Should You Buy An Older Resale HDB Flat If You Are In Your 20s/30s?

September 2, 2024

Older resale flats may be spacious, but lease decay and age are major concerns. Whilst the most crucial issue is to not outlive the flat, there are other factors as well: older resale flats could have more maintenance issues, and the more central ones can come with more Cash Over Valuation (COV). Not everyone is happy to deal with these issues, or realises this is what’s in store for the future (many of these problems can only get worse with time). So this week, we look at the likely challenges and risks posed by these older flats, to young adult buyers:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why the interest in older resale flats, from younger Singaporeans?

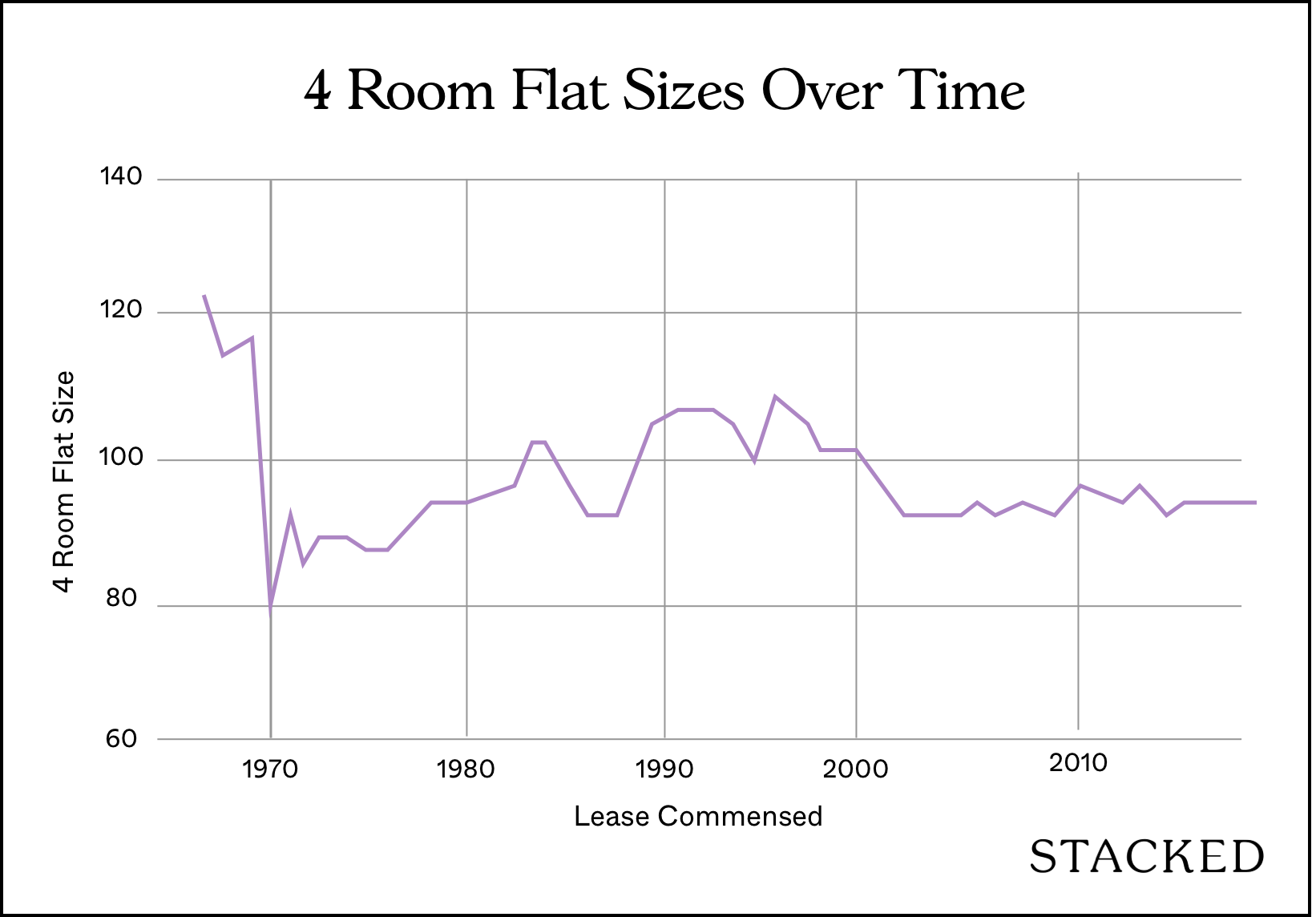

With the exception of 3-room flats, most HDB projects have shrunk over the years (see this article for more precise details); so part of the reason for wanting an older flat is more space.

Besides this, older flats can be found in the prized Central Area region, or close to the neighbourhood hubs. And while we have Plus and Prime model flats today, the older resale flats can be found in central locations without the 10-year MOP and other restrictions.

For those in their late 20s and 30s, this will likely boil down to flats built in the ‘80s and ‘90s. This is likely to be the oldest flats they can get, while still being able to use the maximum amounts from their CPF.

(If the flat’s lease won’t last till the youngest buyer turns 95, the amount of CPF usage allowed will be prorated).

Now flats in mature areas, which were built in 2010 or later, tend to be at a premium; they’re both quite new and have a great location. As such, buyers who can’t afford the near-million dollar price tags at Ang Mo Kio, Bishan, etc. will probably want an older flat, made more affordable by shorter remaining leases.

Key factors to consider:

1. How much work the previous owner did on the flat

If the previous owner lived in the flat for 30 or 40 years, with no renovations since they moved in, that could entail a higher overhaul cost. After 15 to 20 years (and we’re being generous here), the problems start to show: cracked tiles, sagging shelves, cabinetry and countertops where bits have peeled off, etc.

Perhaps the biggest issue will be the electrical system, where it’s likely that big overhauls are needed. This isn’t something you’d want to skimp on, as electrical works can be annoying to deal with later on. There’s also usually problems with waterproofing, as the window seals will require replacement after such a long period of time.

For even older flats – such as those built in the ‘60s and ‘70s – a complete redesign of the toilet may be in order. For flats in this era, squatting toilets were much more common, so you may need to install a toilet bowl.

This isn’t to say more recent renovations remove the need to redo the flat; you probably still want to renovate to suit your own preferences. But the difference is that, when the current renovations are still tolerable, you can do it slowly over time rather than having to overhaul everything at once.

2. Quality of construction can vary between projects

This can vary significantly between projects. On the one hand, we’ve met people who insist that older HDB flats are better built – this includes claims that tiles are less likely to warp, that walls are thicker, and that concrete spalling is less noticeable (even in the common corridors, not just the flat itself).

On the flip side, we’ve also heard the opposite. Some have complained about the weaker water pressure, with the lifts having issues more often than not. The estate can also look older and tired if it hasn’t been maintained well.

The inconsistency could be because, during the ‘90s and earlier, HDB tended to be much more experimental. A lot of one-of-a-kind designs, or the flats with Bubble lifts, attest to that; and that can also translate to some of the varying quality we see among older flats. With modern HDBs being built by the precast building system, you can expect uniformity among all the new flats.

3. Exit possibilities after a long stay

Only around four to five per cent of older HDB flats will see SERS. On top of that, SERS is not always a windfall, as you can see from this situation in Ang Mo Kio. As for VERS, we have yet to see a single exercise; and given the population density of an HDB project, consensus may not be easy to attain. Older estates tend to also mean older residents – and few people are happy to move in their 70s or 80s.

When you remove en-bloc as an exit strategy, what’s left? Resale is a tough call when the flat is down to its last 60 years (financing gets reduced), and loans from banks are impossible with 30 years or less remaining (20 years or less for HDB loans). This means the flat can’t be relied upon to fund its replacement.

This can leave few options except the Lease Buyback Scheme (LBS) – but that won’t be helpful if your life situation requires you to move. This is more of a risk to someone in their late 20s or 30s, compared to a retiree who faces a shorter horizon.

For those who are looking at older flats, they are most likely looking at this option as their forever home.

4. The neighbours you’ll have

Older neighbourhoods tend to have a bigger variety of residents, compared to newer flats or BTOs, where you are looking at most residents to be of the same age group. This unfortunately means some difficult types, such as those who will smoke in common corridors (this will get into your unit), hoarders, or noisy tenanted units with people moving in and out all the time. And if these neighbours are the sort who have been that way for decades, they may resent your asking them to change.

And whilst we don’t condone ageism, there is a reality that older neighbourhoods tend to mean older residents, which brings certain challenges. One example is elderly parents neglected by their children:

Because some of these ageing residents cannot clean their homes as well, they’re dependent on visiting relatives, children, etc. for help. If that help doesn’t arrive, their home becomes messy, attracts pests, and your neighbouring unit is affected. There are also safety risks involved: some elderly neighbours with conditions like dementia, visual impediments, etc. don’t have the benefit of live-in helpers, or children staying with them. This does raise the risk of things like fires, such as if they forget to turn off the stove or make a mistake in the kitchen.

While this is never true of all older neighbours, you should keep an eye out before you buy.

Finally, you might want to consider that flats built in 1990 are at the “sweet spot” for many younger homeowners

This is because they are still quite spacious, and they don’t come with a bomb shelter. Also, this was around the time when the rubbish chute was moved to a common area. Note that having the chute outside the unit is considered an advantage these days, as it brings fewer pest issues. Last but not least, the tenure left means it can still last the lifetime of a typical person in their 30s.

While today’s policies tend to dissuade younger buyers from older flats, we think many are still attracted to these older homes; and with the restrictions of Plus and Prime flats upcoming, more young Singaporeans may opt for an older resale flat nearby, without the more stringent restrictions.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments