I Bought My First Property In My Mid-20s: Here’s All The Mistakes I Made

January 15, 2024

CX is what Singaporeans might call a “high-flyer”. He owned a car and a condo in his mid-twenties, was a top performer in his company, and managed it all before he became a degree holder. However, his experiences as a young homeowner, who never started on the traditional “HDB route”, weren’t all smooth sailing; and he’s seen the pros as well as the cons of diving into private home ownership at such a young age. Here’s his story:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Choosing a private property over an HDB flat

CX says his first property was a 500+ sq. ft. one-bedder, which he purchased in 2014. There were a few key factors behind his decision:

“I come from a big family, so I was living with my parents, both grandparents, and three siblings in the same condo, which was a four-bedder. I had no real privacy, and I didn’t want to wait till I got married or turned 35 to move out.

Also I was influenced by my immediate manager at work, who was complaining that HDB is all doom and gloom for retirement assets; so I was convinced I wanted something with resale value.

I also felt that I was privileged, as I had the option of moving back home and renting out my property, if things went bad; so I didn’t want to squander this advantage; and this led me to look into private condos.”

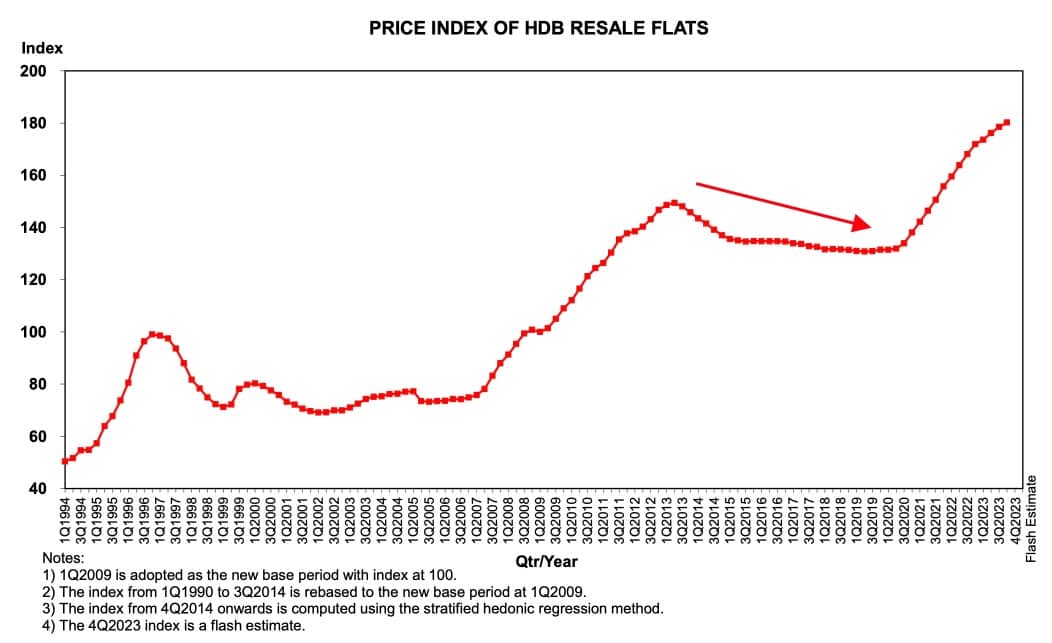

Incidentally, CX’s manager was referring to the decline of HDB resale prices at the time, which started around 2013. This was when the government introduced the Mortgage Servicing Ratio (MSR) and ceased to publish Cash Over Valuation (COV) rates.

This sent resale flat prices into a steady decline, but they skyrocketed back up after Covid.

CX also says he backed out twice, before taking the plunge:

“Highline Residences was actually the first one I looked at, which I still regret not buying. I love Tiong Bahru, but I had cold feet when I went over the numbers with the property agent. I was working on commissions so my income was not stable.

The second time I came close to buying was at The Crest, but I didn’t like the location.”

CX doesn’t want to disclose the address of his unit, he eventually settled on a one-bedder in the Farrer Drive area. This would also allow him to live just a few minutes away from his parent’s home.

Early mistakes when buying the property

CX says that, in his 20s, he greatly overestimated how “minimalist” his lifestyle would be; and within just two years, his belongings were in literal piles on the floor:

“I thought since I was single, there’s no way I could accumulate as much stuff, so I didn’t care about how small my unit was. But I was younger, I was eager to try out a lot of different things. I had snorkelling stuff, pool cues, books, all on the floors at one point. I really underestimated how quickly things can accumulate, even though I was young and single.”

CX also made the mistake of not factoring in how much the maintenance would affect his finances in later years:

“I had fewer responsibilities back then, so a few hundred dollars a month seemed fine.

But now, as I start to contribute to my parents, pay for my dog, have to start saving for my wedding, I really felt the pinch; and quite a few times in the past few years, I wish I had just stayed with my family.”

CX is paying close to $300 a month for his unit, despite it just being a one-bedder.

Perhaps his biggest mistake, however, was “not having any sort of investment strategy.” While he was investment-oriented, CX says that his idea of property investment was simply to “sell it to make a lot of money one day”.

“I didn’t pay attention to things like cash-on-cash returns, holding periods, rental yields, and so forth. I had a very simplistic view of it, and so I bought without any exit strategy.”

More from Stacked

The Rise Of Million-Dollar HDB Flats In Singapore: Is This Going To Be The New Norm?

Million-dollar HDB flats are still outliers, making up some one per cent of HDB transactions; and even those that are…

Life lessons and sacrifices

The biggest crisis for CX occurred during Covid, when his livelihood almost came to an end:

“I work on commissions, and during Covid my industry was dead. There was no chance to meet new clients, we had to close sales over Zoom, which I was bad at, and no one was really buying in that economy.”

He estimates that his income was more than halved at the time; and this was when he came to a dire realisation:

“In my mind, I had always assumed if anything goes wrong I can just sell my property. I am still young enough that my parents are working, so worst case scenario I move back home. I thought in that sense, I have more safety than the average homeowner.

It never occurred to me that, in a downturn like Covid, how am I going to sell? And how much can I get?”

CX also considered his old fallback of renting out the unit and moving back home; but with everybody working from home, his packed parents’ home was impossible as a work environment.

CX was reduced to living paycheque to paycheque for almost two years, and the condo maintenance fees compounded the issue. To rub it in further, CX didn’t receive government aid during the Circuit Breaker:

“My other colleagues who were living in HDB flats had $1,000 a month, for being self-employed. My address was a condo address, and because of that I didn’t receive help. I still feel it’s very unfair, but that’s how it turned out – and during the whole black period, I regretted more than ever buying a condo.”

After these experiences, CX no longer believes that being young and single makes it somehow “safer” to take on home ownership early.

“They say more agile, more adaptable, but it’s all nonsense. Even if you have the backup of moving back in with your parents, the financial damage is still there.”

CX estimates that, had he been forced to sell the unit during Covid, he would have incurred losses of close to $75,000.

A final regret from CX is some missed opportunities, from his 20s:

“Looking at how much I was spending on the house each month, I could have gone overseas maybe twice a year. I could have enjoyed better food, done more snorkelling, hung out with friends. But I sort of missed out on it because I took on bigger loan repayments earlier, so I had to be more controlled with my spending.”

Future plans for the property, and advice for young homebuyers

CX intends to sell the property and move in with his in-laws for a time, after he gets married. The couple will eventually have to find another home, as his one-bedder is not big enough.

He says it will likely be another private property, but he is open to considering a resale flat instead. This is where he might reap the benefits of his one-bedder, as the sale proceeds can likely fund a larger flat.

CX’s advice to young homebuyers is to consider their future financial obligations:

“There’s a period in your 20s to late 20s when your parents are still working, they don’t need your help, and you’re single. You can afford a lot more for yourself. But before you commit to a house, you need to also consider if you can handle the cost when later down the road, you need to contribute to your parents, raise your own family, and so forth. The condo can suddenly feel a lot less affordable.”

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

$300 a month?