What Makes An HDB Flat Prime Or Plus?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

What makes a flat Plus, and what makes it Prime?

I’m convinced this is the next (mostly) unresolvable argument we’ll see in the coming decades; on par with the age-old “freehold versus leasehold” argument. As I’m writing this, we’re about a week away from a historically significant BTO launch: the October 2024 launch which will do away with the old “mature versus non-mature” categorisation, replacing it with three classes of flats: Standard, Plus, and Prime.

Prime housing isn’t completely new, as we’ve seen some of these projects launched already. Plus housing is just being introduced now, however; and what’s interesting is that Plus and Prime housing can be in the same HDB town. For example, Kallang/Whampoa has two Plus sites (Kallang View and Towner Breeze) and one Prime site (Crawford Heights).

The distinction between the two is that Crawford Heights is closer to the city centre. But anyone who visits the sites – or is familiar with the area – will question the price premium that comes from this. Take a look at the sites here, and you’ll notice they’re about a train stop or a few short bus rides from each other.

This is bound to make buyers question if a few minutes difference is going to make up for higher prices and a bigger Subsidy Recovery (SR), upon resale.

Give it a decade or two for these flats to have a resale presence, and we’ll also see eager comparisons between the two: if you have a Plus and Prime flat in the same HDB town, which would hold its value better?

It’s difficult – perhaps even illogical – to have a clear matrix for what distinguishes Plus from Prime. Does the proximity of one specific train line count for more than another? How about access to malls, or nearby offices? As for the distance to the city centre, how much of that is really a contributing factor? Does being five minutes closer to the CBD outweigh being further from schools and the market & food centre?

It might come down to just market prices in the end

It’s too difficult to just draw a clear boundary line, and declare where Plus becomes Prime. More than likely, the decision will be down to the prices of surrounding resale flats. In Singapore, we have quite a lot of trust in free markets to determine value. As more projects are built over time, the Prime locations may become beacons of HDB’s pricier areas; and it could lead to some social stratification as well.

More from Stacked

The Trend of Commission Cashback – Why It Happens And Why It Can Be Harmful

This article below by The Business Times provided a look on the practice of commission cashback - or better known…

With the new classification system, we’ll have to tread lightly but assertively, to prevent them from becoming markers of poor versus rich parts of town.

As an aside, it also makes me wonder about the impact of 5-room flat prices

The Plus and Prime flats are so far confined to 4-room flats as their largest units. But if HDB is building just 4-room flats in these key areas, and not building any more 5-room flats, that seems likely to drive up prices of existing 5-room units.

We don’t have a study of that yet, and the effect may not be observable until a decade or so down the road. But if I owned a 5-room within the vicinity of a Prime project, I’d be much more reluctant to part with it now.

Meanwhile, in other property news…

- Check out Norwood Grand, Woodland’s first new launch condo in over a decade.

- Can HDB flats get to 1,700 sq. ft. in size? Yes, they can. Here are some flats big enough to host your old SAF section this New Year.

- Alternatively, get a double-storey maisonette condo unit. Now you can play games at full volume without annoying the rest of the family.

- Take a look at what I assume to be the safest condos in Singapore. And by that, I mean they’re so jam-packed full of residents, that you can’t even litter without someone seeing.

Weekly Sales Roundup (30 September – 06 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MEYER BLUE | $10,280,000 | 2992 | $3,435 | FH |

| CANNINGHILL PIERS | $5,647,000 | 1959 | $2,883 | 99 yrs (2021) |

| WATTEN HOUSE | $5,165,000 | 1539 | $3,356 | FH |

| KLIMT CAIRNHILL | $4,990,000 | 1496 | $3,335 | FH |

| THE RESERVE RESIDENCES | $4,133,640 | 1561 | $2,648 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PINETREE HILL | $1,398,000 | 538 | $2,598 | 99 yrs (2022) |

| KASSIA | $1,413,000 | 753 | $1,875 | FH |

| 8@BT | $1,437,000 | 517 | $2,781 | 99 yrs |

| THE CONTINUUM | $1,486,000 | 560 | $2,655 | FH |

| HILLHAVEN | $1,516,604 | 700 | $2,168 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $12,700,000 | 2885 | $4,402 | FH |

| D’LEEDON | $4,547,500 | 2239 | $2,031 | 99 yrs (2010) |

| THE CORNWALL | $4,480,000 | 2551 | $1,756 | FH |

| CYAN | $4,450,000 | 1658 | $2,685 | FH |

| MARTIN MODERN | $3,660,000 | 1421 | $2,576 | 99 yrs (2016) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PAVILION SQUARE | $650,000 | 398 | $1,632 | FH |

| HEDGES PARK CONDOMINIUM | $660,000 | 484 | $1,363 | 99 yrs (2010) |

| LE SOMME | $758,000 | 495 | $1,531 | FH |

| D’NEST | $780,000 | 484 | $1,610 | 99 yrs (2010) |

| THE TAPESTRY | $810,000 | 474 | $1,710 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $12,700,000 | 2885 | $4,402 | $3,000,000 | 14 Years |

| THE CORNWALL | $4,480,000 | 2551 | $1,756 | $2,420,000 | 22 Years |

| TERESA VILLE | $3,256,000 | 1959 | $1,662 | $2,006,000 | 17 Years |

| THE CALROSE | $3,218,000 | 2185 | $1,473 | $1,908,000 | 15 Years |

| PAYA LEBAR RESIDENCES | $2,310,000 | 1281 | $1,803 | $1,409,400 | 25 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LOFT@HOLLAND | $1,388,000 | 980 | $1,417 | -$212,000 | 6 Years |

| SEAHILL | $1,180,000 | 710 | $1,661 | -$87,400 | 12 Years |

| ESPADA | $1,250,000 | 560 | $2,233 | -$45,493 | 15 Years |

| VIDA | $1,110,000 | 527 | $2,105 | -$29,953 | 15 Years |

| KINGSFORD WATERBAY | $1,050,000 | 689 | $1,524 | $44,005 | 7 Years |

Transaction Breakdown

Follow us on Stacked for news and homeowner experiences in the Singapore property market.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

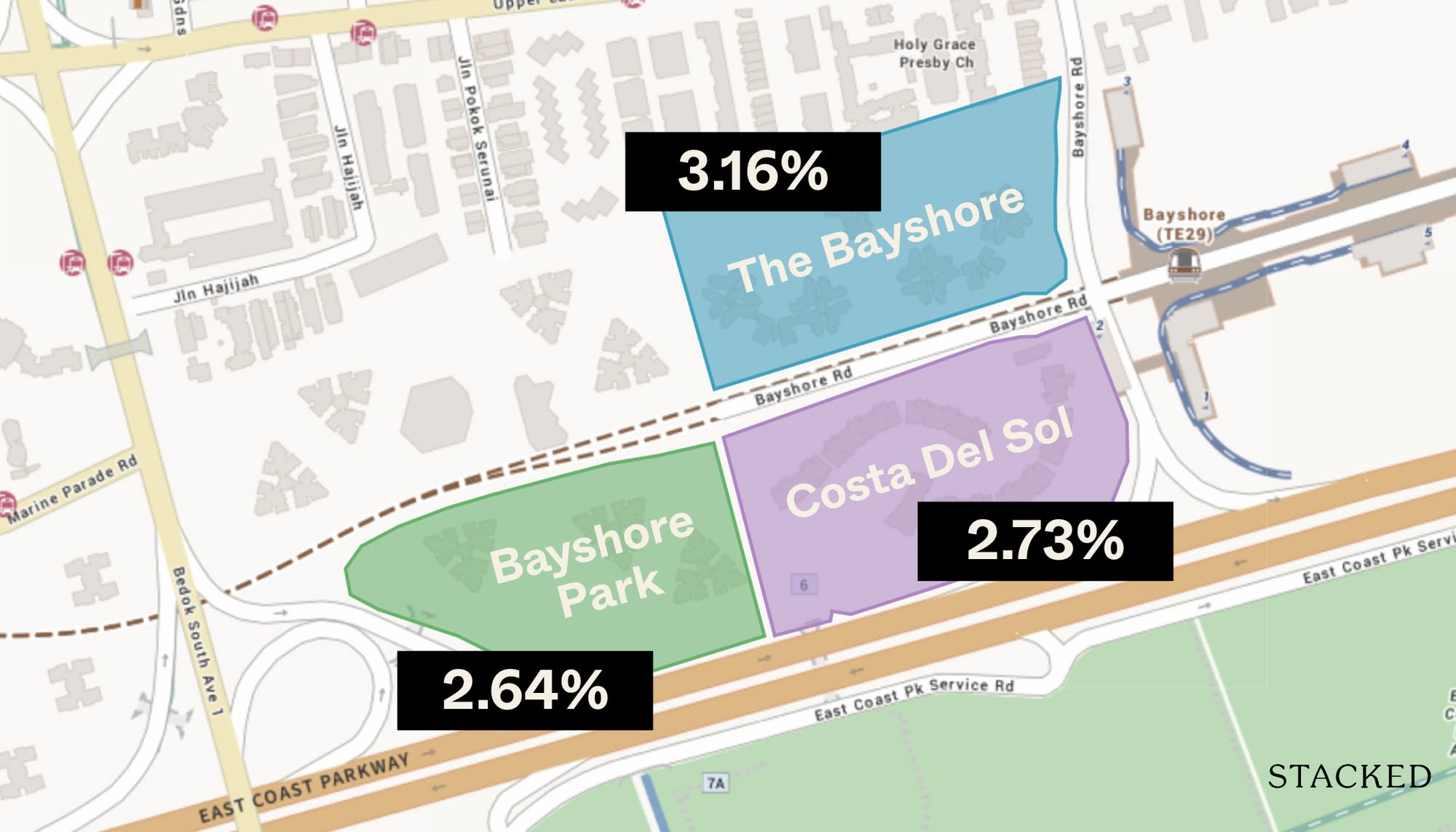

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

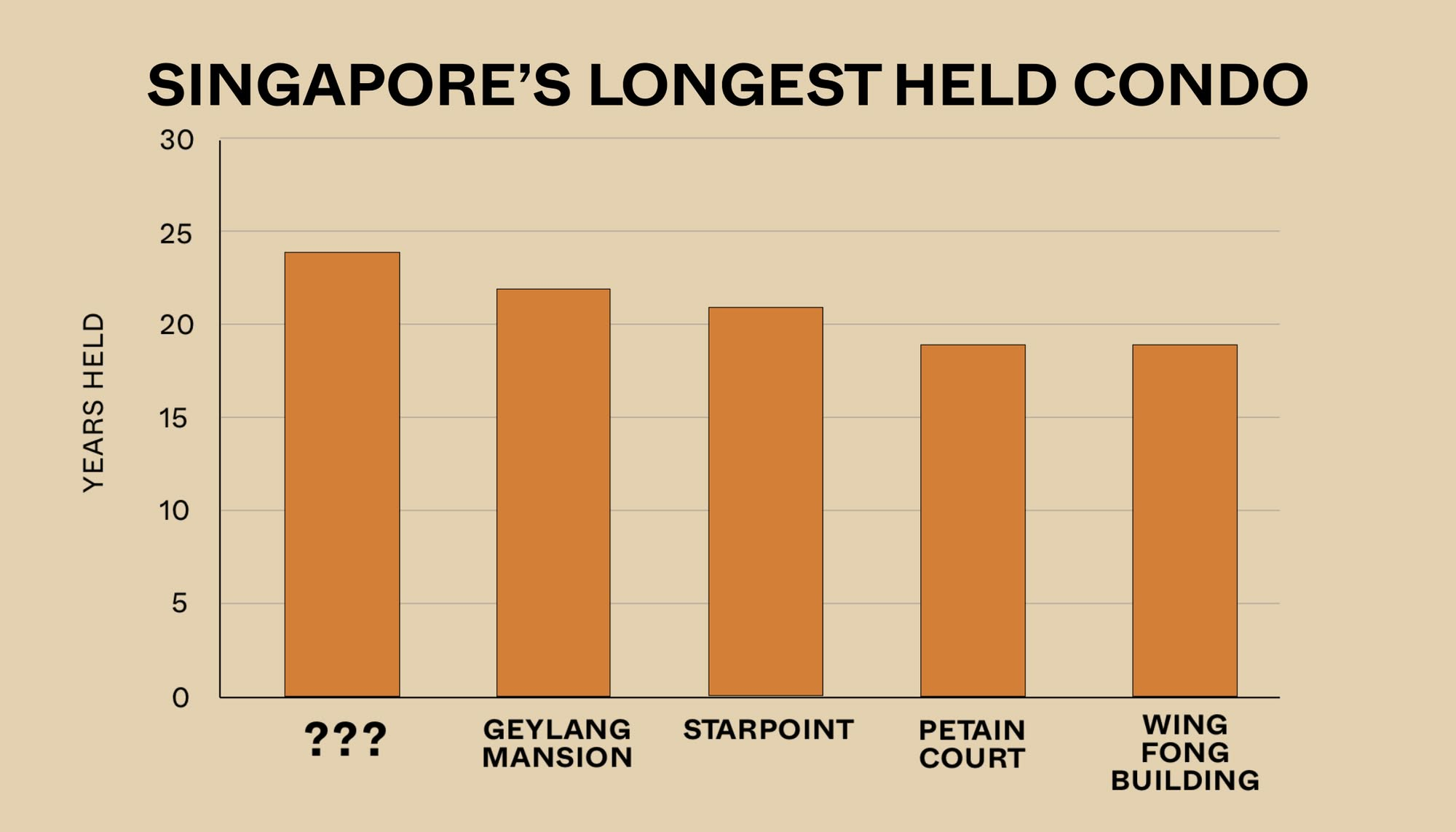

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

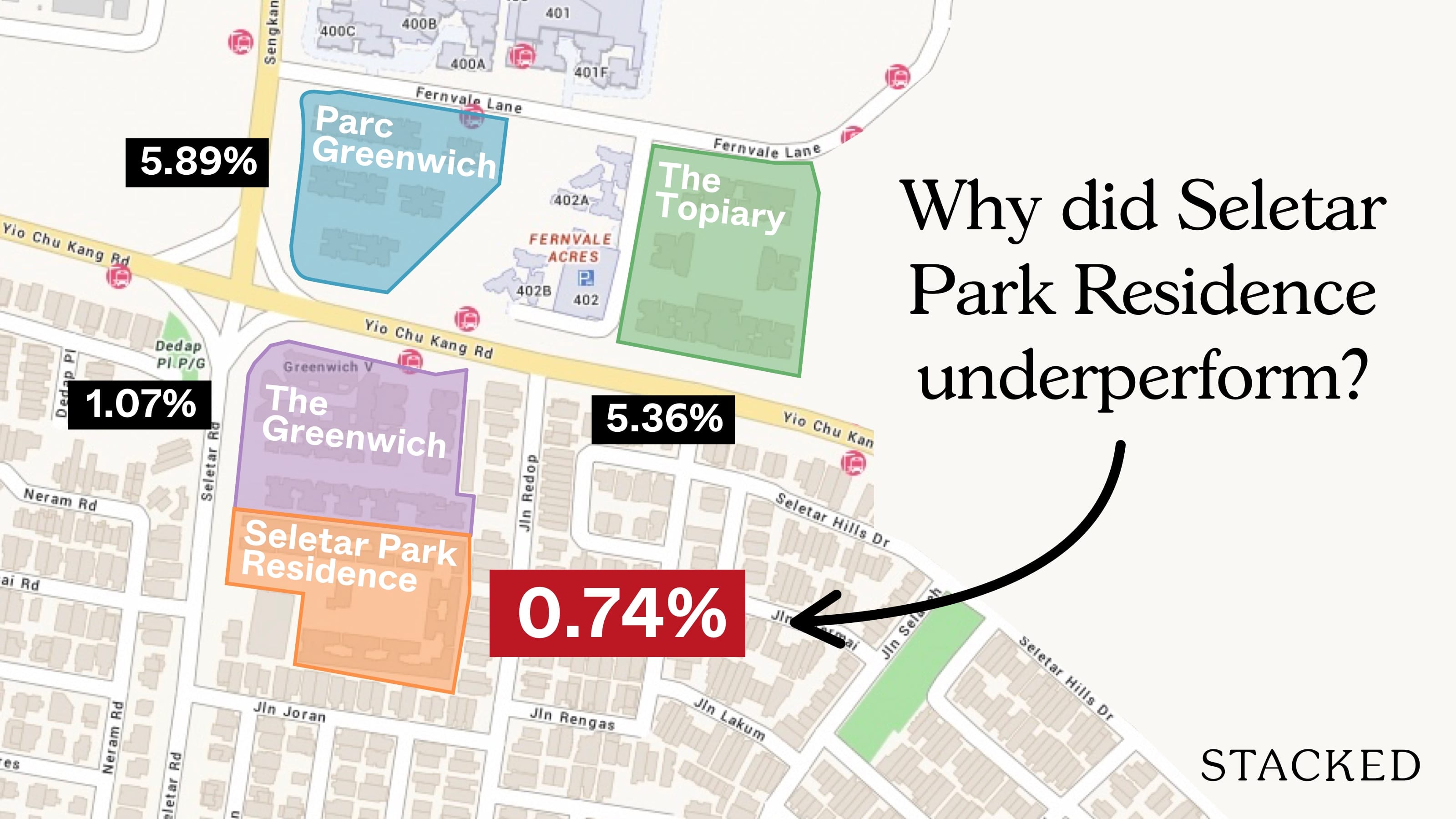

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

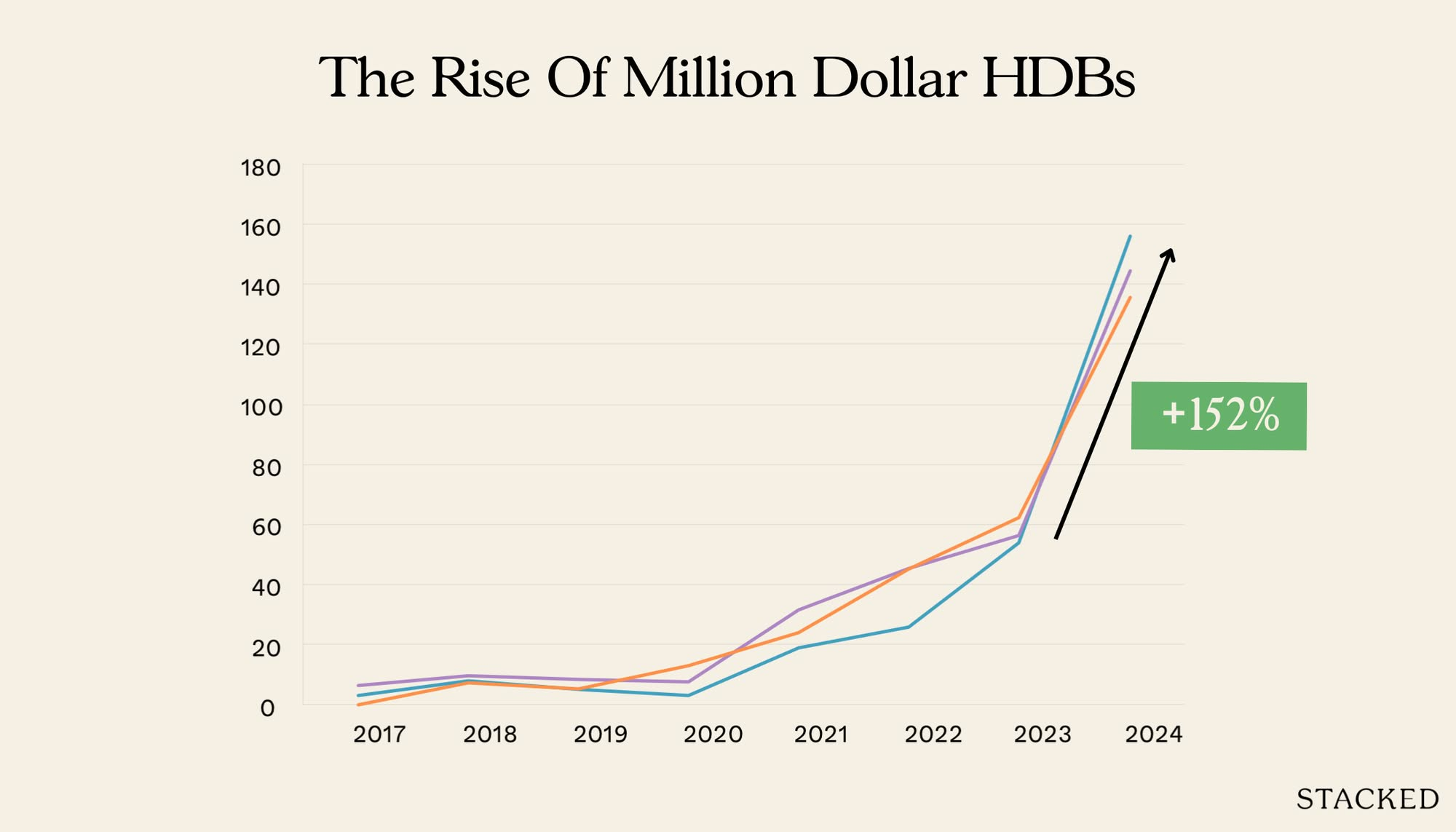

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden