Can You Afford A Sentosa Property Now That It’s “Cheap”?

November 27, 2020

Let’s start with some numbers that we’ve gathered on Sentosa.

Number of Profitable/Unprofitable Transactions

| Condominium | Detached House | Terrace House | Grand Total | |

| Breakeven | 1 | 1 | – | 2 |

| Gains | 518 | 69 | 33 | 620 |

| Loss | 166 | 15 | 7 | 188 |

Average Gains and Losses

| Condominium | Detached House | Terrace House | Grand Total | |

| Gains | $ 872,088.03 | $ 4,707,879.28 | $ 2,147,353.27 | $ 1,366,851.50 |

| Loss | $ (1,018,355.81) | $ (3,536,945.07) | $ (935,571.43) | $ (1,216,224.69) |

No doubt, pretty eye-popping numbers to look at.

To be sure, Sentosa is still what you’d call a high-rent area; but following its lost decade, a lot of the lustre is, well, peeling off.

The most recent blow was in 2019, when a certain property tycoon put forward that Sentosa should try to become the next Bali. The upshot is that it did draw some attention to how low Sentosa prices have fallen; and now some buyers are wondering if it’s not too “out there” to consider a home in Sentosa.

Here’s a snapshot of what the prices are like now:

The prices of condos on Sentosa today:

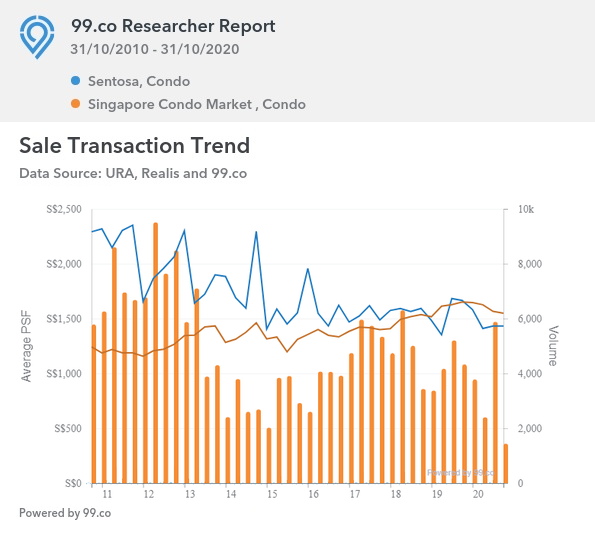

The price psf for Sentosa condos is currently below the average for Singapore’s condo market:

Average price psf in Q3 2020 stood at $1,432 psf for Sentosa (the blue line). The average for the overall condo market was $1,549 psf at the same time (the orange line).

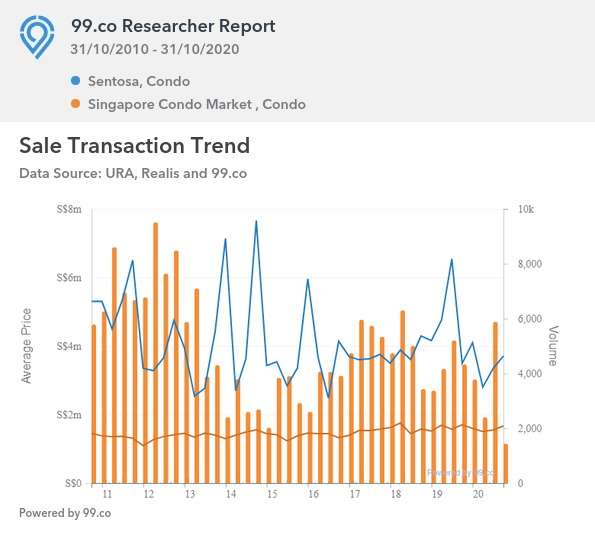

In terms of quantum, however, Sentosa condos are still ahead of the overall market:

As of Q3 2020, the average price for a Sentosa condo stood at $3,344,523, while the average condo price across Singapore was $1,549,357.

We took a closer look at some specific condo developments on Sentosa:

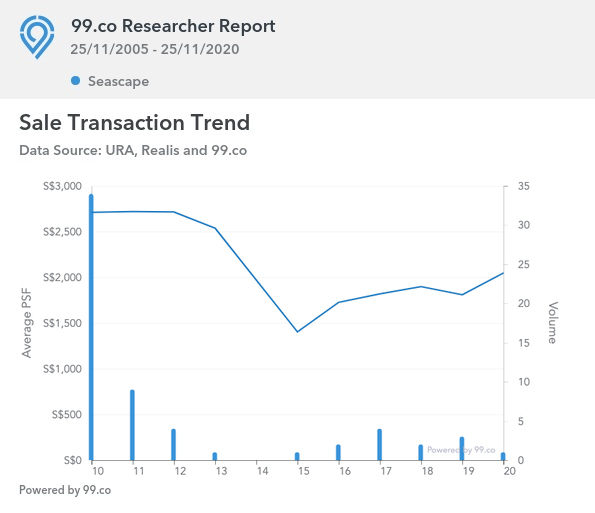

1. Seascape

Prices at Seascape currently average $2,047 psf; much higher than the average suggested above. However, this could be because transaction volume is very low, and hence prices are not reflective of the whole.

We note that Seascape has only 10 recorded transactions, all of which were losses. There were no transactions at Seascape in 2020. The latest two transactions, in 2019, are as follows:

| Date | Unit Size (Sq. Ft.) | Initial buying price | Sale price | Gains / Losses | Annualised Return |

| 26 Sep 2019 | 2,164 | $2,696 psf | $2,072 psf | – $1,350,400 | -2.8% |

| 23 May 2019 | 2,336 | $2,682 psf | $1,327 psf | – $3,165,000 | – 7.4% |

Can you afford a Seascape unit at current prices?

Note that the last two transactions were a year ago, and transaction volumes are low. As such, the reflected prices may have limited accuracy.

At the given average of $2,047 psf, a three-bedder unit (2,164 sq. ft.) would be around $4,429,708.

Let’s assume a bank loan at 1.3 per cent per annum, for 25 years, at full 75 per cent financing. We’ll assume no outstanding debts besides this loan.

Maximum loan amount: $3,322,281

Minimum down payment: $1,107,427

Est. monthly loan repayment: $12,977

Est. minimum combined income: $27,720 per month

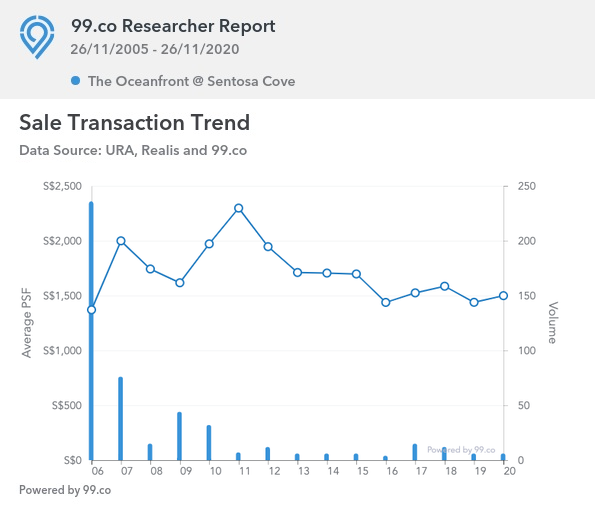

2. The Oceanfront @ Sentosa Cove

The indicative price range at The Oceanfront @ Sentosa Cove is $1,399 to $1,61 psf, with an average of $1,499 psf.

There have been 178 profitable transactions to date, with 50 unprofitable transactions.

These were the most recent transactions in 2020:

| Date | Unit Size (Sq. Ft.) | Initial buying price | Sale price | Gains / Losses | Annualised Return |

| 9 Sep 2020 | 2,077 | $1,481 psf | $1,661 psf | $373,360 | 0.8% |

| 19 Aug 2020 | 3,057 | $1,600 psf | $1,480 psf | – $366,840 | – 0.7% |

| 18 Aug 2020 | 1,884 | $1,550 psf | $1,407 psf | – $270,200 | -0.9% |

| 27 July 2020 | 1,711 | $2,164 psf | $1,578 psf | – $1,004,315 | – 2.4% |

| 22 July 2020 | 4,467 | $1,335 psf | $1,399 psf | $286,150 | 0.3% |

Can you afford a unit at The Oceanfront at current prices?

At the given average of $1,499 psf, a three-bedder unit (1,711 sq. ft.) would be around $2,564,789.

Let’s assume a bank loan at 1.3 per cent per annum, for 25 years, at full 75 per cent financing. We’ll also assume no outstanding debts besides this loan.

Maximum loan amount: $1,923,592

Minimum down payment: $641,197

Est. monthly loan repayment: $7,514 per month

Est. minimum combined income: $16,050 per month

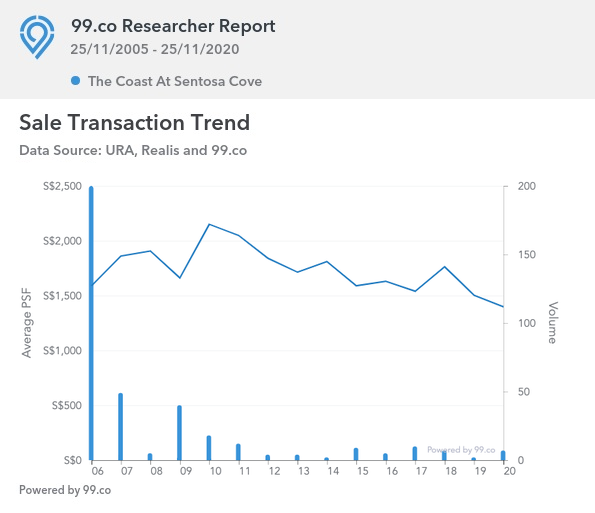

3. The Coast @ Sentosa Cove

Indicative prices range between $1,109 to $1,605 psf, with a given average of $1,423 psf.

There have been 92 profitable transactions, and 45 unprofitable transactions. There have been nine transactions so far in 2020, all of which were unprofitable. These are the five most recent:

| Date | Unit Size (Sq. Ft.) | Initial buying price | Sale price | Gains / Losses | Annualised Return |

| 11 Nov 2020 | 1,916 | $1,619 psf | $1,597 psf | – $41,550 | – 0.1% |

| 14 Oct 2020 | 2,024 | $1,878 psf | $1,482 psf | – $800,000 | – 4.7% |

| 9 Oct 2020 | 2,357 | $2,000 psf | $1,442 psf | – $1,314,000 | -2.4% |

| 7 Oct 2020 | 4,779 | $2,400 psf | $1,109 psf | – $6,196,600 | – 5.7% |

| 25 Aug 2020 | 2,626 | $1,732 psf | $1,466 psf | – $700,000 | – 1.9 % |

Can you afford a unit at The Coast at current prices?

At the given average of $1,423 psf, a three-bedder unit (2,024 sq. ft.) would be around $2,880,152.

Let’s assume a bank loan at 1.3 per cent per annum, for 25 years, at full 75 per cent financing. We’ll also assume no outstanding debts besides this loan.

Maximum loan amount: $2,160,114

Minimum down payment: $720,038

Est. monthly loan repayment: $8,438 per month

Est. minimum combined income: $18,023 per month

Condo ReviewsReflections at Keppel Bay Review: Glitzy Living with Waterfront Views

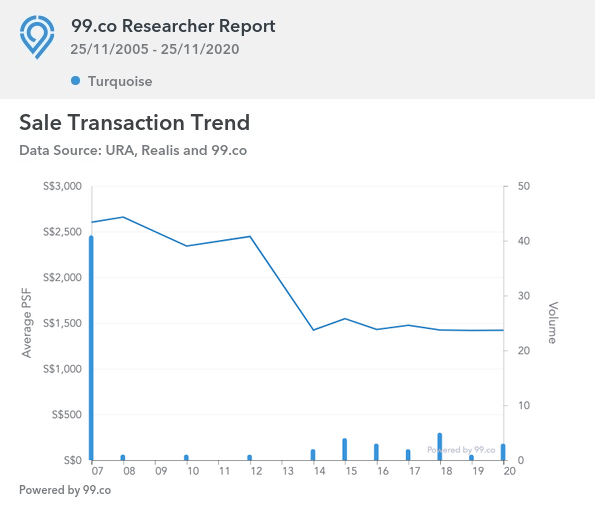

by Reuben Dhanaraj4. Turquoise

The indicative price range is between $1,398 to $1,523 psf. The given average is $1,461 psf.

There are 20 transactions on record, of which only one has been profitable. The last three transactions so far in 2020 are:

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Here’s What I Learnt After Spending 2 Weeks To Earn A $300 Commission.

I know that real estate agents sometimes get a bad rep. People think we are pushy, too salesy and love…

| Date | Unit Size (Sq. Ft.) | Initial buying price | Sale price | Gains / Losses | Annualised Return |

| 29 Oct 2020 | 2,088 | $2,613 psf | $1,523 psf | – $2,277,000 | – 4.1% |

| 18 Sept 2020 | 2,433 | $1,521 psf | $1,298 psf | – $300,000 | – 1.9% |

| 25 Feb 2020 | 2,088 | $2,599 psf | $1,341 psf | – $2,626,960 | -5.2% |

Can you afford a unit at Turquoise at current prices?

At the given average of $1,461 psf, a three-bedder unit (2,088 sq. ft.) would be around $3,050,568.

Let’s assume a bank loan at 1.3 per cent per annum, for 25 years, at full 75 per cent financing. We’ll also assume no outstanding debts besides this loan.

Maximum loan amount: $2,287,926

Minimum down payment: $762,642

Est. monthly loan repayment: $8,937 per month

Est. minimum combined income: $19,090 per month

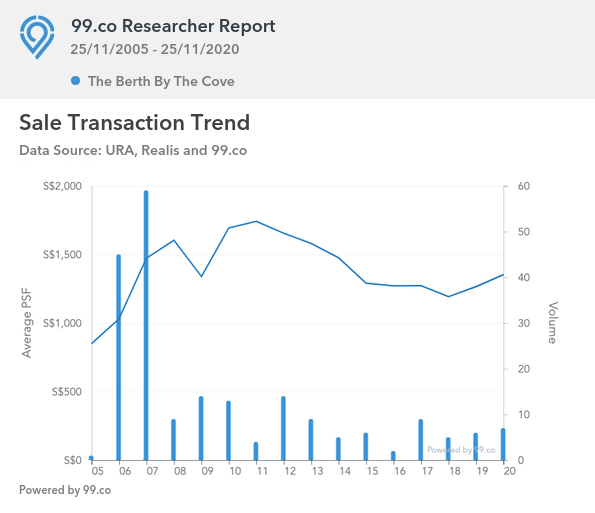

5. The Berth by the Cove

The indicative price range is between $1,134 to $1,492 psf, with a given average of $1,331 psf.

There have been 157 profitable transactions recorded, with 17 unprofitable transactions. These are the past five transactions so far in 2020:

| Date | Unit Size (Sq. Ft.) | Initial buying price | Sale price | Gains / Losses | Annualised Return |

| 15 Oct 2020 | 1,173 | $1,300 psf | $1,492 psf | $225,100 | 1% |

| 13 Oct 2020 | 2,045 | $804 psf | $1,134 psf | $675,700 | 2.3% |

| 13 Aug 2020 | 1,894 | $1,383 psf | $1,267 psf | – $220,000 | -1.6% |

| 29 July 2020 | 1,141 | $843 | $1,490 | $738,650 | 3.7% |

| 30 July 2020 | 1,884 | $1,560 psf | $1,274 psf | – 539,040 | -1.5% |

Can you afford a unit at The Berth By the Cove at current prices?

At the given average of $1,331 psf, a three-bedder unit (1,625 sq. ft.) would be around $2,162,875.

Let’s assume a bank loan at 1.3 per cent per annum, for 25 years, at full 75 per cent financing. We’ll also assume no outstanding debts besides this loan.

Maximum loan amount: $1,622,156

Minimum down payment: $540,719

Est. monthly loan repayment: $6,336 per month

Est. minimum combined income: $13,535 per month

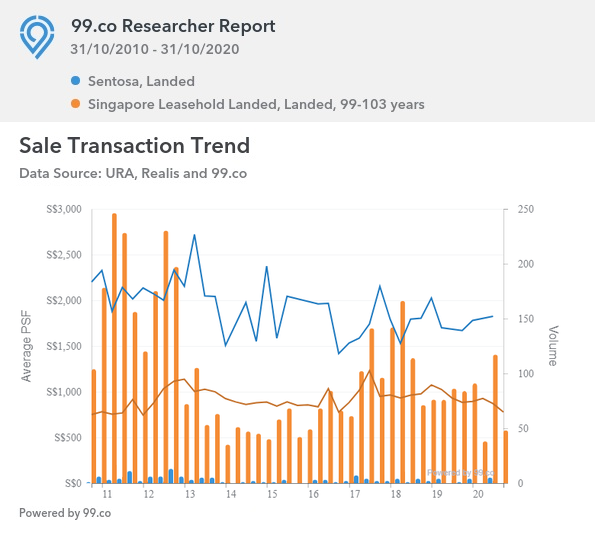

But how about Sentosa Cove’s famous landed properties?

Here are the recent prices according to 99.co, on a psf basis:

Note that we used only leasehold landed properties as the point of comparison, as Sentosa properties are 99-years.

As of Q3 2020, landed homes in Sentosa averaged $1,826 psf. At the same time, leasehold landed homes in Singapore averaged just $869 psf.

Next we looked at the overall quantum:

As of Q3 2020, the average price for a landed home on Sentosa was $14,860,000. At the same time, the average for a landed home Singapore-wide was just $2,731,710.

This is, of course, still way beyond the range of most Singaporeans even with falling prices.

At $14,860,000, the down payment alone would be over $3.7 million, with monthly repayments of at least $43,533 per month.

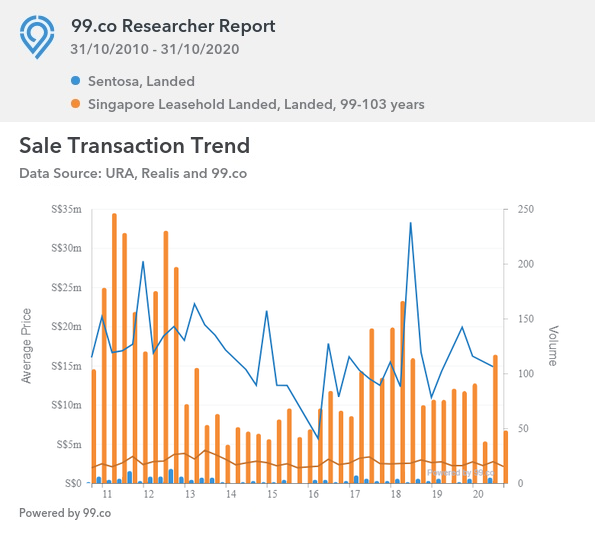

That being said, note that prices of landed homes on Sentosa are volatile, and can be unpredictable (as the graph above suggests). Many of the landed developments have not seen sales for a number of years, and this limits the accuracy of any price estimates; individual landed homes can see significant deviations in price.

There are two takeaways we can draw from Sentosa prices.

The first is that, while Sentosa properties are still beyond the reach of many, they have fallen far from the dizzying heights from 10 years past. This suggests that, with the 20 per cent ABSD dissuading foreign buyers, Singaporeans are showing limited interest in the area.

Perhaps it’s because Sentosa, while glamorous, ultimately lacks the convenience of equally-priced areas like Orchard. You could also make a case for the many attractive recent launches in the prime areas like Wallich Residence and South Beach Residences – just to name a few.

In any case, we can’t foresee many investors happy to jump in at the moment, after some of the developments have shown a slew of sharp losses. It’s especially uncertain if prices won’t fall even further, following the Covid-19 situation.

The second takeaway is that Sentosa’s landed properties seem to be weathering the storm better, while its condo developments have taken a battering. Again though, performance varies significantly between addresses for the landed properties, and there’s little price history to go on.

The lower prices mean some buyers, who are well-off but not super-rich, could possibly qualify for the loans needed

However, we’d stress again that your home loan repayment – plus any other debts – should not take up more than 30 per cent of your monthly income. While the TDSR would allow a limit of 60 per cent, this is not the most prudent move.

You might be able to borrow enough for a $2.16 million condo on a combined income of $13,500+ a month; but you could be struggling and living on the edge for the rest of your 25-year loan tenure.

Sentosa is a lot cheaper than before; but it’s not significantly more affordable to most Singaporeans, despite its long downtrend.

So if you can afford it, should you be buying Sentosa property right now?

It’s a loaded question, but one that nonetheless many would be thinking. Yes, prices are currently at similar levels to 2006, but that doesn’t mean that it would be a good investment.

Just like the recent 38 Jervois case, those who are buying in must be aware – will there be a demand for the type of product at the future price point you are looking to exit?

At these prices, Sentosa property is definitely more an emotional purchase than anything. Foreigners who visited back then might have been swayed by the sea breeze and the views. But many of the developments there now are old, and looking increasingly dated – will these properties still be able to attract buyers even when the market picks up?

Remember rental and prices on Sentosa are heavily dependent on the number of foreigners coming in – they are the cause of what pushes up prices in the area, as Sentosa Cove is the one place foreigners can buy landed homes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are Sentosa property prices currently considered affordable for Singaporeans?

Can I afford a condo in Sentosa Cove with a typical loan?

Is it a good time to buy Sentosa property now that prices are 'cheap'?

How do the prices of landed properties in Sentosa compare to other areas?

What are the risks of investing in Sentosa property at current prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments