Should We Upgrade To A Bigger But Older HDB Or Wait For An EC?

March 24, 2023

Hi Ryan,

Have been reading your articles from stacked for the past few years.

It gives me good information on things to look out for as we look for a flat.

Currently, in a dilemma, staying at a small 4 room flat with 2 young kids and 2 old folks, with a helper and my wife. Was think if we should purchase a EA as size is a priority but afraid that the EA (1993) might be overpriced. Down the road, if I were to sell, market valuation will drop, lease decay set in, and accrued interest of cpf will all eat into the flat sales profit.

If I were to move to a newer 5 room flat. the size will still be the issue. Yes it’s bigger but the room size are abt the same as my 4 room. Only difference is just a larger common space. With that, it’s as good as not moving.

Thought of going up to condo/EC, but prices, and location are not favourable for a high interest rate environment.

Dilemma, should I stay 4 room, sell and change to EA which has size but lease decay with lesser accessibility or wait out till we can afford a EC?

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thank you for your support over the years, we’re glad our content has been of help to you.

This is actually a very common dilemma for those who need a bigger space. Unfortunately, if you are looking for an upgrade on space in the HDB arena, these Executive Apartments/Maisonettes or Jumbo flats are often older. As such, there’s always the fear of lease decay in the future despite the seemingly high demand now.

While it’s also normal to look at prices now and question whether or not these older but bigger flats are overpriced, the fact remains that it is all about willing seller, willing buyer. Whether it be because of the stimulus that has been pumped into the market because of the pandemic, or the demand for more spacious homes due to Covid-19, it’s clear as day that there’s just more demand than there is supply. The big question is, will this continue in the long run?

It probably also doesn’t help that we are in a high-interest rate environment, do you wait out the interest rates or bite the bullet?

As such in this piece, we will look into:

– How Executive units and ECs have been performing

– What do both pathways look like for you financially

– Should you buy now or wait out the interest rates?

Let’s start by looking at how 4-room HDBs in general have performed since 2014.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

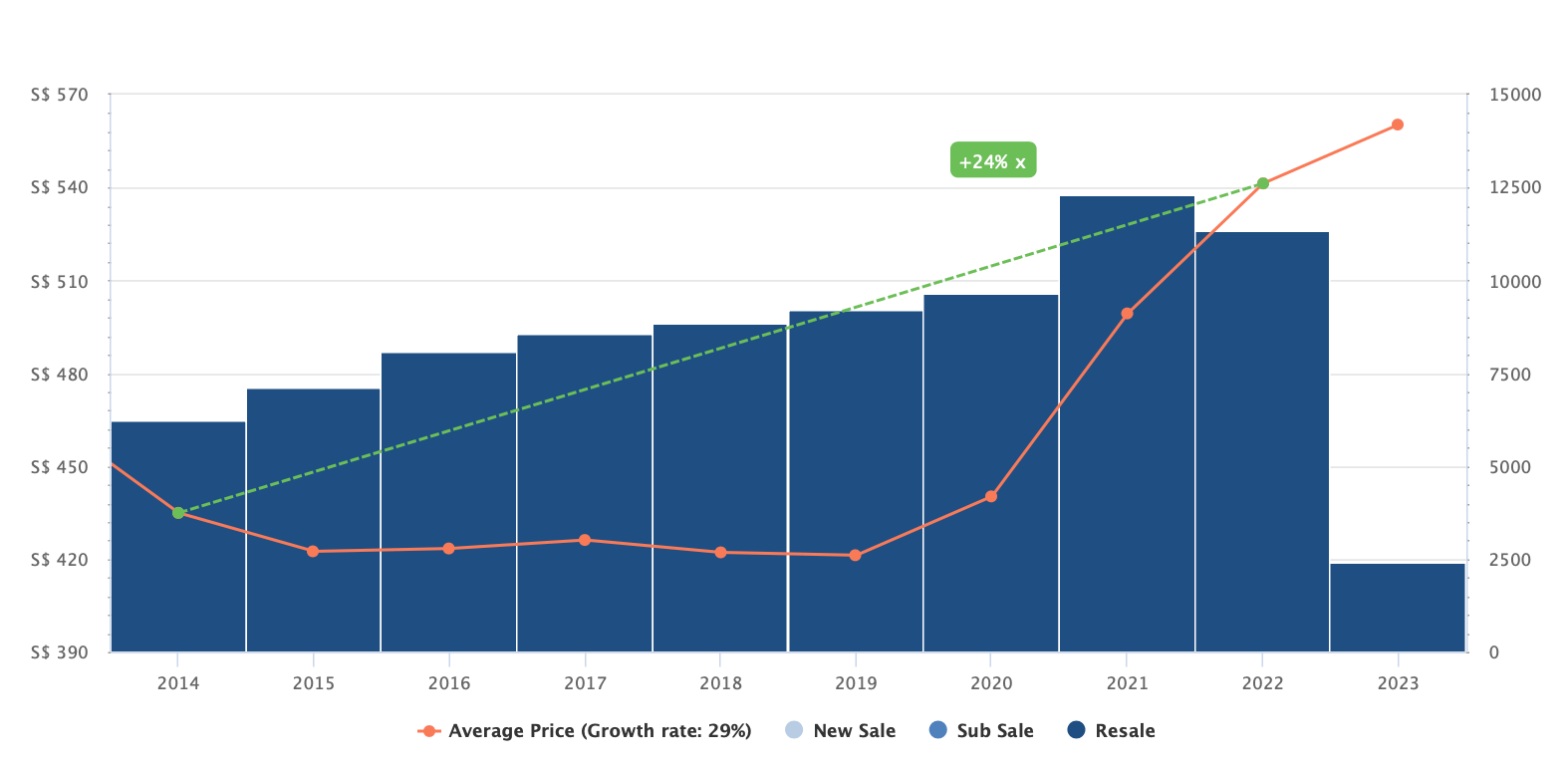

4-room HDB

| Year | 4-rm HDB average PSF | YoY |

| 2014 | $435 | |

| 2015 | $423 | -2.76% |

| 2016 | $423 | 0.00% |

| 2017 | $426 | 0.71% |

| 2018 | $422 | -0.94% |

| 2019 | $421 | -0.24% |

| 2020 | $440 | 4.51% |

| 2021 | $499 | 13.41% |

| 2022 | $541 | 8.42% |

| Annualised | – | 2.76% |

We can see from the graph that from 2014 – 2022, 4-room HDB prices have gone up by 24%. However, if we were to look at the year-on-year growth rate, the pandemic years showed significantly accelerated growth bringing the annualised growth rate over the last 8 years to 2.76%.

Let’s now take a look at how the executive HDBs performed in the same time period.

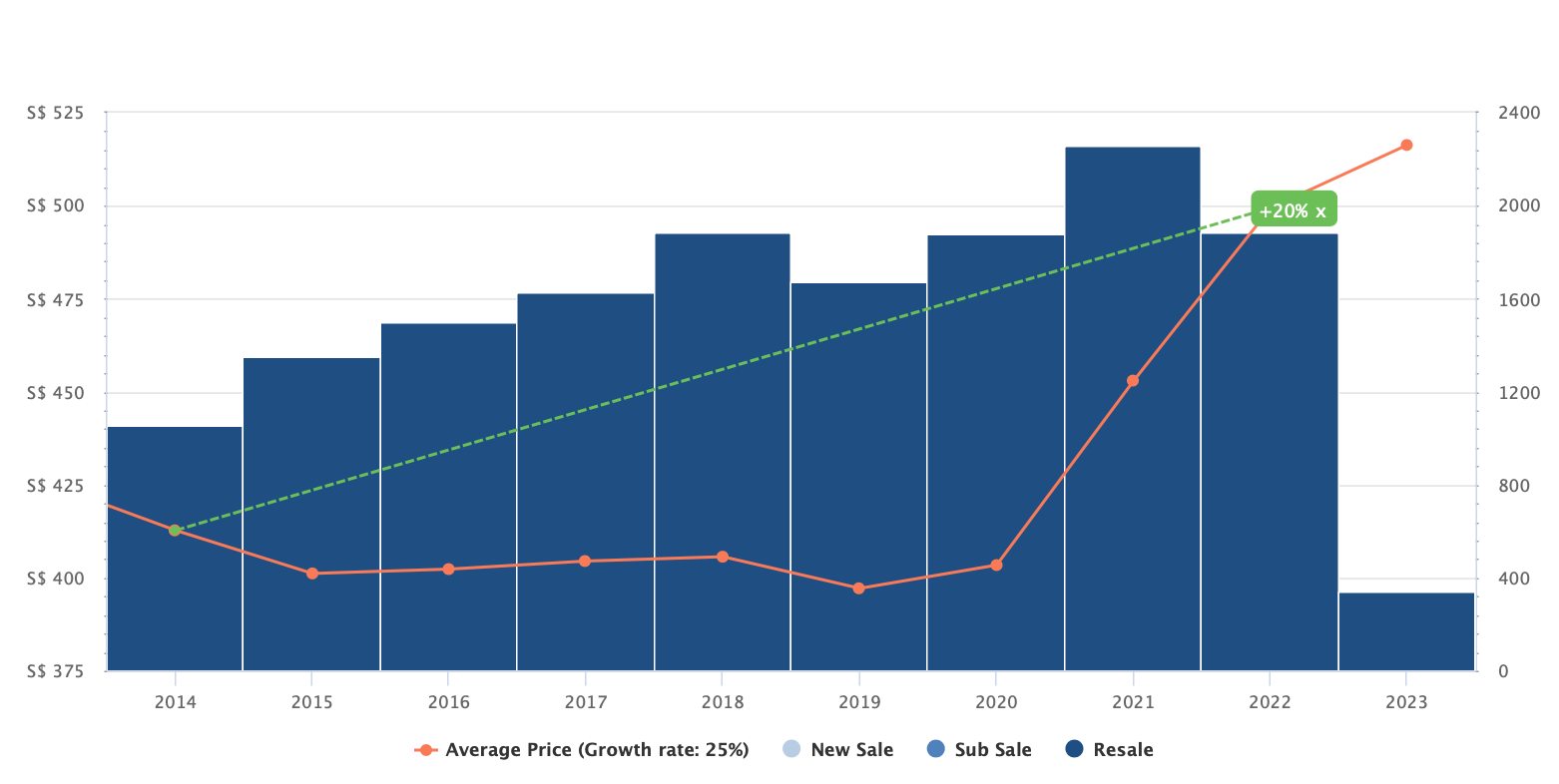

Executive HDB

| Year | Executive HDB average PSF | YoY |

| 2014 | $413 | |

| 2015 | $401 | -2.91% |

| 2016 | $402 | 0.25% |

| 2017 | $405 | 0.75% |

| 2018 | $406 | 0.25% |

| 2019 | $397 | -2.22% |

| 2020 | $403 | 1.51% |

| 2021 | $453 | 12.41% |

| 2022 | $499 | 10.15% |

| Annualised | – | 2.39% |

From the graph, we can see that prices for executive units have gone up by 20% from 2014 – 2022 while the annualised growth rate is at 2.39%. Just as with 4-room flats, the years with the highest notable growth are during the pandemic.

The problem with seeing HDB as an asset…

As you are rightly concerned with the potential lease decay for older HDBs, we are reluctant to view HDBs as an appreciating asset down the road due to how prices behaved between 2014 to 2019. While private property prices went up from 2016, HDB prices continued to stagnate. The surge in growth only happened due to the pandemic, but we are hesitant to apply this growth rate moving forward due to the unprecedented situation.

That being said, one factor that could see Executive HDB units holding their value is their limited supply. The construction of executive units ceased in August 1995, indicating that these units are at least 28 years old. Despite the continual influx of new 4-room HDB units over the years, the growth rates of both 4-room and executive units are not too far off. This suggests that there is still a demand for executive units despite their age.

As such, while we recognise the historical data having shown growth, we’d err on the side of caution and avoid being bullish on this.

Now we’ll take a look at how the Executive Condominiums (EC) and private condominiums have performed in the same time period from 2014 – 2022.

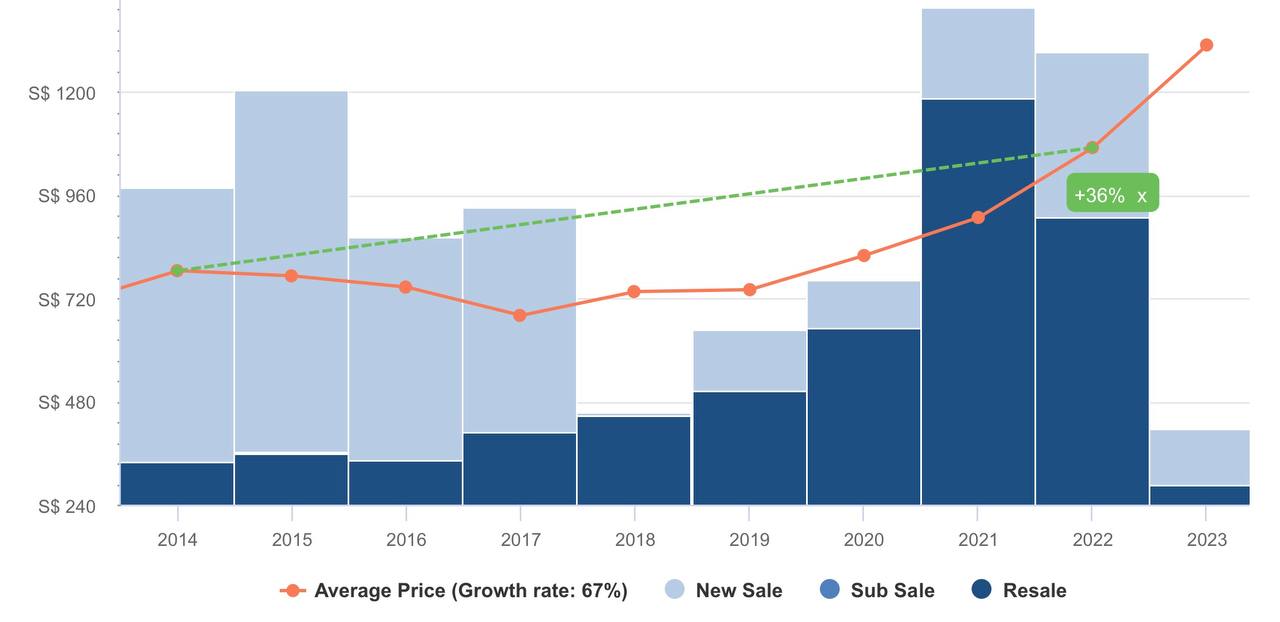

Executive Condominiums

| Year | EC Avg $PSF (>=1,500 sqft) | YoY |

| 2014 | $794 | |

| 2015 | $772 | -2.7% |

| 2016 | $748 | -3.2% |

| 2017 | $729 | -2.5% |

| 2018 | $724 | -0.7% |

| 2019 | $831 | 14.7% |

| 2020 | $823 | -0.9% |

| 2021 | $916 | 11.3% |

| 2022 | $1,111 | 21.3% |

| Annualised | – | 4.29% |

As you are looking for a unit that can accommodate your family of 7, we are looking only at units that are 1,500 sq ft and above which is comparable to the size of the Executive flats that you are looking at.

We can see from the graph that EC prices have appreciated by around 40% from 2014 – 2022 while the annualised growth rate is at 4.29%.

Condominiums

| Year | Condo Avg $PSF (>=1,500 sqft) | YoY |

| 2014 | $1,354 | |

| 2015 | $1,329 | -1.8% |

| 2016 | $1,348 | 1.4% |

| 2017 | $1,365 | 1.3% |

| 2018 | $1,554 | 13.8% |

| 2019 | $1,672 | 7.6% |

| 2020 | $1,500 | -10.3% |

| 2021 | $1,679 | 11.9% |

| 2022 | $1,875 | 11.7% |

| Annualised | – | 4.15% |

Based on the graph, we can see that prices of private condominiums have increased by 38% between 2014 and 2022. However, the annualised growth rate for private condos stands at 4.15%, which is just a tad lower than the annualised growth rate of ECs at 4.29%.

One difference we can notice from the two graphs and tables above is the period between 2019 and 2020. While prices of ECs were on an upward trend, prices of condominiums dipped by 5.23% before going up in 2021.

There could be several explanations for this:

- The government’s implementation of an increase in ABSD in 2018 for Singaporeans and PRs purchasing their second property and for foreigners and entities purchasing any residential property could have led investors to adopt a more cautious approach, resulting in a decrease in demand and subsequent decline in pricing.

- In 2019, the government increased the income ceiling for ECs from $14,000 to $16,000, which could have potentially boosted demand for ECs.

If we were to put the price trends of the 4 different property types side by side, it is clear that ECs and private condominiums are appreciating at a higher rate than that of HDBs.

While this may be very obvious information, we’ll still have to consider several things here:

- Can you afford an EC of equivalent size to an EA today?

- Can you afford to wait?

- After including costs, which scenario would put you in a better financial position?

- Just how important is a bigger space to you?

Can you afford an EC of equivalent size to an EA today?

In the past 6 months, there were 147 transactions of ECs with sizes 1,500 sq ft and above. These are their average prices:

| ECs | Average of Transacted Price ($) |

| 1 CANBERRA | $2,110,000 |

| AUSTVILLE RESIDENCES | $1,780,000 |

| BELLEWATERS | $1,900,000 |

| BELLEWOODS | $1,764,333 |

| BELYSA | $1,660,000 |

| BLOSSOM RESIDENCES | $1,845,000 |

| CHESTERVALE | $1,660,000 |

| COPEN GRAND | $2,010,893 |

| ECOPOLITAN | $1,900,000 |

| FORESTVILLE | $1,475,000 |

| NORTH GAIA | $2,076,500 |

| NORTHOAKS | $1,331,000 |

| NUOVO | $1,800,000 |

| PINEVALE | $1,518,500 |

| PRIVE | $1,850,888 |

| RIVERPARC RESIDENCE | $1,800,000 |

| SEA HORIZON | $1,893,333 |

| SKYPARK RESIDENCES | $1,856,666 |

| TENET | $2,216,553 |

| THE EDEN AT TAMPINES | $1,800,000 |

| THE FLORAVALE | $1,436,000 |

| THE QUINTET | $1,386,667 |

| THE RAINFOREST | $1,750,000 |

| THE TAMPINES TRILLIANT | $2,300,000 |

| THE TERRACE | $2,225,000 |

| THE VALES | $1,932,500 |

| TWIN FOUNTAINS | $1,812,888 |

| TWIN WATERFALLS | $1,800,000 |

| WATERWOODS | $1,908,000 |

| WOODSVALE | $1,500,000 |

| YEW MEI GREEN | $1,480,000 |

As you know, prices really depend on location and age, but since you are concerned about affordability, we’ll use The Quintet as an example since it’s one of the cheaper developments where a 4-bedroom unit on the 12th floor went for $1,380,000. Here’s what your finances should look like:

| Item | Amount |

| Price | $1,380,000 |

| 5% Cash | $69,000 |

| 20% Cash/CPF | $276,000 |

| BSD | $39,800 |

| CPF Or Cash | $276,000 |

| Monthly Mortgage (4.25%, 30 years) | $5,092 |

| Income Needed | $9,257 |

From this table, buying one of the more affordable 4-bedroom ECs today that’s comparable to an executive flat requires a cash outlay of $69,000 with the rest of it payable as cash or CPF.

By contrast, here’s what an Executive HDB costs for those with a lease starting in 1993 based on transactions since 2023 so far:

| Estate | Executive HDB (Avg Price) |

| BEDOK | $932,500 |

| BUKIT BATOK | $779,500 |

| CHOA CHU KANG | $673,333 |

| JURONG WEST | $678,750 |

| PASIR RIS | $771,778 |

| TAMPINES | $807,500 |

| TOA PAYOH | $1,021,000 |

Purchasing a non-mature Executive flat such as those in Choa Chu Kang or Jurong East would set you back only around $675K, which would be just under half of what you’d have to pay for an EC.

What if you wait and buy the EC later?

If you can’t afford one now, then the question is whether or not your income and cash position would allow you to later on, assuming EC prices continue in their trajectory.

| The Quintet | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Price | $1,380,000 | $1,439,202 | $1,500,944 | $1,565,334 | $1,632,487 |

| 5% Cash | $69,000 | $71,960 | $75,047 | $78,267 | $81,624 |

| 20% Cash/CPF | $276,000 | $287,840 | $300,189 | $313,067 | $326,497 |

| BSD | $39,800 | $26,168 | $44,647 | $47,867 | $51,224 |

| Total Cash | $108,800 | $98,128 | $119,694 | $126,133 | $132,849 |

| CPF Or Cash | $276,000 | $287,840 | $300,189 | $313,067 | $326,497 |

| Mortgage | $5,092 | $5,401 | $5,735 | $6,097 | $6,490 |

| Income Needed | $9,257 | $9,820 | $10,428 | $11,086 | $11,800 |

We don’t what your current age is, but we’ll assume that as you wait, your loan tenure reduces by 1 year. We’ve also assumed the 4.29% annualised growth rate here. As you can see, by waiting up to 5 years, the amount of cash you’ll need increases by over $20,000. Likewise, the income you’ll require also goes up.

While some might say that it is far-fetched to think our property market can continue to go up given where we are today and the high-interest rates, you’ll need to be prepared to increase your savings and income by this magnitude in order to purchase one later.

What if you bought an EA now?

Using a size of 140 sqm or 1,507 sq ft for the EA, at an average PSF of $499, this will amount to $751,993.

Besides the age of the flat, these are some other factors that contribute to the rate of lease decay:

- Location: Properties located in prime areas or near amenities and transportation potentially have a slower rate of lease decay compared to those in less desirable areas.

- Market demand: The level of demand can also affect the rate of lease decay. If there is high demand and supply is low, the rate of lease decay may be slower as buyers are willing to pay a premium for a unit with a shorter remaining lease.

- Maintenance: This affects private properties more than HDBs as higher maintenance costs and an increased sinking fund allocation may be necessary for owners of older private homes to manage building deterioration. As for HDBs, the town council’s service and conservancy fees do not increase as the building ages and there are also government initiatives such as the Home Improvement Programme (HIP) which helps to rejuvenate older flats.

- Inflation: Generally as all prices of goods and services go up, so can very old HDBs.

As mentioned earlier, we think it’s best not to see HDBs as an asset that will continue to appreciate. While it’s hard to say exactly when the depreciation would kick in, it would be safer to be prudent and assume that the Executive Apartment wouldn’t be appreciating over the next 10 years as it has done over the last couple of years. This is on the back of where we are in the property cycle, with an increasing supply in the market, as well as the high-interest rates.

As such, here are some projections over the next 10 years if the EA loses 10%, 5%, and 3% and stays the same in value:

| Executive Apartment | -10% | -5% | -3% | 0% |

| Current Price | $751,993 | $751,993 | $751,993 | $751,993 |

| Less | -$75,199 | -$37,600 | -$22,560 | $0 |

| Ending Price | $676,794 | $714,393 | $729,433 | $751,993 |

Moreover, buying an EA would mean taking a bigger loan as compared to a 4-room flat (not accounting for interest costs here). This would result in a greater cost to you if you take this path.

What if you stretch to buy an EC now?

Given the elevated interest rates, buyers may sit on the fence and stay put unless it’s absolutely necessary to move. However, given the continual rise in land and construction prices, property prices are also moving upward over the years.

We’ll do some simple calculations to compare if you were to purchase a private property today in a high-interest rate environment versus 5 years later assuming a lower interest rate.

Let’s say you were to purchase an EC today at $1,380,000 based on the price of a recently sold unit at The Quintet.

Here we are assuming a 75% loan at 4.25% interest and a 30-year tenure. Total cost includes Buyer’s Stamp Duty (BSD), interest expense, property tax, and maintenance fees which we have set at $400/month.

| Period | Total Cost | Total Gains | Profit |

| Start Period | $39,800 | $0 | -$39,800 |

| Year 1 | $89,870 | $59,202 | -$30,668 |

| Year 2 | $139,184 | $120,944 | -$18,240 |

| Year 3 | $187,709 | $185,334 | -$2,375 |

| Year 4 | $235,411 | $252,487 | $17,076 |

| Year 5 | $282,254 | $322,521 | $40,266 |

| Year 6 | $328,201 | $395,559 | $67,358 |

| Year 7 | $373,214 | $471,730 | $98,517 |

| Year 8 | $417,250 | $551,170 | $133,919 |

| Year 9 | $460,269 | $634,017 | $173,747 |

| Year 10 | $502,227 | $720,418 | $218,191 |

Based on the annualised growth rate of 4.29%, if you were to hold on to this property for the next 10 years, the amount of potential profits is $218,191.

What if you waited 5 years first to save up, then purchase the EC?

If you were to stay for another 5 years in your 4-room flat before buying the EC (which would allow you to save up and wait out the high-interest rates) the EC would possibly have appreciated to $1,632,487.

This would mean an increased cost of $1,632,487 less $1,316,400 which equals $252,487. However, we’ve seen from the table above that you don’t actually need an extra $250K – just a higher deposit, stamp duty and income.

Here we are assuming a 75% loan at 3% interest and a 25-year tenure. Total cost includes Buyer’s Stamp Duty (BSD), interest expense, property tax, and maintenance fees which we have set at $400/month.

| Period | Total Cost | Total Gains | Profit |

| Start Period | $51,224 | $0 | -$51,224 |

| Year 5 | $94,676 | $70,034 | -$24,642 |

| Year 6 | $137,112 | $143,072 | $5,960 |

| Year 7 | $178,501 | $219,243 | $40,742 |

| Year 8 | $218,811 | $298,683 | $79,871 |

| Year 9 | $258,010 | $381,530 | $123,519 |

You can see from the above that at the end of 10 years (5 years in your 4-room flat, 5 years after buying an EC), your profit from the EC is well over $100,000. This is less than if you had bought the EC now at a higher interest rate of 4.25% vs 3%.

So what does this mean for you?

Let’s wrap up with the 2 questions that you’ve asked:

- Should I just buy an EA now?

- Should I stay put in my current 4-room flat and buy an EC later?

It’s quite a straightforward answer – no one can guarantee the continued appreciation of HDB prices. There are lots of things to consider, from the injection of new BTO supply to a possible HDB oversupply in the future. No one can predict regulatory changes as well, which as you know has a big impact on the property market.

As such, even without looking at the data, it is still reasonable to assume that buying an EC would be a better choice if you are looking to preserve your property as an asset.

However, as you can see, even if EA prices slide over the next 10 years (or just stagnate), it may just be worth it given your genuine need for more space. The lifestyle benefits that it affords, is not something that you can really quantify, and over a 10 year period that really should not be overlooked.

As such, it would make sense to purchase the EA now and enjoy a higher quality of life. In a couple of years, you may have the income/savings to upgrade to a 4-bedroom EC.

Staying put in your 4-room flat to purchase an EC later could work if you are fine with the living space now and are close to being able to afford an EC. This is because you won’t be restricted to the 5-year MOP again if you just wait a little longer to do so. If you find yourself in a position where you only need to save for another 1-2 years before being able to buy an EC, then it could be better to wait.

If this would take longer than you are comfortable with, then biting the bullet and moving to an EA would probably be your best bet.

Finally, we must add that since we are not privy to your financial information, we cannot definitively ascertain which is the most viable option. There may be certain concessions you have to make, such as compromising on location, in order to afford a more sizeable unit. Many of these soft factors would be something to discuss with your agent to arrive at the option that you feel most comfortable with.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments