Hi there

Happy 2024 in advance!

I have been a silent reader trying to gain bits and pieces of property $ wisdom from your blog (unfortunately I’m still struggling to make sense).

So I wanted to seek advice on our situation.

2024:

- We are DINK.

- Hub, annual income $140-150k

- Wife, annual income $150k

- Hub’s income is stable. Wife may have job stability issue, might also face difficulty getting similar income job.

- Owns 4-room BTO in mature estate costing close to 600K and can sell in 2024. Unfortunately, we are about to fully pay off the house – yes, stupid move – just within 5 years. Hope to be able to sell it above $900k or even the magic $1m.

We wish to cash out from our BTO and buy a condo for own stay. Second investment property will be depending on wife job stability and income. I guess we have no choice but to go with resale condo for own stay because we need an immediate place to stay and don’t feel renting a place in the interim is wise.

Requirements for condo

- near MRT (hopefully not too far east, west or north)

- preferably 3B2B as we may rent one room out or standby if we have kids

- no boutique condo

- best if condo is below 15 years old

PS- we like Redhill, Toa Payoh, Bishan area but the prices seem out of reach.

Given our requirements and preference to rely on husband income (in case wife is laid off):

- what’s the condo price range we should look at?

- which would be suitable condos for us?

- is it correct that we should look at resale condo for own stay?

- what should we take note to plan for our condo purchase?

Cash savings

- prefer to use what we can cash out from our HDB and not touch our existing cash savings

- however, if there’s a good condo with great investment horizon, we can squeeze out $200k

Last thing, for our own stay condo, we intend to move out after 3-5 years if it’s the right time to sell and profit.

Thank you ☺️

Hi there,

Thanks for writing in!

As you’ve probably seen from countless examples, the profits that one can get from a BTO serve as a great stepping stone that can significantly assist with the downpayment for your next property.

To address your concerns, we’ll take a look at your affordability given the information above, the costs incurred depending on the various options you take, what options you can consider and whether these are acceptable.

Affordability

Since you will fully pay off the loan for your HDB next year, you will receive the full sale price in CPF and cash. To be conservative, let’s use a hypothetical selling price of $900,000.

| Description | Amount |

| Selling price | $900,000 |

| CPF to be refunded into OA | $192,700 |

| Cash proceeds | $707,300 |

Husband’s affordability

| Description | Amount |

| Maximum loan based on income of $12,500/month with a 4.6% interest | $1,319,831 (29-year tenure) |

| CPF funds | $107,000 |

| Cash | $707,300 |

| Total loan + CPF + cash | $2,134,131 |

| BSD based on $2,134,131 | $76,306 |

| Estimated affordability | $2,057,825 |

With just your husband’s income and the sales proceeds from your current flat, you can afford a property of up to $2,057,825 (this does not include your cash savings of $200,000). Now that we have a better idea of your budget, let’s look at some pointers to take note of when buying a private property.

Things to note

Whether you’re buying a private property or an HDB, there are certain things you ought to plan for which we have previously discussed in this article.

Given your available funds, the downpayment for purchasing a private property shouldn’t pose a challenge. However, you should note that for HDB (Housing Development Board) properties, you can get a loan with a Loan To Value (LTV) ratio of up to 80%, which means you can use your CPF (Central Provident Fund) to cover the entire remaining 20% of the property price. In contrast, for a private property with a bank loan, the maximum LTV ratio is 75%. This means you have to cover 25% of the property price, and at least 5% of this amount must be paid in cash.

Another aspect to consider is the payment of Buyers Stamp Duty (BSD). When purchasing a resale private property, the BSD must be paid within 14 days of exercising the Option To Purchase (OTP). However, this timeframe might not be sufficient to withdraw the required funds from your CPF account. Therefore, the BSD has to be paid in cash initially (you can seek reimbursement from CPF later on). Conversely, in the case of new launches, you can use your CPF funds to pay the BSD without the necessity of an initial cash payment.

It’s important to highlight, although it might seem obvious, that the monthly expenses for a private property will exceed those for an HDB. Apart from mortgage repayments, the maintenance fees and property tax will also be higher. Additionally, properties being rented out fully incur a non-owner-occupied property tax, which is quite a bit higher than for owner-occupied homes.

Deciding between buying a resale condo or a new launch property predominantly hinges on personal preferences since this will be your place of residence. To provide better clarity, let’s compare the incurred costs in both scenarios.

Costs incurred

For calculation purposes, we will use the same purchase price of $2M for both properties and assume a 5-year holding period.

Buying a resale condo

| Description | Amount |

| Purchase price | $2,000,000 |

| BSD | $69,600 |

| CPF + cash | $814,300 |

| Loan required | $1,255,300 |

Costs incurred

| Description | Amount |

| BSD | $69,600 |

| Interest expense | $238,991 |

| Maintenance fee (Assuming $400/month) | $24,000 |

| Property tax | $18,400 |

| Total costs | $350,991 |

Let’s also take a look at the breakeven price should you decide to sell in the 5th year.

| Monthly repayment based on a loan of $1,255,300 at 4% interest | $6100 |

| Total repayments made in 5 years | $366,000 |

| Outstanding loan on the 5th year | $1,128,265 |

| Initial CPF outlay + accrued interest | $121,061 |

| Initial cash outlay | $707,300 |

| BSD + maintenance fee + property tax | $112,000 |

| Breakeven price | $2,434,626 |

Buying a new launch

For completeness, we’ll also consider a scenario where you purchase a new launch. As you’ve mentioned that you do not have alternative accommodation, buying a new launch would mean having to rent during the interim period.

Looking at the 3 estates you’ve listed down, the average rent for a 4-room flat in Q3 2023 ranges from $3,500 – $3,900. So let’s say you were to rent a unit at the median price of $3,700.

| Description | Amount |

| Purchase price | $2,000,000 |

| BSD | $69,600 |

| CPF + cash | $814,300 |

| Loan required | $1,255,300 |

Progressive payment plan

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 0.00% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 2.77% | $55,400 | $85 | $185 | $269 | 6-9 months | $1,665 |

| Completion of brick wall | 5.00% | $100,000 | $237 | $518 | $755 | 3-6 months | $3,108 |

| Completion of ceiling/roofing | 5.00% | $100,000 | $390 | $851 | $1,241 | 3-6 months | $5,106 |

| Completion of electrical wiring/plumbing | 5.00% | $100,000 | $542 | $1,185 | $1,727 | 3-6 months | $7,110 |

| Completion of roads/car parks/drainage | 5.00% | $100,000 | $695 | $1,518 | $2,213 | 3-6 months | $9,108 |

| Issuance of TOP | 25.00% | $500,000 | $1,458 | $3,185 | $4,643 | Usually a year before CSC | $38,220 |

| Certificate of Statutory Completion (CSC) | 15.00% | $300,000 | $1,916 | $4,185 | $6,101 | Monthly repayment until the property is sold | $25,110 |

| Total interest paid in 5 years | $89,427 |

*For calculation purposes, we presumed the longest duration at each stage

| Description | Amount |

| BSD | $69,600 |

| Interest expense (Assuming a 4% interest) | $89,427 |

| Maintenance fee (Assuming $400/month) | $7,200 |

| Property tax | $7,360 |

| Rental expense (Assuming $3,700/month for 3.5 years) | $155,400 |

| Total costs | $328,987 |

*Maintenance fees and property tax are only payable upon TOP

Let’s also take a look at the breakeven price should you decide to sell in the 5th year.

| Total repayments made in 5 years | $130,359 |

| Outstanding loan on the 5th year | $1,214,359 |

| Initial CPF outlay + accrued interest | $121,061 |

| Initial cash outlay | $707,300 |

| BSD + maintenance fee + property tax + rental expense | $239,560 |

| Breakeven price | $2,412,639 |

As you can see from the above, if both resale and new launch options are priced similarly, there isn’t a significant difference in the incurred costs or breakeven price at the end of 5 years.

In the case of purchasing a resale property, especially given the prevailing high interest rates, a substantial portion of the total expenses stems from interest charges, as the full loan amount is disbursed upon completing the transaction.

Conversely, in the scenario of buying a new launch, although the interest expenses may be lower due to the progressive payment plan, the high rental costs significantly contribute to the overall expenses.

Therefore, when solely considering costs, the choice ultimately hinges on your personal preferences. Resale properties offer more flexibility in terms of selecting projects in your preferred locations today. Whereas, with new launches, the availability of projects in your desired areas becomes a determining factor.

We have previously done an article comparing the profitability of new launches and resale condos and also one that touches on factors to consider when deciding between a new launch and resale condo, which may be helpful for you.

Now let’s take a look at some of the developments you can consider.

Options

As mentioned, considering only your husband’s income, your budget will be around $2.05M. Within this budget, there are a handful of developments in your preferred locations that match your requirements, so let’s take a look at how they are faring.

Redhill

Close to the Redhill MRT station, there are 2 projects with 3-bedders that fit your criteria and fall within your affordability – Alex Residences and Echelon.

The following graph includes sub-sale and resale transactions.

| Project | Artra | Alex Residences | Echelon | Ascentia Sky | The Metropolitan Condominium |

| Tenure | 99 years | 99 years | 99 years | 99 years | 99 years |

| Lease start year | 2016 | 2013 | 2012 | 2008 | 2006 |

| No. of units | 400 | 429 | 508 | 373 | 382 |

| Avg PSF in 2023 | $2,271 | $2,079 | $2,132 | $1,772 | $1,713 |

In comparison to the neighbouring projects, Alex Residences and Echelon are some of the younger developments within walking distance of the MRT station. We can see from the graph that over the past year, the average price PSF at Echelon has marginally surpassed that of Alex Residences.

Alex Residences 3-bedroom transactions under $2.05M

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2023 | 904 | $1,991 | $1,800,000 | #21 |

| Jul 2023 | 883 | $1,903 | $1,680,000 | #04 |

| Jun 2023 | 883 | $2,153 | $1,900,000 | #36 |

| Jan 2023 | 926 | $1,966 | $1,820,000 | #11 |

Echelon 3-bedroom transactions under $2.05M

| Date | Size (sqft) | PSF | Price | Level |

| Sep 2023 | 861 | $2,206 | $1,900,000 | #35 |

| Aug 2023 | 1,001 | $1,893 | $1,895,000 | #06 |

| May 2023 | 1,001 | $2,026 | $2,028,000 | #22 |

| May 2023 | 1,001 | $1,936 | $1,938,000 | #08 |

| May 2023 | 1,001 | $2,037 | $2,038,888 | #36 |

| Mar 2023 | 861 | $2,125 | $1,830,000 | #35 |

Looking at 3-bedroom transactions that are under $2.05M, there is a possibility of getting a bigger unit at Echelon. Even though the average PSF at Echelon is higher, its larger 3-bedder units start at 1,001 sq ft, so the overall quantum is kept under or around $2M. Whereas for Alex Residences, the larger 3-bedroom units start from 1,023 sq ft, resulting in the overall quantum exceeding your affordability.

Alex Residences 926 sq ft unit layout

The 926 sqft 3-bedroom unit at Alex Residences maximises its usable space effectively. Each of the 3 bedrooms offers ample space to accommodate a double bed and wardrobe. However, the kitchen, along with the living and dining areas, is compact. The balcony is decently sized and could potentially function as an alfresco dining area, thereby expanding the living space.

Echelon 1,001 sq ft unit layout

The 1,001 sq ft 3-bedroom unit at Echelon offers 3 bathrooms, providing each room with its dedicated bathroom, alongside an enclosed service yard next to the kitchen. The master bedroom is quite a good size, while one of the common rooms is relatively smaller, accommodating only a single bed. The open kitchen layout contributes to a more expansive living and dining area, although for those who usually do heavy cooking, it might not be the most suitable arrangement. Additionally, the length of the living room and balcony adds to the overall perception of spaciousness.

Considering the marginal difference in the age of the two developments and given a similar price range, our preference leans towards Echelon due to its larger unit size and the additional bathroom it offers.

Toa Payoh

Within Toa Payoh, the availability of condominiums is limited, but there’s one project, Gem Residences, offering 3-bedroom units that match your requirements and fall within your affordability. It is however situated closer to Braddell MRT station than Toa Payoh MRT station.

Another option is Trellis Towers, a freehold development completed in 2000.

The graph below includes sub-sale and resale transactions. While Oleander Towers is nearby, we excluded it as a potential competitor given it is much older.

| Project | Gem Residences | Trevista | Trellis Towers |

| Tenure | 99 years | 99 years | Freehold |

| Lease start year | 2015 | 2008 | – |

| No. of units | 578 | 590 | 384 |

| Avg PSF in 2023 | $1,840 | $1,640 | $1,871 |

An advantageous aspect of developments in this area is their scarcity, presenting limited condominium options for buyers set on residing in Toa Payoh. This scarcity could potentially sustain demand for these projects.

Interestingly, the data reflects that although Trellis Towers is a freehold development, its average price PSF is only slightly higher than that of Gem Residences.

Gem Residences 3-bedroom transactions under $2.05M

| Date | Size (sqft) | PSF | Price | Level |

| Nov 2023 | 947 | $1,858 | $1,760,000 | #07 |

| Nov 2023 | 980 | $1,787 | $1,750,000 | #32 |

| Oct 2023 | 980 | $1,654 | $1,620,000 | #08 |

| Aug 2023 | 1,012 | $1,779 | $1,800,000 | #16 |

| Aug 2023 | 1,055 | $1,818 | $1,918,000 | #09 |

| Jul 2023 | 1,012 | $1,927 | $1,950,000 | #27 |

| Jun 2023 | 947 | $1,879 | $1,780,000 | #29 |

Trellis Towers 3-bedroom transactions under $2.05M

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2023 | 1,141 | $1,791 | $2,043,000 | #09 |

With a similar budget, you will be able to get a decently sized unit in either development, although the units at Trellis Towers are slightly larger.

Gem Residences 1,055 sq ft unit layout

The 1,055 sq ft unit in Gem Residences offers ample comfort in terms of size. The kitchen includes a ventilated utility room, suitable for use as a helper’s room or simply as a storage space. All 3 bedrooms are well-sized, with the potential to create a walk-in wardrobe in the master bedroom. Furthermore, the balcony is notably expansive and could serve as a dining area, thereby creating more space in the living room.

Trellis Towers 1,141 sq ft unit layout

It’s worth noting that the units at Trellis Towers lack balconies, which may or may not align with your preferences. However, the absence of balconies implies that the entire area becomes a usable living space.

The 1,141 sq ft unit unquestionably offers a comfortable size. The kitchen features a yard, WC, and utility room, making it convenient for families with helpers. Additionally, there’s a storage room for putting away miscellaneous household items. Each of the 3 bedrooms is decently sized and can accommodate double beds and wardrobes (even though the floor plan depicts a single bed for the common rooms, allowing for more manoeuvrability).

Based on these recommendations so far, Trellis Towers has the most practical layout assuming you don’t appreciate outdoor spaces. Having a store is useful if you intend to have a helper at some point who can use the utility room. The dedicated yard space is also useful for storing soiled clothing and hanging dry your laundry.

When comparing the two developments, Trellis Towers appears to be a more sensible choice given that for a similar or slightly higher price, you acquire a freehold property. However, the transaction volume for this project is lower, potentially requiring some waiting time for a unit to become available on the market. We must also add that Trellis Towers does not meet your criteria for being 15 years or younger as its TOP was in 2000.

To conclude

Considering the substantial proceeds from the sale of your current flat and your husband’s income, acquiring a 3-bedroom unit in your desired estate that aligns with your requirements is feasible, despite potentially limited options. This constraint, however, could be advantageous as it simplifies decision-making by streamlining your choices. We also think it’s a prudent approach given your uncertainty.

When weighing the costs between purchasing a resale and a new launch condo, the difference is minimal, ultimately relying on your personal preferences. Opting for a resale condo allows you to enjoy the property for the duration of your holding period. Whereas, choosing a new launch condo would mean temporary relocation during the construction phase, limiting your period of stay or even excluding it altogether within a 3 to 5-year holding period.

Given that the suitable projects within your budget are situated in prime locations and are relatively young or possess freehold status (like Trellis Towers), the likelihood of significant price fluctuations in the short term is low, unless major market shifts occur, as seen during the pandemic. As such, the options presented above are rather safe and serve as a good starting point to explore.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

Homeowner Stories I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Landed Home Tours We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

Overseas Property Investing I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

Pro District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Pro New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

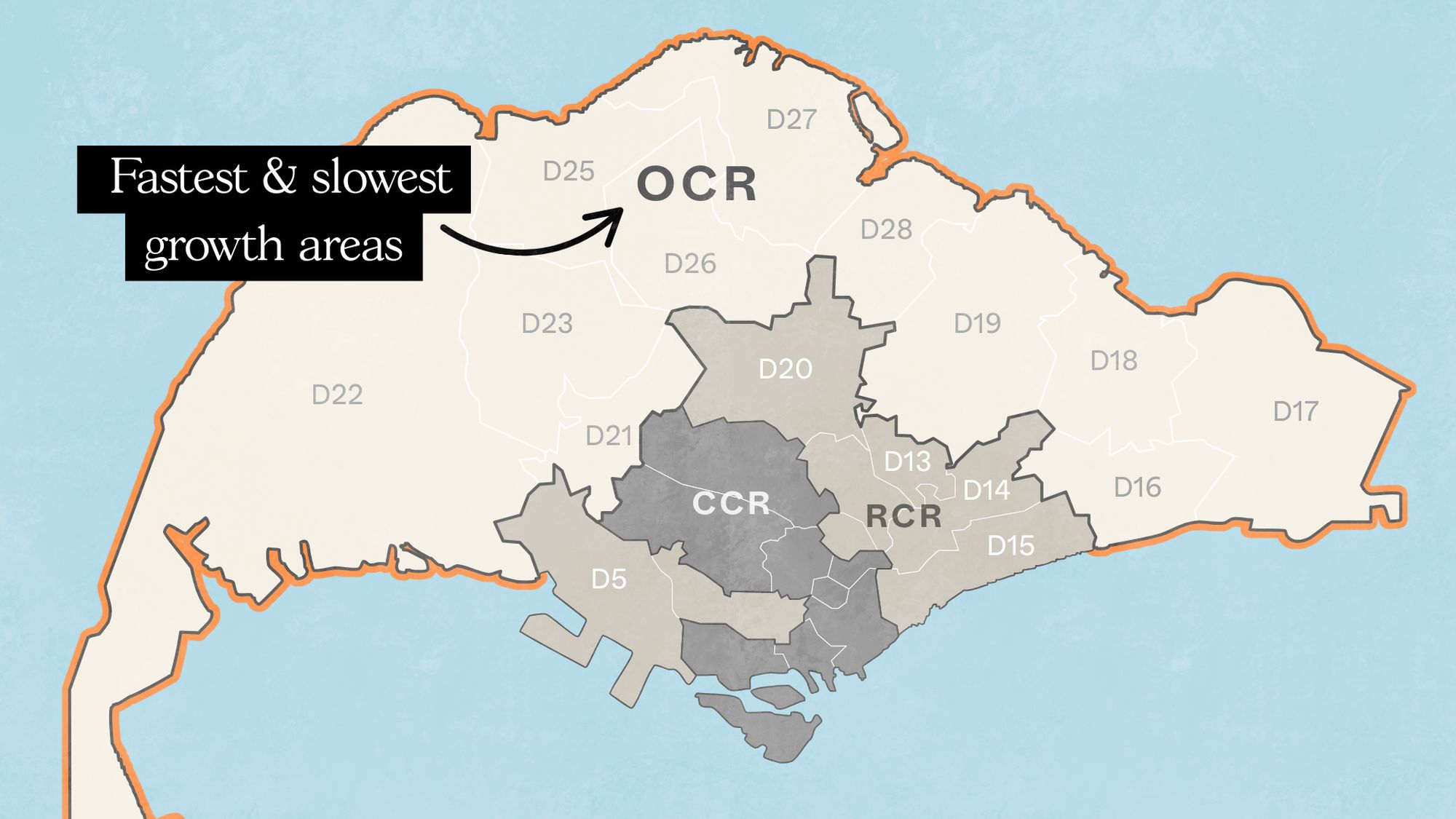

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

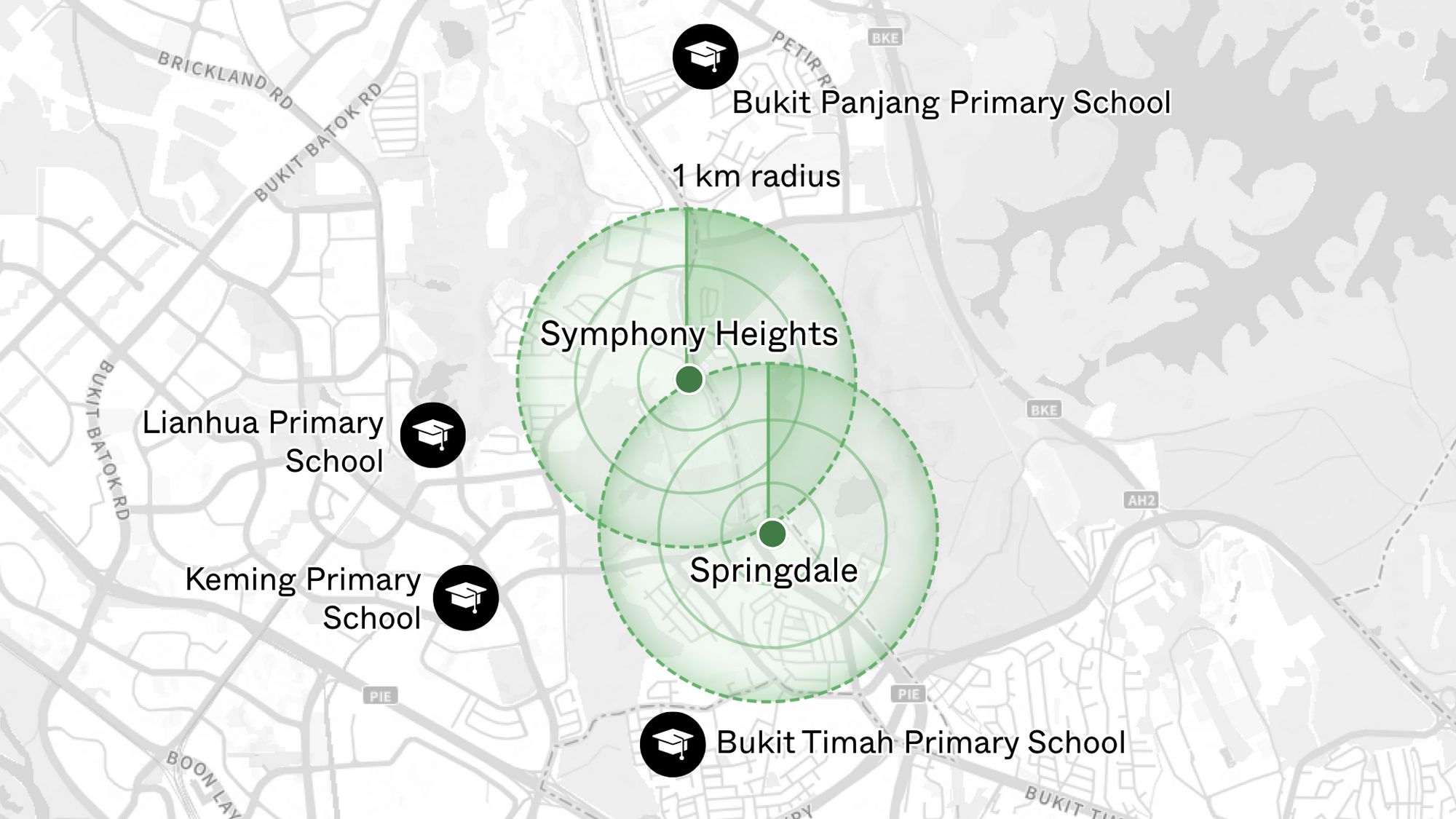

Property Investment Insights Do Primary Schools Really Matter For Property Prices In Singapore? These 6 Condos Suggest Otherwise

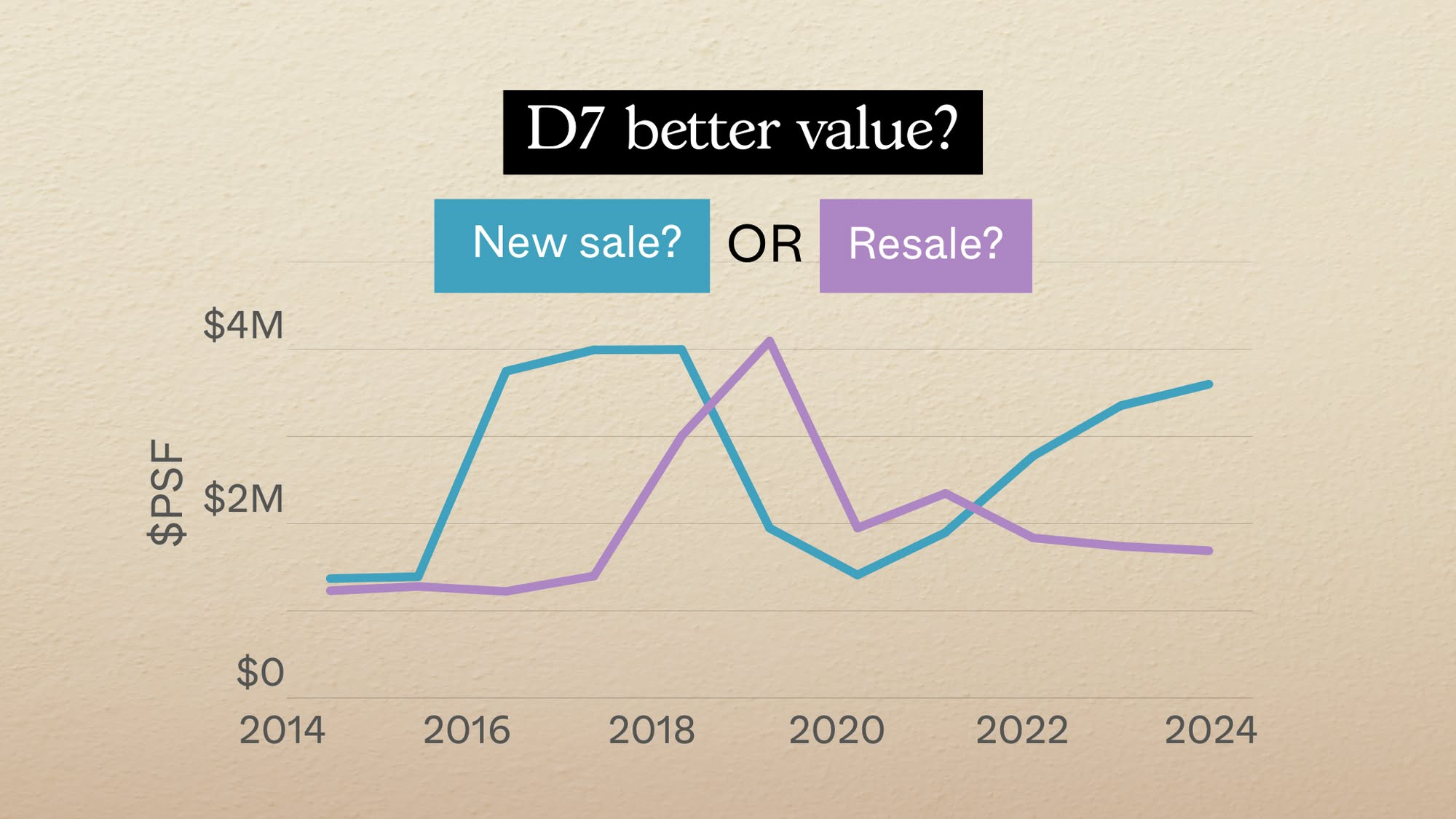

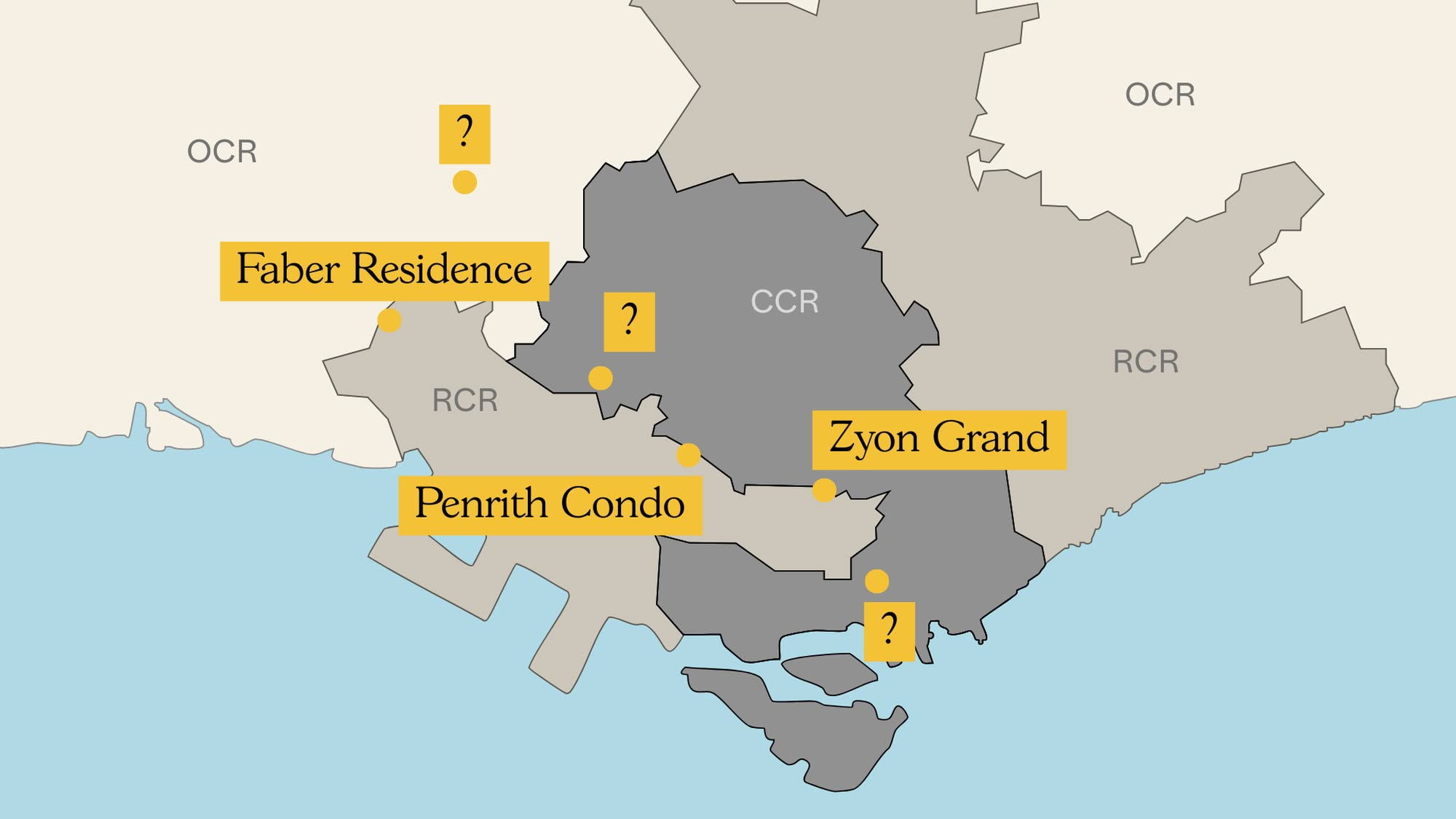

Pro New Launch vs Resale Condos in District 7: Which Bedroom Types Offer Better Value Today?

Property Market Commentary 6 Upcoming New Condo Launches To Keep On Your Radar For The Rest Of 2025

Singapore Property News Decoupling Is No Longer a Property Hack: What the Courts and IRAS Have Made Clear