How High Does The Premium For A Newly-MOP HDB Flat Get?

January 11, 2025

One of the highest premiums attached to resale flats is based on age. When a flat is sold right after MOP (usually five years, except for plus and prime models,) it’s in a desirable state of being ready to move into, with negligible lease decay. Even the renovations are new, thus minimising the time and cost for the buyers. It’s an accepted market norm that, if you pick one of these flats, you’ll end up paying a lot more. But how high can the premium for a “young” flat get? Here’s a look at the numbers:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Five years versus 10 years as a point of comparison

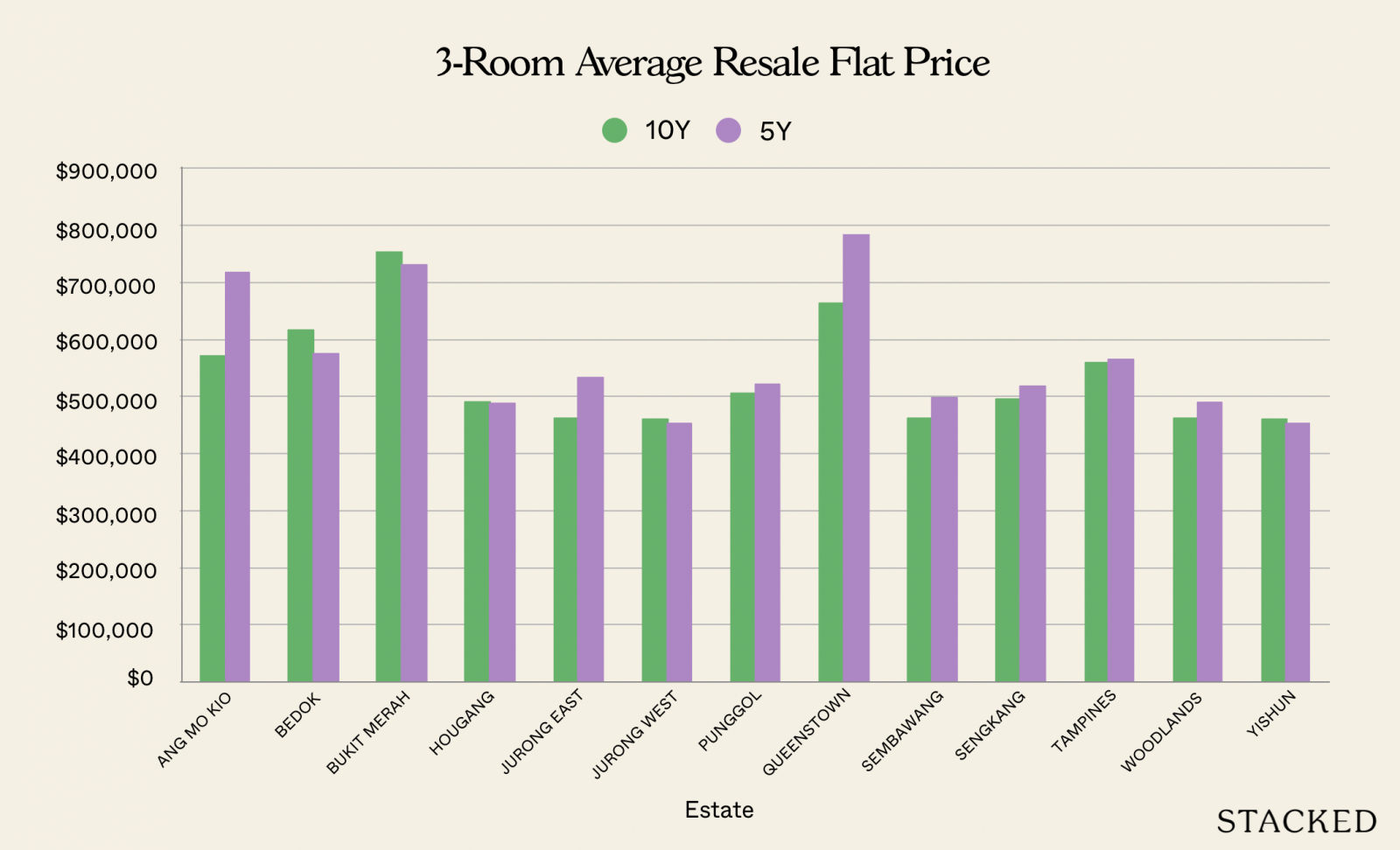

To gauge the typical premium of a five-year-old flat, we compared them to 10-year flats in the estate. It’s difficult to isolate purely HDBs with exactly a 10-year lease difference, so HDBs with lease years between 2013 and 2015 were considered and compared against those that started from 2019. We then divided them by flat size and HDB town to check if these other factors would affect the premium. Here’s what we found:

3 Room

| Estate | 10Y | 5Y | % Difference |

| ANG MO KIO | $570,000 | $716,000 | 25.6% |

| BEDOK | $616,000 | $574,167 | -6.8% |

| BUKIT MERAH | $752,726 | $729,818 | -3.0% |

| HOUGANG | $489,155 | $486,853 | -0.5% |

| JURONG EAST | $461,047 | $532,000 | 15.4% |

| JURONG WEST | $459,928 | $451,340 | -1.9% |

| PUNGGOL | $504,887 | $520,215 | 3.0% |

| QUEENSTOWN | $662,995 | $783,000 | 18.1% |

| SEMBAWANG | $460,889 | $496,951 | 7.8% |

| SENGKANG | $494,598 | $516,216 | 4.4% |

| TAMPINES | $557,979 | $562,711 | 0.8% |

| WOODLANDS | $462,067 | $488,333 | 5.7% |

| YISHUN | $459,320 | $451,933 | -1.6% |

4 Room

| Estate | 10Y | 5Y | % Difference |

| BEDOK | $820,000 | $801,535 | -2.3% |

| BUKIT MERAH | $969,328 | $995,532 | 2.7% |

| HOUGANG | $648,750 | $625,075 | -3.6% |

| JURONG WEST | $626,556 | $611,660 | -2.4% |

| PUNGGOL | $667,303 | $679,269 | 1.8% |

| SEMBAWANG | $554,380 | $643,449 | 16.1% |

| SENGKANG | $634,024 | $639,431 | 0.9% |

| TAMPINES | $762,313 | $739,357 | -3.0% |

| WOODLANDS | $588,753 | $633,763 | 7.6% |

| YISHUN | $599,010 | $572,088 | -4.5% |

5 Room

| Estate | 10Y | 5Y | % Difference |

| BUKIT MERAH | $1,308,413 | $1,414,654 | 8.1% |

| PUNGGOL | $832,223 | $866,595 | 4.1% |

| SENGKANG | $778,668 | $803,250 | 3.2% |

| TAMPINES | $919,216 | $898,206 | -2.3% |

| WOODLANDS | $674,359 | $755,894 | 12.1% |

When we compare the price premium of five-year-old versus 10-year-old flats, we can see the following:

- The price premium is around 10 per cent for newer 3-room flats

- It falls to around eight per cent for newer 4-room flats

- It becomes a small difference of three per cent for 5-room flats

This is partly due to the quantum associated with bigger flats. For a million-dollar 5-room flat, for instance, an increase of $50,000 (i.e., $1 million to $1.05 million) would just be a five per cent premium; but for a $500,000 3-room flat, a $50,0000 increase would be a premium of 10 per cent.

So despite the smaller premium difference (percentage-wise), some buyers may not feel any real difference on their wallets.

Some HDB towns see a bigger premium difference than others

The exact reasons for this are hard to pinpoint, as they’re often a combination of factors. Strong amenities in a mature town can have a bigger impact on price, than just the newness of the flat. Notice that for some flat sizes in certain towns, the newer flats are actually cheaper. Examples are the 3-room flats in Bedok (6.8 per cent lower than their 10-year-old counterparts), and the 4-room flats in Yishun (4.5 per cent lower than older counterparts).

Ang Mo Kio is the most significant standout for 3-room flats. Here, we saw five-year-old flats with a 25.6 per cent premium over 10-year-old counterparts. When we asked realtors, some opined it might be due to the limited number of new flats in such a mature area. Younger flats, which combine limited lease decay with such a strong location, might be an easier sell.

In general though, we cannot generalise the phenomenon of five-year-old flats being higher in every HDB town. Aspiring upgraders, such as those who plan to “flip” their flat after five years, should remain aware of this.

Amenities and accessibility still take precedence over age

While most younger flats come at a premium, there doesn’t appear to be strong, consistent rules for this; not across flat sizes or HDB towns. This shows that other homebuyer concerns, such as public transport access, the availability of schools, childcare facilities, supermarkets, etc. still play a bigger role than how new a flat is. This may be especially true in mature estates, where it’s sometimes the oldest flats that have the best locations (e.g., Tanjong Pagar and Tiong Bahru).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

The CPF Usage rule for OLDER HDB flats is the unclever Govt Policy, shifter younger couples to buy only Newer flats in Mature estates. CPF started off for affordable housing, so there is no need of controlling cpf usage for older flats.

If they don’t remove this, when market down, it will only down for Older flats. Newer flats in Mature estates will keep raising.

What do you say?