Is The $16k EC Income Ceiling Too Low? A Look At How New EC Prices Have Risen And Why It Should Be Raised

August 3, 2023

The income ceiling for Executive Condos currently stands at $16,000. But there has been discussion lately over whether it’s time to raise this income ceiling, along with that of BTO flats. It doesn’t surprise us to hear it: amid rising interest rates, high inflation, and fully-private homes getting out of reach, there are real fears that a low-income ceiling would leave more Singaporeans truly “sandwiched”.

Before we dive into the state of things now, let’s take a look at how income ceilings have been raised over the years.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Key Takeaways

- New EC prices have reached a point in 2023 where eligible buyers have to put in more than the minimum 25% downpayment to meet the Mortgage Servicing Ratio (MSR) requirements.

- Interest rate spikes as the US combats inflation may raise the interest rate floor for the TDSR, requiring higher incomes to qualify for ECs.

- Rising private home prices may leave more Singaporeans “sandwiched,” increasing demand and prices for ECs and resale flats.

- Developers facing higher costs may pressure the income ceiling to justify higher EC prices.

- Raising the income ceiling could encourage more homebuyers to move into less mature areas, contributing to urban development.

Table Of Contents

- Executive Condominium Income Ceiling History

- How have new ECs prices moved over the years?

- Sharp interest rate spikes as the US combats inflation

- Rising private home prices that leave more Singaporeans “sandwiched”

- Developers being pressured into raising EC costs

- We have “ulu” spots that could see better use

Executive Condominium Income Ceiling History

| Period | Max Household Income |

| Before 2011 | $10,000 [1] |

| 2011 – 2015 | $12,000 [2] |

| 2015 – 2019 | $14,000 [3] |

| 2019 – Present | $16,000 [4] |

The income ceiling prior to 2011 was at $10,000 for over 10 years. It wasn’t necessary to raise it prior due to the Asian Financial Crisis, DotCom Bubble bursting and the SARS period. However, the run up of property prices from 2008 saw the need to increase the income ceiling with rising wages and property prices.

How have new ECs prices moved over the years?

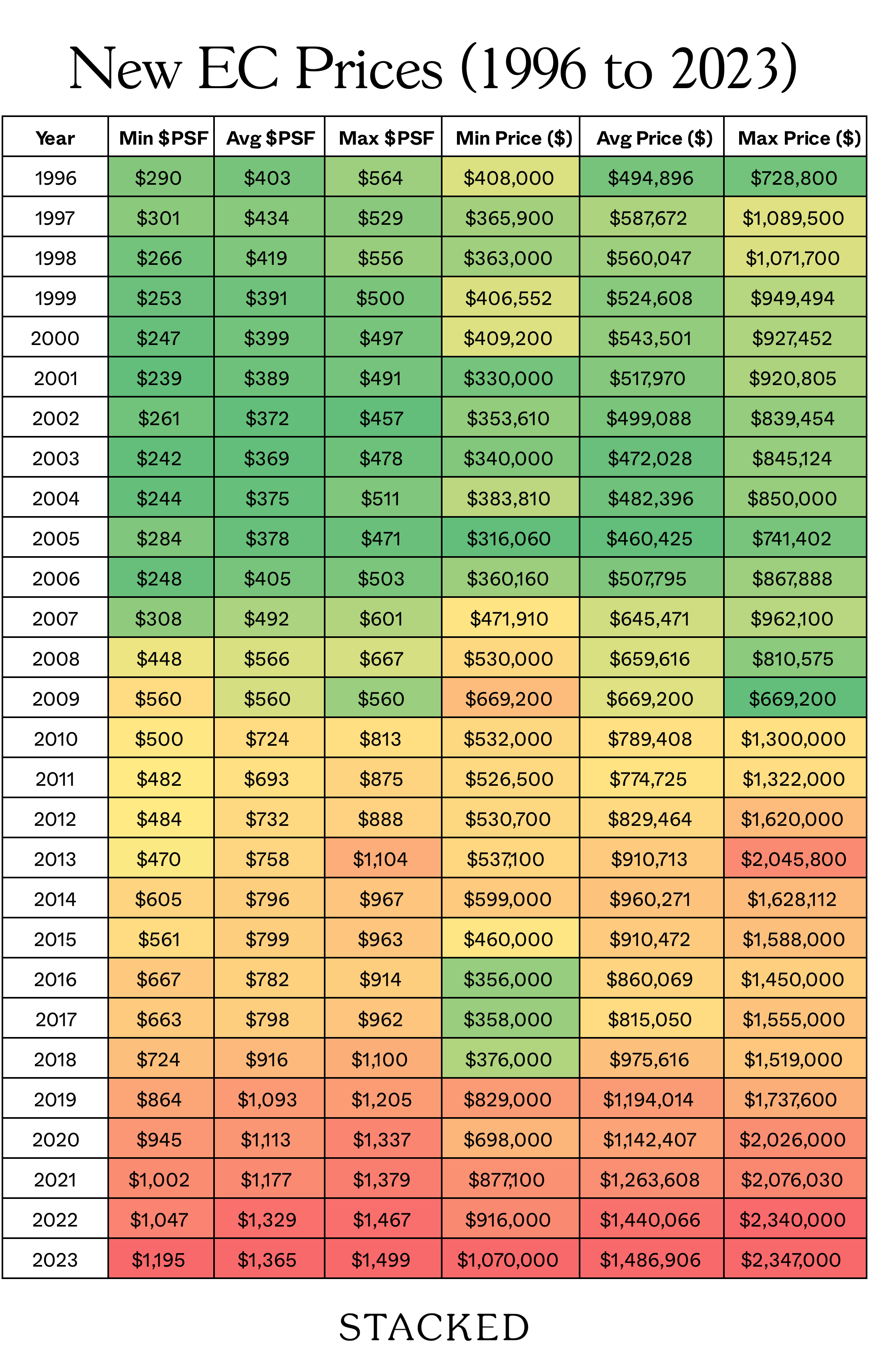

This table describes the minimum, average and maximum $PSF and price of new ECs since 1996:

Notice how in 2023 so far, the average prices of new ECs stood at $1,486,906. This is about $500,000 more than in 2018. The last time prices were $500,000 less was 13 years before that – 2005.

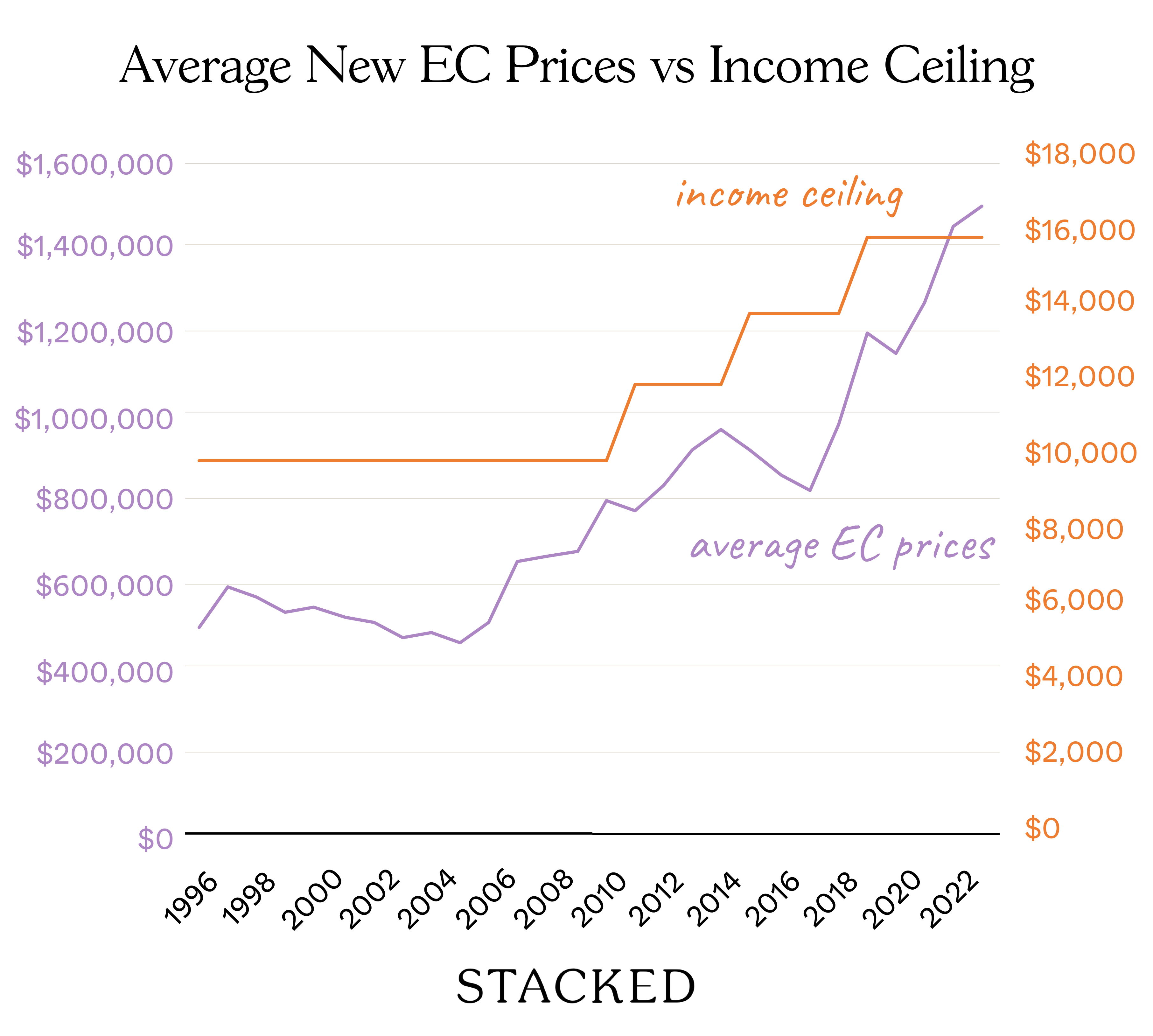

How does this relate to the income ceiling? Here’s a look at the average prices of new ECs and the income ceiling:

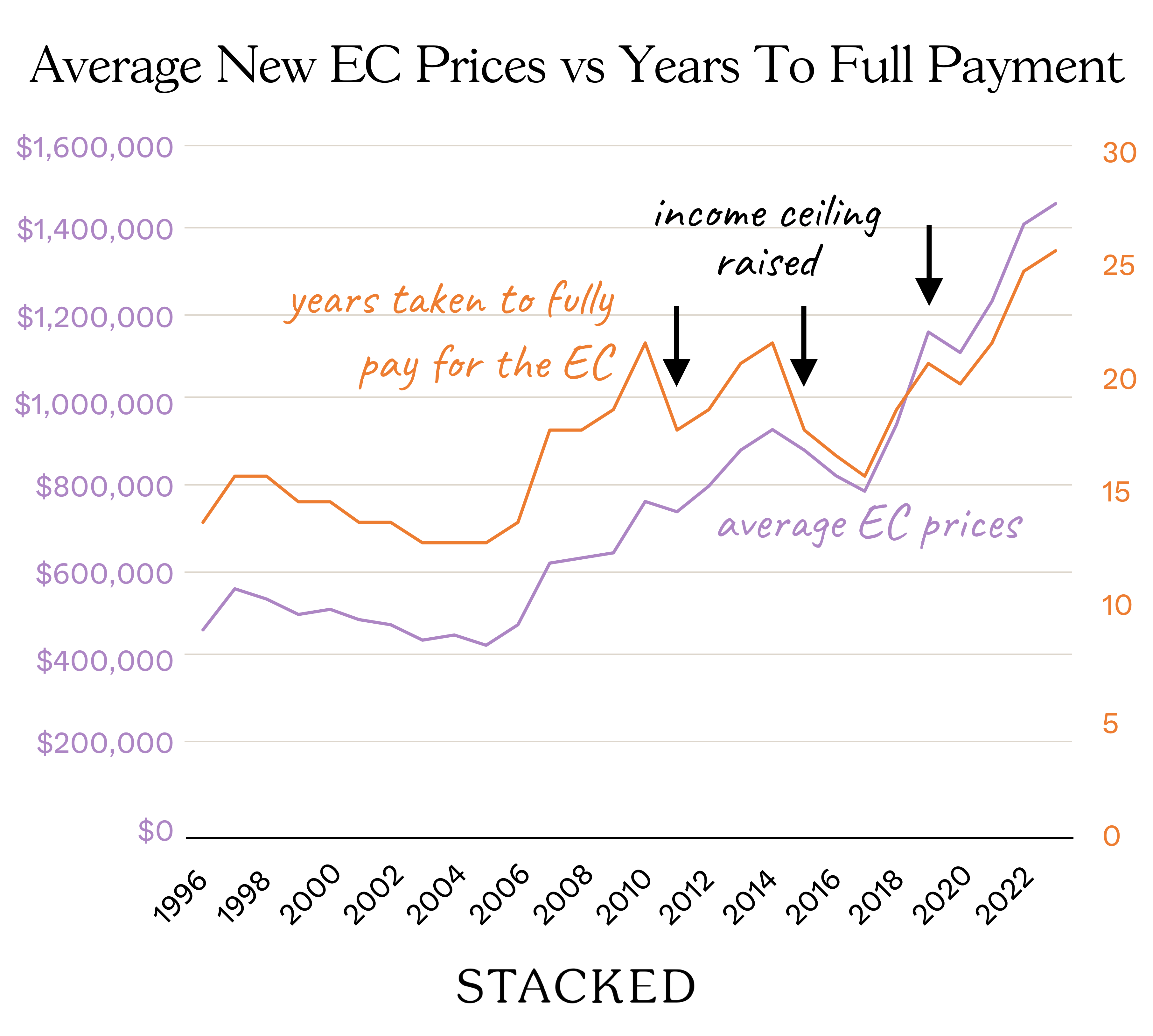

If we assumed that couples earn an income equivalent to the income ceiling and paid 30% of their income towards the house alone (doesn’t include interest expense or the deposit), then here’s how long it takes for them to pay it off:

Prior to 2008, it takes roughly 15 years to fully pay off one’s EC. In 2009 and 2010, property prices moved quickly, raising the number of years it takes to fully pay off one’s EC to 22 years.

Then, the income ceiling was raised from $10,000 to $12,000 which brought this number back down to 18 years.

As prices continued to move up in 2014, the number of years rose again to 22 years.

This was brought back down to 18 years once more with the increase in income ceiling from $12,000 to $14,000.

The number of years taken to pay off an EC completely remained between 16 to 19 years. In 2019, the ceiling was raised from $14,000 to $16,000.

Since then, the number of years taken to pay off an EC rose dramatically from 21 years to 26 years – the most unaffordable at this point in history.

To illustrate just how low this income ceiling is relative to prices, let’s look at the latest Executive Condo launch, Altura.

At a starting psf of $1,375, this means that the most affordable unit would go at about $1.347 million.

If we consider the MSR of 30% and the medium-term interest rate framework MAS set at 4% in calculating mortgage payments, then the maximum amount an EC should be priced at is around $1,340,552 before the buyer has to put down more than the 25% requirement. (Note, this assumes a 30-year loan).

As such, given that $1,340,552 is the minimum, the starting price of Altura EC at $1.347 million means that on top of the usual 25% downpayment (a mix of cash + CPF), the minimum top-up a buyer has to make here is $6,948 – and it can only get higher.

Aside from this, there are ongoing factors that may still prompt a revision:

*75% LTV from a bank loan, HDB loans are not available for ECs

Ongoing factors that could make the $16,000 ceiling too low

- Sharp interest rate spikes as the US combats inflation

- Rising private home prices that leave more Singaporeans “sandwiched”

- Developers being pressured into raising EC costs

- We have “ulu” spots that could see better use

1. Sharp interest rate spikes as the US combats inflation

More from Stacked

Why We Upgraded To A 1,593 Sqft Executive Apartment From A 4-Room BTO (Despite Its Age)

There's been much talk about HDB upgraders in 2021/2022, and while most of the attention seems to be on upgrading…

We wouldn’t be surprised if the interest rate floor for the TDSR goes higher, and soon. Private bank rates, which were once as low as two per cent in 2018, are reaching averages of close four per cent per annum.

But keep in mind the floor rate is supposed to be higher than the actual interest rate; this is to ensure borrowers can cope when interest rates rise. But in the US, we’ve seen 10 rate hikes since the end of Covid, as they try to lower inflation – this is having a knock-on effect on Singapore’s mortgage rates, which brokers now expect to reach five per cent by the end of this year, or early in 2024.

(And the Fed has been especially hawkish, so there’s a chance it won’t even end there)

Pushing up the interest rate floor will cause projected monthly repayments to rise, and will in turn require higher incomes to qualify.

2. Rising private home prices that leave more Singaporeans “sandwiched”

As a good example of this, we were recently speaking to a couple who earned a combined $19,000+ per month.

At such a salary level, you might assume they have no issues buying a private property. However, the couple has elderly parents on both sides of the family, who need ongoing treatment; this includes dialysis costs and a live-in nurse. They don’t qualify for many subsidies due to their income level.

Along with raising two children, the couple’s expenses already consume close to half their monthly income, without factoring in housing. Taking on a fully private, family-sized condo would definitely strain them past prudent limits.

They eventually settled for a resale executive flat. But it would have been ideal if they could have bought a new EC, with a fresh lease given their (still relatively young) age.

We might also consider that the people who can’t get ECs, and also can’t get private condos, might add to the demand and price increases for resale flats.

3. Developers being pressured into raising EC costs

Developers are facing slimmer margins, higher ABSD rates, higher costs for labour and materials, and higher financing costs due to rising interest rates. Despite this, they’re required to price ECs with regard to the income ceiling, MSR, and TDSR. Something has to give.

You might have noticed a trend of “luxury ECs” starting around 2020, with the likes of Ola appearing on the market. These ECs are aggressively marketed as being more “prime” than typical housing of the sort, and we don’t think it’s a fully deliberate choice.

Given their higher costs, developers need to find every possible way to justify the price increments; and this “luxury” labelling is a symptom of that.

But unless some concessions are made (e.g., developers of ECs get some kind of reduction in Land Betterment Charges or ABSD), developers are going to keep trying to push the price; and a higher income ceiling will eventually be needed to accommodate that.

4. We have “ulu” spots that could see better use

For those who haven’t noticed, ECs tend to be in less mature areas, and areas further from the MRT station. It’s not always true, but it’s mostly true. We’re certain that this move is entirely deliberate.

One of the reasons is that ECs are a good tool for getting Singaporeans – particularly the ones rich enough to afford more than a flat – into some of the more “ulu” neighbourhoods. Parc Canberra is one example, and we suspect Tengah Garden Walk will do the same.

This is also how we incentivise private developers to contribute to urban development in more fringe neighbourhoods.

By raising the income ceiling, ECs could potentially convince more home buyers to move into currently fringe areas. This steps up the pace of development in those neighbourhoods, if for no reason besides justifying more coffee shops, retail stores, childcare centres, etc.

For more on discussions and trends in the Singapore property market, private or HDB, follow us on Stacked. You can also follow us for reviews of new and resale properties, including ECs.

Article Sources

1) The Business Times via NLB. “Upgraders more likely to go for exec condos, https://eresources.nlb.gov.sg/newspapers/digitised/article/biztimes19950925-1.2.11.2″

2) The New Paper via NLB, “Revised income ceiling of $12,000 for all EC projects, https://eresources.nlb.gov.sg/newspapers/search?q=executive+condominium+income+ceiling“

3) TODAY online. “Higher income ceilings for new HDB flats, ECs, https://www.todayonline.com/singapore/income-cap-hdb-flats-ecs-s2000-each”

4) Ministry of National Development. “Written Answer by Ministry of National Development on quantitative and qualitative considerations…, https://www.mnd.gov.sg/newsroom/parliament-matters/q-as/view/written-answer-by-ministry-of-national-development-on-quantitative-and-qualitative-considerations-in-determining-changes-to-the-monthly-household-income-ceiling-for-purchasing-hdb-flats-and-executive-condominiums”

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is there a discussion about raising the income ceiling for Executive Condos in Singapore?

How have the prices of new Executive Condominiums changed over the years?

What factors might prompt a revision of the $16,000 income ceiling for ECs?

How do rising interest rates affect the affordability of Executive Condos?

In what ways could raising the income ceiling impact urban development in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

9 Comments

Raising income ceiling or any relaxation of loan rules just allows the developers to price the ECs higher. It does absolutely nothing for the buyers. The article seems to be coming more from the developer’s point of view, ending with a veiled threat to the government.

Considering the income ceiling’s high level and the substantial buyer pool in comparison to the available executive condominiums (ECs), it’s worth examining the challenges faced by most potential buyers who might not reach the income ceiling. Factors like rising interest rates and inflation would require significant effort to pay off, raising concerns about the author’s assumption that couples’ income equals the income ceiling. In reality, this assumption might not hold true for many buyers.

Even at the current income ceiling, EC showrooms are packed. Why would the gov increase it and fuel the property market even further?

Considering the income ceiling’s high level and the substantial buyer pool in comparison to the available executive condominiums (ECs), it’s worth examining the challenges faced by most potential buyers who might not reach the income ceiling. Factors like rising interest rates and inflation would require significant effort to pay off, raising concerns about the author’s assumption that couples’ income equals the income ceiling. In reality, this assumption might not hold true for many buyers.

How can 16k cap be low when ECs after ECs have no problem selling more than half on launch day (would be higher if there is no 30% cap for second timers). Just look at Altura that launched today, most stacks sold mid floors to top floors, while low floors unsold. This shows that people can definitely afford paying higher psf and ECs have no problems selling.

Considering the income ceiling’s high level and the substantial buyer pool in comparison to the available executive condominiums (ECs), it’s worth examining the challenges faced by most potential buyers who might not reach the income ceiling. Factors like rising interest rates and inflation would require significant effort to pay off, raising concerns about the author’s assumption that couples’ income equals the income ceiling. In reality, this assumption might not hold true for many buyers.