Will New Upfront Property Agent Fees Scare Homebuyers Away?

November 19, 2023

We have the solution to the co-broking problem (because hopeless optimism is still a kind of solution)

16 property agencies have signed a Memorandum Of Understanding, on how to resolve co-broking disputes.

If you’re not sure why this is a big issue, let’s put it this way:

By convention (and not by law), buyers in Singapore generally don’t pay their agent (it’s a different case for HDB transactions). When you buy a property, the seller’s agent usually splits their commission with your agent; so the seller pays all, and you pay nothing. For example:

You engage a property agent, and buy a condo unit for $1.5 million. The usual commission is two per cent, or $30,000. The $30,000 is paid by the seller, and the seller’s agent and your agent split this amount – say $15,000 each (but this could be different depending on the market conditions). You, as the buyer, pay no commissions.

But there’s a whole bunch of problems that arise from this, such as:

- The seller’s agent refuses to pick up the phone, when a buyer’s agent calls. Because if they sell directly to a buyer, they get to keep the whole commission. In the above example, if you spent the money to market the listing, take cool photos, conduct viewings, etc., would you want to pay some other guy $15,000? In any case, an inexperienced buyer might lose out here, and end up paying more than they should if faced with a sly seller agent.

- Such scenarios above mean that there are many cases of seller agents not presenting all offers to their seller, because they’ve picked and chosen buyers based on when they can get the highest commissions.

- Behind the scenes, there have been ugly cases of agents ending up in lawsuits with each other. I’ve heard of one situation where the buyer’s agent allegedly agreed to take a lesser cut, but then turned around and sued the seller’s agent for a full 50-50 split of the commission.

There are no actual regulations about these co-broking issues, so the deals are less slick and professional, and more like that Hungry Hungry Hippo game you played as a kid. It gets wild and ends up in too much shouting, is my point.

But now, with the new MOU, it’s suggested that property agents:

- Go through arbitration and mediation schemes, run in partnership with the Law Society of Singapore

- Agents should agree on how the commission is shared before engaging with clients

- Agents must prepare a co-broking agreement if they’re going to share the commission

Now I hate to say this, but as effectiveness goes…

First off, the current system involves a lot of arbitration and mediation schemes already. I don’t know how every agent solves their disputes, but I’m certain most of them aren’t thinking MMA cage matches or knife fights. If their respective agencies fail to help, agents are already turning to other forms of mediation. So this is a bit of a nothingburger.

Then there’s having the agents agree on the commissions beforehand. Look, any agent with a millilitre of common sense will already discuss the shared commission beforehand. Have you seen the paperwork for even one transaction? I once printed all of it, and I still think I caused the intern’s hernia by having him bring it over. No one is doing all that work without certainty of how much they’ll get paid.

The real problem behind the MOU though, is…well it’s an MOU.

More from Stacked

Will Rich Foreigners Still Want Your Prime District Condo In 2022?

As of December 2021, there’s been an ongoing debate on whether Singapore property is still attractive to foreigners. Some believe…

We still don’t have any actual regulations and these are just guidelines. And as long as they remain that way, the solution doesn’t amount to more than sunshine and optimism.

In the meantime, buyers and sellers are at a real risk of being caught in the middle, with agents who may have agendas. And even if their own agent is being ethical, the behaviour of a less professional agent will affect them (e.g., the seller’s agent refusing to co-broke, thus cutting off the buyers from making offers)

The one star that I do give is for acknowledging the issue

The truth is, this is a hard problem to fix. It’s hard to see the current situation changing to the same as they do in HDB transactions, as it has been this way for so long. While it’s better if an agent’s work can move towards a fee-based transaction to account for their time (like how you pay lawyers), most buyers aren’t prepared to pay for that upfront. (We’ve detailed out what it’s like here).

And to be frank, most agencies are unlikely to want such a situation to happen – they would all overall make less than what they do with the current system.

That said, it’s still good to see that so many agencies are out in the open about this, and recognising it as a real issue. That’s the first step toward fixing it, and it’s been a long time coming. But as far as baby steps go, this one barely even made it outside the crib. Let’s take it another step further, and soon.

Weekly Sales Roundup (06 November – 12 November)

Top 5 Most Expensive New Sales (By Project)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | TENURE |

| J’DEN | $3,920,000 | 1485 | $2,639 | 99 years |

| THE CONTINUUM | $3,587,000 | 1238 | $2,898 | FH |

| THE RESERVE RESIDENCES | $3,462,487 | 1475 | $2,348 | 99 yrs (2021) |

| MIDTOWN BAY | $3,427,380 | 1033 | $3,317 | 99 yrs (2018) |

| GRAND DUNMAN | $3,174,000 | 1292 | $2,457 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | TENURE |

| HILLOCK GREEN | $1,085,000 | 517 | $2,100 | 99 years |

| J’DEN | $1,206,000 | 527 | $2,287 | 99 years |

| ORCHARD SOPHIA | $1,327,000 | 474 | $2,802 | FH |

| THE ARDEN | $1,367,000 | 818 | $1,671 | 99 yrs (1969) |

| PINETREE HILL | $1,373,000 | 538 | $2,551 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | TENURE |

| SILVERSEA | $5,000,000 | 2540 | $1,968 | 99 yrs (2007) |

| THE WATERSIDE | $4,150,000 | 2411 | $1,721 | FH |

| GRAND DUCHESS AT ST PATRICK’S | $4,030,000 | 2508 | $1,607 | FH |

| THE BEAUMONT | $3,600,000 | 1475 | $2,441 | FH |

| THE ANCHORAGE | $3,580,000 | 1798 | $1,992 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | TENURE |

| LE REGAL | $618,000 | 420 | $1,472 | FH |

| STRATUM | $640,000 | 474 | $1,351 | 99 yrs (2012) |

| SKYSUITES17 | $650,000 | 355 | $1,830 | FH |

| SEASTRAND | $755,000 | 592 | $1,275 | 99 yrs (2011) |

| THE GARDEN RESIDENCES | $770,000 | 452 | $1,703 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | RETURNS | HOLDING PERIOD |

| BOTANIC GARDENS VIEW | $3,550,000 | 1410 | $2,518 | $2,670,000 | 20 Years |

| THE ANCHORAGE | $3,580,000 | 1798 | $1,992 | $2,500,000 | 17 Years |

| HAZEL PARK CONDOMINIUM | $2,275,000 | 1335 | $1,704 | $1,539,000 | 16 Years |

| COSTA DEL SOL | $2,300,000 | 1561 | $1,474 | $1,371,000 | 17 Years |

| OLEANAS RESIDENCE | $2,400,000 | 1141 | $2,103 | $1,270,000 | 26 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE $ | AREA (SQFT) | PSF | RETURNS | HOLDING PERIOD |

| SILVERSEA | $5,000,000 | 2540 | $1,968 | -$390,000 | 11 Years |

| NOVENA REGENCY | $880,000 | 495 | $1,777 | -$281,000 | 10 Years |

| THE CREST | $2,450,000 | 1281 | $1,913 | -$223,000 | 6 Years |

| THE LAURELS | $2,740,000 | 1001 | $2,737 | -$191,929 | 14 Years |

| SOLEIL @ SINARAN | $1,100,000 | 581 | $1,892 | -$150,000 | 10 Years |

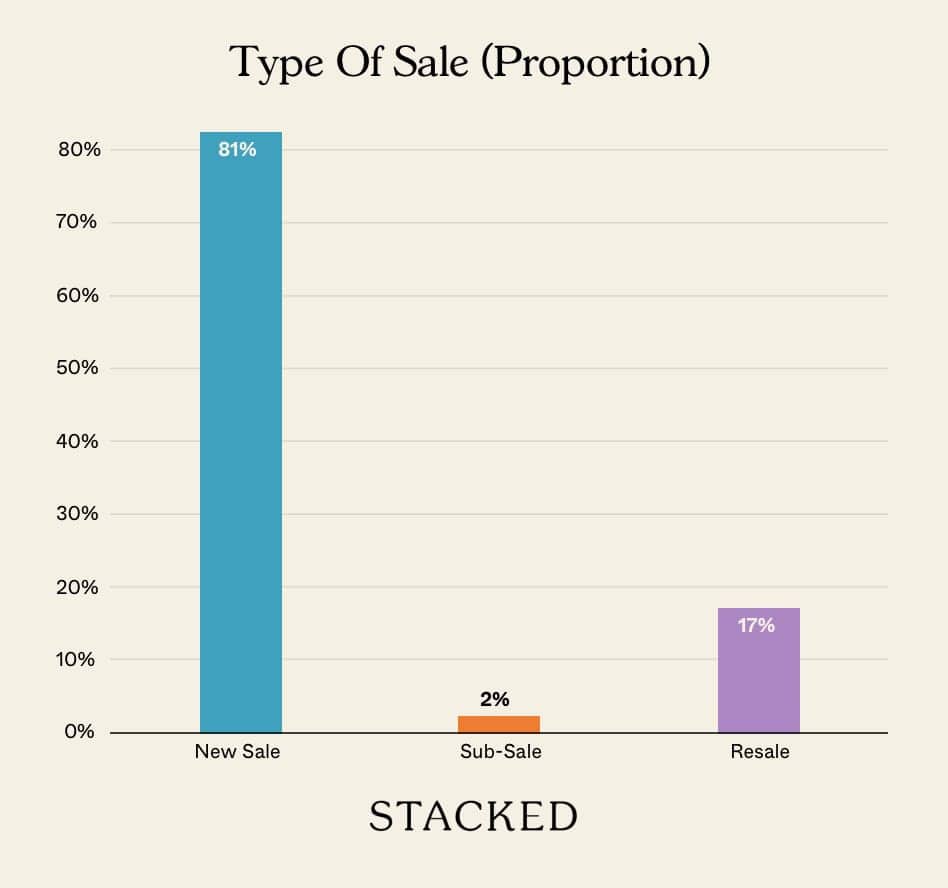

Transaction Breakdown

Meanwhile, in other property news…

- Check out the most expensive houses in Singapore, and a little bit of the history behind them.

- Ever wanted to live right next door to your parents? A family managed to do just that, and they have some useful advice.

- A former Man U footballer is selling UK property in Singapore. Is it worth it? Check out some details here (and no, we’re not getting paid if you buy anything!)

- Check out this 5-room flat designed for rest and play, in the heart of Bidadari.

For news and insights into the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the new rules for property agent fees in Singapore?

Will the new upfront agent fees affect homebuyers in Singapore?

Are property agents in Singapore now required to have formal agreements on commissions?

How effective are the recent changes in resolving co-broking disputes?

What problems exist with the current property agent commission system in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Singapore Property News Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

Singapore Property News 19 Pre-War Bungalows At Adam Park Just Went Up For Tender — But There’s A Catch

Latest Posts

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

0 Comments