So Is The 99-1 Property Split Strategy Legal Or Not?

July 6, 2025

Most people assume it is, since it’s something that’s been going on for over a decade.

The idea is that one co-owner (most often a spouse) owns 99 per cent of the property, whilst another owns just one per cent.

Later, when the funds exist for each one to own a separate property, the owner of the one per cent transfers it to her spouse, thus incurring Buyers Stamp Duty on just the one per cent. She’s then free to buy a property without incurring Additional Buyers Stamp Duty (ABSD), since she has a property count of zero.

For the longest time, this has been the basis of the “sell one, buy two” strategy. But there was an interesting case of late that shed light on an unasked question: is there any illegality involved here?

Here’s the case in question:

A couple bought a Hillcrest Arcadia condo in a 99:1 ownership split. One spouse claimed she owned 99 per cent of the $1.865 million unit, because – well, that’s what the title said. It was a sweet gesture from her then-boyfriend to soothe her fears of infidelity. Would he do something like that if he were intending to cheat? Of course not, he’d lose his home.

(And, ahem, there’s the added side benefit of buying a second home without ABSD if the chance comes.)

But love is eternal for as long as it lasts. So when the couple split less than a year later, she declared the whole 99 per cent to be hers, since that’s what it said on paper.

But two things happened:

First, the High Court wasn’t having it: since her boyfriend bankrolled most of the purchase, the judge ruled he actually owned 54 per cent, based on the paper trail of payments; so her 99 per cent claim was a no-go (Moral of the story: you can fake your relationship on paper, but not your CPF contributions.)

Second, this interesting bit from the case:

“The pair admitted that they planned for Mr Ngor to transfer and pay taxes on his one per cent share to Ms Wong when they decide to buy a second property. Justice Lee said there was no nefarious intention or knowledge that this would be an unlawful act. Moreover, the plan was never carried out.”

The important turn of phrase here is “would be an unlawful act.” This would suggest that, whilst the Court didn’t punish them – partly because the plan was never executed – it wasn’t okay for them to plan to dodge the ABSD.

Here’s something from a parliamentary response to take note of:

“Whether a ‘99-to-1’ arrangement involves tax avoidance depends on the facts and circumstances surrounding the specific case. Should IRAS determine that tax avoidance has occurred, it will recover the rightful amount of stamp duty from the buyers, and may impose a 50 per cent surcharge on the additional stamp duty payable. There is no statutory time limit for stamp duty audits.”

More from Stacked

A $2 Million HDB Flat? Here’s When We May Possibly See The First One

I remember the first time we hit a million dollars for an HDB flat (this was an Executive HDB at…

That would suggest holding a property in a 99-1 tenancy-in-common split is not per se illegal under Singapore law. But, and this is a big “but,” authorities can treat any contrived use of that structure as tax avoidance.

But I wonder how clearly all of this is communicated to us

I’ve spoken to more than a few people who said their property agent or lawyer assured them it was perfectly fine – no risks, no problem. And then they get an audit letter a year later and realise they’ve been sold half a story.

Maybe it’s time we stop giving buyers unrealistic expectations and sending them into legal grey areas. If someone is going to recommend 99-1 as a strategy, then they’d better spell out the risks; not just the headline savings. And if they provided any kind of guarantees they shouldn’t, well, they should shoulder more of the responsibility when the reckoning comes.

This is especially true in 2025 when property prices are higher, and penalties hit harder.

Meanwhile, in other property news:

- There are plenty of factors to consider when buying a property, but what are the most important? Here’s a look at what to prioritise.

- Subletting is hardly a new idea; and for some it can be a great way to secure a much desired location. But it carries hidden risks that you need to brace for.

- The former Robertson Walk is back, but now as Robertson Opus. Is this 999-year project worth considering?

- District 7 now has one of the biggest price gaps between new and resale condos; join our Stacked Pro readers in finding whether resale is simply the wiser choice here.

For more on the Singapore property market as it unfolds, follow us on Stacked.

Weekly Sales Roundup (23 June – 29 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $5,656,000 | 1959 | $2,887 | 99 yrs (2021) |

| GRAND DUNMAN | $4,395,000 | 1690 | $2,601 | 99 yrs |

| NAVA GROVE | $3,949,100 | 1550 | $2,548 | 99 yrs |

| THE ORIE | $3,862,000 | 1453 | $2,658 | 99 yrs |

| AMBER HOUSE | $3,780,035 | 1238 | $3,054 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,231,686 | 420 | $2,934 | 99 yrs |

| NOVO PLACE | $1,383,000 | 872 | $1,586 | 99 yrs |

| AURELLE OF TAMPINES | $1,526,000 | 840 | $1,818 | 99 yrs |

| THE CONTINUUM | $1,544,000 | 560 | $2,758 | FH |

| TEMBUSU GRAND | $1,554,000 | 646 | $2,406 | 99 yrs |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SCULPTURA ARDMORE | $20,000,000 | 3326 | $6,013 | FH |

| RIVERGATE | $6,188,000 | 2088 | $2,963 | FH |

| WARNER COURT | $4,880,000 | 4176 | $1,168 | FH |

| TANGLIN PARK | $3,800,000 | 1507 | $2,522 | FH |

| THE GLYNDEBOURNE | $3,750,000 | 1927 | $1,946 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $650,000 | 431 | $1,510 | 99 yrs (2011) |

| THE NAUTICAL | $674,000 | 441 | $1,527 | 99 yrs (2011) |

| PRESTO@UPPER SERANGOON | $725,000 | 420 | $1,727 | FH |

| THE COTZ | $738,000 | 452 | $1,632 | FH |

| MIDTOWN RESIDENCES | $746,000 | 484 | $1,540 | 99 yrs (2013) |

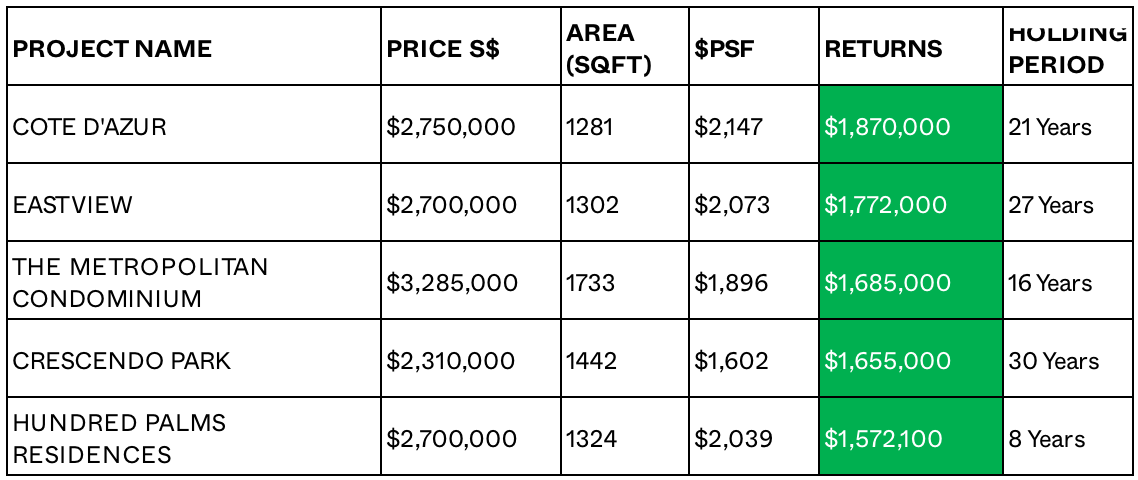

Top 5 Biggest Winners

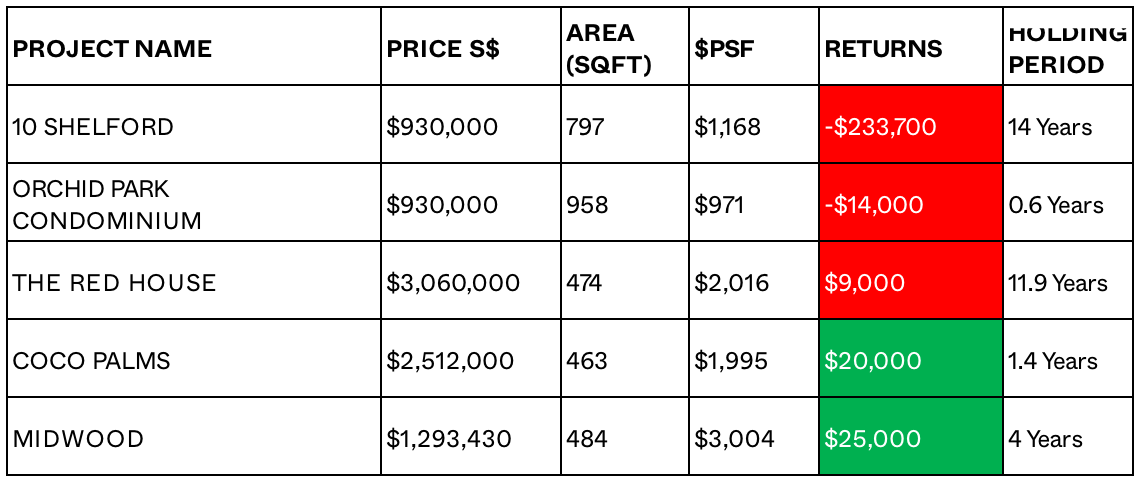

Top 5 Biggest Losers

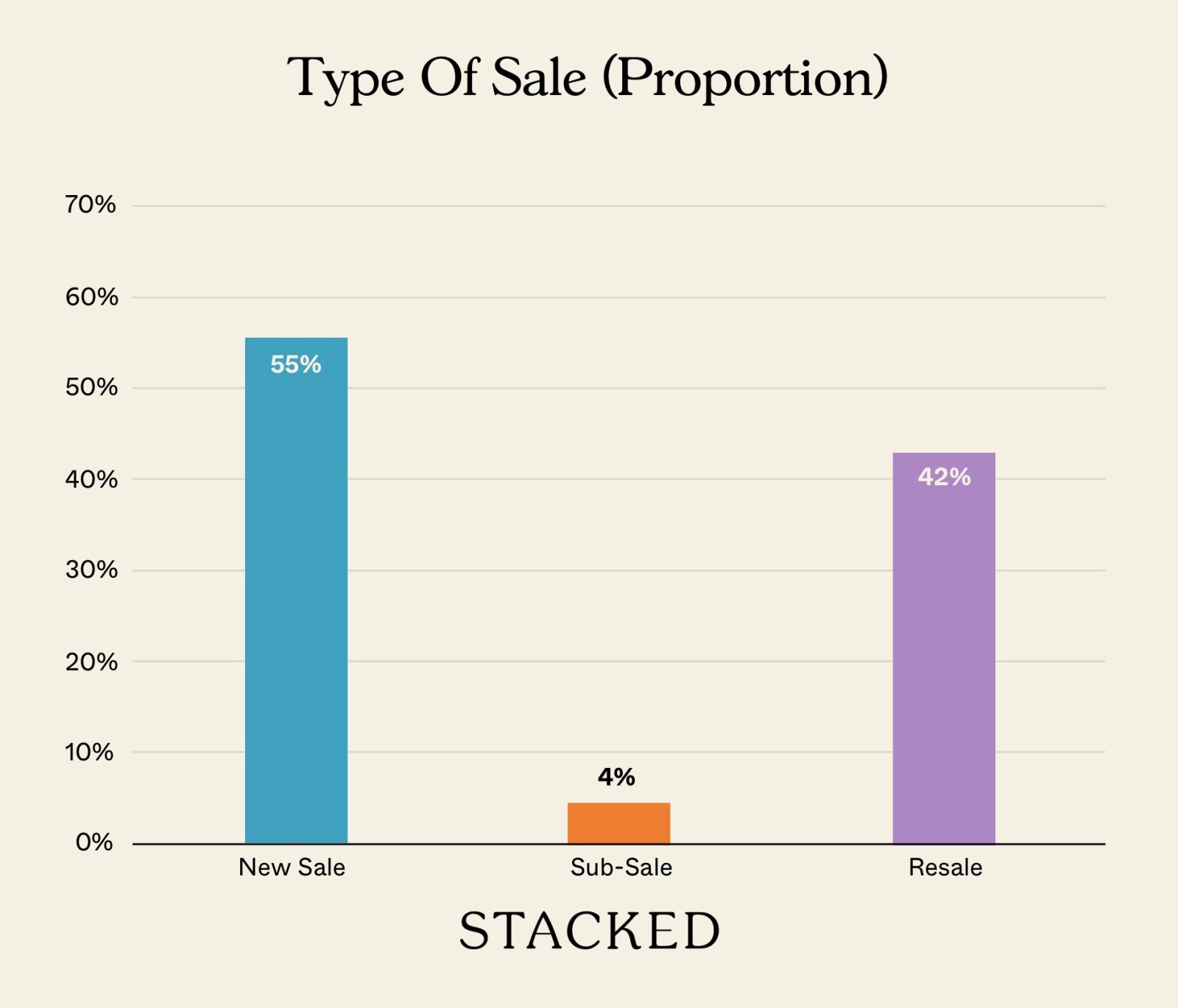

Transaction Breakdown

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is the 99-1 property split strategy legal in Singapore?

What are the risks of using the 99-1 property ownership split to avoid stamp duty?

Can a couple plan to transfer property shares to avoid additional stamp duties in Singapore?

How does the Singapore High Court view ownership claims based on paper documents?

What should property buyers be aware of when considering the 99-1 ownership split strategy?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

4 Comments

There is a lot of mistakes in your Top 5 biggest loser.

U then loser

You then

Can yall be more serious like YL Wong