For Freehold Condos At Stevens, Will Glyndebourne Or The Equatorial Be A Better Option?

November 25, 2021

Hi Stacked Homes,

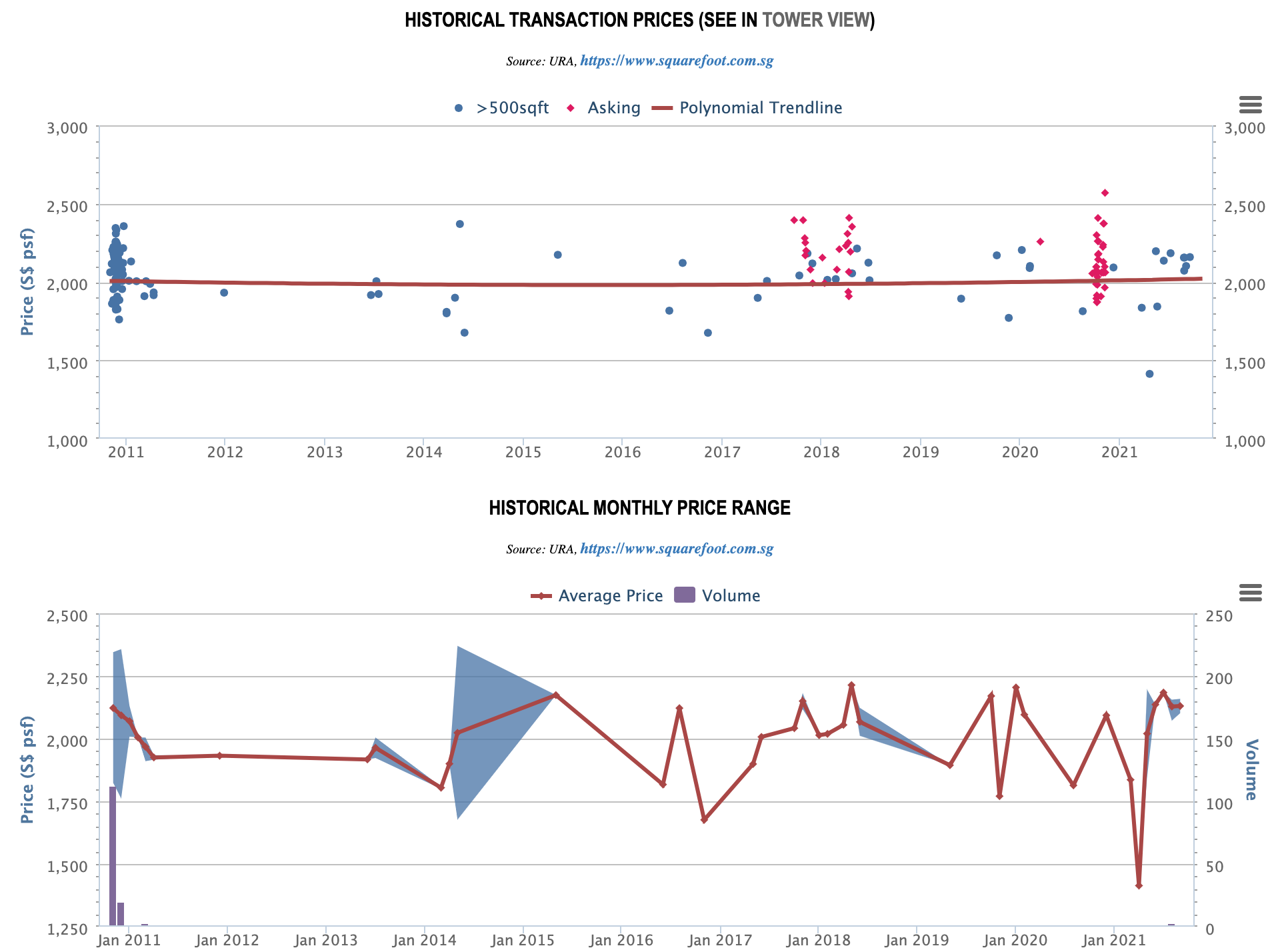

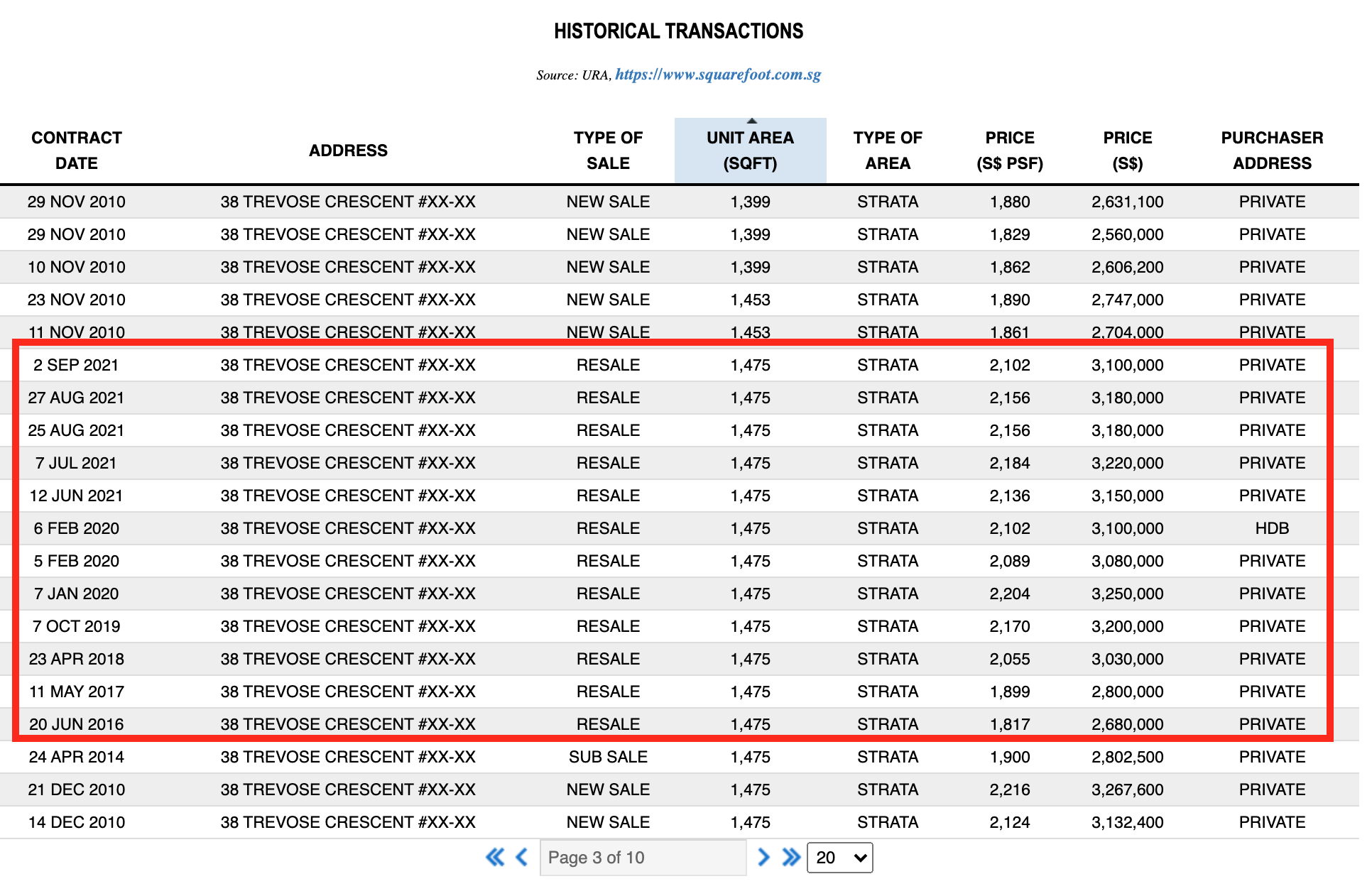

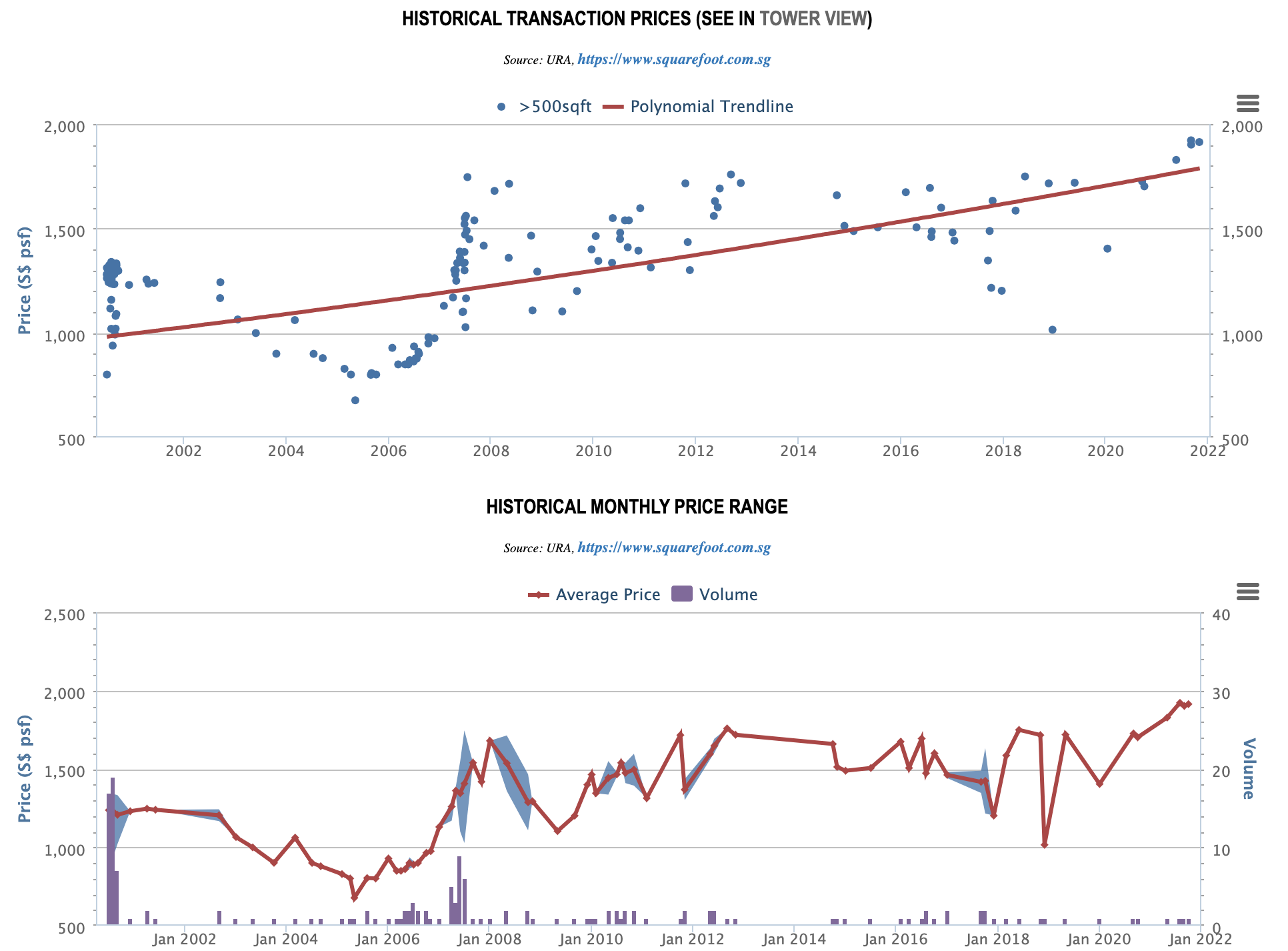

Wanted to get your views on freehold condos around Stevens. I noticed that many of those that are launched around 2010 or so (during the recovery period I assume) have been loss-making, such as Glyndebourne, while those that are sold earlier made money, such as The Equatorial.

I am interested in that area as I believe the value should hold up from here on given:

- near good schools (SCGS primary is within 1km)

- near Stevens MRT which will be an interchange

- near main road (hence there are buses for people who don’t drive or have kids who will take public transport)

- near supermarket (at Alocassia)

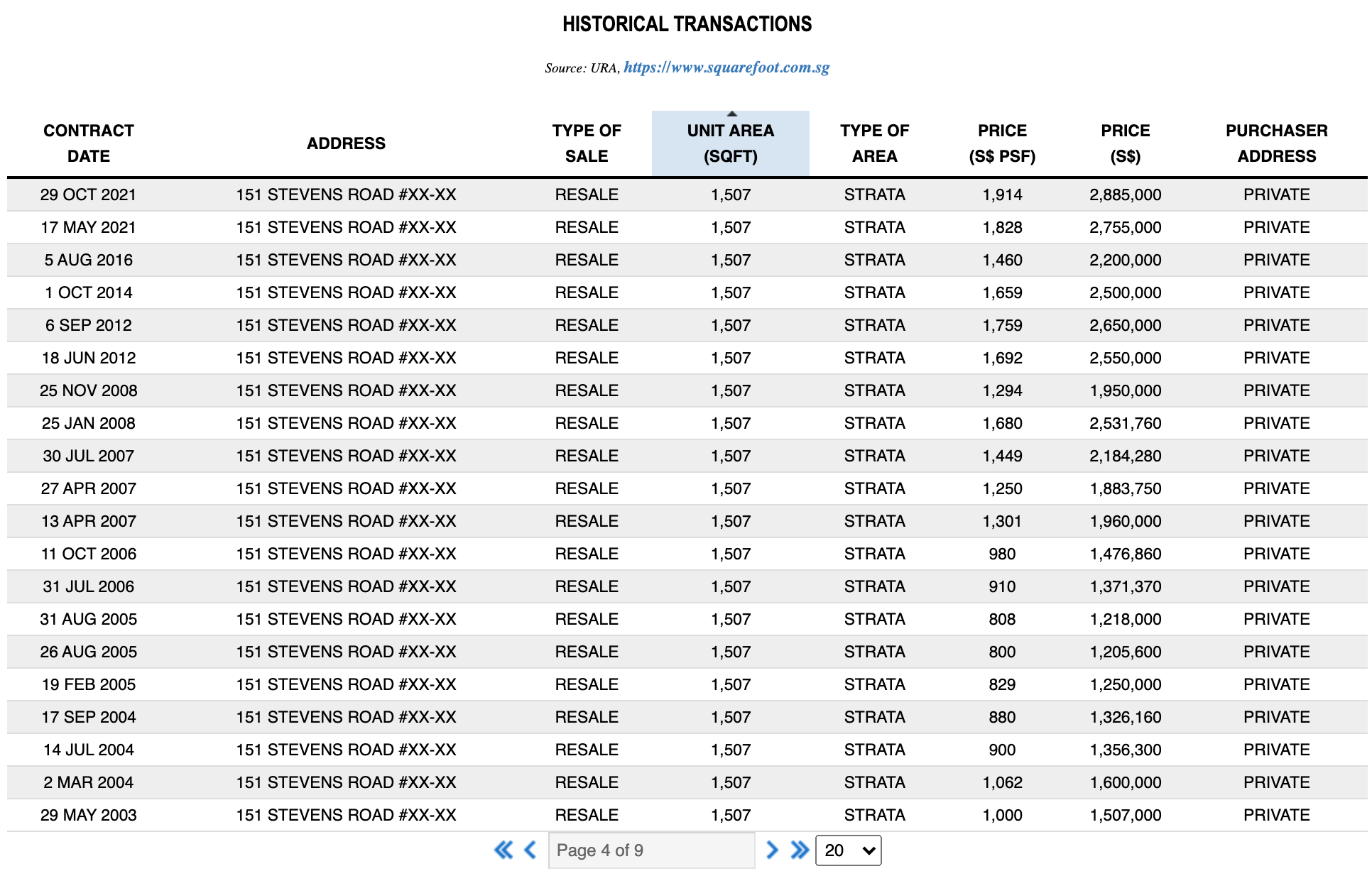

If we were to compare 3BR at Glyndebourne at say $2,100 psf and 3BR at The Equatorial at say $1,800 psf (or high $1,700s), which would you think is a better option? Total quantum for Glyndebourne would be around $3.1m (1,475sqft) and Equatorial would be around $2.7m (1,507sqft). Glyndebourne owner would be selling at a loss from the price he bought in 2010 while Equatorial one would be making a good gain as they bought it way earlier.

I’ve also heard many people not liking both of these projects because they are near the main road so it’s noisy and dusty. Is this a big concern?

Hey there,

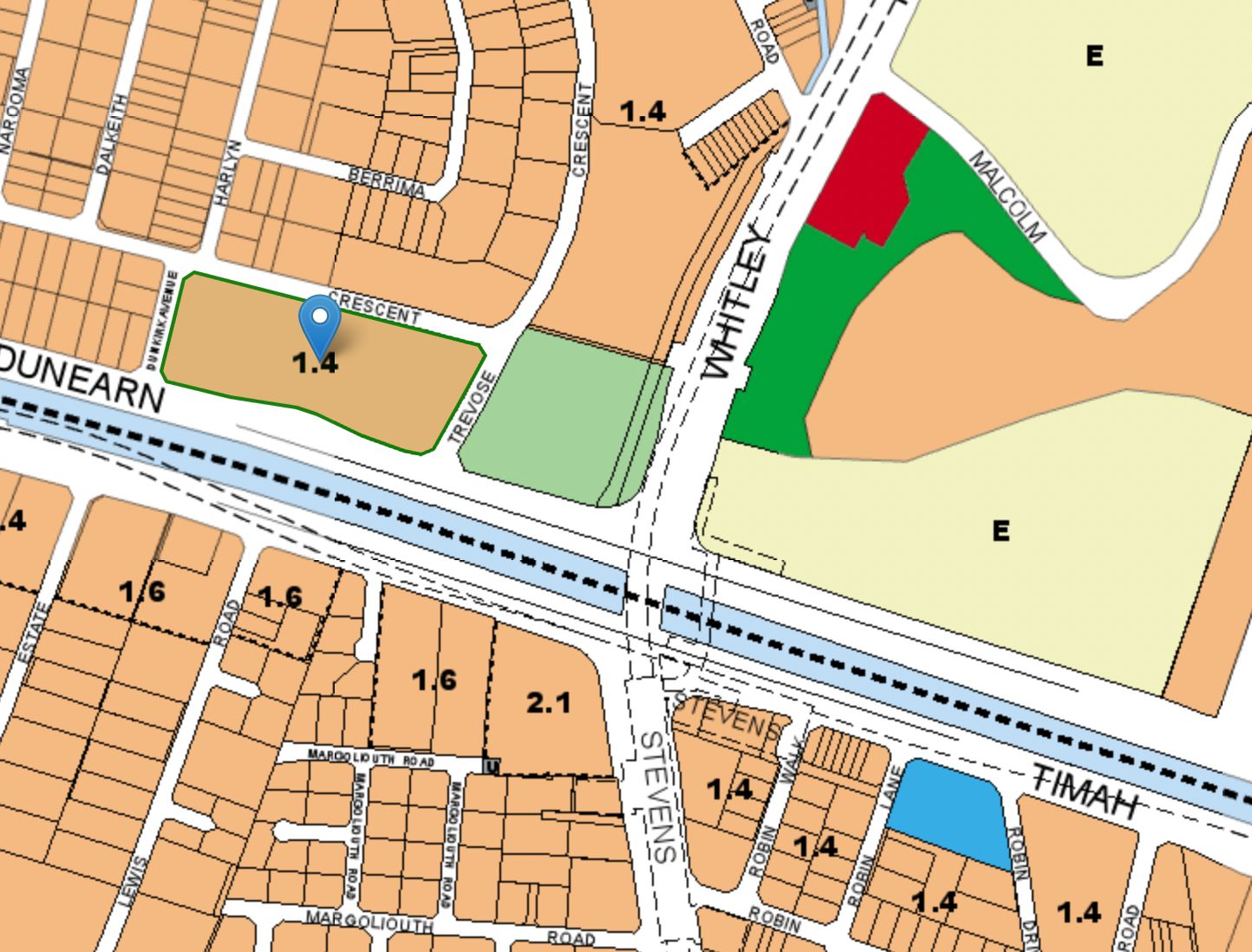

To be fair, there has not been much change to the Master Plan for the Stevens locality, except for the upcoming TEL line which will make Stevens MRT an interchange.

Nevertheless, prices have been stable for most of the older developments over the years.

The area is filled with similar profile condos; Freehold, small density developments within proximity to good schools and the MRT station. The Stevens area would appeal to an own stay profile especially for the address and proximity to the city centre.

We do understand some of your concerns on stagnation in prices for some of the resale development; well, some of the developments were launched during the era when property prices were on an uptrend and the Downtown MRT (DTL) was factored in during the initial launch.

We actually did a case study on Jardin recently; a freehold development launched during the same period as Glyndebourne.

Similarly, DTL was factored in during the initial launch and today it is experiencing more unprofitable than profitable transactions.

You can read up about the case Jardin and Gardenvista case study.

Here are some of our thoughts on the 2 developments that you shortlisted.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Glyndebourne

Launched back in 2010, during the construction of DTL Stevens station. With only 150 units, the freehold Glyndebourne is a small-density development with decent facilities. However, prices have remained flat since the launch. This is likely due to the high launch price and the lack of newer development in the locality to prop up the price in the vicinity. On another note, so far there have been 11 units transacted this year at $21xxpsf on average as compared to 5 units for the whole of last year; indicating demand.

Alternatively, you may consider stacks facing Trevose Crescent; away from the main road noise. This may be a good alternative for privacy and minimal road noise as compared to flyover and bus stop facing stacks.

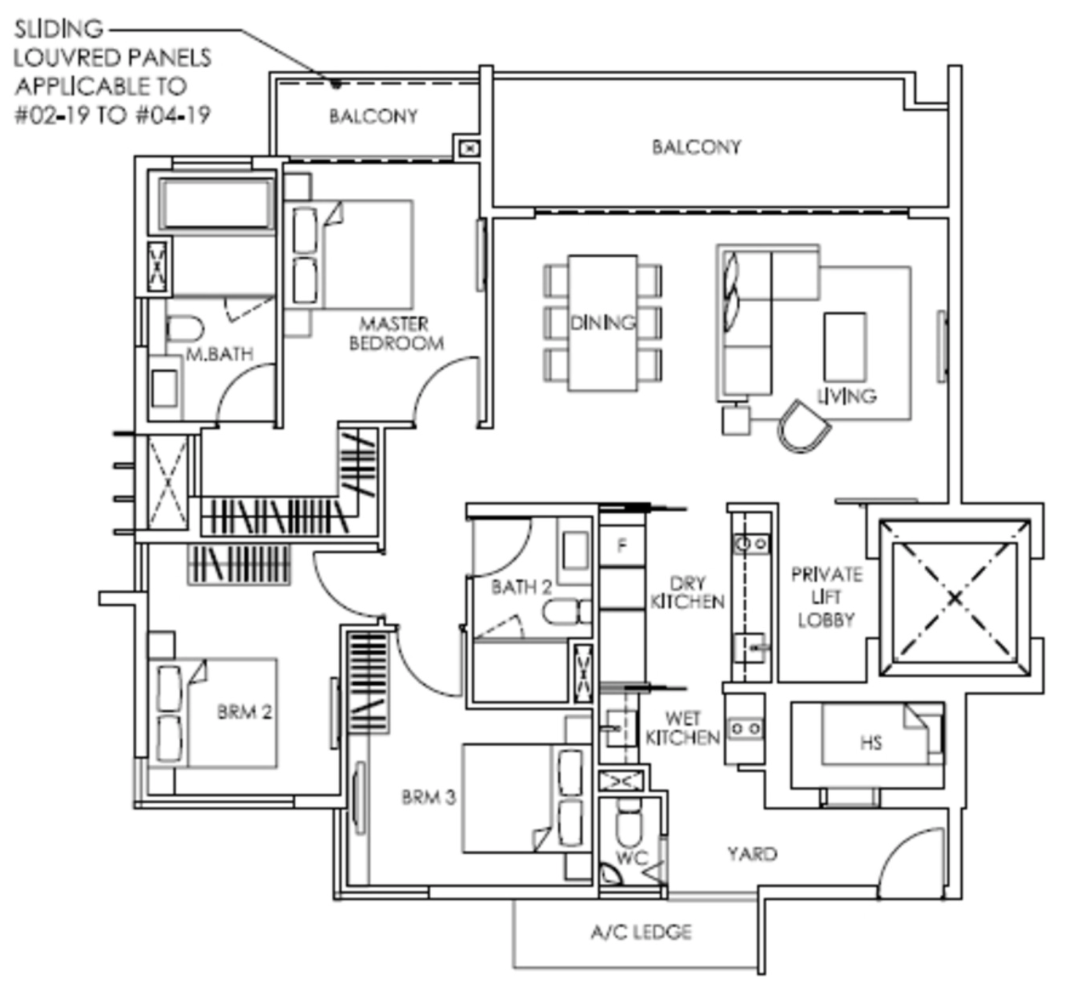

Floor plan analysis:

At 1,475 sqft, the 3 bedder unit comes in spacious and efficient with the provision of private lift and good size bedrooms. Great size kitchen with separate wet & dry kitchen and proper yard area which is great for laundry. However, it does come with an oversized balcony which takes up space.

The Equatorial

Located in a major cross junction with a flyover, the noise would be an issue here.

Equatorial is an older resale that offers small-density living with relatively decent facilities. TOP in 2001, prices have risen significantly over the years fuelled with the opening of DTL Stevens station. With only 4 units sold this year at $1,8xx psf, demand is on the lower side. This is likely due to the fact that it is an older resale which may not be as appealing as compared to the newer condos. Maintenance may be an issue in years to come as well, something to be mindful of for owners. On another note, quantum is quite affordable for a spacious 3 bedder unit, especially for the location.

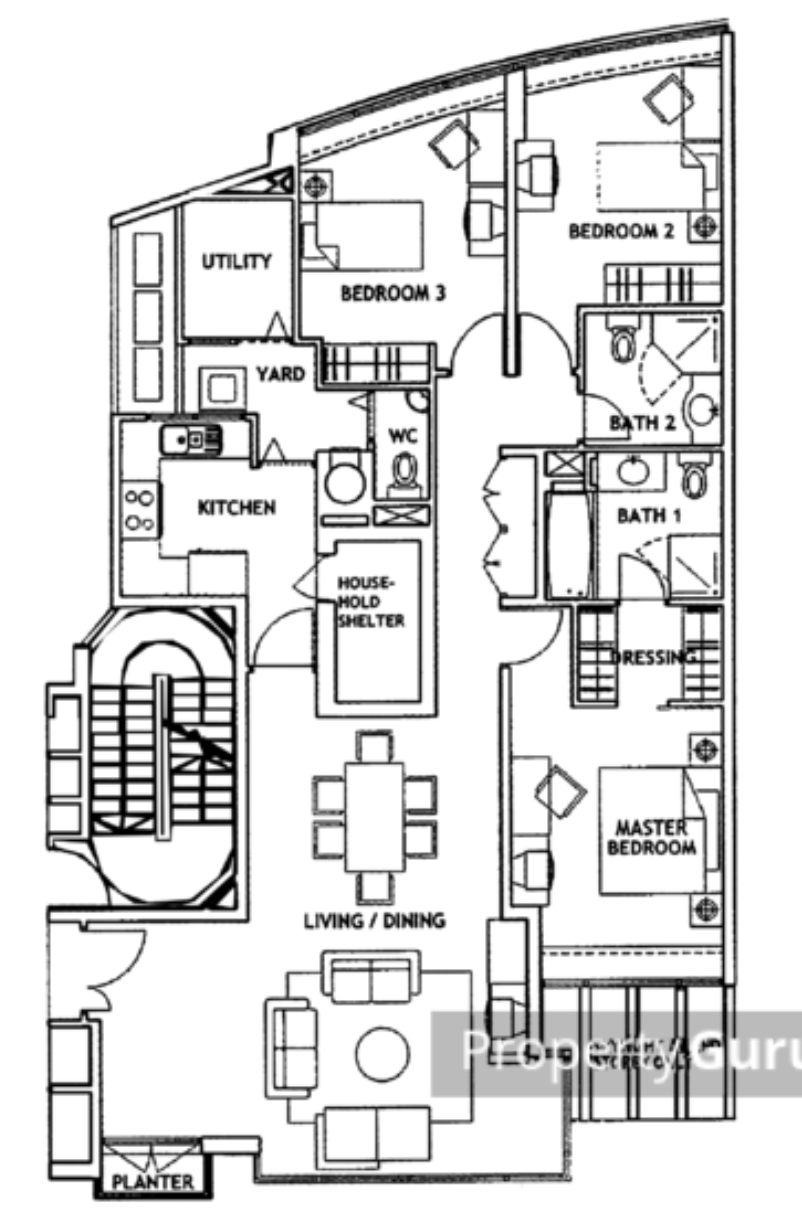

Floor plan analysis:

At 1,507 sqft, the 3 bedder unit is spacious but it lacks the private lift appeal and balcony space area; quite a bummer if you are one that values some outdoor space area. Good size living, dining, and bedroom area though the common bedrooms come in quite irregular in shape. It also comes with a separate utility area for helpers and an in-unit household shelter which can be used for storage. The kitchen area comes in tight but it does come with a proper yard area for laundry.

Conclusion:

Both developments have their fair share of pros and cons. As both are freehold entities, value retention is certain especially in the long run. Glyndebourne for newer and better facilities; slightly away from Stevens MRT station while Equatorial for affordable quantum and closer to Steven MRT station. We do hope that the pointers above will help you in your decision.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments