How Will CPF Changes In 2025 Affect Your Housing Decisions In Singapore?

February 5, 2025

Several changes to the Central Provident Fund (CPF) have taken effect from 2025, prompting questions about their impact on housing purchases in Singapore. The effects vary between individuals, depending on their reliance on CPF for housing and the extent of its use. Here’s a summary of the recent changes and their potential implications for your buying decisions:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Changes to CPF in 2025

These changes mostly took effect from January 2025 and are currently in place:

1. Closure of the Special Account (SA) for members aged 55 and above

As of 19 January 2025, the SA for members aged 55 and above has been closed. Savings in the SA have been transferred to the Retirement Account (RA) up to the Full Retirement Sum (FRS), where they continue to earn long-term interest. Any remaining SA savings have been moved to the Ordinary Account (OA), earning the short-term interest rate, and can be withdrawn when needed.

Impact on housing purchases:

While home loans and stamp duties are typically serviced through the OA, previously, homebuyers aged 55 and above could transfer excess SA funds to their OA, provided they met the FRS in their RA. With the closure of the SA, this option is no longer available, potentially resulting in less money in the OA for mortgage payments or stamp duties for some buyers in this age group.

However, many property buyers aged 55 and above are often right-sizing rather than upgrading. If they are selling a larger property to purchase a smaller one, they may have sufficient proceeds to avoid the need for loans or CPF funds. Note that this change does not impact younger homebuyers.

2. Increased Enhanced Retirement Sum (ERS) amount

From 1 January 2025, the ERS has been raised to $426,000, which is four times the Basic Retirement Sum (BRS). For instance, if the BRS is $106,500:

- Basic Retirement Sum (BRS): $106,500

- Full Retirement Sum (FRS): $213,000 (2x BRS)

- Enhanced Retirement Sum (ERS): $426,000 (4x BRS)

Those who meet the ERS could receive CPF LIFE monthly payouts of around $3,100 to $3,300 for life from age 65. In comparison, those turning 65 in 2025 who had previously met the FRS at age 55 could receive CPF LIFE monthly payouts of $2,500 to $2,700.

Impact on housing purchases:

Older homeowners may consider right-sizing their homes, topping up to the maximum ERS, and living off higher CPF payouts for life. This approach could be more reliable than maintaining a larger property for rental income, which involves finding tenants, managing payments, and potential vacancies.

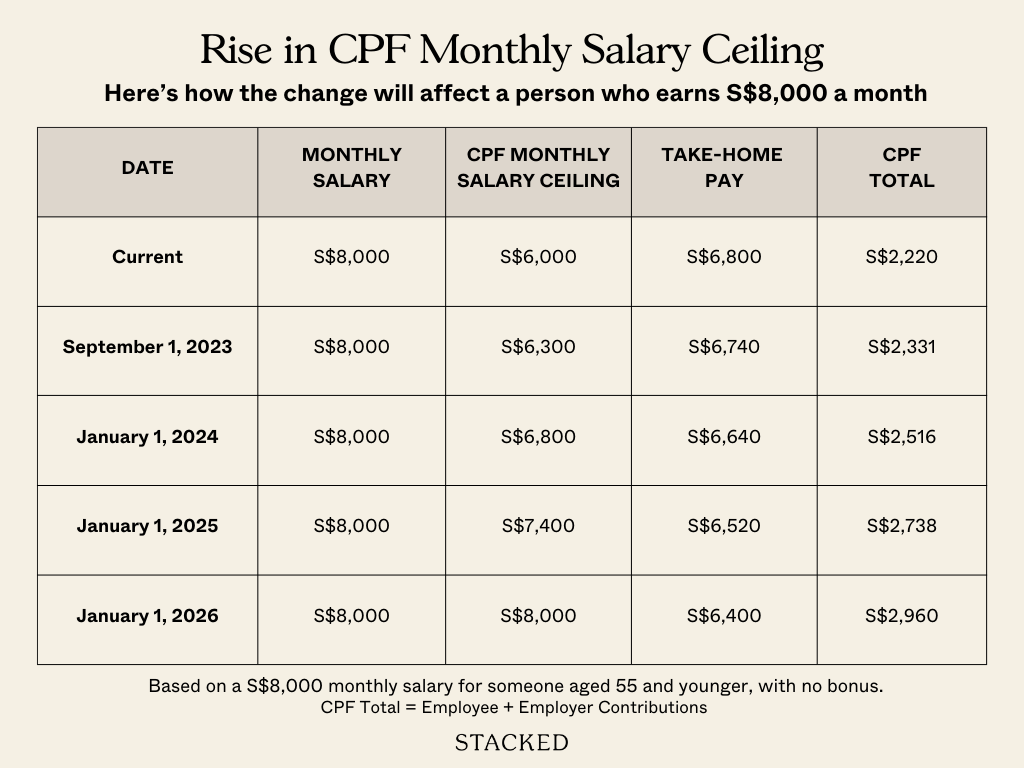

3. Higher monthly salary ceiling for CPF contributions

More from Stacked

My $10,000 HDB Window Horror Story: How It Caused A 10-Month Delay

Most of us don’t think too much about the windows in our HDB flats… until it becomes a problem. Then…

As part of an ongoing plan, the CPF monthly contribution cap increased from $6,800 to $7,400 per month as of January 2025, with a further increase to $8,000 per month planned for 2026.

Impact on housing purchases:

Higher-earning Singaporeans who reach the ceiling are now required to save more, resulting in increased OA balances available for housing expenses. However, this comes at the expense of reduced take-home pay.

4. Enhanced Matched Retirement Savings Scheme (MRSS)

The MRSS is designed to assist those who begin retirement savings later in life. Under this scheme, the government matches voluntary top-ups to the RA dollar-for-dollar. As of 2025, the matching grant cap has been raised from $600 to $2,000 per year, and the age cap has been removed.

Impact on housing purchases:

This enhancement can influence decisions on whether to retain a larger property for rental income or to right-size. For example, a senior could downsize from a five-room flat to a three-room flat and use the cash difference to make voluntary CPF top-ups for higher guaranteed payouts. Alternatively, substantial top-ups could enable seniors to maintain their current home without the need to right-size.

5. Higher CPF contribution rates for seniors and platform workers

For older workers (above 55), contribution rates have increased by 1.5% from 1 January 2025, with employers contributing an additional 0.5% and employees contributing an additional 1%. For platform workers, contributions are mandatory only if born after 1 January 1995; otherwise, it remains an opt-in programme.

Impact on housing purchases:

The main effect is higher OA savings, which can assist when buying a home, though this comes at the cost of lower take-home pay.

Overall, the CPF changes in 2025 lean towards higher forced savings, potentially making homes more affordable for platform workers and older workers with limited CPF savings. The closure of the SA is not likely to impact the average homebuyer significantly, primarily affecting older homeowners who had plans outside of right-sizing. It will be interesting to observe whether older flat owners decide to rely more on CPF than rental income, given the option for higher lifelong payouts.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will the closure of the Special Account for seniors affect their ability to use CPF for housing in Singapore?

What are the recent changes to the CPF retirement sums in Singapore and how might they influence housing decisions?

How does the increase in CPF contribution caps affect housing affordability for higher-income earners?

What is the impact of the enhanced Matched Retirement Savings Scheme (MRSS) on housing choices for seniors?

How do increased CPF contribution rates for older workers and platform workers influence their housing options?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments