Will J Gateway, Hillion Residences, Park Place Residences Or Highline Residences Be A Better Investment For $1.2 Million?

July 15, 2022

Hello Stacked Homes Team!

I’ve enjoyed reading your articles for a couple of years now and naturally thought of the team as I am looking to purchase my 1st property for investment. I was initially looking at getting a new launch unit, but looking at the prices of new launches these days, I thought there could be more value in looking at resale units. However that’s where the headache comes in because there’s just so many resale developments to choose from!

I am not too particular about location since this is not for own stay but am looking for something that fits the following criteria:

- Budget of $1.2mil

- Tenant longevity with decent rental yield (able to cover mortgage and other fees) with exit by 2030 in mind

- Some capital appreciation and resaleability with exit by 2030 in mind

I am looking at 2BR units at J Gateway or Hillion Residences just because those are more familiar areas (as I mentioned earlier I am not particular about location but there are just so many options around that it just seems easier starting from areas I am more familiar with!). Rental yield seems decent enough but I am not so sure about capital appreciation. Other options I am considering are a 1BR unit at Highline Residences or Park Place Residences.

I previously was also considering older but bigger 3BR units since an increase in psf prices for bigger units means a bigger absolute gain (I am aware the reverse is true as well – a drop in psf would mean a bigger absolute loss). That is why I was also looking at older developments like May Springs (again, in a familiar area) which seems to have decent rentability due to its proximity to amenities and transport. However, due to its age, I had concerns on lease decay and resaleability. There seems to also be rumours of en-bloc possibility which can be a good or bad thing depending on what timeline it happens (if it happens), although it does feel unlikely due to the huge land size. Hence overall it felt like this would be riskier than the newer developments above.

Would love to hear your thoughts what will make a better choice for investment, or if there is any other development you would recommend!

Thanks much!

Hey there,

Thanks for sending in your question.

To be honest, if it’s for investment perhaps you shouldn’t discount new launches altogether because prices are seemingly high, as it’s really more of a question of which is the right property for your timeline. Depending on the launch, your luck with the ballot, and your choice of unit – it could also make more sense as you can take advantage of a combination of early pricing, and certain discrepancies in the developer’s pricing. With the progressive payment schedule as well, this could be an additional positive factor to think about.

Resale properties can be a lot trickier to find as you never quite know when a good unit will come online (so you have to be diligent in searching), and with other factors like the amount of renovation done, etc this could also play a part in your eventual decision.

We’d also like to caveat the yield being enough to cover the mortgage and other fees (you can read more on the positive cash-flow properties here), it probably isn’t as easy to find as back in the day. Perhaps with the rental prices at where they are at today, this could have changed, but don’t take this as a given.

But trying to identify a suitable investment property is not really possible at this point without knowing the full picture. So since you have already chosen a few, we’ll be focusing on the hypothetical gains from rent based on current transactions as well as their capital appreciation potential.

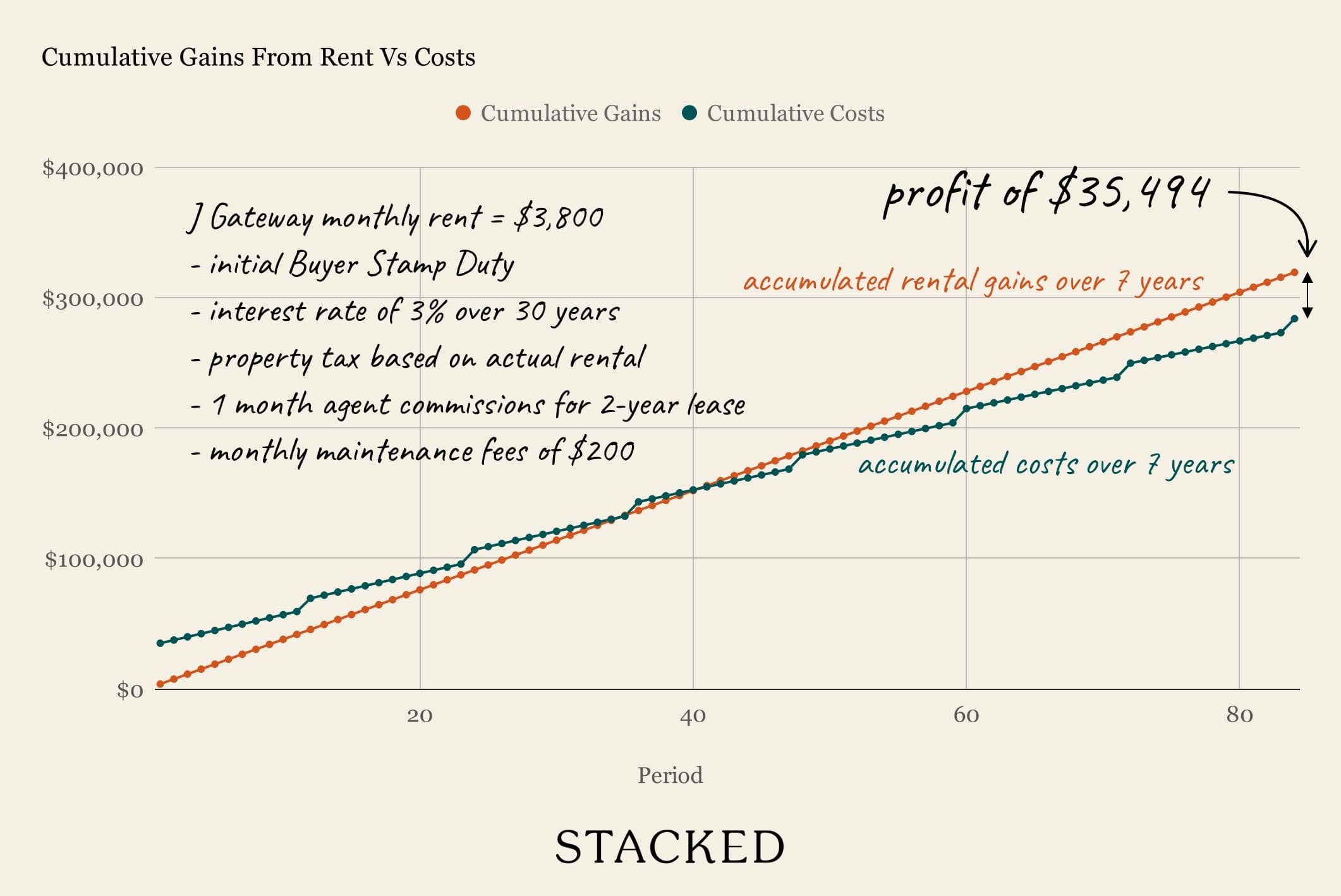

First, let’s consider what your rental returns could look like using J Gateway and Hillion Residences as an example.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Rental returns with J Gateway

J Gateway is a 99-year leasehold development with a lease start year of 2012, making it 10 years old in terms of tenure. The development has 738 units and has pretty decent facilities, although there’s no tennis court. Its main draw to tenants is the proximity to Westgate shopping mall, the office (assuming the tenant works there), and its proximity to Jurong East MRT (just 3-minute away by foot). Views on both sides of the development are also attractive since it’s more or less unblocked on both ends.

Here are some of the recent transactions of the 2-bedroom at J Gateway:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date | Address |

| J GATEWAY | $1,200,000 | 678 | $1,770 | 05 Jan 2022 | 6 GATEWAY DRIVE #13 |

| J GATEWAY | $1,208,000 | 678 | $1,781 | 21 Feb 2022 | 6 GATEWAY DRIVE #08 |

| J GATEWAY | $1,274,000 | 678 | $1,879 | 01 Mar 2022 | 2 GATEWAY DRIVE #31 |

| J GATEWAY | $1,112,000 | 603 | $1,845 | 15 Mar 2022 | 2 GATEWAY DRIVE #12 |

| J GATEWAY | $900,000 | 624 | $1,442 | 07 Apr 2022 | 6 GATEWAY DRIVE #01 |

| J GATEWAY | $1,298,000 | 678 | $1,914 | 04 May 2022 | 2 GATEWAY DRIVE #22 |

| J GATEWAY | $1,145,000 | 603 | $1,900 | 11 May 2022 | 2 GATEWAY DRIVE #17 |

| J GATEWAY | $1,260,000 | 689 | $1,829 | 02 Jun 2022 | 2 GATEWAY DRIVE #19 |

| J GATEWAY | $1,230,000 | 678 | $1,814 | 03 Jun 2022 | 2 GATEWAY DRIVE #14 |

The smaller 2-bedroom unit has just 1 bathroom. These would come under your budget of $1.2 million while the larger 2-bedroom units that come with 2 bathrooms are at or slightly higher than your budget.

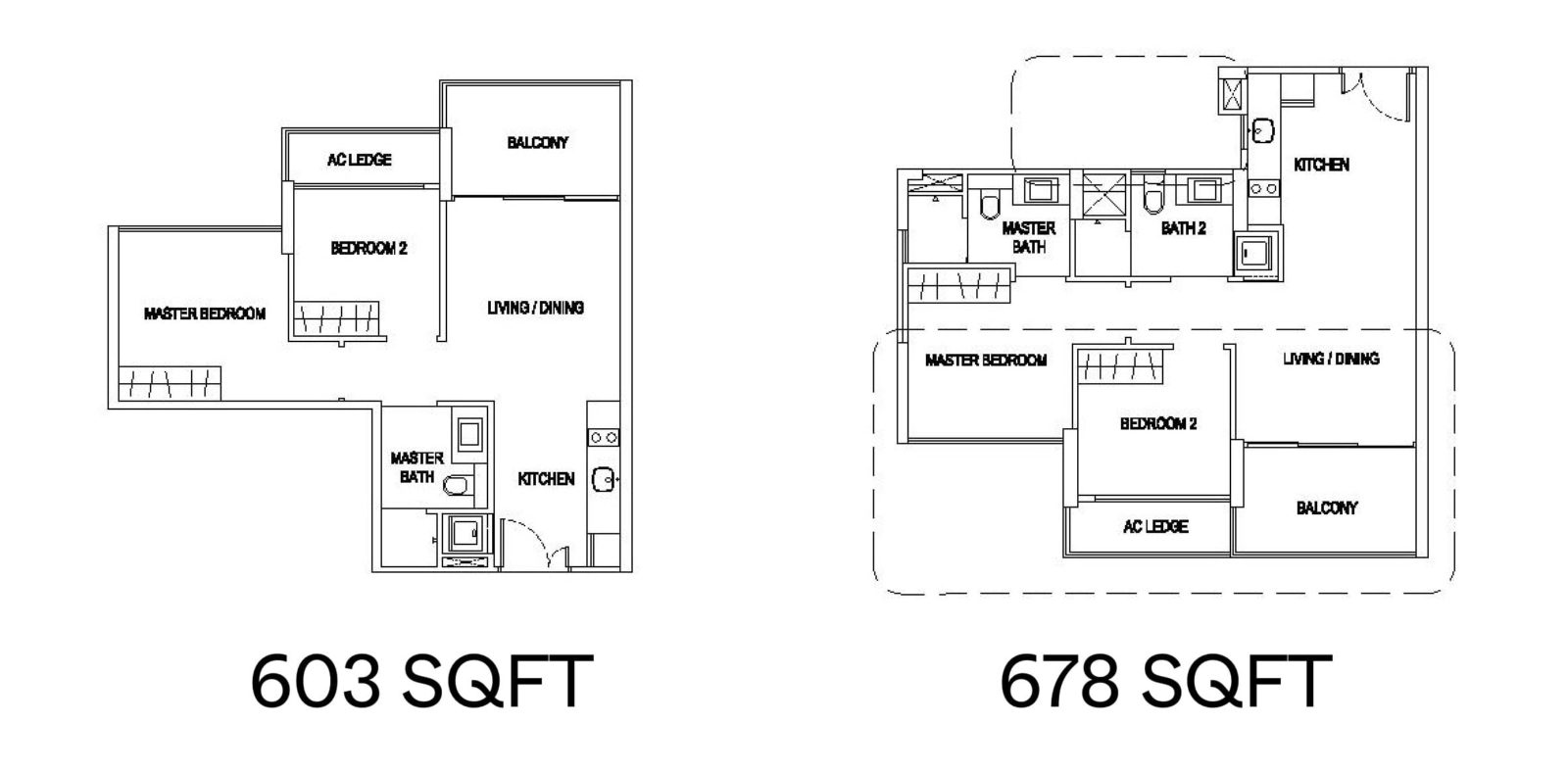

Here’s a quick look at their floor plans:

These are the 2 Bedroom Suites – not the SOHO edition. We would advise against buying a SOHO unit if you are thinking that rental rates would be higher as these are more of a lifestyle purchase (which honestly fell out of trend). Not many tenants are willing to climb and down stairs each day.

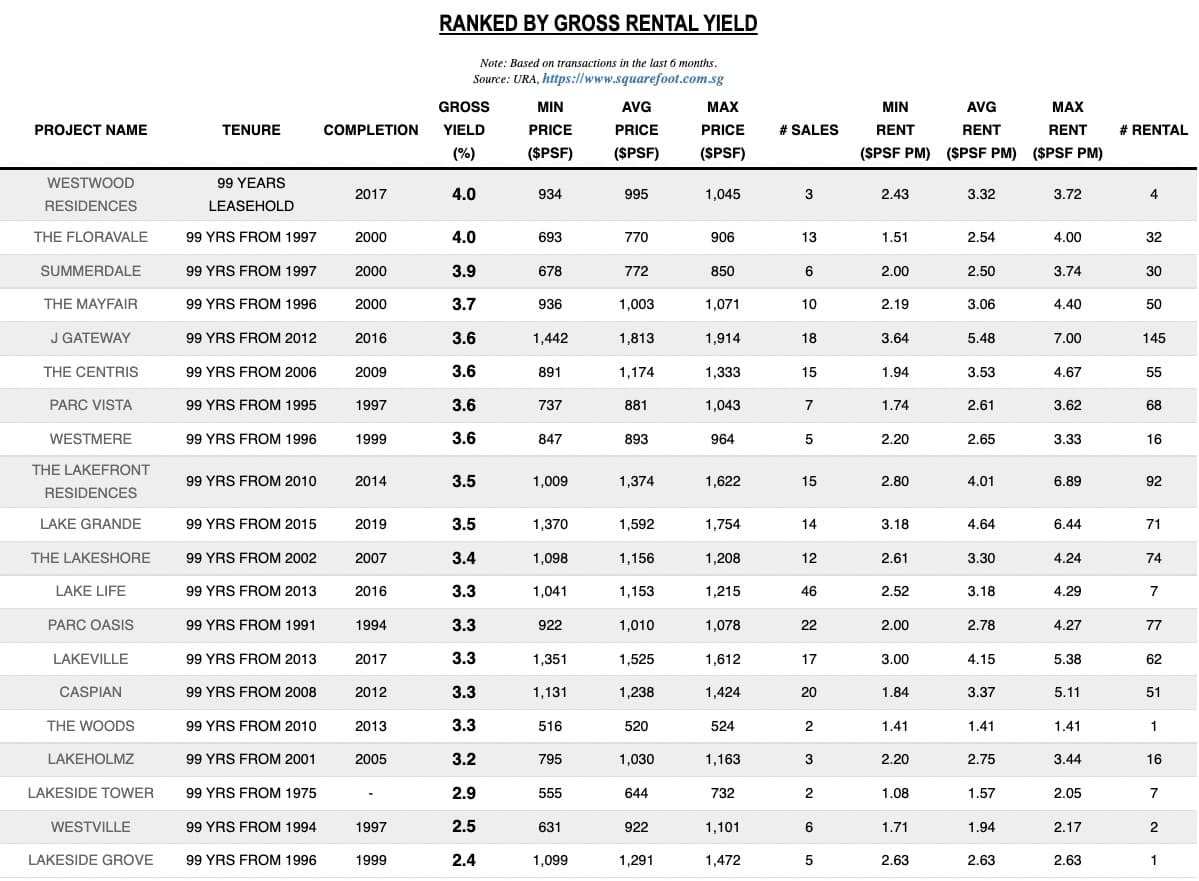

According to Squarefoot Research, the implied rental yield on this property is 3.63% based on the past 6 month’s transactions.

Here are the recent rental contracts for 2 bedroom units at J Gateway in the past 2 months:

| Project Name | No of Bedroom | Monthly Rent ($) | Floor Area (SQFT) | Lease Commencement Date |

| J GATEWAY | 2 | $3,800 | 700 – 800 | May 2022 |

| J GATEWAY | 2 | $3,800 | 600 – 700 | May 2022 |

| J GATEWAY | 2 | $3,500 | 600 – 700 | May 2022 |

| J GATEWAY | 2 | $3,600 | 600 – 700 | May 2022 |

| J GATEWAY | 2 | $4,000 | 600 – 700 | May 2022 |

| J GATEWAY | 2 | $4,100 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $3,800 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $3,400 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $3,800 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $4,000 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $4,550 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $4,000 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $3,600 | 600 – 700 | Apr 2022 |

| J GATEWAY | 2 | $3,700 | 700 – 800 | Apr 2022 |

| J GATEWAY | 2 | $3,500 | 700 – 800 | Apr 2022 |

Given that rental returns form a big part of your investment and being cashflow positive is a consideration, here’s a hypothetical projection based on several assumptions:

- You purchase a 2-bedroom unit costing $1.2m

- Your rental returns are $3,800/mo based on recent rental transactions (resulting in a 3.8% yield)

- You take a 30-year loan with a fixed interest rate of 3% (fixed rates you can get today).

- Property tax is based on non-owner occupied rates and the Annual Value is the actual rent collected

- Maintenance fees are $200/mo

- Buyer Stamp Duty is paid and counted as an investment cost

- Agent fees are paid (1-month rent) assuming the lease is renewed every 2 years

This projection is very simplified as it assumes a constant interest rate, rent, fees, and so on. It does not factor things the risk of damage that you need to pay for, vacancies, increase in interest rates, and fall in rent. On a positive note, you could stand to gain a higher yield if you rent out two individual bedrooms instead of 1 which works out if you purchase the 2 bedroom 2 bathroom unit type.

Assuming you rent out the whole unit at $3,800 per month, over 7 years, you would stand to earn around $35,000 – meaning you are slightly cash positive by around $423 per month which is in line with your objective of being cashflow positive.

$35,000 sounds like a lot, but on a $300,000 initial investment (25% of $1.2 million), the resulting returns are just 11.8% over 7 years. Annualised, you’re looking at a return of just 1.61%. Needless to say, if rental is all you’re looking at, then the returns for the hassle of dealing with a tenant may not be worth it if you perhaps invested the deposit plus taxes in other instruments.

For example, the S&P500 7 years ago traded at $2,000 USD. Despite the stock market correction today, it’s still trading at around $3,800 USD – almost doubling your investment.

What if we considered Hillion Residences? What would your rental returns look like using the same exercise as the above?

Rental returns with Hillion Residences

Hillion Residences is also a 99-year leasehold development with a lease start date of 2013 – 1 year later than J Gateway. It has a total of 546 units and is a full-fledged facility development, meaning it has a gym, pool, and even a tennis court. What’s really special about Hillion Residences is that it’s an Integrated Development sitting atop Hillion Mall and Bukit Panjang Integrated Hub – directly connected to Bukit Panjang MRT along the Downtown Line.

This is ultimately more convenient for residents compared to J Gateway since the shops are directly below them and the journey to the MRT is shorter, though both developments are so near to the MRT, it may make little difference.

On the surface, Hillion Residences seems to be a marginally more rentable development – it has a tennis court and shops just below while having direct access to the MRT.

Here are some of the recent sale transactions of the 2-bedroom at Hillion Residences:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date | Address |

| HILLION RESIDENCES | $1,100,000 | 710 | 1,548 | 20 Dec 2021 | 8 JELEBU ROAD #11 |

| HILLION RESIDENCES | $1,080,000 | 710 | 1,520 | 24 Jan 2022 | 12 JELEBU ROAD #14 |

| HILLION RESIDENCES | $1,150,000 | 710 | 1,619 | 08 Apr 2022 | 8 JELEBU ROAD #17 |

| HILLION RESIDENCES | $1,155,000 | 710 | 1,626 | 18 May 2022 | 10 JELEBU ROAD #13 |

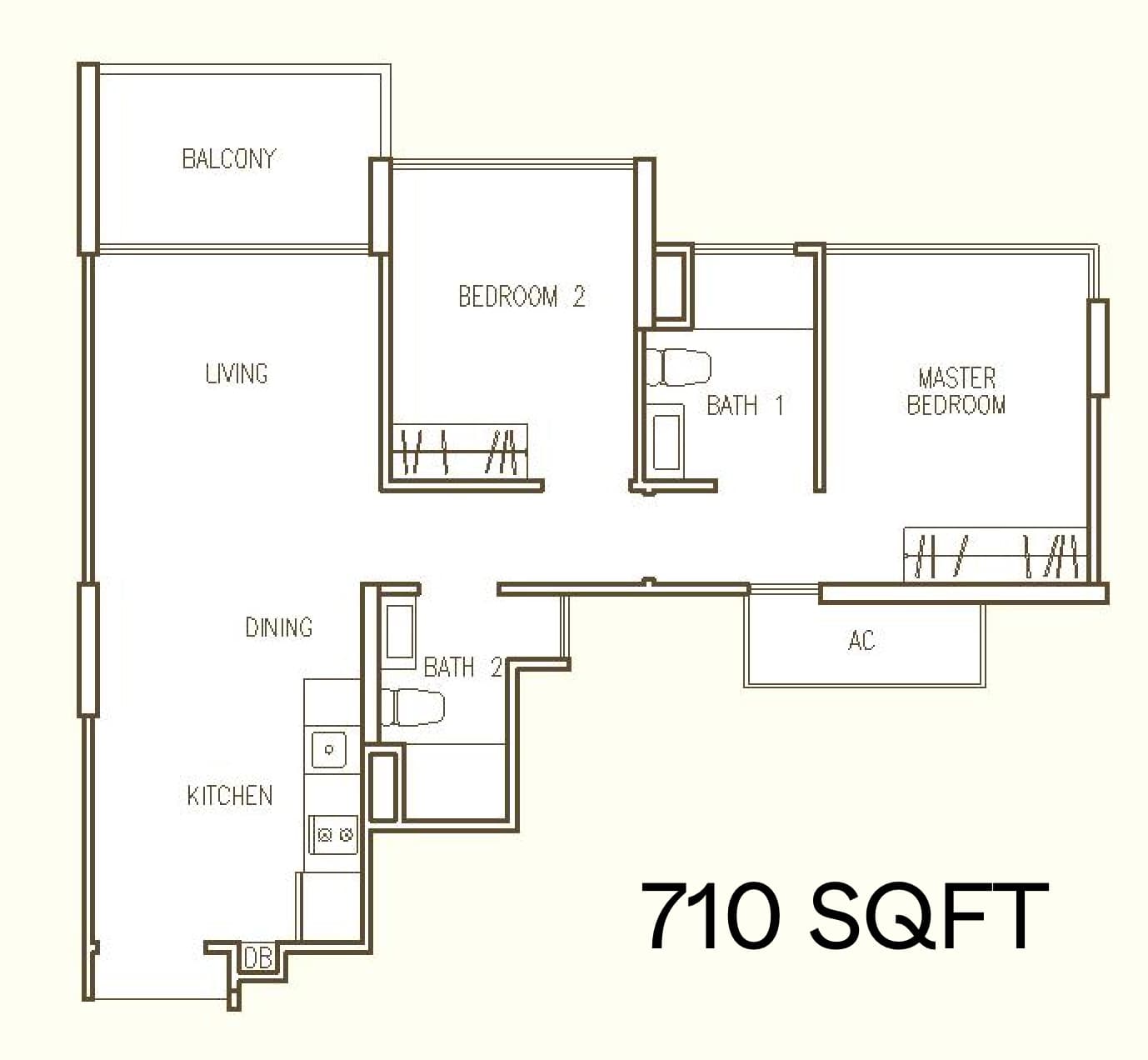

This is what the 710 sqft 2-bedroom looks like at Hillion Residences:

Here are some of the recent rental transactions of the 2-bedroom at Hillion Residences:

| Project Name | No of Bedroom | Monthly Rent ($) | Floor Area (SQFT) | Lease Commencement Date |

| HILLION RESIDENCES | 2 | $2,850 | 700 – 800 | Apr 2022 |

| HILLION RESIDENCES | 2 | $3,000 | 700 – 800 | Apr 2022 |

| HILLION RESIDENCES | 2 | $3,700 | 700 – 800 | Apr 2022 |

| HILLION RESIDENCES | 2 | $3,400 | 700 – 800 | Apr 2022 |

| HILLION RESIDENCES | 2 | $3,300 | 700 – 800 | Apr 2022 |

The 2-bedroom rental here varies from $2,850 to $3,700. This could be differences due to facing, renovation or size since URA only provides a range rather than an exact size. Taking the median value puts it at $3,300 per month. At an average of $1,125,000, this puts your rental yield at 3.52%.

While this is slightly lower than what J Gateway could offer, Hillion Residences seems to offer a price point that’s more palatable to your budget.

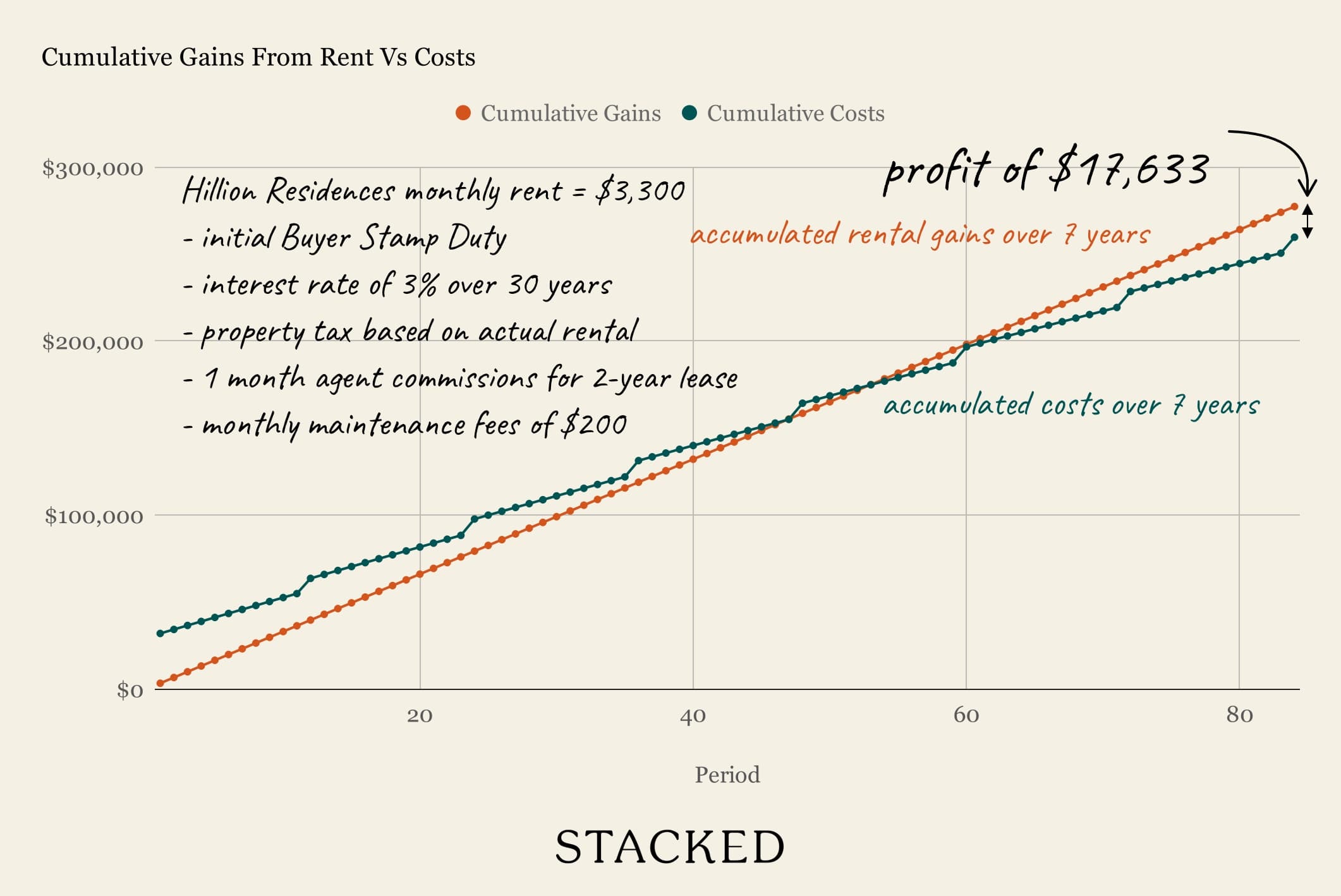

Here’s what your hypothetical cash flow would look like:

As you can see, the rental returns are a paltry $17,633 over 7 years. This is unsurprising considering the higher interest rates today and all of the other costs that go into the investment too. As such, the annualised returns are only 0.87% (6.3% overall) – and this is returns on your deposit only, so we have accounted for leverage here.

What if we considered a 1-bedroom for rental returns? Let’s use Highline Residences as an example.

Rental returns with Highline Residences

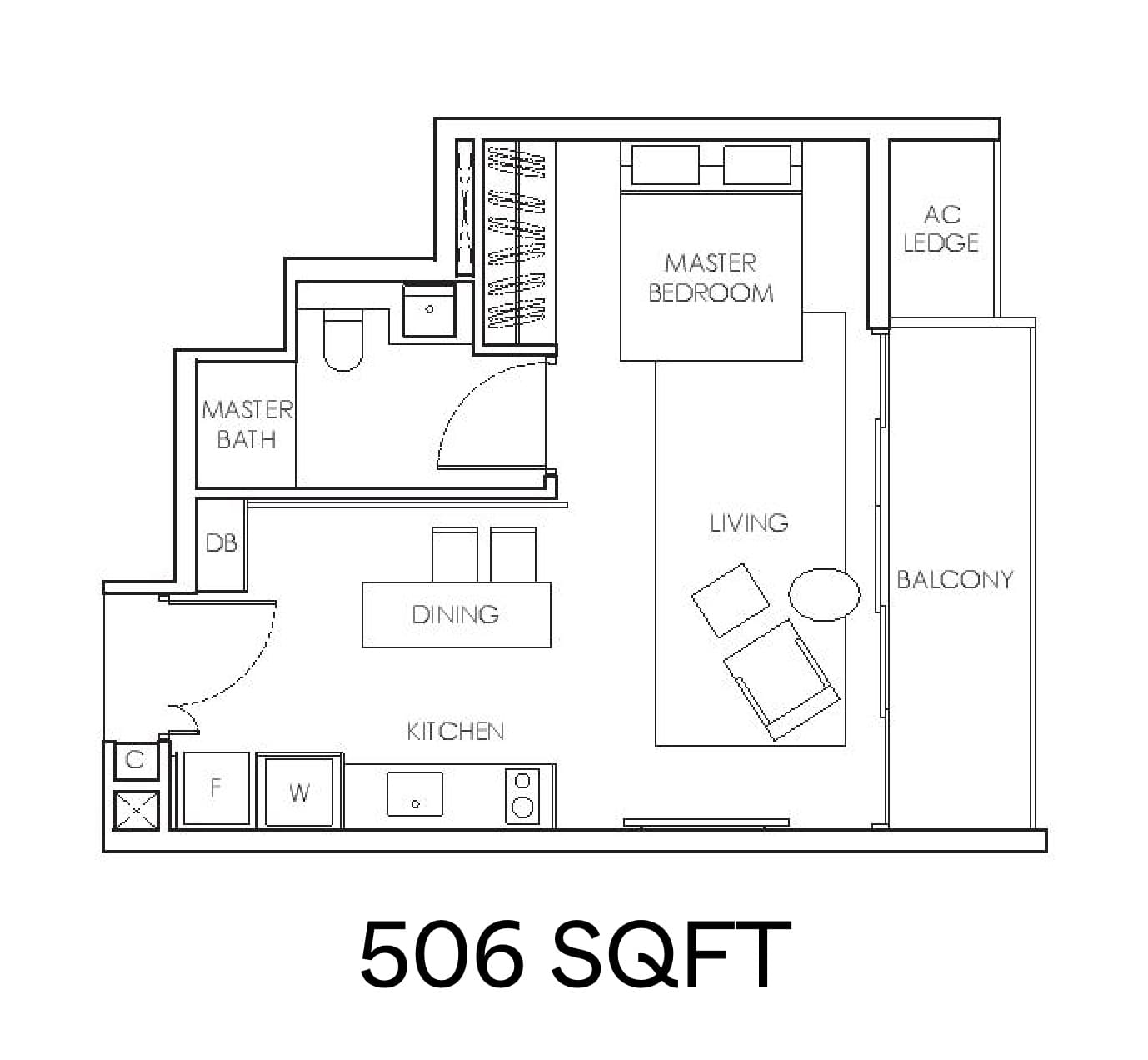

Highline Residences is in quite a different location compared to J Gateway and Hillion Residences. It’s situated along Kim Tian Road (Bukit Merah) and is just about a 5-minute walk to Tiong Bahru MRT. The 1-bedroom unit at Highline Residences comes in at 5063 sqft.

Here are the most recent 1-bedroom transactions:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date | Address |

| Highline Residences | $1,150,000 | 506 | $2,273 | 17 Jun 2022 | 7 KIM TIAN ROAD #21 |

| Highline Residences | $1,068,000 | 506 | $2,111 | 12 May 2022 | 7 KIM TIAN ROAD #08 |

| Highline Residences | $1,086,000 | 506 | $2,147 | 25 Mar 2022 | 9 KIM TIAN ROAD #12 |

| Highline Residences | $1,100,000 | 506 | $2,174 | 21 Mar 2022 | 9 KIM TIAN ROAD #06 |

The 1-bedroom units here are well below your budget and are situated in quite a prime location where rentability is good.

Considering the median rental here is $3,575 and the median 1-bedroom price is $1,093,000, you’ll be looking at a 3.93% rental yield. This is higher than both J Gateway and Hillion Residences which is expected since it is a 1-bedroom unit.

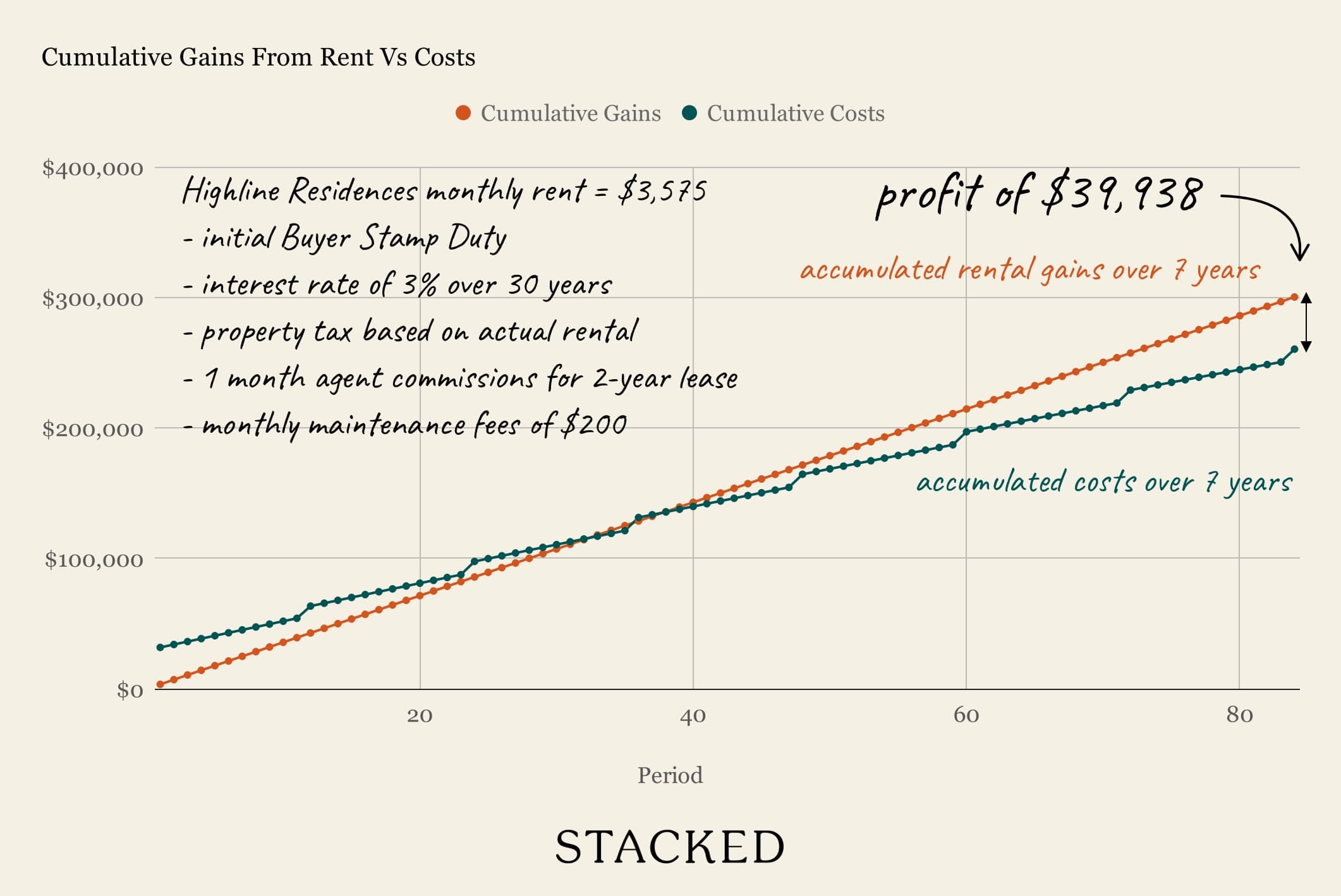

Here’s what the rental simulation looks like:

Disclaimer: These figures are based on assumptions. E.g. $200/mo is a rough estimate and not actual maintenance fees. Income tax could also vary based on the Annual Value (AV).

Overall, this translates to an annualised return of 1.97% (14.6% overall) – the best rental returns so far out of all 3 comparisons, but can still be a dismal return compared to other forms of investment.

If it isn’t clear by now, the prize of property investment isn’t in making rental returns – that is just the safety net. You are already considered to be in a good situation if you are able to cover all of your expenses with your rental income. The real reason why people invest in property is for capital appreciation – so let’s consider the four developments you’ve highlighted.

Additional disclaimer: We’d like to preface this section by saying that nobody has a crystal ball into the future. No one knows what prices would be like, however, we can use the information available today to make an estimated guess on how the situation would play out. No matter how much research is put in, though, there’s always a margin for being wrong.

Now that we got that out of the way, let’s look at the capital appreciation considerations. These are things that we can consider:

- Has the development stagnated?

- What is the unit mix like in the development?

- Will there be any transformation in the area?

Has the development stagnated?

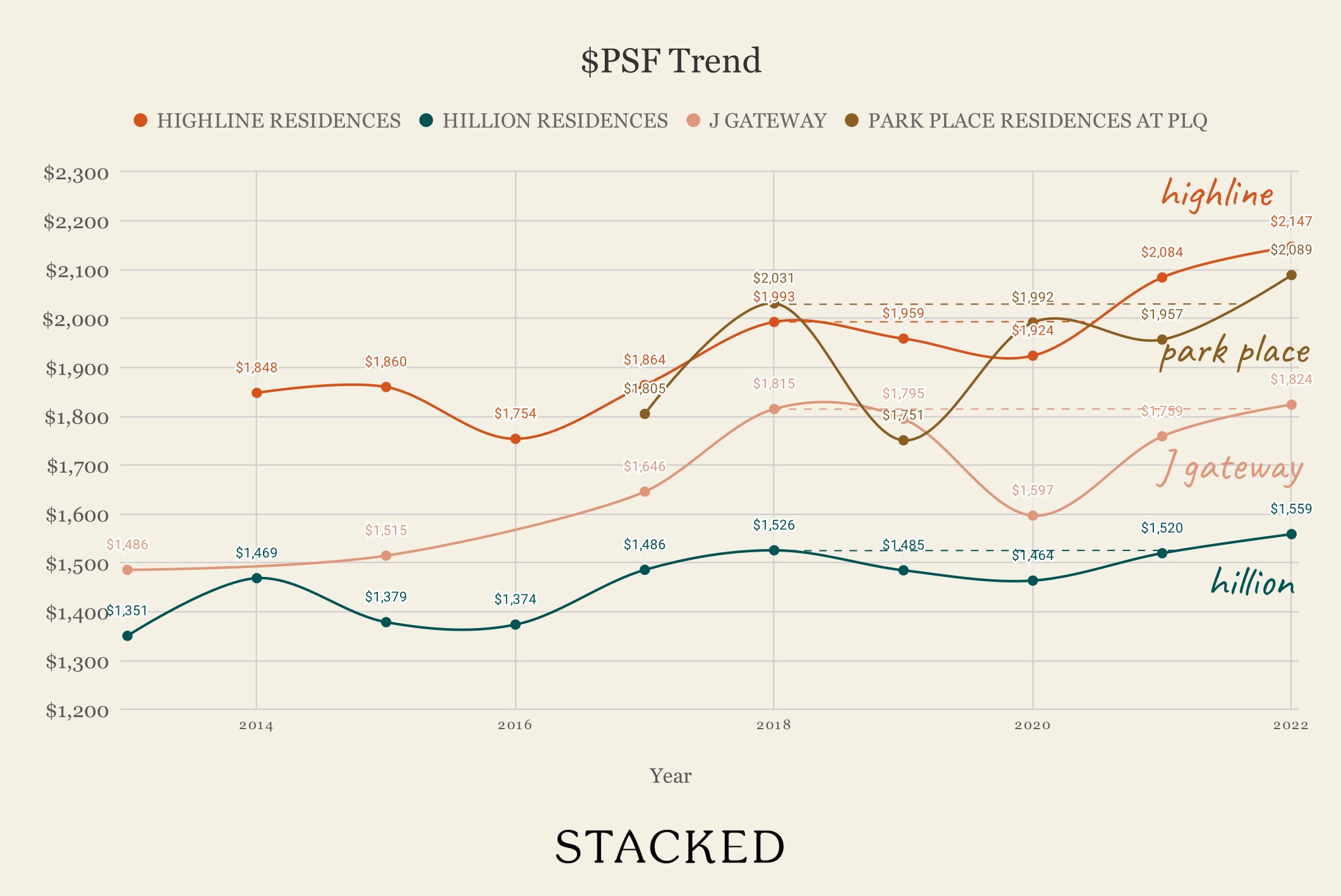

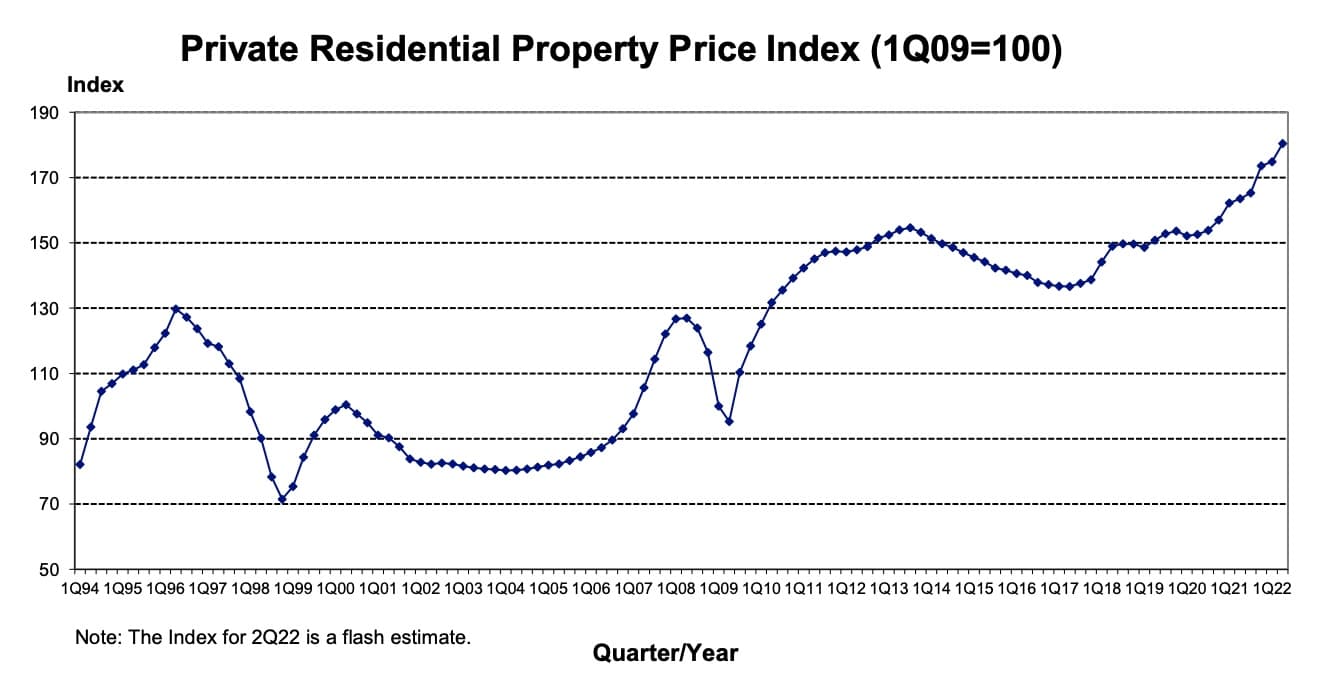

It’s common to find $PSF of properties that were previously overpriced or those that are old to remain flat, meaning stagnant. If the property market is hitting new highs like it is today, yet the $PSF struggles to break its previous highs, then this is the first sign of trouble since we should at least expect a property to perform in line with the market performance.

This just means it keeps up with the property market inflation and is not necessarily “performing well”. Rather, for capital appreciation to be considered, this should be the first thing to look out for since it sets up the foundation for having the potential to grow further.

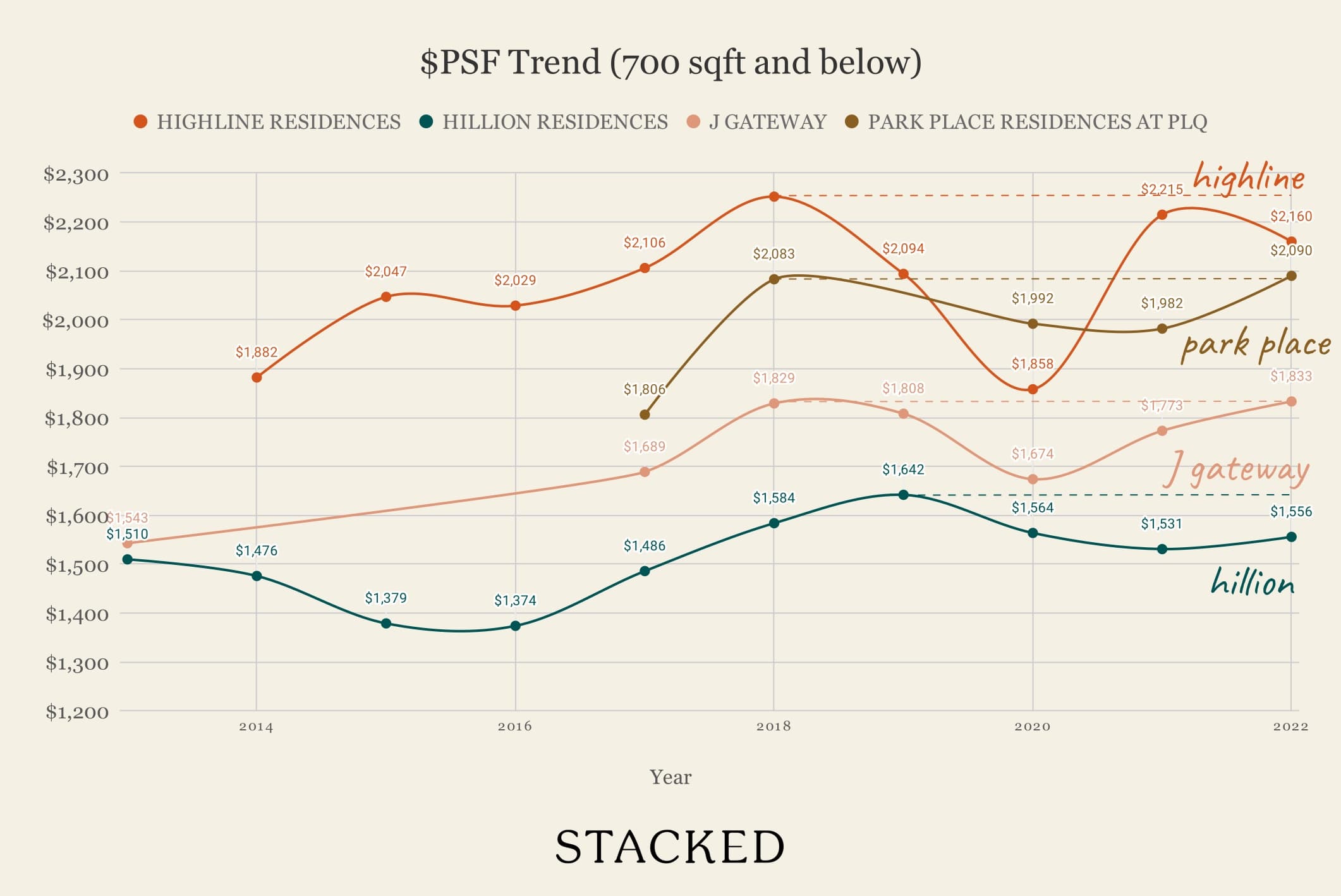

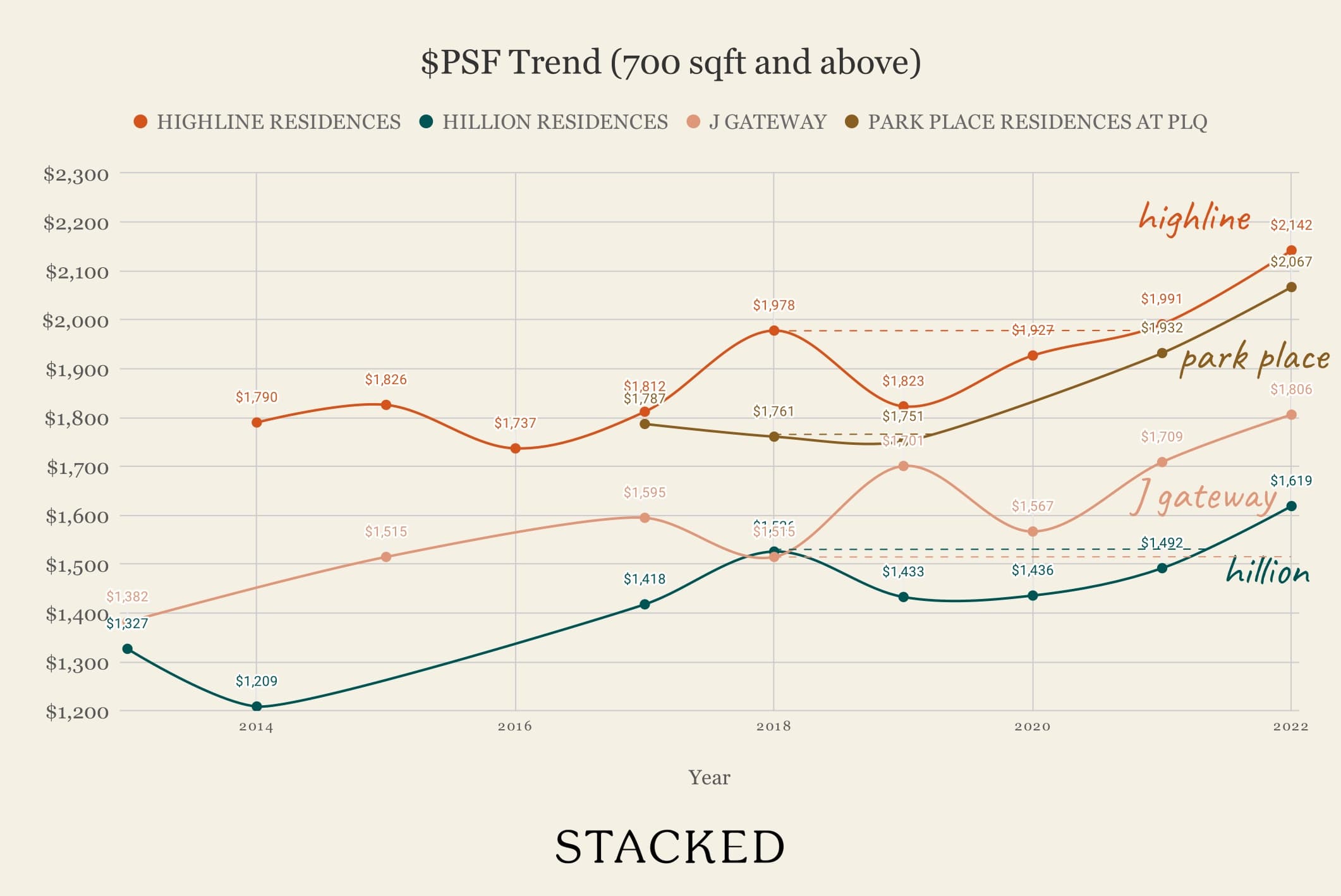

The chart above shows that across all transactions, all developments have managed to surpass their previous highs. Highline Residences in particular broke its previous highs of $1,993 psf by 7.7%. In contrast, J Gateway only surpassed its previous highs by 0.5% – much lesser than the property market appreciation since 2018!

Looking across all unit types is good, but honing into specific sizes will clue us in on how the smaller units in these respective developments perform. This is of interest to you since you’re looking out for 1 or 2-bedroom units for investment. If we restrict the sizes to 700 sqft and below, here’s what it looks like:

Immediately, you’ll see that certain developments are struggling. Hillion Residences and Highline Residences both failed to breach their previous highs (worrying!), while Park Place Residences and J Gateway barely did. None of these developments has managed to be on par with the general property market inflation.

You might be thinking – perhaps this means smaller units would have the opportunity to catch up? Perhaps, but in our opinion, it’s hard to justify any ‘undervaluation’ in the current market conditions. As such, we’re more inclined to believe that these $PSFs are a reflection of the capital appreciation potential of small units.

Some word of caution: we’d be wary of reading too much into the data for Highline in both 2019 and 2020 due to the lack of transaction volume considering the lower number of 1 and 2 bedroom units in this development.

| Sale Date (YYYY) | HIGHLINE RESIDENCES (Vol) | HILLION RESIDENCES (Vol) | J GATEWAY (Vol) | PARK PLACE RESIDENCES AT PLQ (Vol) |

| 2013 | – | 43 | 433 | – |

| 2014 | 100 | 22 | – | – |

| 2015 | 16 | 21 | – | – |

| 2016 | 24 | 54 | – | – |

| 2017 | 44 | 183 | 8 | 173 |

| 2018 | 3 | 4 | 14 | 148 |

| 2019 | 1 | 3 | 12 | – |

| 2020 | 1 | 4 | 5 | 4 |

| 2021 | 4 | 19 | 34 | 9 |

| 2022 | 8 | 13 | 14 | 8 |

If we study units that are 700 sqft and above, however, you’ll notice that these are the units that are pulling the overall development’s $PSF. Larger Highline Residences units have even averaged an 8.3% return over their previous highs.

This could be due to the overall appreciation of larger flats due to the Work-From-Home situation. But even in 2022 as WFH no longer becomes the default, prices here continue to rise so it may not necessarily be due to changing consumer taste for bigger units, but perhaps it could be due to the lack of supply for such units either in the development or area.

So how can we use this information? We’d caution reading too much into it, but what we know is that when it comes to capital appreciation for smaller units in these 4 developments, J Gateway and Park Place have shown some resilience. Hillion has struggled in the last three years, with only a slight uptick this year (so far) while Highline Residences saw a drop in $PSF from the previous year despite having more transactions in 2022 so far. But that being said, Highlight Residences had a low transaction volume, so the data point shouldn’t be given too much weight.

Bearing this in mind, let’s now look at the next consideration:

What is the unit mix of the development?

We are interested in the unit mix to see if the development is geared towards investors or home stay buyers. While this is not proof of performance, the idea behind this is that investor-focused developments tend to be less sticky on their price for two reasons:

- The investor likely does not need to sell the property to fund their new home

- The investor has collected rental returns from the property and can part with their investment since some returns are already realised

On the contrary, family-led developments like those with more 3 and 4-bedroom units tend to be stickier in price, with homeowners needing to sell higher to fund their next purchase.

Here’s what the unit mix looks like:

| Bedroom | J Gateway | Hillion Residences | Highline Residences | Park Place Residences At PLQ |

| 1 | 259 | 328 | 66 | 117 |

| 2 | 245 | 164 | 138 | 234 |

| 3 | 184 | 12 | 249 | 78 |

| 4 | 50 | 24 | 47 | – |

| 5 | – | 18 | – | – |

| Total | 738 | 546 | 500 | 429 |

Based on these calculations, here’s what the 1 and 2-bedroom unit proportions are like:

| Proportion | J Gateway | Hillion Residences | Highline Residences (ex landed) | Park Place Residences At PLQ |

| 1 & 2 Bedders | 68% | 90% | 41% | 82% |

| 3 & Up | 32% | 10% | 59% | 18% |

With the exception of Highline Residences, more than two-thirds of the other developments are dedicated to 1 and 2-bedroom units. While there’s nothing wrong with that, it’s clear that the developers were targeting certain profiles – singles, young working adults with no children, and ex-pats who want to rent a convenient place to live in.

The competition due to the supply of these units may have also contributed to its lacklustre performance when we look at the $PSF of units 700 sqft and below. In particular, Hillion Residences seems to have struggled the most, and it does have over 90% of its units in that category.

So how can we use this information? As highlighted in the Hillion Residences example, we can combine the $PSF movement alongside the unit mix here to see if there’s a narrative here.

Park Place Residences seems to be doing well considering it has over 80% in the 1 and 2-bedder range, yet its $PSF for the smaller-sized units have breached their previous highs. J Gateway has also reached its previous highs, yet has a large number of 1 and 2-bedroom units. As such, we could say that the smaller units in these developments tend to do well, indicating good demand for them despite their supply.

While it’s not perfect, we have at least drawn some inferences using the data, and we can now consider another factor (and probably the biggest one) in capital appreciation: transformation in the area.

Which development could see growth potential based on its surrounding transformation?

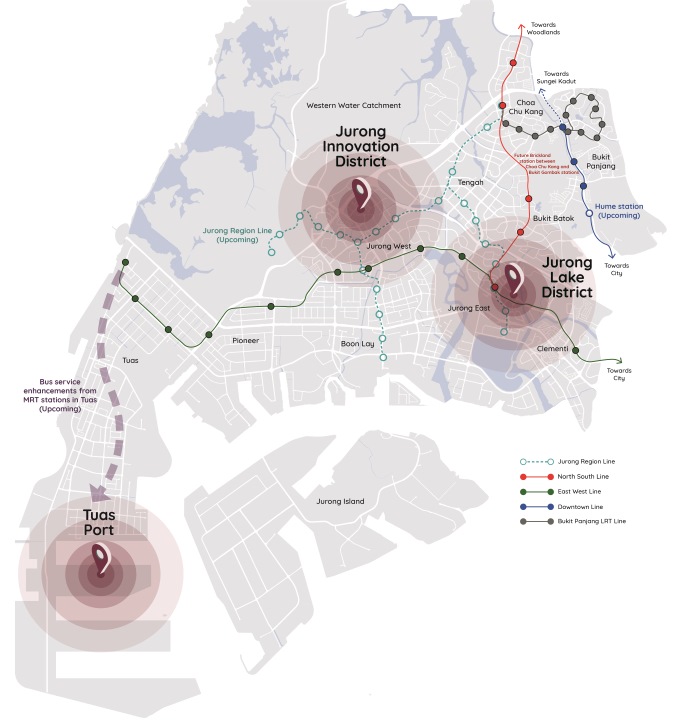

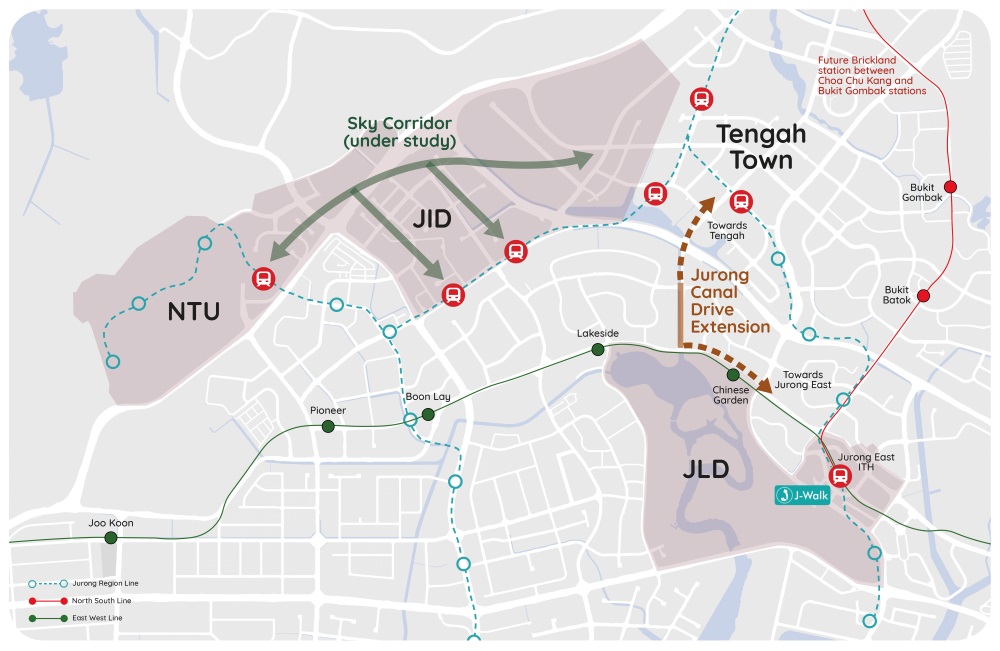

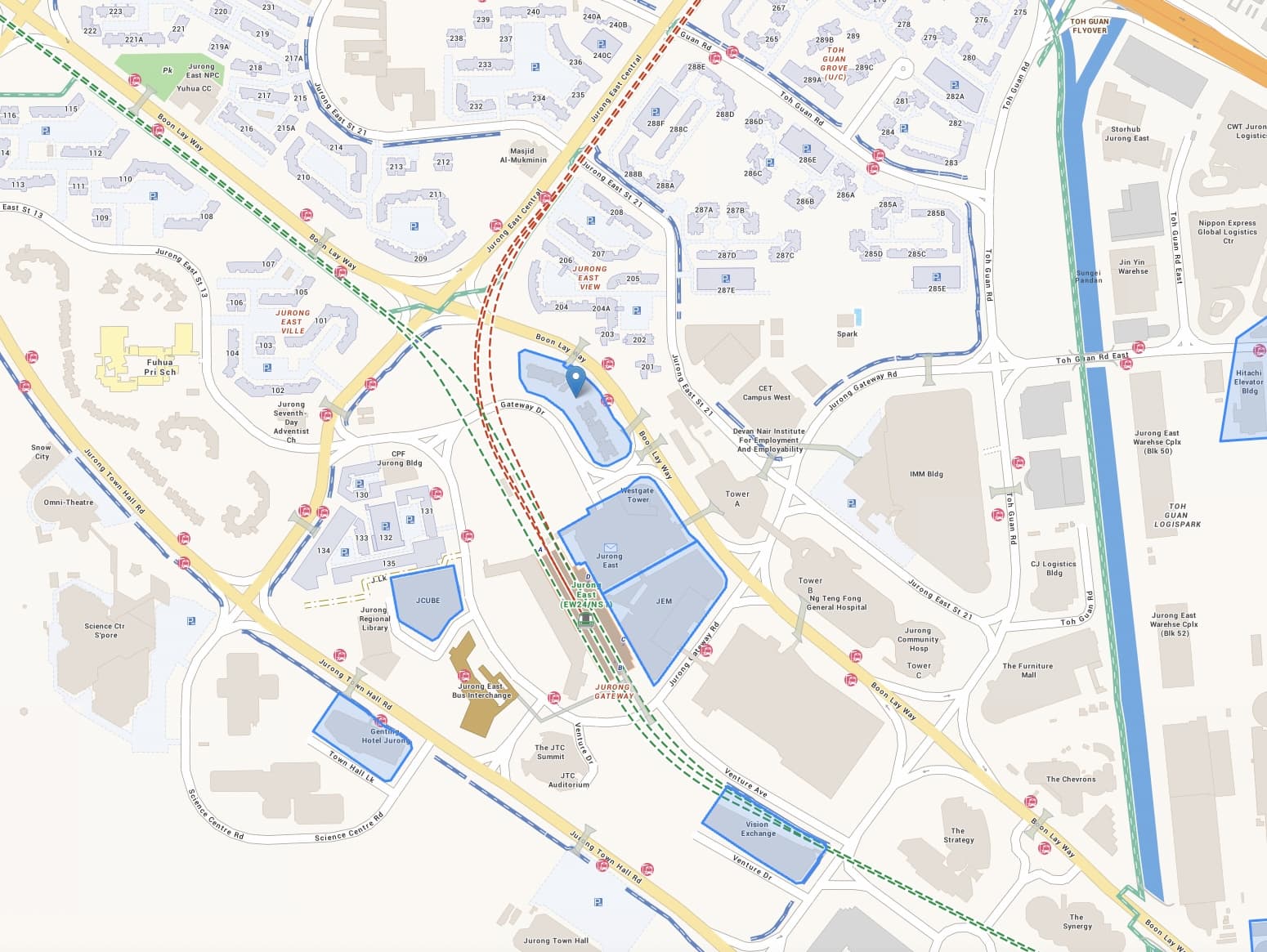

J Gateway

The Jurong Lake District and Jurong Innovation District may be yesterday’s news, but the transformations do not happen overnight. As such, more and more job opportunities would be created over time here (assuming this pans out successfully), increasing demand in the area.

Plus, while there is a new Tengah HDB town that would compete with supply, J Gateway’s locale may seem like a good balance for tenants who want the convenience of living near their work while not being situated too far away. The new Tengah estate would also face teething issues that need to be resolved while the Jurong area will continue to be seen as a more mature place to live in.

Considering J Gateway is the closest condo to Jurong East MRT, the development would continue to remain relevant in the years to come. In this sense, it could be seen as the market leader in the area – want to stay in a convenient location near Jurong East? There’s J Gateway.

Moreover, there aren’t any empty plots around that would see new developments overtaking J Gateway as the market leader in the area:

As such, tenants who want to stay in a new condo that’s convenient don’t really have much choice beyond J Gateway for now, which ensures reliability and price stability, at least while the development isn’t too old.

That said, on the Master Plan there are reserve sites around or the possibility of Ivory Heights going en bloc – but J Gateway will still remain as the best positioned.

Hillion Residences

The Bukit Panjang area has largely been a suppressed estate, but things could yet change. We’ve written about this before in our review of Dairy Farm Residences. The area is still the “nature part of Singapore” and there’s nothing more telling than condos being labelled “Eco Sanctuary” and “Dairy Farm Residences” in the district.

Just one MRT station down is the Hillview area where you’ll find a lot of empty residential plots too. This could be a good or a bad thing – new launches here could pull prices up, or could act as stiff competition to the existing ones in the area. But what matters is that there are alternatives here. The Bukit Panjang area doesn’t have yet the commercial elements that would create or sustain strong demand for renting here. The surrounding area is mostly filled with residential developments, nature reserves, parks, and just trees. Perhaps demand from the German international school counts, but those are in the Dairy Farm area – not so much where Hillion is.

The amount of residential plots here does suggest that there have to be more transformations yet to be announced to support the number of residents here in the future. But given your timeline of 2030, this could still be some time away.

You may be wondering if the area would benefit much from the Woodlands Regional Centre. It’s hard to give a straight answer, but considering Bukit Panjang is the end of the line which doesn’t connect to the North-South line, we’re inclined to believe those that would benefit more from the regional centre are those that are directly connected to it by MRT. These would be the Choa Chu Kang/Yew Tee/Woodlands/Sembawang estates more than Bukit Panjang.

Highline Residences

Highline Residences is located in Tiong Bahru – and there’s no shortage of rental demand here. It may not be as close to the MRT as the other projects, but it’s still within 5 minutes of a very popular one. From here, it’s just 17 minutes to Raffles Place MRT – and this includes a 5-minute walk to the MRT.

But it’s not just its location as a CBD-fridge property that makes this attractive. Given its location along Kim Tian Road, Highline Residences remains an attractive development next to the conserved and charming heritage of Tiong Bahru. This on its own will make the development attractive to tenants looking to stay near the CBD area without the dullness of being in it (the URA plan to revive the CBD district has yet to materialise!).

One exciting transformation that could spill over into Highline Residences is the 20-year SGH Campus Masterplan. Certain aspects of this have already been materialised, but there are more to come which could bring in more demand for jobs – and hence tenants to the area. This would undoubtedly help boost demand at Highline Residences as it’s only a 13-minute journey away by bus – including the walk to the bus stop.

Park Place Residences At PLQ

Park Place Residences At PLQ is probably the transformation in the Paya Lebar area. A decade ago, having a new mall right at the heart of Paya Lebar would be seen as a catalyst for growth of the surrounding property developments.

You might be wondering about the Paya Lebar Airbase moving out. While it shares the same name, you’ll notice that Park Place Residences isn’t really near the airbase at all. In fact, the Kovan and Hougang areas seem to be closer. Moreover, that transformation is only looking set to take place from 2030 – the year in which you hope to exit your investment. Any growth between then and now wouldn’t be a result of completed buildings or an increase in relevant jobs.

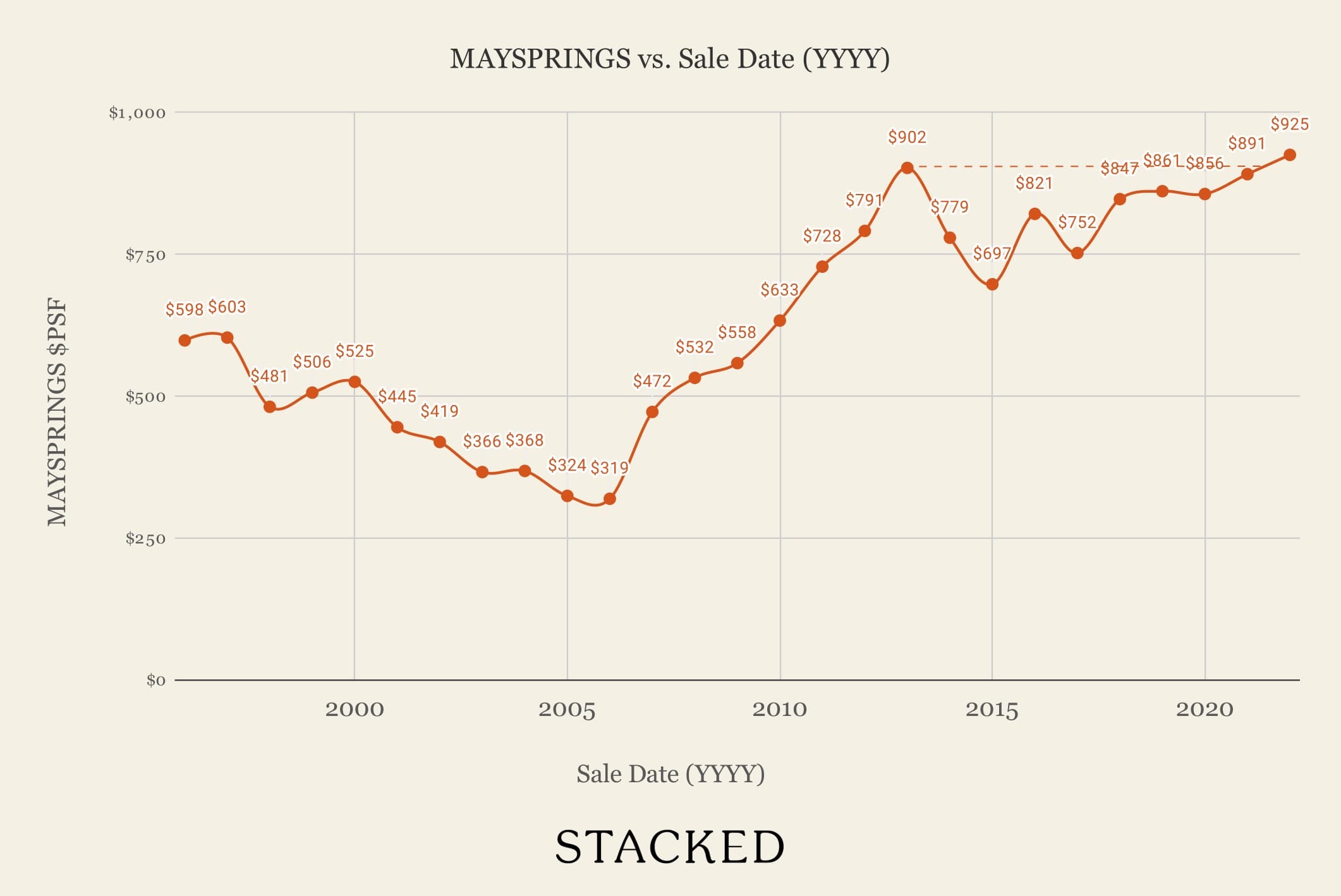

What about Maysprings?

Not to worry, we have not forgotten your query on Maysprings! Maysprings has a lease start date of 1994 meaning it’s almost 30 years old in terms of tenure. Logically, prices should have stagnated. Yet, Maysprings continue to defy its leasehold nature up until today, with its $PSF crossing its previous high of 2013.

Still, we wouldn’t be so positive about it – the property market in 2018/2019 was already reaching the highs of 2013 while Maysprings hovered just below the highs.

As such, we can attribute the recent highs to the general property market inflation just being high enough to push even very old leasehold developments past their previous highs. Relative to younger developments or freehold properties though, the performance isn’t as impressive.

With this in mind, we can’t recommend buying into a very old development. Prices may continue going up, but the relative performance to younger developments or freehold ones would be paltry as the depreciation effect continues to be greater. By the time you’re looking to sell in 7-8 years, the development would only have 63 years left on the lease.

Conclusion

Overall, we have shared our considerations for these four properties when it comes to investment – both in terms of rental and capital appreciation as well as our agreement with you when it comes to the fears of Mayspring’s old age resulting in a poor return later on.

We hope that our insights into these developments will help you in your decision-making.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

11 Comments

Great work, this was very detailed

My friend, Joe left a comment lately but was deleted.

Could you reinstate the comment please?

Good perspectives…. Will be better if the comparison is done for 1bdrm ocr vs the 1bdrm in the rcr… u can’t really compare a 2bdrm ocr vs the 1 bdrm in rcr…

From the ground perspectives… the covid.. changes quite a fair bit of the demand in rental…. now the studio in hillion actually catches up with the 1bdrm in j gate… if modelling the yield on 1bdrm.. it will quite interesting…

Detailed analysis, eye for details, well researched.

I always like the non bias opinions from stackedhomes. But just to correct 1 point. There is 1 sky tennis court at J Gateway. Lv 21 🙂

Thanks for the great article!!! Very informative.

Realised factoring in income tax from the rental, most of these scenarios may not even break even do capital gains over the years is what we have left.