Covid-19 and the Singapore Property Market Outlook: What The Experts Say

April 21, 2020

Just like predicting a stock market bottom, any attempt to pinpoint an end to the current Covid-19 catastrophe might come across as…futile at best.

That said, it never hurts to have an idea of the possibilities that might await us.

In this article, we have a brief look at the current Singapore property market situation (stats included).

More pressingly, we observe what the experts have said and continue to say about Covid-19’s impact on the Singapore property market in the coming months.

What the Experts Said in January 2020

Back when the virus was contained mostly to China and getting fined for having Bak Kut Teh was not a thing in Singapore, many experts held optimistic short to mid-term hopes for both the global and local economy.

Heavy hits to retail sectors were rightly anticipated; and boosts to delivery services, digital communication platforms and the wholesale food industry were correctly forecasted.

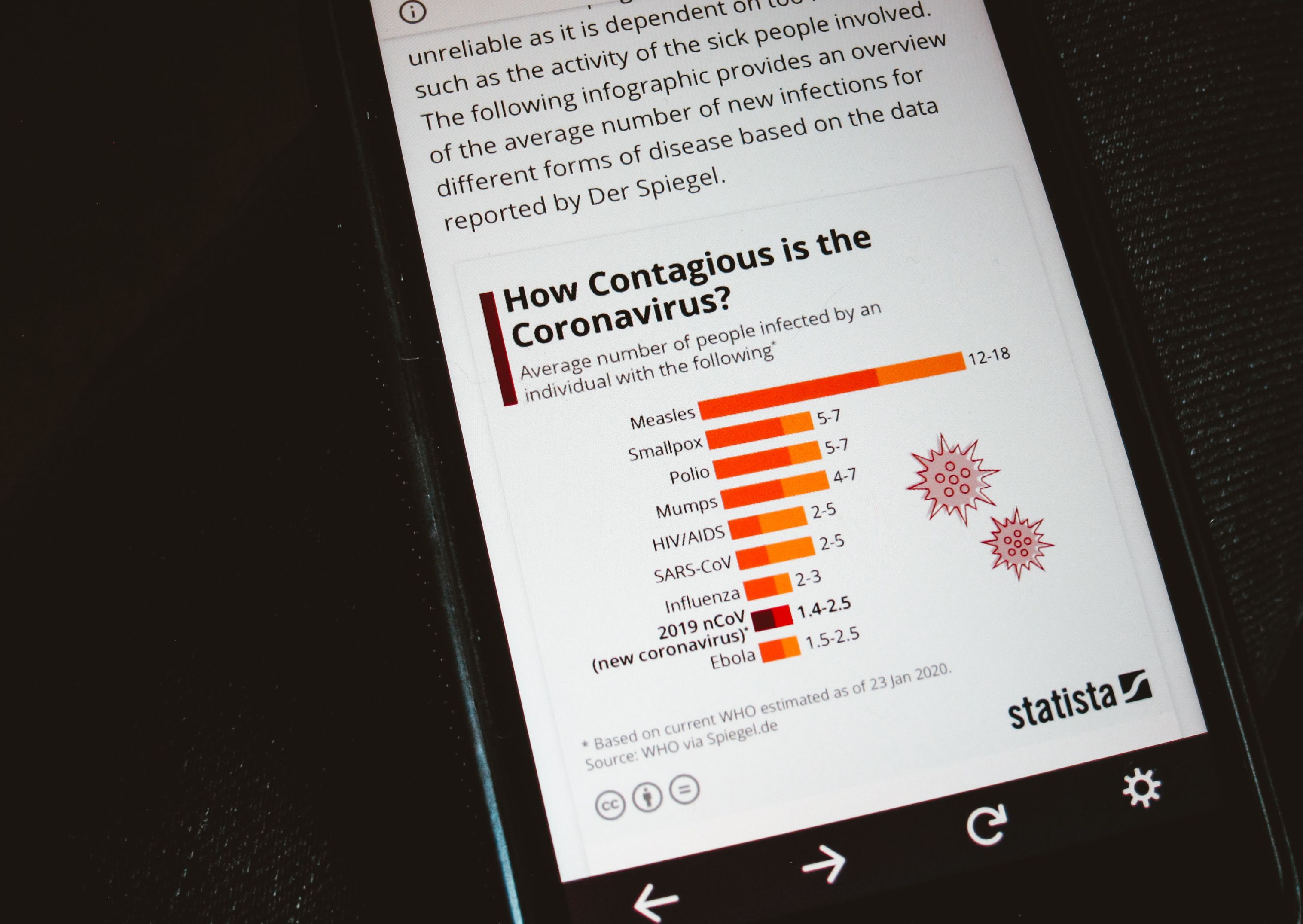

That said, many experts also drew comparisons between Covid-19 and the 2003 SARS phase – and in doing so, predicted an end to the virus by June 2020.

Of course, this was before the global ‘contagious-ness’ of the virus was identified, proving it to be a positive guesstimate at best.

Based on this guesstimate however, many analysts then foresaw a boom (revenge spending) from both investors and consumers once the virus was lifted closer to the second/third quarter of 2020.

A forecast that now seems improbable at best.

One key sentiment widely echoed at that time was that the impact to the Singapore property market would be relatively minimal.

Yes, profit margins for developers and agents would be affected due to drops in new launch/resale deals, but the market would generally be resilient enough to avoid any severe property price corrections.

Can the same still be said for the current Singapore property market outlook?

How have things changed? What are the experts saying now?

In light of the international curtail on foreign travel, nationwide lockdowns and an exponential rise in cases and deaths both globally and locally, it is safe to say Covid-19’s impacts have shifted/abounded meteorically across a number of property sectors in Singapore.

Here’s what the largest real estate firms in the world have to say about the Singapore property market.

Colliers International (APAC Transactional Rebounds)

According to an April Flash from Colliers International on the APAC Real Estate Markets, the initial predictions of activity pick-up in the APAC property markets (sales transactions) starting late Q2 to early H2 have now been pushed back by 3 – 6 months!

Furthermore, Singapore’s position as an open economy driven by international trade flow makes its overall economic outlook more vulnerable to China’s (and subsequently the world’s) economic slowdown.

There have been positive pointers however.

With a number of major investment deals in China and ‘strength’ in both the Singapore property market and second-ranked centres like Yokohama in Japan, price corrections for APAC property markets are expected to stay within a reasonable range (more on that later).

What’s more, ‘historical examples’ have shown analysts at Collier that APAC economic growth/GDP could recover rapidly in late 2020, and subsequently, 2021 – driving up property deal volumes in the process.

Zooming in locally, Colliers International has further stated that the Singapore Property Market looks the most promising out of the quintet (of APAC nations) to potentially observe a transaction volume pick-up during H2 2020 – global investors included.

The reason for this was that the government’s initial strong policy response, which included sizable fund ejections and new measure implementations – that have since been globally recognised, further reaffirming its position as a ‘regional safe haven’ for long-term investments.

(Note: The recent spikes in foreign worker Covid-19 cases that stemmed from clustered living conditions have not yet been taken into account in this report. Depending on how these cases are managed/stemmed, we might be looking at progressively later transaction rebound dates for the Singapore Property Market.)

CBRE/Cushman & Wakefield/JLL (Property Prices to drop + Lowered Investment Volumes)

In a recent article on the South China Morning Post, Cushman & Wakefield’s Wong Xian Yang was quoted forecasting a 3-5% drop in private residential price index by the end of this year.

This, following the 1.2% drop on the private residential price index we already observed in Q1 2020.

CBRE’s head of research for Southeast Asia, Desmond Sim, further added to the sentiment by saying that the overall residential property price index could fall by up to 5-8% this year.

This figure was backed in their most recent report, where CBRE mentioned that the initial 1.2% price index fall could be associated with sales from The M – where its attractive city fringe location and adjusted (competitive) pricings observed sales which contributed to the downward price adjustments.

As a further result of ‘closed sales galleries, stay home measures and ban of foreign visitors to Singapore’, one should expect lower home sales, with some developers delaying project launches and others – those with weaker holding power due to ABSD concerns – offering more competitive pricings for their units.

Real estate investment volume has dropped 31.3% from the previous quarter, with a bulk of these investments (48.6%) came from residential investment sales courtesy of the luxury market and 3 GLS-site awards earlier this year.

Perhaps more pressingly, foreign investments have weathered a 65.1% drop as these figures wait on the ‘pipeline’ for prices to dip further.

CBRE has been further quoted saying that ‘Singapore real estate investment volume (for end 2020) should come in 30 to 40% lower than in 2019’.

More from Stacked

Are HDB Flats Really As Unaffordable As Everyone Claims? We Look At 468,600 Transactions To Find Out.

With the fresh new record of a $1.4 million HDB flat being sold at Henderson, it has yet again sparked…

Buyer-seller price expectation gaps have since been widening.

Savills (An Alternate Price Forecast)

In a recent special publication (dated April), Savills has admitted that looking back at the SARS period for prediction guidance is tempting, but not recommended.

They have gone on to analyse the probability of Covid-19 causing an analogical ‘puncture’ (or a drop in sales and hence prices) in the Singapore property market.

Factoring in death rates as the biggest culprit in this scenario, their research shows that sentiments for super luxury developments in the CCR region might have already punctured – given the drop in wealthy Chinese buyers.

On the other hand however, healthy sales volumes of certain new launches (The M and Luxus Hills) have shown them that the OCR, RCR and non-super luxury CCR currently weather no signs of puncture, even if sales volumes have stretched/thinned.

Based on that, the analysts are offering a surprisingly optimistic outlook by clinging on to the pre-Covid19 outlook that residential property prices will continue to rise 3-5% this year.

(Note: Given the very positive outlook in terms of sale pricings, I believe that this research was conducted before the April lockdowns + pick-up in cases/death – and therefore do not represent a very accurate forecast of the current situation. In a more recent post, Executive Director of Research, Alan Cheong has admitted that if the pandemic does get worse globally, and ‘breaks sentiments’ here, sales will plummet. He is currently calling on slate cooling measures to be aggressively rolled back as they could add further, contrary risk in a poorly sentimented Singapore property market.)

Knight Frank (Keen Interests; Transactions to take longer to proceed)

In congruence with CBRE, Knight Frank has also noted that there is a ‘growing mismatch in price expectations between buyers and sellers’ – which would therefore cause ‘longer (discussions) transaction times’.

(Add in the social distancing measures – together with the inability for buyers to view units, and this really comes with little surprise.)

What the analysts over at Knight Frank are also saying however, is that there will continue to be significant interests in choice properties that are attractively priced.

They are also expecting transaction volumes to rise once the social distancing measures are lifted despite the steep drop in Singapore property market sentiments since March this year.

Here is their full market outlook:

“Market Sentiments are expected to weaken amid concerns over job security and restrictive containment measures due to the COVID-19 virus. With the restrictions on show-flats with the social-distancing measures and reduced viewings, we anticipate the transaction volume to decrease.

Despite the outbreak, it is unlikely that the prices in the primary market will decrease, given that most developers have the reserves to tide through this period. In contrast, the prices in the secondary market will be subject to greater downward pressure as firms undertake cost-cutting measures.”

In a Nutshell..

At the end of the day, the general consensus from the experts is this:

If things continue to stay the way they are for extended periods, then there will continue to be a dip in transaction volumes (and in some occasions, prices).

The light at the end of the tunnel will come when social distancing measures are gradually lifted, resulting in an unavoidable rise in Singapore property market sentiments. As to when this will happen, we do not know.

Should things escalate/be prolonged severely however, measures will be taken by both the government and developers to safeguard their respective interests.

We could then see slate measures being lifted to reduce risk to the market and more attractive pricings set aside by developers to encourage increased, albeit unpredictable transactional sales.

Some Final Thoughts

Due to the volatility of the situation (new measures, cases etc.), carefully curated reports are fast becoming obsolete in terms of both statistical and analytical data.

Essentially, this means that we cannot count completely on the educated predictions of others (as we have recently learnt).

So what should we do then?

Personally, I like to adopt a positive mindset for the future. With all that’s been going around in the news and what not, it’s very easy to fall into panic. Panic that could cost you severely both mentally and financially.

That being said, it is also extremely important to plan for the worst case scenario.

Job loss, unfulfilled mortgage payments etc. It’s scary, but it’s essential that you anticipate these nightmares (without panic!) – both in and outside times of crisis.

Fuel up a contingency; update it daily if you must – then leave it as it is, knowing that you have a fallback in the worst of scenarios.

Finally, be sure to keep some cash in hand – not just for emergency purposes, but to possibly reallocate (wisely!) into potential opportunities that you might come across during or following this period.

Remember, times of crisis never last. And even if they do, we always find a new way to wrap our fingers around it.

Either that, or we’re screwed (…though I very much doubt that!)

Stay safe everyone!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the COVID-19 pandemic affected property prices in Singapore?

What do real estate experts say about the future of Singapore's property market during COVID-19?

Are foreign investments in Singapore real estate expected to decline because of COVID-19?

Will property prices in Singapore go up or down in the near future?

How are property transaction times expected to change during the COVID-19 crisis?

What should property buyers and investors consider during this uncertain period?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments