tariffs and trade tensions affect Singapore's commercial property market?

Are property prices in Singapore likely to rise or fall with US policies?

How has Singapore prepared for potential US policy impacts on its property market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

0 Comments