We Make $250k Yearly With $1.3m In Liquid Assets: Should We Sell Our 5-Room HDB To Upgrade Or Just Invest In Equities Due To The High-Interest Rates?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi Stackedhomes team!

Really impressed with all your editorial content and well-thought advice for all the property owners/investors out there.

Would like to seek your help considering this situation:-

Staying in a resale 5-room HDB flat with spouse, child and helper (similar unit sold at SGD 950k)

Would like to upgrade to private property (condo) around District 14/15/16 for future capital gains but unsure if it is a wise investment in view of high interest rate and property measures.

Some options include:-

- Sell HDB flat and buy one resale 3-bed condo to stay (avoid ABSD but incur high interest rates on mortgage loan)

- Sell HDB flat and decouple to buy resale 3-bed condo for own stay and another (1/2 bed) for investment (have to ensure finances are adequate)

- Keep HDB flat and invest in a condo (have to pay ABSD and 2nd loan)

- Keep HDB flat and invest in equities/bonds etc (investment risk)

- Pay off HDB loan and invest in another condo (can get higher LTV on 1st mortgage loan)

Total annual income for spouse and myself: SGD 250k

Age: Both 40

Total liquid assets: SGD 1.3mn

Advance thanks for your help and please let me know if any queries!

Editor’s Note: Some financial information was removed for privacy reasons

Hello,

Thank you for your kind feedback!

That’s a very fair point that you are asking, and one that is no doubt a major source of worry for many HDB owners looking to upgrade in the current market. It’s often said that “time in the market beats timing the market.,” but is that really true when you are leveraging with a bank loan in a high-interest rate environment?

As such, we’ll be doing some calculations to help you make a more informed decision.

But first, let’s start off by going through your affordability before exploring the various options you’re considering.

Affordability

As there are several options you’re looking at, we will calculate your affordability based on the following scenarios:

- If you sell your HDB and buy either 1 or 2 properties (your points 1 and 2)

- If you hold on to your HDB and buy a second property (your point 3)

- If you hold on to your HDB but pay off the loan before buying a second property (your point 5)

Affordability if you were to sell your HDB before purchasing the next property/properties

Proceeds from selling the HDB

| Description | Amount |

| Estimated selling price | $950,000 |

| Outstanding loan | $500,000 |

| CPF used plus accrued interest to be refunded into OA | $350,000 |

| Estimated cash proceeds | $100,000 |

Combined affordability

By knowing your combined affordability, we can find out what you can afford if you sell your HDB and buy 1 condo (point 1).

| Description | Amount |

| Maximum loan based on a fixed annual combined income of $250K, age of 40, and an interest rate of 4.6% | $2,040,644 (25 years tenure) |

| CPF funds | $420,000 |

| Cash | $1,400,000 |

| Total loan + CPF + cash | $3,860,644 |

| BSD based on $3,860,644 | $171,238 |

| Estimated affordability | $3,689,406 |

Since the precise amounts of individual income and CPF funds are unknown, we will assume an equal split for the purpose of our calculations. With this assumption, both of you will have the same affordability.

Individual affordability

By knowing your individual affordability, we can find out what your options are if you sell 1 and buy 2 (point 2).

| Description | Amount |

| Maximum loan based on a fixed annual income of $125K, age of 40 and an interest rate of 4.6% | $1,020,322 (25 year tenure) |

| CPF funds | $210,000 |

| Cash | $700,000 |

| Total loan + CPF + cash | $1,930,322 |

| BSD based on $1,930,322 | $66,116 |

| Estimated affordability | $1,864,206 |

Affordability for a second property if you hold on to the HDB without paying off the loan

You’ve mentioned the possibility of paying the ABSD to buy a condo if you held onto your HDB without paying off the loan (point 3)

So in this scenario, we will be making the assumption that you acquired your HDB unit five years ago, and obtained an HDB loan with a 25-year tenure and a 2.6% interest rate.

Consequently, the remaining loan period currently stands at 20 years for a loan amount of $500,000, resulting in an approximate monthly repayment of $2,674.

As you already know, the Loan To Value (LTV) ratio for a second mortgage loan is much lower. For a 25-year tenure, the LTV is at 45% of the property value (we will touch more on this later).

| Description | Amount |

| Maximum loan based on a fixed annual combined income of $250K, ages of 40, an interest rate of 4.6% and an outstanding loan of $500K | $1,564,440 (25 years tenure) |

| CPF funds | $70,000 |

| Cash | $1,300,000 |

| Maximum affordability based on down payment of $1,370,000 | $2,490,909 |

So although your maximum affordability is around $2.49M, if we were to work backward and account for both the Buyers Stamp Duty (BSD) and Additional Buyers Stamp Duty (ABSD) based on your available CPF funds and cash of $1.37M, your maximum affordability is at $1,750,500 (BSD $57,125 + ABSD $350,100 + Downpayment $962,775 = $1,370,000).

Affordability for a second property if you hold on to the HDB but pay off the loan first

What can you afford if you decide to pay off your HDB loan to then buy a condo (point 5)?

We will assume that you use $500,000 from your liquid assets to pay off the loan.

| Description | Amount |

| Maximum loan based on a fixed annual combined income of $250K, ages of 40, an interest rate of 4.6% | $2,040,644 (25 years tenure) |

| CPF funds | $70,000 |

| Cash | $800,000 |

| Total loan + CPF + cash | $2,910,644 |

In this scenario, even though your maximum affordability is around $2.91M, if we were to work backward and take the BSD and ABSD payable into account, based on your available CPF funds and cash of $870K, you’ll find that your maximum affordability is at $1,800,800 (BSD $59,640 + ABSD $360,160 + Downpayment $450,200 = $870,000).

Now that we have a clearer picture of your financial capacity, let’s look at the options you’re considering.

So what should you do?

Since there is no mention of a holding period, we will presume your plan is to stay in the next property for the long term seeing as you have a child. This assumption is based on the understanding that long-term housing arrangements are often preferred for families raising children, especially if they are of school-going age. Since there was no specific timeframe given, for the purpose of the calculation, we will use a 10-year timeframe.

However, it must be highlighted that one scenario where the timeline really makes a difference is when you pay the ABSD. This is because the ABSD is an upfront fee. Your Return On Investment (ROI) is hit by this in the short term, but if property prices do appreciate quickly while interest expense remains low, it could actually be better in the much longer-term compared to other options. Regardless, we’ll still consider the 10-year timeframe as a framework to start with.

Now let’s take a look at the costs required for the various options.

Option 1: Sell HDB and purchase a resale 3-bedroom condo

Given that you may stay in the property for an extended period of time, you perhaps may want to look at a freehold/999-year leasehold property seeing as they have better value retention and growth potential in the long run. It’s also possible to buy a newer 99-year leasehold property which you may find more affordable and you may not need to compromise on certain aspects such as lifestyle or location.

These are some 3-bedroom units that are currently on the market that matches your requirements and fall within your budget:

| Project | District | Tenure | Completion year | Size (sqft) | Asking price |

| The Makena | 15 | Freehold | 1998 | 1,152 | $2,399,999 |

| Haig Court | 15 | Freehold | 2004 | 1,399 | $2,750,000 |

| The Waterina | 14 | Freehold | 2005 | 1,345 | $2,700,000 |

Do note that these units have been selected solely based on their alignment with your criteria and affordability. You will need to do more in-depth research on if these are really suitable for your needs.

Let’s say you were to purchase a unit at The Waterina.

Recent 3-bedroom transactions:

| Date | Size (sqft) | PSF | Price | Level |

| Jun 2023 | 1,378 | $1,887 | $2,600,000 | #04 |

| Apr 2023 | 1,346 | $1,849 | $2,488,000 | #06 |

There were 2 transactions made over the last 3 months with an average price of $2,544,000. Let’s use this for the calculation.

| Description | Amount |

| Purchase price | $2,544,000 |

| CPF funds | $420,000 |

| Cash | $1,400,000 |

| BSD | $96,800 |

| Loan required | $820,800 |

The cost involved in buying a 3-bedroom resale unit and holding it for 10 years:

| Description | Amount |

| BSD | $96,800 |

| Interest expense (Assuming an interest rate of 4.6% and a 25 year tenure) | $330,760 |

| Maintenance fees (Assuming $380/month) | $45,600 |

| Property tax | $63,440 |

| Total cost | $536,600 |

The cost involved in buying a 3-bedroom resale unit and holding it for 10 years: $536,600

Option 2: Sell HDB and purchase 2 units, 1 for own stay and 1 for investment

Under the assumption that both your incomes, CPF funds, and cash reserves are equal, your individual affordability is set at $1,864,206. However, considering that one property is intended for your own stay, we will allocate a more significant portion of cash towards this property to expand your available options.

To increase the budget for the own-stay property, an additional $500,000 of cash will be utilised, resulting in a revised budget of $2,364,206. Consequently, the budget for the investment property will be reduced to $1,364,206.

These are some 3-bedroom units that are currently on the market that matches your requirements and fall within your budget:

| Project | District | Tenure | Completion year | Size (sqft) | Asking price |

| The Sunny Spring | 14 | Freehold | 1998 | 1,195 | $2,049,000 |

| Changi Green | 16 | Freehold | 2001 | 1,216 | $1,550,000 |

| Seventy St Patrick’s | 15 | Freehold | 2017 | 936 | $2,200,000 |

Due to the reduced budget, the choices for freehold or 999-year leasehold properties are quite limited. Most of the 3-bedroom units within your budget are found in boutique projects which are generally speaking less favourable because of the limited transactions.

For a 10-year timeframe, you could possibly consider younger 99-year leasehold developments to avoid significant lease decay during your holding period. There is one project that is currently on the market which fits your requirements and budget:

| Project | District | Tenure | Completion year | Size (sqft) | Asking price |

| Parc Esta | 14 | 99 years | 2022 | 1,023 | $2,300,000 |

As for the investment property, these are some younger projects that currently command a decent rental yield:

| Project | District | Tenure | Completion year | Unit type | Size (sqft) | Asking price | Avg rent (Mar-May) | Rental yield |

| Kingsford Waterbay | 19 | 99 years | 2018 | 2b2b | 689 | $1,020,000 | $3,609 | 4.2% |

| Sol Acres | 23 | 99 years | 2019 | 2b2b | 732 | $1,068,000 | $3,700 | 4.2% |

| Parc Riviera | 05 | 99 years | 2020 | 2b2b | 646 | $1,080,000 | $3,986 | 4.4% |

As before, please be aware that these units are picked out solely based on their alignment with your criteria and affordability. There will need to be more research on your entry price, surrounding price support, etc.

Now, let’s also consider the cost involved in this scenario. We will presume you purchase a unit at Parc Esta as your residence and a unit at Parc Riviera for investment.

Recent 3-bedroom transactions at Parc Esta:

| Date | Size (sqft) | PSF | Price | Level |

| May 2023 | 1,119 | $2,187 | $2,448,000 | #05 |

| May 2023 | 904 | $2,035 | $1,840,000 | #04 |

| May 2023 | 1,119 | $2,144 | $2,400,000 | #14 |

| Apr 2023 | 958 | $2,263 | $2,168,000 | #15 |

| Apr 2023 | 926 | $2,107 | $1,950,000 | #15 |

| Apr 2023 | 926 | $2,096 | $1,940,000 | #16 |

| Apr 2023 | 904 | $2,079 | $1,880,000 | #08 |

| Apr 2023 | 926 | $2,117 | $1,960,000 | #11 |

The average transacted price is $2,073,250.

| Description | Amount |

| Purchase price | $2,073,250 |

| CPF funds | $210,000 |

| Cash | $1,200,000 |

| BSD | $73,262 |

| Loan required | $736,512 |

The cost involved in buying a 3-bedroom resale unit and holding it for 10 years:

| Description | Amount |

| BSD | $73,262 |

| Interest expense (Assuming an interest rate of 4.6% and a 25-year tenure) | $296,794 |

| Maintenance fees (Assuming $200/month) | $24,000 |

| Property tax | $39,880 |

| Total cost | $433,936 |

Recent 2-bedroom transactions at Parc Riviera:

| Date | Size (sqft) | PSF | Price | Level |

| Jun 2023 | 710 | $1,619 | $1,150,000 | #26 |

| Jun 2023 | 710 | $1,666 | $1,183,880 | #35 |

| May 2023 | 710 | $1,584 | $1,125,000 | #26 |

| May 2023 | 710 | $1,579 | $1,122,000 | #27 |

| Apr 2023 | 646 | $1,607 | $1,038,000 | #30 |

| May 2023 | 603 | $1,576 | $950,000 | #08 |

The average transacted price is $1,094,813.

| Description | Amount |

| Purchase price | $1,094,813 |

| CPF funds | $210,000 |

| Cash | $200,000 |

| BSD | $28,392 |

| Loan required | $713,205 |

The cost involved in buying a 2-bedroom resale unit and holding it for 10 years while renting it out:

| Description | Amount |

| BSD | $28,392 |

| Interest expense (Assuming an interest rate of 4.6% and a 25 year tenure) | $287,402 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Property tax | $52,540 |

| Rental income (Assuming no vacancy period and a monthly rent of $3,986) | $478,320 |

| Agency fee payable once every 2 years | $17,220 |

| Total profits | +$62,766 |

The total cost incurred if you were to purchase 1 property for your own stay and 1 for investment: $433,936 – $62,766 = $371,170

Through numerous past Q&As, it has been observed that purchasing two properties can often yield the most favourable returns and minimise costs, particularly if the right developments are selected. This is primarily due to the rental income generated, which helps offset various expenses, and the profits become increasingly evident over an extended period of time.

Before we go into the third option, here’s a brief overview of key factors to consider when purchasing a second property for the benefit of those who may be unfamiliar with the details.

- Reduced Loan To Value (LTV) Ratio:

- If you still have an outstanding mortgage loan on your first property, the second mortgage loan you take on will have a lower LTV ratio. Depending on the loan tenure, the maximum loan amount you can obtain will be restricted to either 45% or 25% of the property’s value or purchase price, whichever is lower. This is subject to meeting the Total Debt Servicing Ratio (TDSR) requirements.

- Increased downpayment

- As the loan amount is reduced, the downpayment required naturally increases. If you are taking a second mortgage loan, you will need to provide a cash downpayment equivalent to 25% of the property’s value or purchase price, whichever is lower.

- Additional Buyer’s Stamp Duty (ABSD)

- When purchasing a second property, you will be liable to pay the ABSD in addition to the regular Buyer’s Stamp Duty (BSD). Singaporeans are currently subject to a 20% ABSD for their second property, based on the property’s value or purchase price, whichever is higher. Permanent Residents (PRs) face a 30% ABSD, while foreigners are subject to a 60% ABSD for any property purchase.

Given that these amounts can be quite substantial, it is important to do your sums properly, as they will have a significant impact on your overall affordability.

Option 3: Keep HDB and purchase a condo for investment

Considering that HDB prices are currently at an all-time high and your unit has the potential for a positive sale, it may be worth considering selling the HDB and utilising the funds to individually purchase two properties instead. This approach would help avoid the hefty ABSD.

When taking the ABSD into account, a longer period of time will be required for the investment property to break even and generate positive returns.

Let’s take a look at the cost involved if you were to keep your HDB and purchase a unit at Parc Riviera for investment.

| Description | Amount |

| Purchase price | $1,094,813 |

| CPF funds | $70,000 |

| Cash | $1,300,000 |

| BSD | $28,392 |

| ABSD | $218,963 |

| Loan required | $0 |

In this case, given that the purchase price for a 2-bedder at Parc Riviera is much lower than your maximum affordability, you will not have to take up a loan for the purchase.

The cost involved in buying a 2-bedroom resale unit and holding it for 10 years while renting it out:

| Description | Amount |

| BSD | $28,392 |

| ABSD | $218,963 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Property tax | $52,540 |

| Rental income (Assuming no vacancy period and a monthly rent of $3,986) | $478,320 |

| Agency fee payable once every 2 years | $17,220 |

| Total profits | $131,205 |

Cost of holding on to HDB for 10 years:

| Description | Amount |

| Interest expense (Assuming an interest rate of 2.6% and a 20 year tenure for the outstanding loan of $500K) | $103,156 |

| Town Council Service & Conservancy fees ($85/month) | $10,200 |

| Property tax | $8,200 |

| Total cost | $121,556 |

Total profits if you were to keep your HDB and purchase a second property (without a loan): $131,205 – $121,556 = $9,649

In a scenario where the purchase price is higher and a loan is required, it is likely that this will be a negative figure given the interest expenses incurred. Let’s see if you were to purchase a property based on your maximum affordability of $1,750,500.

| Description | Amount |

| Purchase price | $1,750,500 |

| CPF funds | $70,000 |

| Cash | $1,300,000 |

| BSD | $57,125 |

| ABSD | $350,100 |

| Loan required | $787,725 |

The cost involved in buying a 2-bedroom resale unit and holding it for 10 years while renting it out:

| Description | Amount |

| BSD + ABSD | $407,225 |

| Interest expense (Assuming an interest rate of 4.6% and a 25 year tenure) | $317,431 |

| Maintenance fees (Assuming $300/month) | $36,000 |

| Property tax | $87,040 |

| Rental income (Assuming no vacancy period and an average rental yield of 3%) | $525,120 |

| Agency fee payable once every 2 years | $23,630 |

| Total cost | $346,206 |

Total cost if you were to keep your HDB and purchase a second property: $346,206 + $121,556 = $467,762

Assuming that you are comfortable living in your current HDB flat, considering the option of retaining it depends on several factors. The unit’s location, age, demand in the area, and the development of new clusters nearby (if any) can all impact its future performance.

Depending on the investment property you purchase, the lower holding costs associated with an HDB flat compared to private property (despite the substantial ABSD) present the possibility of generating a profit in this scenario.

This potential is especially evident if you opt for an affordable unit (like Parc Riviera, which is priced well below your affordability), leveraging the loan while investing a portion of your available cash into other investments, as discussed in Option 1.

However, it is important to note that purchasing a more expensive property would result in higher costs compared to selling the HDB flat and acquiring two separate properties, as illustrated by the calculations above.

Option 4: Keep HDB and invest in equities or bonds

Diversification across asset classes is a widely recognised strategy that aims to reduce investment risk and optimise potential returns. By spreading investments across different types of assets, such as equities, bonds, and property, investors can potentially benefit from the performance of multiple sectors and mitigate the impact of any single investment’s underperformance.

However, it is important to note that diversification does not guarantee profits or protect against all types of risk. It is essential to consider factors such as individual risk tolerance, investment goals, and time horizon when constructing a diversified portfolio.

Let’s assume an annual return of 7% (according to the average annualised return of 7.58% since 1971) and with all your liquid assets of $1.3M invested:

| Time period | Investment amount | Profits |

| Start | $1,300,000 | $0 |

| Year 1 | $1,391,000 | $91,000 |

| Year 2 | $1,488,370 | $188,370 |

| Year 3 | $1,592,556 | $292,556 |

| Year 4 | $1,704,035 | $404,035 |

| Year 5 | $1,823,317 | $523,317 |

| Year 6 | $1,950,949 | $650,949 |

| Year 7 | $2,087,516 | $787,516 |

| Year 8 | $2,233,642 | $933,642 |

| Year 9 | $2,389,997 | $1,089,997 |

| Year 10 | $2,557,297 | $1,257,297 |

The $70,000 in your CPF OA will also earn an interest of 2.5% annually.

| Time period | Amount in OA | Interest earned |

| Year 0 | $70,000 | $0 |

| Year 1 | $71,750 | $1,750 |

| Year 2 | $73,544 | $3,544 |

| Year 3 | $75,382 | $5,382 |

| Year 4 | $77,267 | $7,267 |

| Year 5 | $79,199 | $9,199 |

| Year 6 | $81,179 | $11,179 |

| Year 7 | $83,208 | $13,208 |

| Year 8 | $85,288 | $15,288 |

| Year 9 | $87,420 | $17,420 |

| Year 10 | $89,606 | $19,606 |

Total profits if you were to hold the HDB for 10 years while investing your cash on hand: $1,257,297 + $19,606 – $121,556 = $1,155,347

Given that a significant portion of the expenses incurred in property acquisition is attributed to interest payments, which is not a factor when investing in equities or bonds, the potential profits from these investments tend to be considerably higher than those from purchasing a property. But do note that this is based on costs alone and we have not taken the potential capital appreciation of the property into account.

Option 5: Keep HDB but pay off the loan before purchasing a second property for investment

One advantage of property investment is the ability to leverage the loan. Assuming your existing loan is an HDB loan, the interest rate is currently lower compared to bank loans.

As such, it may not be the most rational decision to use $500,000 of cash to fully repay the loan and additionally incur a substantial ABSD for the purchase of a second property. Although you may be eligible for a higher loan, it only marginally increases your overall affordability compared to purchasing a second property without paying off the HDB loan. Therefore, this option may not be the most ideal choice.

Cost of holding on to HDB for 10 years:

| Description | Amount |

| Town Council Service & Conservancy fees ($85/month) | $10,200 |

| Property tax | $8,200 |

| Total cost | $18,400 |

We will assume as in Option 3, that you purchase an investment property at $1,750,500 and incurring the cost of $346,206 over 10 years.

Total cost if you were to pay off the HDB loan before buying a 2-bedroom resale unit and holding it for 10 years while renting it out: $18,400 + $346,206 = $364,606

What should you do?

So far, we’ve only considered the costs in all options involving property purchase. However, it’s only fair to compare option 4 (investing in equities/bonds) with properties if we assume capital appreciation is involved.

To ascertain the gains, let’s take a look at the Property Price Index and HDB Resale Price Index over the past 10 years and determine its annualised performance:

| Year | Property Price Index (PPI) of Residential Properties | YoY | HDB Resale Price Index (RPI) – Q1 of each year | YoY |

| 2012 | 151.5 | – | 138.5 | – |

| 2013 | 153.2 | 1.1 | 148.6 | 7.29% |

| 2014 | 147.0 | -4 | 143.5 | -3.43% |

| 2015 | 141.6 | -3.7 | 135.6 | -5.51% |

| 2016 | 137.2 | -3.1 | 134.7 | -0.66% |

| 2017 | 138.7 | 1.1 | 133.9 | -0.59% |

| 2018 | 149.6 | 7.9 | 131.6 | -1.72% |

| 2019 | 153.6 | 2.7 | 131 | -0.46% |

| 2020 | 157.0 | 2.2 | 131.5 | 0.38% |

| 2021 | 173.6 | 10.6 | 142.2 | 8.14% |

| 2022 | 188.6 | 8.6 | 159.5 | 12.17% |

| Annualised | – | 2.21% | – | 1.42% |

In order to estimate the potential capital gains for the properties, we will utilise the annualised growth rate of 2.21% for private residential properties and 1.42% for the HDB.

| Option | Capital gains | Costs | Profits |

| 1: Sell HDB and purchase a resale 3-bedroom condo | $621,563 | $536,600 | $84,963 |

| 2: Sell HDB and purchase 2 units, 1 for own stay and 1 for investment | $774,038 | $371,170 | $402,868 |

| 3: Keep HDB and purchase a condo for investment | $571,546 | $467,762 | $103,784 |

| 4: Keep HDB and invest in equities or bonds | $1,276,903 | $121,556 | $1,155,347 |

| 5: Keep HDB but pay off the loan before purchasing a second property for investment | $571,546 | $364,606 | $206,940 |

In the above scenarios, we are using an interest rate of 4.6% in our calculations.

However, do note that 4.6% is considered high in today’s context, especially when it was less than 2% just 2 years ago.

As such, interest rates may rise further or fall, so it’s also good to assume different levels of medium-term interest rates here over the 10-year period:

| Option | Profits at 1.5% interest | Profits at 2.5% interest | Profits at 3.5% interest | Profits at 5.5% interest |

| 1: Sell HDB and purchase a resale 3-bedroom condo | $313,771 | $242,418 | $168,633 | $14,791 |

| 2: Sell HDB and purchase 2 units, 1 for own stay and 1 for investment | $806,995 | $680,969 | $550,647 | $278,928 |

| 3: Keep HDB and purchase a condo for investment | $323,372 | $254,894 | $184,081 | $36,439 |

| 4: Keep HDB and invest in equities | $1,155,347 | $1,155,347 | $1,155,347 | $1,155,347 |

| 5: Keep HDB but pay off the loan before purchasing a second property for investment | $444,928 | $376,450 | $305,637 | $157,995 |

As you can see from the above table, the interest rate greatly affects the costs incurred and consequently, the potential profits made.

From a profit standpoint, it’s easy to conclude that holding onto the HDB and investing the rest is the best outcome. However, you should know that the outcome of earning 7% year on year is a result of investing in equities which is inherently risky and volatile. For example, if you are looking to cash out in the 10th year, the market could collapse 30 to 50% as in the case with Lehman Brothers back in 2008-2009.

This is less likely to happen to property prices given the number of levers and regulations we have in place.

From a cost perspective, retaining the HDB and investing your available cash in equities or bonds incurs the lowest expenses. However, again, it’s important to recognise that the investment risk associated with a property differs from that of equities and bonds.

While the performance of a property is still subject to market conditions, it holds the advantage of being a tangible asset, providing a greater sense of control compared to equities and bonds.

As the owner of the property, you have the ability to make key decisions. Nonetheless, it’s crucial to acknowledge that property investments are less liquid, and accessing funds quickly might present challenges.

A prudent approach would involve diversifying your investments across different asset classes to mitigate risk.

Ultimately, the choice between these pathways depends on your personal circumstances and preferences, as each option comes with its own set of advantages and disadvantages.

Should you sell your HDB?

When considering whether to sell your HDB, the decision will depend on various factors specific to your unit. However, since we do not have access to your address or specific details, we can only provide a general overview of the considerations involved.

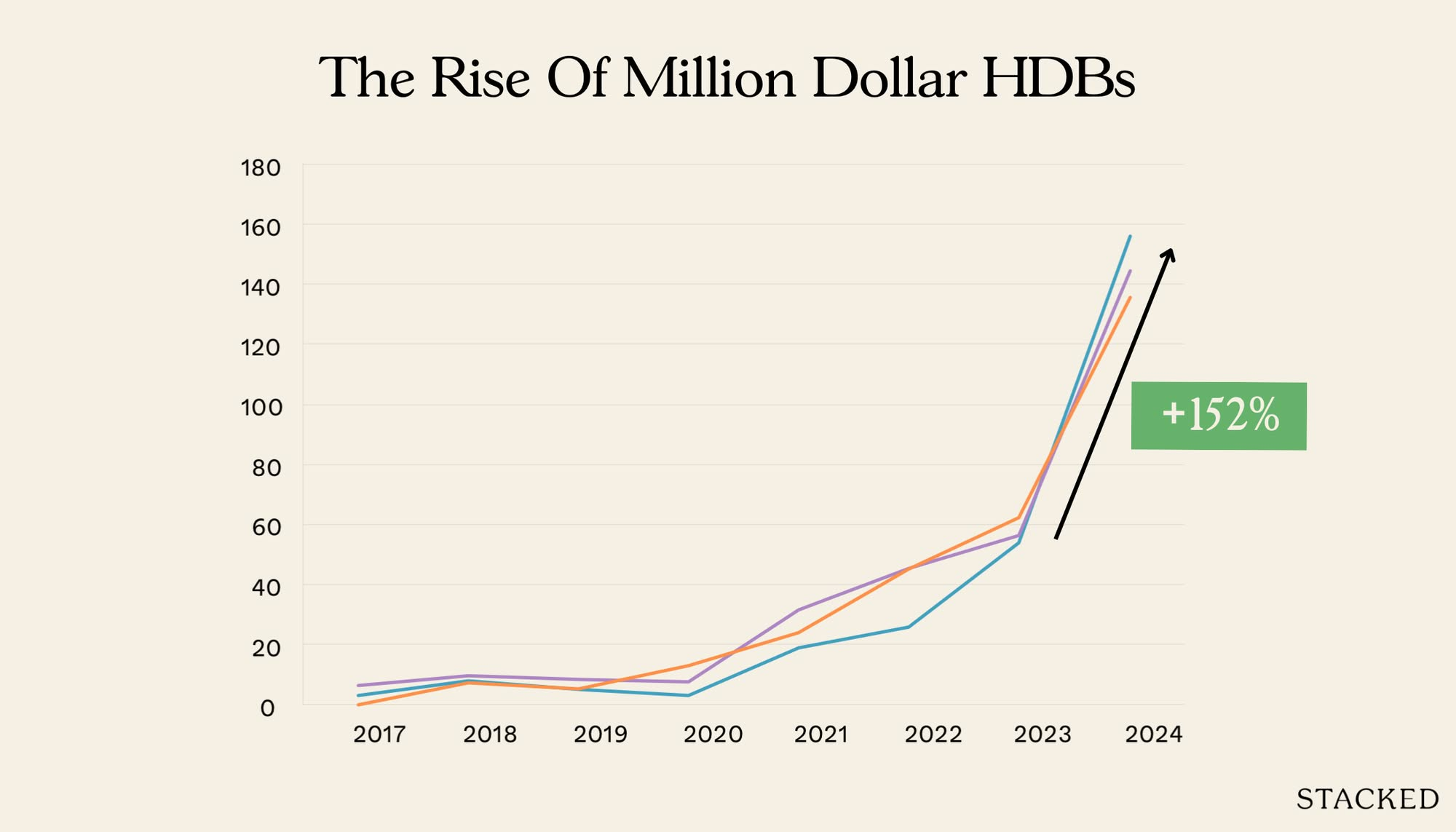

We can see from the table above that there is some disparity between the annualised returns for private properties and HDB flats over the past 10 years. The performance of HDB flats in the years leading up to the pandemic was generally characterised by low growth rates, with some years experiencing negative growth.

Currently, HDB prices are still on an upward trajectory, but the government’s efforts to increase the supply of new flats and reduce construction time may gradually alleviate demand in the secondary market.

The HDB market is more heavily regulated compared to the private market, as its primary purpose is to provide affordable housing for the general population.

While HDB flats are suitable for own-stay purposes, they may not be the optimal long-term investment tool.

Typically, holding two properties tends to be the most cost-effective approach, particularly when one property generates rental income to offset expenses. This arrangement provides increased flexibility, as the investment property and the unit for personal residence are separate entities.

By selling the HDB flat and purchasing two properties, you unlock the profits accumulated from the HDB and gain greater flexibility in allocating funds for each individual property. Additionally, this strategy allows you to avoid the payment of ABSD. If the right properties are chosen, they have the potential to generate substantial capital appreciation.

On the other hand, if you decide to retain the HDB and purchase a second property, the overall cost and potential profits will vary considerably based on factors such as the chosen property’s price and whether or not you opt for a loan. As previously discussed, keeping the HDB, in the long run, may not be the best investment strategy, especially if the unit is older in age.

There are exceptional circumstances that can cause a sudden surge in demand, like the pandemic for example, but it is not a common or predictable occurrence. Therefore, it would be prudent to consider selling the HDB now while there are profits to be made and explore the option of purchasing two separate properties instead.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

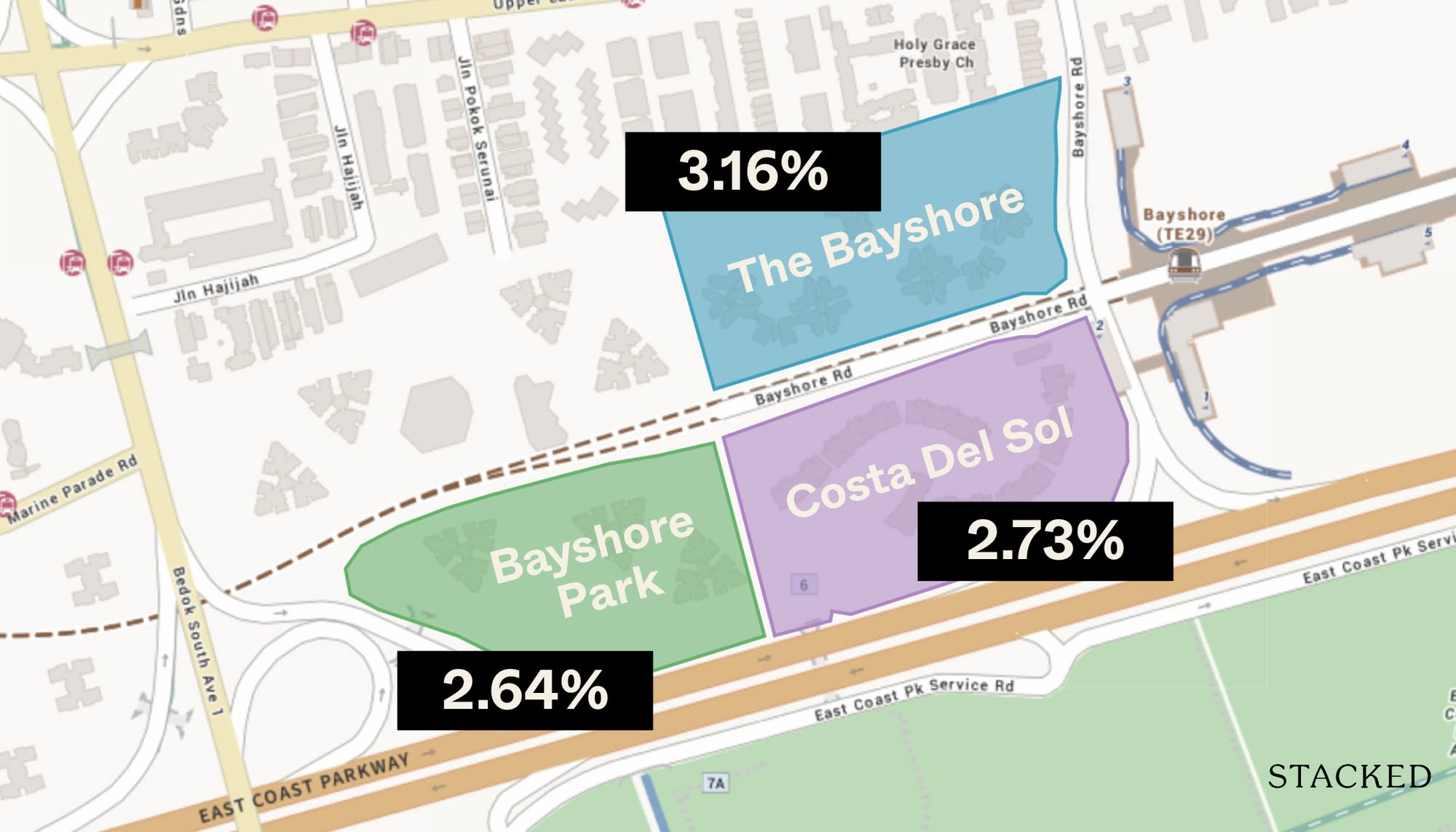

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

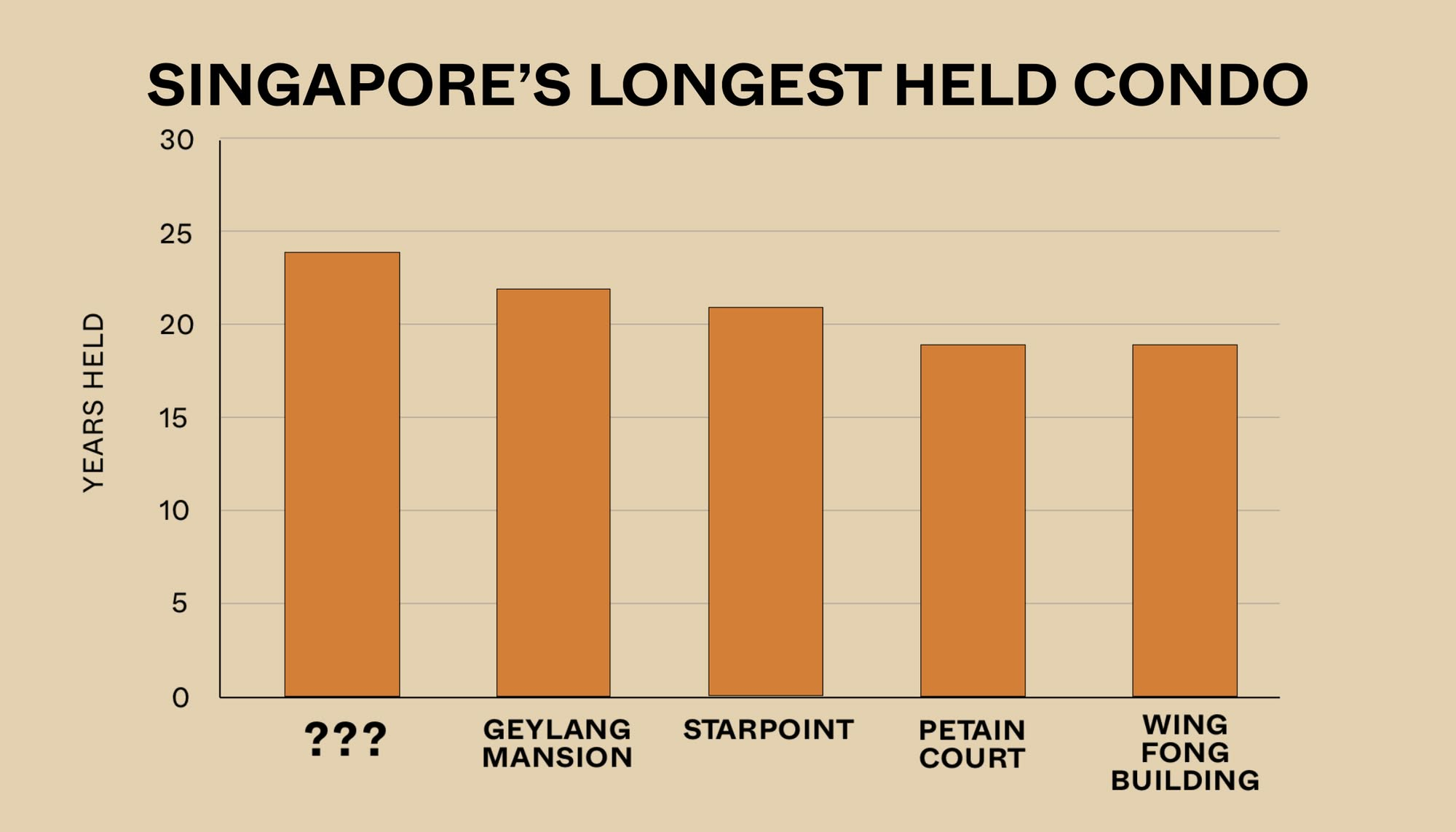

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

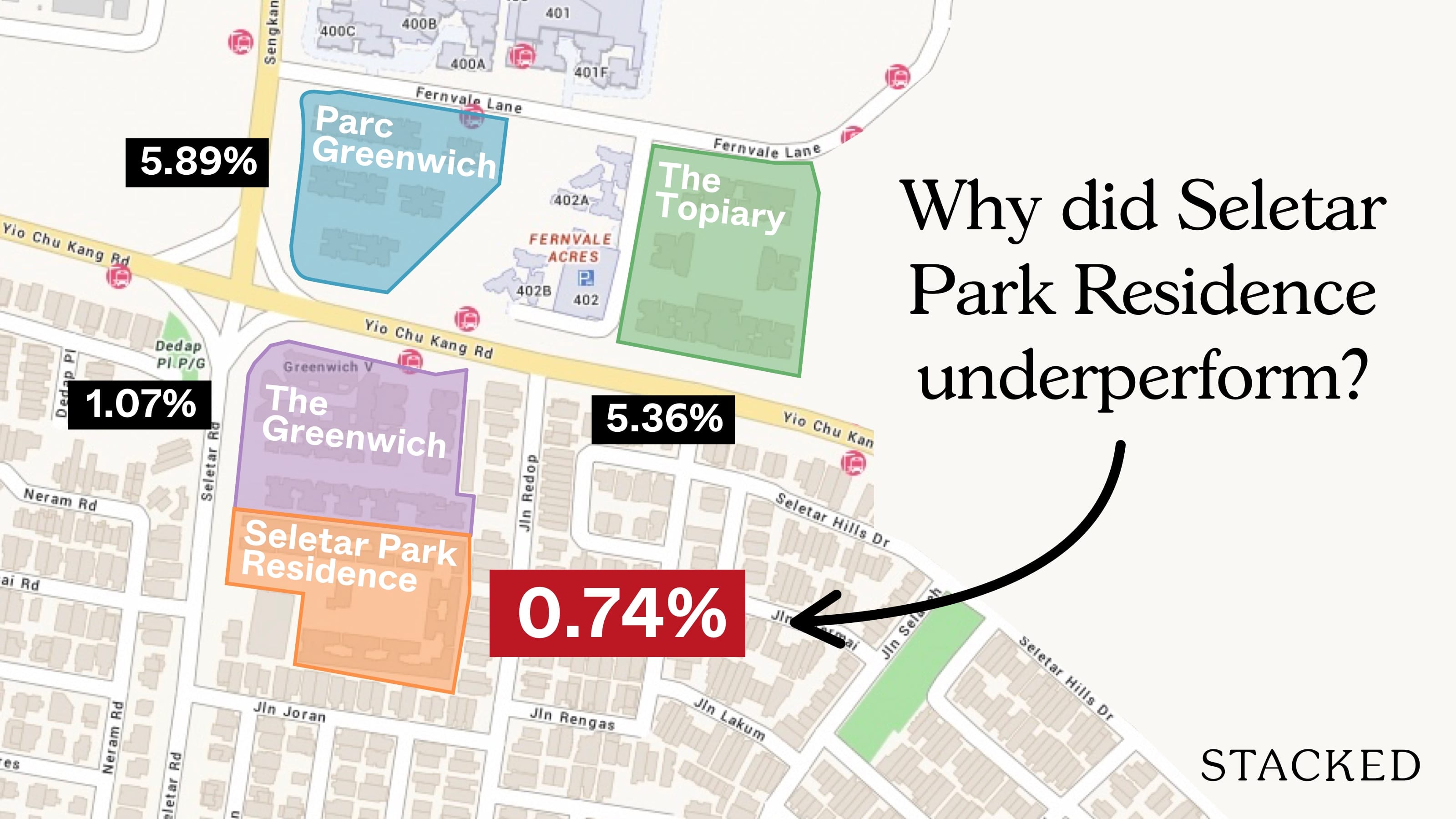

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Hi Ryan, always enjoy your very sharp analysis. we are planning to retire in 1-2 yrs’ time and assume we have a runway of another 20 years. Should we sell our 2 condos and downgrade to a 5-RM resale HDB. Preferred location is in district 4 near mt faber.

Condos are fully paid and we have abt 2 mil in liquidity and 1mil in CPF. Thank you.

I think you need to factor in other cost of investing in property eg property tax, MCST and property agent commission for leasing.