Hi Team,

I’m writing in to ask for some objective advise. My partner and I are below 30 yo, with a combined monthly income of $11.5k excluding bonuses.

But as we are starting out in our careers, we both combined have about cash + cpf ~180k-200k.

We are lucky in a sense that in the event we decide to try for EC, our parents are willing to loan us the cash downpayment needed (but I try not to use this option).

I was wondering in such situation, would you recommend getting a 3br EC or BTO equivalent, and was wondering roughly what is the max loan we’ll be able to get for our combined income.

Looking forward to your reply.

Hi there,

Thank you for getting in touch with us. It’s great that you’re being proactive and thoughtful about your housing decisions, especially at such an age.

In this piece, we will run through the following:

– Your affordability

– Differences between a BTO and an EC

– How BTOs and ECs have been performing

– What you should do

Let’s start by looking at your affordability.

Affordability

We understand that you’re considering purchasing either a brand-new EC or a BTO. Here’s a quick comparison:

- Loan Calculation: Both EC and BTO loans are determined using the Mortgage Servicing Ratio (MSR).

- Loan Tenure: An EC offers a maximum loan tenure of 30 years, while a BTO is capped at 25 years.

- Loan To Value (LTV) Ratio: The LTV ratio for an EC is up to 75% of the purchase price. In contrast, if you opt for an HDB loan for a BTO, the LTV goes up to 80%.

We’ll provide detailed affordability calculations for both options to help you make an informed decision.

Buying a BTO:

| Description | Amount |

| Maximum loan based on a fixed combined monthly income of $11.5K, assumed ages of 28 years old and an interest rate of 2.6% | $760,465 |

| CPF + cash | $200,000 |

| Total loan + CPF + cash | $960,465 |

| BSD based on $960,465 | $23,413 |

| Estimated affordability | $937,052 |

Buying a brand new EC (without taking out a loan from your parents):

| Description | Amount |

| Maximum loan based on a fixed combined monthly income of $11.5K, assumed ages of 28 years old and an interest rate of 4.6% | $672,981 |

| CPF + cash | $200,000 |

| Maximum affordability based on downpayment of $200,000 | $800,000 |

| BSD based on $800,000 | $18,600 |

| Estimated affordability | $781,400 |

With a budget of $781,400, it’s impossible to get a brand-new 3-bedroom EC at this current point. Looking at the latest EC launch at Altura, the 3-bedders transacted at an average price of $1,453,212. If we were to assume this as the purchase price, taking into account Buyer’s Stamp Duty (BSD) and considering your maximum eligible loan, CPF funds, and cash, you will need to loan $622,959 from your parents. It is a substantial amount of cash but let’s assume that your parents will be able to grant this loan to you.

If we look at the cheapest new EC available on the market today, you’ll probably find out about North Gaia. The development has been selling since April 2022 and still has around 60% of its units left unsold. Prices start from $1.167 million which is a lot more palatable than Altura EC, but we can understand why given its location. Even if you do decide to go with this option, you’ll need to loan $385,600 – and this is for the 2nd floor unit in the smallest 3-bedroom available.

Moving forward, it’s also unlikely that new EC prices would fall below Altura – unless its location leaves much to be desired.

Let’s now take a look at some factors to consider when purchasing a BTO or an EC.

Things to take note of

| Buying a BTO | Buying an EC | |

| A BTO has an MOP of 5 years (10 years for Prime Location Public Housing (PLH) and you can sell to any buyer that meets the HDB eligibility requirements. Depending on your estate, there may/may not be ethnic quota restrictions. | A BTO has a MOP of 5 years (10 years for Prime Location Public Housing (PLH) and you can sell to any buyer that meets the HDB eligibility requirements. Depending on your estate, there may/may not be ethnic quota restrictions. | There is a housing grant for first-timer households and based on your combined income, you are eligible for a $10,000 grant. |

| CPF housing grants | There is the Enhanced Housing Grant (EHG) but as your combined incomes exceed the cap of $9,000 for a family nucleus, you will not be eligible for this. | There is a staggered downpayment scheme where the 20% downpayment is split into two installments. You will pay 5% during the signing of the Agreement of Lease and the remaining 15% during key collection. |

| First-timer advantage | There is a staggered downpayment scheme where the 20% downpayment is split into two installments. You will pay 5% during the signing of the Agreement of Lease and the remaining 15% during key collection. | 70% of each new launch EC is set aside for first-timers during the first month from the initial launch. |

| Loan | You can choose between an HDB or a bank loan | You can only take a bank loan |

| Payment schemes | There is a staggered downpayment scheme where the 20% downpayment is split into two instalments. You will pay 5% during the signing of the Agreement of Lease and the remaining 15% during key collection. | There is the normal progressive payment scheme and a deferred payment scheme which allows you just pay the 20% downpayment (5% when obtaining the OTP, 15% when signing the Sale & Purchase agreement), and defer the rest of the payment until the development obtains its TOP. However, the property price will usually be 2-3% higher. |

| Resale levy | In the event you purchase a second subsidised property, a resale levy of $40-45K will be payable depending on whether you purchase a 4/5-room flat. | In the event you purchase a second subsidised property, a resale levy of $55K will be payable. |

| Number of launches | There is a BTO launch every 3 months | Depends on whether an EC land parcel comes up |

Now, let’s look at how BTOs and ECs have been performing.

Performance of BTO and EC

We have previously written an article that discusses in detail whether BTOs are still profitable today. Below, we’ll provide a summarised overview of the key points from that piece.

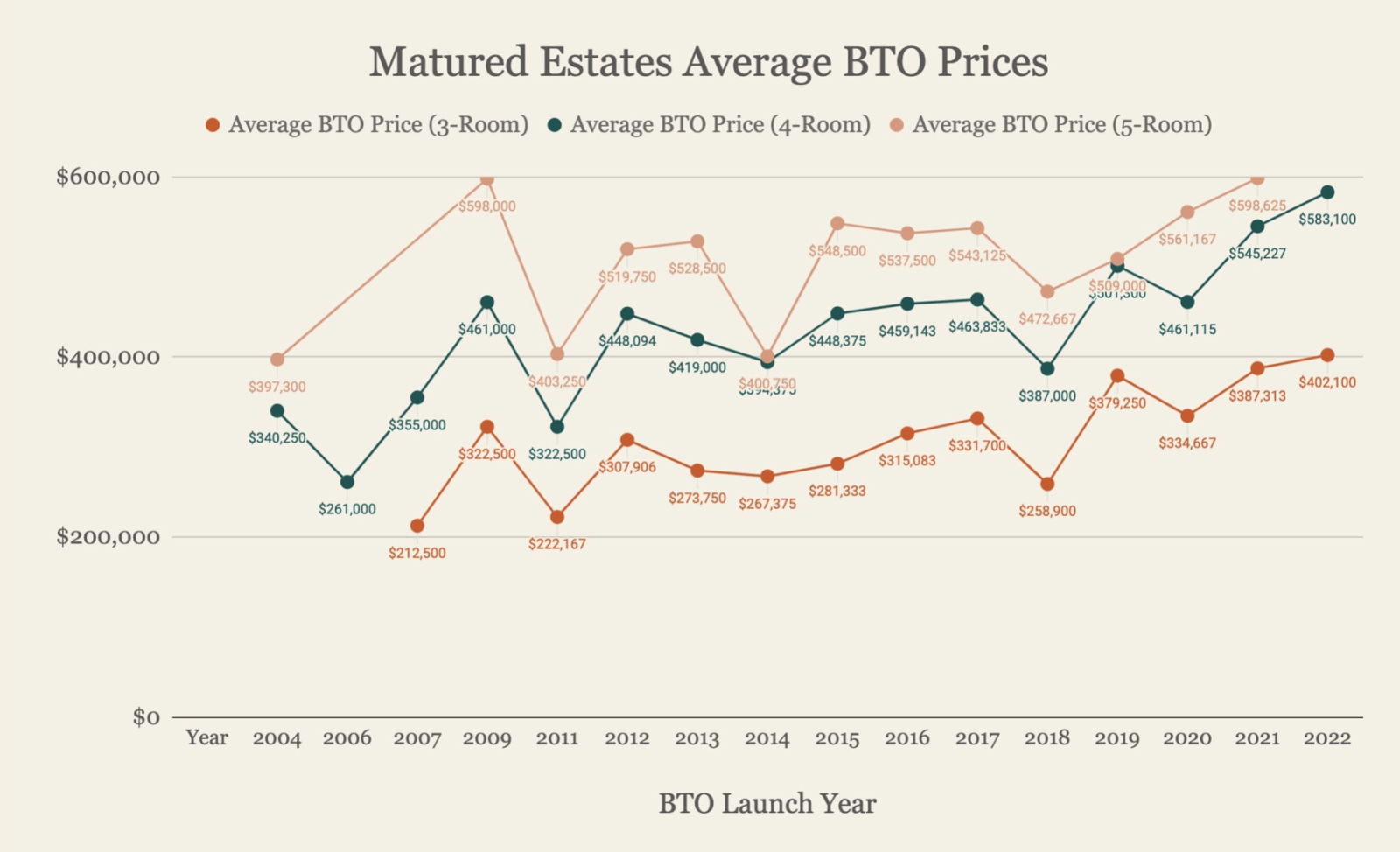

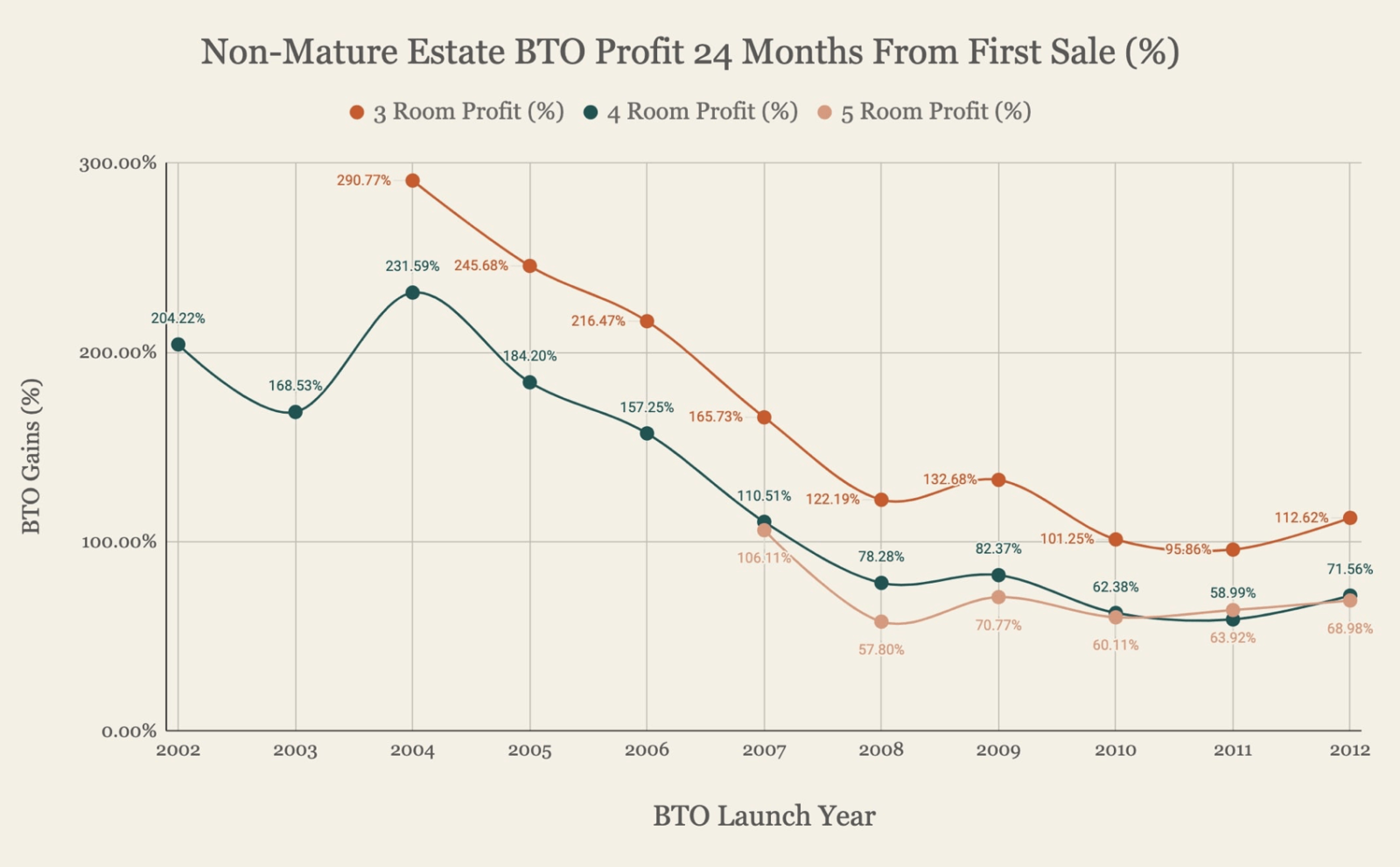

Non-mature estates often see regular BTO launches, leading to a steady increase in prices. Since many of these BTOs are in similar areas, their prices don’t vary much.

On the other hand, mature estates have unpredictable prices. This is because they have fewer BTO launches in a variety of areas. While there’s no specific definition for a mature estate besides being around for at least 20 years, this lack of clarity contributes to different prices. For example, BTOs in Tampines won’t have the same prices as those in the Central region.

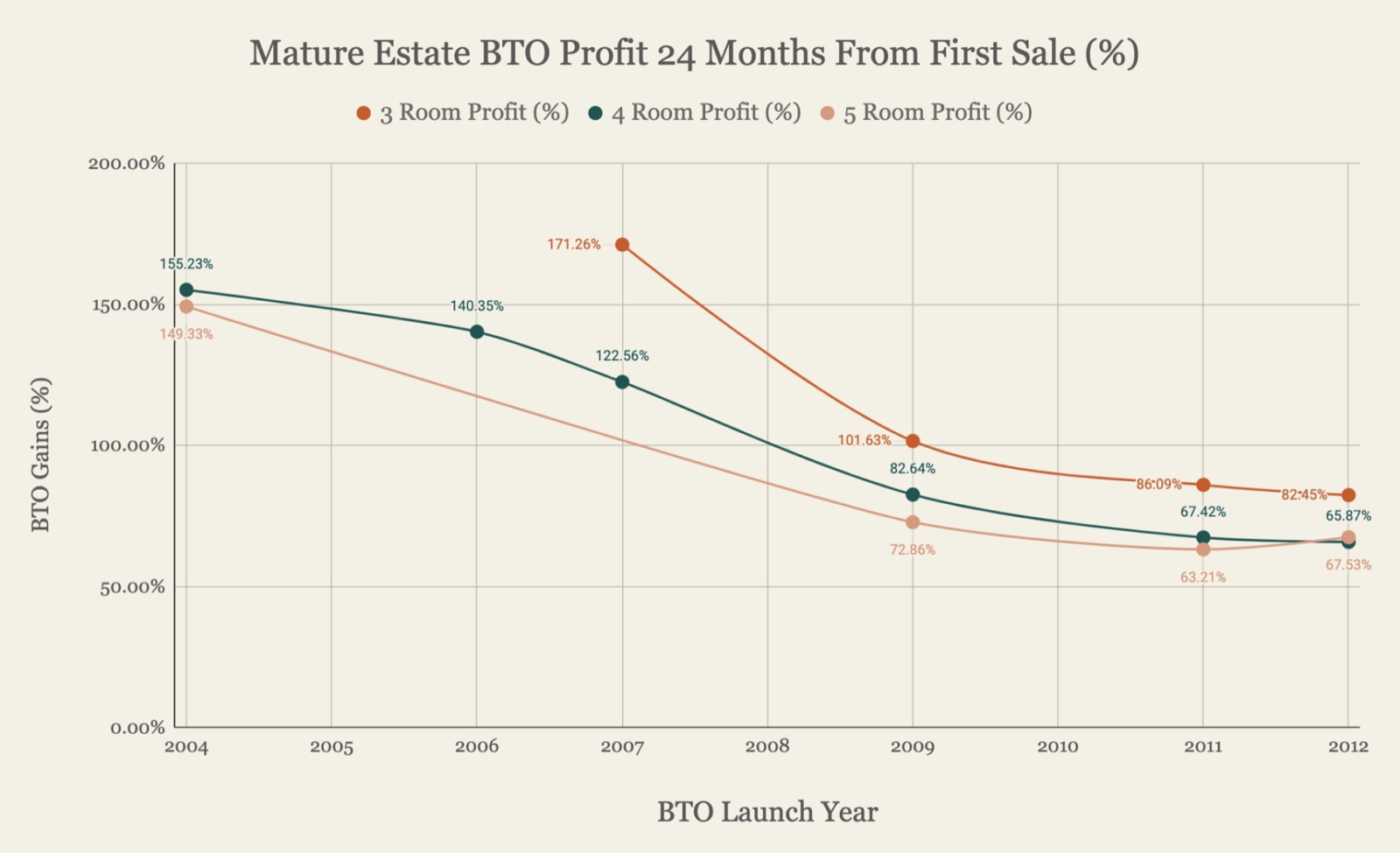

The graphs above show a clear trend: BTO profits have been declining (our assumption here is that these flats obtained their MOP around a decade after the launch). A combination of three cooling measures and HDB’s policy changes in 2013 caused resale market prices to remain stable until the pandemic began. With BTO prices continuing to rise, this likely explains the profit decline. Moreover, the Prime Minister, in his recent National Day Rally, emphasised the government’s efforts to reduce the unpredictability of BTO flat prices.

Nevertheless, it’s worth noting that even though the more recent BTOs are yielding comparatively lower profits than their older counterparts, they still manage to generate decent returns. This is particularly significant given that most buyers possess a favourable level of leverage, since the majority are likely to take up a loan and make only the initial 20% downpayment until the construction completes.

Let’s now look at how ECs have been performing.

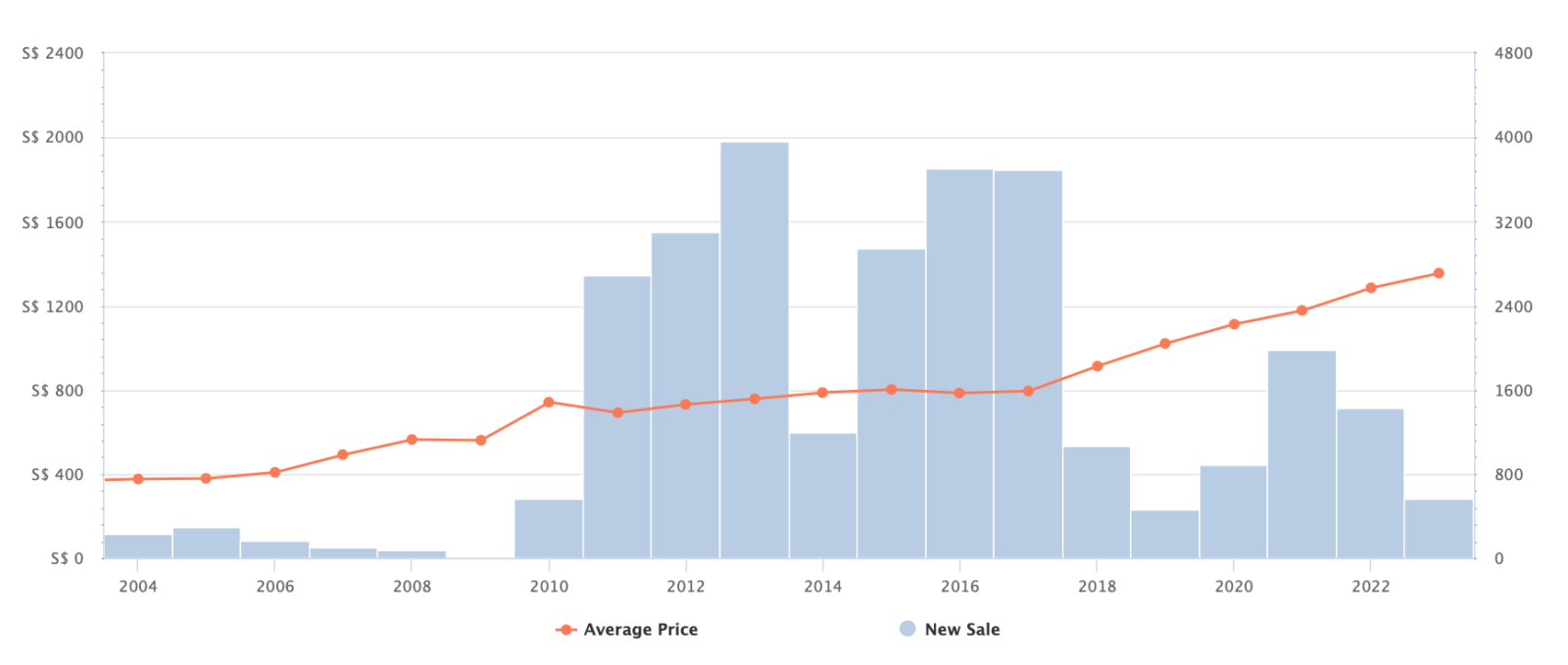

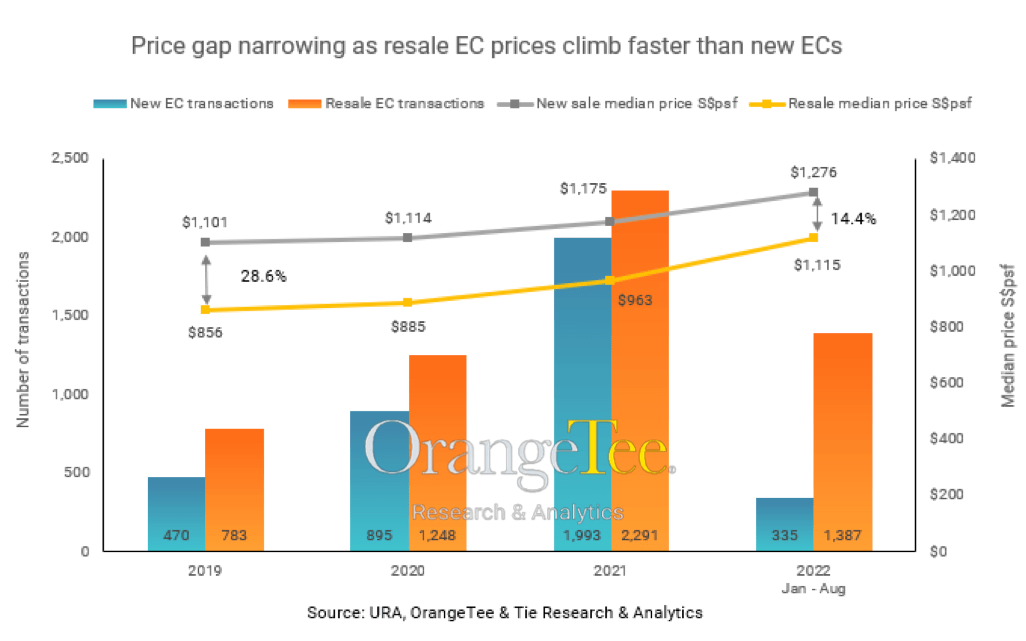

Just as with the BTOs, brand new EC prices are also on an upward trajectory and they are at an all-time high with the latest launch Altura transacting at an average price psf of $1,475.

We have also previously written an article on whether ECs are still worth buying and similarly, we will touch on the main points here.

From the chart provided, we observe that the newer ECs all recorded profits when sold at the fifth-year mark. Conversely, some of the older ECs incurred losses at the fifth-year point but turned profitable by the tenth year. A closer examination of these developments reveals that they were launched in 1997/1998 and underwent various global economic events during their construction and post-TOP phases, including the Asian financial crisis, the bursting of the dot-com bubble, and the occurrence of SARS. As such, these events likely influenced their pricing dynamics.

This underscores that purchasing an EC does not come with a guaranteed profit. The holding period and the timing of entry and exit can definitely impact the unit’s profitability.

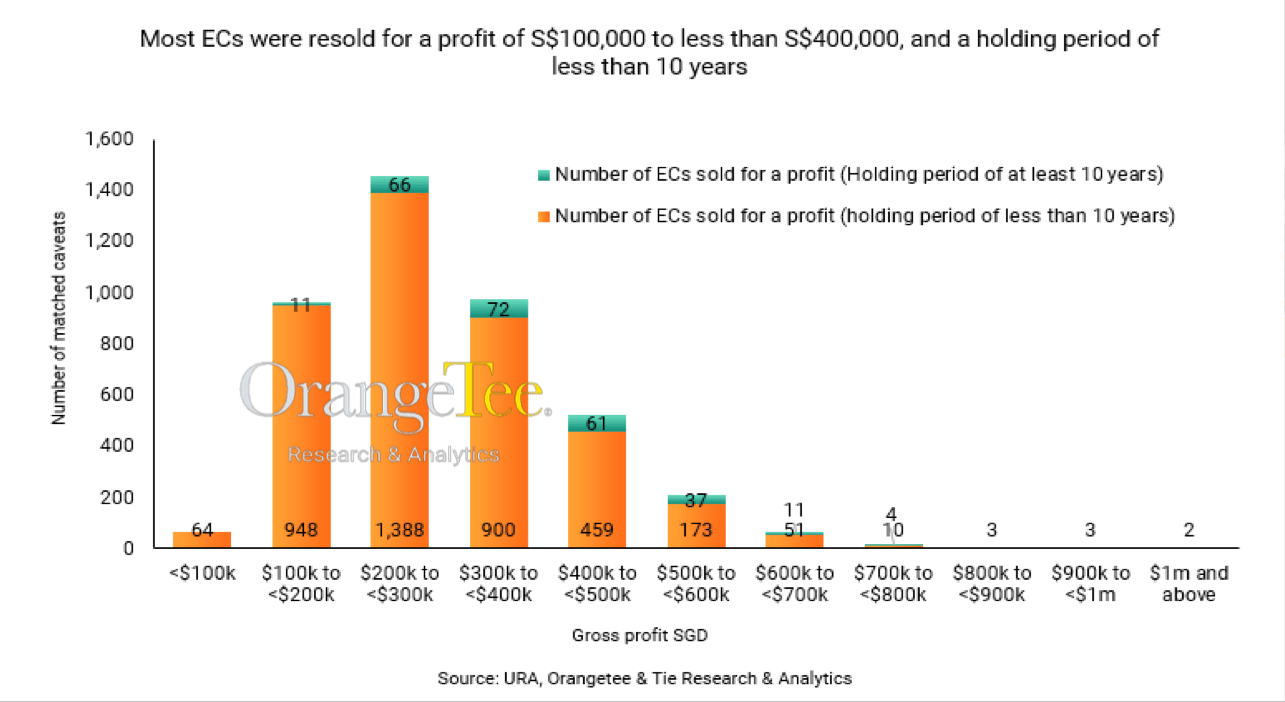

According to a recent study conducted by OrangeTee & Tie, they cross-referenced new EC transaction records with resale transactions spanning from 2007 to August 2022. The primary goal was to analyse the profitability of newly launched ECs. The findings indicated that among the 26,882 new EC transactions, there were 4,266 units that were subsequently sold on the secondary market. Notably, an overwhelming 99.9% of these 4,266 units recorded an average gross profit of S$295,904 per unit. It is noteworthy that 4,001 of these units were resold within a timeframe of less than 10 years from their original purchase date.

The study found that the price gap between new and resale ECs has been narrowing in recent years. This trend can be attributed to several reasons. Firstly, the property market saw a revival post-pandemic. With limited properties available, resale prices naturally rose. Additionally, given the potential profit between the fifth and tenth years after acquiring an EC, many see them as investment opportunities, boosting their demand. Lastly, ECs tend to be priced lower than private condominiums of similar age and location, making them an attractive option for potential homeowners.

Nevertheless, it’s crucial to consider that as the prices of new ECs continue to rise, a development’s success could be influenced by the presence of private properties in the vicinity. This factor has the potential to impact both your holding period and the overall profitability of the project.

For instance, take the case of Bishan Loft. Situated in a highly coveted location, particularly for an EC, and benefiting from a relatively limited supply of private properties in the Bishan area, it managed to achieve a substantial 159% profit by its tenth year.

However, the scenario may differ if the EC is located in an area where there is a surplus of private properties available at lower prices, and the age difference between the EC and these private properties is not significant. In such cases, realising profits may require a more extended holding period. Buyers might take some time to come to terms with the price disparity between the EC and the nearby private properties, which can affect the time it takes to achieve a profitable sale.

Costs and projections

While capital appreciation wasn’t stated as part of your objectives, it’s still useful to see where you’d be better off in terms of finances at the end of your first MOP.

Since you did not indicate a specific holding period, and considering your age, we will assume that you plan to sell the properties after they have reached their MOP and possibly upgrade to a different property class.

Cost of purchasing HDB and holding it for 5 years:

| Description | Amount |

| Purchase price (We will assume you purchase a 4-room flat that is outside the central region) | $380,000 |

| BSD | $6,000 |

| CPF + cash (Assuming you each keep $20K in your CPF OAs) | $160,000 |

| Loan required | $226,000 |

| Description | Amount |

| BSD | $6,000 |

| Interest expense (Assuming you take an HDB loan – 2.6% interest, 25 year tenure) | $27,237 |

| Property tax | $680 |

| Town council service & conservancy fees (Assuming $67.80/month) | $4,068 |

| Total cost | $37,985 |

As the preceding graph illustrated, non-mature estate 4-room BTOs displayed a profit of 59% to 82%. For the purpose of analysis, we’ll assume gains of around 70%.

Total profits made after 9 years: $266,000 – $37,985 = $228,015

Now let’s look at the profits if you had bought a new EC instead.

Cost of purchasing an EC and holding it for 5 years:

| Description | Amount |

| Purchase price (We are using the average 3-bedder prices at Altura) | $1,453,212 |

| BSD | $42,728 |

| Loan required | $672,981 |

| Description | Amount |

| BSD | $42,728 |

| Interest expense (4.6% interest, 30 year tenure) | $148,419 |

| Property tax | $9,200 |

| Maintenance fees (Assuming $350/month) | $21,000 |

| Total cost | $221,347 |

What about EC profits? New ECs are subsidised, so it’s unfair to look at the average performance of resale developments. Instead, we’ll look at the first owner profits of new EC purchases from 2012 to 2013.

Why 2012 to 2013? Considering prices are at an all-time high now, we’ll look at purchases in the last property market peak as a conservative measure.

We’ll also only take into account those sold 5-6 years from the development’s completion year to account for the first MOP, barring any early sales. Here’s what the data looks like:

| Executive Condominium | Avg Profit ($) | Avg Profit (%) |

| 1 CANBERRA | $239,590 | 30% |

| ARC AT TAMPINES | $162,493 | 22% |

| AUSTVILLE RESIDENCES | $185,222 | 26% |

| BELYSA | $292,520 | 35% |

| BLOSSOM RESIDENCES | $171,070 | 24% |

| CITYLIFE@TAMPINES | $455,631 | 44% |

| ECOPOLITAN | $369,706 | 39% |

| ESPARINA RESIDENCES | $191,000 | 26% |

| FORESTVILLE | $269,036 | 29% |

| HERON BAY | $286,605 | 31% |

| LUSH ACRES | $370,839 | 39% |

| PRIVE | $270,000 | 31% |

| RIVERPARC RESIDENCE | $212,027 | 26% |

| SEA HORIZON | $313,489 | 34% |

| SKYPARK RESIDENCES | $380,174 | 37% |

| THE CANOPY | $164,333 | 20% |

| THE RAINFOREST | $281,403 | 34% |

| THE TAMPINES TRILLIANT | $305,246 | 35% |

| THE TOPIARY | $381,351 | 47% |

| TWIN FOUNTAINS | $250,209 | 29% |

| TWIN WATERFALLS | $294,192 | 37% |

| WATERBAY | $332,389 | 39% |

| WATERCOLOURS | $125,576 | 17% |

| WATERWOODS | $233,275 | 24% |

| Grand Total | $295,060 | 35% |

As you can see, the average gain for ECs that were bought new and sold 5-6 years later stands at 35%. While we cannot say if this can be repeated since we cannot predict the market moving forward, it’s still better to rely on this data than using resale data as it’s not as relevant.

Going by this, the EC will make a profit of $508,624.

Total profits made after 9 years: $508,624 – $221,347 = $287,277

What should you do?

From the numbers shown, here’s how we would rank the different pathways:

- Buy a BTO

- Buy a resale flat (we’ll explain why here)

- Buy an EC

While the potential profits from an EC may be slightly higher, the initial financial commitment is considerably higher compared to a BTO flat. As mentioned previously, to purchase a unit worth $1.4M, you’d need to secure a loan exceeding $600,000 from your parents.

On the other hand, opting for a BTO flat provides you with more options within your affordability. You can even consider a PLH or Plus unit soon, though this comes with a 10-year MOP and other post-requisites. Additionally, BTO launches occur more consistently, every three months, as opposed to sporadic EC launches.

And of course, buying a BTO is practically risk free, especially if you were to sell upon hitting the MOP. In contrast, as we’ve observed earlier, ECs can incur losses depending on market conditions. Given these factors, purchasing a BTO might be a more prudent choice for you.

It’s important to note that both options are also ultimately unpredictable, as they are subject to a balloting system (although the odds of getting a BTO in a good location are undeniably lower than an EC).

Alternatively, you could consider buying a resale HDB flat. Given your income falls below the $14,000 cap, you would qualify for the CPF Housing Grant for first-time buyers, which amounts to $80,000. Moreover, if you were to purchase a unit within 4km of either of your parents’ residences, you could also enjoy the Proximity Housing Grant (PHG) of $20,000.

Instead of relying solely on capital appreciation, you can benefit from up to $100,000 in CPF grants, which will be directed into your CPF Ordinary Account (OA) after the flat’s sale.

Buying a resale flat also saves you time, as you won’t have to wait for the property to be constructed, which typically takes 3-4 years. You’ll also be able to choose flats close to one of your parents to unlock the Proximity Housing Grant.

Ultimately though, we should add that making this decision would also be a lot easier if you have a plan for the next stage beyond your first home. For example, an EC may be a good choice here if you are certain you eventually want to upgrade to a condo when you have kids for the facilities.

Likewise, while a BTO naturally be the most prudent, there are other things to think about. For example, the wait time for one, and the additional restrictions in the future should you look to purchase a PLH or Plus flat may mean less flexibility for you. Are you certain of your jobs/careers today? Would the flexibility to be able to move be important? Knowing the answers to this would naturally play a huge part in your final decision.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

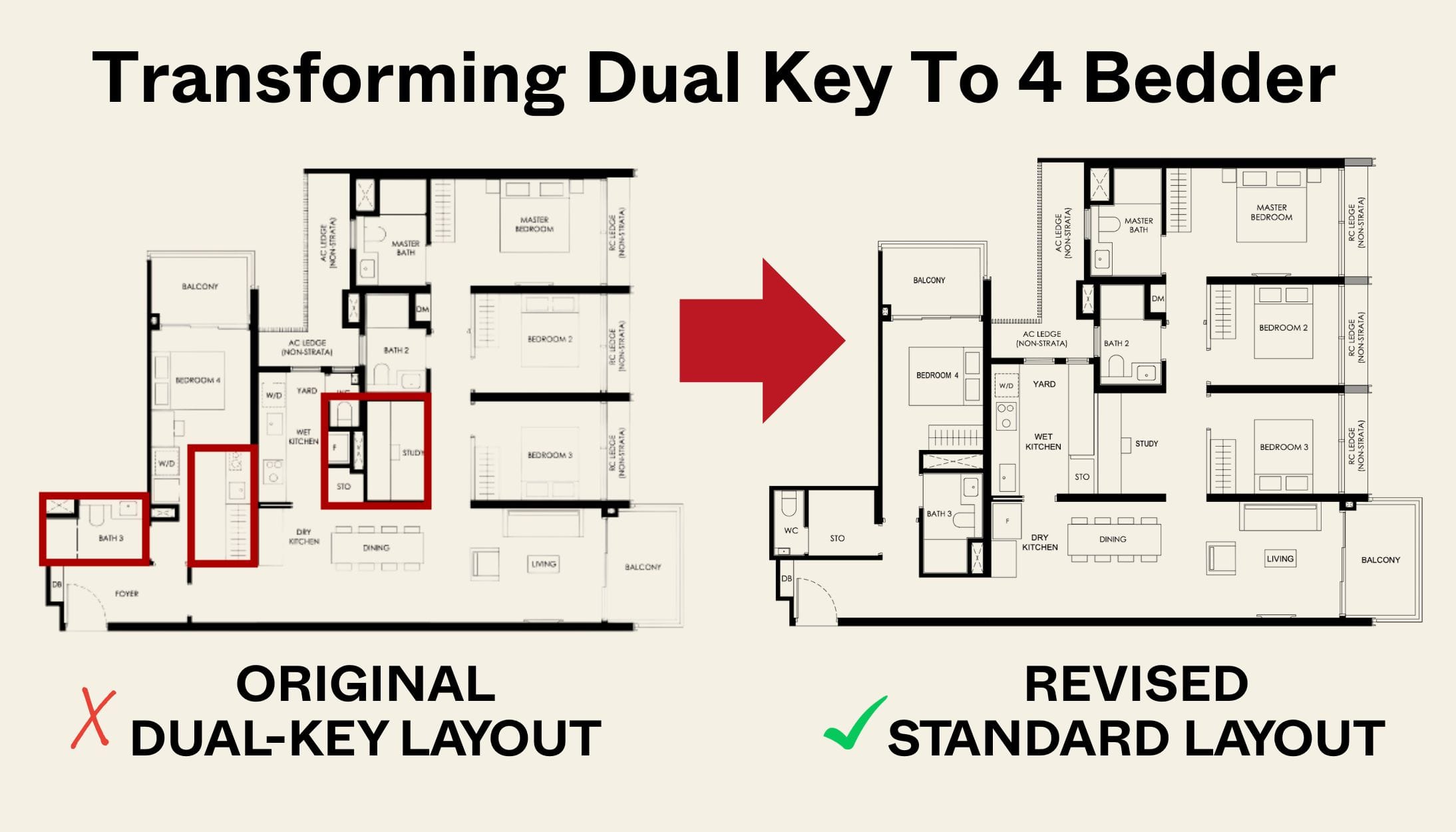

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout