Singapore Property Data Is Transparent: But Here’s Why It Can Still Mislead You

June 13, 2025

In this look at why ROI figures can mislead investors and homebuyers:

- Buying during a market dip doesn’t guarantee strong returns: A unit at Reflections at Keppel Bay, bought near the 2014 market low, showed just a 0.7% annualised gain after 11 years, despite ideal timing. This highlights how the entry point alone doesn’t determine performance.

- Long holding periods inflate profits, but not always meaningfully: A Pandan Valley unit earned over $1 million in gains, but only after 26 years. While impressive in raw numbers, annualised ROI was 4.7%, and doesn’t reflect maintenance or ageing infrastructure.

- Low transaction volume distorts reality: In boutique or less active projects, ROI figures are often skewed by one-off sales. Without broader data, a single sale can make an average-performing project look exceptional, or the reverse.

🔓 Check out our case studies on Kingsford Hillview Peak, Rivergate, Forest Woods, and Marina Bay Suites.

In Singapore’s property market, we’re blessed with transparency. With just a few clicks, anyone can find out how much a unit was bought and sold for. Return on Investment (ROI) figures are publicly available, easily searchable, and widely quoted. But here’s the catch: transparency isn’t the same as clarity.

While it’s tempting to judge a condo project based purely on its apparent returns, this often leads to false conclusions. ROI numbers, when taken at face value, may be deeply misleading. They can make a weak performer look strong, or vice versa. Sometimes, they’re the result of pure market timing. Other times, they reflect a very specific transaction that tells you little about the project as a whole.

In this series, we break down the hidden contexts that shape ROI figures. Using real-world case studies – including Reflections at Keppel Bay, Rivergate, Forest Woods, Marina Bay Suites, and Kingsford Hillview Peak – we reveal what these numbers are really telling you.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Common pitfalls of looking at ROI figures

Let’s start with Reflections at Keppel Bay:

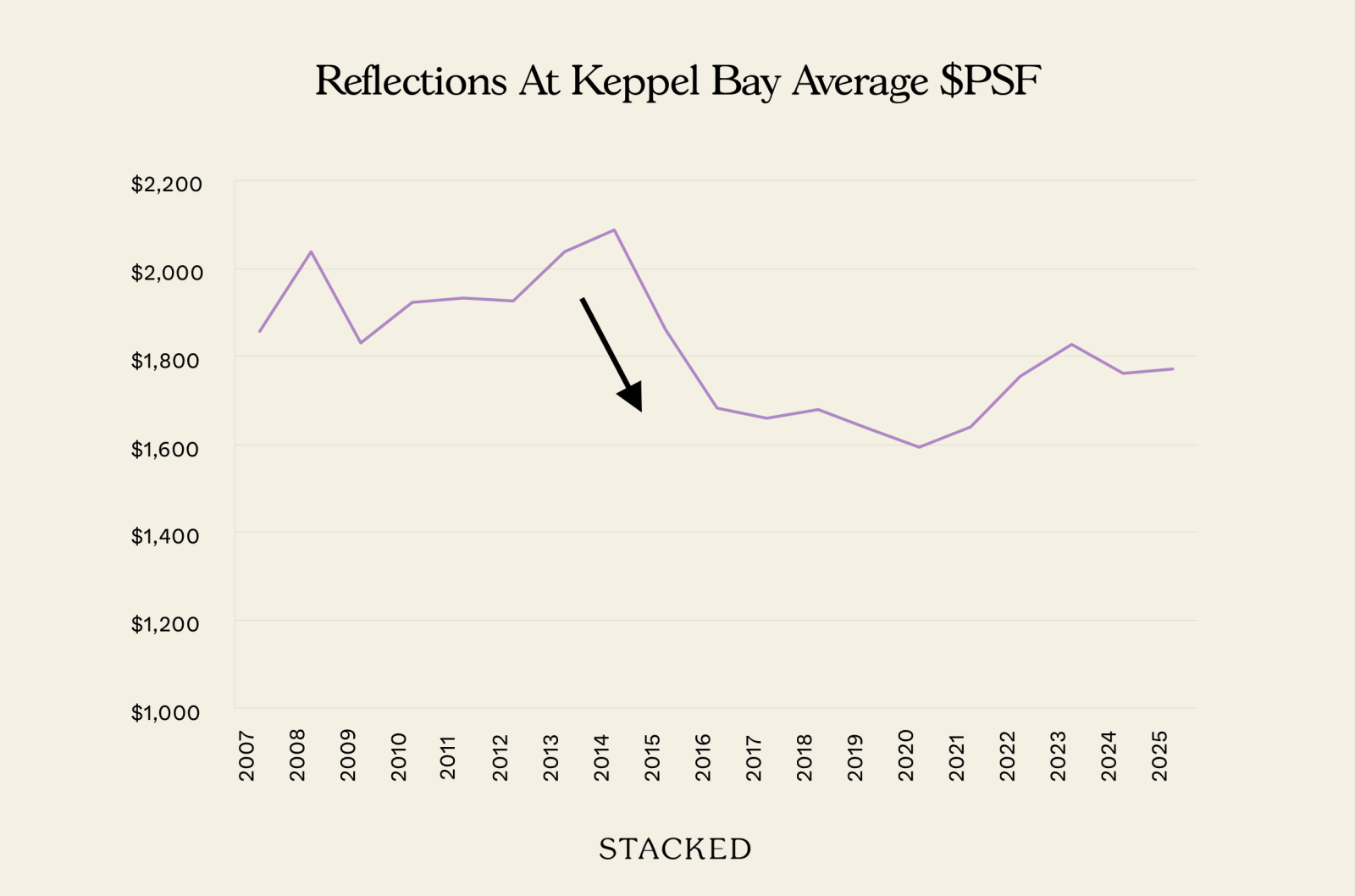

A 915 sq. ft. unit bought in June 2014 for $1.618 million was sold in April 2025 for $1.749 million. That’s a profit of $120,000, roughly a 0.7% annualised return.

On paper, that just looks like someone had a mediocre result. But context changes everything.

This unit was purchased just after the Total Debt Servicing Ratio (TDSR) cooling measures caused a market dip. Buyers at the time had a golden opportunity, prices were lower than in 2013, and savvy investors expected a rebound. Holding for 11 years should have led to a healthy windfall.

Instead, that return barely covers inflation, let alone home loan interest, taxes, and maintenance fees over a decade. Now imagine you didn’t know about the timing or the macroeconomic backdrop: you might assume the project is simply underwhelming. Or worse, you might falsely think this kind of return is “normal.” This is the danger of decontextualised ROI.

We’ll see quite a number of these in our linked case studies. But aside from these, there are other factors to look for:

Some other factors that can make ROI look deceptively low or high:

- The length of the holding period

- Timing during the sales phase

- Performance isolated from surrounding projects

- Transaction volume relative to outliers

1. The length of the holding period

Long holding periods are linked to a high ROI, simply because of the length of time the project has had to appreciate.

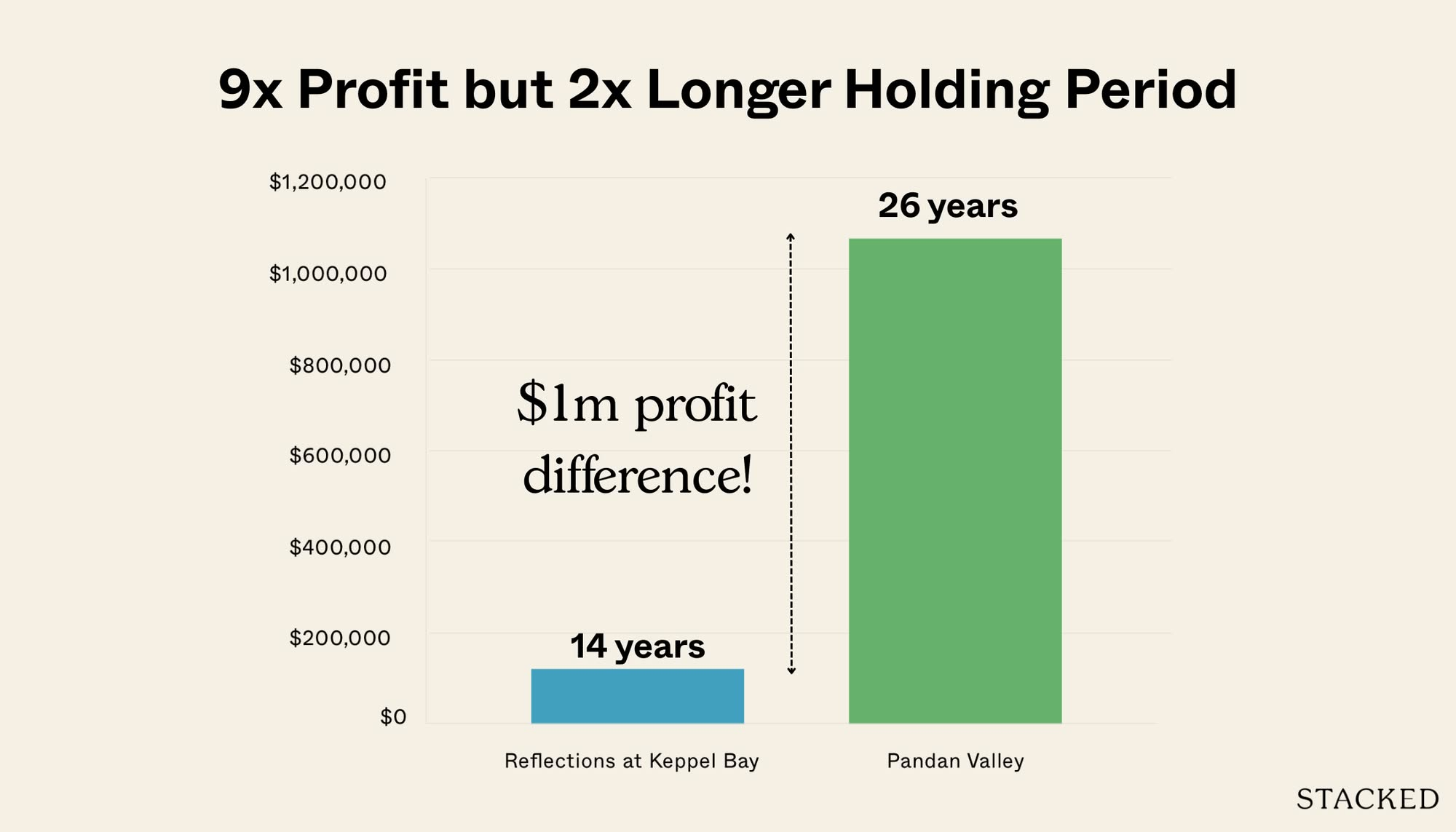

For example, consider a 2,088 sq. ft. unit that was sold at Pandan Valley, on 4th April 2025, for $1.537 million. This transaction had a huge gross profit of $1.066 million, because when the unit was bought way back on 1st June 1999, it only cost $471,000! This also makes its annualised return of around 4.7 per cent a bit misleading (in fact, you’ll find annualised returns reaching as high as over seven per cent in Pandan Valley).

More from Stacked

Why This Large-Unit Condo in the Jervois Enclave Isn’t Keeping Up With the Market

The Crest was a headline development when it launched, and its architecture is iconic: it was designed by Pritzker Prize…

The fact is, Pandan Valley is one of the oldest condos in Singapore, dating back to 1978. This does have real implications in terms of maintenance, as well as facilities being much more dated than surrounding projects; but looking solely at ROI numbers may distract from these issues.

2. Timing during the sales phase

We covered this in detail in our study on whether it’s better to buy earlier or later in a sales phase. But to quickly summarise:

Developers tend to price projects lower at the start, as a way to create urgency. As the sales phases move on, prices “normalise” or climb higher. In one example of this, some buyers at Clement Canopy purchased their units at an eye-watering 18 per cent more than earlier buyers of the same stack.

So when comparing ROI, a particularly low or high return may not reflect on the fundamentals of the project at all (i.e., it has nothing to do with quality of finishing, maintenance, location, and so forth.) You need to also check when in the sale process the original buyer stepped in, as their ROI may reflect nothing more than early-bird discounts at work.

Conversely, a weaker ROI may not mean a flawed project, but just more buyers who stepped in later in the sales process.

3. Performance isolated from surrounding projects

We’ll see more of this in our linked study of Marina Bay Suites, where a less-than-stellar ROI was matched by some surrounding properties. Areas that are underdeveloped or untested can impact ROI: this is often reflected in neighbouring units, and may not reflect inherent problems in any one specific condo.

On the flip side, the presence of new projects can also explain a surge in ROI, over a given period. In our study of Sengkang Grand Residences, we showed how a nearby integrated project could impact the prices of surrounding properties. So when you see a jump in a project’s ROI, it could just be occurring in tandem with new launches or improvements to the neighbourhood; and not due to being “undervalued” or somehow superior.

4. Transaction volume relative to outliers

The lower the transaction volume, the less reliable the ROI numbers become. In a boutique project with 50 units or less, for example, the ROI is heavily affected by the circumstances of the last seller.

If there hasn’t been a transaction in more than a year, for example, and the last transaction happens to be unusually high or low, this will skew the overall impression of the project.

We’ve covered this before in an earlier article, if you want to know more about this “anchoring effect” and other issues. But if you notice that we rarely use boutique condos in our studies, this is the main reason. For projects with 50 units or fewer, it’s best to reach out to us directly, so we can get the relevant experts in the area to answer your questions.

To understand these principles further, we’re going to look at condos with high and low ROI figures. We’ll be looking at Rivergate, Forest Woods, Marina Bay Suites and Kingsford Hillview. These projects have unusually low or high ROI figures, so we’ll examine the context of their returns, and see how their case studies can help us interpret these numbers better.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why can buying during a market dip still lead to poor returns in Singapore property?

How does the length of holding period affect the perceived profitability of a property?

In what ways can transaction volume distort the understanding of a property's ROI?

Why is it important to consider the timing of a property purchase within the sales phase?

How can surrounding developments impact the ROI of a property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

Hi Ryan, regarding your comment in “1. The length of the holding period”, 4.7% annual return is mathematically accurate. May I know why you think this is misleading?