High Park Residences vs Parc Botannia: A Data-Driven Look At Mega vs Mid-Sized Condo Performance

May 22, 2025

In this Stacked Pro breakdown:

Do Mega-Developments Offer Better Investment Returns?

Comparison

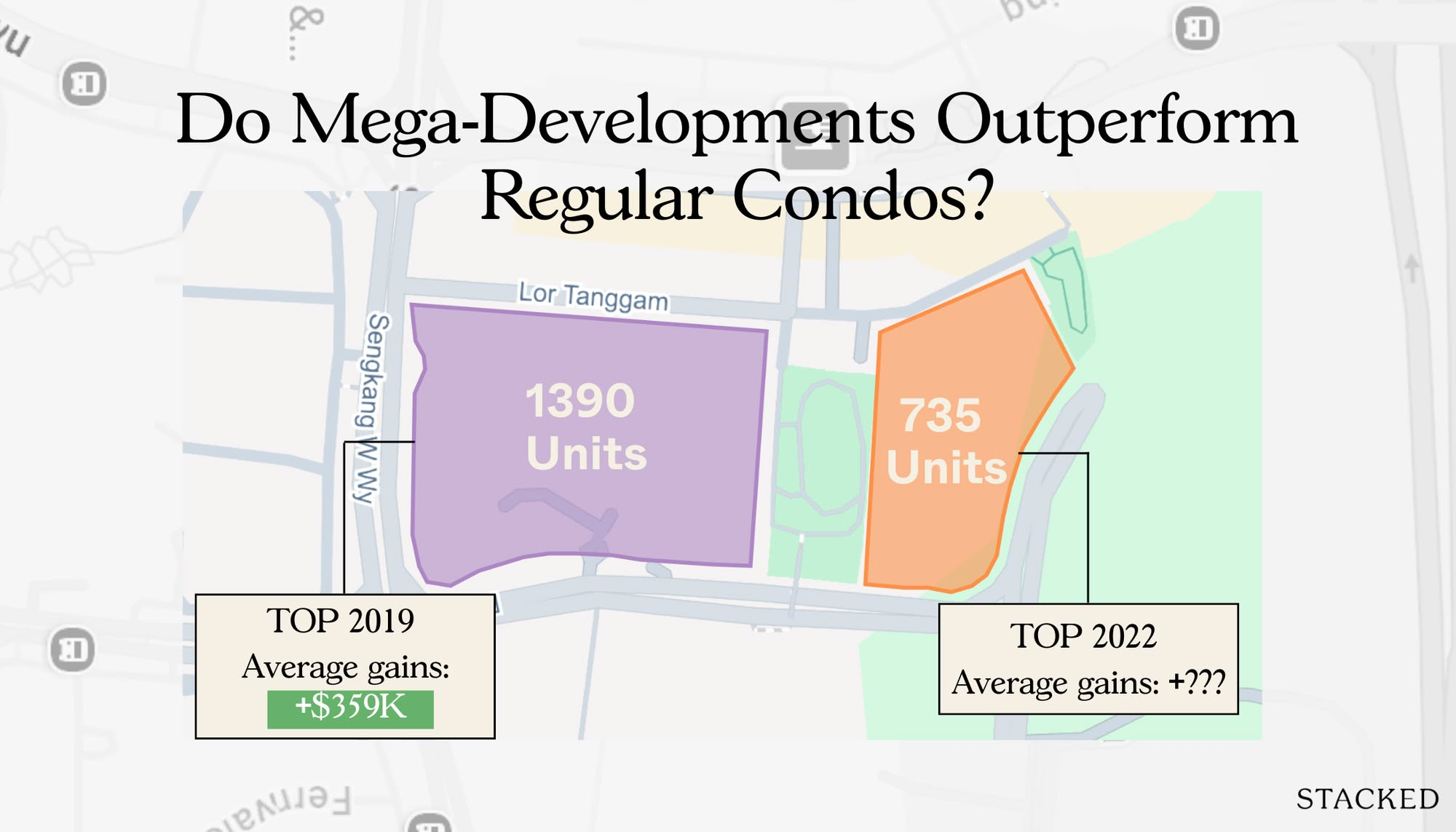

We analysed High Park Residences, a 1,390-unit mega-development, alongside the nearby 735-unit Parc Botannia to see which offered better returns.

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

On The Market

Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

New Launch Condo Reviews

River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

Singapore Property News

The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

February 22, 2026

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

February 21, 2026

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

February 17, 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

February 15, 2026

Latest Posts

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

February 20, 2026

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

February 20, 2026

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

February 19, 2026

Editor's Pick Happy Chinese New Year from Stacked

February 17, 2026

0 Comments