We Have $750k Cash: Should We Buy An HDB In Cash To Avoid The High Interest Or Buy A $2m Condo With A Loan?

February 24, 2023

Dear Stackedhomes Team,

Thank you for the valuable insights and articles in recent years, I have enjoyed them over the past 5 years.

I am at a crossroad selecting my first property purchase – a Resale HDB or a Private Property.

Basic Information about my partner and I:

- Singaporean

- Age 30

- Income of 24k a month (variable), both in sales, fixed income is 14.5k a month (including CPF)

- 750k cash (to be used solely for the property purchase)

Property Considerations:

- Situated in Buona Vista/Commonwealth/Queenstown (District 3,5) area due to parents’ proximity

- 4 Room HDB Resale

The plan was to pay for the entire HDB Resale with the 750k cash (our budget) due to the current high interest environment. We are looking to do the essential occupier scheme which will free one of us to purchase another property in the future.

However, after speaking to our peers, most have advised us to consider looking at a private property (3 Bedroom) due to our age and ability to pay off a huge chunk of the property with our cash on hand.

We are open to a private property in the RCR Region or District 21 and will look to use the 750k as down payment. This should allow us to comfortably purchase a place valued at around $2 million with single ownership (again, to free up the other for another property later)?

Would you give your opinion if we should go for a HDB or a private property if we have 750k cash at the moment.

Thank you and looking forward to hearing your advice!

Hello there,

It’s really nice to hear that you’ve enjoyed our content over the last few years. First of all, to be able to save $750K in cash is great and you guys are certainly in a rather healthy position to have such options. Regardless, buying a property is a huge financial decision, and as you can see, deciding between an HDB or a private property is certainly not straightforward, especially with today’s high-interest rate environment and prices.

HDB or private? A Common Dilemma…

Your dilemma of choosing between HDB and private property is not uncommon, especially with the greater affordability and space that HDBs offer for the same price. One of the main benefits of purchasing an HDB (apart from its lower prices) is the subsidy you can get. Since you mentioned wanting to live near your parents, you’re probably aware that you can access the Proximity Housing Grant, which amounts to $20,000 if you stay within 4 KM of either one of your parent’s homes. While $20,000 is seemingly insignificant in the grand scheme of things for you, it is still something to consider.

Limitations on Government Grants

Apart from the Proximity Housing Grant, do note that you don’t qualify for the recently-increased $80,000 Family Grant because your household income exceeds $14,000.

HDB Loan and Interest Rates

Considering your income, it would be impossible for you to take the HDB loan. We take it from your preference to pay for the HDB in full that the thought of paying the interest expense is frightful – and rightfully so too.

But we can also understand why your friends suggest taking a loan and buying a private property since you are only 30 years old and don’t qualify for many government grants anyway.

As such, given your age, you can still afford to take on leverage. Both your current high incomes would also put you in a comfortable position to service this loan (although of course, we are cognisant that as you are in sales, this may not be as stable).

So beyond these pointers, let’s take a look at what the numbers tell us.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A Numbers-Driven Approach

We don’t exactly have a clear idea of your long-term objectives (which can make a difference to your ultimate decision), but since we have a good understanding of your current situation, we’ll take a numbers-driven approach to illustrate what your position would look like at the end of a medium to long-term period of 5 to 10 years.

Here’s what we’ll look into

- Projected profits 10 years down the road – what would this look like if you bought a private property with a loan versus an HDB in cash?

- What would these profits look like if you decided to take a loan for your HDB instead?

- What other considerations are there?

But first, here are some assumptions in our simulation

Gains: We looked at the HDB Resale Price Index (RPI) and the Property Price Index (PPI) between Q1 2013 to Q4 2022 to calculate the annualised returns and used them in assuming capital appreciation over the next 10 years. This is 1.84% for HDBs and 2.34% for private property on a yearly basis. This makes up the “total gains” that you can make when you sell your property.

Costs: For interest expense, we used 4.25% as the annual rate to reflect the existing market condition. Only interest cost is accounted for as cost. We also took into account property tax (stamp duty and yearly property tax) and maintenance costs (estimated $350 per month for a 3-bedroom condo, $80 per month for the HDB).

Note: Other costs such as legal fees and application fees were ignored as they are insignificant to the outcome. Renovation costs were not considered as they’re very subjective and could be similar for both properties.

Buying a $2 million private property

| Period | Total Cost | Total Gains | Profit |

| Starting Cost | $69,600 | $0 | -$69,600 |

| Year 1 | $130,198 | $46,800 | -$83,398 |

| Year 2 | $189,882 | $94,695 | -$95,187 |

| Year 3 | $248,614 | $143,711 | -$104,903 |

| Year 4 | $306,351 | $193,874 | -$112,477 |

| Year 5 | $363,051 | $245,210 | -$117,841 |

| Year 6 | $418,669 | $297,748 | -$120,921 |

| Year 7 | $473,158 | $351,516 | -$121,642 |

| Year 8 | $526,469 | $406,541 | -$119,928 |

| Year 9 | $578,551 | $462,854 | -$115,697 |

| Year 10 | $629,350 | $520,485 | -$108,865 |

Starting off, your biggest expense is the Buyers Stamp Duty which saw a recent hike where properties above $1.5 Million faced a higher tax rate. Over time, the high-interest expense on the $1.25 Million loan eats into your profit which results in an even bigger loss over the years.

What if you buy an HDB with $750,000 cash?

| Period | Total Cost | Total Gains | Profit |

| Starting Cost | $17,100 | $0 | -$17,100 |

| Year 1 | $19,666 | $13,875 | -$5,791 |

| Year 2 | $22,231 | $28,007 | $5,775 |

| Year 3 | $24,797 | $42,400 | $17,603 |

| Year 4 | $27,362 | $57,059 | $29,697 |

| Year 5 | $29,928 | $71,990 | $42,062 |

| Year 6 | $32,494 | $87,197 | $54,703 |

| Year 7 | $35,059 | $102,685 | $67,626 |

| Year 8 | $37,625 | $118,459 | $80,835 |

| Year 9 | $40,190 | $134,526 | $94,336 |

| Year 10 | $42,756 | $150,890 | $108,134 |

Do note that years 1 – 4 can be ignored as this is within the 5-year MOP.

It’s immediately obvious that the combination of no interest expense with the low monthly conservancy charges and tax rate results in a much higher profit over the years. For one, your Buyers Stamp Duty saves you $52,500 in cash. This doesn’t include the $20,000 Proximity Housing Grant you may get too.

But is ploughing all $750,000 of your hard cash into an HDB necessarily the best approach here?

While you save on interest costs, think about what this means for you in the future. You may wish to keep your HDB several years down the road but also upgrade to a condo. This would allow you to rent out your HDB as a whole unit to unlock good rental yields.

To achieve this, being able to upgrade to a condo without selling to raise the necessary downpayment is necessary. Your income may change later on, and having a larger pool of cash could be handy in reducing the amount of loan you need to take. Many times, the cash down payment to buy a condo is what prevents buyers from going ahead, rather than the monthly mortgage.

Another point is that if you need to sell your HDB to upgrade, buying an HDB later could be a hassle. Once you own a private property, you cannot buy an HDB. And if both of you are married, the only way you can buy an HDB is to sell your private property first – and you may still face the 15-month wait-out period that recently came up (although it isn’t a permanent thing).

Keeping this in mind, it could be useful to take on a bank loan while investing the remaining 75% of the cash in a Fixed Deposit.

Today, you can get a Fixed Deposit at a rate of 3.2% with DBS/POSB. They are higher with other banks, however, we’ll take the lower rate to be conservative. Of course, you could get higher returns with other financial instruments, but we will take the most risk-free approach here.

Here’s what your profits would look like:

| Period | Total Cost | Total Gains | Profit | Interest Gains | Profit + Interest Gains |

| Starting Cost | $17,100 | $0 | -$17,100 | -$17,100 | |

| Year 1 | $43,322 | $13,875 | -$29,447 | $18,000 | -$11,447 |

| Year 2 | $68,985 | $28,007 | -$40,978 | $36,000 | -$4,978 |

| Year 3 | $94,064 | $42,400 | -$51,664 | $54,000 | $2,336 |

| Year 4 | $118,534 | $57,059 | -$61,475 | $72,000 | $10,525 |

| Year 5 | $142,368 | $71,990 | -$70,379 | $90,000 | $19,621 |

| Year 6 | $165,540 | $87,197 | -$78,343 | $108,000 | $29,657 |

| Year 7 | $188,020 | $102,685 | -$85,335 | $126,000 | $40,665 |

| Year 8 | $209,778 | $118,459 | -$91,318 | $144,000 | $52,682 |

| Year 9 | $230,783 | $134,526 | -$96,257 | $162,000 | $65,743 |

| Year 10 | $251,002 | $150,890 | -$100,113 | $180,000 | $79,887 |

Years 1 – 4 can be ignored since you cannot sell your HDB during the MOP.

The profit column shows what you make if you sell in that year, while the profit + interest gains show your profits if you invest the remaining $562,500 out of the $750,000 you reserved for property into a 3.2% p.a. Fixed Deposit.

Let’s say you bought your HDB at $750,000 with a loan and invested the rest in a fixed deposit. Selling in the 5th year nets you a profit of around $19K after costs.

If you had done the same with a $2 million condo, you’d face a loss of $153K.

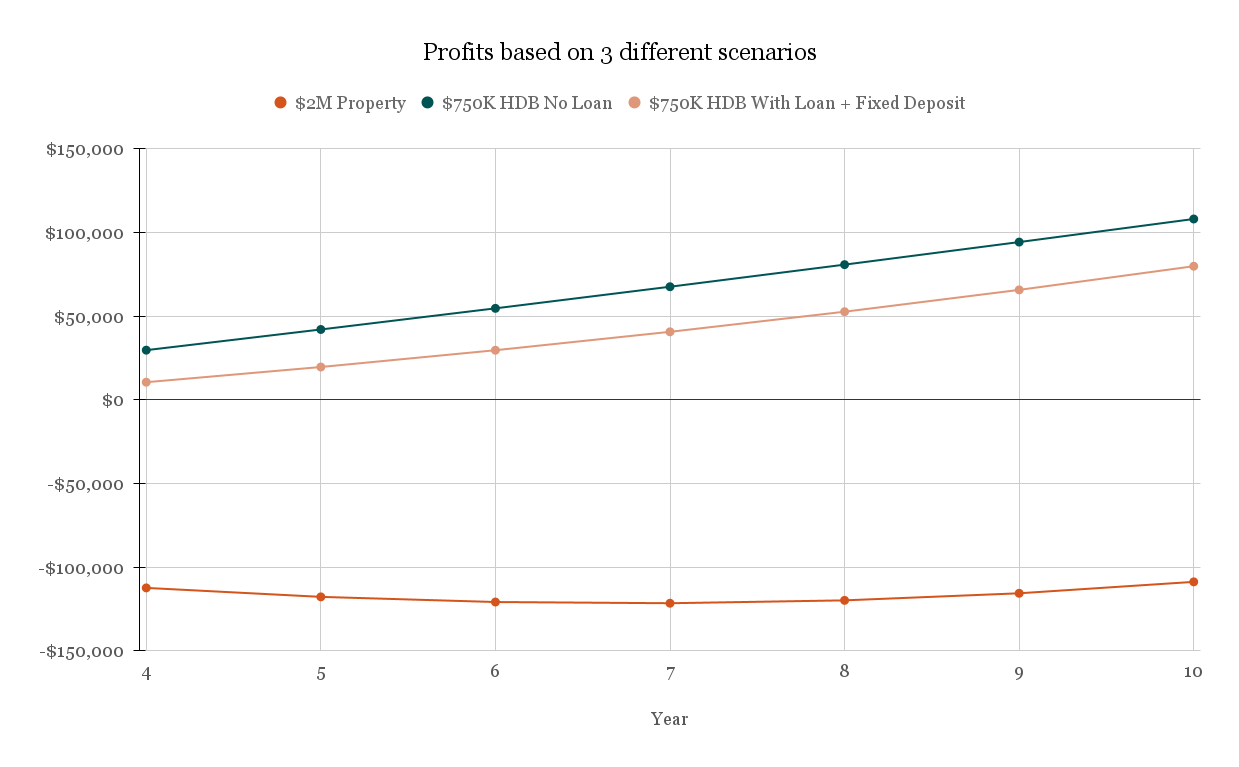

Here’s what all 3 scenarios look like in a chart:

The danger of being priced out later if you buy an HDB now

We’ve taken a look at your supposed profit for up to 10 years, but here’s the problem.

What if you buy an HDB today and get priced out of the private property market later on?

When you mentioned the desire to own 2 properties, we don’t know if it’s both private properties. But let’s say you wish to own 2 private properties at some point, you’d need to sell your HDB to buy a private property each (without incurring ABSD).

As a recap, annualised gains for HDBs and private property are 1.85% and 2.34% respectively. These gains are applied to the property price – the higher it is, the greater the growth.

Even though the profit tables above account for capital gains, if you are looking to sell your HDB and buy a private later, you might have to contend with higher private property prices.

These higher prices could exceed the cost of private property ownership within this 10-year horizon.

Here’s a look at how prices of a $750,000 HDB and a $2 million private property could play out based on their respective growth rates:

| Period | HDB | HDB Profit | Private Property | Private Profit |

| Start | $750,000 | – | $2,000,000 | – |

| Year 1 | $763,875 | $13,875 | $2,046,800 | $46,800 |

| Year 2 | $778,007 | $28,007 | $2,094,695 | $94,695 |

| Year 3 | $792,400 | $42,400 | $2,143,711 | $143,711 |

| Year 4 | $807,059 | $57,059 | $2,193,874 | $193,874 |

| Year 5 | $821,990 | $71,990 | $2,245,210 | $245,210 |

| Year 6 | $837,197 | $87,197 | $2,297,748 | $297,748 |

| Year 7 | $852,685 | $102,685 | $2,351,516 | $351,516 |

| Year 8 | $868,459 | $118,459 | $2,406,541 | $406,541 |

| Year 9 | $884,526 | $134,526 | $2,462,854 | $462,854 |

| Year 10 | $900,890 | $150,890 | $2,520,485 | $520,485 |

As you can see, private property prices would’ve grown $520,485 in 10 years’ time. It’s a large amount, and surely such an amount might make you wonder if you would be priced out later on.

So how should we calculate this and make the optimal decision?

By simply asking: what would it cost me to own this $2 million property (today) 10 years down the road?

Let’s break it down.

| Period | $750K + Loan HDB Option (Profit) | Buyer’s Stamp Duty | Extra Cost To Buy Private | Final Position |

| Start | -$17,100 | -$17,100 | ||

| Year 1 | -$5,791 | $71,940 | $118,740 | -$124,531 |

| Year 2 | $5,775 | $74,335 | $169,030 | -$163,255 |

| Year 3 | $17,603 | $76,786 | $220,497 | -$202,894 |

| Year 4 | $29,697 | $79,294 | $273,168 | -$243,471 |

| Year 5 | $42,062 | $81,861 | $327,071 | -$285,010 |

| Year 6 | $54,703 | $84,487 | $382,235 | -$327,532 |

| Year 7 | $67,626 | $87,176 | $438,692 | -$371,066 |

| Year 8 | $80,835 | $89,927 | $496,468 | -$415,634 |

| Year 9 | $94,336 | $92,743 | $555,597 | -$461,262 |

| Year 10 | $108,134 | $95,624 | $616,109 | -$507,975 |

First situation: Let’s assume you bought the HDB in cash. 10 years down the road, you make a profit of $108,134. You then sell your HDB and pay an extra $616,109 (inclusive of the Buyer’s Stamp Duty) to own this $2 million property that you could’ve bought 10 years back.

This leaves you at a “loss” of $507,975.

| Period | Holding Condo Cost |

| Start | -$69,600 |

| Year 1 | -$130,198 |

| Year 2 | -$189,882 |

| Year 3 | -$248,614 |

| Year 4 | -$306,351 |

| Year 5 | -$363,051 |

| Year 6 | -$418,669 |

| Year 7 | -$473,158 |

| Year 8 | -$526,469 |

| Year 9 | -$578,551 |

| Year 10 | -$629,350 |

Second situation: Let’s assume you bought this $2 million property today and held it for 10 years. Based on interest cost, maintenance and property tax, you’d have incurred a cost of $629,350.

In both scenarios, you’d end up with the same $2 million dollar property 10 years later.

But buying the HDB first and selling it 10 years later for the condo resulted in a difference in cost of $121,375.

In other words, you’d save on this amount if you bought the HDB in cash today, and then buy the $2 million dollar property 10 years later.

Here’s what the table looks like:

| Period | Loss from Scenario #1 | Loss from Scenario #2 | Difference |

| Start | -$17,100 | -$69,600 | -$52,500 |

| Year 1 | -$124,531 | -$130,198 | -$5,667 |

| Year 2 | -$163,255 | -$189,882 | -$26,627 |

| Year 3 | -$202,894 | -$248,614 | -$45,720 |

| Year 4 | -$243,471 | -$306,351 | -$62,880 |

| Year 5 | -$285,010 | -$363,051 | -$78,041 |

| Year 6 | -$327,532 | -$418,669 | -$91,137 |

| Year 7 | -$371,066 | -$473,158 | -$102,092 |

| Year 8 | -$415,634 | -$526,469 | -$110,835 |

| Year 9 | -$461,262 | -$578,551 | -$117,289 |

| Year 10 | -$507,975 | -$629,350 | -$121,375 |

From this table, you can see that holding on to the $2 million property for the next 10 years costs just above $600K versus cashing out the HDB and paying $520,485 more for the same condo later on.

What does this mean for you?

We’ve basically looked at whether you’d be better or worse off between 5-10 years from now based on these assumptions.

Since you mentioned purchasing a property later on (no time horizon defined), buying an HDB without a loan is the best option in our opinion if you wish to sell your HDB later on and purchase two private properties – one each.

Buying an HDB with a loan and investing the rest in a Fixed Deposit is a good option to consider if you intend to keep your HDB to rent out while having enough cash to upgrade to a private property later. This option also protects you from under-utilising your cash when interest rates fall later on.

Several years down the road, you’ll also likely have more savings and a higher income which would increase your options.

Buying a private property at $2 Million today and hoping to purchase a 2nd private property later on makes sense if the private property you purchase now outperforms the market. Otherwise, the high cost to maintain it would put you in a lower financial situation than if you had purchased the HDB. This seems to be the riskier option and something we wouldn’t bank on.

Taking a bigger loan today in such an interest-rate environment is hazardous relative to purchasing an HDB. If upgrading to a condo later on while keeping your HDB is something you’d consider, keeping some cash in a Fixed Deposit to buffer against the interest expense is worth considering.

Of course, these outcomes depend very much on the interest rate environment. If interest rates fall to 1+% in 2 years time, owning a private property would be better since the yearly appreciation on private property is historically better. But so long as interest cost remains high, any form of capital appreciation is easily eroded.

The only downside to buying an HDB is the macro factors that we’re wary of:

- Demographics – There’s a large supply of old HDBs inhabited by the older generation. Should they pass on, we will see an influx of HDB units on the market. This can lead to an oversupply situation, something which has yet to transpire but could have a strong effect on the market when it does.

- Pressure to ramp up supply – With high prices today, there’s a lot of pressure on the government to ramp up supply. Talks about even revamping the BTO system to build first, sell later is being revived. The government is acting now to increase supply in response to today’s prices.

- Keeping HDBs affordable – Continuing point 2, the government is well aware that HDBs should be seen as affordable and is likely to take measures to bolster this. Any such measures are aimed at keeping prices – and hence capital gains low.

With that being said, we think that a crash in HDB prices is very unlikely although you shouldn’t expect prices to appreciate as they have over the last few years. The government has a lot of existing levers to play with to ensure market stability. The greater cost is the interest expense that is certain to eat into your finances.

Other Considerations to Make

Apart from the numbers approach, there are several other considerations to make when deciding which path to settle on. Let’s break them down one by one:

1. Are facilities important to you now?

Since you mentioned buying an HDB, we don’t think it’s an important consideration. Still, we’re putting it out there for thoroughness. If the thought of lounging in the pool by the weekend is too tempting, perhaps this lifestyle quality shouldn’t be overlooked.

2. How important is it to own a 2nd property soon?

HDBs come with the usual 5-year MOP. During this time, the Essential Occupier cannot purchase a private property. If making a private property investment in the short term is a consideration, perhaps it’s a no-brainer that a condo is the better pick now.

3. How important is it to be near your parents?

If being close to parents is important for reasons such as spending time with them, looking after them, or having them help you look after your future kids which could happen in the next 1 to 3 years, then having them nearby is a huge plus. This further bolsters the reason to purchase an HDB versus buying a private property in a less-choice area.

One last consideration

So far, we’ve explored the options you presented – buying a $2 million condo or a $750K HDB.

But we’d also like to share that we have considered perhaps purchasing a lower-priced private development instead of a pricier $2 Million dollar property. For example, you could lower your budget to $1,300,000 which would save you on interest costs.

With that, you can get a pretty decent 3-bedroom condos in the Outside of Central Region (OCR) such as Choa Chu Kang/Bukit Panjang.

Here’s what your profit would look like:

| Period | Total Cost | Total Gains | Profit |

| Starting Balance | $36,600 | $0 | -$36,600 |

| Year 1 | $65,416 | $30,420 | -$34,996 |

| Year 2 | $93,830 | $61,552 | -$32,278 |

| Year 3 | $121,824 | $93,412 | -$28,412 |

| Year 4 | $149,382 | $126,018 | -$23,364 |

| Year 5 | $176,482 | $159,387 | -$17,096 |

| Year 6 | $203,107 | $193,536 | -$9,571 |

| Year 7 | $229,235 | $228,485 | -$750 |

| Year 8 | $254,845 | $264,252 | $9,407 |

| Year 9 | $279,914 | $300,855 | $20,942 |

| Year 10 | $304,418 | $338,315 | $33,897 |

With a $1.3 million condo and a $750K downpayment, your loan would only amount to $550K. This results in a lower interest expense which allows you to even make a profit of over $30K.

Should you consider this option?

It ultimately boils down to whether you’d be comfortable using this as the “investment” property down the road. In other words, your partner would need the financial means to purchase the “own stay” property.

If that’s not a scenario you’re willing to bank on and you’re not willing to stay in the OCR for example, then purchasing a less-than-ideal condo to save on costs may not be worth it.

And if you do sell this property to then buy 2 private properties, being stuck in a condo that’s less than ideal for several years should be taken into consideration.

How should you know when to upgrade to a private property?

There are reasons like changes in lifestyles or tastes, but we can’t speak much about that.

What we can look at are the numbers. Based on our calculations, the high interest rate is the real killer here. From a numbers perspective, we think that the best time to upgrade is simply when interest rates fall.

Why?

Because you’re basically shifting out of your HDB that’s earning 1.85% annually onto a leveraged but stable product earning 2.34%. If the cost of money is less than the appreciation rate, then you’re likely to earn more.

To summarise…

We think that the 5-10 year analysis builds a solid idea of what your financial situation could look like which should help you in making your decision.

Ultimately, the decision to buy either an HDB or a condo is a very personal one. The models we use are also extremely simplistic, and more often than not, assumptions may sound logical today but don’t hold water several years down the road. Data and numbers are the tools we can rely on, but in the end, you’ll need to come to your own terms and be comfortable with why you make your decision today.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

2 Comments

Out of all the articles, I think this is the best article to inform readers on buying property in high interest rate environment

Me too, held off buying a 2.5mio freehold condo after calculating the cost. Bsd Plus interest is easily 450k by year 5.. I can’t foresee these houses can rise by another 500k in the 5 yrs..

Like u said, interest rate will change; hence, I think ain’t too bad to look for gd deals if the next condo/landed is the final goal, and not intending to shift anymore.