Are Mega Developments In Singapore More Profitable Than Regular Condos? Here’s What The Data Shows

May 22, 2025

In this updated look at 1,000+ unit mega-developments:

- Small units shine in mega-developments: 1- and 2-bedders in mega-projects outperformed similar units in regular condos, with gains of up to 3.0% higher ROI. This suggests the best value in mega-developments may lie in their more affordable, compact units.

- Early launch buyers saw the biggest upside: Mega units bought during the developer launch phase averaged 24.0% gains, higher than regular new launch gains of 21.7%. The strongest returns often come from being among the first buyers.

- Larger units tell a more nuanced story: While 4-bedders in mega-developments performed well, 5-bedders and above underperformed compared to regular projects. This challenges the assumption that bigger always means better returns in large-scale condos.

🔓 Check out our case studies on the following mega developments: High Park Residences, Affinity at Serangoon, and Parc Clematis.

Already a subscriber? Log in here

Not long ago, buyers hesitated at the mention of a 1,000+ unit condo. Mega-developments were often seen as chaotic—too many residents, overcrowded pools, and a distinct lack of privacy. If you could afford a smaller project, you bought into exclusivity.

But fast forward to 2025, and the script has flipped.

Today, mega-developments are increasingly positioned as value buys. Agents point to resort-style facilities, lower psf entry prices, and a larger resale audience that keeps demand buoyant. And with rising land costs and shrinking unit sizes, many of these sprawling projects are now seen as a viable way to enter the market at a lower price point.

But does the data actually support this shift in perception?

Are mega-developments just better marketed today—or have they truly delivered stronger gains and better investment value?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The common arguments for and against mega-developments

A mega development (mega-dev for short) refers to projects with 1,000+ units, although it’s sometimes also used for those that come close (e.g., 900+ unit condos). A mega-dev is expected to have the following advantages:

- Better range of facilities, due to the larger land areas of these developments; this means multiple pools, tennis courts, bigger landscaped areas, etc.

- Lower maintenance costs despite the bigger facilities, because there are so many more units to split the cost

- A more competitive price point, if for no other reason than sheer scale. Treasure at Tampines exemplifies this: with over 2,200+ units, it was at a competitive price point from the very beginning

- High transaction volumes. Due to the high number of units that can potentially change hands in a single mega dev, even in just a year, the resale prices tend to be consistent and well-supported.

But does all of this translate to better performance, as some realtors have claimed? Let’s have a look:

An overall comparison between mega-devs and regular projects, since 2015

If we just did a raw, straight up comparison, here’s what it looks like:

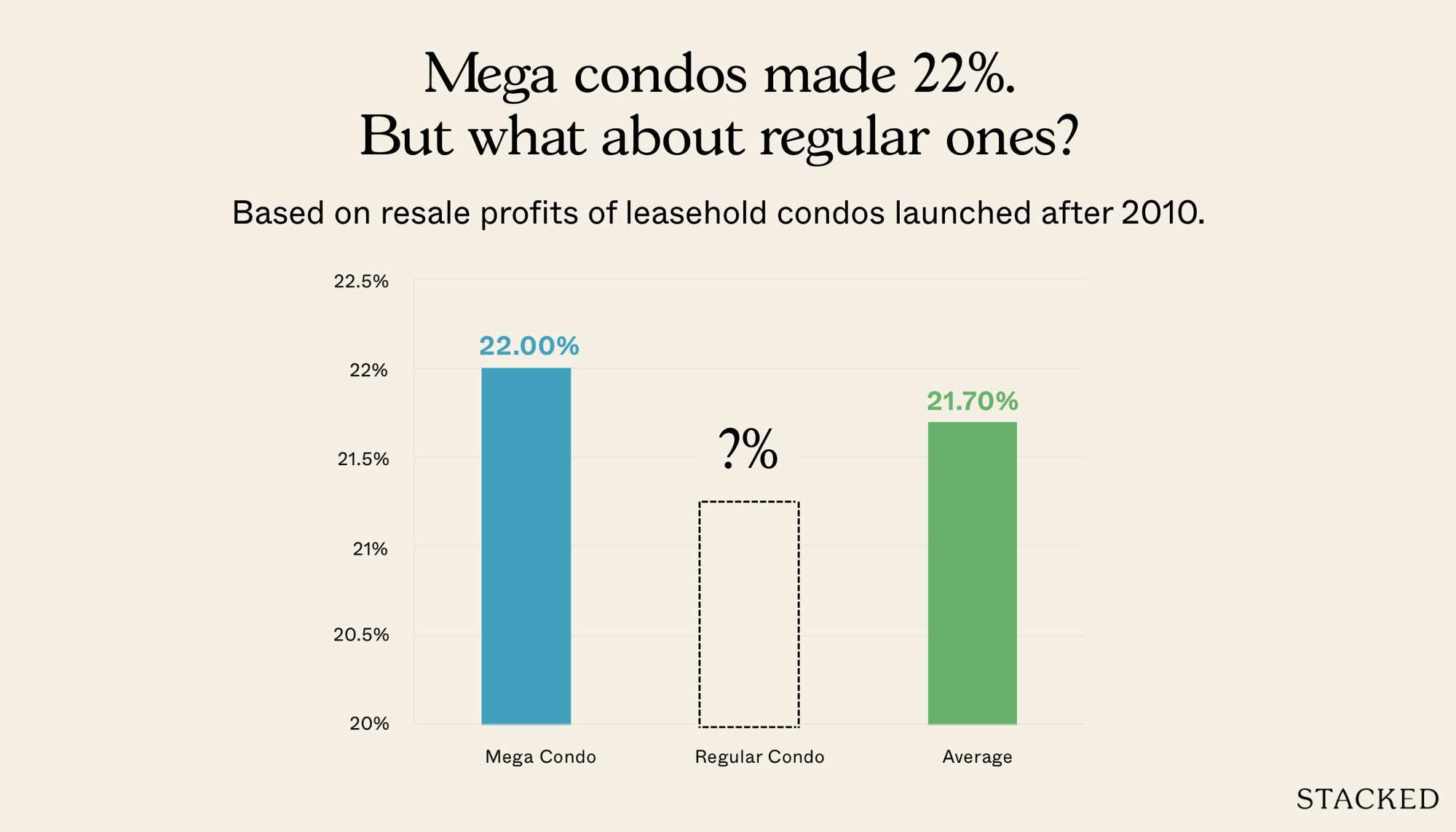

| Type | Average Gains (%) | Average Gains ($) | Volume |

| Mega Condo | 22.0% | $249,983.1 | 4236 |

| Regular Condo | 21.6% | $254,827.6 | 8643 |

| Average | 21.7% | $253,234.2 | 12879 |

In this very broad sense, there doesn’t appear to be much difference between the two. Mega-devs do perform better, but the difference is almost negligible.

This isn’t detailed enough, so let’s compare the performance of different unit sizes.

How well does a small unit in a mega-dev compare to one in a regular project? How well does a large unit compare? Let’s use the following definitions:

Very Small: 1-bedroom units

Small: 2-bedroom units

Medium: 3-bedroom units

Large: 4-bedroom units

Extra Large: 5-bedroom and above units

We’re doing this because using square footage alone can be misleading, especially for older condos that often have larger layouts. For instance, a two-bedder built in the 1990s might be over 1,000 sq. ft., which would count as a three-bedder by today’s standards.

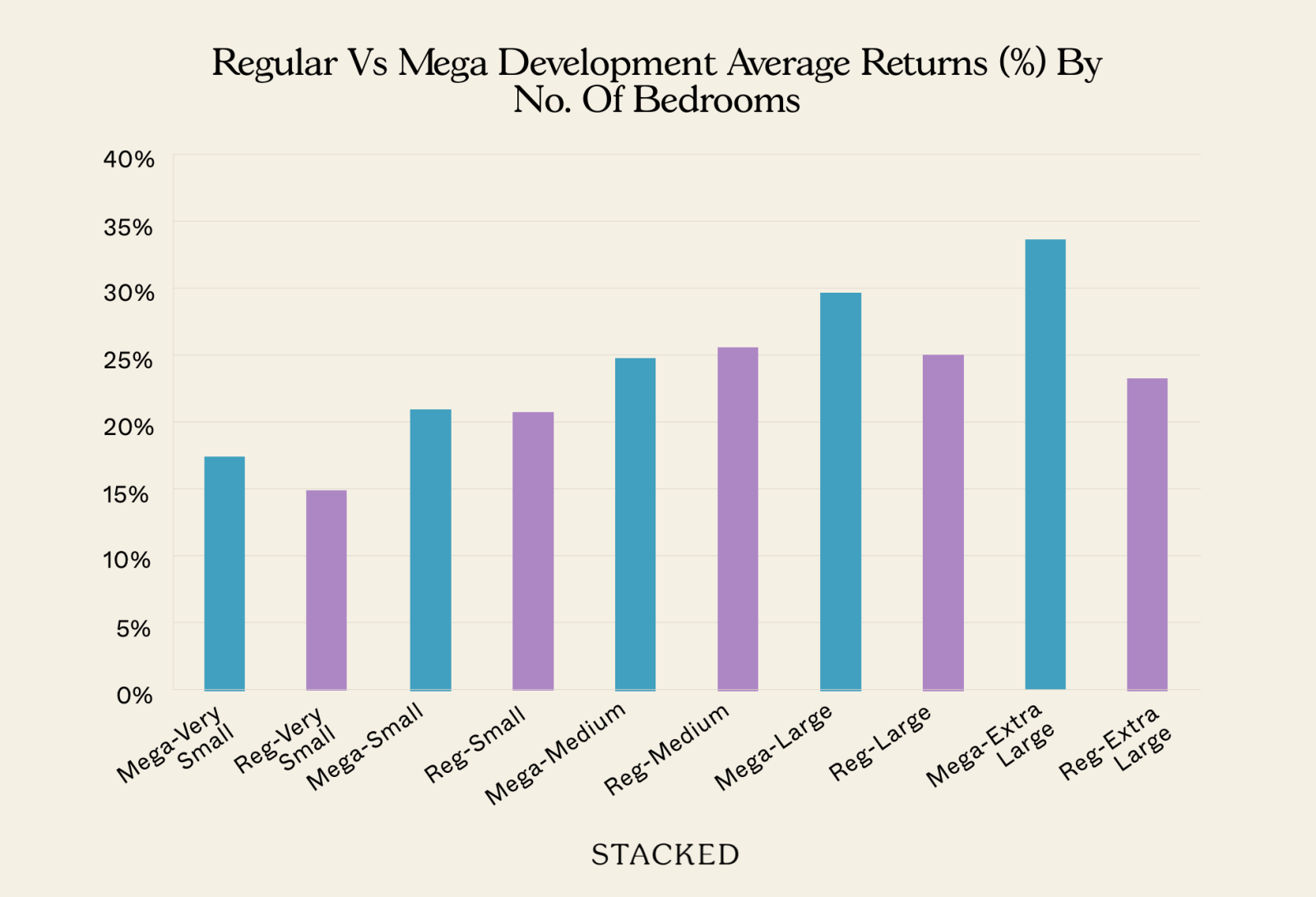

After grouping units by the number of bedrooms, we compared how each category performed in mega-developments versus regular projects:

| Type | Average of % | Average of quantum | Difference in ROI |

| Mega-Very Small | 18% | $118,652 | 2.7% |

| Reg-Very Small | 15% | $107,858 | |

| Mega-Small | 21% | $207,986 | 0.2% |

| Reg-Small | 21% | $212,914 | |

| Mega-Medium | 25% | $338,059 | -0.9% |

| Reg-Medium | 26% | $347,797 | |

| Mega-Large | 30% | $553,739 | 4.6% |

| Reg-Large | 25% | $422,069 | |

| Mega-Extra Large | 34% | $640,015 | 10.5% |

| Reg-Extra Large | 23% | $497,571 |

More from Stacked

Condo Vs HDB Price Gap Analysis: Singapore Estates Where Resale HDBs Present A Clearer Value Case Than Condos

For the price of a new launch two-bedder today - around $1.6 million to $1.8 million - you could have…

The smallest and largest units – specifically 1-bedders and 4- to 5-bedders – performed best in mega-developments. On the other hand, 3-bedders slightly underperformed compared to their counterparts in regular condos. There’s not much of a difference for 2 bedders.

When we check for statistical significance, we can see that 1-bedders, 4-bedders and more have a p-value below 0.05*, which means the difference is unlikely to be due to chance.

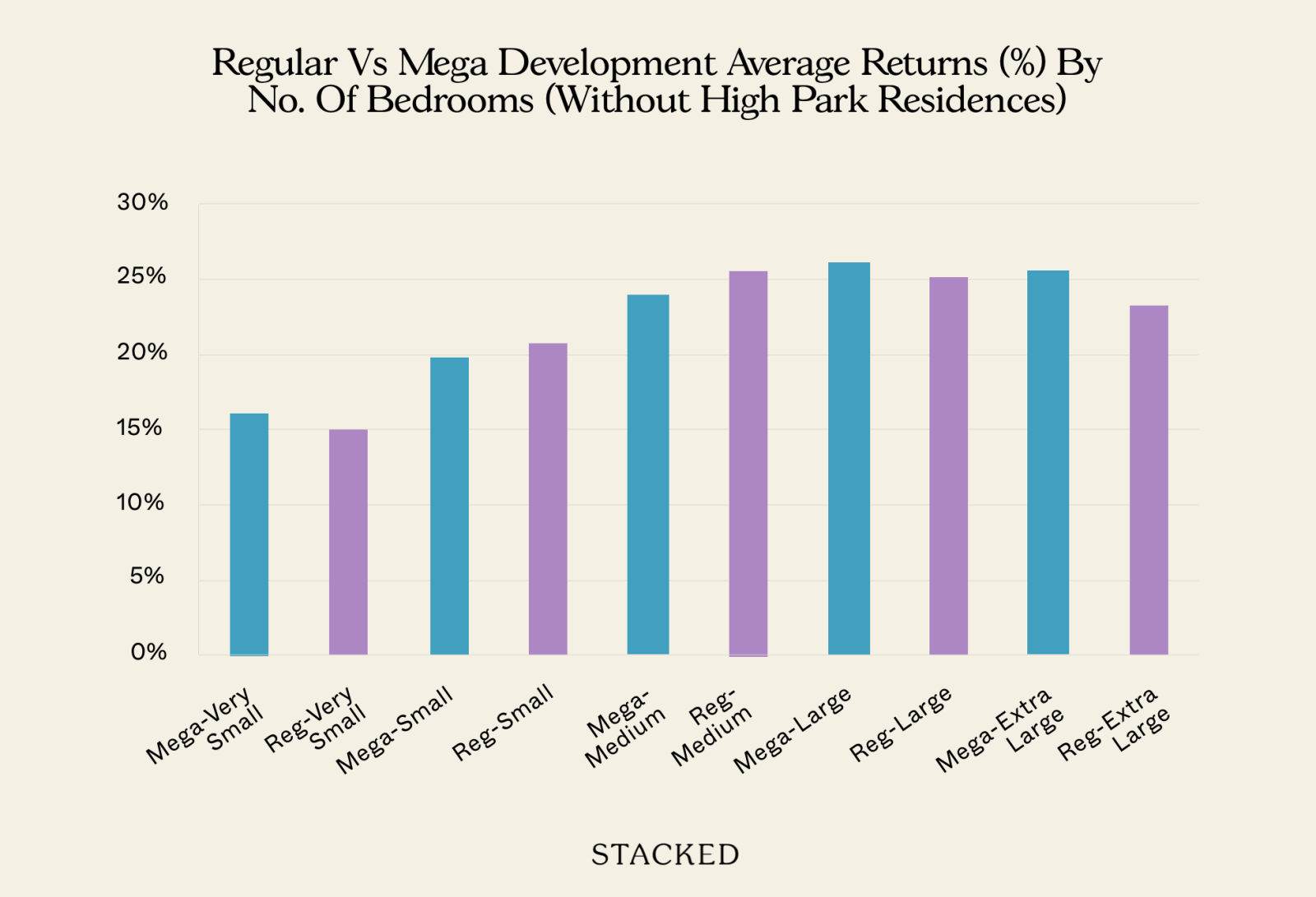

However, we also noticed that High Park Residences has a large number of transactions in the “Extra Large” category. Here’s what the data looks like if we remove this condo:

| Type | Average of % | Average of quantum | Difference in ROI |

| Mega-Very Small | 16.21% | $116,850 | 1.3% |

| Reg-Very Small | 14.94% | $107,858 | |

| Mega-Small | 19.77% | $209,449 | -1.0% |

| Reg-Small | 20.81% | $212,914 | |

| Mega-Medium | 23.97% | $343,071 | -1.8% |

| Reg-Medium | 25.74% | $347,797 | |

| Mega-Large | 26.11% | $570,478 | 0.9% |

| Reg-Large | 25.18% | $422,069 | |

| Mega-Extra Large | 25.64% | $674,102 | 2.4% |

| Reg-Extra Large | 23.22% | $497,571 |

Notice that without High Park Residences, the effect of gains on the 4 bedders or more becomes less pronounced – but still positive. 1 bedders are still more profitable – albeit to a lower degree.

Whilst it’s hard to pinpoint the exact reason, one thing we can see is that extremes in mega developments have done better based on this dataset.

*The p-value is a measure of statistical significance, where anything above 0.05 could more likely be a result of chance.

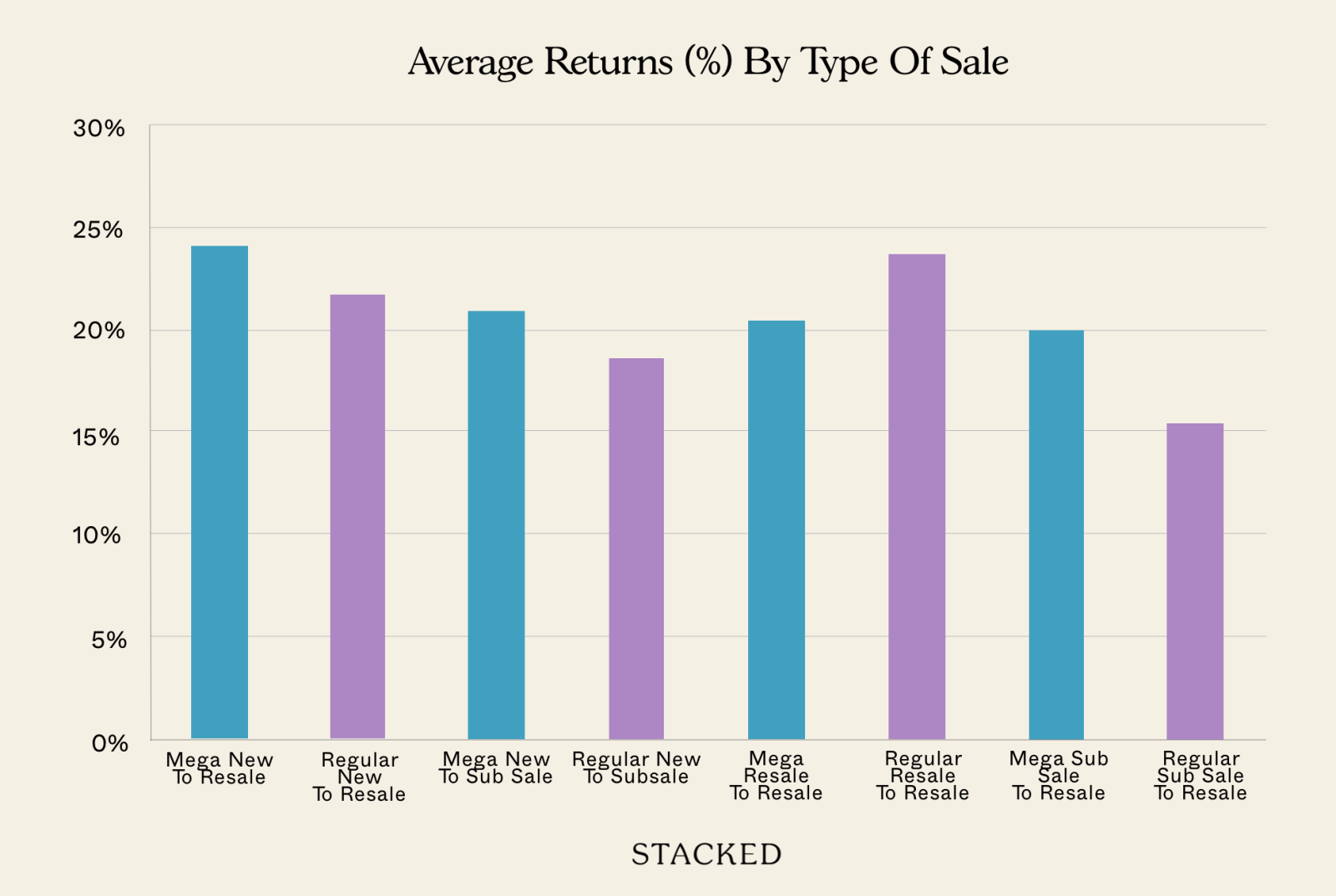

Next, we looked at the transaction types.

This was to determine if, for instance, most of the benefits of mega devs come only if you bought during early sales phases.

(This is more significant to mega devs than most standard projects, as the high unit counts often mean a longer, dragged-out period of developer sales)

We looked at new to resale, new-to-subsale, resale-to-resale, and subsale-to resale:

| Type of sale | Average of % | Average of quantum | Volume |

| Mega New To Resale | 24.0% | $256,352 | 1583 |

| Regular New To Resale | 21.7% | $249,020 | 3828 |

| Mega New To Sub Sale | 20.9% | $238,874 | 2018 |

| Regular New To Subsale | 18.6% | $233,195 | 1593 |

| Mega Resale To Resale | 20.4% | $280,355 | 575 |

| Regular Resale To Resale | 23.7% | $287,054 | 2854 |

| Mega Sub Sale To Resale | 20.0% | $165,911 | 58 |

| Regular Sub Sale To Resale | 15.4% | $158,882 | 362 |

Here’s another interesting result: in all categories save one (resale-to-resale), mega devs come out ahead.

(We would take subsale-to-resale transactions with a pinch of salt though, as those types of transactions tend to be quite rare and low in volume)

That should give us pause for thought. It implies – on the surface – that the advantages of buying a mega dev may come primarily from early developer sales. Perhaps the advantage won’t be present if you buy a resale mega dev unit, and subsequently try to sell.

But there may be another explanation

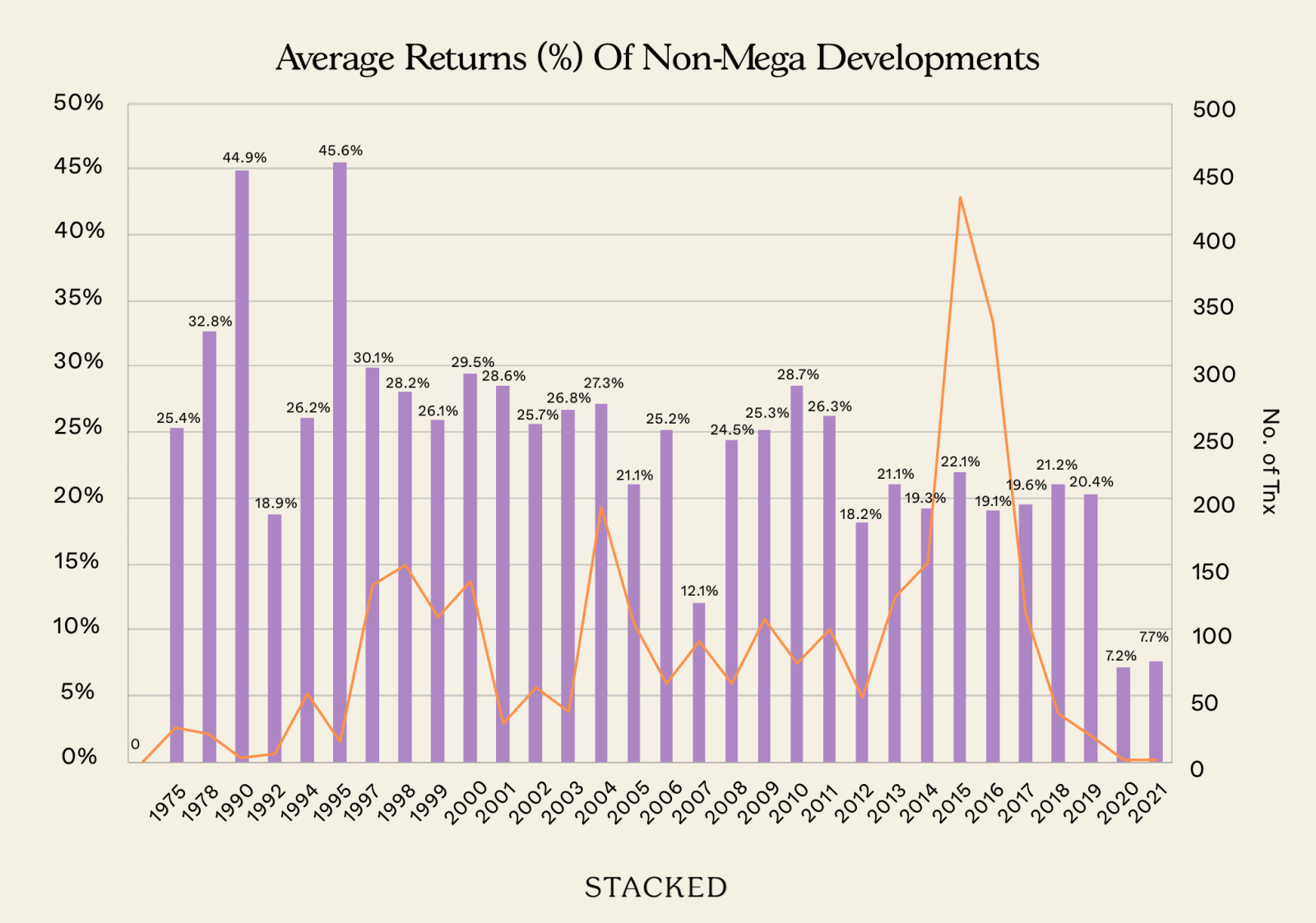

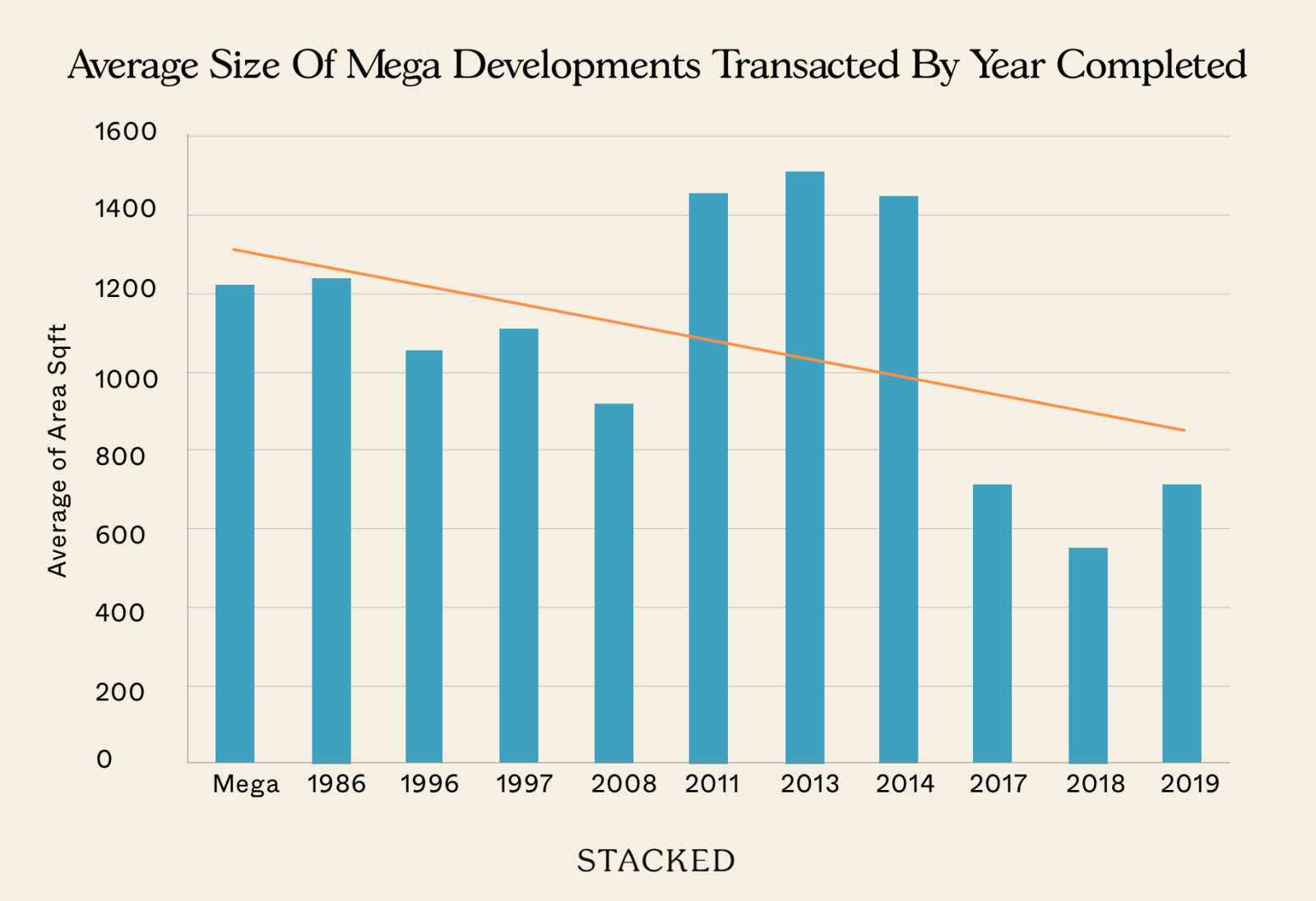

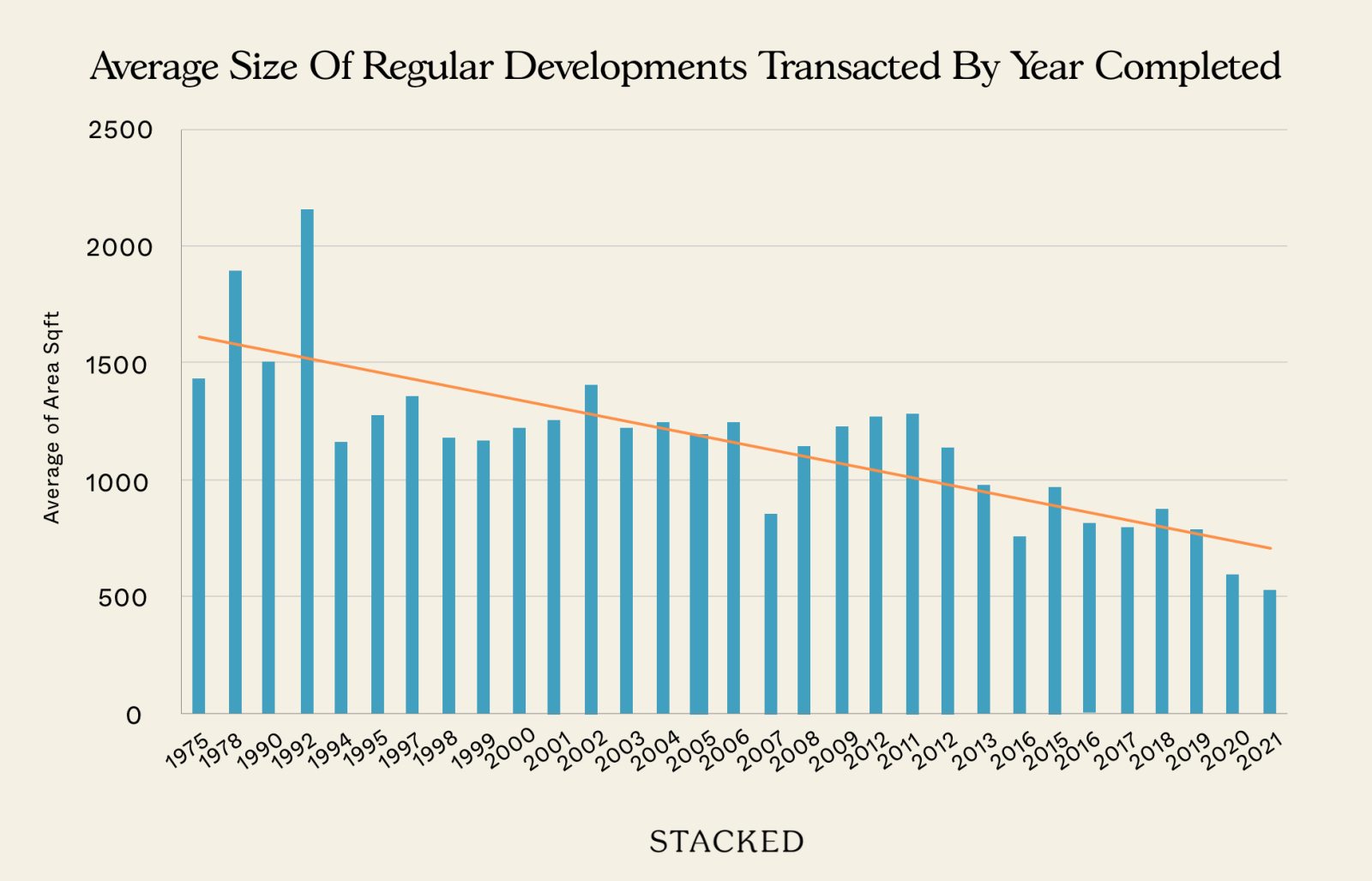

We should consider that, for resale-to-resale, we’re looking at more condos that are older. Note the completion years of the regular condos, versus their mega dev counterparts:

What’s happened here is that there’s a large number of regular older condos, which through consistent performance over time, have pulled up the overall average.

One other issue with older condos is that they’re often built much bigger. As we mentioned above, even a 1,000+ sq. ft. unit could have been considered a two-bedder back in the 1990s. This could also contribute to such older condos performing well in today’s market, where newer units tend to be much smaller.

As an interesting aside, you can also see how much our private homes have shrunk over time!

Overall though, the numbers so far show that mega devs do tend to outperform their regular counterparts

This is still by no means universal. We cannot predict with absolute certainty that a mega dev unit will beat a regular counterpart, or by what exact margin. What it does show, however, is that some of our previous fears may be unwarranted.

It used to be said, for instance, that mega devs face tough resale prospects, because there would be many competing listings at the point of sale (and some landlords claim this is true for rental as well). But from what we’ve observed, this hasn’t caused mega devs to underperform after all.

Our analysis shows that mega-developments have quietly outperformed their regular-sized peers, particularly for smaller units or early launch buyers. They offer better ROI and price resilience than many expected. Want to find out which specific mega-developments have delivered the best returns — and which to avoid?

Book a strategy session with our team to uncover the data-backed insights behind Singapore’s most surprising outperformers, you can do so here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are small units in mega developments more profitable than in regular condos?

Do early buyers in mega developments see higher returns compared to regular new launches?

How do larger units like 4- and 5-bedroom units perform in mega developments versus regular condos?

Does the data support the idea that mega developments are better investments than regular condos?

Are resale units in mega developments less profitable than new purchases?

Has the perception of mega developments as chaotic and less private changed by 2025?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments