We Are In Our 20s With $17k CPF And Are Saving Up $60k For A HDB: Should We Get A 3-Room Flat?

September 22, 2023

Hello,

I hope you are doing well.

I’ve been a follower of Stacked for a long time now, and have enjoyed the content from the beginning. I am writing today to seek some help with my slightly odd situation regarding housing.

So, for introductions, I am T (27), a freelancer, and I am married to my husband S (28), who works abroad at times. We have never owned any property, and have no prior loans or other large financial commitments.

As a freelancer, I am not currently getting much in terms of salary or CPF. My husband on the other hand earns around 3.7K USD per month when he works. He is set for a promotion in April that will raise his salary to 5.2K USD. He is currently abroad, he will be coming back in February, and leaving again in April 2024. During his time abroad, he also gets full CPF. We currently have a combined 17K in cpf, and are saving up for cash for a house. We are hoping to get a place of our own end of next year.

My questions regarding our situation are as follows:

– I understand that in order to qualify for HLE at least one of us needs to be employed for 12 months straight during the time of application. As S will be the main applicant, will the one month of break time from end feb-march affect our application?

– He has already been told that he needs to do his reservist during his time back (feb-mar) would that count as employment/or him not having a break in employment?

– Provided the application is affected by the month’s break in the middle, should we apply for HLE in October itself when he is back, or should (or can I even) start the application around the time he is due back?

– We are thinking of a 3 and above resale HDB as we’d like to move in quickly. From the Stacked page, I saw that most of the 3 room properties are within the 500K price. We are planning to start a family and would like a room to be the nursery and it would be nice to have a small office/working space outside of the bedroom in the house.

Our target savings by October of next year is 50-60K in cash and hopefully, we qualify for the grants.

– With the above in mind, what kind of apartment (3rm/4rm.. etc.) would you suggest we consider for our needs and given our affordability?

– We are looking at areas such as Ang Mo Kio, Kallang, Serangoon, Bishan, and Queenstown

I hope these questions make sense. I hope I can get some suggestions and insight from you.

Thank you and hope to hear from you soon,

Hello,

We appreciate your support all this while, and are glad you reached out!

With the numerous eligibility criteria and ever-evolving policies, it can be challenging when it comes to the process of purchasing your first HDB. This can be particularly intimidating when you are in an exceptional circumstance and struggle to locate clear answers amidst the vast amount of information available online. In situations that are out of the ordinary, we strongly recommend reaching out to HDB directly for an official response.

Regardless, we’ll do our best to address your questions and also explore some potential options.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

HFE & CPF Housing Grant Eligibility

Before officially applying for the HDB Flat Eligibility (HFE) letter, there is a preliminary check available that you can/must undertake.

This check will provide you with information about the amount of loan and housing grants you are eligible for based on the household details you provide.

Regarding the upcoming 1-month break when your husband won’t be receiving any income, it should not negatively impact your HFE application since he remains employed.

We have confirmed with HDB that the treatment of income would thus be assessed over 11 months, rather than 12 months so long as he remains employed.

What this means is that your affordability would be based on the full income rather than being shortchanged on a lower average income if it’s split across 12 months instead of 11.

However, this method would also apply in the assessment of grants which means the income would be higher since it only considers the 11 months rather than 12. As such, this could result in a lower grant amount.

It’s also important to note that the HFE letter is valid for only 6 months and the application process typically takes around 21 working days. So, if you plan to purchase a flat sometime in October 2024, it’s advisable to apply a month earlier. This will ensure that the letter is ready when you start the house-hunting process when your husband returns and will remain valid while you search for a suitable home.

In this case, the assessed income will be based on the average salary your husband drew over the months that he drew income. Since he will return in October, let’s say you were to apply for the HFE in September. This would mean the assessment period will be from August 2023 – July 2024.

| Time period | Income earned each month |

| August 2023 – February 2024 | USD 3,700 |

| April 2024 – July 2024 | USD 5,200 |

Total income earned (excluding the 1-month break next year) = (7 months x USD 3,700 plus 4 months x USD 5,200) = US$46,700.

Next, since the income is in USD, the HDB would assess the income in SGD based on the interbank exchange rates at the point of application.

Since we don’t know what that would be, we’ll look at the exchange rate over the last 3 months which ranged from SGD 1.32 – SGD 1.36 for every USD1. We will use the average of SGD 1.34 which translates to a total income of $62,578 over 11 months. This is equivalent to $5,689/month. (We will use this in our calculations).

Now what if you decided to apply for the HFE when he’s back instead?

Let’s say this is done in February 2024. The income assessed would be from January 2023 – December 2023 which is before the pay increase.

As such, the total income assessed is USD 3,700 x 12 = USD 44,000. This translates to $58,960 over 12 months, equivalent to $4,913/month.

Please be aware that this is simply an estimate and may differ from the precise calculations conducted by HDB – especially if you include your income from freelancing.

It is advisable to submit the preliminary assessment for a more accurate and reliable figure.

Let’s now look at your affordability.

Affordability

To derive the estimated loan you can take and total affordability, you can visit HDB’s calculator here.

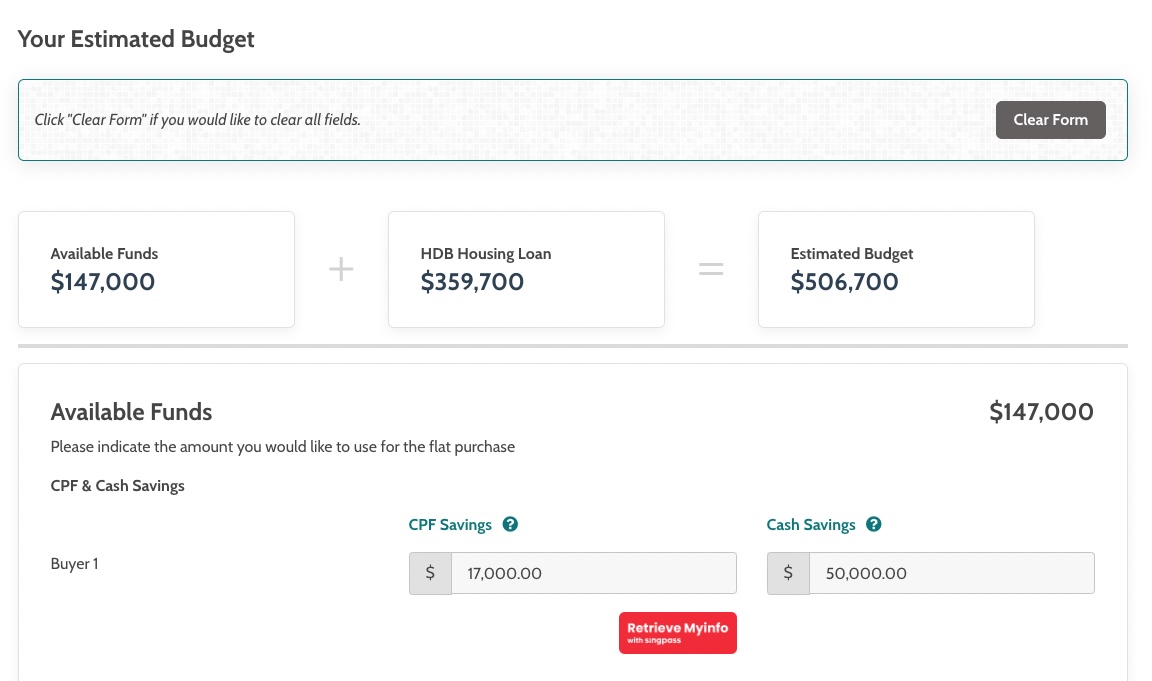

First, we’ll look at your affordability should you choose to wait and include the increased pay.

We’ve factored in your CPF funds of $17,000 and assumed you’ll apply for the $80,000 CPF Housing Grant. (You’re eligible for this grant since you’re purchasing a 4-room or smaller resale flat as a family).

| Maximum loan for an HDB based on age 29 and a monthly income of $5,689 at a 3% prevailing interest rate | $359,700 (25-year tenure) |

| CPF funds | $17,000 |

| CPF housing grants | $80,000 |

| Cash | $50,000 |

| Total loan + CPF + grants + cash | $506,700 |

| Less BSD based on $506,700 | $9,801 |

| Estimated affordability | $496,899 |

Do note that the loan is solely based on your spouse’s income and could potentially be higher if your income were included. Additionally, we only factored in the first-timer family grant of $80,000 applicable if you decide to purchase a 4-room or smaller HDB flat.

Given the upcoming 1-month period during which your partner won’t have income, eligibility for the Enhanced Housing Grant (EHG) remains uncertain. You can read example 2 here under “resale flat” which states that since both applicants did not fully work for 12 consecutive months, they’re not eligible for the EHG.

There’s also more uncertainty in the EHG when it comes to the age of the flat. According to HDB, the full amount would only be disbursed if the remaining lease of the flat can cover the buyer until the age of 95. Otherwise, the amount would be pro-rated.

As such, it may make sense not to include it when planning what to purchase. However, for the sake of thoroughness, an income of $5,689 would allow you to apply for the EHG amount of $35,000 which would bring your affordability up to $532,000.

It’s also worth highlighting that if you decide to purchase a unit within 4km of either of your parent’s homes, you would be entitled to the Proximity Housing Grant (PHG) of $20,000 which can further boost your affordability to $552,000. Adding both grants makes a huge difference since it represents slightly more than 10% of your initial purchase price.

However, we’ll need to exclude the PHG too since it’s restrictive on location.

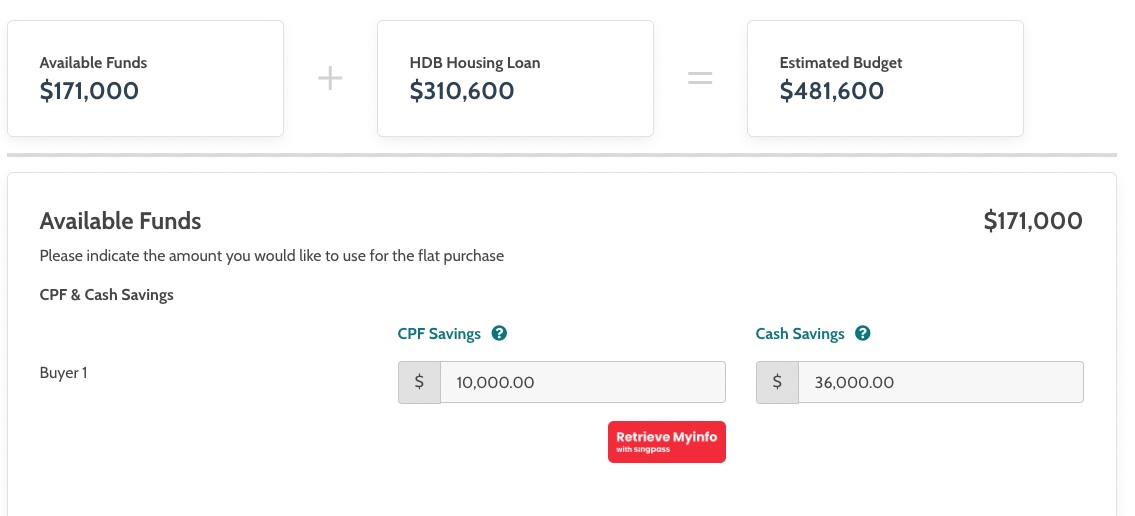

Next, let’s find out more about your affordability if you apply in February 2024 instead of waiting for the pay increase. In this case, we can assume a consistent 12-month employment which translates to a more guaranteed EHG which we’ll take into account.

| Maximum loan for an HDB based on ages of 27 and 28 and a monthly income of $4,913 at an interest rate of 3% | $310,600 |

| CPF funds | $10,000 |

| CPF Housing Grants | $80,000 |

| Enhanced Housing Grant | $45,000 |

| Cash | $36,000 |

| Total loan + CPF + grants + cash | $481,600 |

| BSD based on $450,789 | $9,048 |

| Estimated affordability | $472,552 |

The affordability gap stands at $24,347, calculated by subtracting $472,552 from $496,899. Keep in mind that this amount might change, depending on your actual cash and CPF availability in February 2024. We’ve estimated a lower value, but the exact difference is uncertain.

Furthermore, if there’s a break in continuous employment, you might not qualify for the EHG. In that case, the gap could increase to $69,347 ($24,347 + $45,000). This is a significant amount, potentially limiting your options. So, if you’re considering applying in February 2024, you’ll need to be sure about the EHG eligibility.

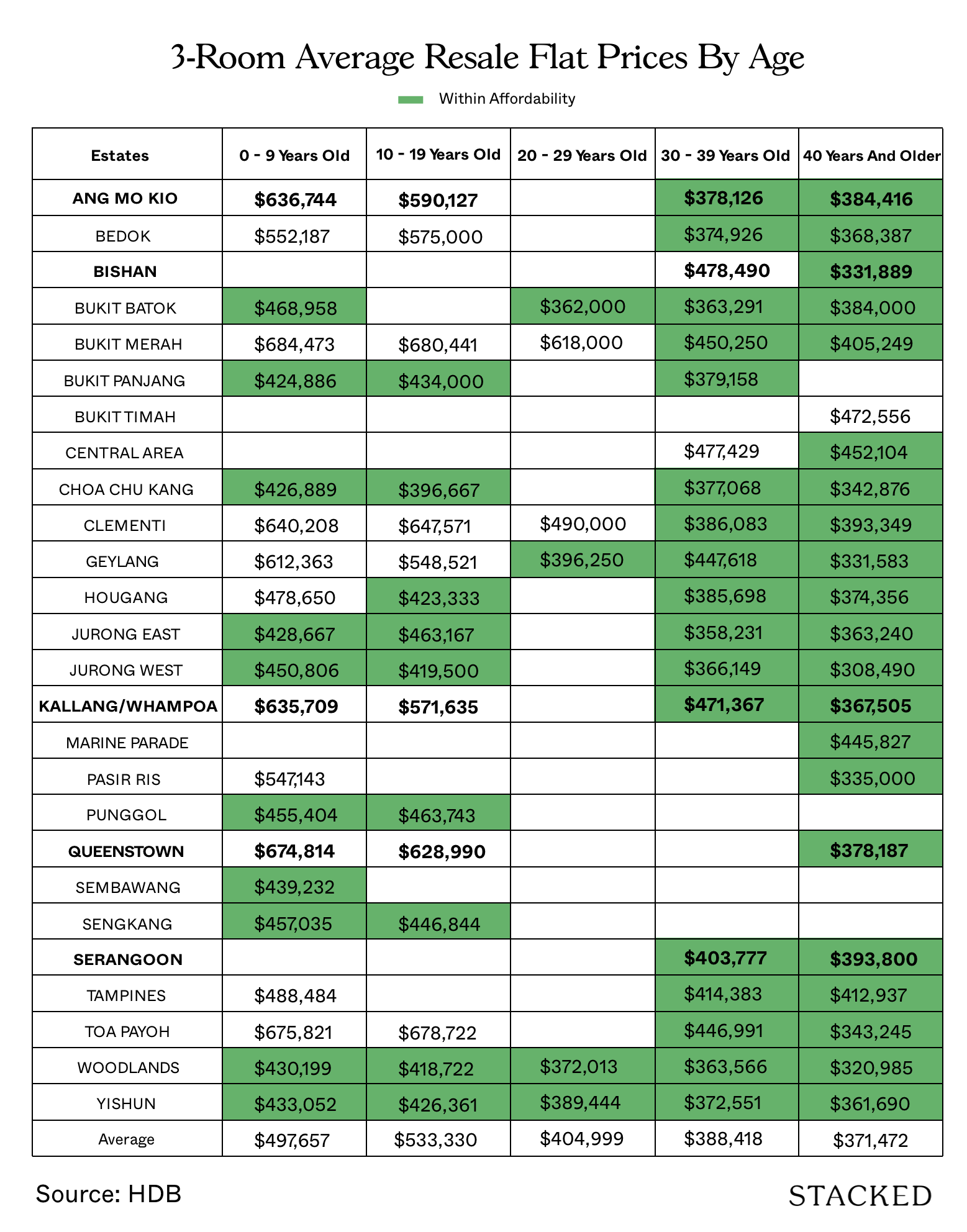

Options

Let’s break down what HDB prices of 3-room flats look like across estates by their age category. Since HDB prices have been moving quite fast, we’ll only consider prices from 2023.

Do note that these are the average prices based on transactions that occurred.

We’ve also taken the liberty to bold your preferred estates. These estates are considered Mature and desirable which explains their high prices.

Given their maturity status, many 3-room flats here are also old, and younger ones tend to be highly-priced.

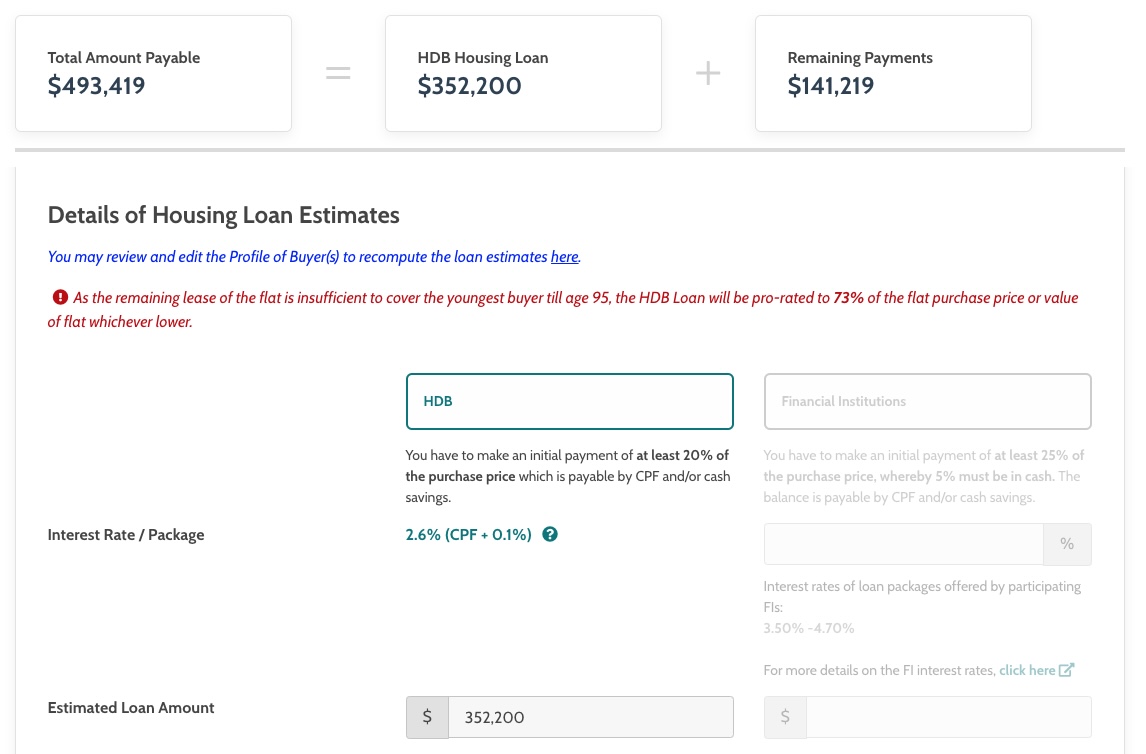

This presents several challenges because the remaining lease of these blocks does not cover the youngest buyer (in this case, yourself) until the age of 95.

Pro-rated Loan-to-Value (LTV) ratio and EHG (if applicable):

In this scenario, only the EHG will be pro-rated, while the first-timer grant and PHG will remain unaffected. Since we’ve not considered the EHG here, it does not apply to our analysis. However, a reduced loan quantum will lead to decreased affordability. According to HDB: “If the remaining lease of the flat does not cover the youngest applicant to the age of 95 and beyond at the point of flat application, the LTV limit will be pro-rated from 80%.”

Decreased CPF Withdrawal Limit (WL)

If the remaining lease of the property covers the youngest buyer until the age of 95, the CPF WL is set at 120% of the valuation or purchase price, whichever is lower. A reduced CPF WL implies that you will need to make more monthly mortgage repayments using cash.

Narrower Buyer Pool in the Future

Considering your desire for one of the rooms to serve as a nursery, we assume that you plan to reside in this house for a good number of years. Do keep in mind that selling the property down the road might prove challenging, as prospective buyers in the future could encounter the same issues you face now. This could potentially discourage younger buyers from considering your unit, thereby reducing your pool of potential buyers.

Judging from the average prices above, it seems that your options are limited to flats that are at least 30 years old if you wish to stay in your desired estate. Average flat prices for HDBs below 20 years of age exceed your affordability of $552,000.

Buying an older flat, in turn, reduces your affordability further. For example, let’s say you purchase a flat that’s 35 years old. This means there are just 64 years left on the lease (99 – 35 = 64).

At age 28, with an additional 64 years, the HDB would only cover the youngest buyer until they’re 92 years old. This falls 3 years short of the necessary 95 years, necessitating a pro-rated LTV. The CPF usage will also be pro-rated. However, on the bright side, the average prices for such older flats are typically below $500,000, so this shouldn’t be a major concern.

Now that we’ve gotten the nitty gritty out of the way, let’s take a look at some listings on sale now. Here are a few examples we found within your desired locations that are also within your affordability:

| Address | Completion year | Unit type | Size (sqft) | Asking price |

| 152 Bishan St 11 | 1987 | 3S | 689 | $440,000 |

| 201 Serangoon Central | 1985 | 3S | 689 | $440,000 |

| 633 Ang Mo Kio Ave 6 | 1985 | 3NG | 721 | $438,000 |

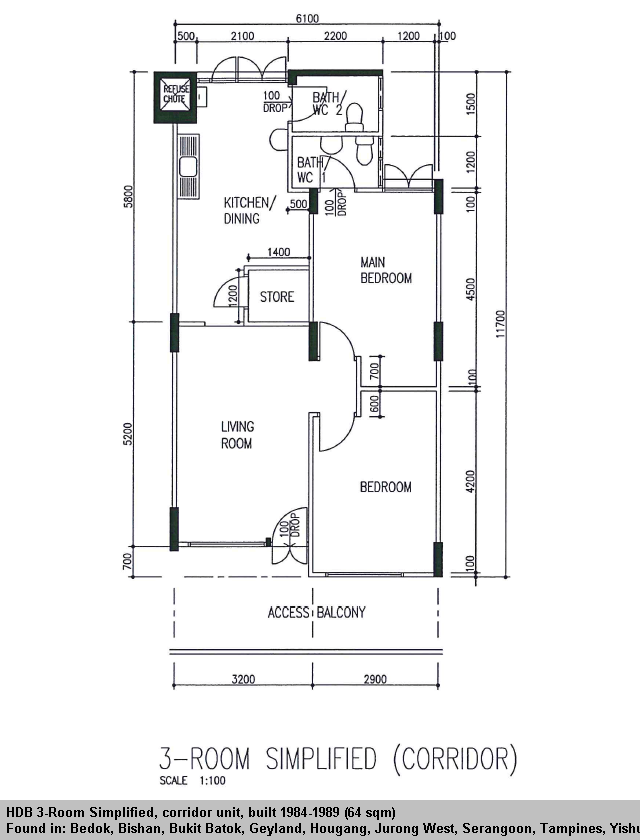

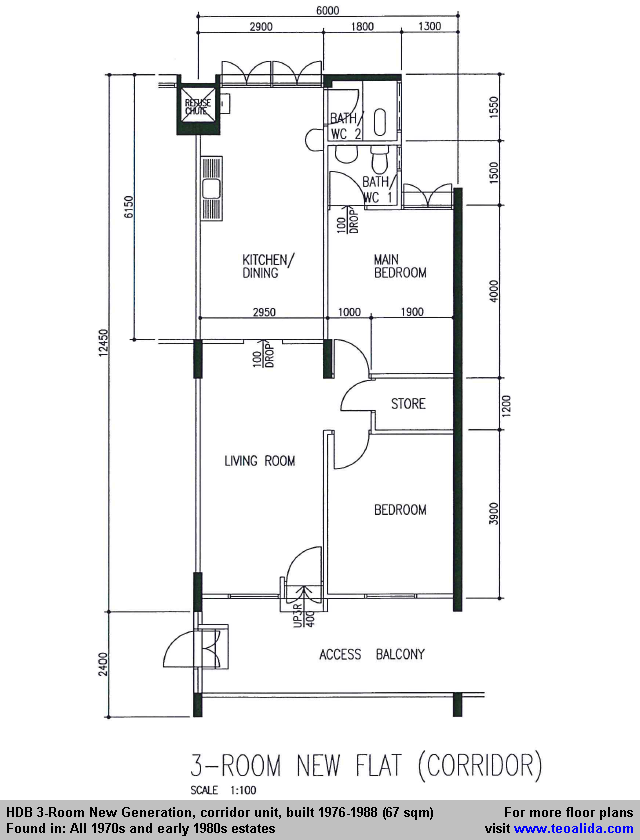

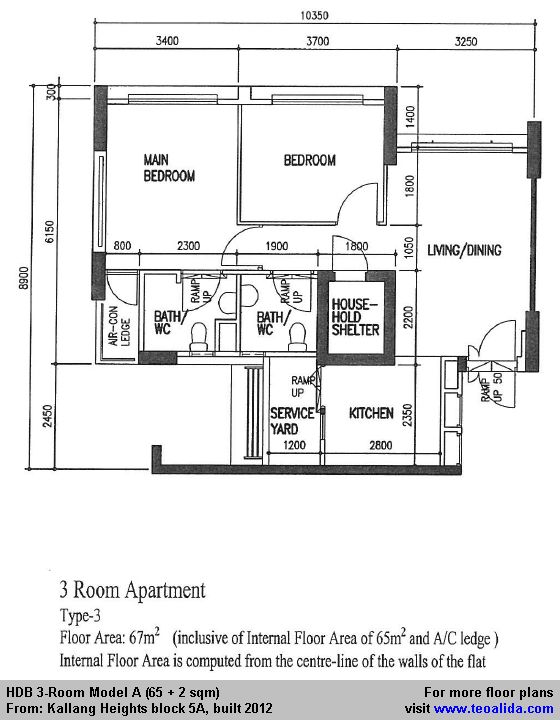

Here are some sample floor plans for 3S and 3NG units.

To illustrate further, let’s say you were to purchase the unit at 152 Bishan St 11.

As there were no 3-room transactions this year along Bishan St 11, we looked at those that were sold along Bishan St 12.

| Date | Block | Level | Completion year | Size (sqft) | Price |

| Sep 2023 | 105 | 07 to 09 | 1985 | 689 | $478,888 |

| May 2023 | 116 | 04 to 06 | 1985 | 689 | $462,888 |

| May 2023 | 132 | 01 to 03 | 1987 | 689 | $488,000 |

| Mar 2023 | 105 | 04 to 06 | 1985 | 689 | $475,000 |

| Jan 2023 | 115 | 07 to 09 | 1986 | 689 | $508,000 |

They averaged $482,555, which is within your budget.

| Description | Amount |

| Purchase price | $482,555 |

| CPF funds | $17,000 |

| CPF housing grants | $80,000 |

| Cash | $50,000 |

| BSD | $9,077 |

| Loan required | $344,632 |

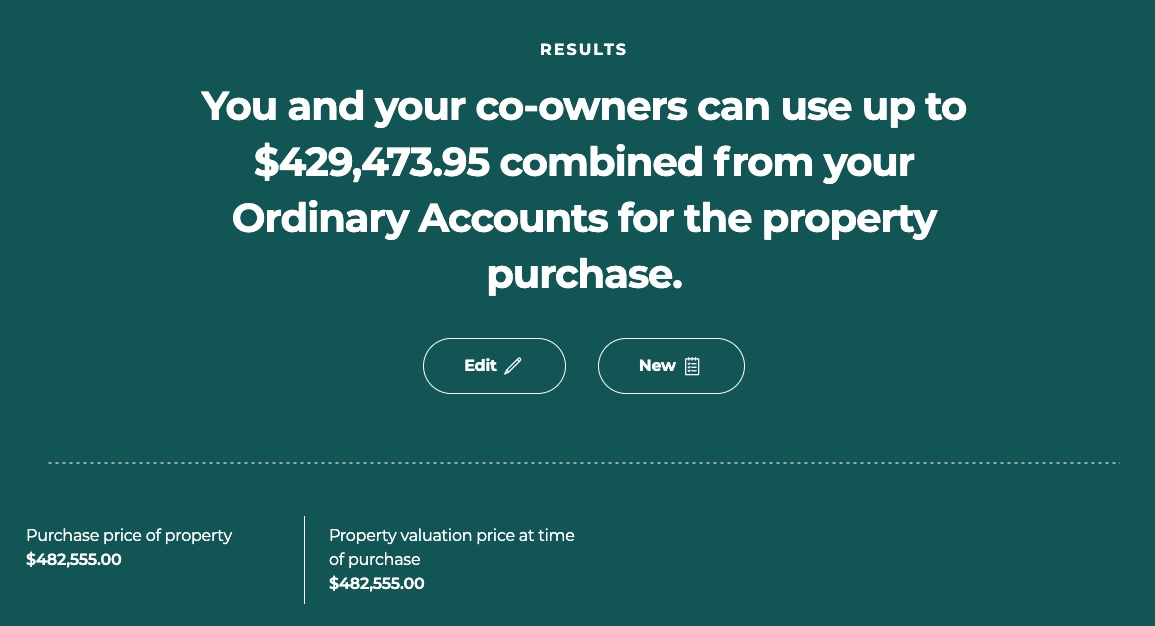

Suppose you were to acquire the property in October next year, at which point you will be 28 years old and your husband will be 29. Considering a property constructed in 1987 with a remaining lease of 62 years, the maximum CPF amount you can use stands at $429,473.95, resulting in a WL of 89%.

As for the LTV, the maximum LTV ratio is 73%, equivalent to $352,200.

Since the required loan is less at $344,632, buying a 36-year-old flat wouldn’t affect your affordability unless you do not use up your entire cash and CPF savings, or if you buy an older flat.

The lower WL implies that after utilising $429,474 of CPF for your mortgage repayments, the remaining payments will need to be settled in cash.

Based on a $344,632 loan, an interest rate of 3%, and a 25-year tenure, the monthly mortgage payment amounts to $1,634. This means you can utilise your CPF funds for monthly repayments for around 22 years.

Therefore, while the LTV and WL are reduced, they should not pose a substantial hindrance to your purchase.

This is due to the remaining lease of 62 years, which covers you until the age of 90 years old, making the 5-year difference less of a significant concern. However, this might not hold if the flat is considerably older.

The last couple of years have been marked by a unique market situation in which demand significantly outpaced supply, leading to substantial price increases, even for older properties.

It’s important to bear in mind that when the market eventually corrects itself, we can anticipate that the prices of older properties will likely return to the trajectory they were following before the recent surge.

If your preference is firmly set on more centralised locations, it may be worth considering them for a short-term stay as property prices typically do not experience a significant decline within such a brief timeframe. Nevertheless, this also hinges on the particular location, property age, and the dynamics of supply and demand in that area.

Let’s also look at what options you have should you decide to explore other locations with younger flats.

These are some of the newest units available on the market that fall within your affordability:

| Address | Completion year | Unit type | Size (sqft) | Asking price |

| 506C Yishun Ave 4 | 2018 | 3A | 732 | $425,000 |

| 115B Canberra Walk | 2017 | 3A | 731 | $430,000 |

| 561B Jurong West St 42 | 2017 | 3A | 731 | Starting from $420,000 |

Besides the age difference, these newer flats are also slightly larger as compared to the older units and mostly do not have any windows facing the corridor which is better for privacy reasons.

Here is a sample floor plan.

Since the remaining lease of these flats can cover you up till the age of 95, you will be able to maximise the loan, grants and CPF WL if necessary.

Another option: 4-room flats

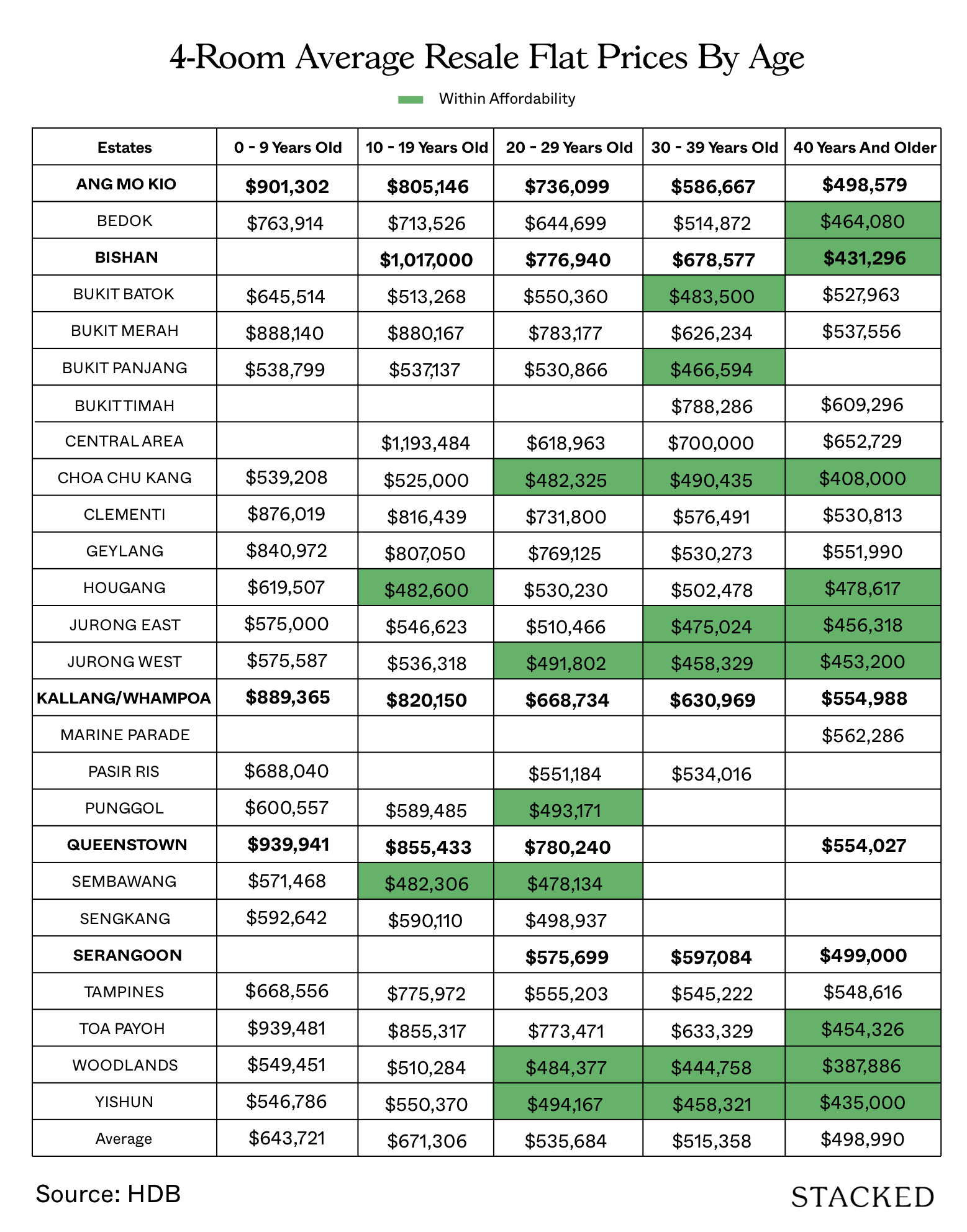

Here’s a look at the average transacted prices of 4-room flats in 2023 so far:

We’ve taken the liberty to bold your preferred estate and highlighted in green those average prices that fall below your affordability levels. As you can see, it is possible to also get a 4-room flat. However, you’d need to look at non-mature estates and generally older flats. It is possible to get a 4-room flat in your desired location in Bishan, however, it’s harder to recommend since it’s past 40 years of age. Furthermore, buying a 4-room flat should be a longer-term plan since the house is bigger and meant to accommodate a bigger family over time.

As such, we would only recommend buying a 4-room flat if you can find one that meets your longer-term goals (at least 10 years). Doing so means buying a property that isn’t too old, otherwise, you may face problems later on if you are trying to sell.

A younger flat means looking into further areas, such as Sembawang and Hougang. If these are areas that you’re not open to, then you’ll need to balance between location, lifestyle and the ability to sell for more later on.

Conclusion

As mentioned earlier, purchasing an older flat raises concerns about potential impacts on your loan, grants, and CPF WL. Depending on the extent to which the remaining lease of the flat can cover you up to the age of 95, the pro-rating of these amounts might affect your affordability. In addition, selling the unit might also pose challenges, as the potential buyer pool tends to be smaller for older properties.

Therefore, you might consider acquiring a unit in your preferred location for short-term occupancy rather than an extended stay. During this period, if your income and savings grow, you could contemplate upgrading to a newer or larger unit thereafter.

However, it’s important to note that older flats may require extensive renovations, which might not be the most worthwhile investment if you plan to stay for only a short duration. As such, you should try to factor in the renovation costs as you view flats relative to your total budget.

If you’re willing to consider properties in the outskirts, you can potentially acquire a newer unit or even an older 4-room flat to accommodate your expanding family and enjoy a more spacious living space.

However, similar to the 3-room flats in your preferred locations, opting for a 4-room flat in this scenario may not be the most financially prudent choice for long-term ownership. It could also strain your budget given a large part of the income depends on a single person. Since this is the case, it’ll also be prudent to keep some cash as a buffer in case the single source of income is lost. You could either delay the purchase by 6 months to save up more, or reduce your budget. Either way, we recommend sticking to a 3-room flat for the time being.

In addition to your location preferences, it can help to further streamline your decision-making process by determining your intended length of stay. If you plan to reside in your property for a short period, acquiring an older flat in your desired area may not pose significant challenges especially since older flats in central areas still enjoy a reasonable level of demand. Additionally, the CPF housing grants serve as a buffer for these older flats as they assist with the purchase considerably.

However, if you intend to stay for an extended duration, it might be wiser to consider purchasing a newer flat. Newer flats tend to depreciate at a slower rate, and you won’t have to worry about potential reductions in the WL or LTV for prospective buyers down the road. In addition, newer flats do not face resale issues later on since young buyers wouldn’t face the prospects of a lower WL or LTV.

In the best-case scenario, the property appreciates and serves to help you in your upgrading later on. However, even if it doesn’t, you would have already gained from the CPF housing grants of at least $80,000, which is a considerable sum. It is also worth considering buying a place near one of your parents as the $20,000 PHG is pretty substantial and can go a long way.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments