We Make $28k Per Month And Own A 4-Room HDB: Should We Buy A New Launch Or Just Rent To Be Near Henry Park Primary?

June 24, 2023

Hello!

First of all, thank you so much for all the neutral and highly informative articles on the Singapore property market. They have been of great help for us to understand the market, especially the amount of data analysis you do!

We have been staying in a 4 room HDB for close to 10 years now, and need a bigger space now for a growing family. Ideally a 4 bedroom and >1,400 sqft of space.

For the next 5-10 years, we are looking to stay near Henry Park Primary and are now evaluating the below options:

1. Buying a new launch 4 bedroom apartment near Henry Park, selling current HDB

2. Renting a 4 bedroom apartment near Henry Park and Buying one (or two) new launch elsewhere for investment, selling current HDB

3. Rent a 4 bedroom apartment near Henry Park and rent out current HDB

Hope to get your expert advice on the better path to take considering costs and maximum capital gains.

Here are some further details:

- HDB estimated Sale Price $850,000 (reference X value from SRX)

- Mortgage loan balance of $320k

- CPF Used $290k evenly split

- Accrued Interest $40k evenly split

Thank you!

Editor’s Note: Some financial and personal information were removed for privacy reasons

Hello,

Thanks for writing in and we’re happy to hear our work has been of help to you!

As frequent readers of our Q&A articles may already know, understanding your desired holding period is a vital aspect when contemplating various housing options, so it’s helpful that you have already determined your preferred timeframe. Before delving into the specific options you are considering, let’s begin by evaluating your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Selling the current HDB

| Description | Amount |

| Estimated sale price | $850,000 |

| Outstanding loan | $320,000 |

| CPF used plus accrued interest to be refunded into OA | $330,000 |

| Cash proceeds | $200,000 |

Combined affordability after selling HDB

| Description | Amount |

| Maximum loan based on ages of 38 and fixed monthly combined income of $28k, with a 4.6% interest | $2,854,386 (27 years tenure) |

| CPF funds | $610,000 |

| Cash | $500,000 |

| Total loan + CPF + Cash | $3,964,386 |

| BSD based on $3,964,386 | $177,463 |

| Estimated affordability | $3,786,923 |

Husband’s affordability

| Description | Amount |

| Maximum loan based on age of 38 and fixed monthly income of $14k, with a 4.6% interest | $1,427,193 (27 years tenure) |

| CPF funds | $355,000 |

| Cash ($500,000 split evenly) | $250,000 |

| Total loan + CPF + Cash | $2,032,193 |

| BSD based on $2,032,193 | $71,209 |

| Estimated affordability | $1,960,984 |

Wife’s affordability

| Description | Amount |

| Maximum loan based on age of 38 and fixed monthly income of $14k, with a 4.6% interest | $1,427,193 (27 years tenure) |

| CPF funds | $255,000 |

| Cash ($500,000 split evenly) | $250,000 |

| Total loan + CPF + Cash | $1,932,193 |

| BSD based on $1,932,193 | $66,209 |

| Estimated affordability | $1,865,984 |

Now that we have a better understanding of your affordability, let’s look into the options you’re considering.

Options

Option 1: Selling current HDB and buying a new launch 4 bedroom apartment near Henry Park

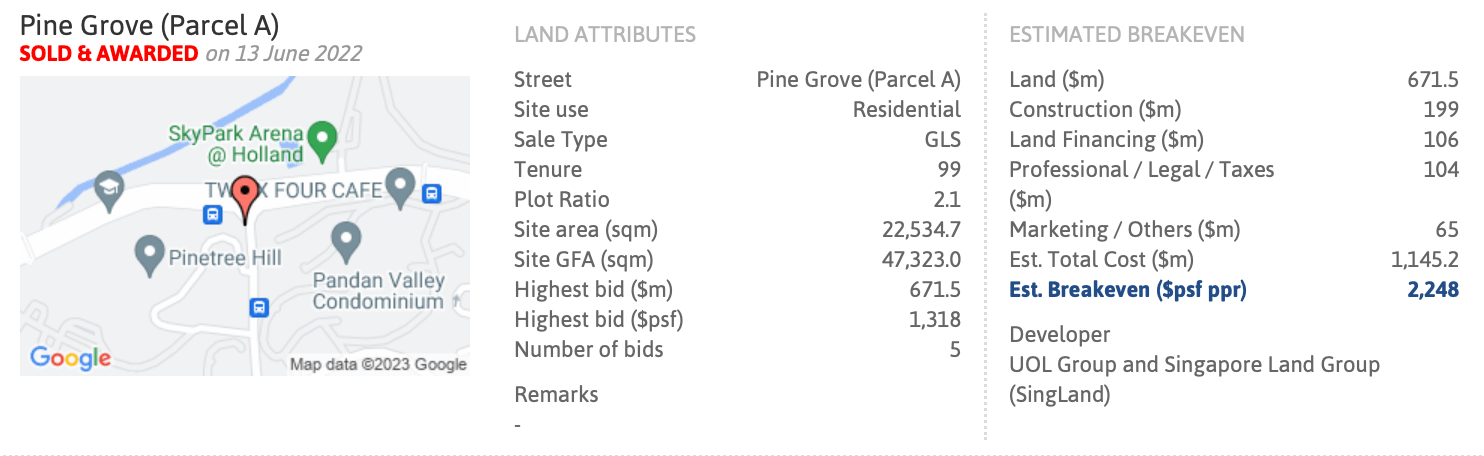

If you are looking within a 1 km radius of Henry Park Primary School, the choices available may be quite restricted, even if we consider resale projects. We presume that the new launch you are referring to is Pinetree Hill, since it is the only one coming up in the area currently. It is officially launching today, so we don’t have a full picture of what it is really like yet.

Nevertheless, it’s worth noting that no new developments have been introduced in this vicinity for over a decade. Depending on its price, there should be a reasonably good support as many of its neighbours are much older (and bigger) so on a quantum level it should be attractive enough.

Here is what we do know.

The estimated breakeven for the development is at $2,248 psf ppr.

Assuming that developers’ profit margins range from 15% to 20%, with an average of 17.5%, you would typically be looking at a potential launch price for Pinetree Hill at an average of around $2,641 psf.

However, given Pinetree Hill is about to launch, we have heard word on the ground that the starting $PSF would be set at $2,350 psf. As such, let’s just assume the 4-bedroom would be priced at $2,350 psf.

All 4-bedders at Pinetree Hill come equipped with a private lift. The 4 Bedroom Deluxe units range in size from 1,292 to 1,485 sq ft, while the 4 Bedroom Premium units span from 1,464 to 1,668 sq ft. Based on your requirement of at least 1,400 sq ft, you would need to consider the 4 Bedroom Premium units, as the 1,485 sq ft Deluxe units include the strata void above the living and dining area, resulting in a liveable space of approximately 1,292 sq ft.

Assuming a price psf of $2,350 and a size of 1,464 sq ft, this will amount to $3,440,400 which is well within your budget of $3,786,923. However, please note that this is an estimated price and the actual price could be higher or lower.

You could also consider looking at resale options but your choices may be limited as a majority of developments in the area are priced beyond your budget due to their larger floor plates, particularly those with a freehold/999-year leasehold tenure.

For instance, these are some of the latest transactions for newer freehold/999-year leasehold 4-bedders in the vicinity of Henry Park:

| Date | Project | Tenure | Completion year | Size (sqft) | PSF | Price |

| Jan 2023 | The Trizon | Freehold | 2012 | 2,099 | $2,025 | $4,250,000 |

| Jul 2022 | Glentrees | Freehold | 2006 | 2,626 | $1,523 | $4,000,000 |

These are some units that are currently available on the market that fall within your affordability:

| Project | Tenure | Completion year | Size (sqft) | PSF | Price |

| Pandan Valley | Freehold | 1979 | 1,668 | $1,948 | $3,250,000 |

| Pine Grove | 99-years | 1984 | 1,755 | $1,133 | $1,990,000 |

| The Serenade @ Holland | 99-years | 2004 | 1,904 | $1,733 | Starting from $3,300,000 |

| Quinterra | 99-years | 2009 | 1,787 | $1,863 | $3,330,000 |

Do note that these developments are picked out purely because they match your budget and requirements. You definitely need to do more research to see if they are suitable for your needs/timeline.

We can observe from the table that older freehold projects are priced comparably to newer 99-year leasehold developments and potentially Pinetree Hill. In this regard, these older properties hold an advantage for buyers with long-term plans. For a similar price range, they may opt for a larger, older freehold/999-year leasehold property over a newer, but smaller, 99-year leasehold development. However, individual preferences can vary, so this is a general rational perspective.

Considering that Pinetree Hill is projected to obtain its Temporary Occupation Permit (TOP) in 2027, and assuming you don’t have alternative accommodation, you will need to rent a place in the meantime. Since we are unaware of your child’s age and when you require the address for primary school registration, we will assume you need it as soon as possible. As such, you will need to find a rental property within a 1 km radius of Henry Park Primary School.

A quick search on PropertyGuru reveals that currently, the most affordable 4-bedroom rental option within 1 km of Henry Park Primary School is available at The Serenade @ Holland, with an asking price of $7,000 per month. Based on URA records, the latest rental transaction for a 1,500 – 1,600 sq ft unit in the development was in January this year at $6,000. Let’s say you were to rent this at $6,000/month while waiting for the new launch to be built.

Now, let’s calculate the accumulated cost over 10 years if you were to purchase a 4-bedder at Pinetree Hill, assuming it falls exactly within your budget of $3.7M.

| Description | Amount |

| Purchase price | $3,700,000 |

| BSD | $161,600 |

| Total CPF funds and cash | $1,110,000 |

| Loan required after deducting CPF funds and cash | $2,751,600 |

| Booking fee (5% cash) | $185,000 |

| Completion (15% cash/CPF) | $555,000 |

| Foundation stage (5% cash/CPF) | $185,000 |

| Total downpayment | $925,000 |

The following is the progressive payment plan. We are using an interest rate of 4.6% and the longest duration for each stage.

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 5% | $148,000 | $798 | $567 | $231 | 6-9 months (from launch) | $5,103 |

| Completion of reinforced concrete | 10% | $370,000 | $2,795 | $1,986 | $809 | 6-9 months | $17,874 |

| Completion of brick wall | 5% | $185,000 | $3,793 | $2,695 | $1,098 | 3-6 months | $16,170 |

| Completion of ceiling/roofing | 5% | $185,000 | $4,791 | $3,404 | $1,387 | 3-6 months | $20,424 |

| Completion of electrical wiring/plumbing | 5% | $185,000 | $5,789 | $4,113 | $1,676 | 3-6 months | $24,678 |

| Completion of roads/car parks/drainage | 5% | $185,000 | $6,787 | $4,822 | $1,965 | 3-6 months | $28,932 |

| Issuance of TOP | 25% | $925,000 | $11,778 | $8,368 | $3,410 | Usually a year before CSC | $100,416 |

| Certificate of Statutory Completion (CSC) | 15% | $555,000 | $14,772 | $10,496 | $4,276 | Monthly repayment until property is sold | $692,736 |

Costs incurred after 10 years if you were to buy a new launch near Henry Park

| Description | Amount |

| Rent for 4.5 years at $6,000/month | $324,000 |

| BSD | $167,600 |

| Interest expense | $906,333 |

| Maintenance fee (assuming $500/month) and property tax – payable for 78 months after TOP | $146,991 |

| Total cost | $1,544,924 |

Let’s also look at the costs incurred if you were to purchase a resale property near Henry Park instead. We will assume you purchase the unit at Pandan Valley for $3,250,000.

| Description | Amount |

| Purchase price | $3,250,000 |

| BSD | $134,600 |

| Total CPF funds and cash | $1,110,000 |

| Loan required after deducting CPF funds and cash | $2,274,600 |

Costs incurred after 10 years if you were to buy a resale property near Henry Park

| Description | Amount |

| BSD | $134,600 |

| Interest expense (with 4.6% interest and 27 year tenure) | $932,618 |

| Maintenance fee (assuming $500/month) and property tax – payable for 78 months after TOP | $173,300 |

| Total cost | $1,240,518 |

With the considerable expense of rental costs, opting to purchase a resale property would allow you to save a minimum of $378,000 that would have been spent on rent.

However, when considering the purchase of an older development such as Pandan Valley, it is important to factor in the potential renovation costs. The extent of renovation work required will vary depending on the specific unit. But for the sake of giving you some estimates, if you were to undertake a complete overhaul of the property (assuming an estimated renovation cost of $120 psf) for a unit spanning 1,668 sq ft, the total amount would reach $200,160.

Option 2: Selling your current HDB and renting a 4 bedroom apartment near Henry Park while buying one (or two) new launches elsewhere for investment

It’s a common sales pitch that you might have come across, that buying a new launch property will always yield higher profits compared to a resale property. However, this is not always the case. While the progressive payment scheme can alleviate the financial burden in the initial years, it really is very dependent on the new launch that you pick (entry price, surrounding price support, etc etc).

On the other hand, if you opt for a resale property, you can immediately rent out the unit, and the rental income can help partially offset the loan repayments.

You have a healthy budget considering your individual affordability of $1.8M and $1.9M. Let’s consider three scenarios: purchasing two new launches, purchasing two resale properties, and purchasing one new launch and one resale property.

We will focus our attention on 2-bedroom units as they generally offer greater resale potential compared to 1-bedroom units.

These are some new launches that currently fall within your affordability:

| Project | Tenure | Completion year | Type | Size (sq ft) | Level | Price |

| The Continuum | Freehold | 2027 | 2b2b | 646 | #05 | $1,748,000 |

| The Botany @ Dairy Farm | 99-years | 2027 | 2b2b | 829 | #13 | $1,620,000 |

| Terra Hill | Freehold | 2026 | 2b2b | 678 | #03 | $1,861,000 |

| Claydence | Freehold | 2026 | 2b2b | 786 | #05 | $1,847,100 |

There are also some 3-bedroom compact new launch units that fall within your affordability which you can consider as an investment. 3-bedders tend to cater to families and less to investors which results in better price stickiness. Its practical but compact layout caters to families on a budget looking for a condo.

| Project | Tenure | Completion year | Type | Size (sq ft) | Level | Price |

| The Botany at Dairy Farm | 99-years | 2027 | 3b2b | 926 | #03 | $1,898,000 |

| Sceneca Residence | 99-years | 2027 | 3b2b | 904 | #03 | $1,864,000 |

| Royal Hallmark | Freehold | 2025 | 3b2b | 797 | #03 | $1,830,000 |

| Zyanya | Freehold | 2025 | 3b2b | 893 | #06 | $1,780,800 |

And these are some resale units on the market within your affordability with decent rental yields:

| Project | Tenure | Completion year | Type | Size (sqft) | Asking price | Avg 2 bedder rent (Mar – May) | Rental yield |

| Whistler Grand | 99-years | 2022 | 2b1b | 614 | $1,220,000 | $4,250 | 4.18% |

| Principal Garden | 99-years | 2019 | 2b2b | 764 | $1,605,000 | $5,373 | 4.02% |

| Sol Acres | 99-years | 2019 | 2b2b | 710 | $1,050,000 | $3,700 | 4.23% |

| Kingsford Waterbay | 99-years | 2018 | 2b2b | 689 | $1,020,000 | $3,609 | 4.25% |

As before, these developments are simply picked out purely because they match your budget and requirements. There could be better resale alternatives out there.

Scenario 1: Purchasing two new launches

Let’s say your wife was to purchase a unit at The Continuum for $1,748,000 and you purchase a unit at Terra Hill for $1,861,000, renting them out after TOP. We will assume a rental yield of 3% interest rate of 4.6% and the longest duration for each stage of the progressive payment plan.

Similarly, we will calculate the cost accumulated in 10 years.

The Continuum

| Description | Amount |

| Purchase price | $1,748,000 |

| BSD | $57,000 |

| Total CPF funds and cash | $505,000 |

| Loan required after deducting CPF funds and cash | $1,300,000 |

| Description | Amount |

| BSD | $57,000 |

| Interest expense | $428,130 |

| Maintenance fee (assuming $300/month) and property tax – payable for 78 months from TOP | $79,839.50 |

| Rental income (assuming 3% yield and no vacancy periods) | $340,860 |

| Agency fee payable once every 2 years | $14,160 |

| Total cost incurred in 10 years | $238,270 |

Terra Hill

| Description | Amount |

| Purchase price | $1,861,000 |

| BSD | $62,650 |

| Total CPF funds and cash | $605,000 |

| Loan required after deducting CPF funds and cash | $1,318,650 |

| Description | Amount |

| BSD | $62,650 |

| Interest expense | $421,629 |

| Maintenance fee (assuming $300/month) and property tax – payable for 78 months from TOP | $86,008 |

| Rental income (assuming 3% yield and no vacancy periods) | $362,934 |

| Agency fee payable once every 2 years | $15,075 |

| Total cost incurred in 10 years | $222,428 |

Cost incurred after 10 years if you were to purchase two new launches while renting

| Description | Amount |

| Rent for 10 years at $6,000/month | $720,000 |

| Cost for The Continuum | $238,270 |

| Cost for Terra Hill | $222,428 |

| Total cost | $1,180,698 |

Scenario 2: Purchasing two resale properties

Now let’s say your wife was to purchase a unit at Kingsford Waterbay for $1,020,000 and you purchase a unit at Sol Acres for $1,050,000, renting them out immediately. We will use the average rent of $3,609 and $3,700 respectively and an interest rate of 4.6%.

Kingsford Waterbay

| Description | Amount |

| Purchase price | $1,020,000 |

| BSD | $25,400 |

| Total CPF funds and cash | $505,000 |

| Loan required after deducting CPF funds and cash | $540,400 |

| Description | Amount |

| BSD | $25,400 |

| Interest expense | $221,572 |

| Maintenance fee ($290/month) and property tax – payable for 10 years | $97,420 |

| Rental income (assuming no vacancy periods) | $433,080 |

| Agency fee payable once every 2 years | $19,490 |

| Total profits made in 10 years | $69,198 |

Sol Acres

| Description | Amount |

| Purchase price | $1,050,000 |

| BSD | $26,600 |

| Total CPF funds and cash | $605,000 |

| Loan required after deducting CPF funds and cash | $471,600 |

| Description | Amount |

| BSD | $26,600 |

| Interest expense | $193,363 |

| Maintenance fee ($230/month) and property tax – payable for 10 years | $92,400 |

| Rental income (assuming no vacancy periods) | $444,000 |

| Agency fee payable once every 2 years | $19,980 |

| Total profits made in 10 years | $111,657 |

Cost incurred after 10 years if you were to purchase two resale properties while renting

| Description | Amount |

| Rent for 10 years at $6,000/month | $720,000 |

| Profits for Kingsford Waterbay | $69,198 |

| Profits for Sol Acres | $111,657 |

| Total cost | $539,145 |

Scenario 3: Purchasing one new launch and one resale property

So let’s say your wife was to purchase Kingsford Waterbay and you purchase Terra Hill.

Cost incurred after 10 years if you were to purchase one new launch and one resale property while renting

| Description | Amount |

| Rent for 10 years at $6,000/month | $720,000 |

| Profits for Kingsford Waterbay | $69,198 |

| Cost for Terra Hill | $222,428 |

| Total cost | $873,230 |

Putting capital appreciation aside, when considering costs alone, purchasing two resale properties while renting would result in the lowest expenditure over a span of 10 years. The next option, in terms of cost, would be to purchase one new launch and one resale property. Finally, the most expensive option would be to buy two new launches. The difference in costs between acquiring two resale properties and two new launches is over half a million which is a considerable sum. By being able to promptly rent out the properties, it significantly offsets the expenses incurred.

Option 3: Rent a 4 bedroom apartment near Henry Park and rent out current HDB

Without the specific address of your HDB, we are unable to provide a detailed analysis. However, based on the estimated selling price of $850,000 for a 4-room flat, we can infer that it is probably situated in the central region or could be a newer flat located in the city fringe.

| HDB towns | Avg 4-room rent (Q1 2023) |

| Ang Mo Kio | $3,200 |

| Bishan | $3,200 |

| Bukit Merah | $3,630 |

| Central | $3,650 |

| Kallang/Whampoa | $3,300 |

| Queenstown | $3,800 |

| Toa Payoh | $3,350 |

| Average rent | $3,447 |

Considering the general trend of 99-year leasehold properties, their prices typically decline as the remaining lease diminishes. If your HDB flat is relatively older, holding onto it for another 10 years may not be the most ideal option, despite the favourable rental yields associated with HDB flats due to their more affordable price range.

Additionally, if your HDB flat is located in an area where numerous new HDB clusters are being developed, this could potentially negatively impact its demand and consequently its price, even if it happens to be a relatively young block.

Cost incurred after 10 years if you were to rent a 4 bedroom apartment near Henry Park while renting out your HDB

| Description | Amount |

| Rent for 10 years at $6,000/month | $720,000 |

| Interest expense (assuming you took a HDB loan (2.6% interest) with the maximum tenure of 25 years 10 years ago) | $3,456 |

| Rental income from HDB (assuming the average rent of $3,447 and no vacancy period) | $413,640 |

| Town council service and conservancy fee ($68/month) and property tax – payable for 10 years | $66,890 |

| Agency fee payable once every 2 years | $18,615 |

| Total cost | $395,321 |

So what should you do?

When solely considering costs, the option of renting out your current HDB while renting a 4-bedroom condominium near Henry Park Primary School would result in the least financial burden.

However, if we take into account the potential for appreciation, this option may not be the most suitable depending on the age and location of your HDB, as discussed earlier.

Even though holding two resale private properties and renting for a duration of 10 years would incur approximately $144,000 more in expenses compared to renting a 4-bedroom condo near Henry Park while renting out your HDB, the former option could be more favourable. This is because investing in multiple properties diversifies your risk, and depending on the specific developments you purchase, their potential for appreciation could be greater than that of an HDB.

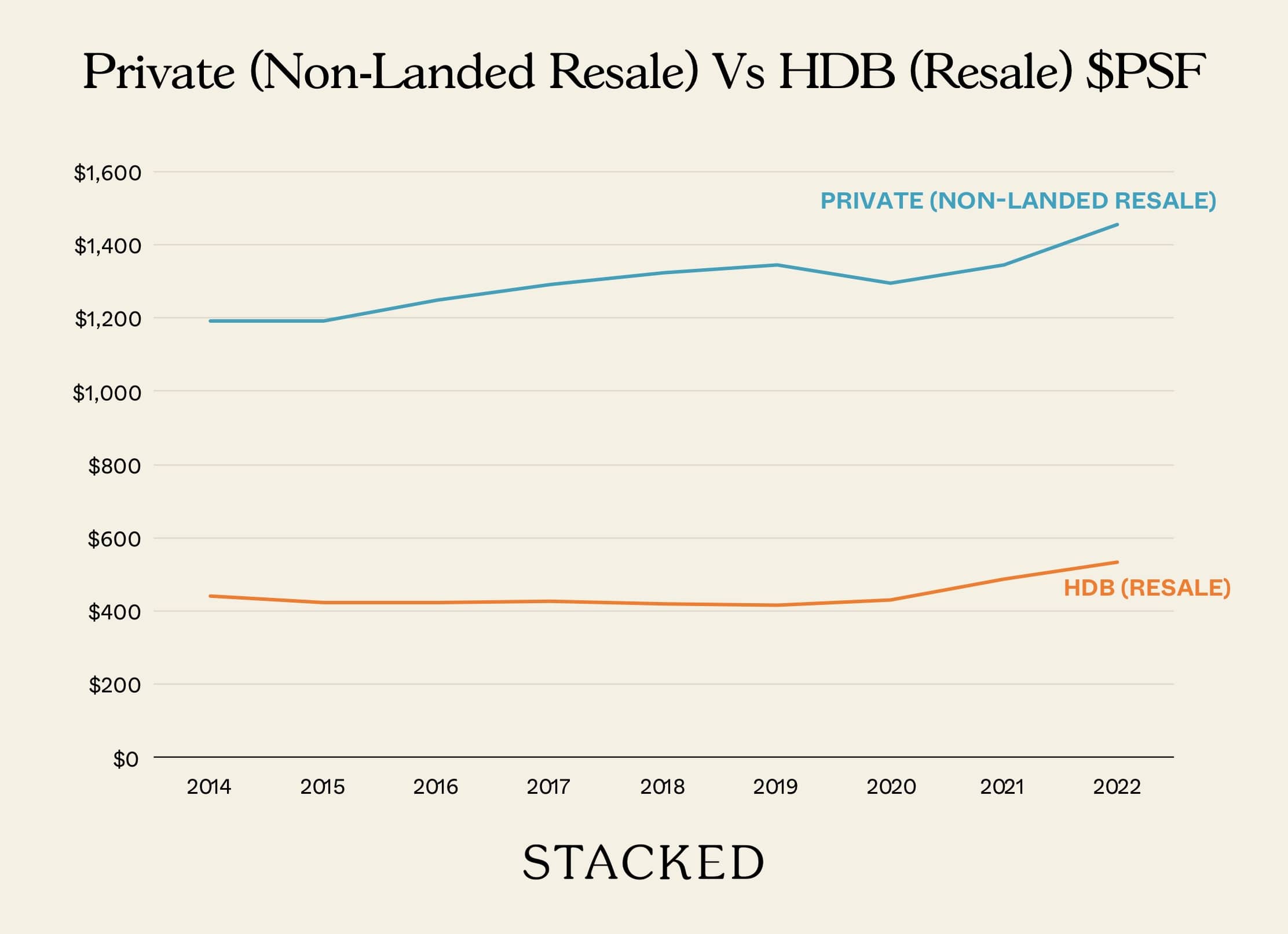

| Year | Private non-landed (resale) | YoY | HDB (resale) | YoY |

| 2014 | $1,190 | – | $441 | – |

| 2015 | $1,191 | 0.08% | $423 | -4.08% |

| 2016 | $1,248 | 4.79% | $424 | 0.24% |

| 2017 | $1,292 | 3.53% | $425 | 0.24% |

| 2018 | $1,324 | 2.48% | $419 | -1.41% |

| 2019 | $1,344 | 1.51% | $416 | -0.72% |

| 2020 | $1,294 | -3.72% | $431 | 3.61% |

| 2021 | $1,345 | 3.94% | $488 | 13.23% |

| 2022 | $1,455 | 8.18% | $532 | 9.02% |

| Annualised | – | 2.55% | – | 2.37% |

The graph and table above illustrate that prior to the pandemic, while there was a noticeable growth in prices for private non-landed properties, HDB prices remained relatively stagnant. Looking ahead, as HDB increases the supply of new flats with reduced waiting times in the upcoming years, this is expected to alleviate the demand for resale flats. Consequently, it is likely that HDB prices will not experience a significant upswing similar to what occurred during and after the pandemic.

When comparing the expenses associated with purchasing a 4-bedroom property near Henry Park Primary School versus acquiring two investment properties while renting in the vicinity of the school, it becomes clear that the former option, especially if considering a new launch, would result in the highest costs over a span of 10 years.

As mentioned earlier, while holding two investment properties offers the benefit of risk diversification, it also entails trading off the opportunity to reside in a customised home that aligns with your unique lifestyle and preferences, as you won’t have the freedom to renovate it according to your liking. For many individuals, the duration of 10 years is significant, and having a place that is tailored to their living preferences might hold great importance.

| Year | Pandan Valley | YoY | Ridgewood Condominium | YoY | The Serenade @ Holland | YoY | Pine Grove | YoY | Quinterra | YoY | All SGP non-landed (resale) | YoY |

| 2014 | $1,011 | – | $1,206 | – | $1,278 | – | $924 | – | $1,238 | – | $1,190 | – |

| 2015 | $970 | -4.06% | $1,195 | -0.91% | $1,204 | -5.79% | $902 | -2.38% | $1,211 | -2.18% | $1,191 | 0.08% |

| 2016 | $950 | -2.06% | $1,220 | 2.09% | $1,161 | -3.57% | $812 | -9.98% | $1,203 | -0.66% | $1,248 | 4.79% |

| 2017 | $943 | -0.74% | $1,139 | -6.64% | – | – | $917 | 12.93% | $1,175 | -2.33% | $1,292 | 3.53% |

| 2018 | $1,162 | 23.22% | $1,267 | 11.24% | $1,210 | – | $949 | 3.49% | $1,260 | 7.23% | $1,324 | 2.48% |

| 2019 | $1,284 | 10.50% | $1,218 | -3.87% | $1,226 | 1.32% | $1,085 | 14.33% | $1,365 | 8.33% | $1,344 | 1.51% |

| 2020 | $1,113 | -13.32% | $1,323 | 8.62% | $1,195 | -2.53% | $973 | -10.32% | $1,363 | -0.15% | $1,294 | -3.72% |

| 2021 | $1,223 | 9.88% | $1,416 | 7.03% | $1,287 | 7.70% | $1,103 | 13.36% | $1,463 | 7.34% | $1,345 | 3.94% |

| 2022 | $1,389 | 13.57% | $1,552 | 9.60% | $1,398 | 8.62% | $1,182 | 7.16% | $1,522 | 4.03% | $1,455 | 8.18% |

| Annualised | – | 4.05% | – | 3.20% | – | 1.13% | – | 3.13% | – | 2.62% | – | 2.55% |

Looking at the performance of various developments situated within a 1 km radius of Henry Park Primary School that offer 4-bedroom units within your budget, it is apparent that the majority of these developments have shown a more robust annualised growth rate when compared to the overall private non-landed market with the exception of The Serenade @ Holland.

It is worth noting that Pine Grove, a 99-year leasehold project completed in 1984, continues to demonstrate strong growth despite its age. This indicates a healthy demand for properties in this particular area. While we cannot currently provide an extensive analysis of Pinetree Hill, considering the performance of similarly sized projects in the vicinity, and the future of more residential plots in the area, it is likely to be a reliable store of value.

So if you are comfortable with the prospect of residing in a rented home for the next 10 years, opting to buy two investment properties while renting in the vicinity of Henry Park would seem to be an optimal choice. The decision of whether to purchase two newly launched properties, two resale properties, or a combination of both would also hinge upon your risk tolerance. As demonstrated in the calculations, the ability to promptly rent out the properties would substantially diminish the expenses involved. Furthermore, the potential appreciation of a resale property could possibly be on par with that of a new launch, depending on the specific project you acquire.

And obviously, buying two properties is a lot more stressful than just owning one from a financial and logistical standpoint.

We have previously written a piece discussing if new launches are a sure win, and our analysis revealed that on average, the variance in capital appreciation between new launches and resale properties is not significant.

However, it is worth noting that new launches offer the advantage of more readily identifying opportunities compared to sporadic resale listings, which are influenced by market conditions rather than direct developer pricing. Nevertheless, as always, the potential for appreciation ultimately depends on the specific project chosen.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

0 Comments