Can You Upgrade From An HDB To A $1.8M Condo In 2025? Here’s What It Takes

May 23, 2025

There was a time when $1.8 million could buy you a spacious 1,200+ sq. ft. condo, and you’d still have room left over for renovations and a nice dinner to celebrate. In 2025, however, that same amount may just barely get you a compact two-bedder, especially in a well-loved area like Clementi.

In this article, we’ll explore what it takes to upgrade to a $1.8 million private condo today, assuming you already own an HDB flat and have built some equity. Is it enough to take the leap?

Let’s Meet the Couple: A Typical Upgrader Scenario

Meet Ken and Rachel, both 36, and parents to a five-year-old daughter. They’ve been living in a 4-room HDB flat in Clementi for the past seven years. Now that their child is about to enter primary school, the couple is keen to stay in the neighbourhood, close to schools like Pei Tong, Clementi Primary, and eventually, NUS or NUS High.

Ken and Rachel are in a stronger financial position than when they first bought their flat. Today, both draw a monthly income of $7,500 each (or $15,000 combined), which puts them comfortably above the BTO income ceiling, making a private upgrade feel like the logical next step.

They’re eyeing ELTA, the new launch along Clementi Avenue 1 by MCL Land and CSC Land Group. It’s the first new condo in the area in years and seems ideal for their next phase of life.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

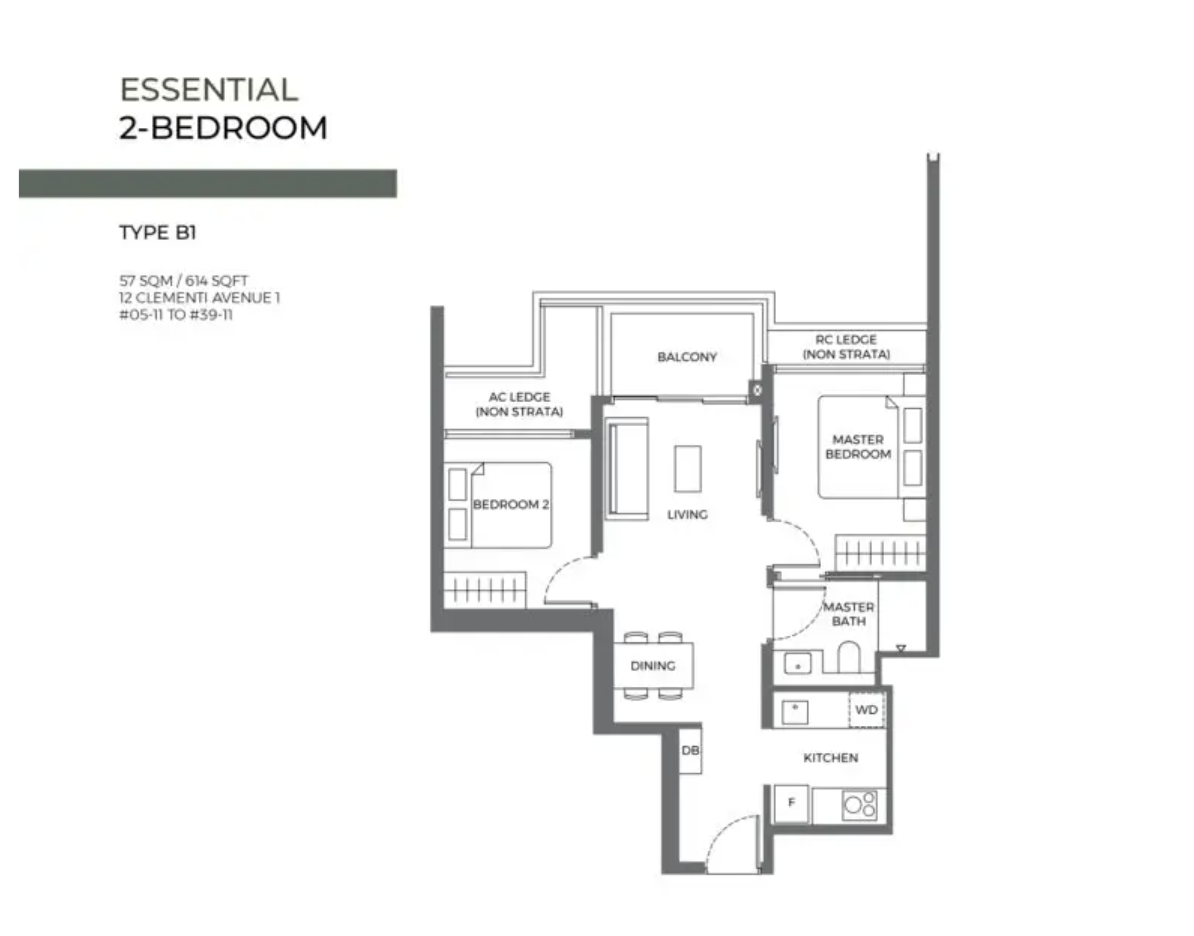

The Unit They’re Eyeing: 614 sq. ft. of New Beginnings

After visiting the showflat, Ken and Rachel settle on a compact but modern two-bedder that meets their basic needs. Based on an actual transaction at ELTA, here are the unit details:

- Unit: #34-11, 12 Clementi Ave 1

- Size: 614 sq. ft.

- Price: $1,698,000

- Price psf: $2,768

Add Buyer’s Stamp Duty (BSD) of roughly $54,120 and some legal fees (~$3,000), and the total cost comes to approximately $1.755 million—just under their $1.8 million ceiling.

What About Their Sale Proceeds?

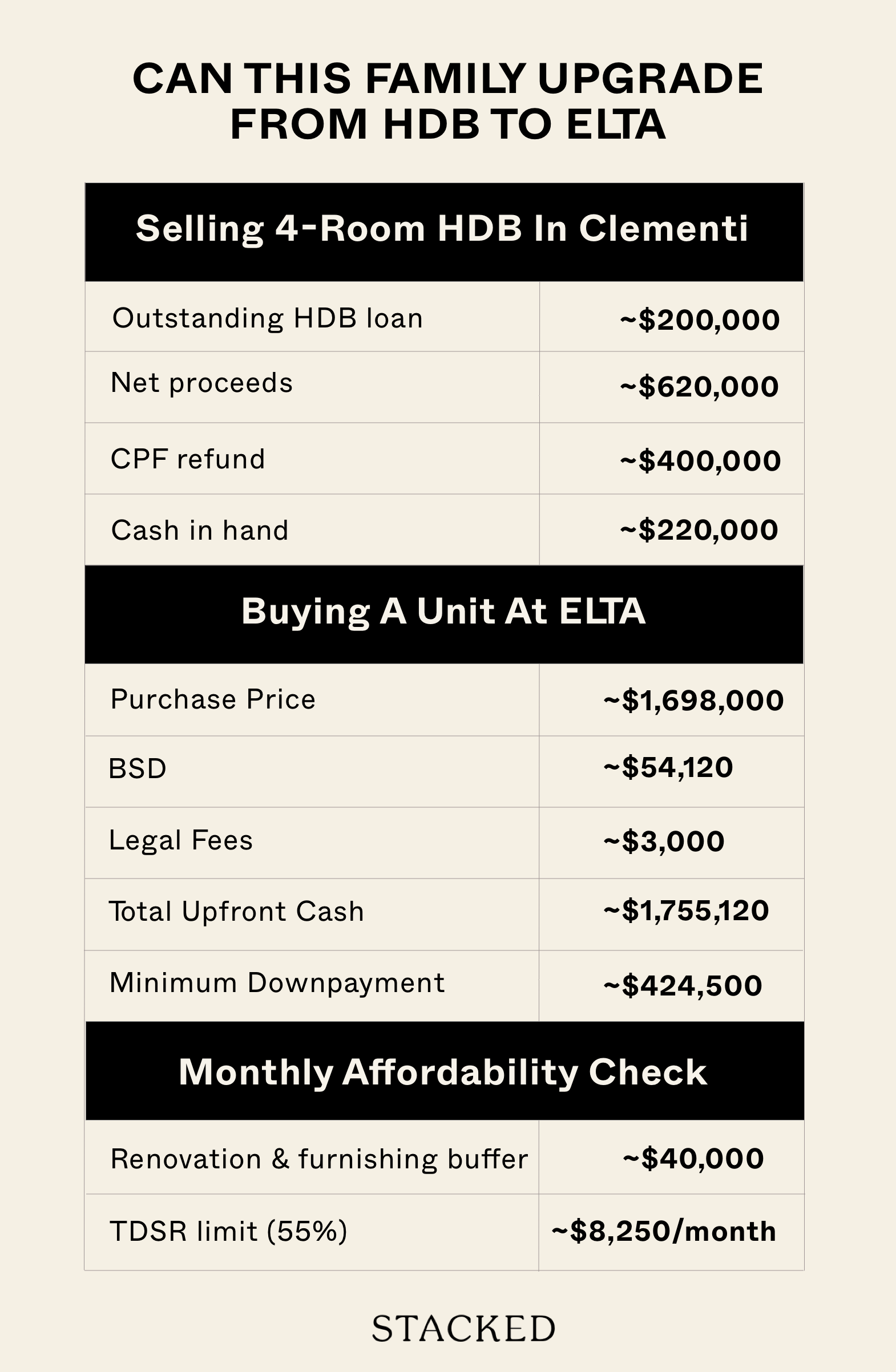

Let’s assume their Clementi 4-room flat sells for around $820,000. Here’s how that breaks down:

Outstanding HDB loan: ~$200,000

- Net proceeds: ~$620,000

- CPF refund: ~$400,000

- Cash in hand: ~$220,000

That $220,000 in cash becomes critical—it will help them meet the 5% minimum cash down payment required for a private property purchase.

ELTA Purchase Breakdown

- Purchase Price: $1,698,000

- BSD: ~$54,120

- Legal Fees: ~$3,000

- Total Upfront Cost: ~$1,755,120

- Minimum Downpayment (25%): $424,500

- Cash (5%): $84,900

- CPF/Cash (20%): $339,600

- Cash (5%): $84,900

Their $220,000 cash buffer more than covers the $84,900 initial cash requirement, and their refunded CPF can cover the remaining 20%.

Can Their Monthly Income Support the Loan?

Assuming a standard bank loan of 75%, the couple will borrow $1,273,500. At an interest rate of 4% over a 30-year tenure, monthly repayments would be around $6,080.

More from Stacked

New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

District 15 is one of the most recognisable names in the private property market. Mention it, and most Singaporeans will…

- Combined income: $15,000

- TDSR limit (55%): $8,250/month

They clear the Total Debt Servicing Ratio (TDSR) with room to spare, but it’s worth noting:

- That $6,080 monthly repayment is over 40% of their income—a bit tight, especially once you factor in other expenses or debts.

- It’s triple what they likely paid for their HDB loan, which might have been around $1,200 to $1,500 per month.

- Any additional loans (e.g., car or personal loans) could eat into their TDSR eligibility.

They qualify, but this is a serious step up in financial responsibility.

The True Cost: Not Just Purchase Price

- Total upfront: ~$481,620

- Renovation & furnishing buffer: ~$40,000

- Estimated total cash/CPF needed: ~$521,620

With a tight margin, even small surprises—like a slightly lower resale price or renovation overruns—could push them into discomfort.

Space Constraints and Future Limitations

Here’s where reality bites a little:

- They’re moving from a 960+ sq. ft. HDB flat to a 614 sq. ft. condo. That’s a major downgrade in space – especially for a young family with growing needs.

- At ELTA, a three-bedder (926 sq. ft.) recently went for $2.503 million – over $800,000 more than their two-bedder.

- Want more room? A 1,023 sq. ft. unit was sold for ~$2.85 million – a full $1.15 million leap from their current price point.

That means upgrading again in a few years, say, when their daughter becomes a teenager, could be extremely difficult without a major income boost or windfall. They might end up stuck in a home that no longer works for them.

Let’s Not Forget the Risk Factors

We’ve painted a relatively optimistic scenario, but real life often complicates things. Consider:

- Delays in HDB resale can reduce or stall proceeds.

- Renovation costs may balloon past the $40,000 budget.

- Job changes, maternity leave, or pay cuts can impact their ability to service the mortgage.

- Interest rate hikes will impact their monthly payment—unlike HDB loans, private mortgages tend to be floating rate.

Final Thoughts: It’s Doable, But Not for Everyone

Upgrading to a $1.8 million private condo on a $15,000 monthly income is possible, but it’s far from easy. It requires good financial discipline, little to no existing debt, and the emotional readiness to downsize your space while upsizing your mortgage.

Buyers in variable-income jobs, or those with significant other financial obligations, might want to consider Executive Condominiums (ECs) or larger resale flats as more comfortable stepping stones.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I upgrade from an HDB to a condo worth $1.8 million in 2025?

What are the main costs involved in upgrading from an HDB to a $1.8 million condo?

Will my monthly income support a $1.8 million condo loan?

How much cash or CPF do I need to upgrade to a condo in this price range?

What are the space and future considerations when upgrading to a $1.8 million condo?

What risks should I be aware of when upgrading to a private condo?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

2 Comments

Are these upgraders for real? The slightest hiccup in their precarious financial situation will upend everything.Furthermore they will live a life not different from indentured servants being slaves to what is essentially slightly larger than a shoebox. Don’t even get me started on their quality of life especially y after sacrificing so much they definitely will need a larger space. A case of a bird in the hand fable?

i can never understand the logic behind downgrading so much in space area just for the potential capital appreciation of private housing.