We Make $360K Per Year & Own A Condo & HDB In Our 50s: Should We Sell Or Keep Our Properties To Retire?

August 19, 2023

Dear Stacked Homes,

I have been following your site for sometime and really want to thank you and your team for sharing your expertise and insights with us.

I will like to seek your opinion as my hubby and I are planning for retirement in about 10 years. I don’t think we have issues retiring by early 60s but I wonder if we should review our plans so that we can retire comfortably without relying on anyone or afford to go for frequent tours (airbnb – non luxury holidays). And also to leave something for our 2 kids. My hubby and I are 53 and 51 respectively. Our monthly combine is about 30K today. We have 2 teenagers. They should finish their education in 10 years time.

We are staying in a fully paid 22 years old 4 room HDB in district 3. It is held under my parent and my name. Hubby and myself has a 99 leasehold condo unit district 3 which we bought at 1.7m. It TOP in 2016 and is rented out currently. Intention is to pay off remaining 300K by 2024 and be totally debt free.

My HDB was paid by me and has accrued interest of 119K. Current market value is 800K. I have about 200k OA and 200K SP in CFP. You can assume same for hubby for OA and SP. His CPF is untouched apart from the initial down payment. We can assume to hold slightly over 0.6 M cash after we clear off condo debts.

Original intention is to retire by early 60s and live off rental + cash saved up and continue staying in current HDB. We also have the intention to do a reno and age proof current hdb in about 5 years time; that may take up slightly over 100K.

As leasehold depreciates after sometime, I am wondering when is normally a time/signal to sell lease hold? Also should I contemplate to keep condo till we (hubby and I) are gone and have kids sell it away and split the money? Are there any other options that we can consider without jeopardizing retirement plans? Do we keep status quo or should we evaluate other investment? Or should we even contemplate selling away all and restart with HDB in future? My husband has never applied for HDB before.

We do not have much finance knowledge (Stocks etc) and hence are both a little risk adverse. My current assumption is that we have to pay for kids up till they complete local uni. Hope to leave them something when we are gone and hence back to question of keeping leasehold for them to sell in future. We are open to all suggestions.

Our current life style is very low key (public transport and hawker food most of time). I do not foresee much change in lifestyle after retirement. Apart for affordable holidays if possible. Maybe I will spend more on personal pursuits or hobby but as by then I will be ‘kids free’, I assume cash outflow will still be lower as compared to today. Appreciate your insights.

Do let me know what information I should provide you if anything is missing.

Thank you.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

First and foremost, thank you for being a loyal follower of our site. We genuinely appreciate your trust in us and are always glad to hear from readers like you.

It’s great to hear that you’re in the planning stages of your retirement, and you’re already thinking proactively about ensuring a comfortable life for you and your family. Planning ahead is crucial, especially when considering both your desires for frequent travel and the future well-being of your children.

Owning two fully owned properties (once you clear the remaining condominium mortgage next year) is undeniably a favourable position. It allows you to be stress-free should you decide to remain status quo but also serves as a valuable foundation if you opt to restructure your portfolio.

Given your combined monthly income and the time frame you’ve provided, there are several strategies you can consider (property-wise) to ensure you meet your retirement goals. Before we fully get into it, we would also like to preface this by saying we aren’t financial/retirement experts by any means, but we hope to give some clarity from a property perspective. Let’s start by looking at your affordability first:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

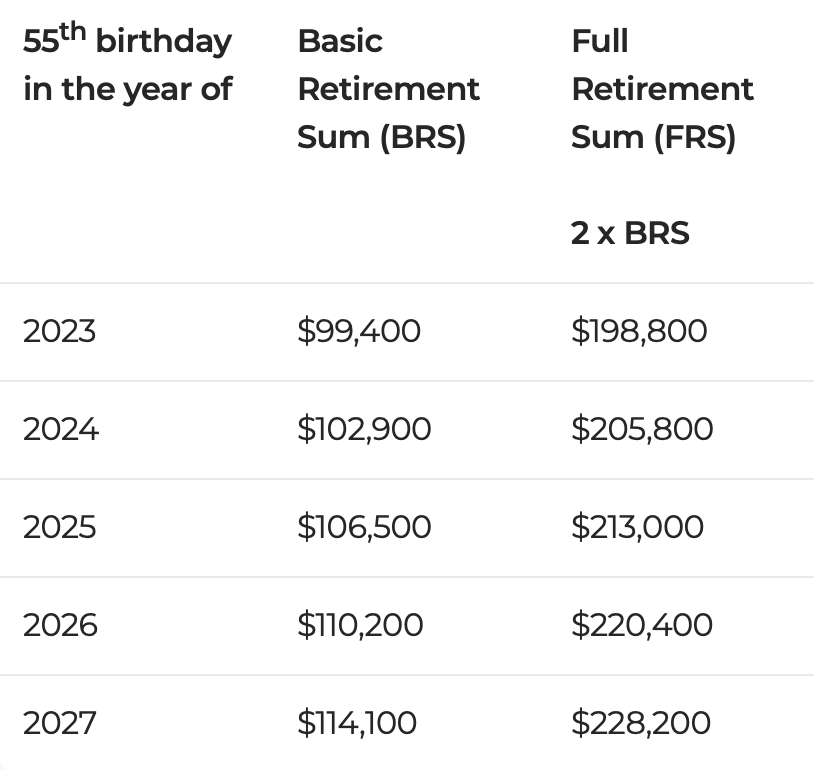

The following table shows the Basic and Full Retirement Sum based on your age.

Looking at the CPF retirement sums, it’s evident that both you and your husband will surpass the Full Retirement Sum (FRS) by the age of 55. Therefore, any amount exceeding the FRS can be withdrawn at your discretion. Furthermore, as your intention is to settle the condo’s payment by the upcoming year, should you opt to sell your properties at a later point, you will receive the entirety of the selling price in the form of CPF funds and cash. As you have met the FRS requirement, the CPF funds received from the sale of the property/properties can also be withdrawn as cash.

Let’s list down all the funds you have in order to provide better clarity.

While we don’t have the actual development in District 3 at hand, let’s assume it’s Echelon based on the age and price given:

| Date | Size (sqft) | PSF | Price | Level |

| May 2023 | 1,001 | $2,026 | $2,028,000 | #22 |

| May 2023 | 1,001 | $1,936 | $1,938,000 | #08 |

| May 2023 | 1,001 | $2,037 | $2,038,888 | #36 |

We will assume the average transacted price of $2,001,629 as the selling price.

| Description | Amount |

| If you sell the HDB | $800,000 (CPF and cash) |

| If you sell the condo | $2,001,629 (CPF and cash) |

| Cash on hand after paying off the loan | $600,000 |

| Husband’s CPF (That can be withdrawn after setting aside FRS) | $187,000 |

| Wife’s CPF (That can be withdrawn after setting aside FRS) | $171,800 |

Let’s now look at the various pathways that you’re considering.

Pathways

Ultimately, you will have to determine your priorities. Do you aim to leave behind an asset for your children, or do you see yourself liquidating your properties to fully enjoy your retirement?

Either way, you’ll pass something onto them – be it cash, property, or other investments.

The key is to pinpoint your inclination, as it shapes your decision-making. If your children already own property, bequeathing them another can be advantageous. Transferring property through a Will bypasses the ABSD. Plus, it could serve as a future home for them, an option not available with cash or other softer investments.

Now, onto your options:

Option 1: Remain status quo

One positive aspect of this pathway is that, in addition to your retirement funds, you will also benefit from the monthly rental income generated by the private property. This establishes a consistent stream of passive income, which can serve to complement your retirement funds. With this pathway, you will be leaving behind 2 properties for your children.

However, as you have rightly mentioned, a leasehold property may face lease decay at some point. So if you were to hold on to these 2 properties for an extended period of time, they may not fetch the same price that they do today. Let’s take a look at how properties in different age groups are performing in District 3.

4-room HDB in District 3

| Year | D3 4-room HDB 11-20 y/o | YoY | D3 4-room HDB 21-30 y/o | YoY | D3 4-room HDB 31-40 y/o | YoY | HDB Resale Price Index (RPI) – Q1 of each year | YoY |

| 2012 | $708 | – | $645 | – | $523 | – | 138.5 | – |

| 2013 | $745 | 5.23% | $673 | 4.34% | $580 | 10.90% | 148.6 | 7.29% |

| 2014 | $716 | -3.89% | $653 | -2.97% | $554 | -4.48% | 143.5 | -3.43% |

| 2015 | $761 | 6.28% | $615 | -5.82% | $536 | -3.25% | 135.6 | -5.51% |

| 2016 | $730 | -4.07% | $622 | 1.14% | $526 | -1.87% | 134.7 | -0.66% |

| 2017 | $741 | 1.51% | $631 | 1.45% | $525 | -0.19% | 133.9 | -0.59% |

| 2018 | $739 | -0.27% | $643 | 1.90% | $539 | 2.67% | 131.6 | -1.72% |

| 2019 | $755 | 2.17% | $653 | 1.56% | $511 | -5.19% | 131 | -0.46% |

| 2020 | $773 | 2.38% | $635 | -2.76% | $511 | 0.00% | 131.5 | 0.38% |

| 2021 | $811 | 4.92% | $664 | 4.57% | $524 | 2.54% | 142.2 | 8.14% |

| 2022 | $856 | 5.55% | $701 | 5.57% | $553 | 5.53% | 159.5 | 12.17% |

| Annualised | – | 1.92% | – | 0.84% | – | 0.56% | – | 1.42% |

| Age of flat | Average PSF (2022) | % difference |

| D3 4-room HDB 11-20 y/o | $856 | – |

| D3 4-room HDB 21-30 y/o | $701 | -22.11% |

| D3 4-room HDB 31-40 y/o | $553 | -26.76% |

The data presented in the above tables reveals that 4-room HDBs within District 3, aged between 11 and 20 years, outperform the overall HDB market. However, those aged 21 years and above are displaying a slower growth rate. Notably, there is a considerable decline in the average price PSF as the flats get older.

99-year leasehold non-landed property in District 3

| Year | D3 99y non-landed 11-20 y/o | YoY | D3 99y non-landed 21-30 y/o | YoY | D3 99y non-landed 31-40 y/o | YoY | Property Price Index (PPI) of Residential Properties | YoY |

| 2012 | $1,362 | – | $1,280 | – | $1,163 | – | 151.5 | – |

| 2013 | $1,435 | 5.36% | $1,364 | 6.56% | $1,254 | 7.82% | 153.2 | 1.1 |

| 2014 | $1,477 | 2.93% | $1,296 | -4.99% | $1,219 | -2.79% | 147.0 | -4 |

| 2015 | $1,401 | -5.15% | $1,252 | -3.40% | $1,169 | -4.10% | 141.6 | -3.7 |

| 2016 | $1,380 | -1.50% | $1,211 | -3.27% | $1,171 | 0.17% | 137.2 | -3.1 |

| 2017 | $1,461 | 5.87% | $1,201 | -0.83% | $1,177 | 0.51% | 138.7 | 1.1 |

| 2018 | $1,812 | 24.02% | $1,281 | 6.66% | $1,348 | 14.53% | 149.6 | 7.9 |

| 2019 | $1,852 | 2.21% | $1,308 | 2.11% | $1,351 | 0.22% | 153.6 | 2.7 |

| 2020 | $1,690 | -8.75% | $1,293 | -1.15% | $1,331 | -1.48% | 157.0 | 2.2 |

| 2021 | $1,678 | -0.71% | $1,391 | 7.58% | $1,367 | 2.70% | 173.6 | 10.6 |

| 2022 | $1,819 | 8.40% | $1,511 | 8.63% | $1,431 | 4.68% | 188.6 | 8.6 |

| Annualised | – | 2.94% | – | 1.67% | – | 2.10% | – | 2.21% |

In a previous case study conducted by NUS, it revealed that when 99-year leasehold private properties hit the 21-year mark, they started to experience a significant depreciation rate of 30%. This is a much higher rate as compared to HDBs and freehold private properties.

Now, let’s delve into the associated expenses. You might be wondering – why bother looking at expenses? Our goal here is to see which strategy puts you in the best financial position, so looking at cost is crucial here.

Given your intention of ultimately passing these properties on to your children, it’s assumed that you plan to retain ownership until the time comes. For the purpose of our calculations, we’ll consider a timeframe of 30 years. Of course, any projection for this duration must be taken with a pinch of salt – costs will likely increase over time, so the further we project out, the chances of it being less accurate is higher. That being said, this is purely just to give you some indication.

The cost incurred to hold HDB for 30 years:

| Description | Amount |

| Town Council service and conservancy fees (Assuming $67.50/month) | $24,300 |

| Property tax | $19,200 |

| Total costs | $43,500 |

The cost incurred to hold a condo for 30 years:

There were twenty 3-bedroom rental transactions between April to June this year at an average price of $7,123/month. We will assume this to be the rent.

| Description | Amount |

| Maintenance fees (Assuming $400/month) | $144,000 |

| Property tax | $599,130 |

| Rental income (Assuming $7,123/month) | $2,564,280 |

| Agency fees payable once every 2 years | $115,395 |

| Total profits | $1,705,755 |

Total profits made in 30 years: $1,705,755 – $43,500 = $1,662,255

Amount of funds you will have for your retirement (not including the above profits):

| Description | Amount |

| Cash on hand (After deducting $100K for renovation of your HDB) | $500,000 |

| Combined CPF funds that can be withdrawn after setting aside FRS | $358,800 |

| Total | $858,800 |

Option 2: Sell both properties and buy an HDB (BTO/resale)

This approach would entail more detailed planning due to the varying procedures involved, depending on whether you opt for a BTO or a resale flat, and whether the purchase is made before or after you turn 55. Let’s explore the various scenarios.

Given that both you and your husband will still be working for the next decade, your income will render you ineligible to purchase a BTO unit or to take up any CPF Housing Grants. So let’s assume you opt to sell both properties and acquire another resale HDB.

Presently, there’s a 15-month wait-out period for individuals who sell their private property before they can buy a resale HDB flat. However, there’s an exception for buyers aged 55 and above, who are buying a 4-room or smaller non-subsidised unit. Therefore, there’s no hindrance if the purchase takes place after both of you turn 55. Nevertheless, if you intend to sell and buy prior to the age of 55, you’ll need to observe the 15-month wait-out period.

One approach is to sell the private property while residing in the HDB during this period. You can then dispose of your current HDB within 6 months of the purchase.

Alternatively, if your aim is to obtain a BTO after retirement, a 30-month wait-out period applies after disposing of your private property before you can apply for a BTO flat (unless you opt for a 2-room Flexi or Community Care unit). However, considering your children will likely still be living with you, a 2-room flat might not be practical.

Should you decide on this route, you could sell the private property 30 months before retiring, apply for the BTO after retirement, and await completion (around 3-4 years) while residing in your current HDB flat. Similarly, you will have 6 months to dispose of your current HDB.

The latter option appears more logical since it capitalises on your husband’s first-time buyer status, allowing you to acquire a new and subsidised flat. Having said that, do take note that if you’ve previously purchased a subsidised flat, a resale levy will be payable.

Let’s look at the costs involved presuming you were to take the route of buying a BTO after retirement.

The cost incurred to hold the condo for 7 years:

| Description | Amount |

| Maintenance fees (Assuming $400/month) | $33,600 |

| Property tax | $107,506 |

| Rental income (Assuming $6,055/month) | $508,620 |

| Agency fees payable once every 2 years | $19,617 |

| Total profits | $347,897 |

The cost incurred to hold current HDB for 14 years (Assuming BTO takes 4 years to complete):

| Description | Amount |

| Town Council service and conservancy fees (Assuming $67.50/month) | $11,340 |

| Property tax | $8,960 |

| Total costs | $20,300 |

The cost incurred to hold a new BTO for 16 years:

| Description | Amount |

| BSD (Assuming you manage to get one in the central region at a price of $750K) | $17,100 |

| Town Council service and conservancy fees (Assuming $67.50/month) | $12,960 |

| Property tax | $9,280 |

| Total costs | $39,340 |

Total profits made in 30 years: $347,897 – $20,300 – $39,340 = $288,257

Amount of funds you will have for your retirement (not including the above profits):

| Description | Amount |

| Cash on hand (Assuming you set aside $100K for the reno of BTO) | $500,000 |

| Combined CPF funds that can be withdrawn after setting aside FRS | $358,800 |

| Selling condo (Assuming you can still fetch the same price as today) | $2,001,629 |

| Selling HDB (After deducting the purchase price of $750K for BTO) | $50,000 |

| Total | $2,910,429 |

Option 3: Sell either one of the properties

Numerous factors come into play when determining which property to put up for sale. Opting to retain the condo provides the advantage of allowing your children to inherit it without the necessity of selling, should that align with their preference. Whereas, with the HDB, they would need to fulfil specific eligibility criteria to inherit the flat, potentially leading to a more intricate process.

While your residence has been the HDB all along, you might also contemplate a change of environment for your retirement years. Then there is also the cost factor, by staying in the HDB, the monthly town council service and conservancy fees as well as property tax will definitely be much lower than that of the condo. The decision regarding which property to sell hinges on your personal preference.

Let’s look at simple calculations for both scenarios:

The cost incurred to hold HDB for 30 years:

| Description | Amount |

| Town Council service and conservancy fees (Assuming $67.50/month) | $24,300 |

| Property tax | $19,200 |

| Total costs | $43,500 |

Amount of funds you will have for your retirement:

| Description | Amount |

| Cash on hand (Assuming you set aside $100K for reno) | $500,000 |

| Combined CPF funds that can be withdrawn after setting aside FRS | $358,800 |

| Selling condo | $2,001,629 |

| Total | $2,860,429 |

The cost incurred to hold condo for 30 years:

| Description | Amount |

| Maintenance fees (Assuming $400/month) | $144,000 |

| Property tax | $110,610 |

| Total costs | $254,610 |

Amount of funds you will have for your retirement:

| Description | Amount |

| Cash on hand | $600,000 |

| Combined CPF funds that can be withdrawn after setting aside FRS | $358,800 |

| Selling HDB | $800,000 |

| Total | $1,758,800 |

Alternative option

Given your intention to maintain ownership of the property/properties over an extended period, an alternative worth contemplating is to retain the condominium in the interim since it is still relatively new and has good reliability. If the main concern now is for passive income, a leasehold property generating rental would be preferable.

Then, post-retirement, you could explore the possibility of liquidating the condominium and redirecting the funds towards acquiring a freehold property to counter any lease decay over a longer hold. This property should be purchased under your husband’s name so as to not incur any ABSD.

The cost incurred to hold HDB for 30 years:

| Description | Amount |

| Town Council service and conservancy fees (Assuming $67.50/month) | $24,300 |

| Property tax | $19,200 |

| Total costs | $43,500 |

The cost incurred to hold current condo for 10 years:

| Description | Amount |

| Maintenance fees (Assuming $400/month) | $48,000 |

| Property tax | $199,710 |

| Rental income (Assuming $7,123/month) | $854,760 |

| Agency fees payable once every 2 years | $38,465 |

| Total profits | $568,585 |

Let’s assume that after selling your existing condo, you purchase a freehold 2-bedder in D3 for $2.5M, and rent this out at $5,000/month for 20 years.

| Description | Amount |

| BSD | $94,600 |

| Maintenance fees (Assuming $300/month) | $72,000 |

| Property tax | $216,000 |

| Rental income (Assuming $5,000/month) | $1,200,000 |

| Agency fees payable once every 2 years | $54,000 |

| Total | $1,636,600 |

Total profits made in 30 years: $568,585 + $1,636,600 – $43,500 = $2,161,685

Amount of funds you will have for your retirement (not including the above profits):

| Description | Amount |

| Combined CPF after deducting BSD (That can be withdrawn after setting aside FRS) | $264,200 |

Other things to note

In both scenarios 2 and 3, given the substantial cash proceeds from the sale of your property/properties, you might contemplate allocating a portion of these funds toward investments to potentially augment your resources. Understanding your inclination towards risk aversion, a prudent approach could involve directing a portion of these funds to top up your CPF Retirement Account (RA), benefiting from its stable 4% interest rate.

In both options, you will have well over a million dollars in hand, so let’s say you were to put $1M into your CPF RA account for 30 years.

| Starting point | $1,000,000 |

| Year 1 | $1,040,000 |

| Year 2 | $1,081,600 |

| Year 3 | $1,124,864 |

| Year 4 | $1,169,859 |

| Year 5 | $1,216,653 |

| Year 6 | $1,265,319 |

| Year 7 | $1,315,932 |

| Year 8 | $1,368,569 |

| Year 9 | $1,423,312 |

| Year 10 | $1,480,244 |

| Year 11 | $1,539,454 |

| Year 12 | $1,601,032 |

| Year 13 | $1,665,074 |

| Year 14 | $1,731,676 |

| Year 15 | $1,800,944 |

| Year 16 | $1,872,981 |

| Year 17 | $1,947,900 |

| Year 18 | $2,025,817 |

| Year 19 | $2,106,849 |

| Year 20 | $2,191,123 |

| Year 21 | $2,278,768 |

| Year 22 | $2,369,919 |

| Year 23 | $2,464,716 |

| Year 24 | $2,563,304 |

| Year 25 | $2,665,836 |

| Year 26 | $2,772,470 |

| Year 27 | $2,883,369 |

| Year 28 | $2,998,703 |

| Year 29 | $3,118,651 |

| Year 30 | $3,243,398 |

You can see from the table above that by doing so, it can greatly help to supplement your retirement funds. Do note that any withdrawals during this 30-year period will affect the final balance.

Revisiting your options

| #1: Remain status quo | #2: Sell both properties and buy a HDB (BTO/resale) | #3a: Sell condo, keep HDB | #3b: Sell HDB, keep the condo | #4: Keep HDB, sell current condo and buy a freehold condo | |

| What you will leave behind for your children | 1 HDB, 1 condo | 1 HDB | 1 HDB | 1 condo | 1 HDB, 1 condo |

| Costs incurred over 30 years | $1,433,475 (Profits) | $288,257 (Profits) | $43,500 | $254,610 | $2,161,685 (Profits) |

| Retirement funds you’ll have (After meeting FRS) | $858,800 | $2,910,429 | $2,860,429 | $1,758,800 | $264,200 |

Each of the four options possesses its own set of benefits. And as we mentioned previously, the decision ultimately hinges on your individual preferences. A more straightforward way to look at this is: it’s a tradeoff between having more properties to pass on vs enjoying more cash for your retirement.

Under Options 1 and 4, you will enjoy a consistent flow of rental income which could potentially offset your monthly expenses. Consequently, you can retain surplus CPF funds in the RA account, thereby generating interest. This choice also entails bequeathing two properties to your children. In the age where ABSD is more or less here to stay, this could be the most viable option as it means your children could potentially own multiple properties next time in the most fuss-free way.

Option 2 entails amassing a substantial cash reserve for your retirement. Leveraging your husband’s “first-timer” status enables you to procure a brand-new HDB unit. Given the current ages of your properties (22 and 10 years), projecting three decades ahead, they will age to 52 and 40 years. Given their 99-year leasehold tenure, their future market value may decline compared to present prices. By purchasing a BTO after your retirement, the flat’s age will remain below 20 years (factoring in 3 – 4 years for construction) in 30 years’ time. This would ensure the property remains relatively young if passed on to your children. Do note that if you have previously purchased a subsidised flat, a resale levy will be payable when you purchase the BTO.

Option 3 necessitates deciding whether to dispose of either the HDB or the condo, contingent upon your living preferences. Opting for the HDB incurs fewer expenses and augments your liquid assets. However, passing it down entails your children meeting HDB’s eligibility requisites, or otherwise divesting it. On the other hand, inheriting the condo is simpler, albeit with higher costs.

Ultimately, regardless of your chosen course, your children will inherit an asset. Considering the extended time horizon, Option 2 would be our pick if you’re focused on having a large retirement fund while not having to worry about holding on to a depreciating asset.

Additionally, you can capitalise on the “Singaporean privilege” to acquire a new flat. The resultant cash infusion can be partly directed toward augmenting your CPF RA account, which accrues a stable 4% interest, enhancing the longevity of your retirement funds and would eventually serve as a bountiful inheritance for your kids that’s liquid and easy to invest (or spend) which makes things less complicated for them later on.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

4 Comments

Omg. No need to write a phD thesis to answer. Answer is keep status quo, don’t do anything.

Great analysis, details, and helfpul insights. Seems like this couple have, what we call, a “good problem”.

In option 4, how is the couple going to finance their 2.5m freehold condo after selling the condo at 2.01m? I’m not sure if you can pump in $1m into RA and even if it does, RA compounds at 4% but I think the interest will be channeled to the cohort account so effectively, you will get a higher monthly CPF Life payout till your death but not a $3.2m golden tap for you to tap on.