Hi Stacked Homes,

I have been reading your articles which I find interesting and objective. I am particularly interested in those articles providing analysis and advice to people who wrote in.

Your analysis on various scenarios and situations helped me consider a wider perspective on the uniquely Singapore real estate scene, because of ABSD measure.

I’ve seen many articles on upgrading from BTO or HDB to condo, or decoupling to buy another property to avoid or reduce ABSD.

However, I’ve not seen many articles about people who bought multiple properties much earlier before ABSD existed or when ABSD was still in single digit percentages, and what their options could be.

I’m currently in my late 40s years old, living in a 5-rm HDB, with my wife in her early 50s. I’m currently earning >$12k/mth and my wife is a freelancer with significant but unstable earnings.

We co-own a 2-bedder condo which has been rented out for $3100. My wife also owns another 2-bedder condo in her name solely and it’s rented out for $3900.

The HDB and the 2 condos are fully paid up with no CPF used.

I’ve always wanted to upgrade and live in a condo even though my family and I are very happy living in a spacious HDB with matured amenities at our convenience.

I’ve always pondered whether I should sell my HDB and the co-owned condo, and buy a bigger condo under my sole name, in order to avoid paying ABSD.

However, my family was not willing to part with our HDB flat.

Recently, during covid period 2021, we decided to jointly buy another new launch 3-bedder condo ~2.2mil. We took a 50% loan ($1mil), paid 15% ABSD, and wiped out our combined CPF of ~$750k.

This condo is held jointly by tenancy-in-common, with me holding a 99% share, in case we decide to decouple later on.

It will be TOP soon at the end of the year or early next year, and the mortgage will kick in by then. But we are still not certain about moving in and staying there when it is TOP.

We have a combined savings of ~$500k. The two 2-bedder condos are valued ~$950k each, and the new 3-bedder condo has appreciated as well.

I’ve been stuck to my existing properties, and unable to sell or buy new ones because of ABSD consideration, unless I decide to sell away multiple properties on hand, including my HDB, and start all over again.

I strive to retain my asset value through properties and will rely on my rental properties for my retirement.

Should I stay status quo with rental play, or make a drastic move to sell existing properties in order to renew my property portfolio to maximize capital appreciation?

Do you have any advice for property owners who are stuck in this similar ABSD situation?

Thank you for your consideration.

Best Regards.

Hi there,

Thank you for writing in, and we’re happy to hear you’ve been enjoying our content.

The property landscape has certainly changed a lot since you’ve acquired these properties – long gone are the days where you can buy multiple properties or buy and sell a property within a few days with no taxes!

In a nutshell, there’s little discussion for multiple property owners because if you were to sell and reinvest today, there are limited avenues to avoid paying ABSD if you intend to hold more than one property.

Before we go into the potential pathways you can consider, let’s start by taking a look at the key years in which Additional Buyer’s Stamp Duty (ABSD) was introduced and revised, along with the corresponding rates.

Introduction of ABSD (December 2011)

- Singapore Citizens: 3% for second and subsequent property

- Singapore PRs: 3% for second and subsequent property

- Foreigners: 10% for all properties

First Revision (January 2013)

- Singapore Citizens:

- 0% for first property

- 7% for second property

- 10% for third and subsequent properties

- Singapore PRs:

- 5% for first property

- 10% for second and subsequent properties

- Foreigners: 15% for all properties

Second Revision (July 2018)

- Singapore Citizens:

- 0% for first property

- 12% for second property

- 15% for third and subsequent properties

- Singapore PRs:

- 5% for first property

- 15% for second and subsequent properties

- Foreigners: 20% for all properties

Third Revision (December 2021)

- Singapore Citizens:

- 0% for first property

- 17% for second property

- 25% for third and subsequent properties

- Singapore PRs:

- 5% for first property

- 25% for second and subsequent properties

- Foreigners: 30% for all properties

Fourth Revision (April 2023)

- Singapore Citizens:

- 0% for first property

- 20% for second property

- 30% for third and subsequent properties

- Singapore PRs:

- 5% for first property

- 30% for second and subsequent properties

- Foreigners: 60% for all properties

When comparing the years in which ABSD rates were revised against the Residential Property Price Index, a clear and unsurprising pattern emerges: revisions are typically introduced when the property market is on an upward trend. These revisions are often part of broader cooling measures aimed at reining in price growth. While such measures may not immediately stabilise prices, they have been effective in slowing down the rate of increase.

Given the government’s ongoing efforts to manage housing affordability and prevent speculative bubbles, it is very unlikely that ABSD rates will be reduced in the near future, so buyers should expect these measures to remain in place or even be tightened further if prices continue to climb.

If you are considering selling your current properties and resetting your portfolio, it’s important to acknowledge that avoiding ABSD when purchasing a second property is nearly impossible. However, one potential way to mitigate this is by purchasing a property under a trust if you have children under the age of 21.

Purchasing a property under a trust is a legal arrangement where ownership is held on behalf of another person, typically for estate planning purposes or for managing assets for a beneficiary, such as a minor. A trust allows a trustee, either an individual or corporate entity, to hold and manage the property for the benefit of the beneficiary.

Trusts are commonly used in property purchases for various reasons. One of the primary reasons is buying property for minors under the age of 21, as they cannot legally own property in Singapore. Parents or guardians often use trusts to hold the property until the child reaches legal age. Trusts are also popular in estate planning, allowing property to be passed on without the need for probate, giving the settlor control over the distribution of assets after their death.

To purchase a property under a trust, certain conditions must be met. The most important is that the property must be fully paid in cash, as mortgages are not permitted in such transactions. While BSD applies based on the property’s purchase price or market value, ABSD may not be payable if the beneficiary does not already own any residential property at the time of purchase.

The trust can be terminated when the beneficiary reaches a certain age (typically 21 for minors) or when the terms of the trust deed are fulfilled. Once the trust is terminated, legal ownership of the property can be transferred to the beneficiary, who then becomes the legal owner.

Since purchasing a property under a trust can be complex, it is advisable to seek legal counsel to ensure the trust is set up correctly and in compliance with regulations.

Now before exploring the potential pathways, let’s organise your current properties into a table to get a clearer understanding of your situation.

Since we don’t have the exact address of your HDB flat, we will use the median price of all 5-room flats transacted in Q2 of this year for our calculations. Additionally, as you’ve indicated that the new launch property has appreciated, we will assume a 10% increase in its value.

| Property held | By who | Estimated value | Rental income (if any) | Rental yield |

| HDB | Husband | $719,505 | – | – |

| Condo #1 | Husband and wife | $950,000 | $3,100/month | 3.9% |

| Condo #2 | Wife | $950,000 | $3,900/month | 4.9% |

| Condo #3 | Husband and wife | $2.44M | – | – |

From this, the only scenario where you can avoid paying ABSD is if you sell the HDB, condos #1 and #3, and purchase another property in your name. This would leave you with two properties—one under your name and the other under your wife’s.

Since the HDB and condos #1 and #2 are fully paid in cash, if you have children under the age of 21, you could consider another approach. Instead of buying the new property in your name, you could sell the HDB and either condo #1 or #3, then purchase the larger condo under a trust for your child. This strategy would allow you to hold three properties without incurring ABSD, while still achieving your goal of maintaining assets in property and securing rental income for your retirement.

However, if this option isn’t feasible and you aim to own more than two properties, paying ABSD will be unavoidable.

Let’s now examine the potential pathways and the associated costs.

Potential pathways

Remain status quo

While it’s still unclear whether you’ll move into condo #3 or remain in your HDB, for the purposes of this calculation, we’ll assume you choose to move into the new condo and rent out the HDB. As usual, let’s look at this over 10 years.

Due to the relatively lower price points of HDB flats, they tend to offer higher rental yields. For this scenario, we’ll use a rental yield of 5% in our calculations.

Gains from renting out the HDB

| Rental income | $359,760 |

| Town council service and conservancy fee (Assuming $80/month) | $9,600 |

| Property tax | $47,950 |

| Agency fees (Assuming it’s payable once every 2 years) | $16,340 |

| Total gains | $285,870 |

Gains from renting out condo #1

| Rental income | $372,000 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Property tax | $50,400 |

| Agency fees (Assuming it’s payable once every 2 years) | $16,895 |

| Total gains | $274,705 |

Gains from renting out condo #2

| Rental income | $468,000 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Property tax | $71,040 |

| Agency fees (Assuming it’s payable once every 2 years) | $21,255 |

| Total gains | $345,705 |

Cost of holding condo #3

| Interest expense (Based on a $1M loan, 14-year loan tenure and 4% interest) | $278,735 |

| Maintenance fee (Assuming $350/month) | $42,000 |

| Property tax | $57,200 |

| Total costs | $377,935 |

Total gains if you were to take this pathway: $285,870 + $274,705 + $345,705 – $377,935 = $528,345

As condo #3 has already been purchased, we have not included the ABSD paid in this calculation. However, if we factor that in, based on a purchase price of $2.2M and a 15% ABSD rate in 2021, it amounts to $330,000. This is a significant sum to break even on, and based on the above calculations, it would take 10 years of renting out condo #2 to recoup this cost.

Sell HDB, condos #1 and #3 and purchase a bigger condo

Since the HDB and condo #1 are fully paid up in cash, the sales proceeds will be in full cash.

Selling condo #3

| Selling price | $2,440,000 |

| Outstanding loan | $1,000,000 |

| CPF to be refunded into OA | $750,000 |

| Sales proceeds | $690,000 |

Total funds available for the next purchase: $719,505 + $950,000 + $690,000 + $375,000 (half of CPF refund from the sale of condo #3) = $2,734,505

Here, we have not accounted for the $500,000 in savings you have, as we are already using the proceeds from the sale of the three properties. If you choose to use these savings, it would increase your affordability.

With a total budget of $2.7M, you could find a well-sized 3 or even 4-bedroom unit for your family, depending on the districts you are considering. Also, this might mean you won’t need to take out a loan. Nonetheless, we will still calculate your affordability assuming you decide to take one.

Husband’s affordability

| Maximum loan based on the age of 48 with a monthly income of $12K at a 4.8% interest | $919,187 (17-year tenure) |

| CPF + cash | $2,734,505 |

| Total loan + CPF + cash | $3,653,692 |

| BSD based on $3,653,692 | $158,821 |

| Estimated affordability | $3,494,871 |

With increased affordability, you’ll certainly have more options at your disposal, but your final choice will depend on your preferences. Opting for a loan, especially in a high-interest rate environment, will result in higher costs.

Let’s presume for this calculation that you purchase a $2.7M property and pay it in full.

Cost incurred

| BSD | $104,600 |

| Maintenance fee (Assuming $350/month) | $42,000 |

| Property tax | $72,800 |

| Total costs | $219,400 |

Total gains if you were to take this pathway: $345,705 (gains from renting condo #2) – $219,400 = $126,305

With fewer properties available for rent, your potential gains are also diminished.

To provide a comprehensive view, let’s consider another scenario.

Sell both co-owned properties and purchase another 2 individually

This means you would retain the existing flat and condo #2 while acquiring two additional properties individually. This way, each of you will end up with two properties in your name.

Total funds available for the next purchase: $950,000 + $690,000 + $750,000 (combined CPF) + $500,000 (combined savings) = $2,890,000

For calculation purposes, we will split equally in half.

Husband’s affordability

| Maximum loan based onthe age of 48 with a monthly income of $12K at a 4.8% interest | $919,187 |

| CPF + cash | $1,445,000 |

| Total loan + CPF + cash | $2,364,187 |

| BSD based on $2,364,187 | $87,809 |

| ABSD based on $2,364,187 | $472,837 |

| Estimated affordability | $1,803,541 |

Wife’s affordability

Given that your wife is a freelancer and her income may be inconsistent, securing a loan could be more challenging. Therefore, for our calculations, we will assume she purchased the property without taking out a loan.

| CPF + cash | $1,445,000 |

| BSD based on $1,445,000 | $42,400 |

| ABSD based on $2,364,187 | $289,000 |

| Estimated affordability | $1,113,600 |

Let’s say you were to purchase a property at $1.8M and your wife purchases one at $1.1M. We’ll presume you continue residing in your HDB and rent both of these properties out at a 3.5% yield.

Husband’s property

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| ABSD | $360,000 |

| CPF + cash | $1,445,000 |

| Loan required | $774,600 |

| BSD | $59,600 |

| ABSD | $360,000 |

| Interest expense (Assuming a 17-year tenure and 4% interest) | $237,428 |

| Maintenance fee (Assuming $350/month) | $42,000 |

| Property tax | $118,800 |

| Rental income | $630,000 |

| Agency fee (Assuming it’s paid once every 2 years) | $28,615 |

| Total costs | $216,443 |

Wife’s property

| BSD | $28,600 |

| ABSD | $220,000 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Property tax | $53,000 |

| Rental income | $384,960 |

| Agency fee (Assuming it’s paid once every 2 years) | $17,485 |

| Total gains | $35,875 |

Holding the HDB

| Town council service and conservancy fee (Assuming $80/month) | $9,600 |

| Property tax | $6,870 |

| Total costs | $16,470 |

Total gains if you were to take this pathway: $216,443 + $16,470 – $35,875 – $345,705 = $148,667

What should you do?

| Potential pathway | Number of properties owned | Total gains in 10 years | Monthly rental income | Funds leftover |

| Remain status quo | 4 | $528,345 | $9,998 | $500,000 |

| Sell HDB, condos #1 and #3 and purchase a bigger condo | 2 | $126,305 | $3,900 | $875,000 ($500,000 savings + $375,000 of wife’s CPF) |

| Sell both co-owned properties and purchase another 2 individually | 4 | $148,667 | $12,358 | $0 |

Assuming the first three properties were purchased before the introduction of ABSD, you are clearly in a favourable position, given the significant cost implications we observed in the last pathway.

We understand the desire to leverage your existing properties, but unless you are confident that the new properties you acquire will appreciate more than the ABSD and other associated costs, it might be more prudent to stick with your current portfolio.

Looking at your existing investment properties, their strong rental yields suggest that their appreciation over the past decade may have been somewhat lacklustre. Given your age and financial position, there’s an opportunity to consider liquidating these assets and reallocating the capital into a larger property with stronger appreciation potential. While this strategy could enhance long-term capital growth, it’s important to note that it may lead to a reduction in passive income from rental yield in the short term, as larger properties may trade off immediate cash flow for higher future value.

Since you’ve expressed a desire to keep your assets in real estate and rely on rental income for retirement, holding four properties would undoubtedly be more beneficial than just two. This strategy would provide greater diversification and more rental income. If your strategy involves long-term rental rather than flipping properties, focusing on rental yields rather than appreciation potential becomes more important.

Additionally, consider the ABSD paid for condo #3. Unless the property’s appreciation over recent years has offset this cost, selling it now may not be the most advantageous move unless there’s an urgent need. Renting it out while residing in the HDB and waiting for property values to rise could be a better strategy.

Also, if you’re able to set aside any emotional attachment to your HDB, selling it could free up additional capital that can be reinvested into the private property market, which offers greater potential for a stronger ROI.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

New Launch Condo Analysis LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Property Investment Insights Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Latest Posts

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

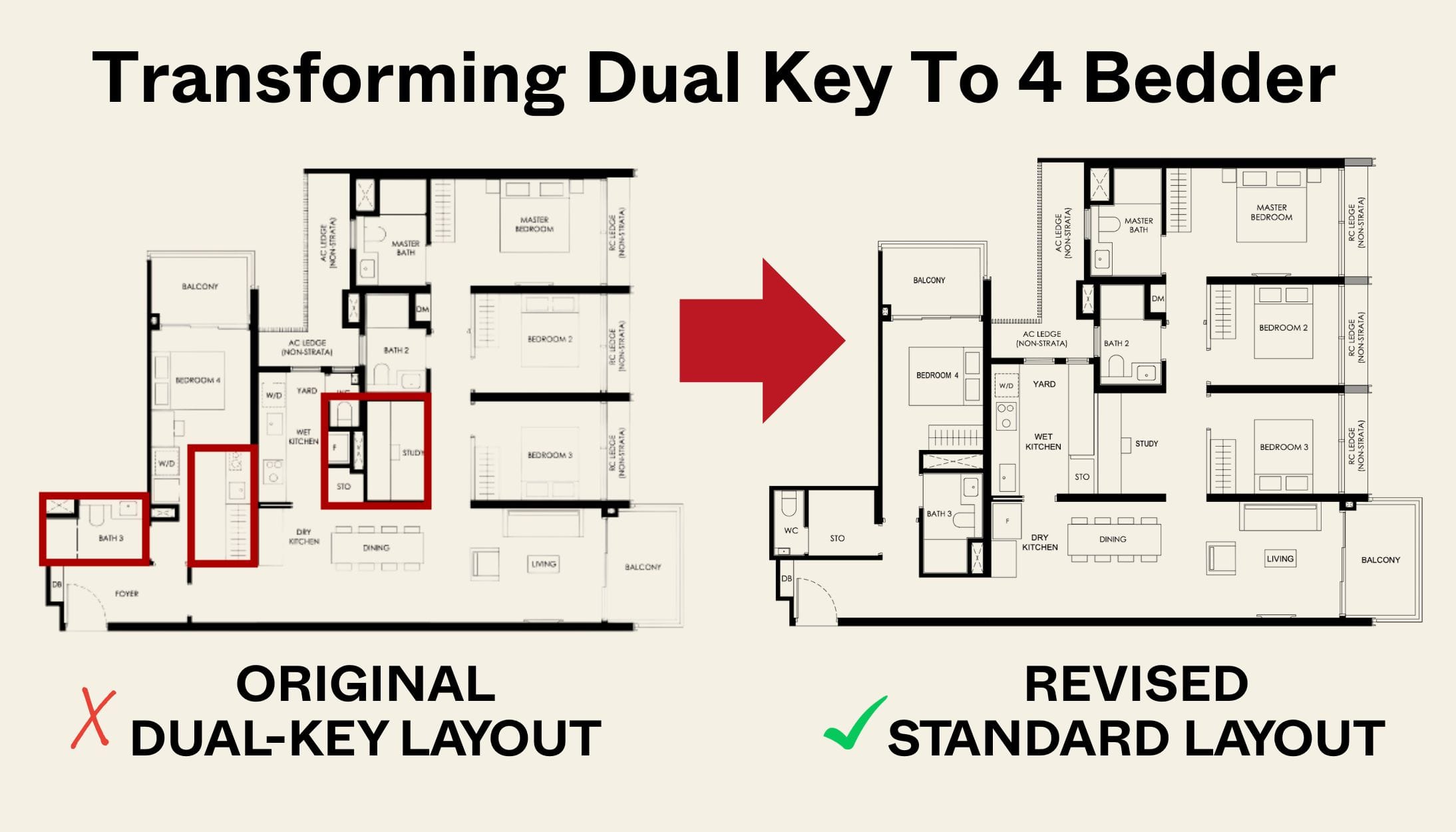

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Absolutely disgusting behaviour. 4 properties with passive income from 2, and still looking to make more money off the resale market. These parasites are jacking up home prices across the country and pricing out the lower-middle class with upgrading aspirations. The government should have banned HDB owners from buying additional private property from the very start.

Good read.

For option using trust, his son would not be able to buy hdb with tat.

Might be a big concern