How Singapore’s New Rental Rules May Benefit Landlords (And Tenants)

December 23, 2023

Sometimes, we need to remember who depends on who, when it comes to foreign workers.

Domestic helpers aside, I’m also talking about foreign workers of the non-Sentosa-Cove variety. From Malaysia, India, Bangladesh, Myanmar, Indonesia, etc., we rely on foreigners for several key positions; be it nursing, or keeping those 24-hour supper spots running. So it’s a good thing the government does care about the sort of rent they’re paying.

The new occupancy limits, which apply to both private and HDB units, increase the number of unrelated tenants allowed in the same unit. This doesn’t just help Singaporean renters, who are escaping tough home situations, waiting for their flats to be built, etc. It also helps foreign workers, who aren’t all affluent expats.

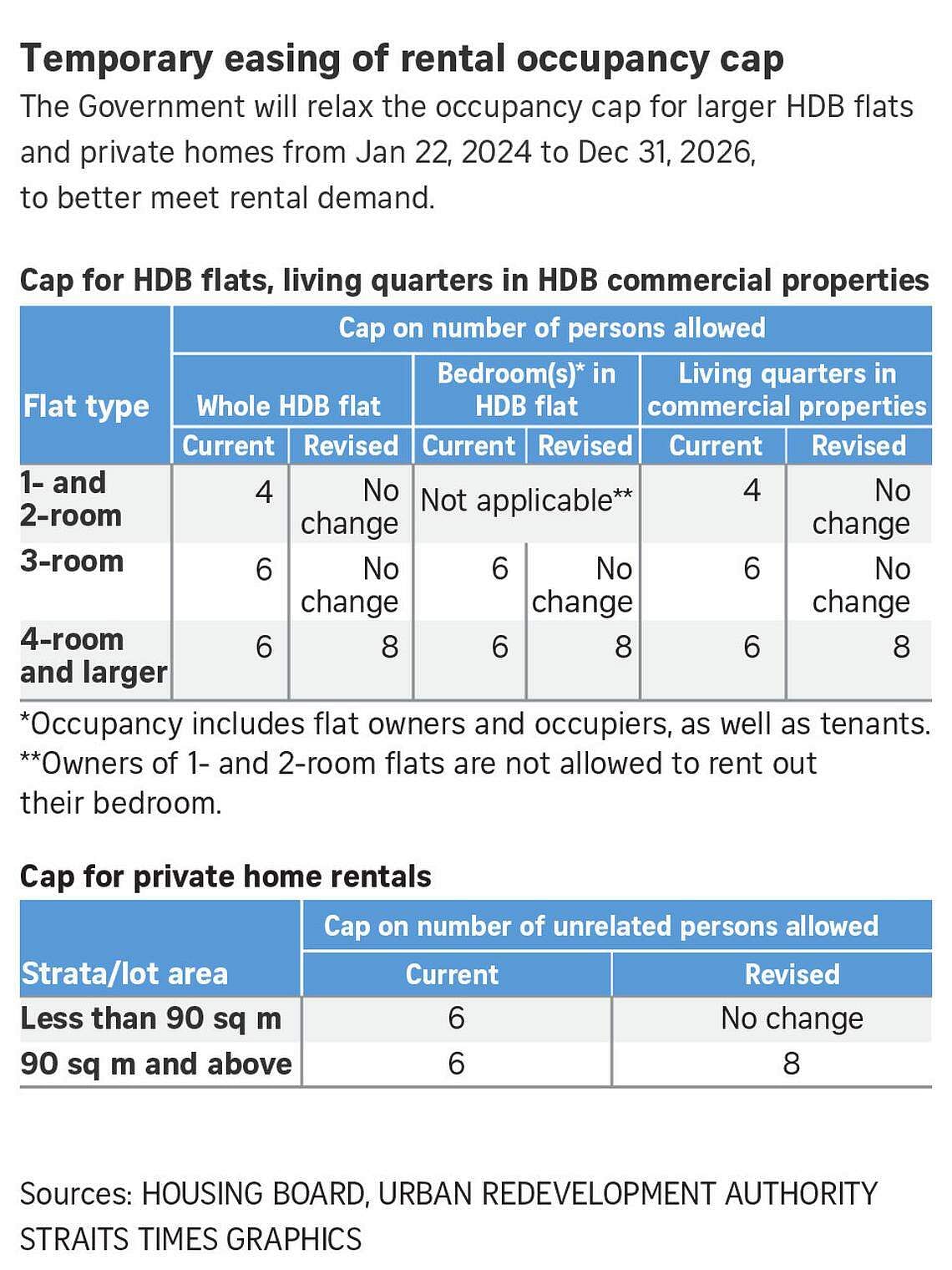

The new occupancy limits are:

A switch to eight unrelated tenants makes a huge difference, to tenants splitting the rent. Assuming $3,500 to rent a flat, six tenants splitting it is roughly $583 per person*. Split eight ways they’ll average $437.50 each. For a foreign worker in a zhi char stall/small restaurant, where wages may be just $1,200 a month, that’s a difference of about 12% of their monthly wage.

Of course, it does come with the discomfort of more housemates.

*Don’t take this literally – some tenants will pay more for bigger rooms, for example; but you get the general idea.

Some landlords could also use this to earn more rental income

With more tenants, a landlord could inch up rental rates by a smaller amount, and count on the one or two more tenants to balance this out.

If a landlord wants to push the rental from $3,500 to $4,000 a month, for instance, it may be viable to maintain the rental rates of six existing tenants, while making up the difference with one more new tenant. This may result in a bit less space, but some tenants would be happy to make the compromise if it means no rental increases.

Also, the rule changes are only being applied to the larger flats (4-room and up), so landlords can’t do the inhumane thing and try to stuff eight people into a 3-room flat.

On the flipside, co-living companies will probably be overjoyed at this news – as with landlords who prefer to rent out room by room to maximise their rent. As I recently wrote about a reader who shared their conversion story of a 3 bedder into a 4 bedder dual key, this move would definitely benefit landlords that do so.

But to come back to the issue of dependency, I feel Singaporeans as a whole will win when rent is kept affordable.

If businesses can’t afford to house their employees, or foreign workers go elsewhere because rent’s unmanageable, we all lose out in the long run. And just in case anyone is thinking “Come on Ryan, as if it’s so high they won’t work here anymore,” here’s a reminder that the current rental record for a 5-room flat is $7,600 a month.

More from Stacked

Every En Bloc sale in 2017/2018 (Updated)

Since late 2016, en bloc sales in Singapore have been spiking up. In 2017 alone there have been 26 successful…

If that were your monthly loan repayment for a condo, you’d need to earn $13,820 per month just to qualify for it.

Foreign workers aside, what about Singaporeans who do need to rent? There’s a much greater strain on our social support system, if rent becomes so high that more families need rental flats; or if people are forced to stay in dysfunctional home environments. Remember that, during the post-pandemic era, we spent 2.9 per cent of our GDP just on handling depression.

Those kinds of health problems tend to rise when people literally can’t find a space of their own. We need to rethink the assumption that, just because 90 per cent of Singaporeans own their homes, it’s somehow irrelevant how hard we squeeze the remaining 10 per cent.

Meanwhile in other property news…

- We found some commercial buildings on sites that are clearly zoned as residential. What’s going on?

- Did you know you can get four-bedder condos at $1.6 million or below? Here’s where we managed to find them.

- Do really old leasehold condos still appreciate? They should be “going to zero” right? Turns out that doesn’t always happen.

- Dual-key units are great, but what if your condo doesn’t have this layout? This owner took it into her own hands, and made her own.

Weekly Sales Roundup (11 December – 17 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $14,391,000 | 5177 | $4,080 | FH |

| MIDTOWN MODERN | $4,118,000 | 4166 | $1,464 | 99 yrs (2019) |

| 19 NASSIM | $3,829,000 | 1539 | $1,109 | 99 yrs (2019) |

| THE REEF AT KING’S DOCK | $3,253,840 | 1841 | $1,249 | 99 yrs (2021) |

| J’DEN | $3,148,000 | 2863 | $1,259 | 99 year |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PINETREE HILL | $1,322,640 | 538 | $2,458 | 99 yrs (2022) |

| GRAND DUNMAN | $1,374,000 | 549 | $2,503 | 99 yrs (2022) |

| THE LANDMARK | $1,412,601 | 495 | $2,853 | 99 yrs (2020) |

| THE MYST | $1,493,000 | 678 | $2,202 | 99 yrs (2023) |

| THE CONTINUUM | $1,528,000 | 560 | $2,730 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CORALS AT KEPPEL BAY | $8,400,000 | 3025 | $2,777 | 99 yrs (2007) |

| THE ORCHARD RESIDENCES | $8,300,000 | 2465 | $3,367 | 99 yrs (2006) |

| PATERSON SUITES | $4,400,000 | 1679 | $2,620 | FH |

| VIVA | $3,800,000 | 1518 | $2,504 | FH |

| THE OCEANFRONT @ SENTOSA COVE | $3,650,000 | 2056 | $1,775 | 99 yrs (2005) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| JUPITER 18 | $710,000 | 409 | $1,736 | FH |

| THE TAPESTRY | $725,000 | 441 | $1,643 | 99 yrs (2017) |

| TROPIKA EAST | $728,000 | 474 | $1,537 | FH |

| MY MANHATTAN | $778,888 | 506 | $1,540 | 99 yrs (2010) |

| THE TAPESTRY | $815,000 | 474 | $1,721 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE HACIENDA | $3,400,000 | 1894 | $1,795 | $1,250,000 | 17 Years |

| SPRING GROVE | $3,180,000 | 1668 | $1,906 | $1,050,000 | 22 Years |

| VIVA | $3,800,000 | 1518 | $2,504 | $2,330,580 | 14 Years |

| CLAREMONT | $2,450,000 | 1119 | $2,189 | $1,000,000 | 24 Years |

| PATERSON RESIDENCE | $3,300,000 | 1313 | $2,513 | $1,987,200 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| V ON SHENTON | $2,600,000 | 1356 | $1,917 | -$749,500 | 1 Year |

| THE GLADES | $900,000 | 581 | $1,548 | -$40,000 | 10 Years |

| EON SHENTON | $1,170,000 | 538 | $2,174 | -$40,000 | 6 Years |

| DEVONSHIRE 12 | $985,000 | 452 | $2,179 | $5,000 | 5 Years |

| SKYSUITES@ANSON | $953,000 | 366 | $2,604 | $31,600 | 6 Years |

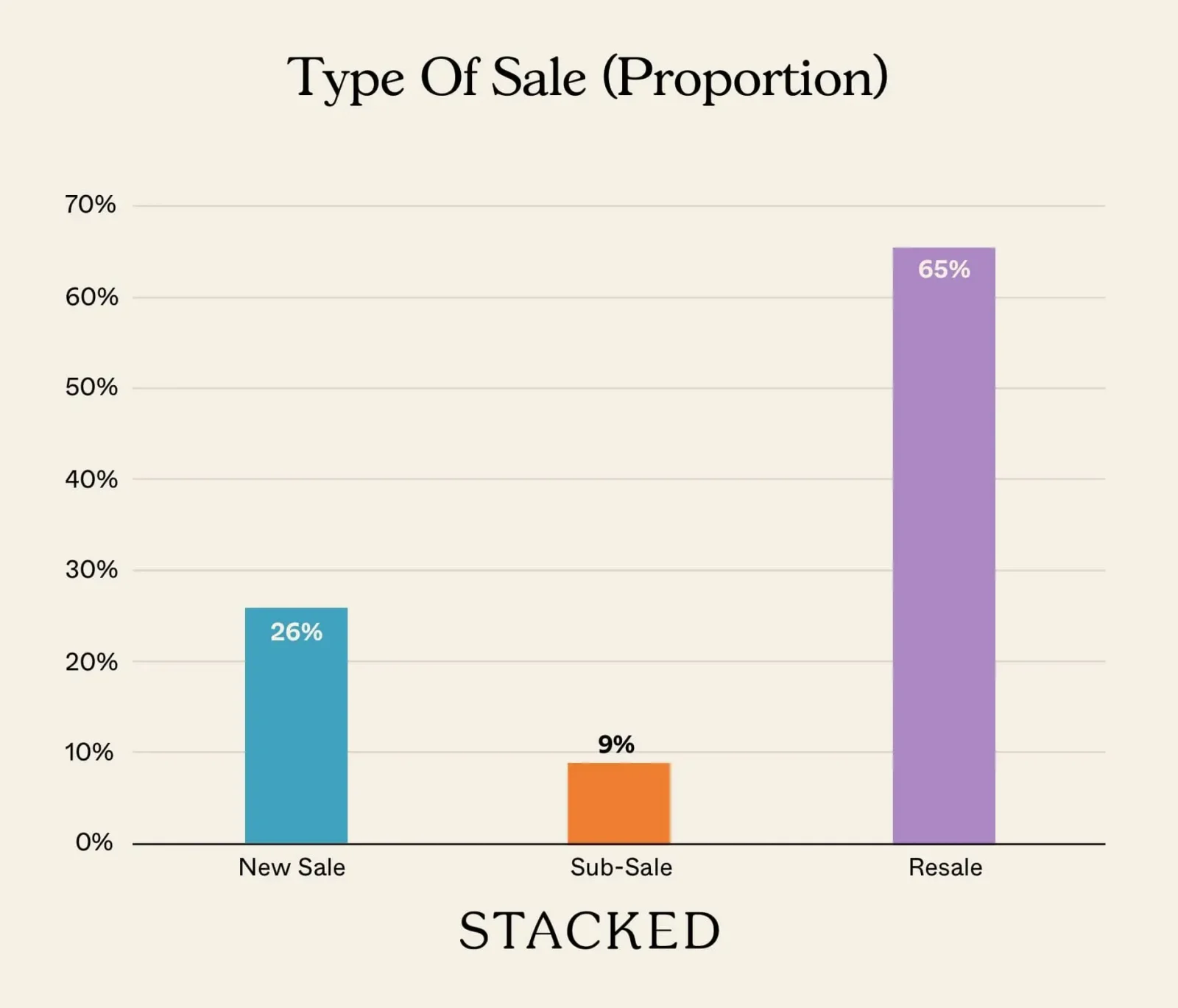

Transaction Breakdown

For more news and stories about the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do the new rental rules in Singapore affect foreign workers and their housing options?

What are the specific changes to occupancy limits for flats in Singapore?

How might landlords benefit from the new rental rules?

Are there restrictions on applying these new occupancy limits to smaller flats?

Why is affordable rent important for Singaporeans and the country’s social health?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

4 Comments

Govt. has also increased Property Tax where landlords will lose. Mainly it is Govt. who will gain.

Good job. Keep it coming.

I’m a local renter that rents from co-living companies because I can’t afford a place of my own in a location that isn’t terrible. They do come at a premium, but the co-living places have the decency to cap the number of people in most of their units to 4 unless the place is is really big.

I’ve seen enough small-time landlords to know that they’ll only use this rule to squeeze more people into a tiny property without lowering the rent, because people have already been willing to pay the old prices. I wasn’t even aware of the new rule until I was casually scrolling room rental ads and noticed properties for 7 to 8 tenants. They partitioned 3 bedrooms into 7 and got a result that was hilariously similar to those Hong Kong coffin rooms. Both sides of the bed touch the walls, that kind of thing. And one that made me laugh where the closet was built into the room, but the partitioning didn’t create a sensible spot to place the bed, so the bed was right in front of the door and you had to climb over it to get to the desk and closet. The prices weren’t anything to marvel at either. With the number of low-income foreign workers coming in, there’s going to be someone willing to put up with these awful conditions. This really doesn’t benefit renters at all.