We Have $600k In Cash: Should We Wait 15 Months For An HDB Or 2 Condos Instead?

November 1, 2024

Hi Stackedhomes,

I have been following you for awhile and always enjoy your insights and advice.

We are a couple in our early 40s who had just sold our condo (joint name). Currently we are staying in a rental unit as we would like to purchase a resale hdb which we can only do so after the 15 months waiting period.

We would like to seek your advice as we were also thinking of a getting a condo each where 1 is for rental purpose and the other is for staying purpose.

our combine cpf is about 500k and cash is about 600k.

We do have a young daughter at age 3.5 and our next priority is her primary school.

Hi there,

We’re happy to hear that you enjoy the content.

The two options you’re considering come with significantly different costs and potential gains, each with its own set of pros and cons. In the article, we’ll explore these aspects along with some relevant numbers to give you a clearer understanding.

Let’s start by looking at your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Since we don’t have all your financial details, we will provide an estimate based on what you’ve provided.

With your available cash and CPF savings, purchasing an HDB property shouldn’t pose an issue. To calculate your affordability in acquiring two private properties, we will assume that your CPF funds are equally divided between both you and your partner, and we will allocate a larger portion of cash towards the purchase of your own residence.

Let’s assume you use $650,000 from your CPF and cash for the 25% down payment on your own stay property. Based on this, the maximum purchase price would be approximately $2.6M. After factoring in the Buyer’s Stamp Duty (BSD), your actual affordability would be approximately $2.25M. Keep in mind, however, that this estimate depends heavily on the loan quantum you are eligible for.

| Purchase price | $2,250,000 |

| BSD | $82,100 |

| CPF + cash | $650,000 |

| Loan required | $1,682,100 |

Assuming you are 42 years old and using a 4.8% interest rate for the stress test calculation, you would need to have a monthly income of approximately $18,500 to qualify for a loan of $1,682,100.

For the investment property, with a 25% down payment of $450,000 and after factoring in the BSD, the maximum purchase price would be around $1.58M, depending on the loan amount the purchasing party qualifies for.

| Purchase price | $1,580,000 |

| BSD | $48,600 |

| CPF + cash | $450,000 |

| Loan required | $1,178,600 |

Similarly, assuming that the buyer is 42 years old and using a 4.8% interest rate for the stress test calculation, they would need a monthly income of approximately $13,000 to qualify for a loan of $1,178,600 for the investment property.

Since we don’t have details on your income, we can’t confirm the feasibility of this option. Additionally, depending on the location and unit size you’re considering, you may not need to stretch your budget to the maximum.

Before we go into the options you’re exploring, let’s first compare the performance of HDB flats against private properties.

Performance of HDB vs private property

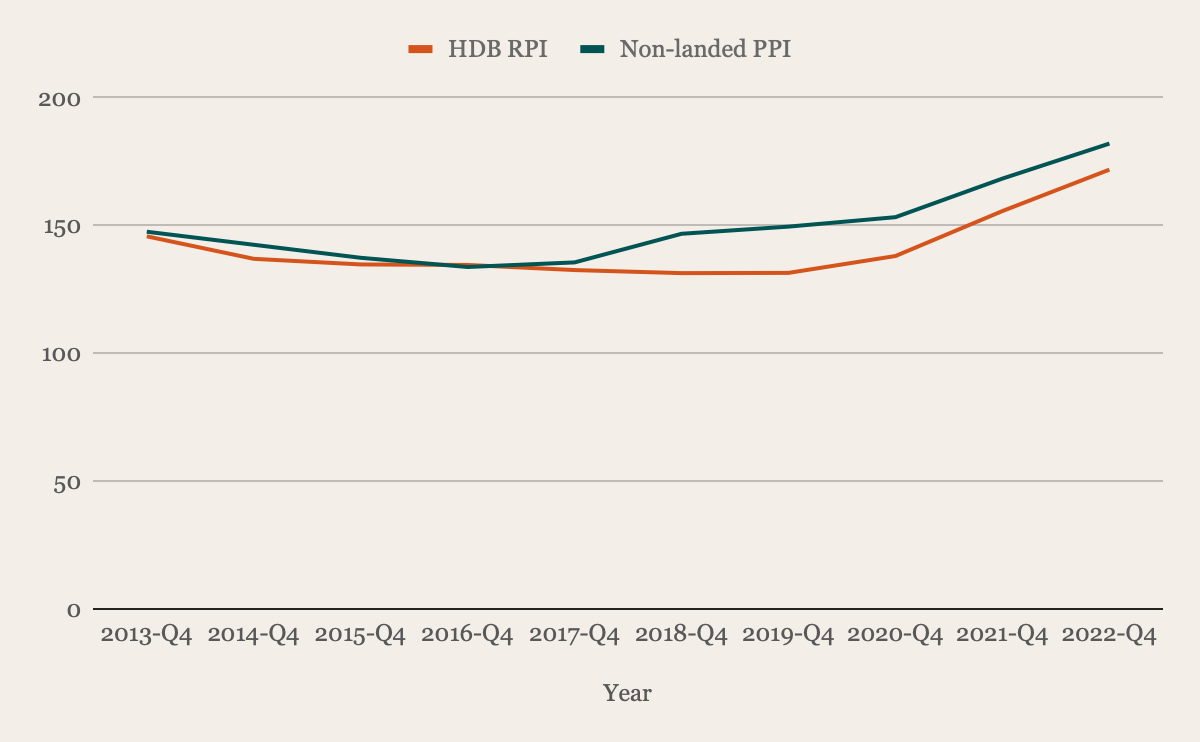

Here we are only looking at non-landed private properties.

| Year | HDB Resale Price Index (RPI) | Non-landed Property Price Index (PPI) |

| 2013-Q4 | 145.8 | 147.6 |

| 2014-Q4 | 137 | 142.5 |

| 2015-Q4 | 134.8 | 137.4 |

| 2016-Q4 | 134.6 | 133.8 |

| 2017-Q4 | 132.6 | 135.6 |

| 2018-Q4 | 131.4 | 146.8 |

| 2019-Q4 | 131.5 | 149.6 |

| 2020-Q4 | 138.1 | 153.3 |

| 2021-Q4 | 155.7 | 168.4 |

| 2022-Q4 | 171.9 | 182.1 |

| 2023-Q4 | 180.4 | 194.2 |

| Average | 2.30% | 2.90% |

This table shows that on average, non-landed private property prices have outperformed HDB flats over the past decade. Notably, non-landed private property prices rebounded more quickly following the post-2013 downturn, whereas HDB prices only saw substantial growth during the pandemic.

This difference is largely due to the distinct purposes and regulatory frameworks governing each property type. HDB flats are designed as affordable housing for the general population, so their prices are more strictly regulated to ensure affordability remains within reach. As a result, their price growth is often more gradual and stable.

On the other hand, private properties are subject to fewer regulations and are more accessible to a wider pool of buyers, including both local and foreign investors. This makes private property prices more sensitive to economic conditions and capable of greater price fluctuations.

While HDB flats offer the advantages of affordability and price stability, they generally don’t see as much appreciation as private properties. This makes HDBs more suitable for own-stay purposes rather than serving as an investment. Private properties, on the other hand, while riskier, offer higher potential returns and are seen as a form of investment.

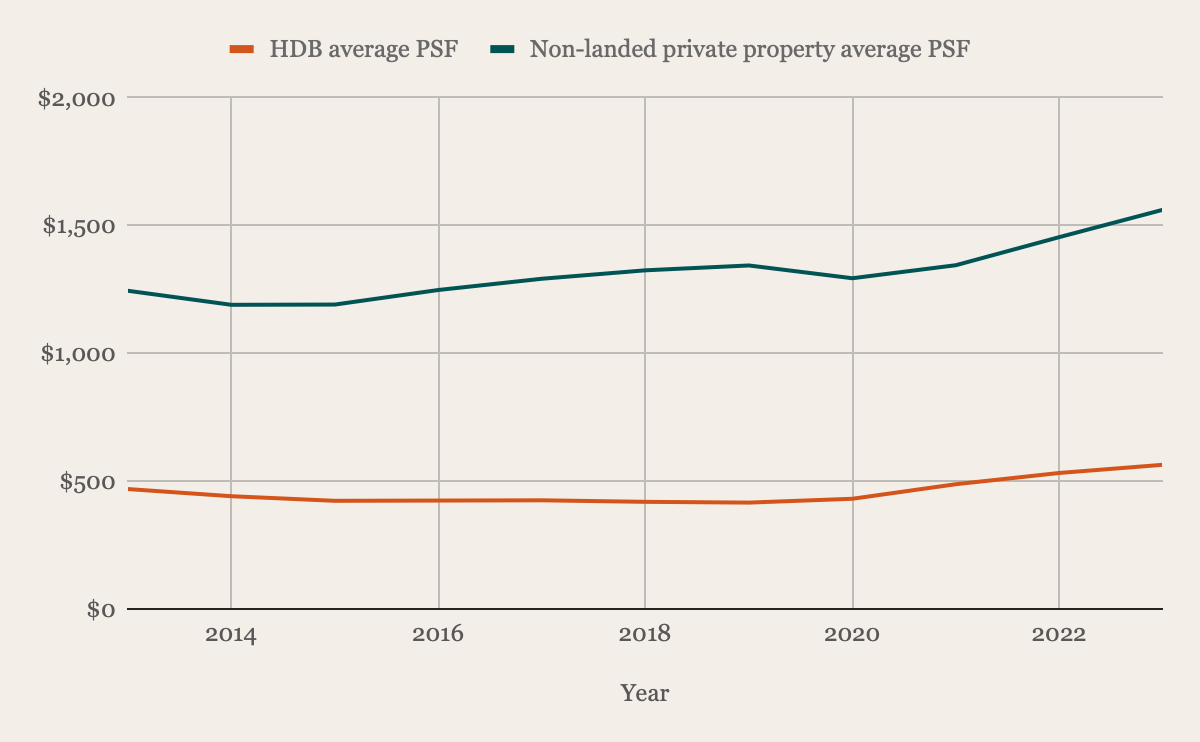

| Year | HDB average PSF | Non-landed private property average PSF | % difference |

| 2013 | $469 | $1,245 | 165.46% |

| 2014 | $441 | $1,190 | 169.84% |

| 2015 | $423 | $1,191 | 181.56% |

| 2016 | $424 | $1,248 | 194.34% |

| 2017 | $425 | $1,292 | 204.00% |

| 2018 | $419 | $1,325 | 216.23% |

| 2019 | $416 | $1,344 | 223.08% |

| 2020 | $431 | $1,294 | 200.23% |

| 2021 | $488 | $1,345 | 175.61% |

| 2022 | $532 | $1,455 | 173.50% |

| 2023 | $564 | $1,562 | 176.95% |

We observe here that the price gap between HDB flats and private properties has steadily widened over the years, making it more difficult for HDB owners to upgrade to private properties without a substantial top-up. Although HDB prices have shown consistent growth over the past three years, private property prices have risen at a similar rate, preventing any significant narrowing of the gap.

Now let’s take a look at the pathways you’re considering.

Potential pathways

Buying an HDB now and buying a condo later

Seeing as you’re also considering the option of purchasing two private properties, you might explore buying the HDB under the owner-occupier arrangement. In this scenario, one of you would be the owner while the other acts as the occupier. After the flat has fulfilled its Minimum Occupation Period (MOP), the occupier can then proceed to buy a private property without incurring Additional Buyer’s Stamp Duty (ABSD). However, keep in mind that the occupier’s CPF funds cannot be used for the HDB purchase.

This approach would enable you to ultimately own two properties. However, it comes with certain drawbacks, such as the 15-month wait-out period and the 5-year MOP, which could result in lost opportunities. Additionally, since the party planning to buy the investment property can only do so after six years, this would shorten the loan tenure, potentially affecting the loan quantum.

Considering the timeline, if you wish to enrol your daughter in a primary school with priority admission under the Home-School Distance category, the HDB you purchase will need to be within 1 km of your preferred school.

Now let’s take a look at the numbers.

Since there are a few uncertainties—such as the exact location of your purchase, your current rent, how far you are into the 15-month wait-out period, and your loan amounts—we’ll need to make some assumptions for the calculations:

- You still have 12 months remaining before you’re eligible to purchase an HDB.

- Your current rent is $3,000 per month.

- The purchase price of the HDB is estimated at $885,000 (based on the average price for a 4-room flat in Bukit Merah in Q2 2024; we’re using a higher estimate to be safe).

- The purchase price of the investment property is estimated at $1.5 million.

- The investment property will generate a rental yield of 3%.

For these calculations, we’ll consider a 10-year timeframe. This means you’ll be renting for 1 year before purchasing and staying in the HDB for 9 years. Likewise, the investment property will be purchased after the HDB’s MOP and rented out for 4 years.

Buying the HDB

| Purchase price | $885,000 |

| BSD | $21,150 |

| CPF + cash | $350,000* |

| Loan required | $556,150 |

*For this purchase we only utilised $100K from your cash savings to leave more funds for the purchase of the investment property

Cost of holding the HDB for 9 years

| Interest expense (Assuming 4% interest and 23-year tenure) | $173,441 |

| BSD | $21,150 |

| Property tax | $6,678 |

| Town council service & conservancy fees (Assuming $72/month) | $7,776 |

| Rent cost (during the wait-out period) | $36,000 |

| Total costs | $245,045 |

Buying the investment property

| Purchase price | $1,500,000 |

| BSD | $44,600 |

| CPF + cash | $750,000 |

| Loan required | $794,600 |

Cost of holding the investment property for 4 years

| Interest expense (Assuming 4% interest and 17-year tenure) | $116,342 |

| BSD | $44,600 |

| Property tax | $26,400 |

| Maintenance fees (Assuming $280/month) | $13,440 |

| Rental income | $180,000 |

| Agency fees (Assuming it’s paid once every 2 years) | $8,176 |

| Total costs | $28,958 |

Total cost if you were to take this pathway: $245,045 + $28,958 = $274,003

Another option to explore is the possibility of moving into the private property while renting out the HDB. Once the HDB reaches its MOP, you will have satisfied the 30-month requirement for the Home-School Distance priority admission category, which means you won’t be restricted to staying within a 1km radius of the school.

Let’s examine how this approach impacts the numbers, assuming you rent out the HDB at a 5% yield.

Cost of holding the HDB for 9 years (staying for 5 and renting for 4)

| Interest expense (Assuming 4% interest and 23-year tenure) | $173,441 |

| BSD | $21,150 |

| Property tax | $29,510 |

| Town council service & conservancy fees (Assuming $72/month) | $7,776 |

| Rent cost (during the wait-out period) | $36,000 |

| Rental income | $177,024 |

| Agency fees (Assuming it’s paid once every 2 years) | $8,038 |

| Total costs | $98,891 |

Cost of holding the investment property for 4 years

| Interest expense (Assuming 4% interest and 17-year tenure) | $116,342 |

| BSD | $44,600 |

| Property tax | $7,920 |

| Maintenance fees (Assuming $280/month) | $13,440 |

| Total costs | $182,302 |

Total cost if you were to take this pathway: $98,891 + $182,302 = $281,193

Opting for this route will result in slightly higher overall costs, but it comes with the benefit of living in a private property, allowing you to enjoy the facilities and lifestyle that come with it (if that aligns with your preferences).

Buying 2 private properties

Purchasing two private properties offers greater flexibility with the timeline, as you won’t have to adhere to the 15-month wait-out period, and you will be able to buy both properties simultaneously. Additionally, since there’s no MOP, you have the option to sell your own stay property after three years, once the Seller’s Stamp Duty (SSD) period is over and purchase a property within 1km of your preferred primary school. While this timeline may be tight, it provides flexibility in not having to commit to a property near the school immediately.

The downside, of course, is the higher upfront cost of buying two private properties. However, renting out one of the properties will help to offset some of the ongoing expenses, making it more manageable.

As we do not know your income, we cannot determine if you can fully maximise your budget based on your available CPF funds and cash. As such, let’s assume the following:

- The purchase price of your own stay property is $1.8M.

- The purchase price of the investment property is $1.2M.

- The investment property will generate a rental yield of 3%.

Buying the own stay property

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| CPF + cash | $650,000 |

| Loan required | $1,209,600 |

Cost of holding the own stay property for 10 years

| Interest expense (Assuming 4% interest and 23-year tenure) | $410,858 |

| BSD | $59,600 |

| Property tax | $28,800 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Total costs | $541,258 |

Buying the investment property

| Purchase price | $1,200,000 |

| BSD | $32,600 |

| CPF + cash | $450,000 |

| Loan required | $782,600 |

Cost of holding the investment property for 10 years

| Interest expense (Assuming 4% interest and 23-year tenure) | $265,821 |

| BSD | $32,600 |

| Property tax | $48,000 |

| Maintenance fees (Assuming $280/month) | $33,600 |

| Rental income | $360,000 |

| Agency fees (Assuming it’s paid once every 2 years) | $16,350 |

| Total costs | $36,371 |

Total cost if you were to take this pathway: $541,258 + $36,371 = $577,629

What should you do?

Given that we don’t have a complete picture of your financial situation, it’s challenging to determine which option might be the best fit for you or whether either option is feasible. While the first option seems to present a more prudent choice based on the costs involved, your ultimate decision will hinge on your comfort level with your financial situation and the level of flexibility you desire.

Opting to purchase an HDB flat first can provide more financial breathing room. This approach will allow you time to save up which could open additional options for you, or enable you to reduce your loan quantum. While the costs associated with purchasing an HDB are significantly lower, it’s important to recognise that the appreciation potential is also more limited. By delaying the purchase of an investment property, you may have more time to observe market conditions but it’s crucial to consider the opportunity cost associated as you’ll be missing out on potential appreciation during that time.

On the other hand, choosing to buy two private properties will involve higher costs due to the larger loans you’ll need to take on. However, this approach offers higher growth potential, if you choose the right properties. By purchasing both properties simultaneously, there is a greater opportunity for capital growth over time. Additionally, the absence of a 15-month wait-out period allows you to avoid extra rental costs.

Another consideration is the timeline for your daughter’s education. If you choose the HDB option and wish to apply for priority admission under the Home-School Distance category, you’ll need to decide on a school before purchasing the HDB which could limit your options.

Ultimately, your decision should reflect not just the financial implications but also your long-term goals and lifestyle preferences. If you prioritise investment growth and can manage the associated costs and risks, purchasing two private properties may be the way to go. However, if you prefer a more gradual approach that allows for greater financial stability and less immediate pressure, starting with an HDB would be more suitable.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments