We Have $500k In Cash And Looking To Buy Our First Home. Should We Buy A Resale HDB And Upgrade Later Or Buy A Condo First?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi StackedHomes,

Thank you for generating such insightful content on this really engaging platform! Appreciate your efforts to provide these pertinent information to the community, and I would love to seek your professional advice.

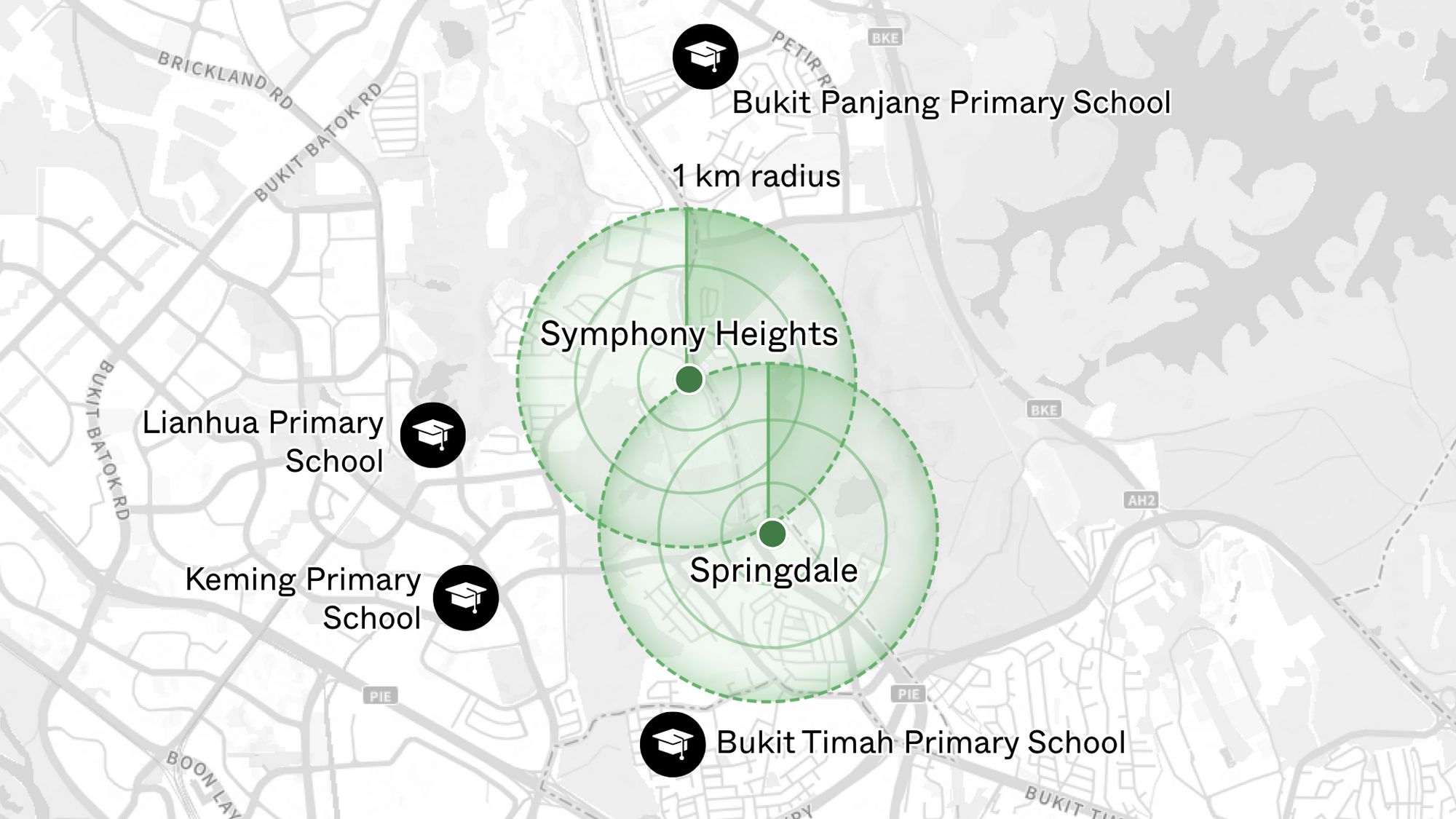

My partner turns 32 and I, 28 this year. We have a combined monthly income of $22K and ~$500K in cash, and are looking towards purchasing our first matrimonial home. We do have plans for kids in future, thus proximity to primary schools, and a space sufficient to accommodate a hypothetical family of 4 is important to us. We’d also like to be in an area within close accessibility to MRT, if possible.

We are considering the following options:

1. 3 bedroom freehold condo

– This is our preferred, considering the space allowance and potential for capital preservation, but we acknowledge that it might be abit of a stretch financially. Some potential considerations we had looked are Seletaris and Robertson 100.

2. 3 bedroom 99yr leasehold condo

– This would be more comfortable on our finances, but we are concerned about the potential for capital gains given its 99yr leasehold status.

3. Purchase a 4/5rm HDB resale flat, then aim to upgrade to a 3BR freehold condo 5 years later

– This could be the most affordable and practical option as a start, but we are concerned about the potential for capital preservation for a resale HDB, given the high prices currently. Furthermore, with a min. 5-year MOP, we felt that there is less flexibility for future options.

We are more drawn towards options 1-2, as they offer the option of renting out and there is also a shorter holding period.

As first-time home owners, we would really appreciate your advice on this, feel free to correct any misconceptions that we might have, or alternative points of consideration that we might have overlooked.

Apologies for the long email, but thank you for your time in advance!

Hi there!

Buying a home for the first time can be both an exciting and yet daunting experience with so many aspects to consider. While it may seem like an uncertain time to buy a property, the same can be said at many different periods before too. Whether it’s during the early stages of the pandemic (when Covid-19 threatened to wreck havoc), when property prices were at all-time highs (would it still continue to go up?), or right now when interest rates are increasing and the economy seems uncertain – there never seems to be the “right” time to buy a property.

It does seem like you are still in the early stages of your property journey, as you haven’t quite narrowed down on a location yet.

As such, we will run through the following and hopefully help you make a more informed decision on which pathway to take:

- Affordability

- Factors to consider before buying

- The different market segments and their pros and cons

- Pathways you can consider

Let’s start by taking a look at your affordability!

Affordability

| Description | Amount |

| Maximum loan based on a combined monthly income of $22K and ages 32 and 28 | $2,534,481 (30 years tenure) |

| CPF funds | $170,000 |

| Cash | $500,000 |

| Maximum affordability based on 25% downpayment of $670K ($170K + $500K) | $2,680,000 |

| BSD based on $2,680,000 | $91,800 |

| Estimated affordability | $2,588,200 |

Do note that although the maximum loan based on your income and age is $2.53M, your maximum affordability is $2.68M (including BSD) because the total CPF funds and cash that you’ll be using to pay for the 25% downpayment is $670K. Taking BSD into consideration, your estimated affordability will be $2.58M.

With a budget of $2.58M, getting a 3 bedroom unit is definitely doable. However, before getting into the details, we’d like to highlight some important pointers to take note of for a first-time home buyer.

- What is your expected holding period?

- You mentioned that you’ve plans to start a family and that proximity to primary schools is an important factor. However, your mention of the inflexible 5-year MOP that applies to HDB goes against that because if you’re planning for primary schools, it’ll mean you have to live in the property for at least the next 12 years or longer depending on when you give birth to your kids.

- If you do plan to have a kid in the next few years, moving might be a hassle too as there’d be many other considerations then. You may also want a bigger home that can accommodate a helper during this period.

- Your holding period determines what type and age of property you should be looking at. For instance, if you’re planning to stay for the short term say 3 – 5 years, getting a leasehold property might be a better option as prices tend to move faster than a freehold in the short run. But if you’re planning to stay for the long term say 10 – 15 years, it’s perhaps better to look at younger leasehold or freehold developments so there is better value preservation and potential for growth.

- Where do you want to stay?

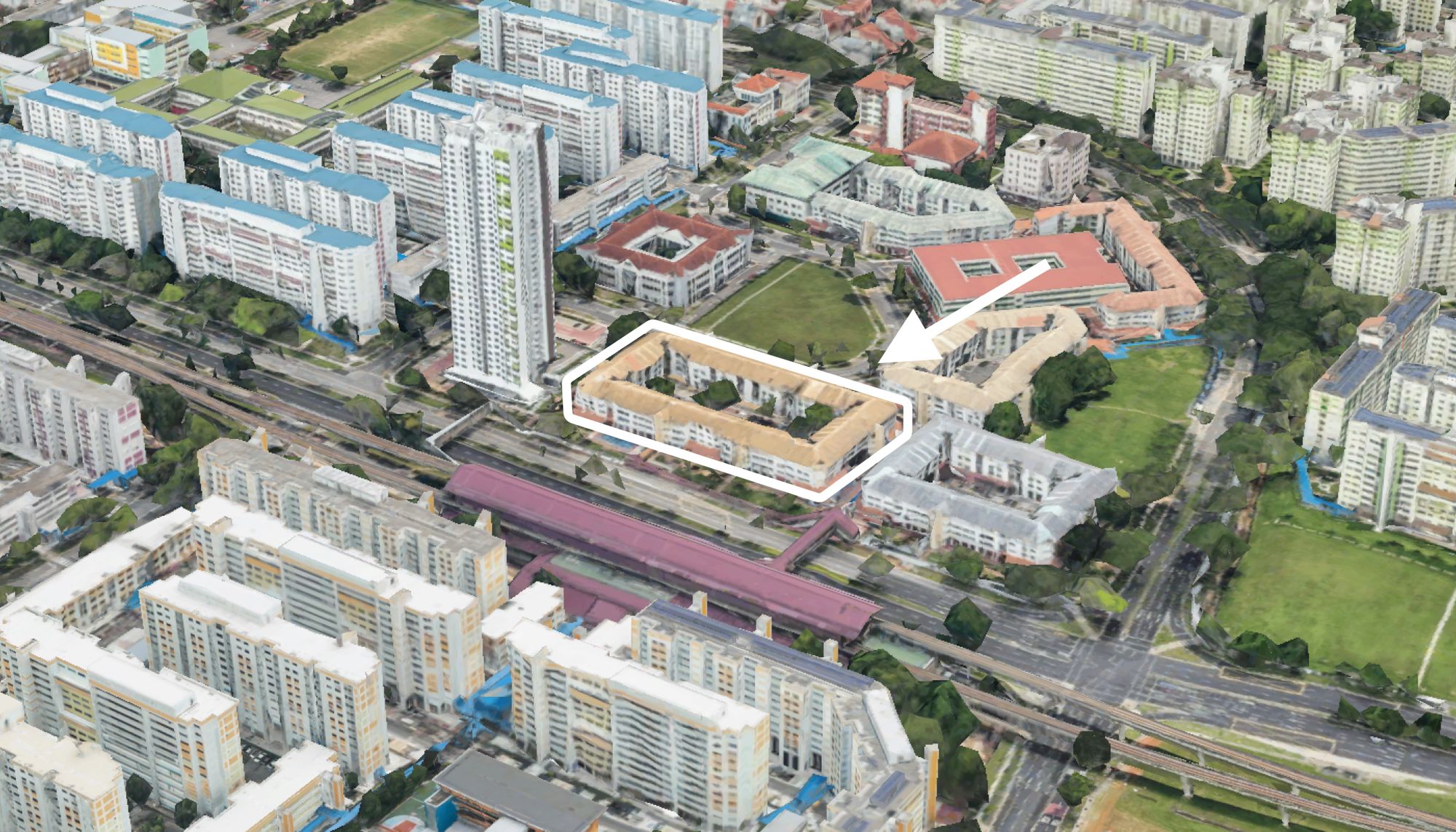

- We are presuming you shortlisted Seletaris and Robertson 100 based on them being freehold and within your affordability – but we note that they are in two very different locations (Sembawang and Robertson Quay respectively). With the plan to start a family, perhaps living close to your parents might be something to consider. Other factors that typically influence where buyers make their purchases are – distance to their workplace, which schools they want their kids to attend, proximity to amenities, lifestyle, etc.

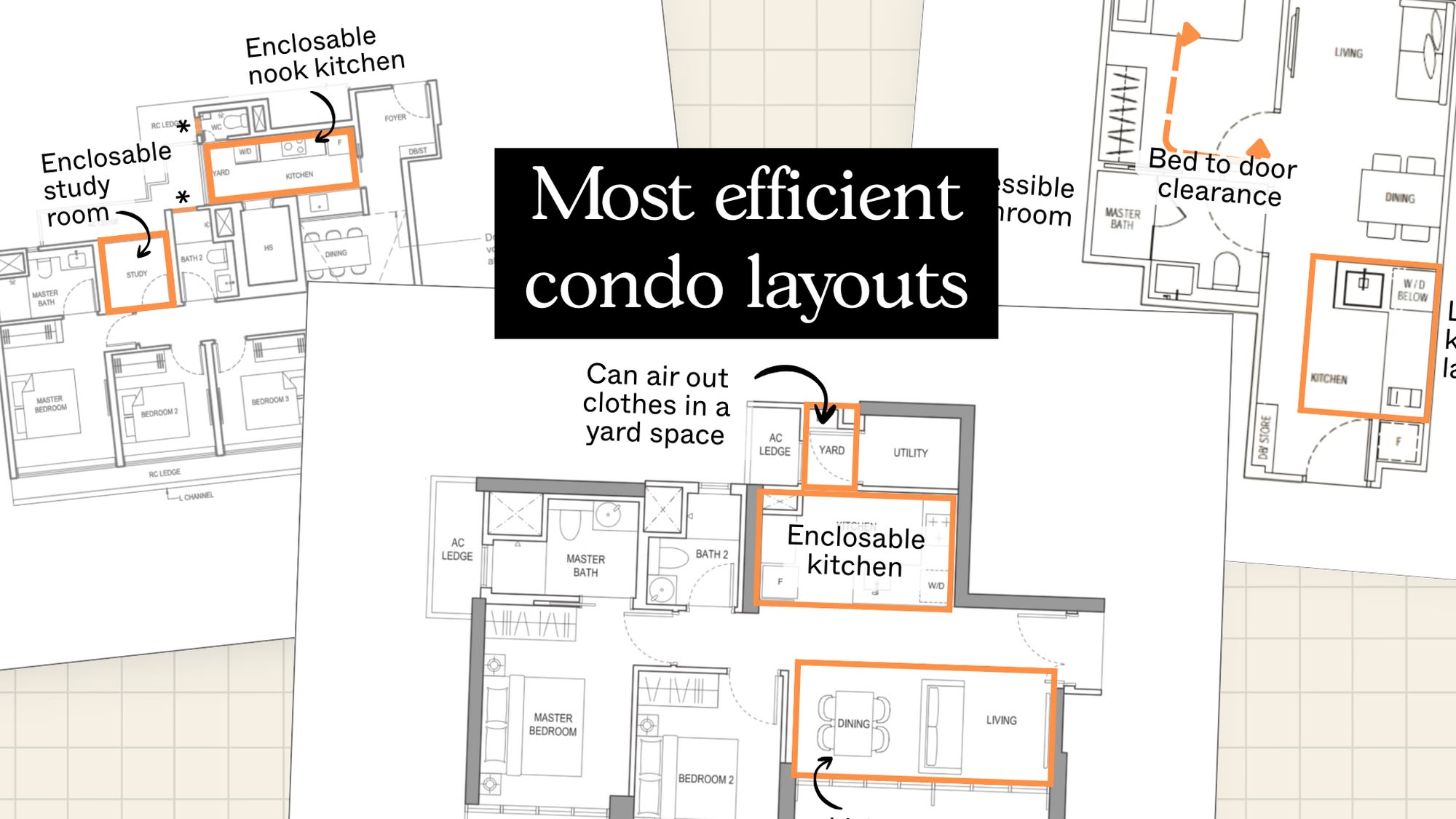

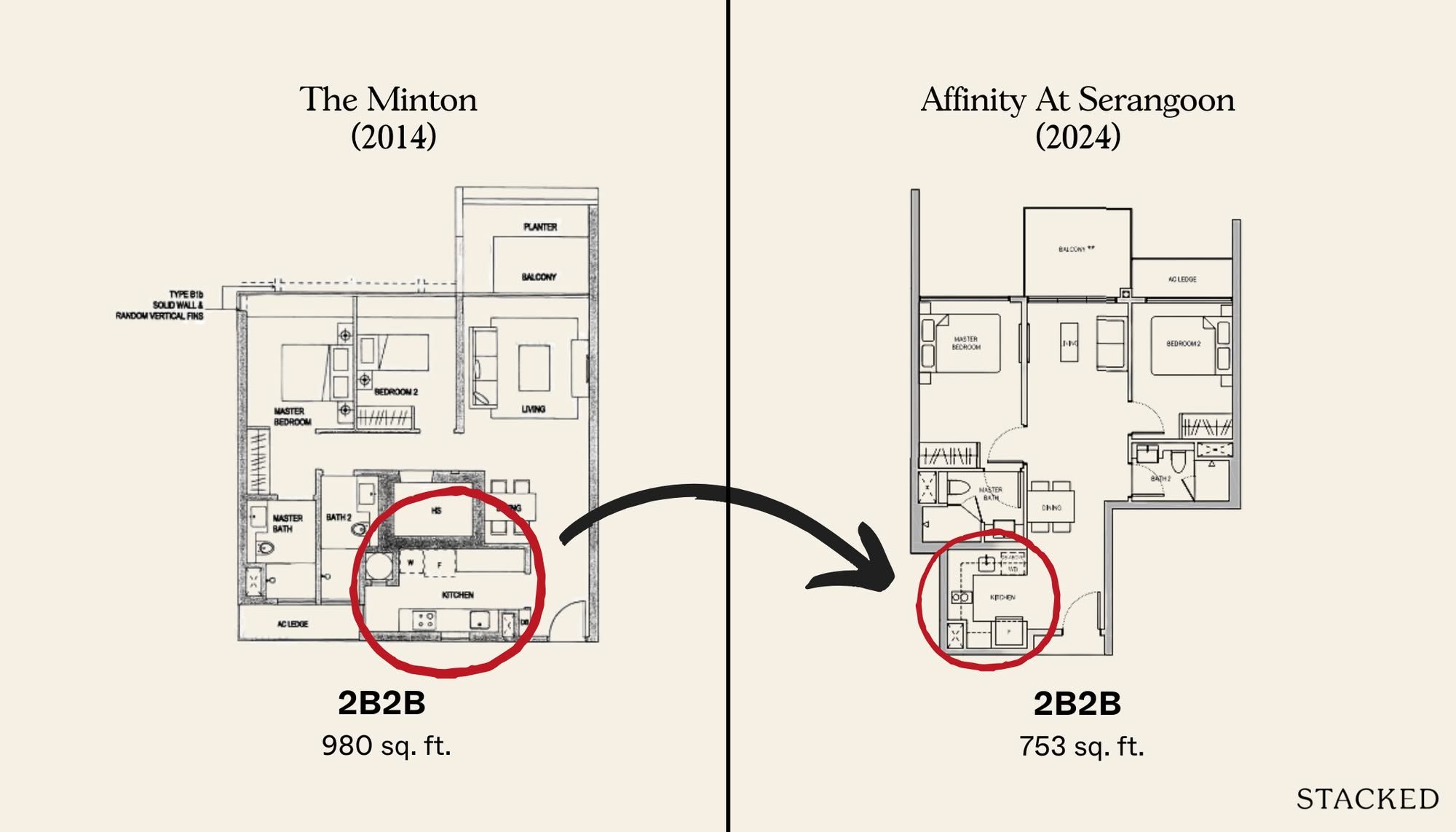

- What size are you looking at?

- With plans to have 2 kids, a 3 bedder may seem sufficient but you’d need to find one with a helper’s/utility room. There are also other considerations here for young parents to think about – looking for a dumbbell layout for more privacy, or an enclosed kitchen to prevent the young ones from getting in.

- With plans to have 2 kids, a 3 bedder may seem sufficient but you’d need to find one with a helper’s/utility room. There are also other considerations here for young parents to think about – looking for a dumbbell layout for more privacy, or an enclosed kitchen to prevent the young ones from getting in.

- What is the purpose of the purchase?

- Many buyers have a similar mindset of “I’m buying for investment but I may move in” or “I’m buying for own stay but I also want to make money”. There’s nothing wrong with that, but the criteria for an own stay property will be different from that of an investment property so it’s important to know what holds greater importance for you. After all, a great home is an investment in your quality of life. It’s better to optimise for one than to try and aim for both but achieve neither.

- You mentioned that buying a private property offers more flexibility as you’ll be able to it rent out. Is your plan to stay in the property and rent out the bedrooms or rent out the whole unit until the time comes when you need to move in? If you’re not in urgent need of a place, perhaps the first property can be an investment property, and thereafter move into something that better fits your lifestyle since it will also be some time before your kid starts attending primary school.

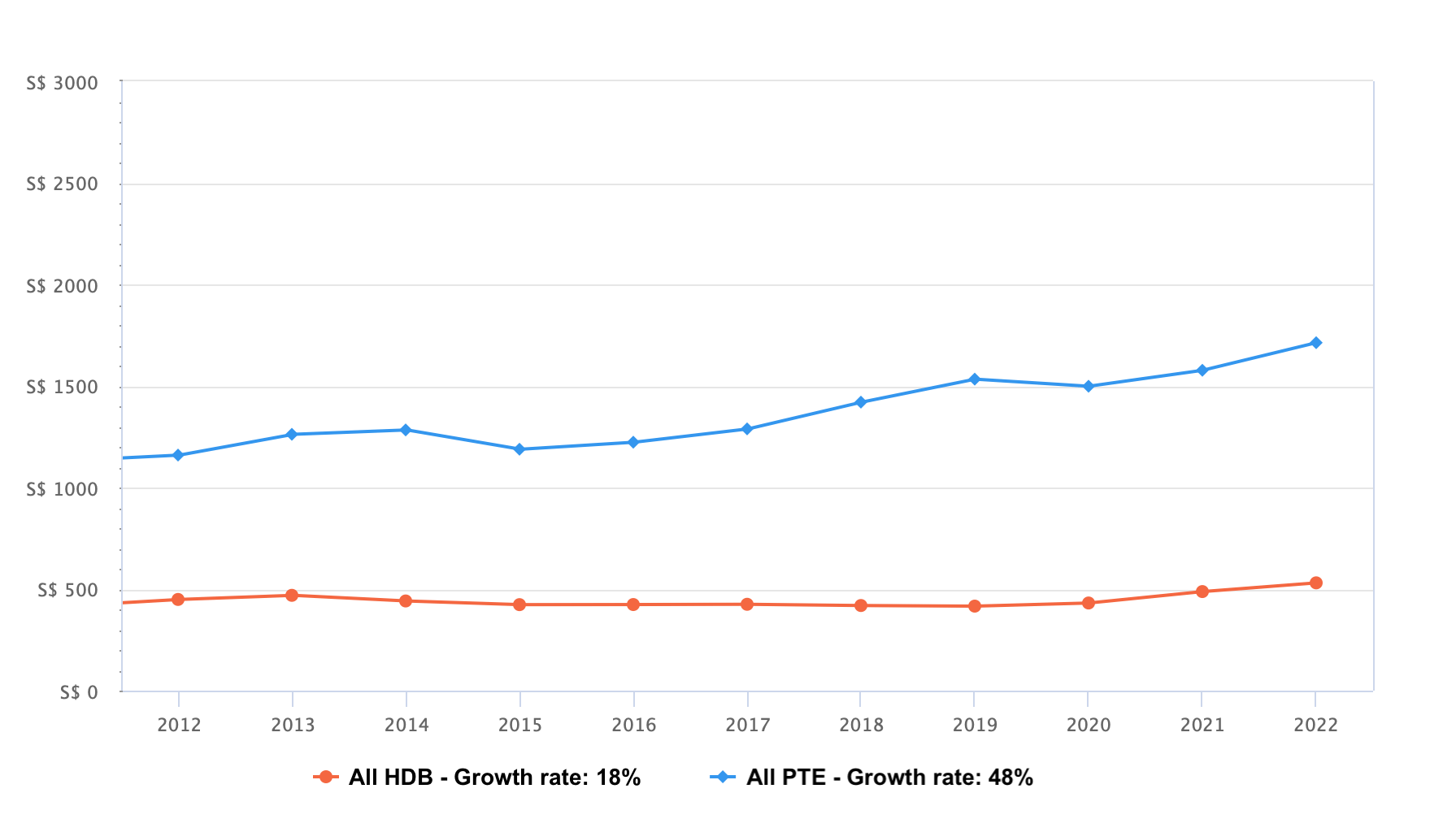

Now that we’ve shared some perspectives for you to consider, we’d like to share some fundamentals about the property market before going into some recommendations. First off – how prices of the different property types have performed:

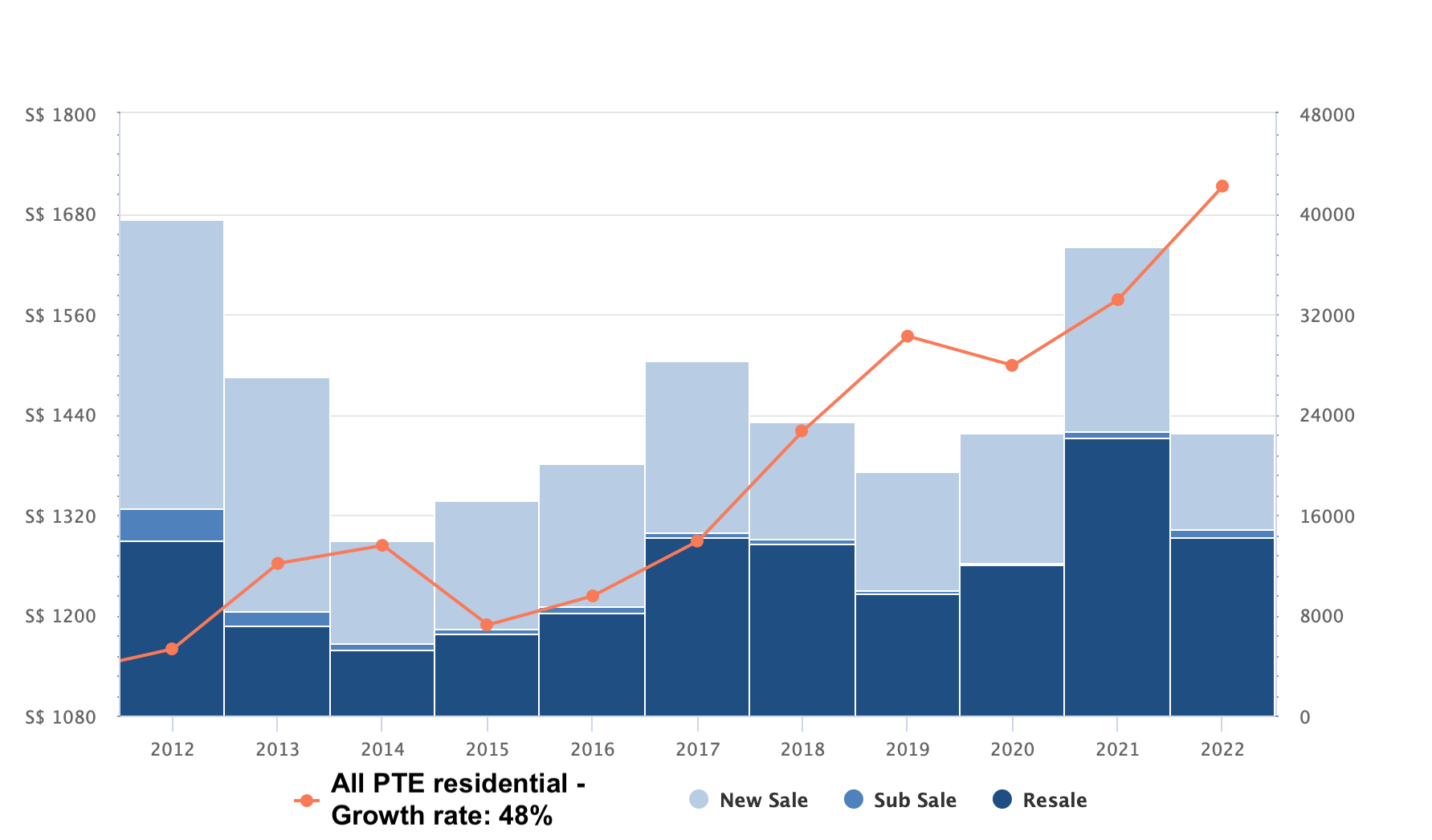

Overall Private Residential Market

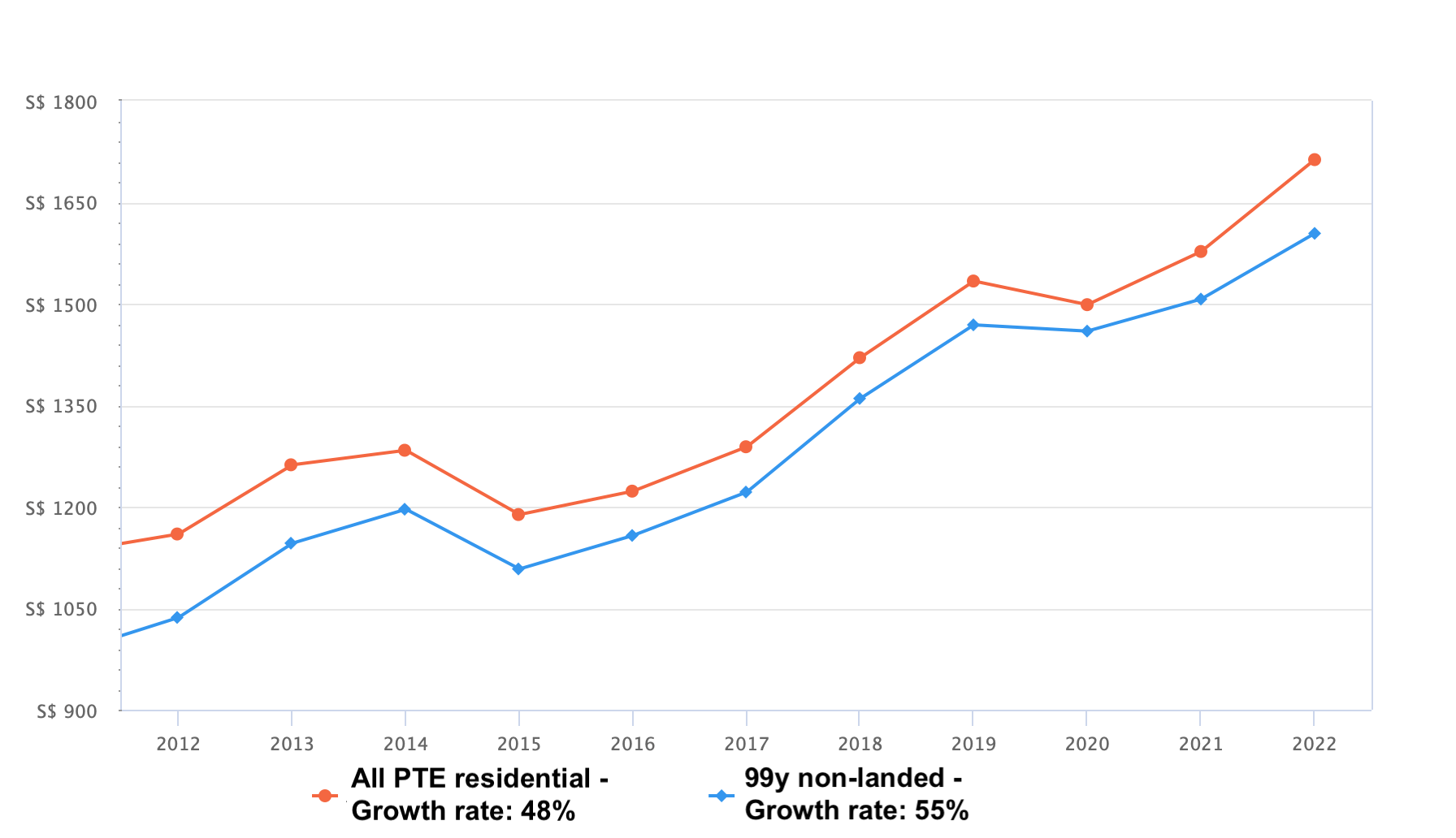

Do note that the overall private residential market includes all non-landed and landed property of all tenures. In the last 10 years, the average growth rate is 48%.

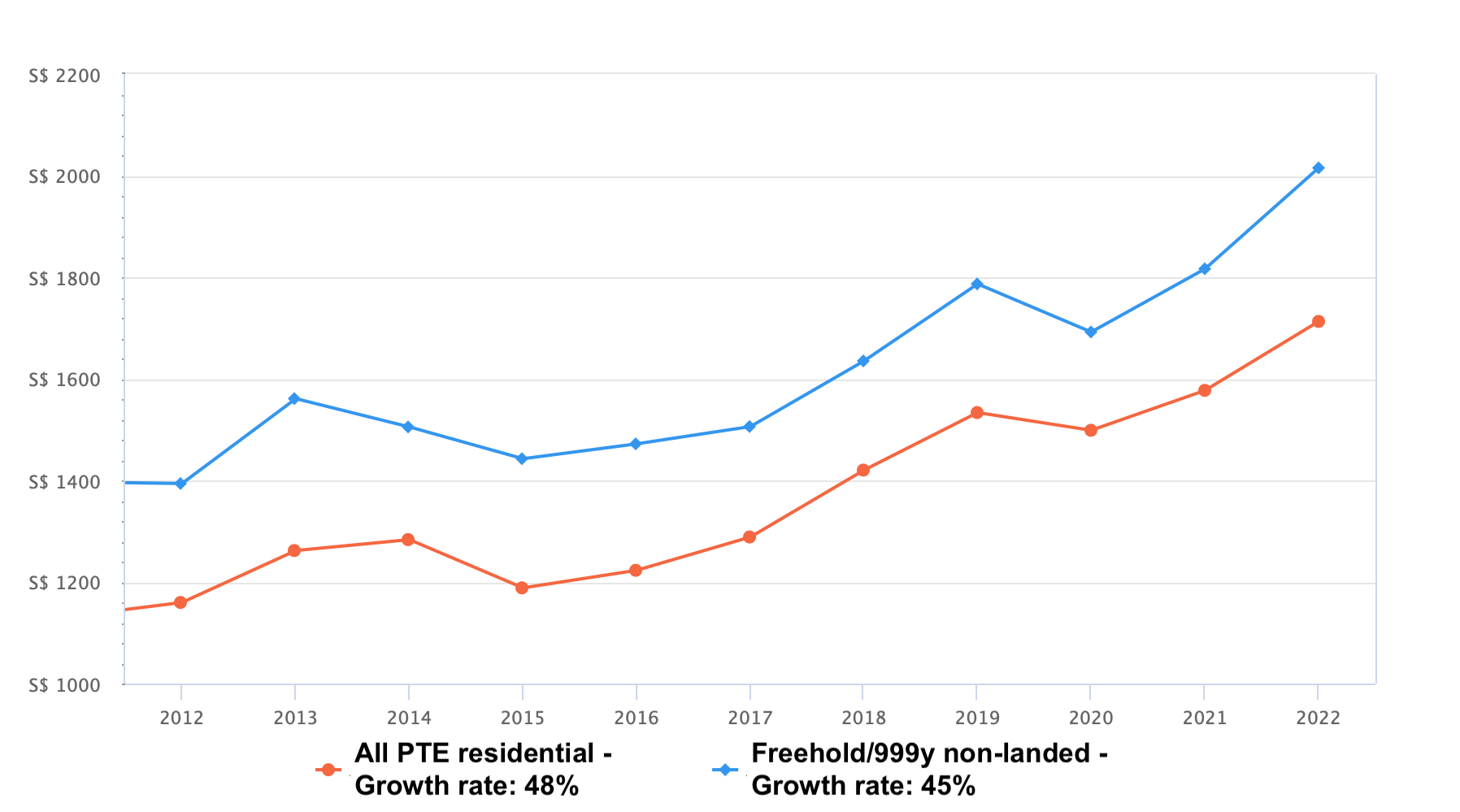

Next, you mentioned your concern over buying a 99-year leasehold property, so let’s take a look at how freehold/999-year ones performed.

Freehold non-landed properties

The following graph shows the comparison between the average growth rate of all private residential properties versus freehold/999 years leasehold non-landed properties:

We can see from the first graph above that prices of non-landed freehold/999-year leasehold properties are moving in line with the overall private residential market.

However, it may be surprising to you that freehold properties did not outperform the overall market. There are many reasons for this, one reason could be due to the increasing cooling measures which made it more difficult for people to pay higher prices, thus increasing the demand for 99-year leasehold properties. Many new launches today are also leasehold in nature which plays a part in bringing up the average $PSF considering their smaller sizes and age.

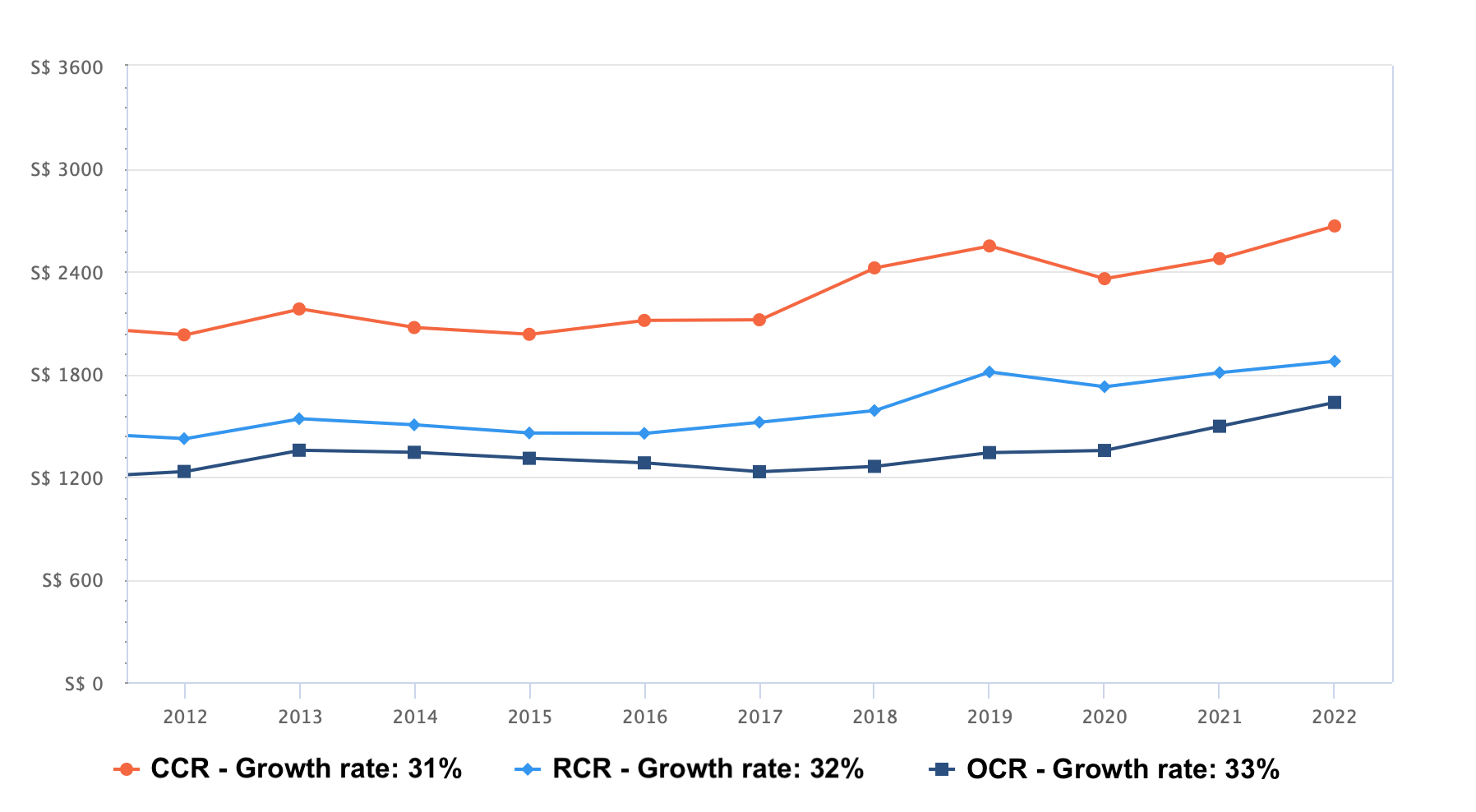

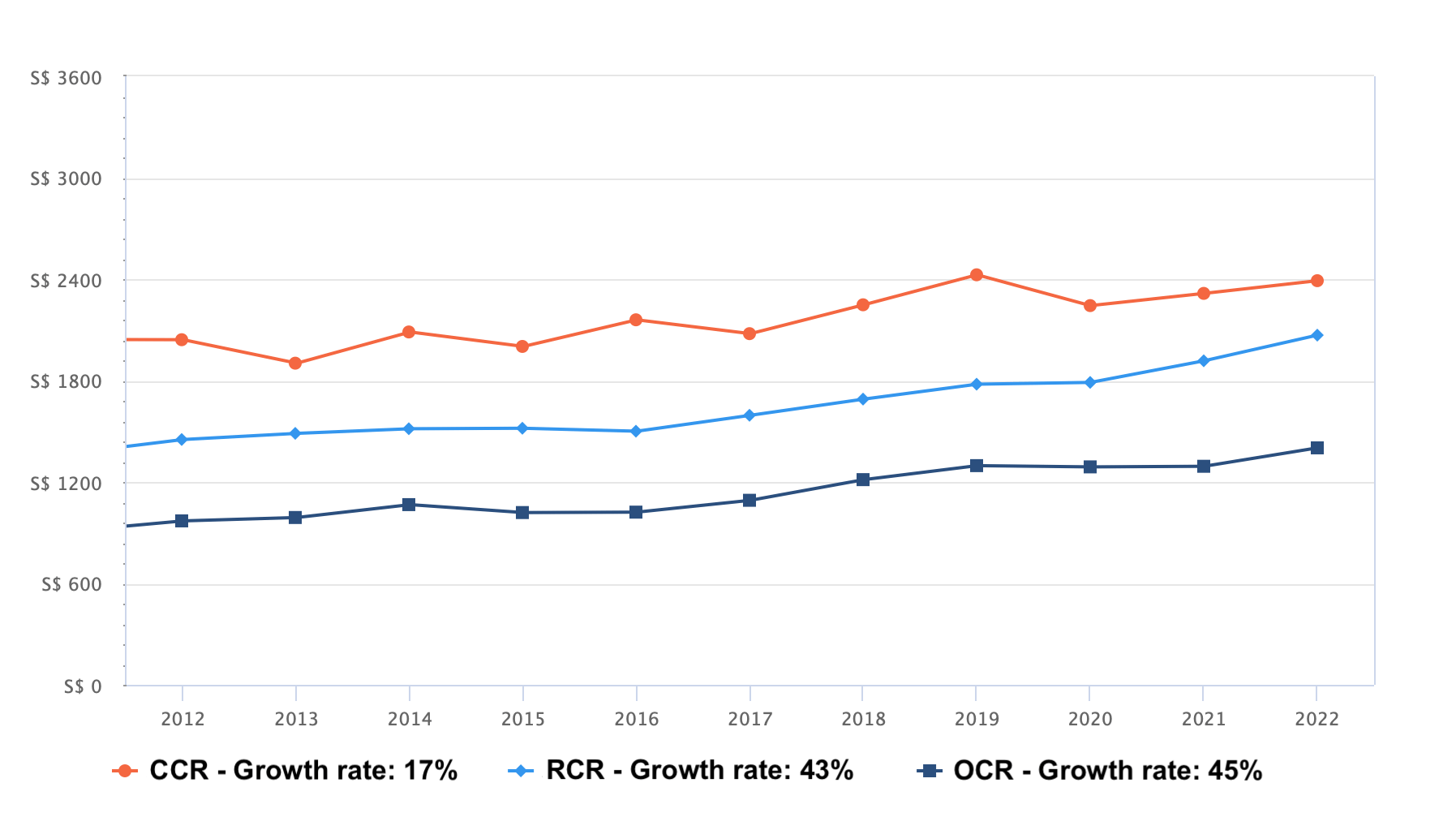

Freehold/999 years leasehold non-landed properties by region:

The average growth rate of non-landed freehold/999 years leasehold properties in the different regions is also almost on par with one another.

If you are considering a freehold property, here’s a quick rundown of their pros and cons:

| Pros | Cons |

| No lease decay concerns | Typically costs more than a 99-year leasehold property |

| Better value retention potential in the long run | Possibly slower growth rate in the short run |

| Limited supply of freehold land so demand is consistent | Lower rental yield due to higher entry price |

While young leasehold properties generally do not have problems when it comes to price appreciation, older ones will definitely lose out when compared to freehold.

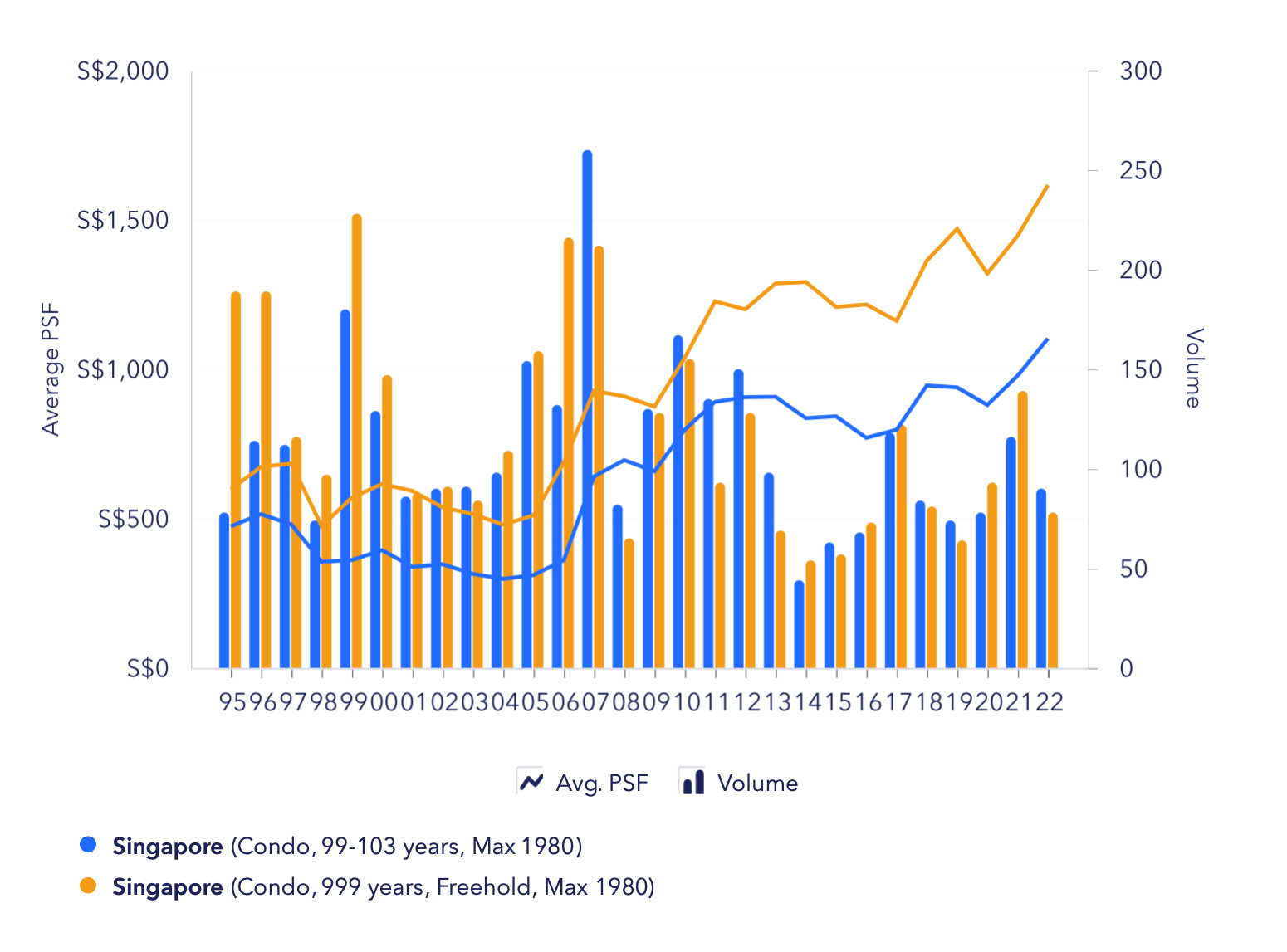

To illustrate this, the graph above shows the price movements of freehold/999 years leasehold condos versus that of 99 years leasehold condos that were completed before 1980, making them at least 42 years old currently. Although both are on an uptrend, you’ll notice that the price gap between the two is widening as the years pass. This is one major advantage that freehold properties have over 99-year leaseholds in the long run.

Still, let’s see how leasehold properties have performed in general:

99-year leasehold non-landed properties

The following graph shows the comparison between the average growth rate of all private residential properties versus 99-year leasehold non-landed properties:

99-year non-landed leasehold properties have grown in $PSF faster than the overall market. As mentioned earlier, this could be due to both the cooling measures as well as the increased proportion of new launches being leasehold in nature.

99-year leasehold non-landed properties by region:

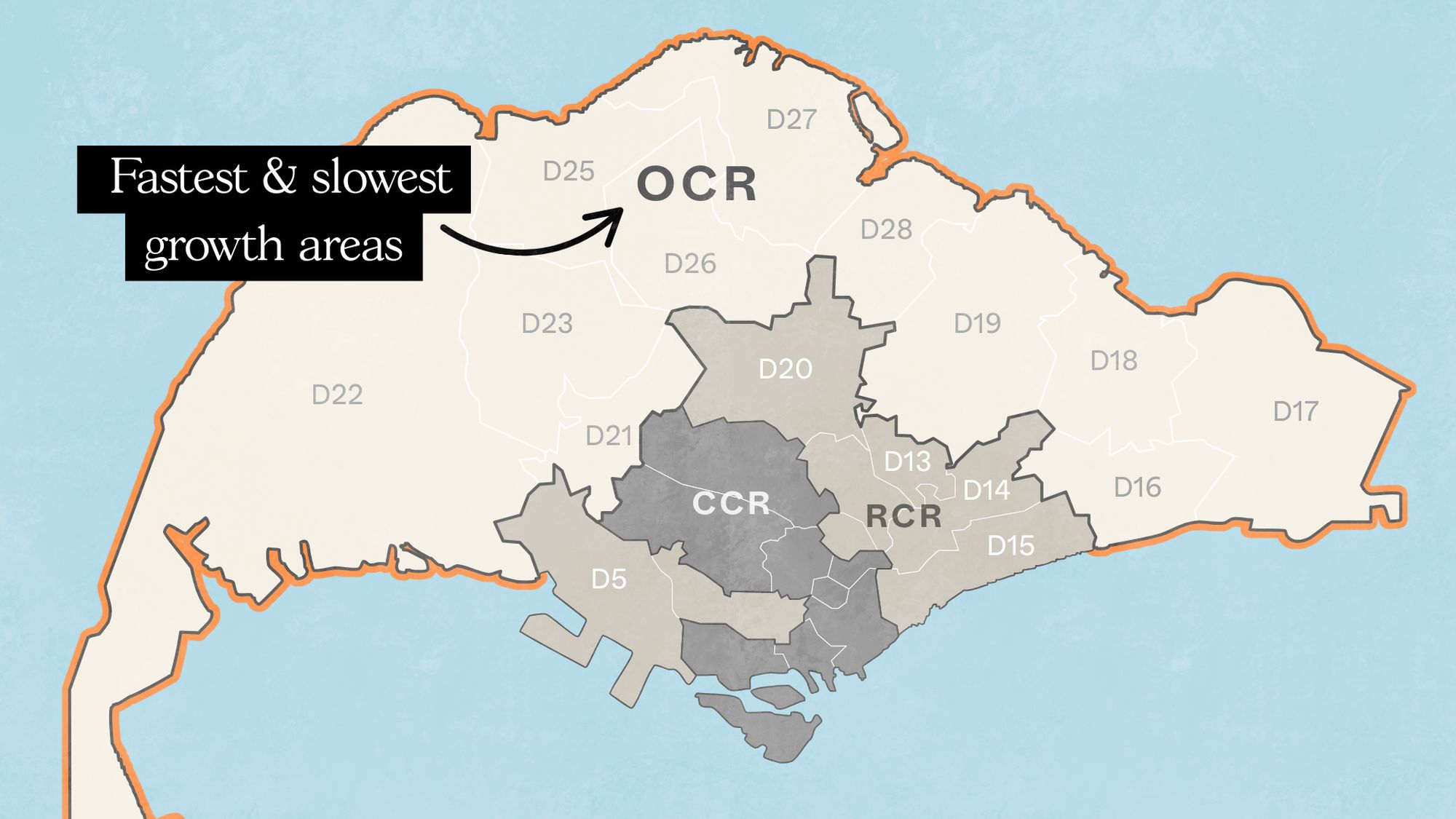

From the graphs above we can see that prices of non-landed 99 years leasehold developments are growing a tad faster than the overall private market and prices of these developments in the RCR and OCR have appreciated two times more than in the CCR over the past 10 years. Some reasons that can explain this is the increasing decentralisation within Singapore (partly due to the pandemic) and cooling measures making it harder to afford a home in more central areas. HDB upgraders also form a big part of this demand, and more often than not will be looking in the outside central areas for a home as well.

Pros and cons of 99 years leasehold condominium:

| Pros | Cons |

| Generally more affordable than a freehold property | Concerns of lease decay |

| May see a higher appreciation rate in the short run as compared to a freehold | Buyer pool may decrease as the project ages due to restrictions on financing |

| Higher rental yield due to lower entry price |

Due to its declining lease, we generally want to buy into a 99 years leasehold development as young as possible.

So overall, what does this mean when it comes to buying between freehold and leasehold?

Freehold VS 99 years leasehold

One common misconception that buyers have is that a freehold property is better than a leasehold. But as with everything else that we’ve found, it’s never the case that a generalised statement such as this holds true. There are many factors that contribute to the growth rate of a development such as the size of the project, its turnover rate, entry price, proximity to amenities and renowned schools, future integration, etc. Even smaller details like how the ambiance of a development feels in real life can play a part in resale buyer perception, and subsequently, the popularity of the development.

For instance, if we were to look at many of the freehold boutique developments, they usually have a low turnover rate because of the low number of units and thus prices remain stagnant or grow very slowly. Whereas larger 99-year leasehold developments in the vicinity that have a higher turnover rate see an accelerated growth in comparison.

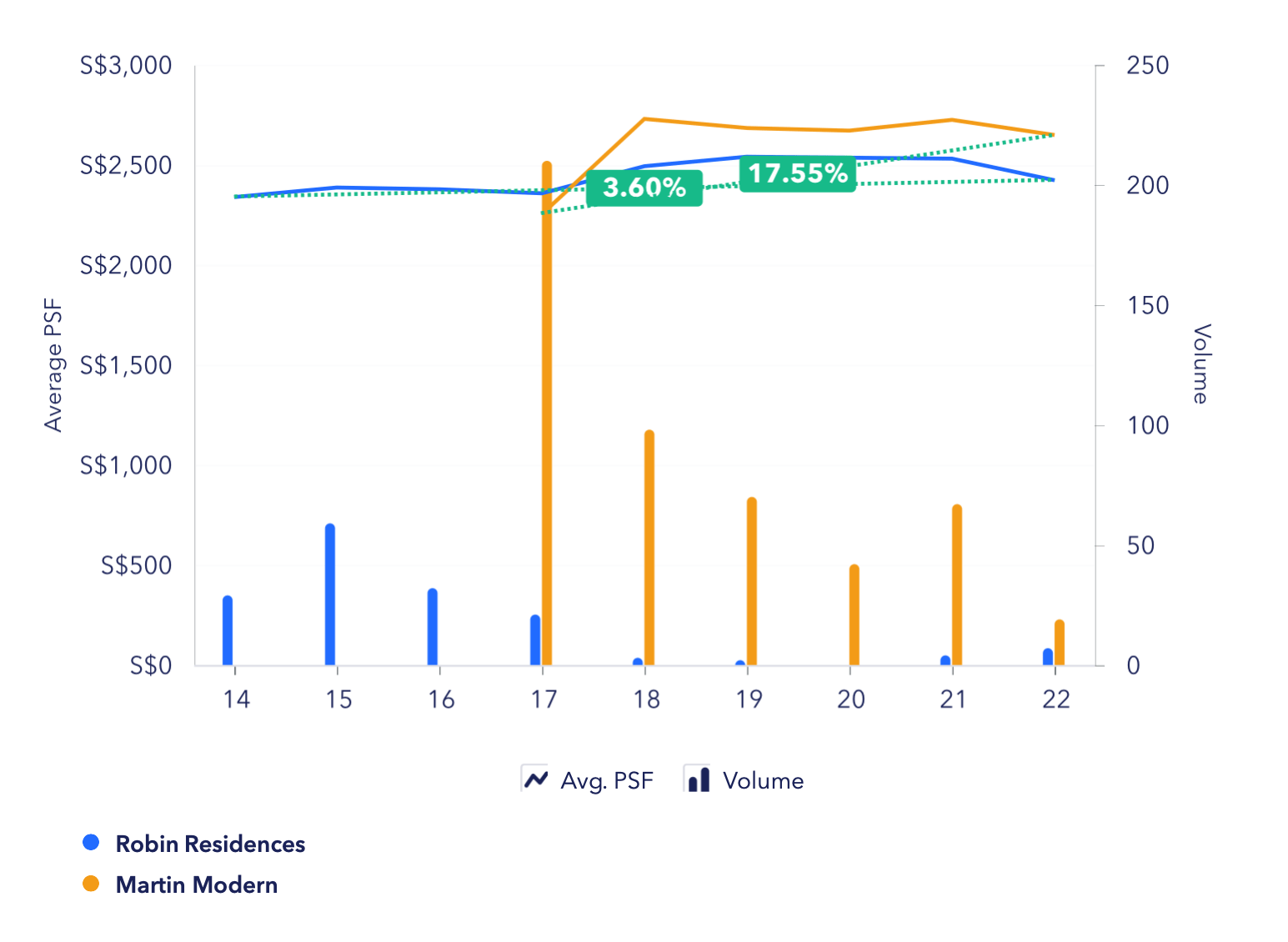

One example is Robin Residences, a small freehold project located in D10. It’s got a great location opposite good schools like SCGS and SJI, and it’s a 5-minute walk away from Stevens MRT station (Downtown and TEL line) with a Cold Storage just next door.

Compare this to Martin Modern, a mid-sized 99-year leasehold project located in D9 which is a 10-minute walk away from the newly opened Great World MRT station and Great World City. This is also a project that is surrounded by freehold condos, and many buyers were put off by that in the earlier days.

In 2017, both developments were priced similarly in terms of PSF and their unit sizes are comparable as well. Most buyers would naturally assume that Robin Residences is a better buy given its proximity to renowned schools and its freehold status, however, the numbers tell us otherwise.

Since its launch, prices at Robin Residences have only gone up by 3.6% while prices at Martin Modern have appreciated by 17.55%.

It’s a similar story when it comes to rental. A 2-bedroom unit in Robin Residences of a size 700 to 800 square feet has recorded rental rates of $3,850 in the last few months. While a 2 bedroom unit at Martin Modern of a similar size has commanded $7,000 and more in the last few months.

Of course, this is just for comparison’s sake, but it goes to show that there is more to the growth of a development than its tenure.

Overall HDB Market

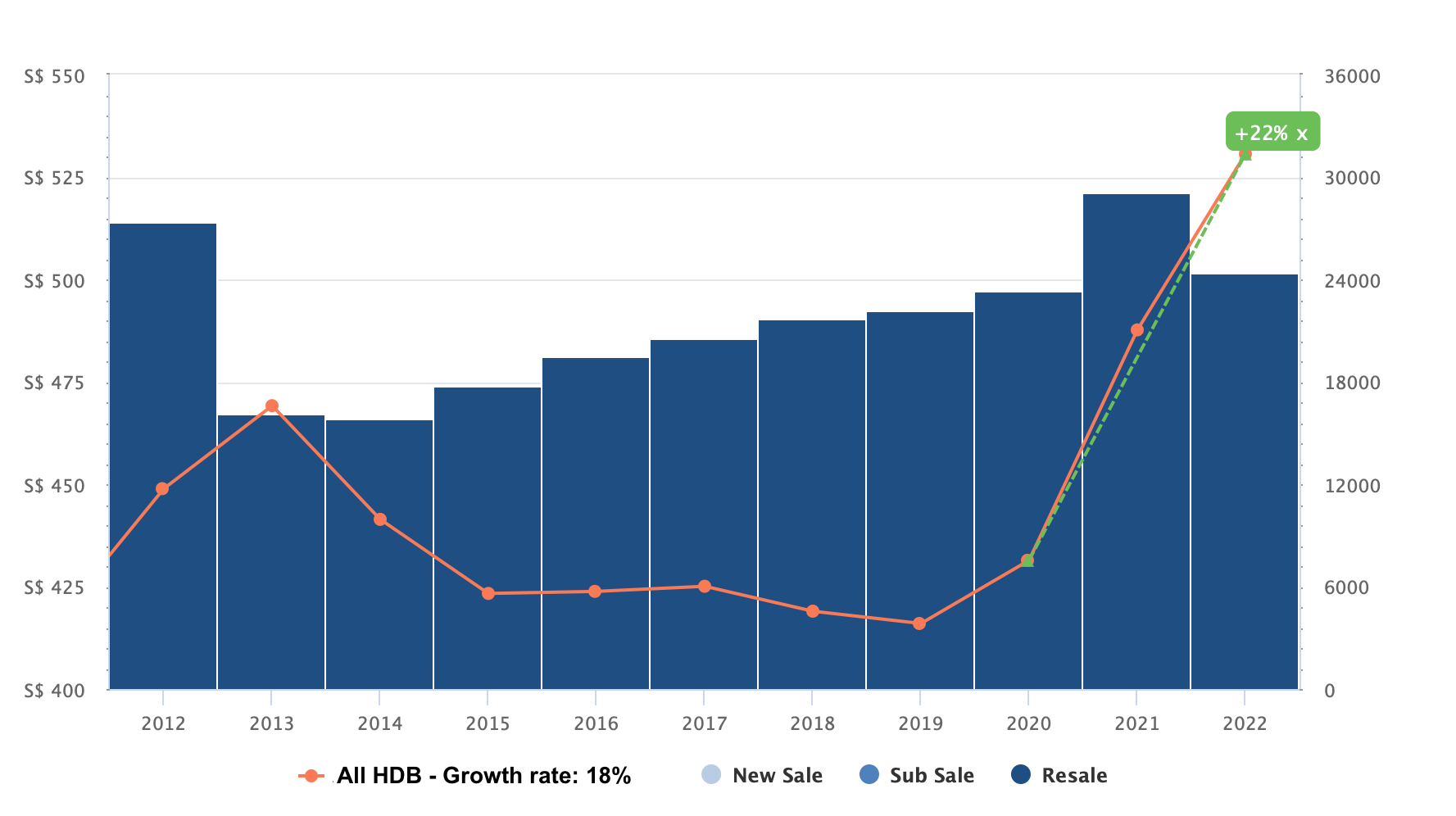

Since the change in HDB’s procedure of applying for a flat’s valuation only after obtaining the OTP in March 2014, prices have been rather stagnant with buyers being more cautious when buying a HDB. From 2014 to 2019, COV was rare in most estates, perhaps with some exceptions in the prime districts.

However, this changed drastically since the pandemic and COV has become more rampant even with older HDBs due to the short supply. We can see from the first graph that HDB prices have gone up by 22% in the last 2 years.

In spite of that, the price disparity between HDBs and private properties is still widening, making it increasingly difficult for HDB owners to upgrade to a private one.

Pros and cons of an HDB:

| Pros | Cons |

| More affordable | Longer minimum holding period |

| Generally larger space | Unable to rent out the whole unit within MOP |

| Lower maintenance cost | Lacks facilities like swimming pool, function rooms and tennis courts. |

| Lacks privacy |

Now that we’ve run through the overview of freehold vs leasehold properties, as well as how HDBs have performed, let’s take a look at your options.

Pathways to consider

We think the main issue here is that as a first-time homebuyer, it seems that you are still in the early stages of your journey. This is very common among first-timers because they haven’t actually lived in a place long enough, or made property decisions that had an impact on their life for them to be sure of what they want in their home.

Here are general options you can take:

#1 – Wait and see

With the current high-interest rates and prices, a very viable option is to just do nothing for now if moving in immediately is not your priority. This may be the case since you mentioned renting out and having a short holding period.

To illustrate why this could be a viable choice for you, let’s say you were to purchase a $2.5M property today at 4% interest and hold it for the next 3 years:

| Description | Amount |

| Purchase price | $2,500,000 |

| Loan (Assuming 75% loan with a 30-year tenure) | $1,875,000 |

| Monthly repayment | $8,952 |

| Interest costs after 3 years | $219,106 |

Today, fixed rates are already above 4% – so you can say this is conservative since interest rates do not look like they’ll be heading down any time soon. This interest cost alone represents almost 9% of your purchase price – or about 10 months of your combined monthly income in just 3 years.

Even if you do rent it out for the full 3 years at a 3.5% yield, the returns are meagre once you factor in the property tax, Buyer’s Stamp Duty, maintenance fees, and agent fees. You may also have other maintenance costs to consider if things do break down.

Compared to if you were to buy at a presumably lower interest rate of 2.5% in about 3 years time and hold it for 3 years:

| Description | Amount |

| Purchase price | $2,500,000 |

| Loan (Assuming 75% loan with a 30 year tenure) | $1,875,000 |

| Monthly repayment | $7,409 |

| Interest costs after 3 years | $135,917 |

The amount of interest saved over just 3 years is $83,189 which could have gone to something like your renovation works.

The only benefit to buying in today’s market is if the market truly does go higher – but with the government having introduced a series of cooling measures recently, rising interest rates, and incomes growing slower than the overall property market, you may want to err on the side of caution for now.

So you have to ask yourself – what is your priority?

Are you leaning more towards an investment or for your own stay? Given that you don’t have a kid yet, and even if you do have a kid in the next 1 – 2 years, it’ll be another 6 – 7 years before he/she attends primary school, it does give you some time to really consider your needs.

#2 – You want an own-stay property with some investment upside

Perhaps you can consider buying a smaller private unit for investment for a short term of 3 – 5 years and upgrade to a bigger one thereafter.

Purchasing a smaller unit (2 bedroom) first will lessen your financial burden for the time being, giving you time to save up for the upgrade as well.

You could potentially capitalise on the current market situation to earn some decent rental yield and maybe even capital gains if you buy the right property – but as mentioned earlier, this is not guaranteed. If you do buy an investment property, you get peace of mind that you’re now hedged against the real estate market inflation.

And as you’ve rightly said, a private property will give you more flexibility in terms of having a shorter holding period and you’ll be able to rent out the entire unit immediately.

One great advantage to this is that you get to understand the nuances of your property choices. Generally, second-time homebuyers are more confident in their purchase since they know what they want – or don’t want in their home. This wisdom could ultimately land you in a better position when you eventually move into your longer-term home.

#3 – Buy now and stay for the long term with good upside potential

If your plan is to buy a property now and stay for the long term until your kids finish primary or secondary school, which will be minimally 12 – 16 years later, then buying a freehold property will make more sense as you won’t have to worry about lease decay.

What this means is taking out a bigger payment today – and shouldering a mortgage in one of the priciest times in the past 10 years all so you can avoid the hassle of having to move again when your longer-term plan of having a kid near the primary school of your choice comes to fruition.

#4 – Buy a lower-priced HDB now in a location you like first – one that’s close to a primary school you’re eyeing.

HDBs are for own stay rather than investment. Given this quality, we cannot expect HDBs to appreciate more than private properties. However, this means that you’ll be putting up less capital for your home which not only saves you on interest costs, but it could allow you to invest in other assets that could help you grow the amount needed for the eventual upgrade.

Do note that since your monthly income exceeds the maximum allowed to take an HDB loan, you’ll have no choice but be at the mercy of bank interest rates.

With an HDB, you can also rent out bedrooms for extra income too – especially if you are not having kids or do not work from home often.

Buying an HDB in a location you are thinking of staying in lets you experience what it’s like to be in the neighbourhood first too, giving you extra confidence when you intend to upgrade later on.

Moreover, both of you are still relatively young – 28 and 32 years old! It’s likely that as you progress in your career, so will your monthly income. This means you can afford to take on a bigger loan later due to the TDSR requirements, allowing you to purchase homes that are bigger, or in areas with more popular primary schools.

Overall, there’s no right or wrong here given that they’re all viable and are down to your personal preference. However, we’d lean towards option 2 since this combines the best of both capital appreciation upside and flexibility. As primary school is something you only have to consider years down the road, perhaps a smaller home to start off with makes more sense.

Buying, renovating, and living in a home would also give you a better idea of what you’d like and don’t like in your next home. You can also choose to buy a home in a neighbourhood that you’re thinking of staying for in the long-term, or just rent it out altogether.

We hope that our sharing has given you a clearer idea of what you should consider and we wish you all the best in your home-hunting journey!

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice The New Condos In Singapore With The Most Efficient Layouts In 2025 Revealed – And What To Look Out For

Property Advice The Hidden Costs of Hiring a “Cheaper” Agent In Singapore

Property Advice The Math Behind Why 30–35 Is The Sweet Spot To Upgrade From HDB To Condo

Property Advice The Ideal Size for Each Room of Your Condo to Actually Feel Liveable Revealed

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

Pro District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Editor's Pick I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Pro New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

Editor's Pick We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

Editor's Pick I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

Editor's Pick Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m