We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

July 9, 2025

Way back in 2012, Singapore saw its first-ever million-dollar HDB flat transaction: a rare a flat at 149 Mei Ling Street in Queenstown. At the time, it was a headline-grabbing anomaly: shocking to some, amusing to others, but mostly dismissed as a one-time outlier. Even on the ground, the analysts and realtors who said it would “one day be common” were predicting far off dates like “in 50 years’ time.”

None suspected that a mere 12 years later, in 2024, a million dollars wouldn’t even be an exceptional price; and in some neighbourhoods, it may soon become a baseline. This week, we examined the top HDB towns where a million dollars has become the default pricing tier for larger or better-located units. And as a reminder, 2024 alone saw 400 flat transactions reach the million-dollar mark, in just three towns:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

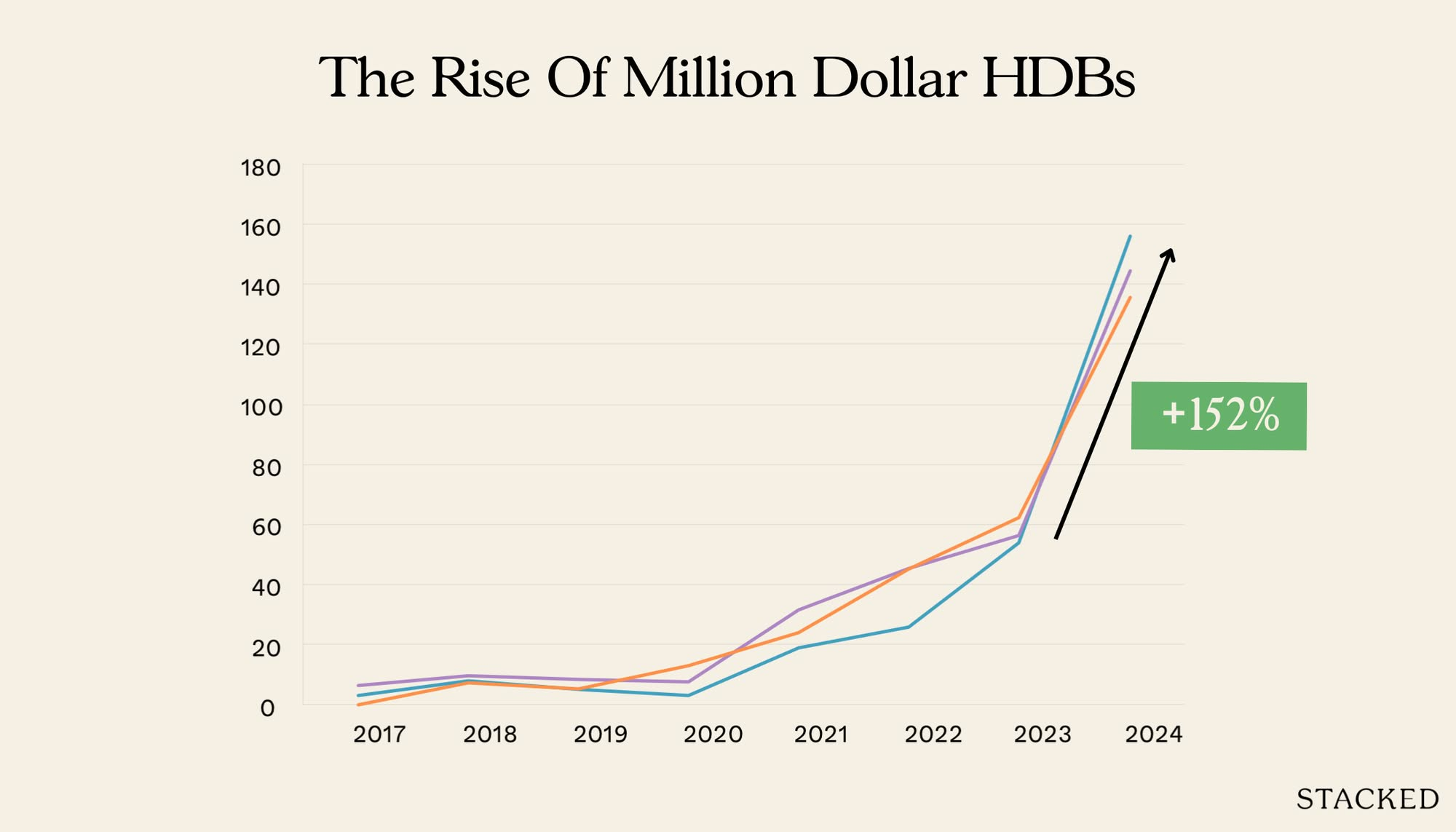

The early rise of million-dollar flats, through to the present

The first three towns to kick off the trend were Toa Payoh, Kallang/Whampoa, and Bukit Merah:

| Year | KALLANG/WHAMPOA | TOA PAYOH | BUKIT MERAH |

| 2017 | 3 | 6 | 0 |

| 2018 | 8 | 9 | 7 |

| 2019 | 5 | 8 | 5 |

| 2020 | 3 | 7 | 13 |

| 2021 | 19 | 31 | 24 |

| 2022 | 26 | 45 | 45 |

| 2023 | 54 | 56 | 62 |

| 2024 | 156 | 144 | 135 |

| 2025 | 71 | 148 | 109 |

| % increase from 2017 | 5200% | 2400% | 1929% |

These are the same three towns where the million-dollar flat phenomenon emerged. From 2014 through 2016, not a single HDB town recorded a million-dollar resale transaction.

A year later though, in 2017, Toa Payoh and Kallang/Whampoa became the first to see million-dollar flats, with six and three resale transactions respectively.

In Toa Payoh, the first million-dollar resale flat was at The Peak @ Toa Payoh, a Design, Build, and Sell Scheme (DBSS) project. DBSS is now defunct today, but it was originally a “sandwich class” housing product: the flats were designed and built by private developers, but remain HDB projects.

(This is not the same as Executive Condominiums, or ECs, as DBSS projects do not have full suite condo facilities; and unlike ECs, they are never privatised.)

Since then, The Peak has continued to dominate million-dollar transactions in the town. Over 10 units from The Peak sold above $1 million in the first half of 2022, for example, and in August 2024, Block 138B recorded a $1.5 million sale for a 5-room unit.

In Kallang/Whampoa, we don’t have details on the first three flats to reach a million dollars, although their presence is clear in the broader HDB resale data.

By the next year (2018), Bukit Merah became the third town to join them, recording its first seven transactions that reached $1 million+. Since then, Bukit Merah has steadily climbed the charts, thanks in large part to the Tiong Bahru View development, a SERS-replacement project with fresh 99-year leases and central location appeal.

Tiong Bahru View made its mark in July 2018, when a high-floor 4-room flat transacted at just over $1 million. A more recent standout was in April 2024, when a 5-room flat at Block 9B of Tiong Bahru View sold for $1.588 million, at the time the highest-ever price for a resale flat.

After the first examples in 2017 – and especially after COVID (2020) – million-dollar transactions began to ramp up.

The pandemic years marked a critical turning point for the resale flat market. As construction delays hit the BTO pipeline, and lockdowns redefined what people wanted in a home, larger flats in mature estates suddenly found themselves in high demand. We covered the growing surge in this article, five years ago.

More from Stacked

This Hasn’t Happened In The Singapore Property Market In 20 Years…

This GLS site at Upper Thomson, next to Springleaf MRT station, has attracted a record-breaking zero bids from developers. This…

Buyers – especially families and former private property owners – began to value spacious layouts, long leases, and ready-to-move-in units more than ever.

This shift in priorities, combined with lower interest rates and a sharp reduction in new flat supply, and rising private property prices, funnelled demand into the resale segment. In mature towns with prime locations, that demand quickly pushed prices past the million-dollar mark.

As such, what started as a handful of resale anomalies has since evolved into a recognisable trend.

By 2021, all three towns – Toa Payoh, Kallang/Whampoa, and Bukit Merah – were recording over 20 such transactions per year. By 2024, each had crossed the 130 mark, contributing more than 400 transactions collectively; a staggering leap from single digits just seven years prior.

What are the top three districts with the highest percentage of flats sold in the million-dollar range today?

| Year | BUKIT TIMAH | CENTRAL AREA | BISHAN |

| 2017 | 3.51% | 5.49% | 3.81% |

| 2018 | 4.92% | 10.17% | 2.96% |

| 2019 | 4.23% | 11.76% | 2.64% |

| 2020 | 0.00% | 12.94% | 3.13% |

| 2021 | 15.85% | 28.74% | 6.49% |

| 2022 | 16.13% | 23.47% | 10.75% |

| 2023 | 30.43% | 24.62% | 11.84% |

| 2024 | 38.71% | 26.11% | 20.42% |

| 2025 | 38.46% | 29.55% | 23.68% |

In Bukit Timah, over a third (38.71 per cent) of resale flats in 2024 crossed the $1 million threshold. That’s nearly 4 in every 10 flats. In the Central Area, which includes high-profile projects like Pinnacle@Duxton and blocks in Tanjong Pagar, over one in four flats were million-dollar deals. And in Bishan, where a mix of spacious older flats and DBSS units remain in strong demand, more than 1 in 5 flats seem to be transacting at seven figures.

This shows that, in these districts, the million-dollar flat is no longer a stretch; it’s becoming a larger proportion, and they’re redefining what used to be called “affordable public housing.” It also means that, if you want a resale flat in these three locations, you might want to start saving up money aggressively – odds are those prices will be far above the actual HDB valuation, so you’ll be paying a lot of Cash Over Valuation (COV).

Let’s also take a quick look at the unit types that tend to cross the $1 million mark.

We’ll look at our three hotspots, as well as our three catalysts:

| Flat type | BISHAN | BUKIT MERAH | BUKIT TIMAH | CENTRAL AREA | KALLANG/WHAMPOA | TOA PAYOH |

| 3 ROOM | 4 | |||||

| 4 ROOM | 3 | 55 | 30 | 106 | 73 | |

| 5 ROOM | 38 | 80 | 12 | 17 | 39 | 56 |

| EXECUTIVE | 37 | 12 | 7 | 15 |

*We can ignore the 3-room flats because they’re not actually flats, but terrace houses. These were landed homes built by the now-defunct Singapore Improvement Trust (SIT), which HDB later replaced.

As expected, 5-room and executive flats make up the bulk of million-dollar transactions. This is simply a matter of buyers wanting more space. But what’s surprising is the sheer number of four-room flats breaching $1 million, especially in Kallang/Whampoa, where more than 100 four-room flats sold above that mark in 2024 alone.

Many of these units tend to have special features like being high-floor or DBSS units; but it is surprising to see just how much buyers are willing to fork out for that. For now, million-dollar flats are still outliers, as the authorities are quick to remind us. But given how fast the volume has grown in less than a decade, it may not be long before we start complaining about $2 million flats.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

When did the first million-dollar HDB flat transaction occur in Singapore?

Which towns in Singapore saw the rise of million-dollar HDB flats first?

How has the number of million-dollar HDB flat transactions changed from 2017 to 2024?

Which districts have the highest percentage of flats sold for over a million dollars in 2024?

What types of HDB flats most commonly reach the million-dollar mark?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

1 Comments

– odds are those prices will be far above the actual HDB valuation, so you’ll be paying a lot of Cash Over Valuation (COV).

This isn’t true. The HDB valuation takes reference also to factors such as market prices. I know of people who bought at Pinnacle who paid 0 to 20k COV.